撰文:1912212.eth,Foresight News

5 月 30 日,比特币 2025 大会最后一日,市场再度应验逢会大跌的魔咒。

比特币今晨一度跌破 10.5 万美元,最低下探至 10.46 万美元。以太坊也自最高 2788 美元一路下跌至最低 2557 美元。山寨市场普遍迎来回调,部分山寨如 BERA 甚至创下历史新低。

合约市场方面,据 Coinglass 数据显示,过去 1 小时全网爆仓 3.3 亿美元,其中多单爆仓 3.21 亿美元,空单爆仓 789 万美元。

宏观市场方面,美股加密股中 COIN、MSTR 盘后均下跌。关于美联储降息则反复摇摆不定,美联储戴利周四表示,尽管政策制定者们仍有可能在今年降息两次,但目前利率应保持稳定,以确保通胀率能够达到美联储 2% 的目标。戴利强调,只要通胀率高于目标且存在不确定性,通胀率就会成为关注焦点,因为劳动力市场状况稳健。此外,美国贸易法院周三阻止特朗普关税措施的裁决被周四上诉法院推翻,凸显出贸易政策的不确定性,许多企业和美联储对此感到不安。

本次回撤到底是健康的短期回调,还是即将再度进入长期的盘整震荡?一起听听大咖与分析师的市场观点。

Placeholder 合伙人:市场小幅回调不代表行情结束,风险结构依然良好

Placeholder 合伙人 Chris Burniske 在社交媒体上发文表示,「不要把小幅回调误认为是行情结束,整体的风险 / 回报结构依然良好。」

Matrixport:合约数据显示交易员或正平仓以获利了结

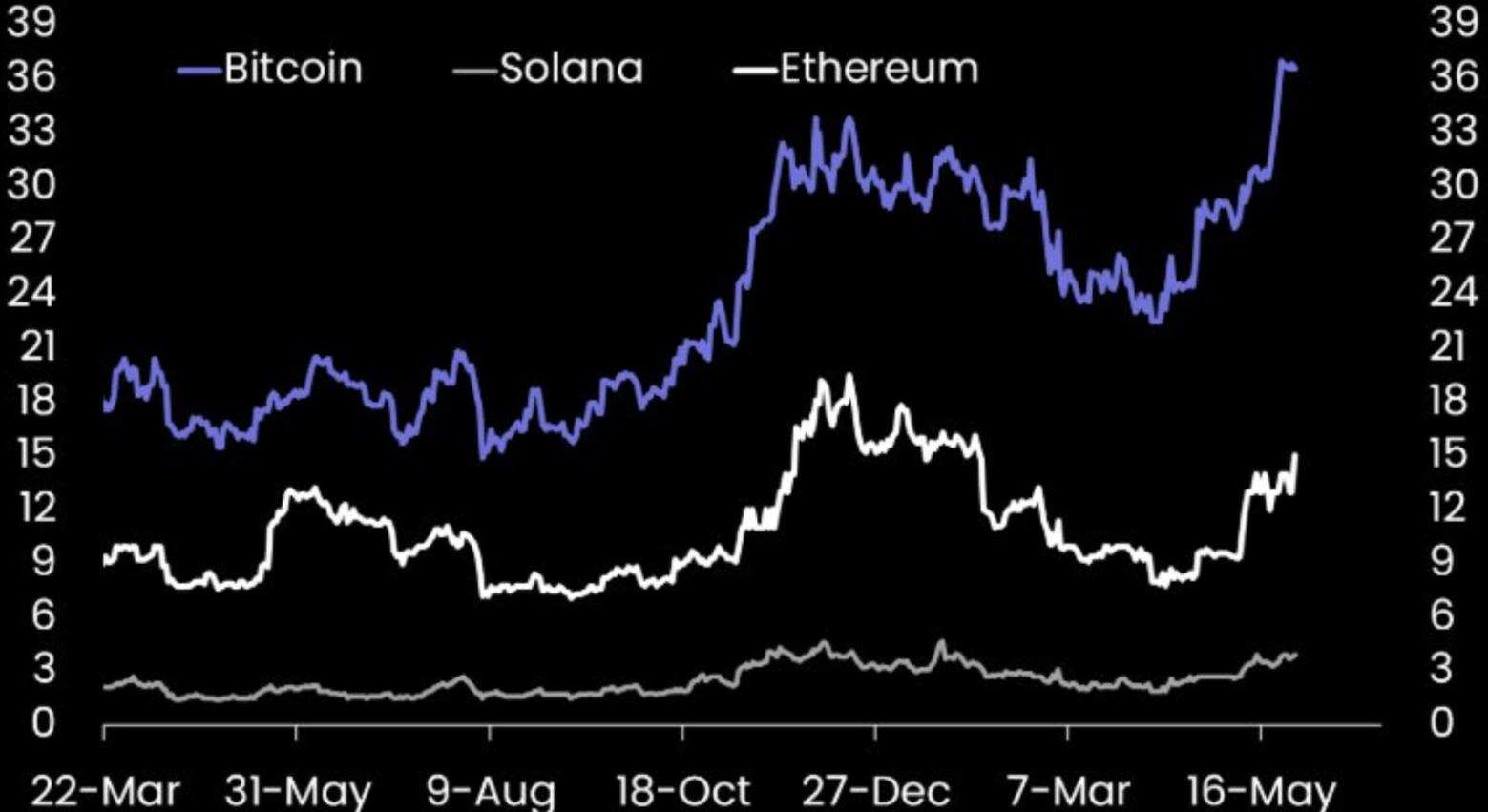

据 Matrixport 发布最新报告(分析师为 10x Research 的 Markus Thielen)显示,自 4 月低点以来,期货未平仓合约大幅攀升。尽管 Solana 因 meme 币和 Pump.fun 热潮降温而退居次席,比特币的未平仓合约却出现显著增长。这一激增可能反映出市场风险偏好的转变,尤其是在特朗普近期关税政策逆转之后。比特币继续扮演着「风险偏好」与「避险」双重角色,并日益契合「数字黄金」的叙事。

然而,未平仓合约目前似乎趋于平稳,这可能印证了我们的观点——交易者正开始获利了结,并计划在更低点位重新入场。

Bitfinex 报告:比特币进入健康盘整阶段,短期持有者获利了结或引发抛压

Bitfinex Alpha 于 5 月 26 日曾发布报告称,在 1 月份创下历史新高后,比特币经历了 32% 的回调,但此后强劲反弹逾 50%,创下新的高点——111,880 美元,目前已进入一个健康的盘整阶段。强劲的 ETF 资金流入、现货市场参与度飙升,以及正向的「已实现净资本」增长,推动了市场中的结构性买盘,而非过度投机。尽管宏观风险偏好有所回落,例如传出美国可能对欧洲进口商品征收 50% 的关税,但比特币依旧表现坚挺——在去杠杆和获利了结的过程中并未出现明显的下跌。

这种韧性正引发市场对比特币演变为一个「宏观敏感、信念驱动型资产」的关注,它的交易行为如今更多与全球流动性走向相关,而非散户情绪。值得注意的是,日本 Metaplanet 公司增持了价值 1.04 亿美元的比特币,以及美国密歇根州提议推出有利于加密资产的立法,这些都进一步验证了机构和政策层面对数字资产日益增长的支持。

展望未来,比特币能否继续维持在其短期持有者成本基础(约 95,000 美元)之上盘整,将是关键。在过去一个月中,短期持有者已实现超过 114 亿美元的利润,因此短期内可能存在一定的抛压,但结构性需求依然存在。ETF 买盘的强度、低波动率,以及现货市场的溢价信号,都表明市场正在走向成熟,一旦宏观环境明朗,后续可能迎来进一步的上涨。目前来看,接下来的几周将决定,比特币此次突破是阶段性的顶部,还是 Q3 更强劲涨势的序章。

Arthur Hayes:以太坊价格今年有望翻倍至 5000 美元

BitMEX 联合创始人 Arthur Hayes 在比特币 2025 大会上表示,以太坊价格今年有望达到 4000-5000 美元。Hayes 认为以太坊目前是"最不受欢迎的第一层公链",但在市场周期转换时期,这反而可能是一个投资机会。

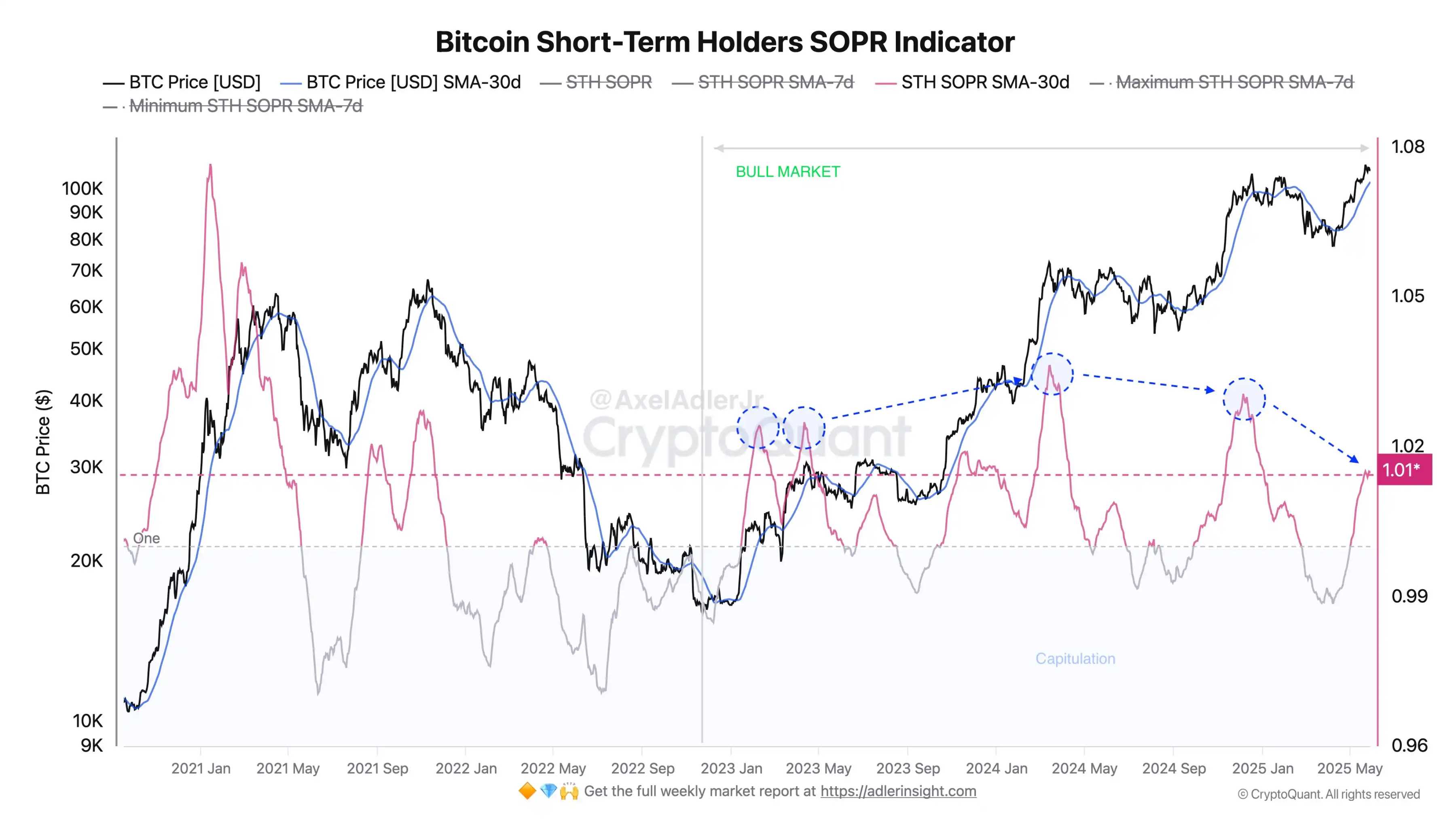

CryptoQuant 分析师:BTC 短期持有者已实现利润达局部高点,但尚未达到过往牛市巅峰水平

CryptoQuant 分析师 Axel Adler Jr 在社交平台发文表示,衡量短期投资者链上花费代币时平均已实现盈亏的指标 STH SOPR(30 日移动平均线)近期触及局部高点,表明短期持有者已实现利润明显上升。

尽管如此,市场对代币的需求依然保持强劲,未影响当前的上涨趋势。该指标尚未达到此前重要价格高点时出现的狂热水平。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。