JPMorgan Analyzes the Performance of Leading Cryptocurrencies in April

- Bitcoin has outperformed gold over the past year

- Bitcoin's outlook remains positive

This marks a stark turnaround from a few months ago when Bitcoin was languishing around $80,000. JPMorgan's research found that Bitcoin's price continued to strengthen in April, with an even more rapid increase in May.

In the weeks prior, the market had suffered a severe blow—U.S. President Trump announced comprehensive tariffs, triggering fears of a global trade war and putting pressure on international markets.

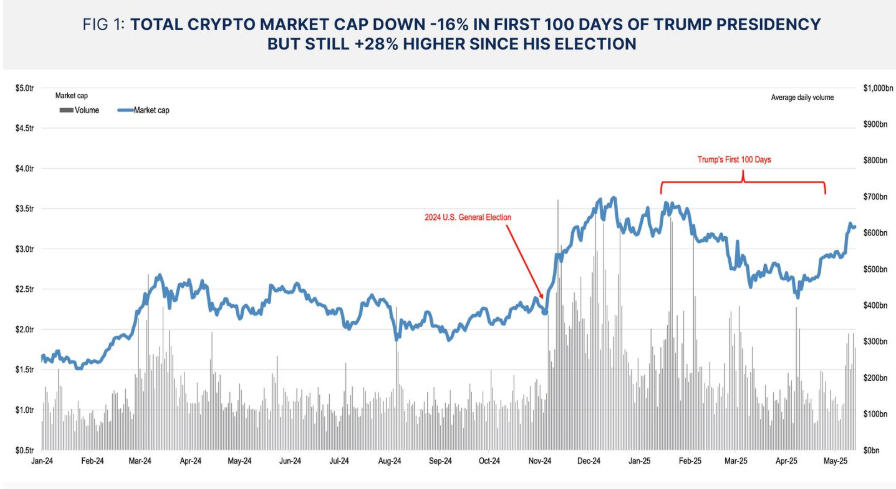

In a report on May 14, JPMorgan noted that while Trump has touted support for cryptocurrency policies, he has failed to drive up crypto prices or achieve regulatory reform during his first hundred days in office.

However, as Trump made concessions on trade issues and more signs of global cryptocurrency adoption emerged at both corporate and national levels, market pessimism has gradually dissipated.

"The foundation for Bitcoin's bull market has never been so solid," tweeted David Marcus, a former PayPal executive and well-known Bitcoin supporter, on May 10. "Buckle up."

This leading cryptocurrency has risen 10% since May, currently priced at $103,500.

JPMorgan outlines its recovery trajectory through six charts.

Revaluation of Bitcoin's Value

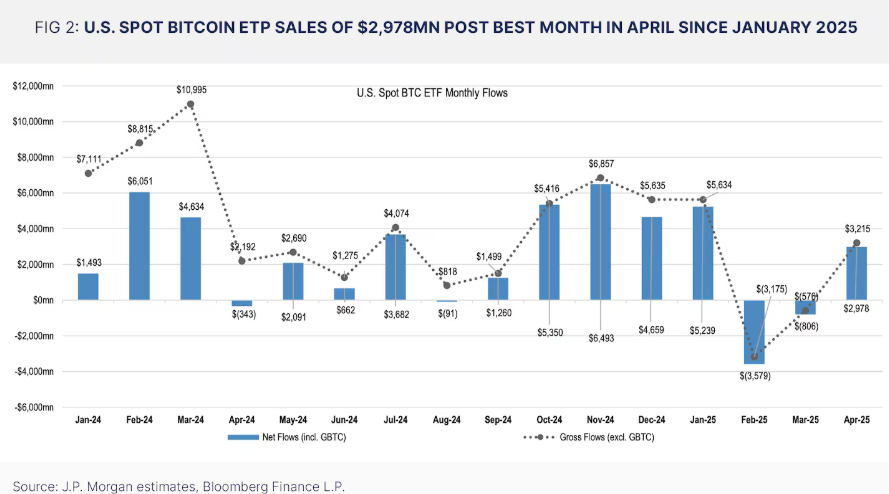

The sharp decline at the beginning of the year has now reversed, with inflows into exchange-traded products, including Bitcoin ETFs issued by BlackRock and Fidelity, turning positive, achieving the best monthly performance since January.

Total Crypto Market Capitalization Jumps to $2.9tr (+10% MoM) at End of April, but Volumes Remain Muted this Month. Source: JPMorgan.

JPMorgan pointed out that BlackRock's IBIT was undoubtedly the biggest winner in April, accounting for 84% of total inflows into Bitcoin ETFs, with an overall inflow of $3 billion in April.

U.S. Spot Bitcoin ETP Sales of $2,978mn Post Best Month in April Since January 2025. Source: JPMorgan.

According to Dune Analytics, the Bitcoin ETF market is currently dominated by BlackRock's IBIT, which holds a market share of 52%.

According to DefiLlama statistics, Bitcoin ETFs have accumulated $96 billion in funds since their launch in 2024, while Ethereum ETFs have only managed $5 billion in assets under management.

Bitcoin's Value "Recaptures Lost Ground"

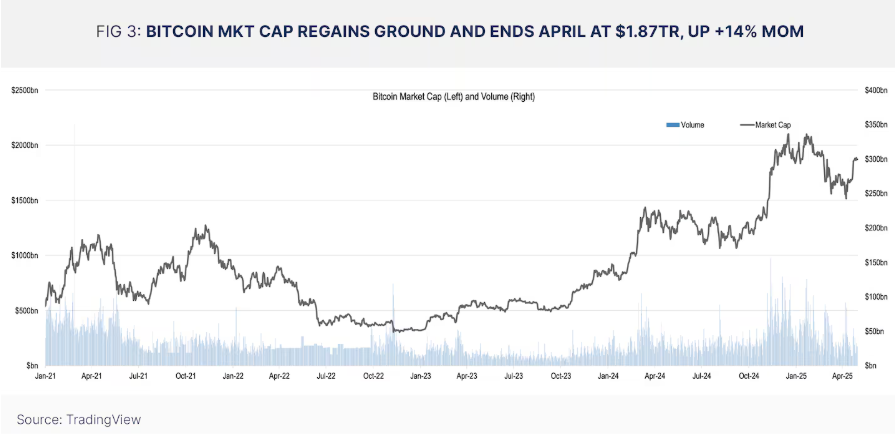

April's market was dominated by the turmoil from Trump's tariffs, leading to significant volatility until recent pauses in tax increases and agreements helped push prices back up.

Bitcoin's historical correlation with tech-heavy Nasdaq index saw it trading about 15% lower than the level on Trump's inauguration day for most of April.

With Bitcoin now strongly breaking through the $100,000 mark, the Nasdaq has also begun to recover. JPMorgan noted that most of Bitcoin's gains for the month were "concentrated in the last week."

Bitcoin Mkt Cap Regains Ground and Ends April at $1.87tr, Up +14% MoM. Source: JPMorgan.

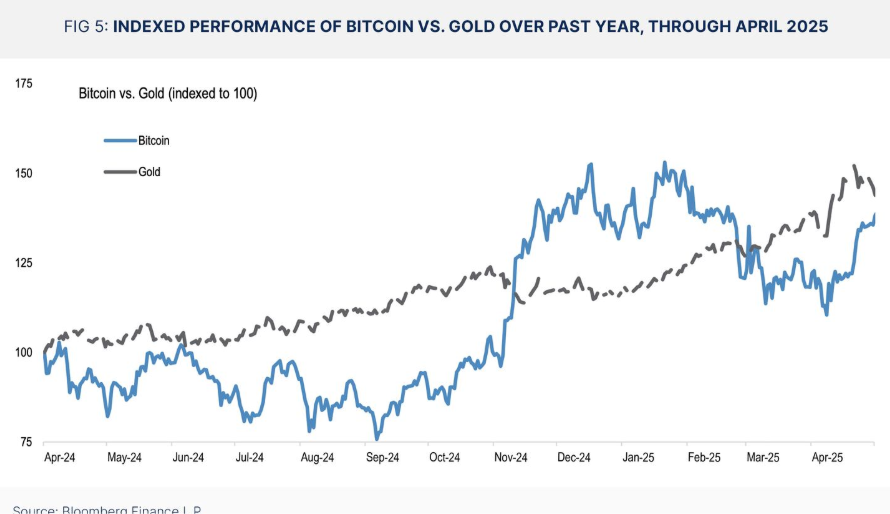

The Battle with Gold

BlackRock CEO Larry Fink has touted Bitcoin's potential as a safe-haven asset similar to gold.

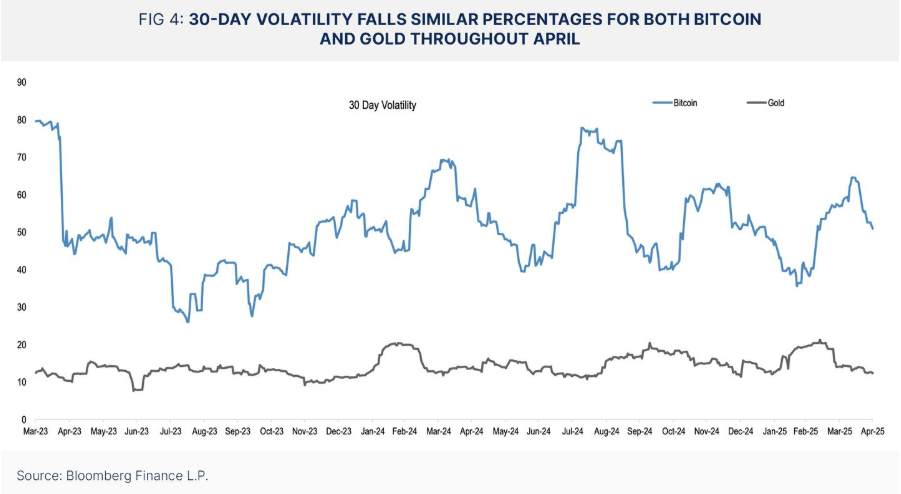

However, JPMorgan's research found that this potential has yet to materialize.

At the same time, Bitcoin's volatility continues to decrease. According to CoinGlass data, JPMorgan noted that the 30-day volatility of Bitcoin and gold has shown a synchronized downward trend.

30-Day Volatility Falls Similar Percentages for both Bitcoin and Gold Throughout April. Source: JPMorgan.

In standardized comparisons (setting the initial value of two or more assets equal at the beginning of a specific period to compare performance, as shown in the chart below), Bitcoin had risen 15% by the end of March, while gold had increased by 5%.

Indexed Performance of Bitcoin vs. Gold Over Past Year, Through April 2025. Source: JPMorgan.

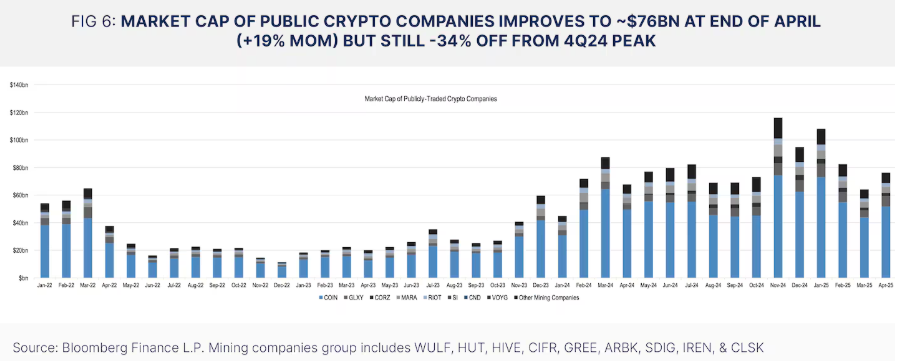

Surge in Cryptocurrency Stocks

The total market capitalization of publicly listed crypto companies has shrunk by 34% from a historical high of nearly $120 billion after the November 2024 elections to $76 billion by the end of April.

April brought a glimmer of hope, with total market capitalization achieving a 19% month-over-month increase.

JPMorgan noted that Galaxy Digital announced plans to go public in the U.S. in April, becoming the biggest winner in market cap growth for the month, with an increase of 45%.

This week, news emerged that Coinbase will be included in the S&P 500 index starting May 19. This news propelled its stock price to surge by 16%, with JPMorgan data showing the company's total market cap increasing by 18%.

Market Cap of Public Crypto Companies Improves to ~$76bn at End of April (+19% MoM) but Still -34% Off from 4Q24 Peak. Source: JPMorgan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。