The "artificially piled up" apparent trading volume is likely to experience a cliff-like drop once external stimuli are lost.

Author: Kevin, the Researcher at Movemaker

The Failure of Binance Alpha1.0 and the Strategic Shift to Alpha2.0

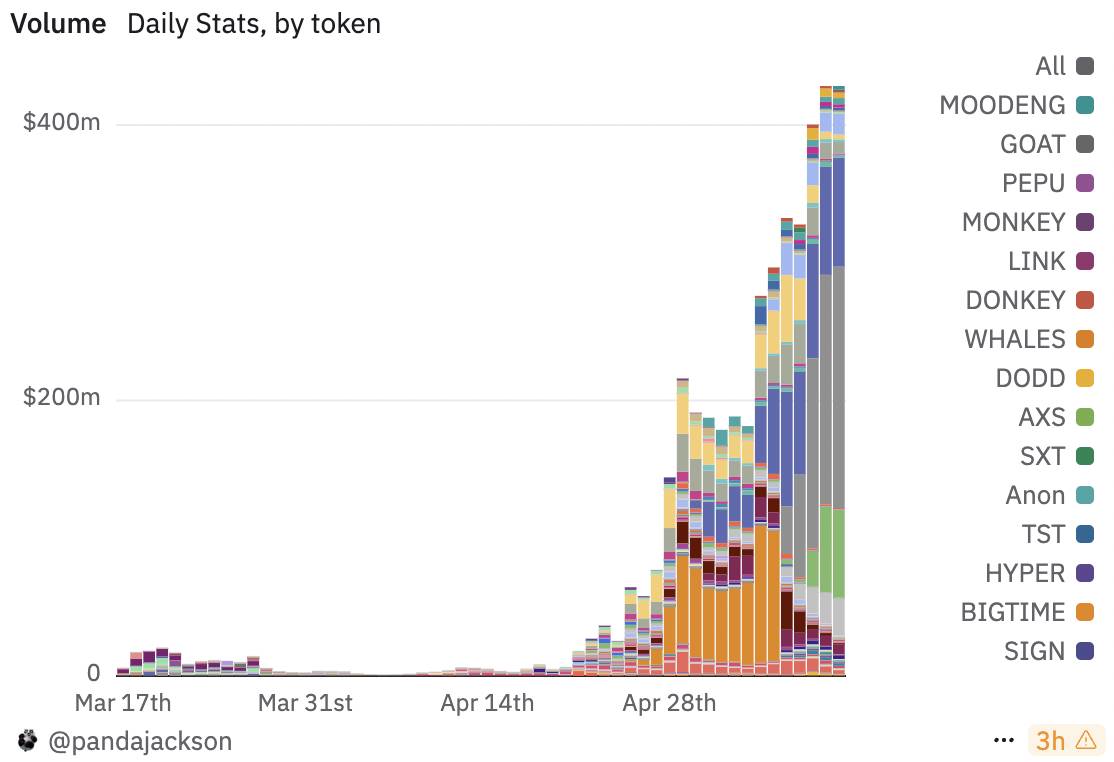

Due to setbacks on the Binance wallet, Binance Alpha1.0, which served as a liquidity bridge on the Binance chain, has been declared a failure. The trading volume and user numbers before the upgrade fell to historic lows, with the total daily trading volume of all tokens on Alpha being less than $10 million and daily transactions dropping below 10,000, which is undoubtedly a stark contrast to the volume within the Binance exchange. Not only did it fail to attract on-chain users and corresponding liquidity to the exchange, but it also had a negative impact on marketing.

As a result, Binance Alpha was upgraded to Binance Alpha2.0 at the end of March. Unlike 1.0, which could only be accessed through the Binance Web3 wallet, the upgrade allows users to purchase Alpha tokens directly using funds from the exchange.

The inability to expand the wallet user base means that Binance's strategy of using Binance Alpha as a bridge to compete for on-chain liquidity has not been effective, failing to attract liquidity while enhancing attention on BSC. In other words, when Binance's on-chain growth cannot form a natural positive cycle, it can only go against the grain by injecting traffic from the exchange back into Alpha, allowing Binance Alpha to achieve a quantitative change that attracts market attention, and under sufficient wealth effect, complete a qualitative change, ultimately becoming a forward base for Binance to attract on-chain liquidity and amplify the presence of the BSC chain.

The Waiting Period Without Consensus Confirmation: The Low Point Before Alpha2.0's "Gunshot"

This assumption is reasonable, but for it to be effective, a major prerequisite is needed: providing a consensus for observing funds in a market where liquidity is not abundant, which would serve as a trigger to ignite market attention for Binance Alpha2.0. Without such a trigger, even if Alpha upgrades to 2.0, the data from late March to mid-April shows that both the order book depth and the promotion of the wealth effect can only stimulate market discussion for less than a week within a brief window, quickly returning to silence and falling back into a low point in early April.

Of course, this is not a failure of the Alpha2.0 upgrade or a misstep in strategic direction, because to expand Alpha's scale, which is the total trading volume of Alpha, apart from introducing liquidity from DEX, the only option left is to inject liquidity from Binance's own exchange. The reason 1.0 chose the former option is that it is a ready-made strategy for second-tier exchanges, which the market can quickly accept; on the other hand, Binance's absolute confidence as a leading exchange differs from that of second-tier exchanges, which view the introduction of on-chain liquidity as their foundation. Therefore, they can achieve agile responses in user experience or marketing, while Binance's approach to on-chain liquidity is more of a precaution rather than an urgent need. Consequently, the poor experience of the Binance wallet and the sharp downturn in the Q1 market made it difficult for Binance to quickly pivot, leading to the premature demise of Alpha1.0.

Thus, it can be said that the reverse injection of liquidity from the exchange is Binance's last resort and the most powerful upgrade. However, based on the data from Alpha2.0 between March 20 and April 20, it can still be described as bleak. Why? Because even though the pipeline or path for injecting liquidity has been successfully built, the influx of liquidity still requires a signal, a gunshot. In the current atmosphere of despair where all narratives in the crypto market have collapsed, only Bitcoin can take on the role of that starting gun.

Bitcoin Signal Activation, Alpha2.0 Trading Ecosystem Welcomes a Turning Point

The price of Bitcoin has become closely tied to the macroeconomic trends in the United States, and for Bitcoin to break out into a new trend, it also needs support from macro market confidence. In the previous article, Bitcoin's hovering around $85,000 for a week was waiting for confirmation of macro confidence. Therefore, when the market was deeply entrenched in fears from tariffs and recession, and due to the favorable news of a 90-day tariff cooling period, strong U.S. economic performance, and progress in U.S.-China negotiations, a brief market easing period emerged. At this moment, there was no need to consider the risk of further deterioration of tariffs, and the funds could ignore the safe-haven caused by recession. In the not too long future of several days, the source of negative news was tightly restrained, which provided sufficient confidence confirmation for Bitcoin. The market began to activate on April 21, and from Ethereum's strong breakout over three days, it can be seen that large funds were rushing in, entering the second phase of the market.

Thus, when Bitcoin sends out a signal, the thirsty liquidity will first flow into high-risk assets, and the pipeline created by Alpha2.0 will begin to show its effects.

Point Incentives and Token Bubbles: The Dual-Drive Strategy of Alpha2.0

Returning to Alpha2.0 itself, its main role, in addition to attracting on-chain liquidity mentioned earlier, is to serve as a reservoir for Binance. To weaken Binance's coin listing effect, it is necessary to pre-allocate liquidity when new coins are listed while ensuring that this liquidity is indeed within Binance and not spilling over to other exchanges. Therefore, when Bitcoin sends out a signal and the market's short-term consensus is strong, the next direction for Alpha2.0 becomes very simple: how the market makers hype narratives in each cycle, that is, how to create bubbles in the reservoir. Alpha2.0 chooses two methods to create bubbles:

Bottom-up point promotions

Alpha points are direct incentives to increase trading volume and liquidity, calculated by adding balance points and trading volume points within 15 days.

Balance points: Different assets held in the exchange and wallet with varying balances can earn different points daily, for example: $10,000 to $100,000 = 3 points/day.

Trading volume points: Points are awarded based on the purchase volume of Alpha tokens, for example: every $2 purchased earns 1 point, and every time the purchase amount doubles, an additional point is awarded (e.g., $2 = 1 point, $4 = 2 points, $8 = 3 points…).

The level of Alpha points is related to eligibility for airdrop activities, for example: having 142 Alpha points can qualify for an airdrop of 50 ZKJ tokens.

The difficulty of obtaining points increases with the rise in balance and trading volume. The goal of Alpha2.0 is to provide incentives to the widest range of users, encouraging them to maintain a certain asset balance in the exchange and wallet and actively participate in Alpha token purchases, ultimately driving market depth and activity. The double trading volume points event starting on April 30 stimulated the enthusiasm of longer-tail users, allowing anyone who places an order or directly buys BSC tokens to earn double points. Binance uses double points to allow a broader range of users to qualify for airdrops, creating market heat and activity, giving the main force of Alpha tokens more sufficient momentum to drive up prices.

From the trading volume of Alpha2.0 since April 20, Binance has effectively increased the asset holdings and trading volume on the platform, further enhancing the overall market activity and depth. As more and more users actively participate, the market liquidity of Alpha tokens will be significantly enhanced, and the continuous operation of this virtuous cycle will be key for Binance to stand out in future market competition.

The liquidity convergence forming a leading effect

Observing the daily trading volume trend of Alpha tokens after the shift to Alpha2.0, it can be seen that the change in rules itself did not create enough stimulation or generate interest among market participants. However, the signal from Bitcoin is a strong consensus, and the main sources of daily trading volume for Alpha tokens are: $KMNO, $B2, $ZKJ.

$KMNO: The DeFi protocol Kamino Finance on Solana, which began a one-sided decline after entering Binance Alpha on February 13. Over the week starting April 28, trading volume began to expand, increasing 40 times compared to two weeks ago, but the price fluctuated only between $0.065 and $0.085. It wasn't until May 6, when it was listed on Binance for spot trading, that the trading volume returned to normal levels.

$B2: A Bitcoin ecosystem L2 protocol, which issued tokens on April 30 and entered Binance Alpha. Its market cap peaked at only $30 million, currently at $27 million, with trading volume gradually increasing after the token issuance, showing a clear pattern of higher trading volume during Asian daytime and lower volume at night.

$ZKJ: The ZK protocol Polyhedra Network, which issued tokens on May 6 and entered Binance Alpha. Its market cap is $130 million. The fluctuations in trading volume are similar to $B2, with higher trading volume during Asian daytime and lower volume at night.

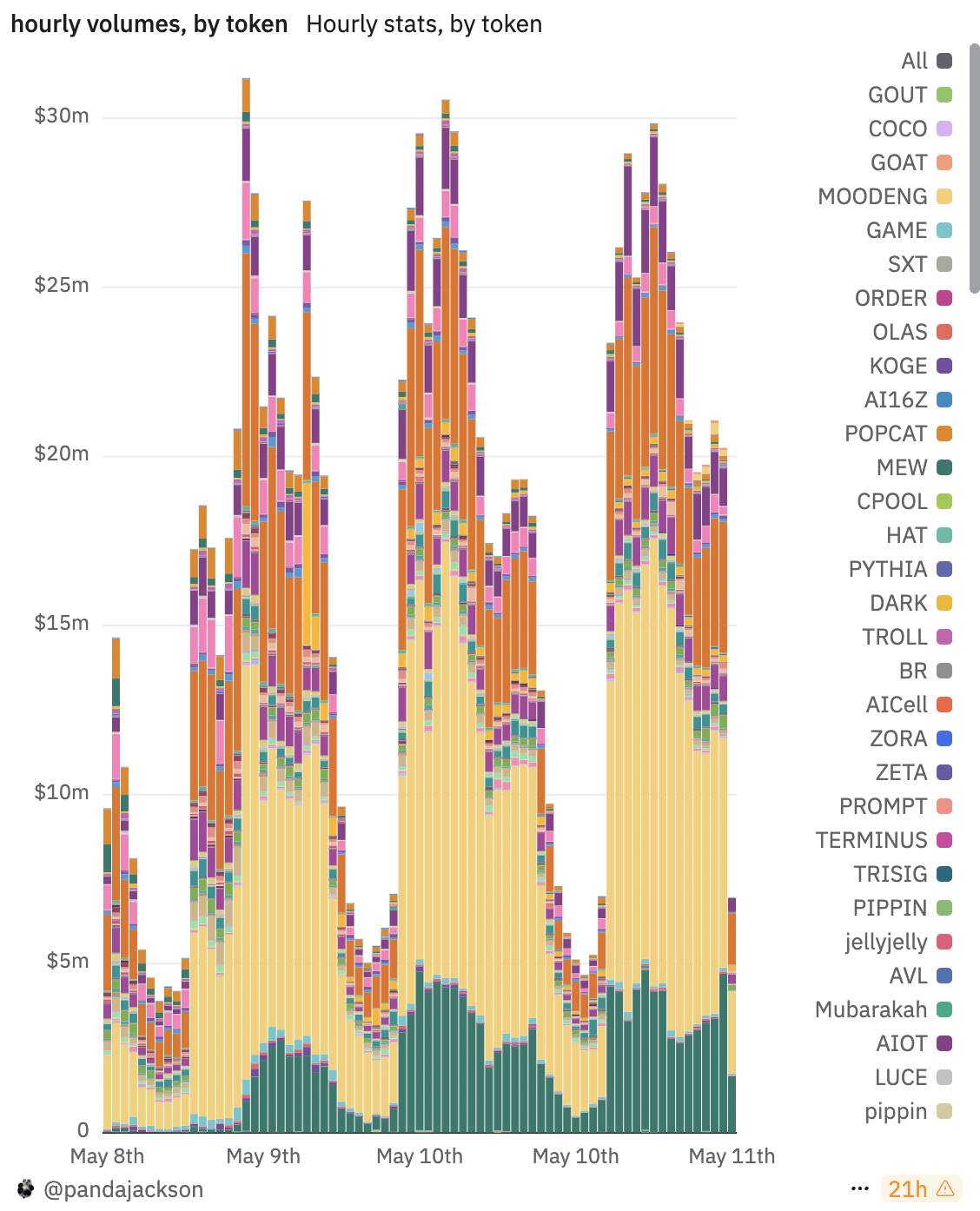

The Asian Daytime Driving Model: The True Picture of Alpha Liquidity

From the hourly trading volume charts, it is clear that the main contributing tokens to Alpha 2.0's trading volume exhibit strong intraday cyclical volatility characteristics. This regular trading behavior was repeated over four days from May 8 to May 11, showing significant trading volume increases from midnight to noon UTC (approximately from 8:00 AM to 8:00 PM Beijing time), while trading volume noticeably declined or even languished from the afternoon to late night UTC (Beijing time from evening to midnight). This rhythm completely aligns with the working hours of the Asian trading zone, indicating that the trading ecosystem of Alpha 2.0 is currently highly reliant on liquidity support from the Asian market. Especially during active daytime hours in Asia, the total hourly trading volume frequently exceeded $25 million, even approaching $30 million at times, demonstrating a highly concentrated market-making and trading operation.

In addition, from the trading volume distribution structure of various tokens, ZKJ (yellow) is the absolute main force in trading volume, dominating the majority of time periods. Its trading volume changes in sync with the overall market rhythm, further strengthening the inference of "systematic market making." Besides ZKJ, tokens like B2 and SKYAI also show significant activity during peak periods, forming a "market-making matrix" within the Alpha 2.0 ecosystem. The trading volume fluctuations of these tokens are highly consistent, resembling not spontaneous trading by natural users, but rather batch orders and matching operations controlled by automated market-making systems or bots. The fixed time periods for initiating and withdrawing trades likely stem from a standardized, automated trading program, possibly operated by a team during Asian daytime hours, with strategies shutting down or significantly reducing activity at night.

Overall, the current trading activity of Alpha 2.0 exhibits a typical "Asian daytime market-driven model," where market depth and liquidity largely depend on the market-making activities of a few leading tokens and the natural trading of global users. While this model can support trading volume and activity in the short term through concentrated market-making actions, it also exposes the platform's ecosystem to reliance on a single time zone and limited market-making entities. Once these market-making accounts cease operations, the platform's trading volume may experience a cliff-like drop. To build a more sustainable trading ecosystem in the future, Alpha 2.0 needs to introduce more time zones and more participants' natural trading behaviors, thereby breaking free from the current overly singular rhythm and obvious market-making traces.

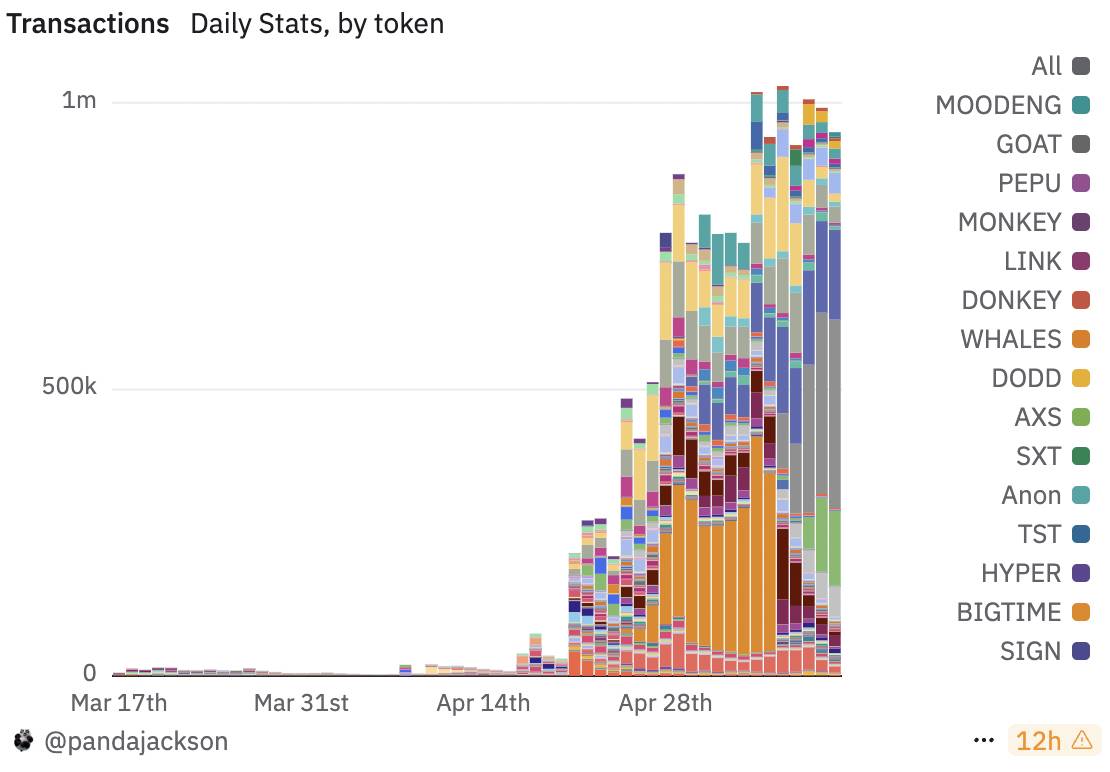

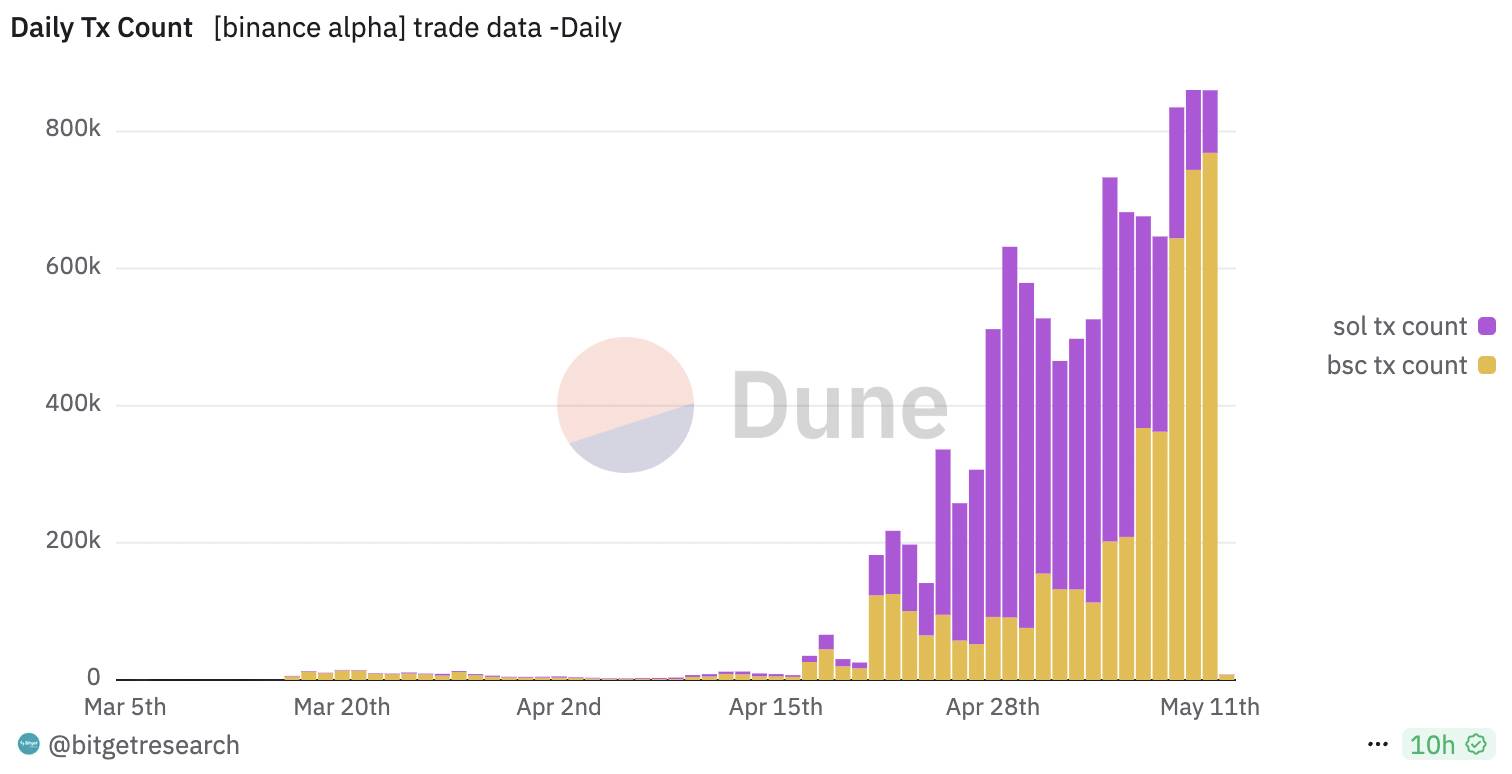

From the chart below, it can be observed that after April 20, the platform's trading activity entered a rapid growth phase, with the number of transactions quickly climbing from the hundreds of thousands to an average of nearly one million per day. However, starting around April 28, although trading volume remained high, the daily transaction count began to stabilize, even showing a slight decline in recent days. This divergence of "slowing growth in transaction count while trading volume continues to rise," when combined with the previous "hourly trading volume distribution chart," points to a very clear structural change: the trading behavior on the Alpha 2.0 platform is gradually shifting from a high-frequency, low-value "retail trading" model to a low-frequency, high-value "market-making driven" model.

The main driving force behind this change is likely the strengthening of market-making strategies for leading tokens. The tokens shown in the previous chart, such as ZKJ and B2, experience dramatic increases in trading volume during specific periods (especially during Asian daytime), indicating that these tokens have become the liquidity hub of the platform. The trading of these tokens is typically executed by a small number of market makers or automated trading bots, whose strategies may no longer pursue high-frequency matching transactions but instead focus on placing orders, matching, and arbitraging with larger transaction amounts. Therefore, even if the number of transactions grows limited, the volume of individual transactions may significantly increase, thus driving the overall trading volume to continue rising. This structural "quality substitution" phenomenon, combined with the incentives for users to place orders during the double points event, indicates that Alpha 2.0 has entered a new phase characterized by liquidity depth optimization and concentrated trading of core tokens.

Further inference suggests that this structural change also reflects the development bottlenecks and adjustment strategies currently faced by the platform. On one hand, the platform's original phase relied on a large number of tail tokens and retail participation to drive transaction counts, but the marginal effect of this growth model is gradually diminishing; on the other hand, the platform is attempting to maintain or even elevate overall trading volume by introducing stable market-making mechanisms and a leading token ecosystem, thereby attracting more liquidity and user attention. If this trend continues, Alpha 2.0 will face two strategic choices: one is to further expand market maker participation, guiding the formation of more "high-value low-frequency" main trading pools; the other is to optimize user experience and fee structures to re-stimulate retail daytime activity, achieving a new peak of "high-frequency high-value" trading.

Inter-chain Switching and Market-Making Structure: The Liquidity Migration Logic of Alpha2.0

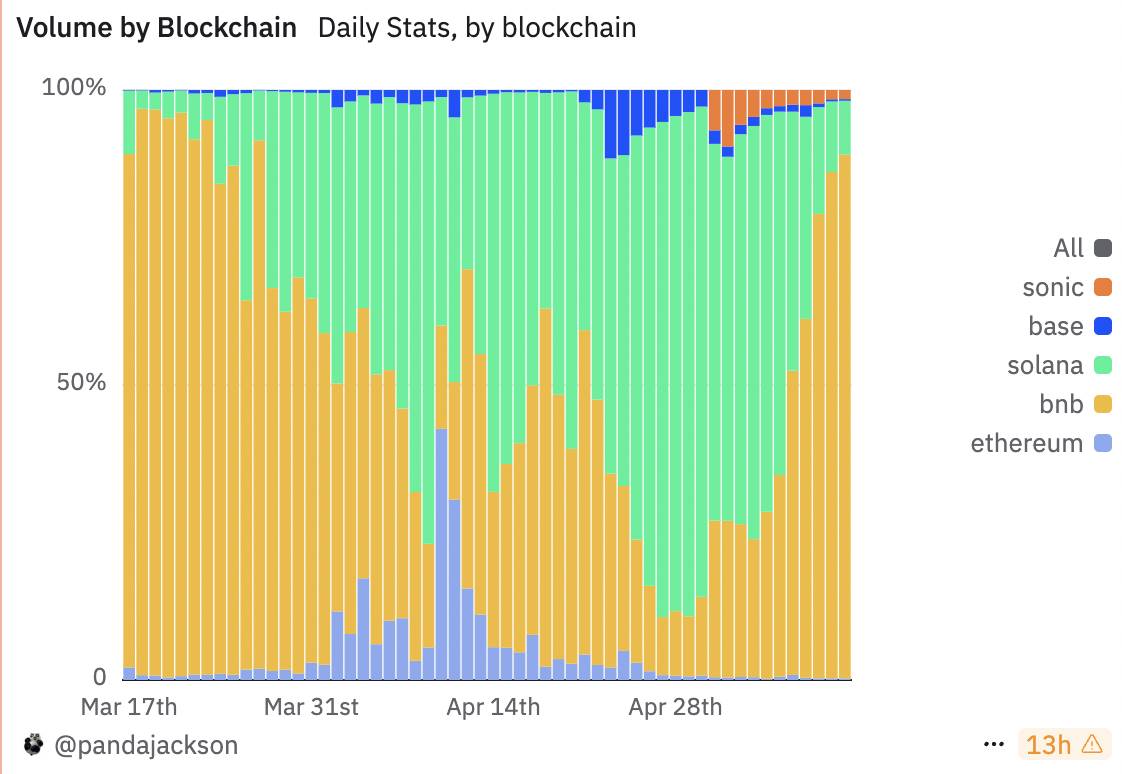

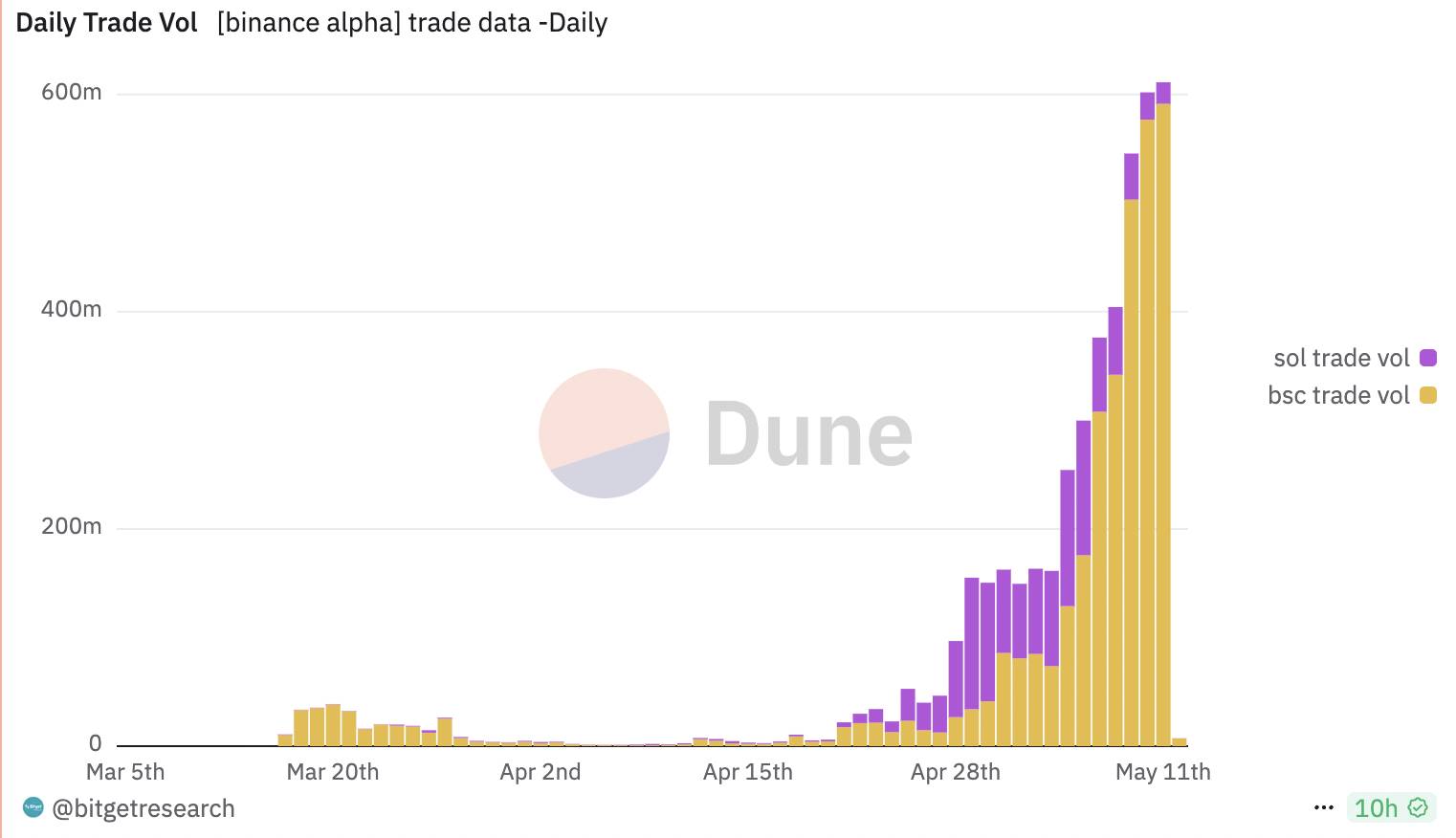

From the chart below, it can be seen that the daily trading volume of Alpha 2.0 tokens has undergone significant structural migration between different blockchains, showing a clear phase-based change in dominant chains. Starting from mid-March, after the rule changes of Alpha 2.0, the BNB chain (orange) was the absolute dominant force, accounting for nearly 100% of the trading volume. However, by the end of March and early April, Solana (green) gradually rose, beginning to compete for dominance with the BNB chain, and by mid-April, it surpassed BNB, stabilizing at over 60%-80% of daily trading volume for about two weeks, becoming the liquidity main stage of Alpha 2.0. This period can be seen as the true traffic level of Alpha 2.0 during a market lull.

Following this, from late April to early May, the BNB chain regained its dominant position, with its share rising back to nearly 60%-70%, marking a round of inter-chain liquidity return.

From this trend, several key changes can be interpreted: first, the liquidity of Alpha 2.0 is highly migratory, and it can also be seen that BSC's activity is highly dependent on market makers and bots; second, Solana once became the preferred chain for carrying Alpha trading demand due to its high-speed and low-cost on-chain performance, but this lead is not stable; as long as market sentiment reverses, BSC can quickly inject a massive amount of trading volume.

Overall, the current rhythm of trading volume migration between chains in Alpha 2.0 reflects a typical "liquidity arbitrage + incentive migration" driven model, rather than being solidified in long-term cultivation on a single chain. This also indicates that the future traffic construction of the Alpha platform will still be constrained by inter-chain competition, cross-chain deployment costs, incentive strategies, and other external variables, and it is not ruled out that a new round of main chain switching may occur.

When comparing the changes in trading volume and transaction counts of Alpha 2.0 tokens on BSC and SOL, it can be found that overall, Binance Alpha2.0 experienced explosive growth after mid-April, and this growth trend continued until mid-May.

In terms of transaction counts, Solana performed particularly well in the early stages (especially in late April), with its transaction numbers significantly exceeding those of BSC, indicating that during this phase, the main liquidity of Alpha2.0 was still on Solana. However, by early May, the transaction numbers on BSC quickly caught up and even surpassed those on Solana, showing that as time progressed, Alpha2.0's activity on BSC rapidly increased, possibly related to adjustments in market-making strategies. Although Solana still maintained stable trading volume, its growth rate appeared to slow down slightly.

Opportunities and Concerns During the Emotional Recovery Period: The Next Challenge for Alpha2.0

In the current recovery period following the recession and tariff shocks, the crypto market has fallen into a stalemate lacking narrative breakthroughs: without new mainline stories, it is impossible to form market synergy, and the common leading effects seen in mainline narratives are difficult to manifest, making it challenging to generate real wealth effects. Although USDT is abundantly supplied in the market, overall liquidity remains tight in horizontal comparison. At this time, no other narrative can take on the responsibility of driving the overall situation; only Ethereum can play the dual role of "narrative core" and "liquidity reservoir" in the fleeting wave of opportunity. While it is difficult to firmly state that expectations of network upgrades or the actual implementation of ETF staking have brought buying pressure to Ethereum, looking at it from another angle, the current market has deteriorated to the point where Ethereum needs to become the main carrier of market sentiment and capital flow; in the past, the role of the leading project often fell to the top projects.

When Ethereum or some memecoins or other hot assets experience short-term explosive growth, strong projects and top exchanges (like Binance) must unhesitatingly follow this wave of enthusiasm, never remaining on the sidelines or missing opportunities due to hesitation. Because the current small cycle bull market catalyzed by emotional recovery has uncertainty about whether it can further evolve into a larger-scale bull market. If strong projects do not respond in a timely manner to price K-lines or trading volume on exchanges, they can easily be judged by the market as "lacking energy" and subsequently abandoned. Even if the current small bull market ultimately fails to upgrade successfully, there are still many potential positives (such as liquidity recovery) to initiate market movements. In this context, strong projects and exchanges should leverage every rising cycle to cultivate market confidence and solidify wealth consensus: as long as liquidity is continuously injected and transactions are actively generated before market corrections, they can establish a positive image in investors' minds of "ample funds and a keen market sense." Conversely, if they choose to "remain inactive" at critical junctures, they are likely to be seen as lacking sustained driving force, making it difficult to gather sufficient market synergy when larger-scale market movements arrive.

For Alpha2.0, the current emotional recovery period brings both opportunities and exposes concerns. From the perspective of real on-chain traffic, the activity on BSC is almost negligible—this is clearly not the ideal result that Binance and its ecosystem hope to see. The current buzz and noise of Alpha2.0 rely more on concentrated operations by market makers and project parties rather than spontaneous participation from global retail users. This "artificially piled up" apparent trading volume is likely to experience a cliff-like drop once external stimuli are lost. How many more rounds of small or large bull markets will it take to gradually cultivate a truly spontaneous and positive liquidity ecosystem? This is precisely the core variable we need to focus on when observing the future development of Alpha2.0.

About Movemaker: Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecological partners.

Disclaimer: This article/blog is for reference only, representing the author's personal views and does not represent the position of Movemaker. This article does not intend to provide: (i) investment advice or investment recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific issues, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling these data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。