Part One: Bitcoin Miners' Sell Pressure Drops to Lowest Since 2024—Is the Market Gearing Up for New Highs?

1. Shift in Miner Behavior: From Selling to Holding

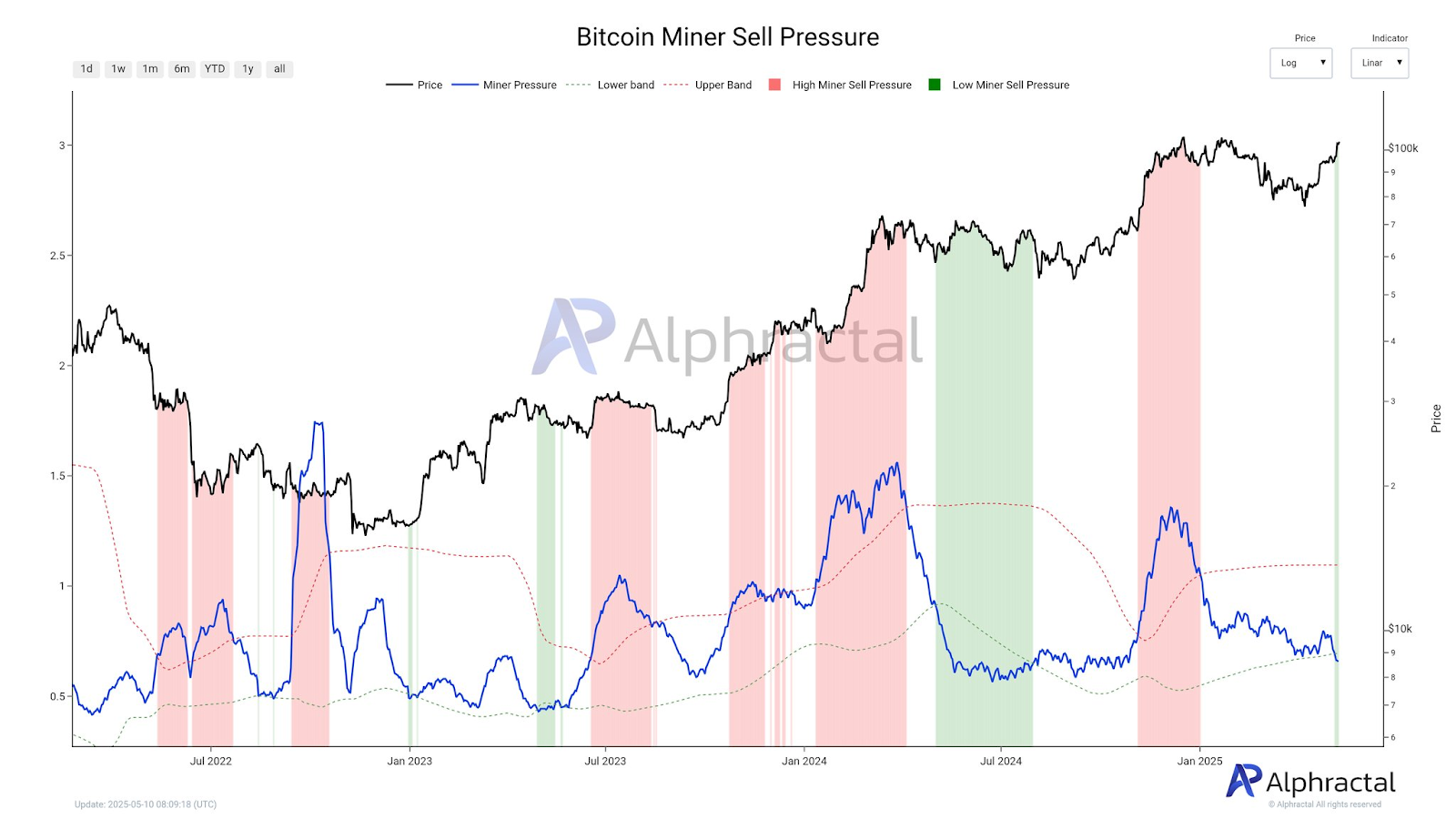

According to the latest data from cryptocurrency analysis platform Alphractal, the Bitcoin miner sell pressure indicator (which measures the ratio of outflows to reserves over a 30-day period) has fallen below the lower bound, reaching its lowest level since 2024. This phenomenon indicates that miners are shifting from the past model of "selling to cover operating costs" to a more strategic accumulation approach.

This stands in stark contrast to the dilemma faced by miners after the 2024 halving, when miner income was halved (with daily sell volumes increasing from 900 to 1200 BTC), but the current market environment has prompted miners to adjust their strategies:

- Profit Expectations Drive Accumulation: With Bitcoin's price recently breaking $100,000 and approaching historical highs, miners are more inclined to hold Bitcoin in anticipation of higher returns rather than cashing out in the short term.

- Structural Optimization in the Industry: The scale of mining led by publicly listed companies (such as Bitfarms and CleanSpark) has reduced the exit risk for inefficient miners, and the increased industry concentration has alleviated sell pressure.

- Learning from Historical Experience: In past cycles, excessive leverage and long-term holding by miners led to liquidity crises (such as the 2018 bear market), prompting a greater focus on short-term financial stability today.

2. On-Chain Data Reveals Market Resilience

Alphractal's miner sell pressure indicator shows that the current market structure is markedly different from the "panic selling" seen at the beginning of 2024:

- Long-Term Holders Dominate: Currently, over 80% of Bitcoin is held for more than six months, significantly lower than the dominance of short-term holders at historical cycle peaks, providing stable support for prices.

- Exchange Reserves at New Lows: Bitcoin exchange reserves continue to decline, indicating that the market is in a "high-speed accumulation phase," with sell pressure dispersed through over-the-counter trading or institutional holdings.

- Risks in the Derivatives Market: Although the spot market remains stable, there are significant high-leverage long positions in the $100,000 to $110,000 range, which could trigger a multi-billion dollar liquidation wave if prices fluctuate.

3. Price Trends and Future Expectations

As of May 12, 2025, Bitcoin's price is reported at $104,250, with a 24-hour increase of 1% and a cumulative rise of over 30% in the past month. The market's focus on future trends is divided on the following points:

- Technical Signals: The RSI (75) indicates overbought conditions, but the MACD continues to trend upward; if the key support level of $10,000 is breached, it may trigger sell-offs from short-term holders.

- Impact of Macroeconomic Variables: Expectations of Federal Reserve interest rate cuts (if cuts exceed 100 basis points in 2025) could provide Bitcoin with a "Davis Double" opportunity, but stagflation risks may weaken its safe-haven attributes.

- Dynamics of Miner Behavior: If prices break above $110,000, miner sell pressure may rise, but the current low sell levels suggest the market may enter a "calm upward phase."

Part Two: Market Concerns Behind "Substantial Progress" in US-China Trade Agreement

1. White House Statement and Agreement Outline

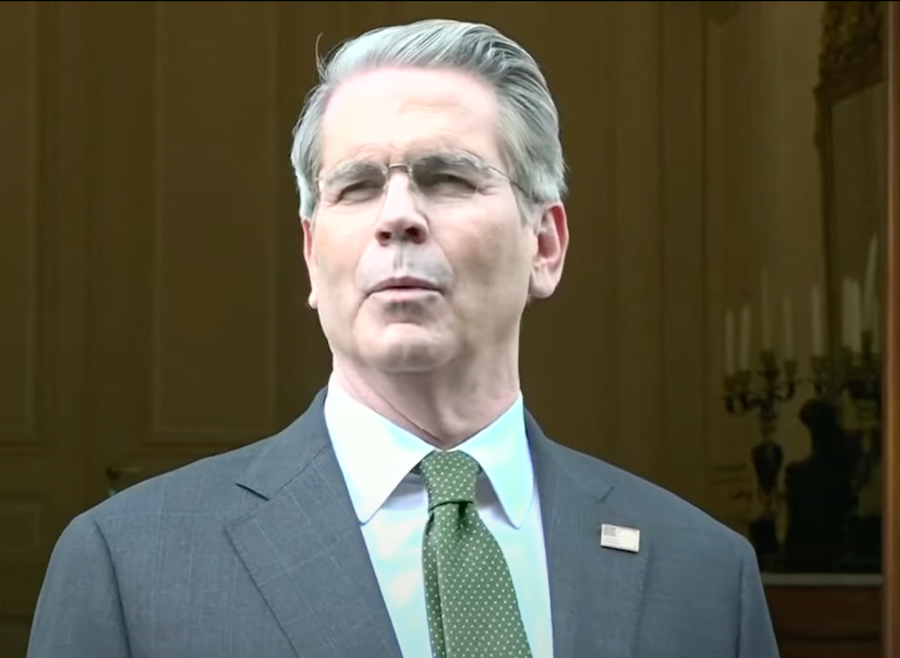

On May 11, US Treasury Secretary Scott Bansen and Trade Representative Jamison Greer jointly announced that the US-China trade negotiations have made "substantial progress," with both sides reaching a principled consensus in the following areas:

- Market Access: China has committed to expanding imports of US agricultural products, and the extension of tariff exemptions on certain US technology products.

- Intellectual Property Protection: Establishing a cross-border enforcement cooperation mechanism to lower barriers to technology transfer.

- Dispute Resolution Mechanism: Setting up a permanent consultation platform to prevent the escalation of trade frictions.

2. Market Reaction and Concerns

Despite the positive signals from officials, the lack of details in the agreement has led investors to be cautiously optimistic:

- Residual Uncertainty: The volatility of Trump administration policies (such as the "one-day trip" of the 2024 electronic tariff exemption) has weakened market trust, and risk assets remain under pressure until the agreement is finalized.

- Unresolved Structural Contradictions: Competitive policies between the US and China in areas like semiconductors and artificial intelligence (such as "Trade War 2.0") may continue through non-tariff means.

- Diverging Liquidity Effects: If the agreement leads to a decline in the US dollar index (DXY), Bitcoin may benefit from a restart of the "anti-fiat" narrative; however, if negotiations break down and trigger safe-haven demand, gold may divert funds.

3. Global Economic Ripple Effects

The potential systemic impacts of easing US-China trade tensions include:

- Supply Chain Restructuring: The agreement may accelerate the trend of "nearshoring," enhancing the manufacturing hubs in Mexico and Southeast Asia, and increasing demand for cross-border cryptocurrency payments.

- Inflation Relief Expectations: Tariff reductions are expected to alleviate pressure on the US CPI, providing room for the Federal Reserve to cut rates, indirectly benefiting risk assets.

- Geopolitical Risk Shifts: If US-China cooperation strengthens, alternative crises such as the Russia-Ukraine conflict and Middle East tensions may become new sources of market volatility.

Part Three: Market Game and Investment Strategies Intertwined with Dual Main Lines

1. Resonance Between Bitcoin and Macroeconomic Policies

- Interest Rate Sensitivity and Correlation: The correlation between Bitcoin and the Nasdaq index (0.78) indicates that it has not yet detached from the traditional risk asset framework; if the US-China trade agreement boosts tech stocks, Bitcoin may benefit in tandem.

- Miner Behavior as a Leading Indicator: Historical data shows that after miner sell pressure bottoms out, Bitcoin often enters an upward cycle (as seen in the bull market following miner capitulation in 2023), and the current low sell levels may signal a similar trend.

2. Risk and Opportunity Assessment

- Short-Term Volatility Risks: The accumulation of leverage in Bitcoin derivatives and the ambiguity of US-China agreement details may trigger price fluctuations, with the support level of $10,000 becoming a dividing line for bulls and bears.

- Long-Term Narrative Strengthening: The average daily accumulation of Bitcoin ETFs (800 BTC) remains higher than miner output (450 BTC), with the institutionalization process offsetting some market shocks.

Conclusion: Certainty Logic in a Complex Market

The global market in May 2025 stands at the dual juncture of Bitcoin's "post-halving cycle" and the "rebalancing of US-China trade relations." The low sell pressure from miners and the White House's progress on the agreement may seem independent, but they point to a core proposition: asset repricing under liquidity reconstruction. Whether Bitcoin breaks previous highs or the US-China agreement materializes, the market will ultimately validate a truth—amid the collision of macroeconomic iron curtains and crypto narratives, only assets that combine resilience and efficiency can achieve long-term victory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。