Perhaps it is more like a "wrong recognition correction" triggered by extremely low valuations and weak expectations.

Written by: ChandlerZ, Foresight News

At this time last year, the Bitcoin ecosystem was at the peak of its narrative. From the inscription craze sparked by BRC-20, to the rapid expansion of market capitalization for assets like ORDI, and the multiple projects such as SATS and RATS completing several-fold increases in a short period, the on-chain transaction volume, Gas fees, and miner income of Bitcoin once soared, pushing the Bitcoin ecosystem to an unprecedented high.

But the heat dissipated in an instant. Over the past year, the performance of the Bitcoin ecosystem has almost become a "reverse indicator" of sector rotation. In terms of price decline, several representative projects like ORDI and SATS have seen maximum drawdowns exceeding 95%; in terms of on-chain activity, inscription transaction volumes have continued to shrink, and the intervals between project launches have significantly lengthened; in terms of community expectations, several project airdrops have disappointed, and the enthusiasm for the Runes ecosystem has rapidly declined after its launch, with overall sentiment trending towards caution or even indifference.

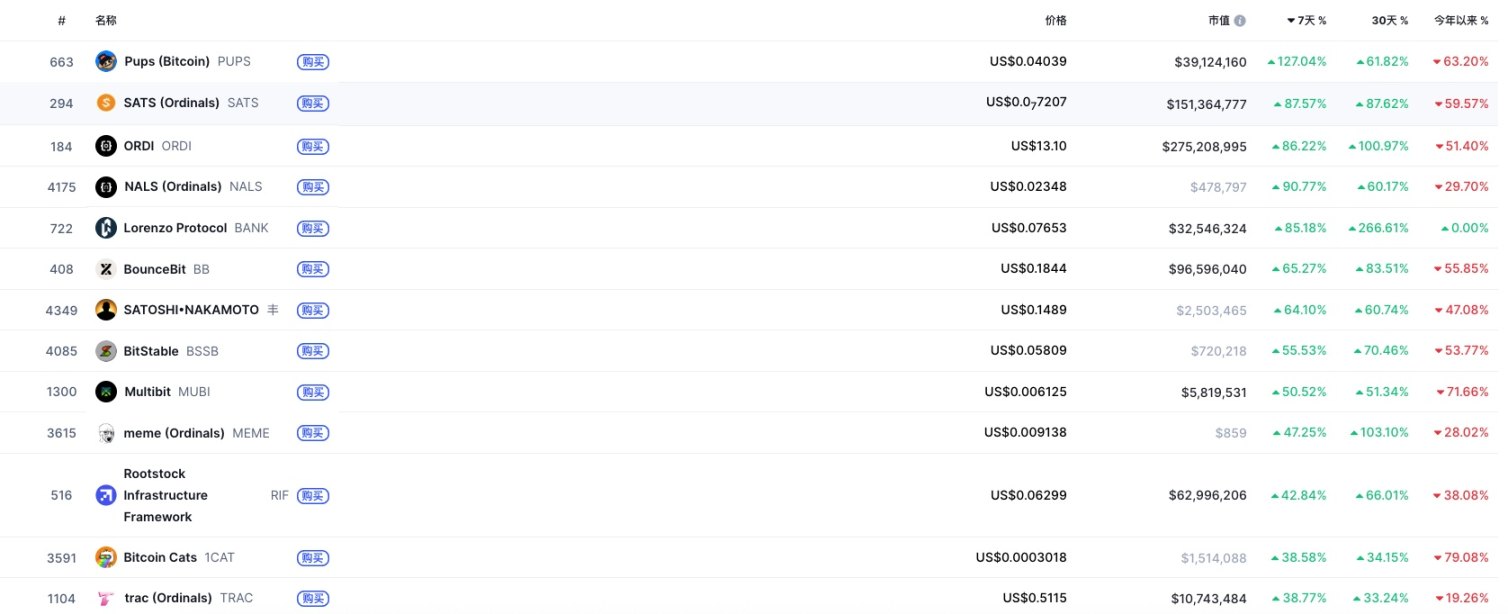

In the past week, there have been significant signs of rebound in the Bitcoin ecosystem sector. The leading asset ORDI has increased nearly 97% in six days, PUPS has risen 127.04%, making it one of the strongest performers in this round of rebound; SATS has increased 87.57%, nearly doubling from its lowest point this year; ORDI and NALS have risen 86.22% and 90.77% respectively, while several other assets like BANK, BB (BounceBit), and BSSB have recorded weekly increases of 40–80%, with mainstream assets in BRC-20 and Runes all experiencing recovery. Meanwhile, on-chain capital inflows have noticeably increased.

"The Difficult Situation" of the Ecosystem

Behind this rapid rise, looking back at the medium to long-term trends of the entire Bitcoin ecosystem, investors can easily identify its "two extremes" characteristics:

- Since the beginning of the year, the decline has generally been between 50–70%, with many projects seeing drawdowns exceeding 90% from their peaks;

- The fundamental progress of most projects is lagging, with BTC L2 mostly in idle stages, lacking mature product implementations;

- Airdrops and incentives have fallen short of expectations, with some projects once highly anticipated but progressing slowly, leading to long-term community confidence issues;

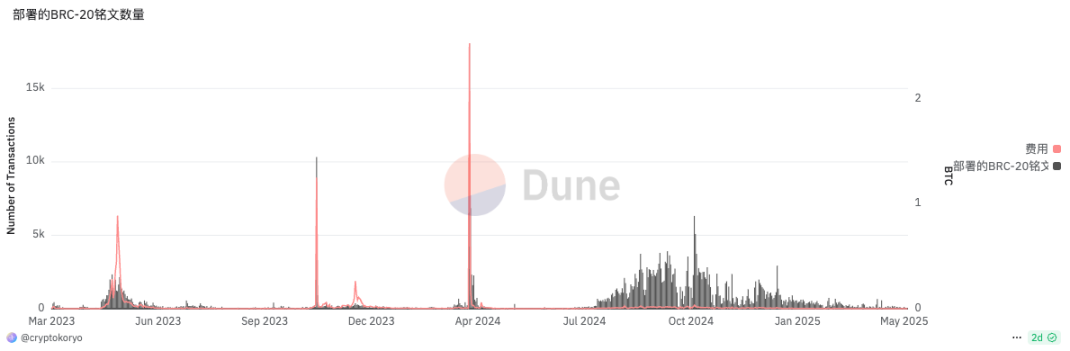

- Various protocols are scattered, with the enthusiasm for protocols like Runes dissipating quickly; although it once accounted for over 60% of BTC on-chain transactions at its launch, the data peak lasted only a few days before rapidly declining to single-digit levels.

From the number of deployed BRC20, it is currently close to "freezing point"

These data indicate that this rise is not based on a strong fundamental shift, but rather resembles a "sentiment repair" + "capital rotation" driven high-elasticity gamble.

Why is there a rebound at this time?

- Clear background of market style switching

Ethereum previously rebounded 50% under the pressure of significant community FUD, validating the typical market structure of "low expectation reversal." This phenomenon has triggered capital to migrate towards more undervalued and fully corrected sectors.

- The Bitcoin ecosystem has deep declines and high elasticity

Almost all leading projects have generally fallen over 90% after last year's boom, and the market widely views them as "value compressed to the point of no trading logic." Rebounds often start from these "abandoned" areas.

- Enhanced speculative gambling

Marginal ecosystem assets have instead become high-volatility targets for short-term capital.

Does the subsequent market have sustainability?

Although the current increase is eye-catching, if we extend our perspective, the current rebound in the Bitcoin ecosystem appears more as a form of expectation repair rather than a confirmation of trend reversal. The ecosystem still faces a series of structural issues that constrain its sustained performance.

First, from the overall development pace, whether BRC-20 or Runes, the progress of related projects remains slow. The "Bitcoin native DeFi" that was originally highly anticipated has yet to build a complete vertical system, and the lack of supporting infrastructure makes it difficult for the ecosystem to form a true synergy. At the same time, developer enthusiasm has also waned. The update frequency of several core projects on GitHub has significantly decreased, and the overall activity of the technical community is far less than that of chains like Ethereum and Solana. Against the backdrop of capital and user attention shifting periodically, the cooling of the developer ecosystem undoubtedly further weakens mid-term expectations.

In summary, this round of rebound resembles a "wrong recognition correction" triggered under extremely low valuations and weak expectations. After a year of emotional exhaustion and valuation decline, capital is refocusing on these deeply fallen assets at the point of style switching, releasing phase elasticity.

To truly bring the Bitcoin ecosystem out of an independent market, merely relying on price increases is not enough. The recovery of the ecosystem depends on more solid product delivery, more convincing user growth data, and the community's renewed cohesion towards the future. If the rebound can be ignited by sentiment, then the continuation of the trend must be built on confidence and substantial progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。