North America is leading as expected.

Author: Samora Kariuki

Translation: Deep Tide TechFlow

Global AI Wave

How Are Banks Actually Using Generative AI?

Setting aside the headlines and hype, the essence of the question is: how are the world's largest banks using generative AI? Not the potential of the future, nor the vendor's marketing, but where are the actual applications that have already been implemented?

In the past two years, the global financial industry has quietly entered the era of generative AI. However, this process is not uniform; it presents a pattern of internal and external distinctions: the low-key deployment of internal tools, cautious experiments aimed at customers, and a few bold innovations are gradually reshaping the internal structure of the banking industry.

Starting Internally, Then Gradually Expanding

A common point in the application of AI is that it starts as an internal productivity tool.

The main applications of generative AI focus on enhancing internal productivity—these tools help employees accomplish more work with fewer resources. From JPMorgan's analyst assistant analyzing equity research to Morgan Stanley's GPT-driven tools supporting wealth management advisors, the early focus has been on empowering bank practitioners rather than replacing them.

Goldman Sachs is building AI assistants for developers; Citi's AI summary tool helps employees handle memos and write emails; Standard Chartered's "SC GPT" has been launched among its 70,000 employees, covering everything from proposal writing to human resources issues.

Given that we are in a highly regulated environment, the deployment of internal tools is particularly reasonable. This allows banks to experiment and enhance AI capabilities without crossing regulatory red lines. If we refer to the recent actions of the CBN (Central Bank of Nigeria) against Zap, then "caution first" is clearly the wiser choice.

Business Line Observations: Where's the Value?

The progress of AI applications varies across different departments. There are differences in the speed at which various business units adopt generative AI. Among them, retail banking is leading in transaction volume. In this field, generative AI-driven chatbots like Wells Fargo's Fargo and Bank of America's Erica handle hundreds of millions of interactions annually. In Europe, Commerzbank recently launched its own chatbot, Ava.

However, the issue is that some of these tools do not actually use generative AI but rely on traditional machine learning techniques. For example, Bank of America's Erica operates more like a "Mechanical Turk," creating the illusion of automation through human operation. Nevertheless, what matters is the experiments themselves, not the technical labels.

In the corporate and investment banking sector, the transformation is more subtle. JPMorgan's internal tools primarily support research and sales teams rather than being directly customer-facing. Deutsche Bank is using AI to analyze customer communication logs, which is not customer service but data empowerment, helping bankers understand and serve clients faster and better.

Wealth management lies somewhere in between. Morgan Stanley's AI tools do not directly interact with clients but ensure that advisors are well-prepared for every meeting. Deutsche Bank and First Abu Dhabi Bank are piloting assistants aimed at top clients, designed to answer complex investment questions in real-time.

Regional Differences: Who's Leading?

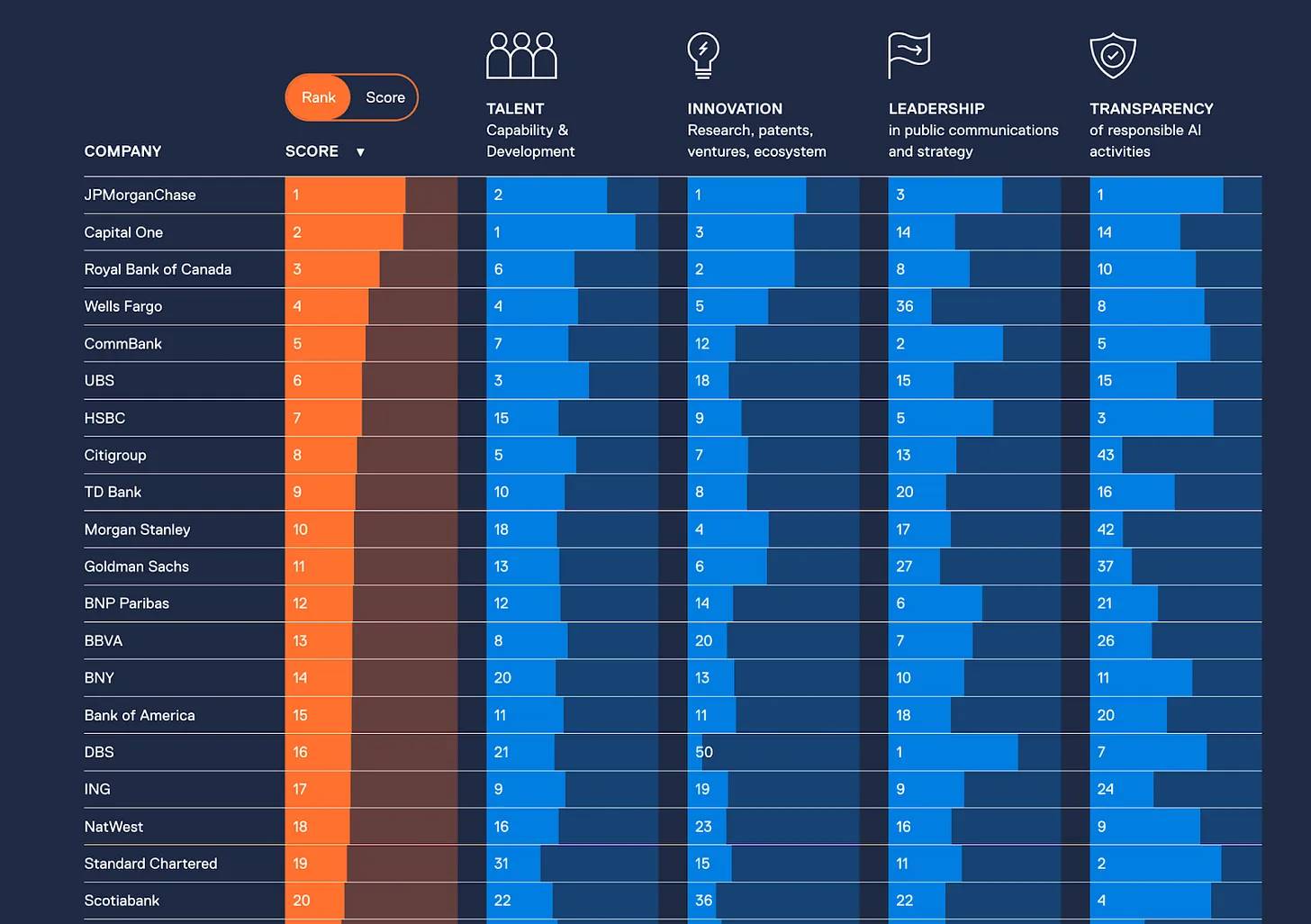

Source: Evident AI Index

North America is leading as expected. Banks in the U.S., such as JPMorgan, Capital One, Wells Fargo, Citi, and the Royal Bank of Canada (RBC), have transformed AI into a productivity engine. Thanks to partnerships with OpenAI and Microsoft, they have been among the first to access cutting-edge AI models.

Europe, on the other hand, is more cautious. BBVA, Deutsche Bank, and HSBC are internally testing AI tools and have set up more safety measures. The European General Data Protection Regulation (GDPR) has a profound impact on this. As in the past, Europe is more focused on regulation than on technological advancement, which may come at a cost.

Africa and Latin America are still in the early stages of AI development but are making rapid progress. Brazil's Nubank stands out, collaborating with OpenAI to first deploy AI tools internally before expanding to customer service. In South Africa, Standard Bank and Nedbank are piloting AI initiatives covering risk control, support services, and development.

China: Building an Independent AI Technology Stack

Chinese banks are not only using AI but are also building their own AI technology stack.

The Industrial and Commercial Bank of China (ICBC) has launched “Zhiyong,” a large language model with 100 billion parameters, developed in-house. This model has been called upon over a billion times, supporting 200 business scenarios ranging from document analysis to marketing automation. This is not just an application of internal tools but a fundamental shift in the way banks operate.

Ant Group has launched two large language models in the financial sector—Zhixiaobao 2.0 and Zhixiaozhu 1.0. The former targets ordinary users of Alipay, aiming to explain financial products; the latter supports wealth management advisors by summarizing market reports and generating portfolio insights.

Ping An Group, as a fintech giant integrating insurance, banking, and technology, has gone even further. Its generative AI assistant AskBob serves both customers and client managers. For customers, AskBob can answer investment and insurance questions in natural Chinese; for advisors, it can extract and summarize client history, product data, and marketing materials, transforming each agent into a digitally enhanced financial expert. Ping An's goal is to redefine financial consulting through AI, not just answering questions but predicting needs in advance.

In China, the regulatory framework strongly encourages data localization and model transparency, leading these institutions to choose a longer-term path: building customized AI that can adapt to domestic regulations, language, and market environments. Additionally, China has a sufficient talent density, allowing banks to independently develop foundational models, which may be a unique achievement globally.

Who Is Providing Technical Support?

Some well-known companies frequently appear globally: Microsoft, through Azure OpenAI, is currently the most common platform. From Morgan Stanley to Standard Chartered, many banks are running their models in Microsoft's secure sandbox environment.

Google's LLM (large language model) is also being used, for example, Wells Fargo utilizes Flan to support its Fargo. In China, there is a reliance on local technologies, such as DeepSeek and Hunyuan.

Some banks, like JPMorgan, ICBC, and Ping An Group, are training their own models. However, most banks are fine-tuning existing models. The key is not to own the model itself but to control the coordination between the data layer and the model.

Diverse Exploration of Global AI Applications

Original image in the original text, translation: Deep Tide TechFlow

So What?

In a highly regulated industry, caution is crucial, which is why banks are involving AI rather than standing directly on the front lines. However, as we have observed in other platform transformations, decisive decision-making and rapid experimentation are key. Regulation will never be ahead of execution, and waiting for regulations to be in place before conducting AI experiments is not wise. I remember building an agency banking business in a country without relevant regulations over a decade ago. Once we completed the build, we became the ones explaining this business to the central bank. If I were a member of a bank's board, I would ask: "How many experiments are we conducting? How many insights are we generating?"

To truly measure progress, we must return to the fundamental principles of platform transformation. Your AI strategy must answer the following questions:

"Does our AI strategy rebuild the core architecture? Does it reduce costs by 100 times? Does it unlock new value models? Does it stimulate ecosystem connections? Does it disrupt the market? Does it achieve democratization of access?"

The logic is clear—maintaining a skeptical attitude is necessary, but logic and facts indicate that AI represents a new platform transformation. Furthermore, logic and facts also show that past platform transformations have often brought revolutionary changes to financial markets. For example, Citi's technological applications in the 1970s and 1980s significantly expanded its retail business. Capital One emerged from nothing to become one of the top ten banks in the market, gaining a significant position in related industries such as auto loans and mortgages. In Africa, Equity Bank capitalized on the client-server technology wave, becoming the largest bank by market value in East Africa. Similarly, Access Bank, GT Bank, and Capitec have also ridden this wave in their respective markets.

The era of AI platforms has arrived, and it will create winners. The focus should not be on the losers but on how the winners capture significant market share in specific areas. For instance, Stripe's success in the payment sector is a typical case. These early breakthroughs often lead to market share growth in adjacent fields, such as Nubank becoming a significant player in the SME and retail banking sectors through its credit card business.

My point is that the winners in the AI era will focus on relationship costs. This is no longer just a transaction game. The transactions have already occurred; now it is a game of customer experience and relationship management. This is the core insight that financial services leaders should focus on. How can we achieve a 100-fold improvement in customer experience and relationship banking at an extremely low cost? As a bank, how can we leverage intelligent technology to better help customers manage their finances, businesses, and lives? Players who can answer and execute these questions will become the ultimate winners.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。