Author: Wenser, Odaily Planet Daily

On May 26, Hyperliquid officially announced that several metrics on the platform have once again reached historical highs: the total value of open contracts reached $10.1 billion; the 24-hour fee income was $5.6 million; and the USDC locked amount reached $3.5 billion. This indicates that, with the recent market highs, Hyperliquid, known as the "on-chain CEX," is gradually becoming the focal point of market liquidity. Previously, several crypto whales engaged in long and short trades here, with many reaping substantial profits. Recently, the well-known James Wynn leveraged Hyperliquid's epic positions to drive the BTC and PEPE markets up and down, attracting attention and liquidity that even spilled over to meme coins like moonpig.

It is no exaggeration to say that, to some extent, Hyperliquid has become a hunting ground for crypto whales, with many influencing market sentiment through publicly available on-chain positions, thereby achieving market price manipulation to complete their hunting profits.

This article briefly discusses this trend and its future direction.

Hyperliquid Trading Volume Hits New Highs: A Feast Driven by Crypto Whales

For readers who want to fully understand the whale James Wynn, feel free to read the article "Who is James Wynn: The Trading Genius from a Small Town, Betting $1 Billion." Today, we will discuss the potential and transmissive impact of crypto whales like James Wynn on the crypto market in the current market environment.

It is worth mentioning that James Wynn is not the first crypto whale to "influence market direction through positions." Previously, the "Hyperliquid 50x Leverage Whale" known as @qwatio also stirred market dynamics by opening positions on Hyperliquid. In March, he made over $9 million in profit by betting on the Federal Reserve's decision, and due to the precise timing of his trades, he was dubbed the "50x Insider." On-chain detective ZachXBT previously revealed that his true identity might be William Parker (originally named Alistair Packover), a scammer and phishing hacker with a criminal history, as detailed in the article "The Identity of the 50x Hyperliquid Whale Revealed: A Scammer Who Made UK Headlines?"

Regardless, the current reality is that Hyperliquid provides a massive "on-chain stage" for crypto whales with substantial capital—where they can showcase their strength, attract attention, and even gain followers through opening positions. Additionally, they can engage in alternative trading games here, indirectly influencing market focus and the underlying market sentiment.

As an on-chain contract platform that has risen in recent years (despite Hyperliquid's claims of being a high-performance L1 public chain), Hyperliquid has become a significant liquidity hub in the crypto market, making it a battleground for market makers (MMs).

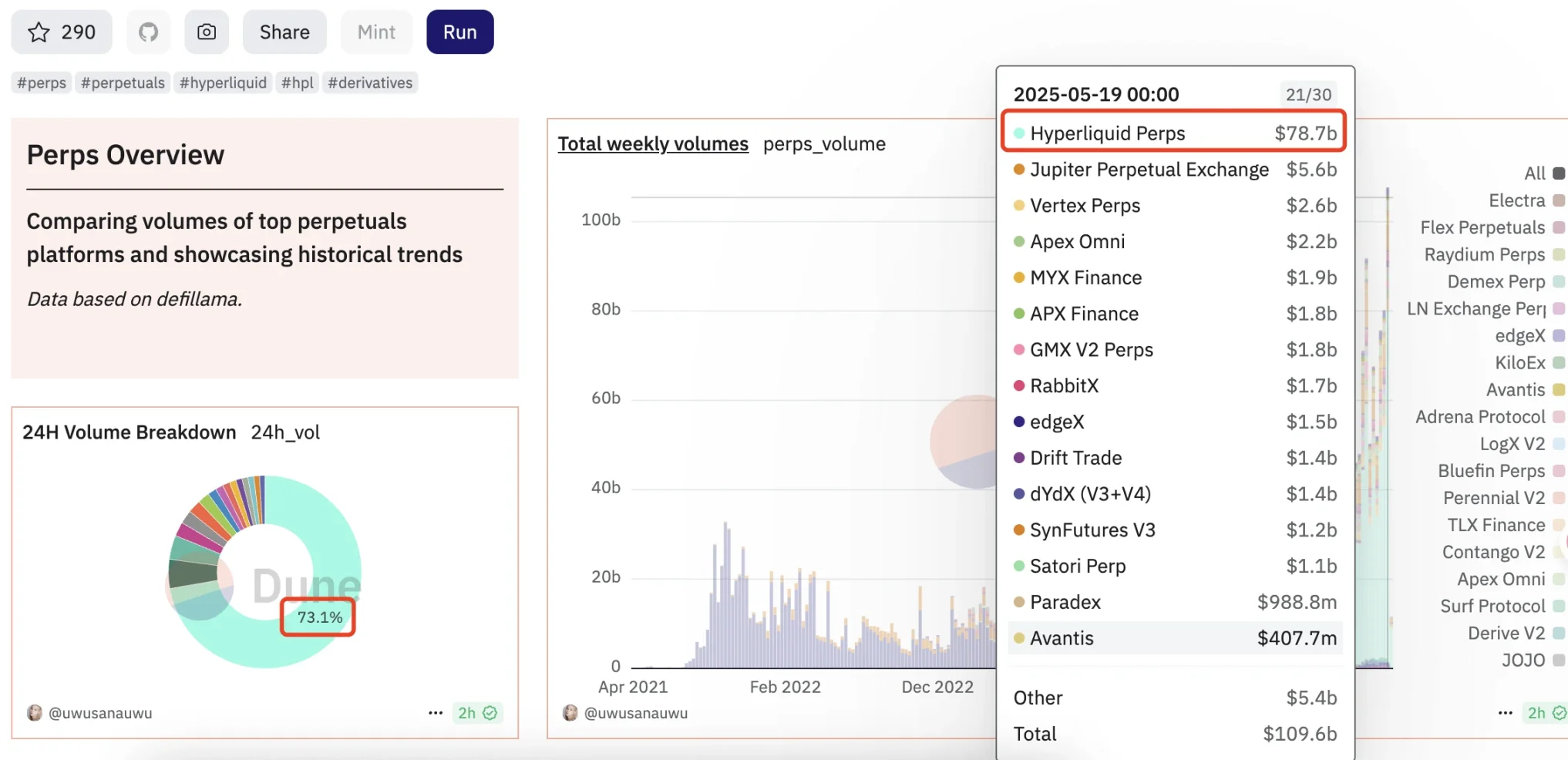

According to Dune data, from May 19 to May 25, the contract trading volume on the Hyperliquid platform reached $78.7 billion, while the overall market trading volume was approximately $109.6 billion, accounting for a staggering 71.8%. Furthermore, in terms of 24-hour trading volume, Hyperliquid's share today reached 73.1%, with a 7-day trading volume increase of about 46%; the 30-day trading volume increase was about 20%, ranking first among crypto trading market contract platforms.

Hyperliquid Market Trading Volume Share Weekly Data

Such a massive trading volume is primarily driven by crypto whales with positions often amounting to millions, tens of millions, or even hundreds of millions of dollars. As we previously published in the article "Bull Retreat vs. Bear Carnival: Has $100,000 Become BTC's 'Maginot Line'?", many whales have chosen Hyperliquid as their "preferred platform for opening positions." As an important barometer of the current crypto market, the various large long and short positions on Hyperliquid, along with the traders behind them, undoubtedly serve as the best "market baton."

Hyperliquid Becomes a New Battlefield for Attention: James Wynn and the Volatile moonpig

As the hottest trader at the moment, every move of James Wynn has drawn significant market attention, similar to the previous Hyperliquid 50x leverage whale, the former meme coin godfather Murad, and the consistently active trader Ansem. His latest "masterpiece" may be the meme coin project called moonpig.

Success and Failure of Meme

moonpig first appeared in the public eye on May 10, when its price surged past $0.02.

Just two days later, its price doubled again, rising to $0.04, and after a 10-day interval, on May 22, it broke through $0.05 and $0.1 consecutively. At that time, it was the moment when the legendary trader James Wynn gained immense market attention due to his large long position in BTC.

In just a few days, moonpig achieved a threefold increase in market capitalization, soaring from $30 million to over $100 million, with many attributing its upward momentum to James Wynn's enthusiastic calls. However, today, moonpig experienced a sharp decline of up to 30% due to whale sell-offs, with its market cap dropping to around $52 million (Odaily Planet Daily note: it has since rebounded to about $79 million), leading to dissatisfaction in the market towards James Wynn. Many believe he profited from dumping the coin, although he later denied this and even hinted at withdrawing from the contract market, along with making withdrawal operations. Yet, his subsequent opening of positions made people quietly remark, "He really can't stay away from trading."

Recent news indicates that James Wynn has once again deposited 4 million USDC into Hyperliquid as margin, currently holding a 40x long position in BTC valued at $75.12 million, with a liquidation price of $97,702.

In fact, the controversies and doubts surrounding James Wynn and his public calls have never ceased.

Previously, James Wynn faced criticism for charging for Baby Pepe calls and blacklisting the project's team. This time, moonpig is also seen by many as a "stain on James Wynn's trading career." After all, as he mentioned in his previous statement—"Do you really think that when I hold over $100 million in contract positions, I would care about selling tens of thousands of dollars worth of tokens?" If he truly didn't care, why would he be so concerned about endorsing and publicly calling out trades?

Of course, history is written by the victors, and the crypto market is no exception. While James Wynn continues to validate his investment logic with tens of millions of dollars, countless people still choose to believe in his judgment, while dissent is inevitable.

Trader Eugene's Sharp Commentary: The Disadvantages of Public Large Positions Outweigh the Benefits

Trader Eugene commented that James Wynn's behavior of publicly establishing oversized positions is quite controversial, stating, "From experience, this is almost always a bad idea, as the negative externalities often outweigh the positive effects." He added that it will be worth monitoring how Wynn utilizes 10 to 20 times leverage under extremely high position sizes while maintaining long-term risk management capabilities.

In the long run, moonpig, as a meme coin that has attracted a certain level of market attention, still aligns with our previous assertion that "the most important aspect of meme coins is not just symbols and narratives, but attention." The current price recovery in the K-line trend also serves as evidence, suggesting that the price may still be on an upward trend.

Conclusion: Onchain Summer Has Arrived, Hyperliquid Becomes a New Paradise for Whales

With crypto exchanges like Binance, OKX, and Bybit entering the on-chain ecosystem through Alpha, Wallet, and other forms, traditional investment institutions entering the crypto market through ETFs, and listed companies hoarding BTC to enjoy stock price appreciation dividends, Onchain Summer has entered every corner of the crypto market in an alternative way. Hyperliquid, as the largest "on-chain contract platform," has also become a new paradise for many crypto whales.

Here, they can profit by frequently opening positions to track price trends, and at the same time, they can influence off-market sentiment and market direction to some extent through their positions, thereby profiting. In this land of crypto filled with countless risks and opportunities, James Wynn is not the first hunter, nor will he be the last.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。