Author: Paolo Confino, Leo Schwartz

Translation: Min, Wealth Chinese Network

Some people just need to stand there, and they are a loud signboard. Donald Trump is such a person. Long before he became the President of the United States, the name Trump was already a "brand." First, as a billionaire, he had high visibility on television. Second, his mansions and his associations with Hollywood celebrities generated plenty of topics. Third, he created a whole bunch of products branded with his name, such as Trump Hotels, Trump Steaks, and even Trump Continuing Education, among others. Since he became President, the influence of this "brand" has significantly increased, now even including a media company and a digital currency company, which have added billions to Trump's net worth.

During Trump's first term, he was criticized for always finding ways to use his power for personal gain, leaving many opportunities for others to bribe him—such as foreign dignitaries needing to stay at Trump-owned hotels during official state visits to the U.S., which felt like a slap in the face to American taxpayers. Of course, Trump insists that after becoming President, he has distanced himself from his businesses. For example, he placed some of his assets into a revocable trust managed by his eldest son, Donald Trump Jr.

Of course, it seems that with Trump's immense wealth, he may not even care about the small amounts of reception fees. As Trump's personal wealth continues to grow, coupled with his ventures into new investment areas, the Trump family has an abundance of ways to make money, not to mention that he now has many political allies and business partners supporting him. The public simply remains unaware of these matters.

Although Trump's fortune primarily came from real estate, his business empire has long since expanded from the steel and concrete of New York to the high-tech of Silicon Valley. Now, at the age of 78, Trump can even be called a "tech mogul." However, one thing that has never changed is his emphasis on personal branding. The main product Trump sells to clients, and the core selling point he pitches to investors, has always been himself.

Recently, Trump's name has appeared in several business ventures. In the media sector, there is Trump Media & Technology Group; in the digital currency sector, there are the World Liberty Financial project and the so-called meme coin "Trump Coin" ($Trump). Jordan Libowitz, vice president of the watchdog organization Citizens for Responsibility and Ethics in Washington, pointed out, "This marks the transformation of the Trump brand from offline to online."

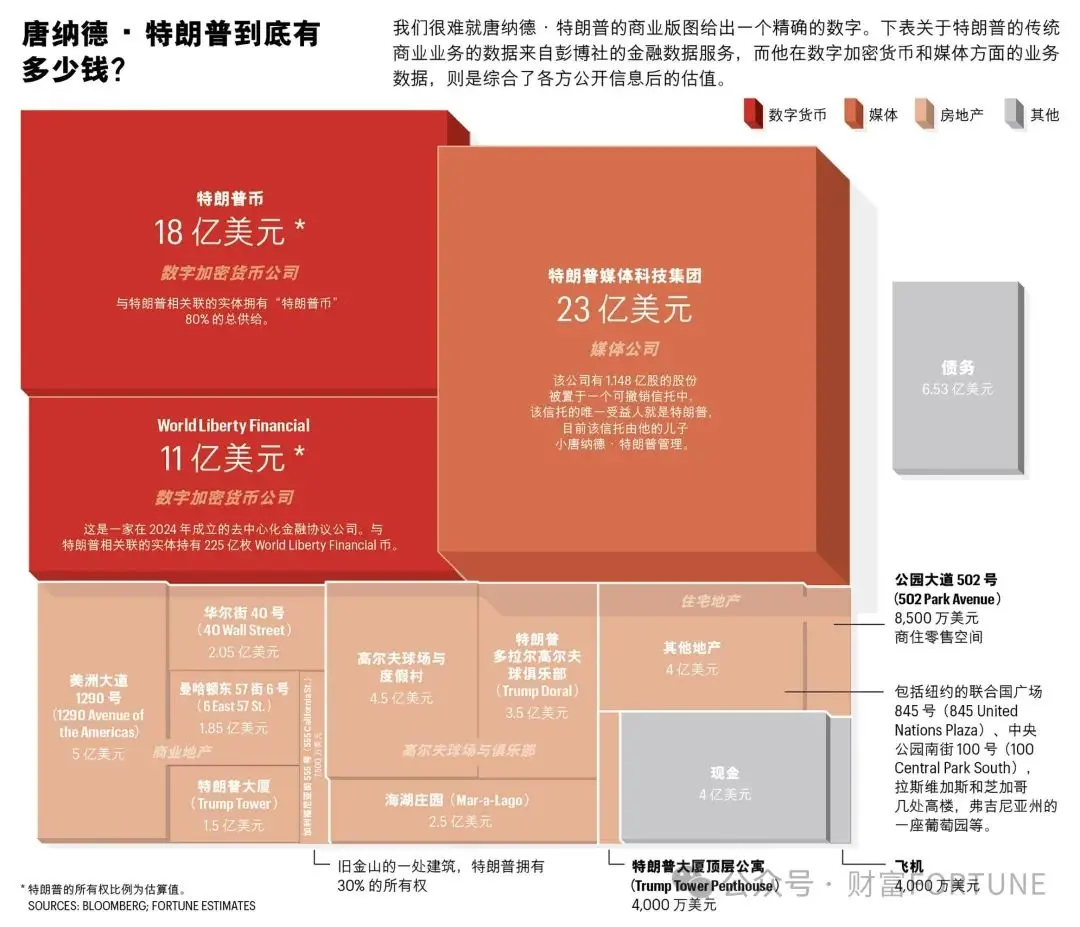

According to Bloomberg, as of mid-March this year, Trump's personal net worth was approximately $4.8 billion. This figure does not include the potential earnings Trump may receive from his two digital currency projects—currently, we do not know the specific value of these two digital currency projects, but Fortune magazine estimates their value could be around $2.9 billion. However, a source close to Trump claims that his actual net worth is higher than Bloomberg's estimate, and that the value of "Trump Coin" alone exceeds $10 billion. But this source did not provide evidence for this claim, so Fortune could not verify this figure. According to Forbes, Trump's net worth during his first term was about $3.7 billion.

To clarify this issue, Fortune reviewed hundreds of pages of financial disclosure documents and interviewed seven observers and experts. We also contacted the Trump Organization, Trump Media & Technology Group, and World Liberty Financial. The results we collected, while covering various aspects, remain incomplete. The structure of Trump's business empire is extremely complex, with multiple LLCs nested like Russian dolls, intertwined with other entities, making it difficult to trace the sources and scale of his wealth. Additionally, his digital currency accounts and the ownership structure of these digital currency projects are almost completely opaque. Due to the reporting rules of the U.S. Securities and Exchange Commission, the stock situation of Trump Media & Technology Group is relatively clear. But even in this regard, the company has only provided minimal disclosures. It does not hold quarterly earnings calls and does not provide any metrics about its user base. In this regard, Libowitz said, "We just need to remember that Trump's financial situation is unlike any other politician in the world; all businesses are controlled by LLCs that are nested like Russian dolls."

In response, White House Press Secretary Karoline Leavitt stated, "President Trump has given up his multi-billion dollar business empire for the country; he has made great sacrifices for the nation." She noted that Trump submits financial disclosure reports every year. As for those who believe Trump's business activities leave opportunities for corruption, Leavitt argued that "this view is unreasonable and absurd." She also pointed out, "The American public clearly does not agree with this view; otherwise, they would not have overwhelmingly re-elected Trump to the White House." She added, "The name Trump, and the Trump brand, have reached an unprecedented height."

The 1.0 Era of Trump's Business Empire: Hotels, Golf Courses, and the Name Trump Itself

Since the 1970s, the world gradually became acquainted with the Trump brand. At that time, Trump was just a somewhat ambitious young real estate businessman in New York City, known for his tendency to boast and promote himself. In 1971, just three years after graduating from the University of Pennsylvania, his father Fred appointed him president of the family business—then called Trump Management. The first thing Trump did upon taking office was to merge the family's scattered businesses into a new corporate entity—the Trump Organization.

However, Trump's path to becoming a real estate mogul was not smooth sailing. There was a time when he was deeply in debt, and several of his casinos went bankrupt, prompting him to seek low-risk sources of income. While Trump continued to develop his real estate projects, he also found a lucrative business in licensing his name for use in other real estate projects. This business even expanded to countries like Turkey, Uruguay, and Oman. Now, whether in Manhattan, the U.S., or around the world, it is not difficult to find buildings adorned with the shiny "TRUMP" name. Trump has a penchant for gold, as if only this high-end color can signify that these buildings are not ordinary but luxurious properties certified by him.

The Trump Organization has always been a family business, and since 2017, the actual controllers of the company have become his two sons—Donald Jr. and Eric. According to the Trump Organization's official website, the company now operates across four continents, owns 20 golf courses, and has more than 30 self-operated or licensed buildings. Although Trump's identity is no longer that of a "builder" who made his fortune from construction, these buildings remain a major component of his personal wealth.

The difficulty in accurately estimating the value of the Trump Organization is partly because it is a private company, and partly because, like other real estate companies, it sometimes manipulates the real estate values it reports to obtain better interest rates or tax benefits. (In February 2024, a New York judge fined Trump and his companies $355 million for lying about property values, constituting fraud against banks and insurance companies. Trump has chosen to appeal.) Currently, the total value of the real estate held by the Trump Organization is approximately $2.65 billion, accounting for about half of our estimated net worth for Trump, not including his digital currency holdings.

Trump Media & Technology Group: Truth Social, Truth.Fi, and Other Media and Financial Technology Projects

In 2021, facing relentless attacks and a complete ban from American social media, Trump made a strong comeback by establishing another company named after himself—Trump Media & Technology Group. Shortly after the Capitol riot on January 6, 2021, Trump sat down with two contestants from The Apprentice and devised a plan to create his own social media company. (However, later, his accounts on Facebook and X were restored.)

In the following years, a social platform called Truth Social, similar to Twitter, became the flagship product of Trump Media & Technology Group. Since then, the company has slowly expanded into other digital business areas. In 2024, the same year the company went public, Trump Media & Technology Group launched a streaming service called Truth+. At the beginning of 2025, the company announced a partnership with Charles Schwab to launch a fintech platform called Truth.Fi.

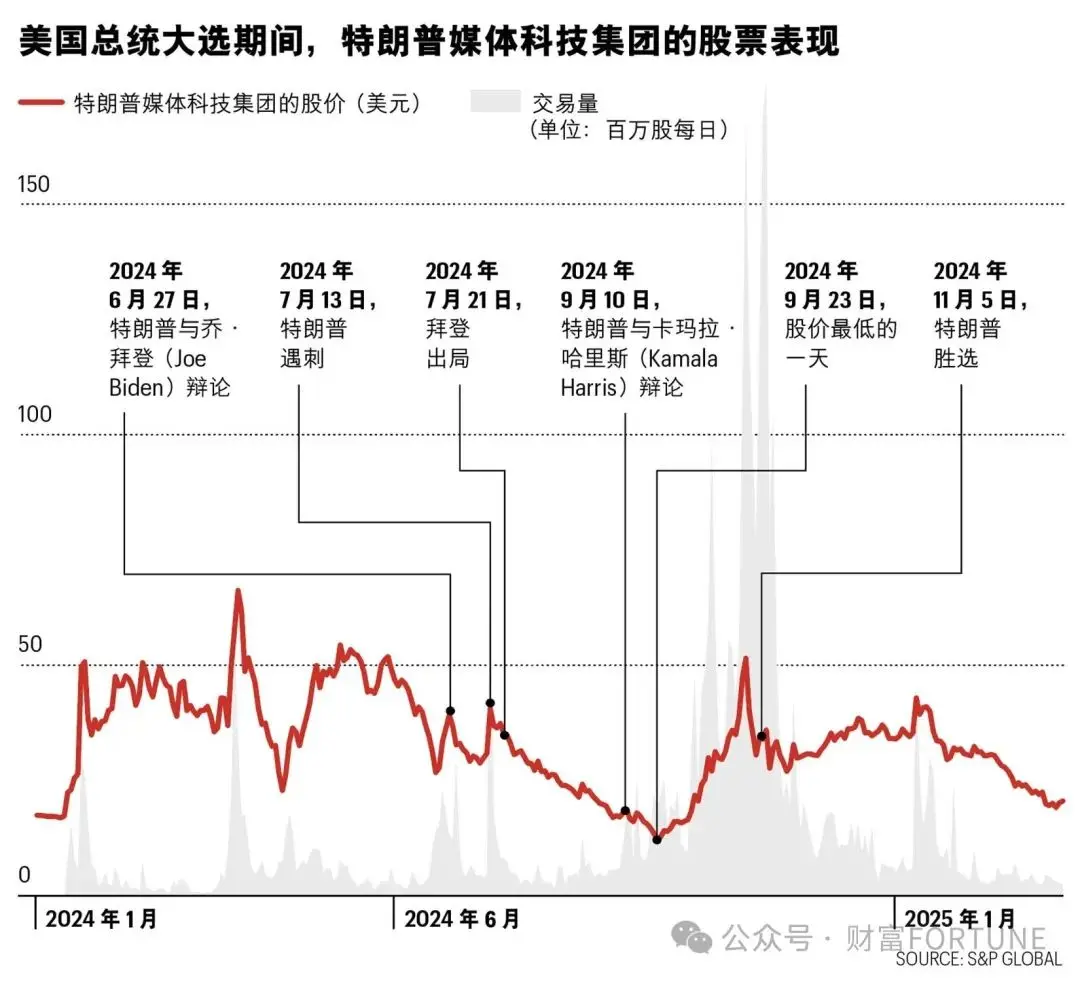

Since its establishment in 2021, Trump Media & Technology Group has faced a rocky development path. First, it was sued multiple times by internal investors, and then it faced penalties from the U.S. Securities and Exchange Commission. However, it ultimately went public in March 2024 through a special purpose acquisition company (SPAC) model. This move created significant value for Trump. It is Trump's personal brand that has given this fledgling tech company a trustworthy aura. On the first day of Trump Media & Technology Group's listing on Nasdaq, the value of the shares held by Trump himself was $6.7 billion. Currently, the value of Trump's shares in Trump Media & Technology Group is approximately $2.3 billion.

From a business perspective, Trump Media & Technology Group can only be described as performing mediocrely. By the end of 2024, the company's revenue was only $3.6 million, while its operating loss reached $400 million. There is a significant gap between the financial performance of Trump Media & Technology Group and its stock price, which is extremely rare. Especially since the company has disclosed very little information, this naturally leads to more speculation. In the latest annual report, Trump Media & Technology Group still did not provide investors with any timeline for when the company's financial situation might improve, stating that it is "too early" to do so.

In terms of popularity, Truth Social lags behind several mainstream competitors. According to data from market research firm Similarweb, in February of this year, Truth Social had an average of only 304,000 daily active users in the U.S., which, although a 12% increase from January, is clearly incomparable to X's 25 million daily active users in the U.S., and pales in comparison to Meta's Facebook (101 million) and Instagram (93 million). (A spokesperson for Trump Media & Technology Group condemned Fortune's reporting on the company as inaccurate but did not provide any details.)

Although Trump Media & Technology Group's performance is poor and its user numbers are dismal, it is remarkable that there are still 650,000 retail investors firmly holding shares in Trump Media & Technology Group—many of whom are simply expressing their political support for Trump.

When discussing the Trump brand, Cait Lamberton, a marketing professor at the Wharton School, pointed out, "Some people may raise a series of questions, but others would argue that this precisely demonstrates the brand's success, or at least its extraordinary resilience."

Of course, many tech companies initially lose money while gaining attention, and Trump Media & Technology Group is no exception. Moreover, the company's balance sheet is quite healthy. Currently, Trump Media & Technology Group boasts $777 million in cash and short-term investments, with total liabilities of only $25 million. About $450 million of this cash comes from a stock purchase agreement with a small financial company in New Jersey called Yorkville Advisors, which is also the registered investment advisor for the Truth.Fi project.

Executives at Trump Media & Technology Group have stated that this cash will be used to expand into new business areas. Earlier this year, the board of Trump Media & Technology Group approved funding for potential acquisition projects.

The company's filings with the U.S. Securities and Exchange Commission indicate that its goal is to build an "irrevocable tech company." Currently, Trump Media & Technology Group is steadily moving in this direction, actively building its proprietary technology infrastructure rather than relying on third-party vendors.

The initial plan for Truth.Fi is to establish six ETF funds that will invest in U.S. energy companies and manufacturing, as well as in the area of digital currency, which Trump has recently become particularly obsessed with.

Trump and the Crypto Space: World Liberty Financial Project and "Trump Coin"

In his second term, Trump has seemingly become a "crypto president." Just a few years ago, he denounced Bitcoin as a "scam." So, what caused his position to undergo a 180-degree turn?

It turns out that after the end of Trump's first term in 2021, he experimented with so-called NFTs, or "non-fungible tokens." NFTs are a type of digital crypto asset typically used to represent digital artwork and have strong speculative attributes. According to financial disclosure reports, Trump launched his first NFT series in 2022, and over the next year and a half, he earned approximately $7 million from NFT transactions.

David Krause, a business professor at Marquette University, stated that NFTs were the "gateway drug" that got Trump hooked on the crypto space. From then on, he realized that digital assets represented a huge business opportunity.

In the U.S., blockchain technology is largely unregulated, allowing speculators to issue their own digital currencies at will, with values not tied to anything other than the project's own brand. On the other hand, it does not require the same level of disclosure as traditional investment tools or provide other consumer protection measures. Although most digital cryptocurrencies on the market can be tracked through blockchain technology (for example, through online, publicly verifiable ledger technology), it is still difficult to identify the entities controlling and trading these crypto wallets. Due to the lack of effective regulation of digital cryptocurrencies, it is nearly impossible to know who the behind-the-scenes forces are for Trump's digital currency projects or how these projects are connected to Trump.

During the 2024 U.S. presidential election, the American digital cryptocurrency industry spent $200 million on campaign support, openly stating that whoever supports the development of the crypto space will receive support from the crypto space. Trump has since fully aligned himself with the crypto space, frequently speaking at industry events and announcing plans such as a government Bitcoin strategic reserve.

Although Trump did not make much money through NFTs, he quickly began further exploring digital assets. In the summer of 2024, Trump and his sons began heavily promoting a digital cryptocurrency project called World Liberty Financial. Trump's son Eric posted on X in August 2024, stating, "A new era of finance has arrived!" Although they provided few details, it was soon reported that the platform would allow eligible investors to purchase a unique token, despite this token lacking a clear practical use. The token began public sales in October 2024.

Alexander Blume, founder and CEO of the digital asset investment firm Two Prime, noted, "When they first launched this coin, it wasn't very popular; you could say it failed. But after Trump was re-elected, everyone started buying this coin again."

Unlike digital cryptocurrencies like Bitcoin or Ethereum that can be traded on exchanges, the "World Liberty Financial Coin" has a fixed price and is non-transferable, sold only to eligible investors. Its function is similar to a "governance coin," allowing users to interact with decentralized financial applications (like lending protocols). "Governance coins" are not uncommon in the crypto space; popular platforms like Uniswap and Aave each have their own governance coins, with market capitalizations reaching billions of dollars. However, unlike World Liberty Financial Coin, they can be traded on their respective exchanges and have specific functions. As for World Liberty Financial Coin, Blume stated that so far, "it has no value other than people's perceived value."

According to the official website of the World Liberty Financial project, entities associated with Trump hold a total of 22.5 billion World Liberty Financial Coins, while the remaining coins are sold at prices ranging from 1.5 cents to 5 cents each. These entities also receive 75% of the sales revenue.

Zaheer Ebtikar, founder of the digital currency hedge fund Split Capital, pointed out that due to the very vague vision of the World Liberty Financial project, combined with the fact that the project's official advisors are Trump's three sons, the market views World Liberty Financial Coin merely as a way to "establish some connection with the Trump family." In other words, it's about buying into a sentiment.

In response to claims that World Liberty Financial Coin has no practical use, a spokesperson for the World Liberty Financial project refuted this. "The World Liberty Financial platform will continue to expand, and ultimately it will connect traditional financial markets with blockchain technology." However, they also noted that World Liberty Financial is not a political organization.

One of the largest buyers of World Liberty Financial Coin is Hong Kong crypto businessman Sun Yuchen, who has previously faced lawsuits from the U.S. Securities and Exchange Commission for alleged fraud. However, Sun's lawyer denied the allegations, claiming that the SEC's lawsuit against him was an attempt to "completely control digital assets." In November 2024, Sun purchased $30 million worth of World Liberty Financial Coin and subsequently became an official advisor to the project. He later invested an additional $45 million in the project. The SEC announced in late February this year that it would suspend its lawsuit against Sun. A spokesperson for the World Liberty Financial project stated that Sun's investment was "purely based on the project's value and market potential."

The World Liberty Financial project has already used part of the funds raised from coin sales to accumulate a portfolio of other digital cryptocurrency assets, including Bitcoin and Ethereum, as well as some lesser-known coins.

Ebtikar believes that some investors may view World Liberty Financial as a weighted index of a series of digital currency assets, which may one day be used for trading or for financial purposes, including lending. Ebtikar said, "This could lead to an interesting outcome."

While investors in the crypto space are still debating the utility of World Liberty Financial Coin, Trump has already begun another attempt in the crypto space—issuing his personal coin. Of course, this coin also seems to have no practical use. "Trump Coin" officially launched on the Friday before his inauguration (on that day, a group of industry leaders was hosting a dazzling crypto industry gala in Washington, D.C.), giving speculators another opportunity to ride the wave.

In this regard, Krause stated, "Many people really like Trump; they would even buy the air that Trump endorses. Trump Coin has no real value."

Like many other businesses under Trump's name, the structure of this project is also quite opaque, with 80% of the total supply of Trump Coin held by several entities associated with Trump, and all Trump Coins will be gradually issued over three years. As of mid-March this year, the trading price of Trump Coin was approximately $11, with a total planned issuance of 1 billion coins. So theoretically, Trump stands to profit billions from selling the coins. However, the project's market value has already plummeted nearly 85% from its peak at the time of issuance.

According to blockchain analysis firm Chainalysis, several entities associated with Trump have earned up to $350 million in transaction fees and commissions, although this figure does not include losses from the subsequent decline in coin value.

Since digital cryptocurrencies remain largely outside the regulatory purview of government agencies, and the Trump administration continues to push for deregulation, critics argue that Trump's various crypto projects effectively provide foreign officials and entities with opportunities for "indirect bribery," allowing them to invest in Trump's businesses outside the scrutiny of the American public.

Krause said, "Is this a scam, greed, or genius? To some extent, it is all three. This reflects Trump's marketing genius." (Wealth Chinese Network)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。