30,000 TPS, 1 Second Final Confirmation, Will Pharos, Founded by Core Members of Ant Group, Become the Core Hub Linking Real-World Assets and the Web3 World?

Written by: KarenZ, Foresight News

On May 16, Pharos, an EVM-compatible Layer 1 project founded by former executives of Ant Group, announced the official launch of its testnet.

As a modular blockchain focusing on high performance and RWA on-chain, it claims to achieve a transaction performance of 30,000 TPS and 1 second final confirmation. Additionally, its blockchain-based verifiable storage solution can save storage costs by 80.3%, attracting market attention to the new generation of Web3 infrastructure. This article will introduce Pharos from the perspectives of team background, technical architecture, ecological layout, and interaction methods.

Team Background

The core team of Pharos consists of former blockchain backbones from Ant Group and former executives from leading Web3 projects:

Founder Alex Zhang: Former CTO of Ant Blockchain, former CEO of Ant Group's Web3 project ZAN, and head of Alibaba DAMO Academy's Blockchain Lab.

Co-founder and CTO Wish Wu: Former Chief Strategy Officer of Ant Group's Web3 project ZAN.

CMO Laura Serein: Formerly worked at Solana, PayPal Crypto, and Visa.

Ecosystem Director Wilguish: Formerly worked at Wormhole.

Pharos is currently hiring for positions such as Senior Blockchain Engineer (C++), Social Media Director, Web3 Research Intern, and Blockchain R&D Intern (C++).

In terms of financing, in November 2024, Pharos announced the completion of an $8 million seed round, led by Lightspeed Faction and Hack VC, with participation from SNZ Capital, Reforge, Dispersion Capital, Hash Global, Generative Ventures, Legend Star (Lenovo's early investment and incubation sector), MH Ventures, Zion, and Chorus One. At that time, Pharos co-founder and CEO Alex Zhang revealed to The Block that this round of financing began fundraising in July and was completed in September, using a Simple Agreement for Future Equity (SAFE) format, accompanied by token warrants.

In March 2025, Pharos also launched a $20 million ecosystem grant program aimed at promoting innovation and growth within the ecosystem by providing funding and support to projects that contribute to Pharos's technological advancement and application.

Additionally, according to researcher @WorldOfMercek, Pharos will launch its mainnet in the third quarter, at which point $300 million in renewable energy RWA assets will be put into use (according to @_FORAB, Pharos has already secured a commitment for $300 million in RWA assets). In the fourth quarter, SPN will be launched and the RWA environment optimized, with plans to expand new asset types and introduce more institutional partners in 2026.

How is Pharos Architected?

Pharos is an EVM-compatible modular and full-stack parallel L1 blockchain network, focusing on high throughput, low latency, and scalability, while supporting heterogeneous computing and cross-chain interoperability. Its core goal is to provide enterprise-level infrastructure for Web3 applications while supporting the integration of RWA and DeFi. From Pharos's documentation, the Pharos framework is similar to the Cosmos SDK, supporting the construction of L1 or L2 on this infrastructure.

From a macro system perspective, Pharos adopts a three-layer architecture:

1. L1-Base (Base Layer): Provides data availability and hardware acceleration capabilities.

2. L1-Core (Core Layer): A high-performance globally distributed blockchain network driven by decentralized nodes.

3. L1-Extension (Extension Layer): A modular extension layer based on L1-Core, supporting network expansion in three dimensions:

Creating customized special processing networks (SPNs) using heterogeneous computing: Supports running blockchain networks, sidechains, or non-blockchain applications (similar to subnets), such as HFT, ZKML, and AI models.

Native re-staking: Validators can re-stake mainnet staked tokens to SPNs, achieving secure sharing, staking reward distribution, and penalty mechanisms.

Cross-SPN interoperability: Achieves seamless asset and data flow between different networks through cross-SPN protocols, supporting the collaboration of infrastructure-type, middleware-type, and application-type SPNs, building a highly modular composable ecosystem.

From the functional module perspective, the Pharos modular blockchain stack is divided into consensus layer, execution layer, settlement and re-staking layer, and data availability layer.

Consensus Layer: Pharos supports multiple consensus models, including PBFT, PoS, and PoA, ensuring effective communication and verification between SPNs and the main network. The Pharos network topology and consensus mechanism utilize three basic node types: validator nodes, full nodes, and relay nodes. Validator nodes operate based on a Byzantine Fault Tolerance (BFT) proof-of-stake protocol, ensuring network security and efficiently processing user transactions. In addition to transaction fees and staking rewards, validators can also earn additional income through re-staking. Full nodes and relay nodes support the distribution of blockchain data and provide services such as state synchronization, parallel hint generation, indexing, querying, and APIs.

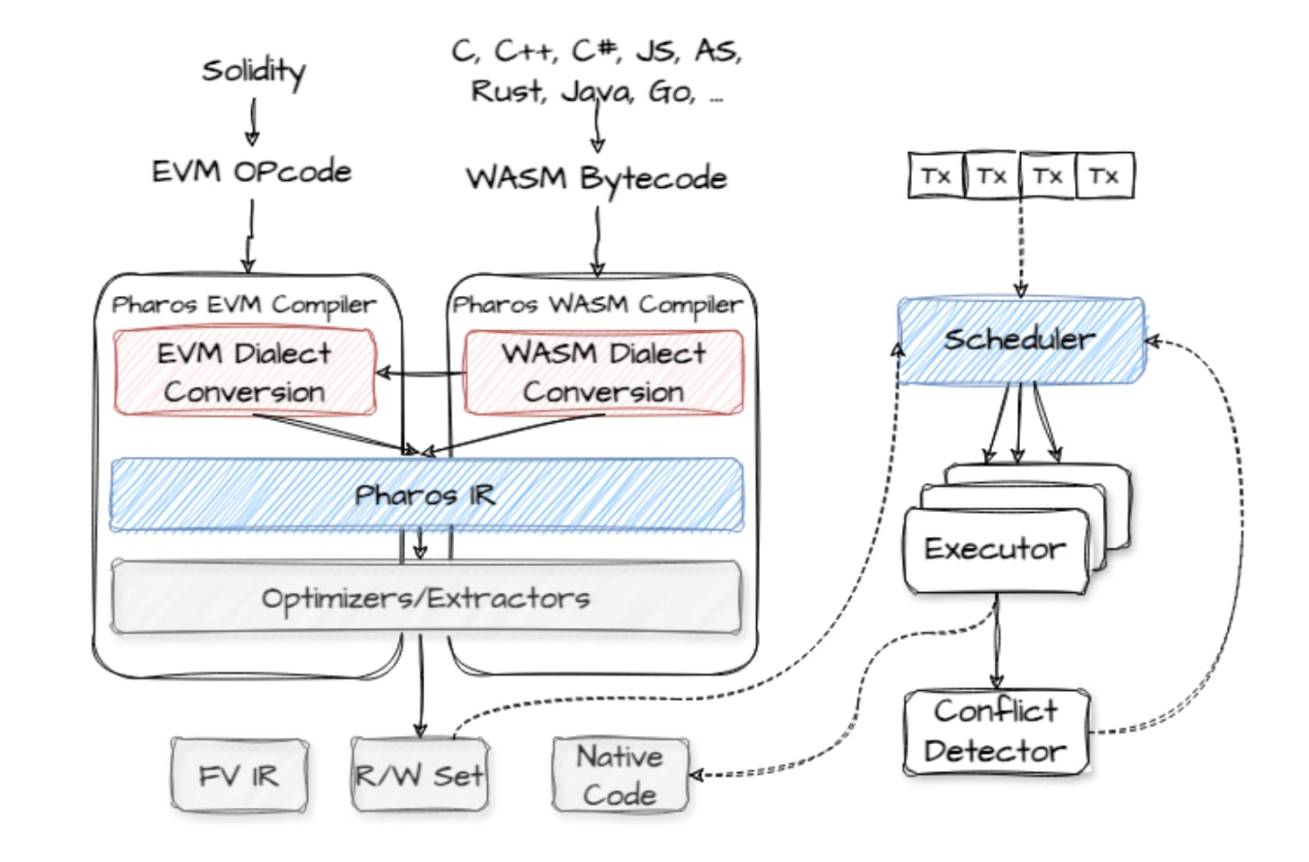

Execution Layer: There are two key components: the scheduler and the executor. The scheduler is the core component for parallel scheduling and executing transactions, utilizing optimization algorithms to achieve maximum parallelism and minimal conflict; the executor uses a dual virtual machine (EVM and WASM) engine to quickly and flexibly execute smart contracts. Pharos also employs optimistic execution and the "Pipeline Finality" algorithm, allowing execution results to quickly converge and effectively determine the final state. In the Pipeline Finality algorithm, Pharos prioritizes transaction finality to enhance user experience and sets a maximum final time for each block.

Source: Pharos

Settlement and Re-staking Layer: Validators in the main network can participate in SPN re-staking, thereby enhancing dual rewards for both SPNs and the main network. Using the Pharos re-staking protocol, SPNs can be quickly launched, ensuring shared security, resource pooling, and incentivizing validators.

Additionally, Pharos supports multi-asset protocols and can seamlessly integrate with re-staking protocols such as Babylon and Eigenlayer, thereby expanding the interoperability and security of the entire network.

Data Availability Layer: Utilizes authenticated data structures (ADS) to achieve high throughput and low latency storage. Pharos states that its blockchain-based verifiable storage solution can achieve up to 15.8 times the throughput, with storage costs saving 80.3%. For SPNs, the combination of cross-SPN protocols and native re-staking is said to achieve second-level finality.

Furthermore, the Pharos Gas model adopts the Ethereum Gas mechanism, compatible with EIP-1559 (base fee + priority fee). The base fee is dynamic and recalculated at each epoch.

Pharos's Ecological Potential and Application Scenarios

Pharos co-founder and CEO Alex Zhang revealed to The Block that real-time payments and RWA are the two main use cases prioritized by Pharos. Pharos has also established a strategic partnership with Ant Group's Web3 brand ZAN, aiming to jointly develop Web3 infrastructure focused on node services, security, and hardware. Alex Zhang emphasized that the collaboration with ZAN will focus on RWA use cases, while another collaboration with the Global Stablecoin Payment Network (WSPN) will also focus on stablecoin payment use cases.

According to the description on Pharos's official website, Pharos has the following use scenarios:

Institutional-level RWA tokenization: Supports on-chain and off-chain credit systems for assets such as renewable energy, real estate, and supply chain finance through zkDID certification. Pharos's CTO has stated that the RWA application of Pharos aims to use trusted data and blockchain technology for asset pricing, rather than relying on centralized financial institutions.

Full-chain central limit order book contracts or spot DEX: Supports advanced order types such as take profit, stop loss, and time-weighted average price (TWAP).

Real-time payments: Leveraging 1-second finality and extremely low transaction costs to help achieve a seamless mixed payment system.

Scalable DePIN

Unified liquidity across multiple virtual machines: Supports cross-virtual machine interoperability of EVM and WASM smart contracts, allowing developers to build cross-chain applications under a unified account system, reducing multi-chain deployment costs.

How to Interact?

Considering that Pharos adopted the SAFE format in its seed round financing last year, accompanied by token warrants, and that the testnet has deployed the native token PHRS as network fees, we can reasonably expect Pharos to launch its native token. Pharos's official Twitter stated that within 24 hours of the testnet going live, there were over 110,000 real users.

Pharos's specific interaction strategy is as follows:

Connect Wallet: https://testnet.pharosnetwork.xyz/

Faucet for Test Tokens:

Scroll down the page to claim 0.2 PHRS every 24 hours (human verification required).

Claim 0.2 PHRS every 24 hours on the ZAN website (https://zan.top/faucet/pharos) (registration required).

Claim USDC or USDT at the faucet on https://testnet.zenithswap.xyz/faucet (the author failed to claim).

- Complete on-chain tasks and social tasks. (https://testnet.pharosnetwork.xyz/experience)

On-chain tasks include:

Swapping tokens on Zenith (https://testnet.zenithswap.xyz/swap) and providing liquidity;

Transferring PHRS tokens to other addresses;

Inviting friends.

- Then explore other ecological projects of Pharos. (https://testnet.pharosnetwork.xyz/ecosystem)

Challenges and Opportunities for Pharos

With the technical accumulation and resource integration capabilities of core members from Ant Group, Pharos may demonstrate differentiated competitiveness in areas such as RWA on-chain and high-performance DeFi. Its modular architecture and SPN design provide flexible customization space for enterprise-level applications, while EVM compatibility lowers the migration threshold for developers. However, balancing performance with decentralization, addressing regulatory compliance requirements (especially in the RWA field), and building a sustainable token economic model will be key challenges it faces after the mainnet launch.

As the testnet opens fully, whether Pharos can secure a place in the Web3 infrastructure race will depend on the speed of technological implementation, the efficiency of expanding ecological partners, and the acceptance of traditional financial institutions. If it can deliver on its performance promises and bridge the value loop between RWA and DeFi, it is expected to become a core hub linking real-world assets and the blockchain world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。