Author: Lawrence, Mars Finance

On May 19, 2025, Binance's Alpha platform officially announced that it will launch the SOON token ($SOON) on May 23, becoming the first trading platform to integrate this project. This move not only marks a key breakthrough for the Solana Virtual Machine (SVM) ecosystem in the Layer2 track but also signifies a new phase of large-scale application for modular blockchain technology. As a star project with over $22 million in funding in 2025, SOON aims to address the performance bottlenecks and cross-chain interoperability challenges of public chains like Ethereum with its architecture design of "decoupled SVM + OP Stack + configurable DA layer." The community-driven distribution mechanism and potential value capture ability in its token economics have garnered significant market attention.

1. Team Background: From Aleo to SVM Infrastructure, Assembling Top Industry Resources

The core team of SOON can be described as a "dream team" in the blockchain field.

CEO Joanna Zeng previously served as Vice President of the privacy public chain Aleo, leading the commercialization of zero-knowledge proof technology, and has accumulated extensive Layer2 development experience at institutions like Coinbase and OP Labs.

Chief Marketing Officer Ruki Hu comes from Hong Kong's top investment bank JDI Global, where she led investments in SVM ecosystem projects like Sonic SVM. Her strategic management background from the HSBC Business School at Peking University provides methodological support for SOON's market expansion.

Technical lead AndrewZ is a Rust language expert who participated in the development of Solana's core client and has deep experience in optimizing the SVM architecture.

Notably, SOON's advisory team includes heavyweight figures such as Solana co-founder Anatoly Yakovenko and Celestia core developer Mustafa Al-Bassam. This integration of "technology + capital + ecosystem" resources allows it to stand out quickly in the competitive Rollup track.

2. Financing Journey: Community-Based Fundraising Paradigm Innovation, $22 Million Building a Moat

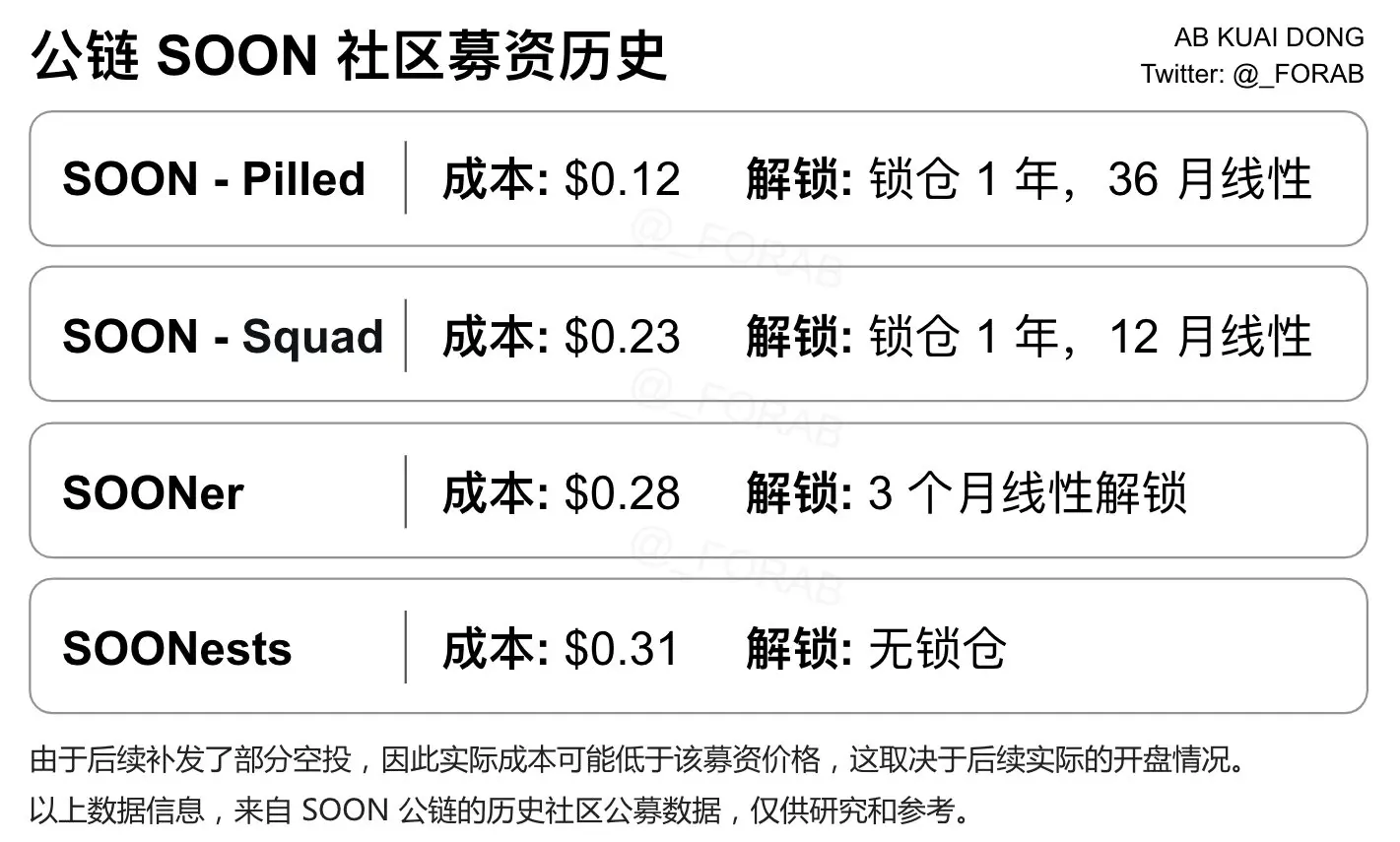

Image source: @_FORAB

SOON's financing path breaks the traditional venture capital-dominated model, pioneering an innovative fundraising mechanism of "NFT sale + community co-construction."

In January 2025, the project raised $22 million through tiered NFT sales, with 51% of the tokens distributed fairly through three types of NFTs: the $900 tier provides short-term liquidity with a 3-month linear unlock, the $2,850 tier is designed with a 12-month lock-up period to filter long-term holders, while the $22,500 high-threshold tier locks for 36 months, attracting strategic investors to participate deeply in ecosystem construction. This design avoids the impact of VC shares on secondary market sell pressure and distinguishes user risk preferences through time dimensions.

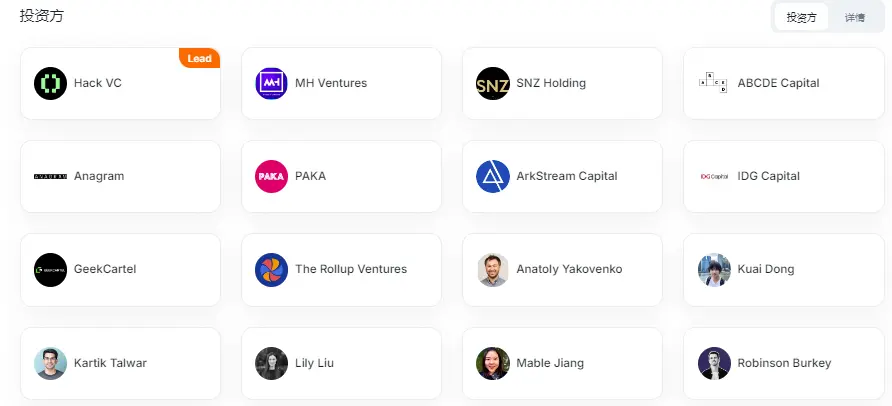

The lineup of investors also reflects industry recognition—top institutions like Hack VC and ABCDE Capital led the investment, with strategic backing from the Solana ecosystem fund and Celestia Labs, and even traditional capital like IDG and PAKA made rare investments. The funds are primarily directed towards three major areas: 40% for mainnet and cross-chain protocol development, 30% for developer ecosystem incentive programs, and the remaining 30% reserved for market volatility and security audits.

3. Technical Architecture: Decoupling SVM to Restructure Performance Boundaries, Modular Design Defining Industry Standards

SOON's technical innovations revolve around three core components:

1. SOON Mainnet: The First SVM Rollup Execution Layer on Ethereum

By decoupling the Solana Virtual Machine (SVM) from native consensus, the SOON mainnet achieves a block time of 50 milliseconds and a throughput of 30,000 TPS on Ethereum, more than five times the improvement over OP Rollups like Optimism. Its key technological breakthroughs include:

- Merklization Optimization: Utilizing Merkle root compression for state verification data, improving cross-chain transaction verification efficiency by 80%;

- Horizontal Scaling Architecture: Distributed nodes process transactions in parallel, combined with data availability solutions like EigenDA, allowing for elastic scaling up to 650,000 TPS;

- Native Cross-Chain Settlement: Using Ethereum as the final settlement layer while being compatible with modular DA solutions like Celestia and Avail, reducing Gas costs to 1/10 of Arbitrum.

2. SOON Stack: Multi-Chain Rollup Deployment Framework

Developers can deploy customized SVM Layer2 on public chains like BNB Chain and Ton with one click through SOON Stack. Testnet data shows that the svmBNB chain built on this framework has achieved 15,000 TPS and supports high-performance scenarios like AI agent trading and real-time game engines. This "Lego-style" architecture makes SOON the first universal Rollup solution spanning both EVM and non-EVM ecosystems.

3. InterSOON Protocol: Intermediary-Free Cross-Chain Communication Layer

Based on an improved messaging protocol from Hyperlane, it allows assets and smart contracts to interact directly across multiple chains, eliminating the custodial risks of cross-chain bridges. In test cases between Solana and Ethereum, the cross-chain transfer of USDC was reduced from an average of 8 minutes to 22 seconds, with transaction fees lowered by 95%.

SOON Token Investment Value Assessment: Unlocking Dual Risks of Sell Pressure and Valuation Bubble

Although SOON has attracted market attention with its innovative technical architecture and community-driven token distribution mechanism, its investment risks are significantly amplified under the dual pressure of token unlocking cycles and valuation model imbalances. The following analyzes its potential risks from the dimensions of structural flaws in token economics, market supply-demand imbalances, and comparisons with similar projects.

1. Token Unlocking Mechanism Hides Large-Scale Sell Pressure Risks

According to SOON's disclosed token distribution plan, 51% of the tokens are allocated through community distribution (including NFT presales), while the team and co-builders hold 10% of the share, and the foundation and ecosystem incentives account for 31%. Although the project emphasizes a "linear unlock" design, the actual unlocking pace may still trigger a market sell-off:

Short-term arbitrage motives of NFT holders: Among the 510 million tokens distributed to the community, the first tier (900 USD NFT) corresponds to 3,200 tokens that are only locked for 3 months. These investors have costs concentrated in the $0.28-$0.31 range, and if the price exceeds $0.5 in the early listing, profit-taking pressure will be quickly released. Historical data shows that retail investors sell off 65%-80% within 30 days after unlocking, which may lead to a circulation increase of over 50%.

Delayed impact of team and institutional unlocks: Although the 100 million tokens held by the team are set with a 12-month lock-up period, based on experiences from similar projects, core members typically reduce their holdings by over 40% after the lock-up period ends. Based on the current FDV (Fully Diluted Valuation), the potential sell pressure could reach $400 million. Additionally, the off-market shares held by strategic investors (like Hack VC and ABCDE Capital) may be transferred early through OTC markets, indirectly increasing secondary market supply.

Token dumping risk from ecosystem incentives: The ecosystem development fund, which accounts for 25% of the total (250 million tokens), uses a "release on demand" mechanism, but project parties often overissue rewards to attract developers. Referring to operational data from projects like Optimism, the actual circulation speed of ecosystem incentive tokens is 2-3 times faster than planned, potentially releasing an additional 50 million tokens each year.

2. Valuation Bubble: FDV/TVL Ratio Severely Deviates from Industry Benchmarks

Analyzing the fully diluted valuation (FDV) before the launch of the SOON mainnet, its preset total supply of 1 billion tokens, if calculated at the minimum valuation of the NFT presale ($0.9 million FDV), results in an FDV/TVL (Total Value Locked) ratio as high as 18.7 (assuming TVL is $5 million), far exceeding mature Layer2 projects like Optimism (2.3) and Arbitrum (1.8). Even when compared to Sonic SVM, which is also part of the SVM ecosystem (FDV $22 million, TVL $11 million), SOON's valuation still shows a significant premium, but the technological differentiation has yet to form a moat.

More alarmingly, market sentiment has already overdrawn technical expectations. Although the SOON mainnet TPS (30,000) is higher than mainstream Rollups, the Celestia DA layer it relies on has not undergone large-scale stress testing, and actual performance may be discounted by 30%-50%. If there are outages or security incidents after the mainnet launch, the supporting logic for FDV will quickly collapse.

3. Deteriorating Competitive Landscape: Shortened Window of Technological First-Mover Advantage

SOON's core narrative—decoupling SVM and modular architecture—is facing direct challenges from projects like Eclipse and Movement. Eclipse has secured $50 million in funding led by Polychain Capital and announced the deployment of a general Rollup based on SVM on Solana, with superior developer tool compatibility and ecosystem resource integration capabilities compared to SOON. Additionally, the cost advantage of Celestia's native DA layer (60% lower than SOON) further weakens the persuasiveness of its modular narrative.

In terms of market share, the SOON testnet has attracted only over 80 DApps to migrate, while the number of developers for Arbitrum and zkSync has exceeded 3,000 during the same period. The lag in ecosystem cold start may lead it to become a "technical laboratory" rather than an actual application layer.

4. Investment Advice: Risk Avoidance in High Volatility Periods

In summary, the SOON token will enter a period of concentrated risk release from May to August 2025:

- Short-term (1-3 months): The liquidity premium in the early stages of Binance Alpha's launch may push the price up to $0.4-$0.5, but as the first round of NFT unlocks approaches in August, market panic will trigger a correction, with support potentially dropping to $0.22.

- Mid-term (6-12 months): The unlocking of team and institutional tokens (Q1 2026) may create secondary sell pressure. If the TVL does not exceed $200 million during the same period, the FDV/TVL ratio will revert to the industry average, and the token price may be halved to the $0.1-$0.15 range.

- Long-term (over 1 year): As competition in the modular track intensifies, if SOON fails to achieve breakthroughs in cross-chain interoperability, the token may become a "governance tool," losing its value capture ability.

For investors with lower risk tolerance, it is recommended to observe on-chain data (TVL, cross-chain asset scale, developer activity) for three months after the mainnet launch, and to strategically position once technical validation and token supply-demand balance are achieved.

Conclusion: Valuation Traps Under Innovative Narratives

Although SOON's modular vision aligns with industry evolution trends, its token model design and market competitive landscape have yet to form a safety margin. When the technological halo fades, the resonance of unlocking sell pressure and valuation bubbles may lead to a double whammy. As the Layer2 war enters the decisive phase of "application landing," investors should focus more on the genuine value creation of the ecosystem rather than the inward competition of technical parameters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。