Organized by: Jerry, ChainCatcher

Important News:

- Binance to Launch MyShell (SHELL) and Start HODLer Airdrops

- SEC Ends Investigation into Gemini Trust, No Enforcement Action Taken

- FBI Confirms North Korean Hacker Group Responsible for $1.5 Billion Theft from Bybit

- Upbit to Block Withdrawals Related to Bybit Hacking Incident at FBI's Request

- Starknet Announces 2025 Decentralization Roadmap: Key Plans Include Staking Mechanism

- Hasu Defends Safe Amid Controversy, Wintermute Founder Claims His Statements Distort Facts

“What Important Events Happened in the Last 24 Hours”

Binance to Launch MyShell (SHELL) and Start HODLer Airdrops

According to the official announcement, Binance will launch MyShell (SHELL) on February 27, 2025, at 13:00 (UTC), and open trading pairs SHELL/BTC, SHELL/USDT, SHELL/USDC, SHELL/BNB, SHELL/FDUSD, and SHELL/TRY. SHELL will carry a seed label.

Users need to deposit BNB into SimpleEarn (flexible and/or locked) and/or on-chain yield products between 00:00 (UTC) on February 14, 2025, and 23:59 (UTC) on February 18, 2025, to qualify for the SHELL airdrop. Airdrop information is expected to be announced within 12 hours, and the new tokens will be distributed to users' spot accounts at least 1 hour before trading begins.

SEC Ends Investigation into Gemini Trust, No Enforcement Action Taken

SEC documents show that the U.S. Securities and Exchange Commission (SEC) has concluded its investigation into Gemini Trust Company, LLC, and decided not to take enforcement action. Gemini co-founder Cameron Winklevoss confirmed on social media that the investigation lasted 699 days, and they received a Wells notice 277 days ago.

Winklevoss criticized the SEC's regulatory actions for causing significant harm to the crypto industry, accusing the agency of enforcing without clear rules, leading to high legal costs and economic losses for businesses. He called for regulatory reform, including requiring the SEC to compensate affected companies threefold for legal fees, firing relevant enforcement personnel, and banning those who abuse regulatory power from holding government positions again.

Previously, the agency (SEC) had withdrawn its lawsuit against Coinbase and ended investigations into OpenSea, Robinhood, and Uniswap.

FBI Confirms North Korean Hacker Group Responsible for $1.5 Billion Theft from Bybit

According to an FBI announcement, the Federal Bureau of Investigation has issued a Public Safety Announcement (PSA) confirming that a North Korean hacker group is responsible for the theft of approximately $1.5 billion in digital assets from the Bybit exchange.

The FBI stated that the hacker group acted quickly, converting some of the stolen assets into Bitcoin and other digital assets, and dispersing them to thousands of addresses across multiple blockchains. It is expected that these assets will be further laundered and eventually converted into fiat currency.

Upbit to Block Withdrawals Related to Bybit Hacking Incident at FBI's Request

Upbit announced that following the recent hacking incident involving Bybit, the FBI has issued an official document requesting all digital asset service providers to block transactions related to these addresses. Upbit will closely cooperate with the investigative agency. Upbit strongly advises users not to withdraw funds to addresses related to the hacking incident and has listed the Ethereum wallet addresses associated with the hackers as released by the FBI.

Starknet Announces 2025 Decentralization Roadmap: Key Plans Include Staking Mechanism

Starknet announced its 2025 decentralization roadmap, aiming to become the first fully decentralized Layer 2 (L2) that scales Ethereum on a large scale. Key plans include staking mechanisms, decentralized operation, and governance independence.

Staking: Starknet will launch the first phase of staking (Staking v1) in November 2024, with over 170 million STRK already staked by 63,000 delegators and 106 validators. Staking v2 to v4 will be rolled out in phases in 2025, ultimately making validators fully responsible for network security and block validation.

Decentralized Operation: Starknet will gradually migrate from the existing architecture to fully open-source Apollo sequencers and Stwo provers, with plans to launch a distributed consensus layer on the mainnet by the end of 2025, where validators will participate in block voting to achieve decentralized operation.

Governance Independence: The Starknet Security Council will further promote decentralized governance of core contracts while enhancing the network's censorship resistance.

Meanwhile, Starknet's latest version v0.13.4 has been launched on the testnet, bringing optimizations such as state compression, fixed L2 gas prices, and Cairo-native performance improvements, with plans to launch the mainnet between March 17 and 24. Future version v0.14.0 will also introduce 2-second block times, more efficient sequencers, and improved fee markets.

Hasu Defends Safe Amid Controversy, Wintermute Founder Claims His Statements Distort Facts

Safe investor Hasu stated on social media that while the recent Bybit theft was due to a breach of the Safe frontend rather than Bybit's infrastructure, Bybit's infrastructure was also insufficient to monitor such a simple hacking attack. When transferring funds exceeding $1 billion, there is no reason not to verify the integrity of the message on a second offline machine. Blaming SAFE instead of Bybit here completely misses the lesson.

In response, Wintermute founder wishfulcynic.eth claimed that Hasu's statements were somewhat misleading and distorted the facts (gaslighting).

Hasu rebutted his series of comments, stating that evaluating whether Safe was at fault in the incident is a difficult question to answer (not because he is an investor in Safe). Safe provided a solution through a centralized frontend, but it should never be fully relied upon. He believes the biggest problem with Safe is that it did not collaborate with large capital clients to provide them with security education; the breach of Safe developers' devices is also one of the issues, but learning from it is more important.

“What Interesting Articles Are Worth Reading in the Last 24 Hours”

Can top security infrastructure be undermined? Should Safe bear liability?

PvP Temporarily Ends, Is Capital Preservation Arbitrage the Current Priority?

An overview of six popular DeFi arbitrage tools.

Multiple Perspectives|New Leadership Aya Miyaguchi, Can Ethereum Regain Market Confidence?

The issues surrounding Ethereum are too complex.

Twist of Events, Bybit's $1.5 Billion Theft Turns Out to Be Safe Protocol Developer Breach

Lazarus is a government-backed North Korean hacker group known for complex social engineering attacks on developer credentials, sometimes combining them with zero-day vulnerabilities.

Review of "Celebrity Coins" Harvest Records: 15 Tokens in 60 Days, Most Down Over 90%

Celebrity/institution tokens led by TRUMP are no exception, with most down over 90% from their peak.

Meme Popularity Rankings

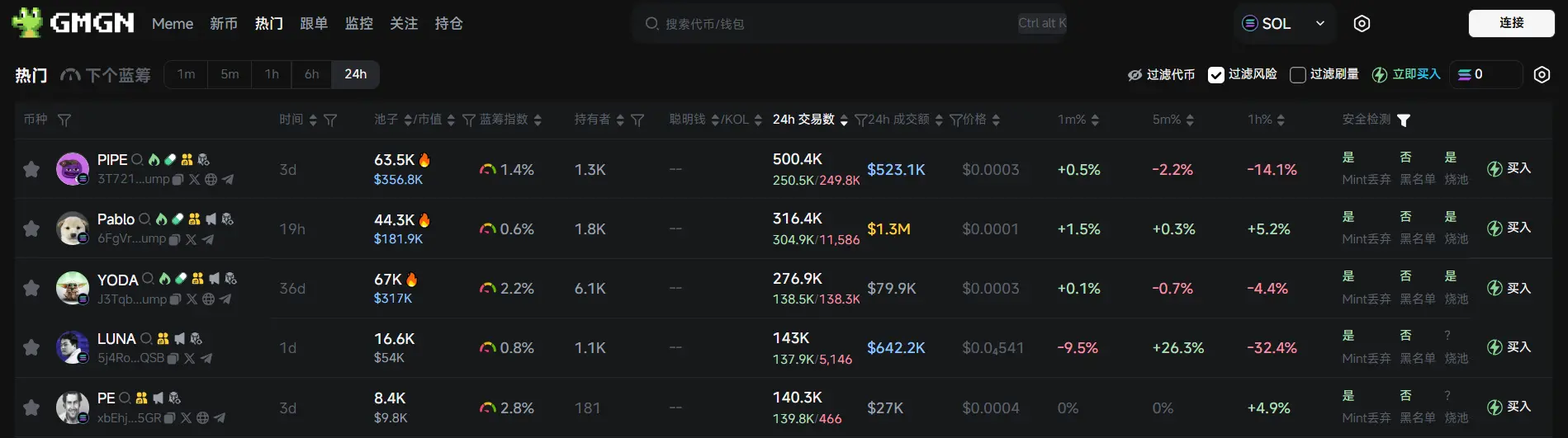

According to the meme token tracking and analysis platform GMGN, as of February 27, 19:50:

The top five popular Ethereum tokens in the past 24 hours are: CLAY, MKR, SPX, LINK, UNI

The top five popular Solana tokens in the past 24 hours are: PIPE, Pablo, YODA, LUNA, PE

The top five popular Base tokens in the past 24 hours are: VIRTUAL, KAITO, BRIAN, AIXBT, EURC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。