In Vakee's view, the Agent is not an upgraded version of an app, but rather the next generation of user interface. She even asserts, "All apps will disappear in the future and will be replaced by Agents."

01

Before developing Bobby, Vakee had been trading stocks for over 20 years.

She started trading at the age of 9 (three years later than Buffett) and can intuitively make various trades. After graduating from Imperial College, Vakee first worked at a quantitative fund, using machine learning to trade futures and futures derivatives. In her twenties, she made her first 10 million by shorting a certain U.S. stock.

The numbers in her account swelled like game scores. For Vakee, making money was too easy, which made it a bit boring. She lacks interest in any effortless enjoyment, such as buying bags, traveling, or hoarding luxury goods. Usually, she shops on Pinduoduo and never flies business class unless one day business class can fly faster.

When trading becomes as simple as breathing, one must find crazier games.

After working in product research and development at a large company for a few years and then doing VC investment in the primary market for five years, Vakee officially started her own business. Her first product was RockFlow, a smart brokerage for U.S. stocks aimed at global users.

RockFlow simplifies the investment process with AI, launching modules like daily trading opportunity recommendations, automatic following of trades, and ultra-simple options, making the originally complex financial platform as fun as a game.

However, this product, launched in 2021, is essentially still a "smarter tool"; it cannot understand "why users want to trade at this moment," and of course, it cannot help you place orders directly.

Now, Vakee is about to launch a new project: an AI Agent named Bobby.

Bobby's goal is to completely replace apps; ordinary users only need to express their thoughts in natural language, and Bobby can complete the entire process of intention breakdown → strategy generation → order execution, closing the trading loop.

- RockFlow app order interface vs Bobby natural language order page

For example: When you are browsing the Pop Mart page, Bobby might pop up: "You have spent 2000 yuan on Pop Mart this month, and the Labubu topic has topped the TikTok trends. The secondary market premium rate for the Labubu x Vans collaboration has reached 1284%. Do you need to increase your position in the trendy toy sector?"

This creates a generational gap compared to chatbots that can only answer questions (like BloombergGPT or the Morgan Stanley GPT currently in development) or smart tools that require manual operation (like the original RockFlow).

In Vakee's view, the Agent is not an upgraded version of an app, but rather the next generation of user interface.

She even asserts, "All apps will disappear in the future and will be replaced by Agents."

To take it a step further, when you say to Bobby, "I hate Trump," Bobby will provide suggestions based on your attitude towards Trump, such as avoiding or shorting Trump-related stocks (like DJT), while also recommending you to go long on the renewable energy sector, considering his support for traditional energy policies. It will also ask about your investment expectations, helping you choose targets that better match your risk preferences and expected returns.

A person's emotions and values are turning into trading instructions.

This is precisely the starting point for Vakee to create Bobby.

02

Vakee's love for "trading" is as natural as many people's love for food and travel. For most people, investing is complex and has barriers. But for her, every day upon waking is a world full of trading opportunities. Anytime, anywhere, it's at her fingertips.

For example, during this year's Spring Festival, when DeepSeek exploded, relatives back home started chatting with AI. The RockFlow team quickly applied for DeepSeek-related services from cloud vendors, and she immediately bought Alibaba, as the cloud computing business would inevitably benefit from the demand for computing power brought by open-source models.

One year, when she traveled to Japan, she found that Sagami's ultra-thin condoms were sold out on the shelves of every convenience store. She immediately researched the company and discovered that its exploration of ultra-thin polyurethane material was earlier and more aggressive than Okamoto's, and it was the best-selling item on domestic cross-border e-commerce platforms at the time. This stock ultimately yielded her a fourfold return that year.

Trading is a lifestyle, and Vakee firmly believes in this.

She does not enjoy luxury; she usually shops on Pinduoduo. In contrast, she is almost fanatical about anything that requires training, challenges, and extreme mobilization. She enjoys the thrill of challenging a project in a short time, having achieved the remarkable feat of passing the judicial examination in nine days and once obtaining a highly regarded American ACE fitness instructor license with the highest score.

After that, she directed her passion towards AI. For the past decade, she has either been involved in AI product development, investing in AI, or starting businesses focused on AI.

Now, Vakee has finally found a new boss that is interesting enough: Bobby.

- The RockFlow team is mostly composed of people, and team-building activities involve sitting silently and looking at the sky.

03

When we met with Vakee, the trade war had just begun. In the café, the panicked market sentiment flowed through everyone's phone screens like electricity.

"What can Bobby do now?" I asked.

"Bobby, find companies that are least affected by tariffs and have the potential for unexpected growth in the next three months," Vakee said.

A few seconds later, Bobby provided the answer:

"Consider areas with tariff exemptions, such as AI infrastructure, data centers, and semiconductor manufacturing equipment, which may receive partial tariff exemptions or deferred implementation. Leading domestic production companies in the U.S. are also expected to exceed expectations due to their ability to avoid import tariffs by manufacturing locally."

"In addition, leading companies in rigid demand industries and defensive sectors can also be appropriately allocated. Please refer to the list of potential tariff stocks."

And it actively inquired, "Do you need me to automatically place an order if the stock price of these companies drops more than 10% within a week?"

In the AI era, some use large models to create videos and PPTs, some chat with DeepSeek to replace dating, and others want to raise an immortal AI cat.

But Vakee believes that future trading will be a game between AI and AI, so everyone needs a Bobby.

Dialogue with Vakee

Part 01

About Bobby

AI is inhuman, which is why it makes money

AI NOW!: Many financial products today have integrated large models, such as Bloomberg's BloombergGPT, and Morgan Stanley is also developing the AI assistant GPT Copilot. What distinguishes Bobby from them? Is it just a chatbot that can place orders?

Vakee: If Bobby were just a chat tool that can place orders, I wouldn't have created it at all. Have you ever asked those financial chatbots, "What should I buy right now?"

AI NOW!: They analyze the market, provide some suggestions, and will definitely add, "Investing involves risks."

Vakee: Right, because they are just answering questions, not making decisions. Bobby is different. For example, if you say, "I hate Trump," it won't give you a summary of "The impact of Trump's policies on the market," but will directly ask, "Do you want me to exclude stocks related to the Republican Party? I detect that the renewable energy sector may benefit; these are specific targets. Do you want help adjusting your position?"

AI NOW!: Is this a more advanced version of semantic understanding?

Vakee: No, it's a completely different logic. A chatbot responds to what you ask, while Bobby calculates even before you ask. For example, if it notices you've been reading semiconductor news but don't hold any chip stocks, it will proactively ask, "Do you want me to monitor TSMC's earnings report? If it exceeds expectations, would you consider buying?"

Of course, you can also teach Bobby your own analysis logic.

AI NOW!: It sounds like Bobby addresses the key issue of translating a person's "initial thought" about trading into execution. Is this difficult for the average user?

Vakee: It's difficult for many people. Take the recent drop in U.S. stocks as an example; everyone knew it would likely lead to a significant drop before the tariffs were imposed, but determining a specific time to act and deciding which stocks to sell and how much requires diligent market research to track details for correct action. Most people have ideas but lack execution; they may be lazy or simply not know how to operate specifically.

For instance, the simplest trading strategy—buy low and sell high—many people fail to execute. When a stock rises by 30%, most people are unwilling to sell, always hoping it will rise further, maybe to 50%. Without timely profit-taking, it often drops significantly afterward, and once it falls, panic selling is common.

But AI won't do that because AI lacks human weaknesses.

AI NOW!: Can one not make money in the stock market if they have human emotions?

Vakee: Human emotions are often filled with greed, anger, and ignorance. It is anti-human nature that allows one to make money in the stock market, so AI is definitely better at making money.

AI NOW!: If I say to Bobby, can you help me adjust my investment portfolio to achieve zero risk and 100% return?

Vakee: You see, that's greed, haha. Bobby will honestly say, "That's not possible," and then help you translate your desire for overnight wealth into an executable plan with an annualized return of 20%.

AI NOW!: But won't the trust cost of a trading agent be too high? If a PPT agent makes a mistake, it can be corrected; at worst, it's just a mistake. Won't users worry that the agent will lead to losses?

Vakee: We have set safety words. You can say, "Bobby, just monitor without trading," "Call me when Nvidia drops to $98," or "No single trade over $10,000." In fact, most people feel more at ease after trying it out, for the same reason: AI lacks human weaknesses.

Part 02

About Entrepreneurship

On the first day of entrepreneurship, I was training an AI trader

AI NOW!: Your initial entrepreneurial project was RockFlow, a Gen Z brokerage platform. Is Bobby a must-do based on this, or is it because everyone is starting to create AI agents this year?

Vakee: My vision for RockFlow from day one has been "to make investing simpler." Over the past two years, we have used many methods to achieve this concept, such as making the app extremely simple. But I found that it wasn't enough.

By 2025, I believe the new generation of young users, especially those who are natives of the AI era, can completely place orders and trade using natural language. As long as you speak, Bobby can quickly break down your thoughts, generate strategies, and execute orders.

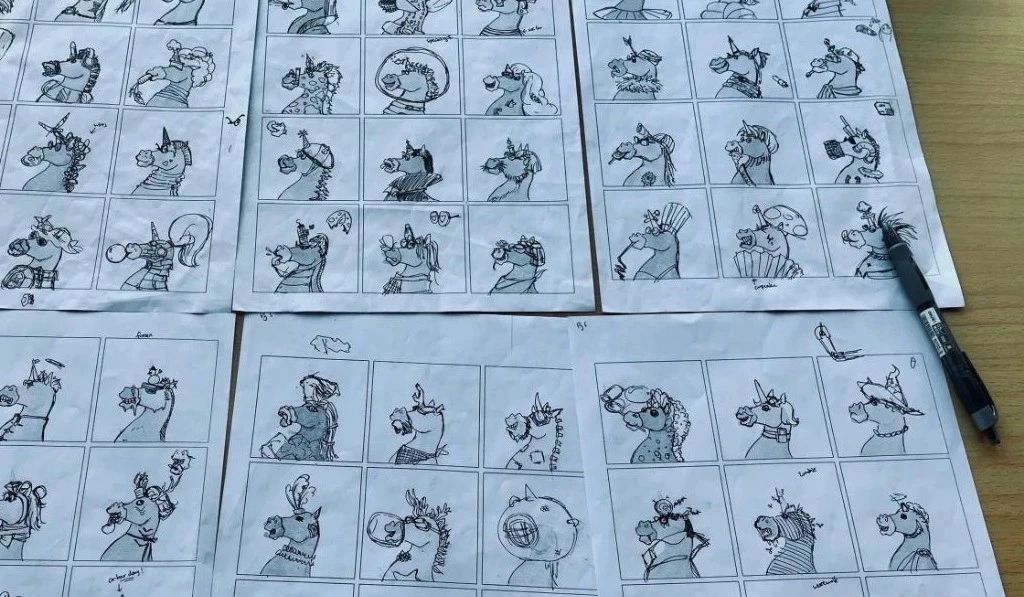

- RockFlow's initial NFT avatar design draft

AI NOW!: Many brokerage platforms are now choosing to integrate general large models to provide investment advice. Why didn't you first add a chat box to RockFlow, like integrating DeepSeek for stock selection? This seems like the most natural upgrade path.

Vakee: General large models can indeed provide standardized analysis, but that is far from sufficient for real investment trading. When we need to conduct precise research and analysis based on each user's personalized needs and trading preferences, while also meeting real-time requirements and guiding immediate trade execution, general models fall short. They can only batch process the information they find and cannot complete a true decision-making loop.

Bobby uses a workflow + LLM/Agent model to maximize AI creativity while controlling costs and risks.

The key is that all the information we integrate into our workflow—whether it's user data, market volume and price data, or capital market sentiment data—has been processed through our professional know-how. Only in this way can we generate responses that are both reasonable and truly understand the user, ultimately completing the trade execution.

AI NOW!: There are also many general agents integrating vertical domain knowledge bases, such as Koushijian claiming to integrate a certain expert system. Why do you insist that vertical agents like Bobby are the future, rather than waiting for general agents to become more powerful?

Vakee: This goes back to a fundamental question: there are two types of needs in the world.

The first type is life-and-death needs. For example, financial trading, medical diagnosis—most people cannot achieve a score of 70 in these areas, and failing to reach 70 is equivalent to scoring 0, as it can lead to serious consequences. The characteristics of these tasks are: extremely high professional thresholds and very low tolerance for error. However, there are clear methods to achieve a score of 70;

The second type is enhancement needs. For example, making a PPT or writing a travel guide—it's okay if an ordinary person doesn't achieve a score of 70, but not achieving 70 doesn't mean scoring 0; it just means it's not perfect.

General agents are suitable for solving the second type of need. However, for life-and-death needs like financial trading, it must be completed by vertical agents. There are several reasons for this:

Different data dimensions: We need to process millisecond-level market data, real-time user positions, and other professional information.

Different levels of responsibility: A wrong investment suggestion can lead to significant losses for the user.

Different decision-making mechanisms: It's not about giving "possible maybe" suggestions, but making executable judgments.

AI NOW!: Just like you wouldn't let a general practitioner perform heart surgery?

Vakee: Right, you wouldn't dare. Bobby has been a "finance major" since its inception, and every judgment it makes is based on the training of a professional trader.

AI NOW!: Many people think that workflows can only handle simple query-type narrow tasks. How do you make Bobby truly "understand finance"?

Vakee: The workflow itself is just a tool; the key is how to use it.

Industry knowledge is the foundation, but the real breakthrough lies in: we enable the workflow to dynamically generate trading information most relevant to the user at that moment—including risk preferences, real-time positions, trading intentions, and market sentiment—combined with the financial know-how accumulated by the team, through thousands of dynamic nodes for real-time combination and interpretation. This is not simple information retrieval; it is real-time analysis and response to market signals like a professional trader. In the investment scenarios validated by RockFlow, the execution efficiency of this system is several orders of magnitude higher than that of general large models.

The ideal model we pursue is to build a data-driven, self-evolving world model that allows financial decisions to continuously learn and adapt in a dynamically changing market, achieving true intelligence and efficiency.

AI NOW!: What about the "understanding the user" aspect? How does Bobby know who you are and what you want to do?

Vakee: Bobby integrates RockFlow's over-the-counter trading system, real-time market data, and user data, acting like a hedge fund manager on standby 24/7.

For example, when a user says, "I just lost my job and want to invest conservatively," Bobby will automatically lower the risk preference, recommend a combination of government bonds and high-dividend stocks, and set a dynamic stop-loss line. It may proactively ask during market fluctuations, "I detected that the Federal Reserve may raise interest rates; do you need to adjust your bond position?"

AI NOW!: If financial vertical agents are the future, why haven't we seen Robinhood or Futu moving in this direction yet?

Vakee: The AI-native investment trading platform experience requires a fundamentally different technical architecture from day one compared to mobile internet brokerages. The more successful predecessors find it harder to abandon all existing business infrastructure and user experience to achieve a self-revolution in the AI era.

The mission of the previous generation of mobile internet brokerages was to provide users with a very good mobile client experience, significantly improving upon traditional brokerages like Interactive Brokers from the PC era. They did this well and met the needs of users from the 70s and 80s. However, in the AI era, the younger generation of users, represented by Gen Z, has new investment trading experience needs.

RockFlow is different in that we have been clear from day one of our entrepreneurship that we want to create an AI-native investment and wealth management platform for the new generation of investors, building our own AI infrastructure and over-the-counter trading system suitable for AI training. We are the only ones in the world doing this.

AI NOW!: Wait, what does building your own over-the-counter trading system mean?

Vakee: For brokerage platforms, the over-the-counter trading system is equivalent to Douyin's recommendation algorithm. Using someone else's system is like a black box; not every module will be open for model training, so we must do it ourselves. Only in this way can we obtain structured, continuous user behavior data from the ground up, understand the user's true decision-making path, and continuously feedback and optimize based on that.

When we initially designed the RockFlow over-the-counter trading system, we already considered how each module would be implemented for machine learning in the future. This data is not a static asset; it is the raw material for training each person's personalized Bobby.

Part 03

About AI

Killing the APP, the Agent is the ultimate evolution of all services

AI NOW!: It sounds like you've been preparing for the Agent from day one.

Vakee: I flipped through the minutes of our first meeting about Bobby, which was in September 2023. From the very beginning of RockFlow, we designed the entire system with an AI-native goal, including the trading system, data, and product architecture. However, the thinking has indeed become clearer over time, and we have taken some detours in the design of the Agent architecture; these are valuable experiences.

Every generation of user-facing products has its historical mission. In the AI era, your product mission is certainly not just to be a bit more feature-rich or to simplify design interactions, adding or removing a button or something like that.

AI NOW!: What is the mission of products in the AI era?

Vakee: I believe it is the first time that it is truly possible to understand users and proactively serve them. Good products in the mobile internet era made users "operate more efficiently," while in the AI era, it is about making users not operate—being served directly.

So in the past, on apps, it might have guided you step by step on "how to buy options" or "how to find suitable options," but today AI directly recognizes your intention—"I want my investment return to be 20%" or "I want to avoid this stock market crash." This is a fundamental revolution in the underlying paradigm.

So I believe the Agent is not an upgraded version of the app; it is the next generation of user interface.

AI NOW!: Specifically for Bobby, what is its mission?

Vakee: My original intention in doing this is that I believe investing is quite personalized; it is a comprehensive reflection of a person's values and worldview.

As we discussed earlier, many people have ideas; they have various perceptions of what happens every day, but they are trapped by some details, which prevents them from acting correctly and in a timely manner. People often say trading is about monetizing cognition—but for most people, the biggest difficulty lies in the transition from cognition to trading; they don't know how to operate. Bobby is here to help everyone solve this problem.

AI NOW!: Whether I hate or like Trump, it can all be used for trading.

Vakee: Both can be traded, and both can make money.

AI NOW!: From operating a tool to being served by an agent.

Vakee: Yes. In this sense, I believe all apps will disappear in the future and will be replaced by Agents.

AI NOW!: I also believe in this future. But have you ever worried that you started too early and became an industry pioneer?

Vakee: I don't think that way. For the past ten years, I have either been investing in AI or starting businesses focused on AI. All my experiences have led me to do Bobby today. The brave enjoy the world first.

• Since 2025, what has shocked you the most about AI?

Vakee: When DeepSeek visualized its deep reasoning and presented it to everyone.

• In the past year, what is something in the AI field that you initially didn't think highly of but later completely changed your mind about?

Vakee: Text-to-image generation. Accurately generating images while ensuring consistent character poses and meaningful text was very difficult at first. I thought the path to commercialization for text-to-image generation was still very far away. However, with the emergence of new technologies and products starting from Diffusion Transformers, it has been very powerful, far exceeding expectations. Now, text-to-image generation can be fully utilized in various production scenarios.

• If you could personally shut down an AI product or trend that you think is completely a false demand or misdirection, which one would you choose?

Vakee: It's difficult to do general functions on companies like OpenAI or products that haven't deeply integrated into business scenario loops. OpenAI's new models can easily be disrupted; for example, when the GPT-4o feature for one-click generation of Ghibli-style content came out, many startups died because they hadn't figured out how to build a business moat.

So for me, the most important thing is not "whether I use AI," but "what problem I solve," whether I can abstract needs in vertical scenarios and consider long-term commercial value and business barriers. The industry still lacks more excellent AI product managers.

So back to Bobby, creating Bobby is not about showcasing AI technology, but about making investing simpler and creating value. If one day I find that Bobby cannot achieve this, it can also be completely discarded; there is no need to be attached.

• At this stage of AI development, what do you think is underestimated? What is overestimated?

Vakee: The demand for computing power is underestimated, while the arrival of AGI is overestimated. Now everyone thinks that stacking more GPUs and training larger parameter models can bring us closer to AGI, but the real bottleneck is actually at the application level—I believe the next few years will be an explosion period for vertical agents, and this is a long-term process. Each niche field requires customized computational optimization. Just like after the popularization of electric vehicles, charging stations are the real bottleneck.

• What are you most looking forward to in 2025?

Vakee: The "Cambrian explosion" in vertical application fields. In complex scenarios such as finance, healthcare, education, tourism, and supply chains, true agents that reconstruct user experiences will emerge, not just simple chatbots.

For example, an agent that can automatically complete personalized travel planning, negotiate prices, and make payments; or an educational agent that can customize personalized learning paths based on learning abilities and preferences. These do not need to wait for general artificial intelligence (AGI); existing technologies and vertical data can achieve this.

• Finally, recommend three of your favorite books to everyone!

Vakee: "The Pleasure of Finding Things Out" by Richard Feynman, "Right View" by Dzongsar Khyentse Rinpoche, and "Deng Xiaoping and the Transformation of China" by Ezra F. Vogel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。