USD1 has rapidly risen with a market capitalization of $2.1 billion, thanks to its dollar-pegged mechanism, strong political support, and rapid ecological expansion.

Written by: Oliver, Mars Finance

On May 22, 2025, Bitcoin broke through the historical high of $110,000, igniting excitement in the crypto market. However, Bitcoin's glory was just the prelude to this wave of enthusiasm, as a stablecoin named USD1 quietly took center stage. Launched by the DeFi project World Liberty Financial (WLFI), backed by the Trump family, USD1 is a dollar-pegged stablecoin that sparked a frenzy of ecological tokens after Binance announced support for its trading pair. Within just one day, the token related to USD1, BUILDon, surged by 480%, while usd1doge skyrocketed tenfold, completely igniting market sentiment.

Binance "Ignites": USD1 Trading Pair Explodes the Market

At 8 PM on May 22, Binance officially launched the USD1 trading pair, becoming the third mainstream exchange to support USD1 after HTX and MEXC. This news was like a bomb dropped into the market, quickly igniting the trading of tokens related to USD1. BUILDon (token B) on the Binance Alpha platform was the first to respond, surging 480% within six hours, with a daily increase of 192%, pushing its market capitalization to over $220 million, setting a new historical high. In the community, investors excitedly discussed, "USD1 is set to take over from FDUSD and become Binance's new favorite!"

BUILDon is not an isolated case. The meme coin usd1doge, pegged to USD1, achieved an astonishing tenfold increase within 24 hours, with its market capitalization soaring from $130,000 to $2 million, although it later fell back to $730,000, its performance was still jaw-dropping. Another token, EAGLE, also did not lag behind, being the first project on the Ethereum chain related to USD1, reaching a maximum daily increase of 1067%, with its market capitalization touching $3.74 million at one point. On Binance's gainers list, tokens like LISTA and STO also performed well, rising 46.62% and 20% respectively, as market confidence in the "WLFI concept" and "Binance ecosystem" projects surged.

The direct catalyst for this wave of enthusiasm was Binance's support for USD1. USD1 was launched by WLFI in March 2025, positioned as a stablecoin pegged 1:1 to the dollar, with reserve assets fully backed by short-term U.S. Treasury bonds and dollar deposits, and the custodian being BitGo Trust Company. With strong backing from the Trump family, co-founder Eric Trump's involvement brought inherent traffic to USD1. Within two months, its market capitalization skyrocketed from $128 million to $2.1 billion, making it one of the top seven stablecoins globally. More importantly, USD1's circulation on the BNB chain accounts for as much as 90%, and the trading pair launched by Binance undoubtedly injected new vitality into this ecosystem.

Hot Money Surge: The Catalytic Effect of the Trump Label

The rise of USD1 is not coincidental; it is backed by the dual forces of "dollar hot money + Trump label." In early May, the Abu Dhabi investment firm MGX injected $2 billion into Binance through USD1, an event that not only boosted USD1's market capitalization but also showcased its strong resource integration capabilities. Binance founder Zhao Changpeng publicly stated on May 16 that this investment was completed entirely through USD1 and was unrelated to the TRUMP meme coin being hyped in the market. This statement further legitimized USD1 and filled investors with anticipation for the deep binding between Binance and USD1.

Even more noteworthy is that there are deeper geopolitical layouts hidden behind USD1. On May 23, The Wall Street Journal cited informed sources reporting that Trump's Middle East envoy, Steve Witkoff, had flown to the UAE a month before Trump took office to discuss regional issues and participate in a crypto-themed conference. His son, Zach Witkoff, founder of WLFI, compared Trump to a "godfather" while promoting to crypto companies, claiming that WLFI would fully leverage the increasingly relaxed cryptocurrency regulatory policies in the U.S. Moreover, Zach Witkoff had visited Pakistan, meeting with high-level government officials to propose the idea of "tokenizing" the country's rare earth mineral trade using blockchain technology—weeks later, these officials began negotiations with the Trump administration regarding a ceasefire agreement between India and Pakistan. The person who helped WLFI connect some overseas trips was none other than Binance founder Zhao Changpeng (CZ), although WLFI's spokesperson clarified that CZ was merely a friend of Zach and not a "middleman." Additionally, the WLFI team has discussed token purchase matters with companies in the Gulf region, suggesting that such transactions could assist their expansion in the U.S., although this claim was denied by the company's spokesperson. This series of actions indicates that USD1's ambitions extend far beyond the stablecoin market, attempting to deeply integrate crypto technology with geopolitical strategies to open new avenues.

In the community, some speculate that Binance is "testing the waters" with USD1 through the Alpha platform, intending to make it the core stablecoin of the BNB Chain. After all, USD1 has already achieved multi-chain deployment through Chainlink's CCIP protocol, covering Ethereum, BNB Chain, and Tron, with its ecological expansion speed being astonishing. WLFI co-founder Zack Witkoff revealed on May 1 that USD1 would be natively deployed on the Tron chain, a decision closely related to the investment from Tron founder Justin Sun. As WLFI's largest individual investor, Justin Sun invested $75 million, and his influence undoubtedly supports USD1's multi-chain layout.

Ecological Token Frenzy: Opportunities and Bubbles Coexist

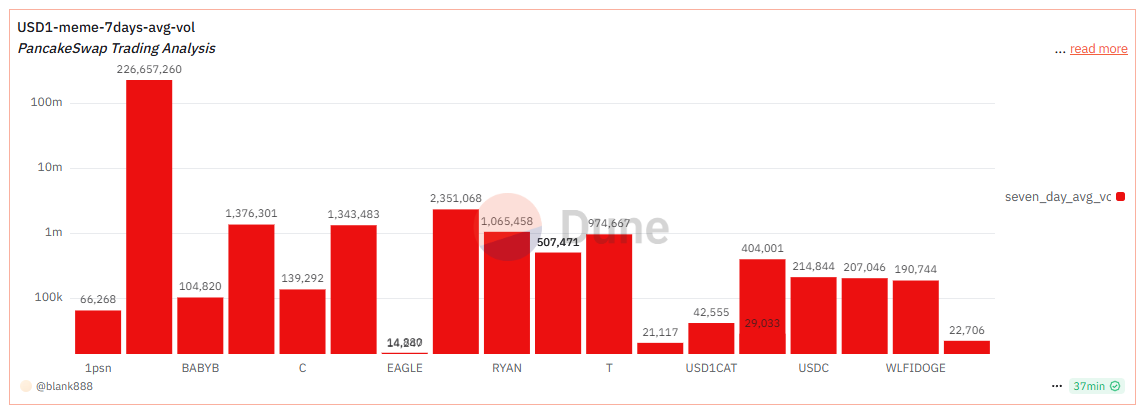

The launch of the USD1 trading pair not only led to a surge in tokens within the Binance ecosystem but also alerted investors to Alpha opportunities. Take BUILDon as an example; this token, fairly launched through the Four.meme platform, was originally just a mascot promoting BSC construction culture, but due to WLFI's support and the USD1 craze, it became the market focus. PancakeSwap data shows that BUILDon's trading volume reached $220 million over seven days, far exceeding other tokens, with an average of 27,487.9 trades per day, indicating high market attention. WLFI officially announced the purchase of token B and the initiation of the USD1 construction plan, which was seen as an important signal for the USD1 ecosystem, quickly igniting investor enthusiasm.

At the same time, protocol tokens collaborating with WLFI also became targets of market pursuit. The token LISTA of Lista DAO rose 46.62% on May 22, as its lending product Lista Lending launched the USD1 Vault, providing the first application scenario for USD1 on the BNB Chain. The token STO of StakeStone rose 20% due to its integration plan with USD1, offering higher asset utilization for USD1 users through its cross-chain yield products. These collaborations not only enhanced USD1's practicality but also brought traffic and funding to related projects.

However, beneath the excitement, the shadow of a bubble is also becoming apparent. The prices of usd1doge and EAGLE significantly retreated in a short time, reflecting strong speculative sentiment in the market. In the community, some excitedly discuss the "next tenfold coin," while others calmly remind, "Such surges are often short-lived, and chasing high carries significant risks." Indeed, while the token frenzy within the USD1 ecosystem has brought opportunities, its sustainability remains to be observed.

USD1's Ambition: From Payment Tool to Ecological Core

The success of USD1 lies not only in the trading pair frenzy but also in its comprehensive ecological construction. It has integrated over 10 DeFi protocols, including Venus Protocol, Meson Finance, and Pyth Network, covering various fields such as lending, cross-chain trading, and oracle services. In consumer scenarios, USD1 has also demonstrated strong expansion capabilities. Decentralized wallets TokenPocket, HOT Wallet, and the Web3 travel platform Umy have all supported USD1, allowing users to book over a million hotels worldwide using USD1. The payment ecosystem Pundi X has also fully integrated USD1, laying the foundation for its application in retail scenarios.

WLFI co-founder Zach Witkoff stated that USD1's goal is to provide secure and efficient cross-border payment tools for institutional clients, with plans to integrate with traditional retail POS systems in the future. This vision inevitably brings to mind the successful paths of USDT and USDC. However, USD1 still has a long way to go to challenge the "dual giants" of the stablecoin market. The transparency of its reserve assets and the stability of its pegging mechanism need to withstand market tests, and the political risks brought by the Trump label cannot be ignored.

Conclusion

The rise of USD1 has injected a shot of adrenaline into the Binance ecosystem and brought a new narrative to the crypto market. From the surge of BUILDon to the linkage of LISTA and STO, the market's enthusiasm for the "Trump concept" is creating a wave of excitement. For investors, the Alpha opportunities within the USD1 ecosystem may be hidden, but high returns often come with high risks. In this crypto feast, maintaining calm and rationality is particularly important. Can USD1 establish a foothold in the stablecoin market and even challenge the positions of USDT and USDC? This wave of enthusiasm sparked by the Trump family's endorsement may just be the beginning of the story.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。