近日的加密市场,好消息一个接一个。

宏观面上,中美联合声明标志关税大战落下帷幕,加全球金融市场迎来大涨,比特币虽在预期落地下有所回落,但山寨市场呈现欣欣向荣之势,以太坊持续领涨,触及2700美元,Defi板块全面抬头,引来一阵山寨季回归口号。

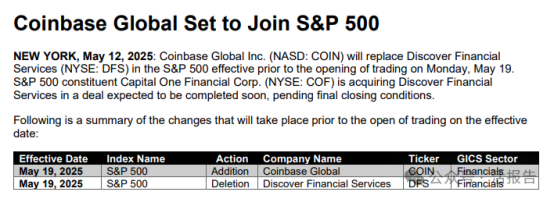

除了宏观环境改善外,在监管利好之余,行业内部,也迎来了新动向。5月13日,根据标普道琼斯指数公司的新闻稿,美国最大的加密货币交易所Coinbase Global将被纳入标普500指数,取代即将被Capital One Financial收购的Discover Financial Services,这一变动将于5月19日交易开始前生效。

在主流市场,加密行业再度拿下里程碑,标志着行业新时代的扬帆起航。与此同时,来自全球的企业与机构们,也在跃跃欲试。

5月12日,中美两国在日内瓦达成的关税休战协议,终于将旷日持久的贸易冲突暂时按下了休止符。协议内容包括暂停24%的互征关税 90 天,保留10%基础税率,并建立第三国协商机制。受此消息影响,美国股指上涨明显,标普500指数期货涨超3%,纳斯达克收涨4.35%。

尽管比特币从10.6万美元回落,最低触及了10.07万美元,但加密市场整体迅速迎来反弹,以ETH、SOL、BNB等为首的山寨币均有不错涨幅。随着关税的告一段落,这一消息面对市场影响将逐步放缓,市场开始回归正常,币种的底部价格均显示出抬升趋势。

宏观面好转,行业面也不甘示弱。近日来,关于行业的利好频频传来,一是美国州政府战略储备迎来首胜,新罕布什尔州通过战略比特币储备法案,该法案授权州财政官可购买比特币或市值超过5000亿美元的数字资产,并设定持仓上限为总储备资金的5%,比特币有望迎来新增量;二是新任SEC主席上任,明确任期内的核心优先事项是建立合理的加密资产市场监管框架,持续释放利好信号,贝莱德也被传正与SEC商讨ETH质押提案,市场信心回升。

宏观转好与监管改善双管齐下,置身其中的加密企业,无疑来到了最好的时代。

就在5月13日,据官方消息,美国最大的加密货币交易所Coinbase Global将被纳入标普500指数,这也是加密企业首次被纳入标普,在加密行业主流化进程中再创佳绩。

对于加密市场而言,Coinbase不至于如雷贯耳,也堪称耳熟能详。作为美国目前规模最大也是以合规著称的加密交易所,Coinbase在全球加密交易所领域,也是独树一帜的存在。Coinbase成立于2012年,距今已有13年的历史,在13年中,其几番在牛熊间沉浮,成为了传统金融观测加密行业的最佳窗口。

2021年,Coinbase登陆纳斯达克,股票代码为COIN,上市当日不仅未如此前加密概念股嘉楠和般破发,股价还一路飙升,最高冲至429.54美元,引发市场轰动。在此之后,Coinbase跟随行业周期波动,股价与加密大盘走向紧密相关,2023年的低谷期最低跌至33.26美元,随后重现增势。时间来到今年,Coinbase再创历史,取代Discover Financial Services,成为首家纳入标普500的加密企业。受此影响,Coinbase首日上涨达到24%,现报256.90美元。

颇为有趣的是,在之前Srategy被纳入纳斯达克100时,其曾被视为最有希望入选标普500的企业,但由于标普500存在累计净利润要求,竞争力略有逊色,但在当时,市场分析也并未将Coinbase纳入核心考量,然而Coinbase稳步超车,于5月拿下了这一里程碑。

尽管短期内不存在拉盘效应,象征意义更为凸显,但从长远而言,加密企业可以迈入美国主要指数,恰恰代表了主流市场的认可,为加密行业与传统金融的交融奠定了基础,打开了加密行业主流化的广阔空间。具体而言,此举不仅从个股的角度基于指数配置开拓了资金流量,也将作为典型企业样本提升加密行业认知度,有望进一步吸引与拓展传统投资者。以其将要取代的Discover Financial Services作为对比,该企业在0.1%的指数权重下被动需求配置就可达到135亿美元。

另一方面,此举也进一步推动了加密企业IPO热潮。从去年开始,Circle、eToro、Bgin Blockchain、Chia Network、Gemini、lonic Digital等多家公司均在推进IPO事宜,Kraken为此已在重设组织机构以满足监管需求,Coinbase珠玉在前,俨然成为典型示范。

这厢华尔街机构急着吃下加密红利,那厢香港的企业也在跃跃欲试。与美国加密企业冲击IPO,机构真金白银ETF买币略有不同,以金融中心为名的香港更为审慎,企业更注重实体协同,瞄上了RWA赛道。继香港金融管理局(HKMA)推出的Ensemble项目开启代币化沙盒试点后,香港的RWA赛道,再次按下了加速键。

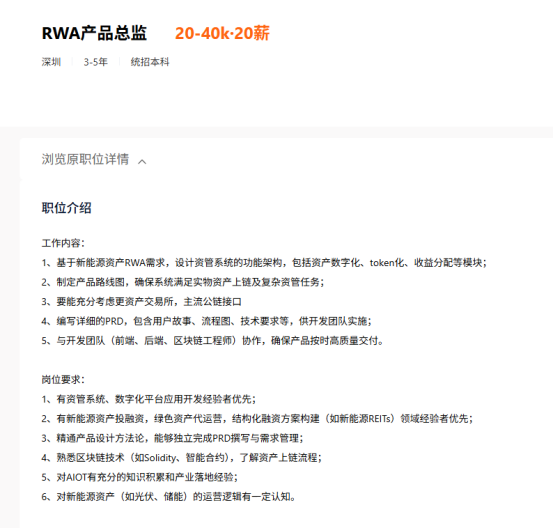

从进展来看,大厂先行趋势凸显,近月来动作频频。曾因进军稳定币备受关注的京东旗下京东币链科技开始组建团队,此前在BOSS直聘、猎聘等招聘网站上发布多项RWA相关岗位招聘信息,招聘资管系统产品总监和解决方案总监,负责新能源资产RWA的资管系统设计、资产获取及产业化落地。此外,币链还宣布与持牌虚拟银行天星银行合作,为京东探索基于稳定币的跨境支付解决方案提供金融合规支持。而据京东集团副总裁沈建光博士透露,京东稳定币属于公司层面去中心化的商业发行,受宏观经济影响波动微小,京东发行稳定币是为了进一步提升京东的全球供应链和跨境支付能力。

京东尚在组织架构中,蚂蚁数科则进度更快,已然有实际案例落地。在去年,蚂蚁数科与绿色能源服务商协鑫能科合作,成功完成国内首单涉及2亿元人民币的基于光伏实体资产的RWA案例,并在后续相继与Conflux树图链、巡鹰集团、Sui等项目合作推动RWA的实际项目落地。

在大厂之外,交易所与机构也正紧锣密鼓的布局。香港本土企业HashKey Chain在今年3月将中国太保投资管理(香港)发起和管理的代币化美元货币市场基金CPIC Estable MMF 成功部署至链上,后续与博时基金(国际)有限公司宣布联合推出的港元及美元货币市场ETF代币化方案也宣布已获得香港证监会(SFC)的批准,截止至今,HashKey Chain已与超过200家机构展开了深入对接,涉及传统金融机构、资产管理公司、科技企业及Web3原生项目等多个领域达成RWA上链合作意向。

技术基础设施趋于完善,经纪人配套也随之跟上。近日国泰君安国际表示,其1月提交的财富管理相关业务计划,涵盖的代币化证券类型包括挂钩多种标的资产的结构性产品、证监会认可基金及非认可基金以及债券,根据香港证监会发布的《中介人从事代币化证券相关活动通函》,香港证监会于2025年5月7日发出确认邮件,意味着业务计划已获监管机构确认无进一步问题。就在今日,老虎证券(香港)也宣布推出加密货币提存币服务,支持虚拟货币存入、交易及提取。

整体来看,无论是美国加密企业IPO,还是香港本土企业推进RWA,在加密行业逐步正名化的当下,企业与机构们都表现出积极布局的态度,但鉴于地区的差异性,参与方式略有不一。

美国由于监管环境明朗程度高,现有领导者大力支持,呈现出监管未动、市场现行的趋势。机构与企业参与手段更为简单粗暴,如机构大肆买入ETF,成为币价的主要支撑者,如Strategy借债买币构建新范式,并由此引发热潮,致使规模较小的上市企业也尝试用加密货币破局,以获取热度抬升股价,又如Block、PayPal和Visa等大型机构以稳定币入局,抢夺市场份额,构建业务矩阵。而企业利好响应也更为快速,Strategy纳入纳斯达克100、Coinbase登陆标普500,毫无疑问代表新买盘的进入。

近一年Strategy股价飙升

与之相比,香港的保守程度更高,尽管政策统一性与一贯性维持的非常好,香港对虚拟资产的监管持续完善,稳步推动代币化的应用与试点,但明确且严苛的合规要求意味着香港只能小步快跑,而非大包大揽、集中冲锋,需在政策语境下行使市场权力,因而企业与机构多秉持合规原则,尽管香港ETF也在蓬勃发展中,但话语权有限,更多机构以业务为主线,通过板块延伸发展,相关业务进入快车道,但盈利点尚未完全体现。

在此背景下,内地市场的动向关注度正持续提升,场内资金的打通是关注的焦点。日前甚至有传言称内地有望在未来开通纸BTC现货ETF,即类似于不做现货交割的账面交易,与纸黄金模式类似,此举既可在资金合规管控下在一定程度上参与加密货币交易,又可避免实际持有,且交易透明可查。当然,传言只是传言,考虑到加密货币对于金融市场的风险性,尤其是在现行规定下,可行性仅能以天方夜谭来形容,但由此也可窥见,市场对于内地资金的开放表达出相当高的期待。

可以预见,随着加密资产主流化程度日益提升,涉足其中的企业也将日益增多,资金、关注、资源将进一步涌入市场,这一轮机构的FOMO潮,仅仅只是刚刚开始。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。