After experiencing the most painful Spring Festival in history, the cryptocurrency market seems a bit cold.

While the Chinese celebrate the Spring Festival, the crypto world is in disarray. It was initially thought that a bright future for crypto was just around the corner after Trump officially took office, but on February 3, the crypto industry and even the global market faced a heavy blow from the new president.

Against the backdrop of a new round of tariff wars initiated in the U.S., global financial markets experienced a rollercoaster ride. On the day of the news, all three major U.S. stock indices closed lower, with significant impacts on the Asia-Pacific markets. The South Korean stock market plummeted over 2.8%, the Japanese stock market fell 2.48%, and Hong Kong stocks dropped 1.9%. Although the subsequent softening from Mexico and Canada led to a one-month delay in the tariff policy announcement on February 3, easing the panic in the financial markets, the crypto market still faced a painful hit amid uncertainty.

The price of BTC once sharply declined, hitting a low of $91,100, with a daily drop of about 7%. Ethereum plummeted by 25%, reaching a low of $2,080.19, the lowest level in nearly a year. Tokens ranked in the top 200 by market cap generally fell, leading to an epic liquidation event, with over 720,000 people liquidated that day. Industry insiders estimate that approximately $8-10 billion was liquidated.

This event seems to have become a watershed moment. Although subsequent news has been frequently positive and mainstream currencies have warmed up, market sentiment still shows a high degree of fragility, with more severe price fluctuations. The altcoin sector has performed poorly, and even the previously strong AI sector has fallen silent due to the emergence of Deepseek.

Has the bull market ended? This question is gradually fermenting in market discussions.

In fact, in the context of the crypto market's heavy reliance on incremental liquidity, the main points of contention in the current market are primarily the Federal Reserve's monetary policy and Trump's crypto policy.

The Federal Reserve's monetary policy points to global liquidity. The significant drop in the market following Powell's hawkish stance in December last year highlights the importance of this indicator. For this reason, global attention to U.S. inflation is unprecedented.

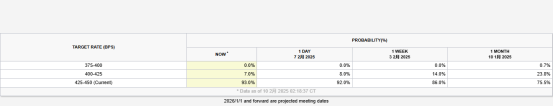

In the early hours of January 30, Beijing time, the Federal Reserve paused its previous three consecutive rate cuts, maintaining the federal funds rate target range at 4.25%-4.5%, in line with market expectations. Compared to the December 2024 policy statement, this statement removed the phrase "the labor market conditions have gradually eased," but emphasized that the unemployment rate remains low. At the same time, it removed the statement that "the inflation rate has made progress toward the committee's 2% target."

Following this, on February 9, the U.S. Department of Labor released a non-farm payroll report showing that the unemployment rate in January was 4%, with 143,000 new jobs added. According to Federal Reserve Governor Cook, this data indicates that "the labor market is healthy, showing neither signs of weakening nor overheating."

The market's reaction was very evident, even the previously overlooked University of Michigan data had a direct impact on prices. A survey released by the University of Michigan showed that consumer expectations for inflation next year surged by a full percentage point to 4.3%, the highest level since November 2023.

As a result, Bitcoin's hard-won rise to $100,000 quickly fell back, starting to fluctuate around $96,000, while ETH hovered around $2,700. Mainstream coins performed poorly, and altcoins continued to decline.

From a macro perspective, the Federal Reserve's caution is understandable, especially with the tariff stick raised by Trump, which has heightened global risk aversion. Various signs indicate that tariffs have become a useful tool in his hands, serving not only as a diplomatic means to achieve border security but also as an economic tool to promote the return of manufacturing, and further as a revenue-generating avenue to reduce the federal deficit.

After initiating tariff threats against its North American neighbors, the prototype of a comprehensive trade war in the U.S. has emerged. Although in the long term, as long as the U.S. manages the targets and products of tariffs well, such as being conservative regarding trade tariffs on Canadian oil and Mexican agricultural products, other goods may still be controllable, the combination of increased tariffs, expelling illegal immigrants, and embracing fossil fuels will likely lead to unavoidable inflation.

To proactively respond to external uncertainties and provide more maneuvering space for policies, a conservative wait-and-see approach is the objective strategy the Federal Reserve needs to adopt. Currently, the U.S. money market largely believes that the Federal Reserve may cut rates in June or July, but the pricing for rate cuts throughout the year has not yet reached two times. From the recent March rate cut outlook, CME's "FedWatch" shows a 92% probability that the Federal Reserve will maintain rates in March, with an 8% probability of a 25 basis point cut, making it a market consensus that there will be no rate cut in March.

Uncertainty is not only external; the internal situation is also chaotic. Under the banner of "cutting expenses" from Musk's DOGE department, U.S. domestic affairs are becoming increasingly disordered. The official website of the Consumer Financial Protection Bureau (CFPB), the highest financial regulatory agency in the U.S., was temporarily down, and recently, Musk has been calling for the impeachment of New York Federal District Judge Paul Engelmayer, as the judge ordered a temporary restriction on the DOGE team's access to the U.S. Treasury's payment systems and sensitive data. Trump's authority is vividly expressed under Musk's promotion, but the relatively subtle competitive relationship between the two is also being discussed in the market, and various farces will only push funds into safer areas.

Aside from the macro adverse impacts, there is a bright side to Trump's authority in crypto, as institutions that once opposed crypto are now facing comprehensive liquidation.

The SEC is at the forefront, with Gary Gensler's departure leading to the resignation of several senior legal officials under him. The previously feared lawsuits and Wells notices are gradually fading, and the SEC has begun to reduce the size of its crypto enforcement division. The SEC's shift directly benefits ETFs, with altcoin ETFs speeding up.

Recently, the SEC has received a series of applications related to cryptocurrency ETFs, including Grayscale's Litecoin ETF application and BlackRock's proposal to allow the iShares Bitcoin ETF to create and redeem physical assets. Cboe has also submitted listing and trading applications for four ETFs aimed at tracking XRP prices. Currently, due to the lack of participation from large capital giants like BlackRock and Fidelity, even if altcoin ETFs are approved, the funding volume may not be substantial. However, physical redemptions and potential ETH staking applications could significantly boost sentiment going forward.

The Federal Deposit Insurance Corporation (FDIC) has also shown a clear change in attitude. Previously, the agency even pressured banks to refuse services to crypto clients to sever the ties between traditional finance and cryptocurrencies. However, now the FDIC has announced that it is actively reassessing its regulatory approach to cryptocurrency-related activities, including withdrawing and replacing Financial Institution Letter (FIL) 16-2022, providing compliance pathways for banks to participate in cryptocurrency and blockchain-related activities while adhering to safety and soundness principles. This move indicates that cryptocurrencies are about to integrate into the traditional financial system, expanding the value chain, enhancing security in the crypto space, and lowering the barriers for individual users to participate in the crypto industry, laying a strong foundation for stablecoins, Payfi, BTCfi, and other directions.

Beyond these two, the White House's cryptocurrency agency has also brought better news. Head David Sacks, upholding the slogan of "building a golden age of digital assets," has taken on the highly anticipated topic of Bitcoin reserves. According to his statements at a press conference, Bitcoin reserves will be included in the White House's digital asset working group's research agenda, assessing its feasibility within 180 days.

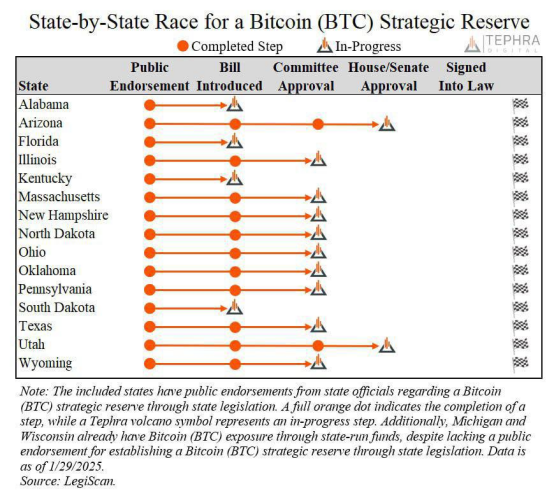

In addition to the U.S. federal level, several states have also initiated applications for Bitcoin strategic reserves, including Alabama, Arizona, Florida, and 15 other states that have launched related plans. Arizona and Utah have progressed to the two-house approval stage, just one step away from becoming law.

From previous statements from the White House, the national-level Bitcoin reserves in the U.S. focus more on the coins already held rather than incremental purchases. However, for the strategic reserves of various states, the prospects are more promising. Whether through pension purchases or public finance purchases, this represents real incremental funds that will directly bring purchasing power, thereby providing more support for coin prices and likely pushing Bitcoin prices higher. At this stage, Trump's policy benefits are still ongoing, and the U.S. sovereign wealth fund under his executive order is speculated to potentially purchase BTC.

Overall, Trump's support for crypto since taking office has been unwavering, with investments in administration, regulation, and funding directions, and positive news has been coming in one after another. However, in contrast, the dismal performance of altcoins is evident, and the upward momentum of BTC and ETH is also not optimistic.

Ultimately, market sentiment is too fragile, with macro expectations gnawing at investors' confidence, risk aversion dominating investments, and turnover decreasing. However, due to the existence of positive news, the mainstream currency accumulation zones remain relatively stable, not triggering a significant drop. For example, Bitcoin's support in the $93,000-$98,000 range is evident; even though it briefly fell below $91,000 during the Spring Festival, it quickly recovered afterward.

From the perspective of institutional movements, confidence in the market remains. Although the market is in a garbage time, institutions are still continuously buying. According to SoSoValue data, from February 3 to February 7, Bitcoin spot ETFs saw a net inflow of $204 million in one week, with BlackRock's IBIT seeing a net inflow of $315 million. At the same time, Ethereum spot ETFs had a net inflow of $420 million in one week, with all nine ETFs showing no net outflows. Since late January, the cumulative inflow of funds into Ethereum spot ETFs has exceeded $500 million.

Institutions are willing to invest, indicating a long-term positive outlook, especially for ETH, which has been continuously subjected to FUD. Despite strong selling pressure in the market, from the layout of BlackRock, Fidelity, and others, whether through staking or RWA, ETH still has speculative themes. From the market perspective, in the short term, due to the lack of strong positive news, Bitcoin is likely to maintain fluctuations, hovering between the recent low of $90,000 and the high of $106,000, with limited potential for a significant decline. The lack of stabilizers may lead to further downward pressure on ETH prices.

However, altcoins do not share the same good fortune. Based on data, the existing supply of altcoins is clearly excessive. The total number of cryptocurrency tokens listed on CoinMarketCap is approaching 11 million, while the number of existing altcoins exceeds 36 million, in stark contrast to the fewer than 3,000 in 2018 and 500 in 2013. Considering the current market funds, the structural misalignment in supply and demand is evident.

On the other hand, Trump's own actions have also doused cold water on altcoins. His own foray into issuing coins and cutting profits has, to some extent, undermined the industry's previously perceived altcoin bull market radiation effect, leading to further liquidity contraction in altcoins. Under the current liquidity conditions, PVP has become synonymous with the industry. In this regard, aside from altcoins backed by large capital or speculative themes, the negative trends of other altcoins are likely to continue in the short term. Even Trump has fallen to $16; to return to the altcoin bull market, it may only be possible to wait for a more relaxed macro environment.

In this context, macro indicators still need to be monitored, as this week is a key week for indicator releases. On February 11 and 12, the U.S. will announce the January inflation expectations for one year and three years from the New York Fed, and Powell will submit the semi-annual monetary policy report to the U.S. Congress. The January CPI, core CPI, and PPI will also be revealed this Thursday.

Cautious risk aversion may be the best market operation at present.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。