Abstract: As Trump's policies are being implemented one by one, attracting manufacturing back through tariffs, actively triggering stock market bubbles to force the Federal Reserve to cut interest rates and inject liquidity, and then promoting financial innovation through deregulation policies to accelerate industrial development, this set of tactics is genuinely changing the market. Among them, the RWA track under deregulation policies is increasingly attracting the attention of the crypto industry. This article mainly introduces the opportunities and challenges of tokenized stocks.

Overview of the Development History of Tokenized Stocks

In fact, tokenized stocks are not a new concept. Since 2017, attempts at STO (Security Token Offering) have already begun. The so-called STO is a financing method in the cryptocurrency field, essentially digitizing and putting traditional financial securities on the blockchain, achieving asset tokenization through blockchain technology. It combines the compliance of traditional securities with the efficiency of blockchain technology. As an important category of securities, tokenized stocks are the most noteworthy application scenario in the STO field.

Before the emergence of STO, the mainstream financing method in the blockchain field was ICO (Initial Coin Offering). The rapid rise of ICO mainly relied on the convenience of Ethereum smart contracts, but most projects issued tokens that did not represent real asset rights and lacked regulation, leading to frequent fraud and exit scams.

In 2017, the U.S. SEC (Securities and Exchange Commission) issued a statement regarding the DAO incident, pointing out that certain tokens might be considered securities and should be regulated under the Securities Act of 1933. This marked the official emergence of the STO concept. In 2018, STO gradually became popular as a concept of "compliant ICO" and began to attract industry attention. However, due to the lack of unified standards, poor liquidity in the secondary market, and high compliance costs, market development was slow.

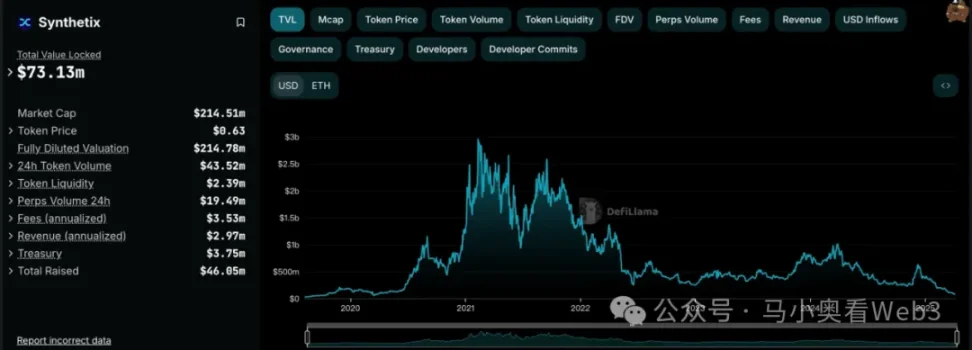

With the arrival of the DeFi Summer in 2020, some projects began to attempt decentralized solutions, creating derivatives linked to stock prices through smart contracts, allowing on-chain investors to directly invest in the traditional stock market without complex KYC processes. This paradigm is typically referred to as the synthetic asset model, which does not directly hold U.S. stocks and allows trading without trusting centralized institutions, thus bypassing expensive regulatory and legal costs. Representative projects include Synthetix and the Mirror Protocol of the Terra ecosystem.

In these projects, market makers can mint on-chain synthetic U.S. stocks by providing excess cryptocurrency collateral and provide market liquidity, while traders can directly trade these assets in the secondary market of DEX, gaining exposure to the prices of the anchored stocks. At that time, the most popular stock in the U.S. market was Tesla, rather than Nvidia from the previous cycle. Therefore, most projects' slogans highlighted the selling point of trading TSLA directly on-chain.

However, from the perspective of final market development, the trading volume of on-chain synthetic U.S. stocks has been unsatisfactory. Taking sTSLA on Synthetix as an example, including the minting and redemption in the primary market, the total cumulative on-chain transactions amount to only 798 times. Subsequently, most projects claimed to have delisted synthetic U.S. stocks due to regulatory considerations and shifted to other business scenarios, but the fundamental reason may be that they could not find PMF (Product-Market Fit) and could not establish a sustainable business model. The logic of synthetic asset business relies on significant on-chain trading demand to attract market makers to mint assets in the primary market and make markets in the secondary market to earn fees. If there is no such demand, market makers cannot earn profits from synthetic assets and must bear the risk exposure of shorting the anchored U.S. stocks, leading to further shrinkage of liquidity.

In addition to the synthetic asset model, some well-known CEXs are also trying to provide crypto traders with the ability to trade U.S. stocks through a centralized custody model. In this model, actual stocks are held by third-party financial institutions or exchanges, and tradable assets are created directly in the CEX. A typical example is FTX and Binance. FTX launched its tokenized stock trading service on October 29, 2020, in collaboration with German financial company CM-Equity AG and Swiss Digital Assets AG, allowing users from non-U.S. and restricted regions to trade tokens linked to U.S. listed company stocks, such as Facebook, Netflix, Tesla, Amazon, etc. In April 2021, Binance also began offering tokenized stock trading services, with Tesla (TSLA) being the first stock listed.

However, the regulatory environment at that time was not particularly friendly, and the core initiators were CEXs, which meant direct competition with traditional stock trading platforms like Nasdaq, naturally facing significant pressure. FTX's tokenized stock trading volume reached an all-time high in the fourth quarter of 2021, with a trading volume of $94 million in October 2021, but its tokenized stock trading service was halted after its bankruptcy in November 2022. Binance also announced the cessation of tokenized stock trading services in July 2021, just three months after launching the business, due to regulatory pressure.

Subsequently, as the market entered a bear phase, the development of this track also stalled. Until Trump's election, his deregulation financial policies brought about a change in the regulatory environment, reigniting market interest in tokenized stocks, but this time it had a new name, RWA. This paradigm emphasizes the introduction of compliant issuers to issue tokens on-chain backed 1:1 by real-world assets, with the creation, trading, redemption, and management of the collateral assets strictly adhering to regulatory requirements.

Current Market Status of Stock RWA

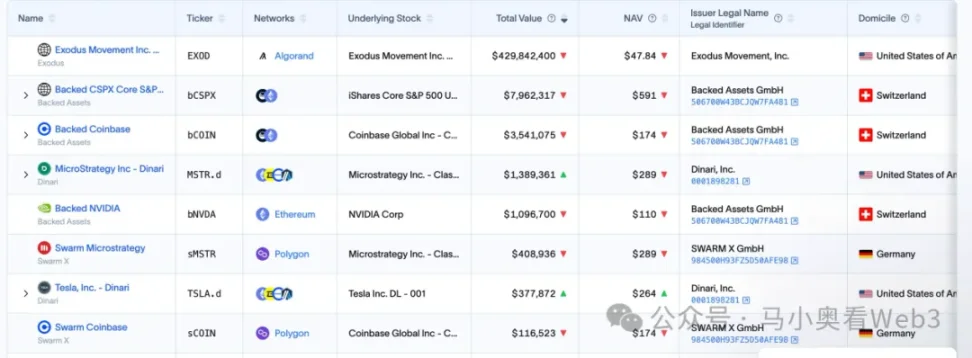

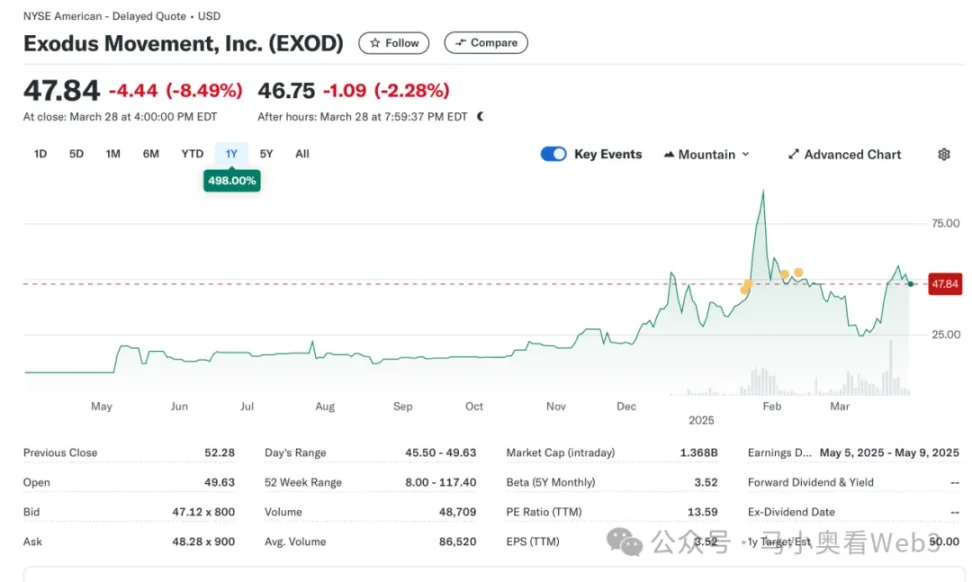

Next, let's introduce the current market status of stock RWA. Overall, this market is still in its early stages and is primarily focused on U.S. stocks. According to data from RWA.xyz, the total issuance of the current stock RWA market has reached $445.40 million. However, it is worth noting that $429.84 million of this issuance is attributed to a single asset, EXOD, which is the on-chain stock issued by Exodus Movement, Inc., a software company focused on developing self-custody cryptocurrency wallets, founded in 2015 and headquartered in Nebraska, USA. The company's stock is listed on the NYSE America and allows users to migrate their common Class A shares to be managed on the Algorand blockchain, where users can directly view the price of this portion of on-chain assets in the Exodus Wallet. The company's total market capitalization is currently $1.5 billion.

The company has become the only one in the U.S. to tokenize its common stock on the blockchain. However, it is important to note that the on-chain EXOD is merely a digital representation of its stock and does not include voting, governance, economic, or other rights, and this token cannot be directly traded or circulated on-chain.

This event is of significant symbolic importance, marking a clear shift in the SEC's attitude towards on-chain stock assets. In fact, Exodus's attempt to issue on-chain stocks was not smooth sailing. In May 2024, Exodus first submitted an application for the tokenization of common stock, but due to the SEC's regulatory policies at that time not having shifted, the on-chain plan was initially rejected. However, in December 2024, after continuous improvements to the technical solutions, compliance measures, and information disclosure, Exodus ultimately received approval from the SEC and successfully completed the on-chain tokenization of common stock. This event also led to a surge in the company's stock price in the market, reaching an all-time high.

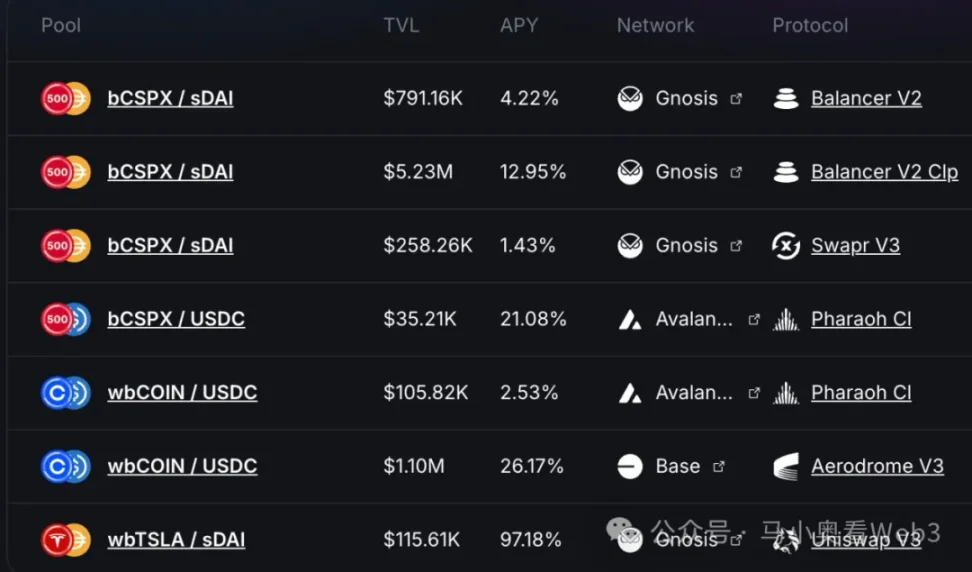

In addition, the remaining market share of about $16 million is mainly attributed to a project called Backed Finance. This is a Swiss company that operates through a compliant structure, allowing users who meet KYC requirements to mint on-chain stock tokens by paying USDC through its official primary market. After receiving the crypto assets, Backed exchanges them for U.S. dollars and purchases COIN stocks in the secondary market (there may be some delays due to stock market opening hours). Once the purchase is successful, the stocks are managed by a Swiss custodian bank, which then mints bSTOCK tokens 1:1 and sends them to users. The redemption process is the reverse. The security of the reserve assets is guaranteed by an auditing company called Network Firm, which regularly publishes reserve proofs. On-chain investors can directly purchase these on-chain stock assets through DEXs like Balancer. Additionally, Backed does not provide stock token holders with ownership of the underlying assets or any additional rights, including voting rights. Only users who have completed KYC can redeem USDC through the primary market.

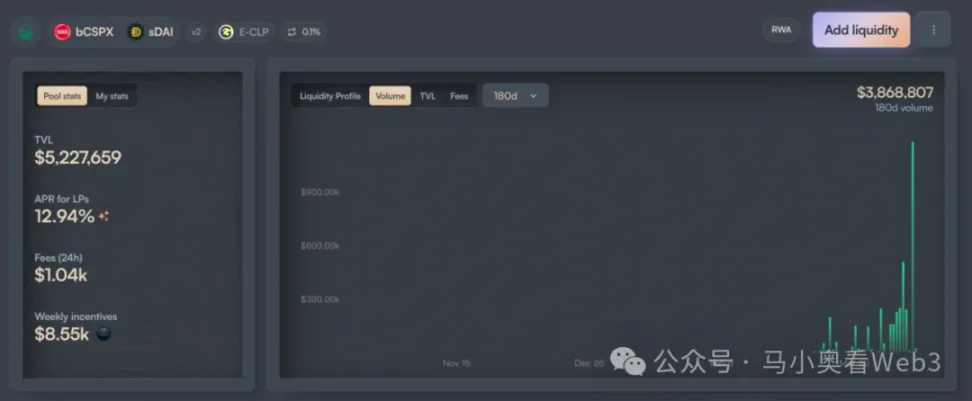

In terms of issuance volume, Backed's adoption is mainly concentrated on two assets, CSPX and COIN, with the former having an issuance volume of about $10 million and the latter around $3 million. In terms of on-chain liquidity, it is mainly concentrated on the Gnosis and Base chains, with bCSPX liquidity of about $6 million and wbCOIN liquidity of about $1 million. However, the trading volume is not very high; for example, the largest liquidity pool of bCSPX has accumulated a trading volume of about $3.8 million and approximately 400 transactions since its deployment on February 21, 2025.

Another noteworthy development is the progress of Ondo Finance. With Ondo announcing its overall strategy for Ondo Chain and Ondo Global Markets on February 6, 2025, tokenized stocks are a core trading target within Ondo Global Markets. Perhaps with broader TradFi resources and a better technical background, Ondo can accelerate the development of this track, but it remains to be seen.

Opportunities and Challenges of Stock RWA

Next, let's explore the opportunities and challenges of stock RWA. Generally, the market believes that stock RWA has the following three advantages:

- 24/7 trading platform: Due to the technical characteristics of blockchain, it operates around the clock. This allows the trading of tokenized stocks to break free from the time constraints of traditional exchanges, fully tapping into potential trading demand. For example, Nasdaq has already achieved the capability for 24-hour trading through extended pre-market and after-hours trading, but regular trading hours are still limited to weekdays. If a trading platform is developed directly on the blockchain, it can achieve round-the-clock trading at a lower cost.

- Low-cost access to U.S. assets for non-U.S. users: With the widespread adoption of payment stablecoins, non-U.S. users can trade U.S. assets directly using stablecoins, without incurring the transaction fees and time costs associated with cross-border fund transfers. For instance, if a Chinese investor uses Tiger Brokers to invest in U.S. stocks, the cross-border remittance fee is about 0.1%, not considering currency exchange costs, and the settlement usually takes 1-3 business days. However, trading through on-chain channels can avoid these two costs.

- Financial innovation potential brought by composability: With its programmable features, tokenized stocks will embrace the DeFi ecosystem, giving them stronger on-chain financial innovation potential, such as on-chain lending scenarios.

However, the author believes that tokenized stocks currently face two uncertainties:

- Speed of regulatory policy advancement: Based on the cases of EXOD and Backed, we can see that current regulatory policies do not adequately address the issue of "equal rights for stock tokens," meaning that purchasing tokenized stocks and physical stocks do not have the same legal rights, such as governance rights. This limits many trading scenarios, such as mergers and acquisitions through the secondary market. Moreover, the compliant use cases for tokenized stocks are still unclear, which to some extent hinders the pace of financial innovation. Therefore, progress heavily relies on the speed of regulatory policy advancement. Considering that the current core policy goal of the Trump administration is still in the phase of manufacturing return, the timeline may continue to be pushed back.

- Development of stablecoin adoption: From past developments, the core target users of tokenized stocks are likely not crypto-native users, but traditional, non-U.S. investors in U.S. stocks. For this group, the increasing adoption of stablecoins is also a matter of concern, which will be closely related to stablecoin policies in other countries. For example, for Chinese investors, obtaining stablecoins through the OTC market incurs a premium of about 0.3% to 1%, which is significantly higher than the costs of investing in U.S. stocks through traditional channels.

Therefore, in summary, in the short term, the author believes that stock RWA has the following two market opportunities:

For listed companies, they can refer to the case of EXOD to issue on-chain stock tokens. Although there are not many practical use cases in the short term, at least the potential for financial innovation can lead investors to assign a higher valuation to the company. For some companies that can provide on-chain asset management services, this method can transform the identity of investors into product users and convert the stocks held by investors into the company's AUM, thereby enhancing the company's business growth potential.

For tokenized high-dividend U.S. stocks, some yield-generating DeFi protocols may become potential users. As market sentiment reverses, the yields of most on-chain native real yield scenarios will significantly decline, and yield-generating DeFi protocols like Ethena will need to continuously seek other real yield scenarios to enhance overall yield and market competitiveness. Specifically, refer to the example of Ethena configuring BUIDL. High-dividend stocks typically belong to mature industries, with stable profit models and ample cash flow, allowing for continuous profit distribution to shareholders. They also tend to have low volatility and strong resistance to economic cycles, making investment risks more controllable. Therefore, if some high-dividend blue-chip stocks can be launched, they may be adopted by yield-generating DeFi protocols.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。