1. Market Observation

Keywords: SOL, ETH, BTC

Trump spoke again this morning, predicting a significant rise in the stock market and pressuring Federal Reserve Chairman Powell to lower interest rates as soon as possible. Meanwhile, the U.S. April inflation data released yesterday unexpectedly cooled, with the CPI annual rate dropping to 2.3%, the lowest since February 2021, while the core CPI annual rate remained at 2.8%. As a result, U.S. short-term interest rate futures prices rose, and traders significantly increased their expectations for a Fed rate cut, with the market generally anticipating the Fed will cut rates for the first time in September. However, major Wall Street investment banks are more cautious in their predictions regarding the timing of rate cuts. Goldman Sachs and Barclays have pushed back their forecasts for the next Fed rate cut to December, while JPMorgan holds the same view, and Citigroup has adjusted its expectations from June to July. Despite the optimistic sentiment from the inflation data, Trump's tariff policies continue to raise market concerns. Analysts point out that the full impact of tariffs on inflation has yet to be fully realized, as retailers are still digesting previously accumulated inventory. However, as the U.S.-China tariff situation enters a truce phase, Goldman Sachs has lowered the probability of a U.S. economic recession from 45% to 35%. Goldman stated in its report that the shift in trade policy has somewhat reduced the risk of economic recession, but the economic pressure from high tariffs and ongoing uncertainty still pose significant challenges to U.S. investors and corporate management, potentially affecting investment decisions and market confidence, thereby impacting economic growth.

Bitcoin is currently in a consolidation range, while Ethereum has broken through $2,700, with its market cap approaching 10%. According to QCP Capital analysis, as the macro narrative shifts from protectionism to trade optimism, BTC may continue to maintain range-bound volatility. In contrast, ETH's trend is clearer, having broken through $2,400 in sync with the Pectra upgrade, and long-term option liquidity has re-emerged, possibly indicating that ETH is becoming the next major asset for market allocation. Investment firm Abraxas Capital has significantly increased its Ethereum holdings, purchasing 242,652 ETH worth approximately $561 million over the past week. Notably, according to Rekt Capital analysis, Ethereum has completely filled the CME day gaps at approximately $2,530 and $2,630 (green area), with the next CME day gap potentially between approximately $2,892 and $3,033.5. If Ethereum's price continues to rise and breaks through the current support area, the market may focus on this area as a potential target price.

Altcoins are collectively rising, with AI and mainstream MEME coins becoming the preferred choice for funds, and on-chain market activity remains high, with competition emerging across multiple platforms and chains for Glonk. The market cap of the letsbonk.fun version reached a high of $18 million, while the Pump.fun version peaked at $15 million. The founders of both platforms have voiced support for their respective versions of Glonk, drawing more market attention, with the letsbonk.fun version appearing to be more popular. Meanwhile, crypto KOL Pata van Goon launched Gooncoin (GOONC) on the Believe platform, and after Moonshot announced its launch, its market cap briefly surpassed $70 million. Additionally, the platform token LAUNCHCOIN (formerly PASTERNAK) on Believe surged from a market cap of $2.7 million on May 9 to $280 million today, with an increase of over 100 times in the past week.

2. Key Data (As of May 14, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $103,564 (YTD +10.92%), daily spot trading volume $32.876 billion

Ethereum: $2,638.26 (YTD -20.2%), daily spot trading volume $35.33 billion

Fear and Greed Index: 74 (Greed)

Average GAS: BTC 1.07 sat/vB, ETH 0.95 Gwei

Market Share: BTC 61.3%, ETH 9.5%

Upbit 24-hour Trading Volume Ranking: XRP, ETH, KAITO, DOGE, BTC

24-hour BTC Long/Short Ratio: 1.0141

Sector Performance: Launchpad sector up 15.15%, Meme sector up 8.51%

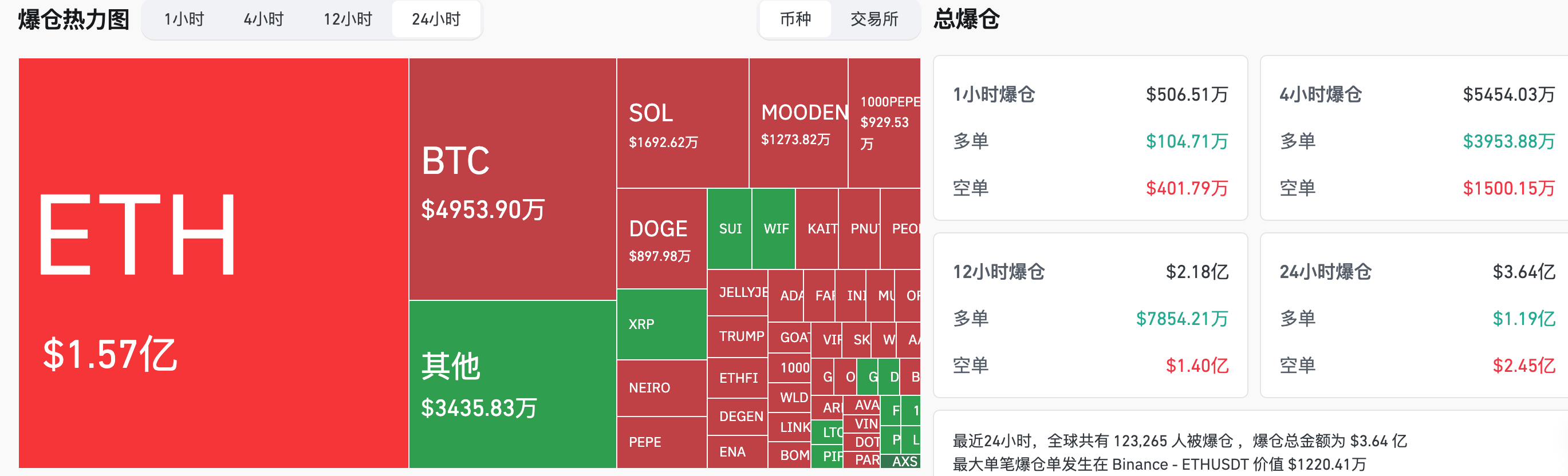

24-hour Liquidation Data: A total of 123,265 people were liquidated globally, with a total liquidation amount of $364 million, including $49.539 million in BTC liquidations, $157 million in ETH liquidations, and $16.926 million in SOL liquidations.

BTC Medium to Long-term Trend Channel: Upper line ($100,716.05), lower line ($98,721.68)

ETH Medium to Long-term Trend Channel: Upper line ($2,287.28), lower line ($2,241.99)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (As of May 13)

Bitcoin ETF: -$96.1425 million

Ethereum ETF: +$13.3728 million

4. Today's Outlook

Binance Wallet will launch the 16th TGE project: Privasea (PRAI) on May 14

Web3 bank Vaulta (formerly EOS) will convert EOS tokens to A tokens at a 1:1 exchange rate

Distributed validator technology project Obol Collective plans to launch its token $OBOL on May 15

Sei (SEI) will unlock approximately 55.56 million tokens, accounting for 1.09% of the current circulation, valued at approximately $14.5 million.

Starknet (STRK) will unlock approximately 127 million tokens, accounting for 4.09% of the current circulation, valued at approximately $23 million.

U.S. initial jobless claims for the week ending May 10 (in thousands) (May 15, 20:30)

- Actual: To be announced / Previous: 22.8 / Expected: 23

Top 500 Market Cap Gainers Today: PEOPLE up 57.55%, SATS up 45.08%, BOME up 40.14%, GODS up 38.79%, NEIRO up 37.94%.

5. Hot News

A trader who spent $9,075 on LAUNCHCOIN a month ago now sees it valued at $4.7 million

Abraxas Capital's ETH holdings have reached $561 million after purchases in the past week

Pudgy Penguin CEO: The TGE for Abstract Chain is expected to take place in Q4

DeFi Development Corp. invested $23.6 million to increase its SOL holdings to 595,988

Twenty One Capital has purchased $458.7 million worth of Bitcoin

DWF Labs acquired 3 million SIREN and withdrew them on-chain

A whale that hoarded over 120,000 ETH in 2022 has completed liquidation, profiting over $131 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。