1.市场观察

上周五以来,全球宏观经济与政策层面风波不断。美国7月非农就业数据远逊预期,仅新增7.3万个岗位,且5月和6月数据被大幅下修25.8万人,引发市场震动。此举直接导致美国总统特朗普解雇劳工统计局局长埃里卡·麦克恩塔弗,并指控其伪造数据,加剧了外界对联邦经济数据质量的担忧。与此同时,美联储理事阿德里ANA·库格勒的突然辞职,为特朗普提前安插可能支持降息的理事提供了契机,市场对9月降息的预期也因此显著升温。

受此影响,叠加新关税政策和欧佩克+增产带来的压力,全球风险资产承压。高盛的Tony Pasquariello指出,尽管大型科技公司财报强劲,但股价反应平淡,而小盘股则遭遇重挫,市场广度严重不足,资金流向明显转向避险。纽约联储主席威廉姆斯认为劳动力市场正温和冷却但仍稳健,对9月降息持开放但审慎的态度;而白宫则将就业数据疲软归咎于技术因素,并预计未来将反弹。然而,市场普遍认为,美联储正面临通胀走高与劳动力市场走弱相互矛盾的困境,政策失误的风险重现。

在亚太地区,RWA领域进展不断,由香港Web3.0标准化协会发起的全球首个RWA注册登记平台宣布将于8月7日正式上线,旨在提供实体资产代币化的全流程服务。HashKey首席分析师Jeffrey Ding对此评价称,该平台的上线是香港在RWA领域迈出的监管创新关键一步,通过建立标准化流程,能够有效提升市场合规性与透明度。他认为,资本市场对RWA赛道的强烈信心,将进一步推动相关技术的研发与商业应用落地,为香港乃至整个亚太地区的数字经济发展注入新的动能。

比特币周末跌破11.2万美元,目前已回升至11.4万美元上方。10x Research指出,价格跌破11.2万美元与美国劳动力市场的疲软迹象有关,或预示着重大行情变化。BitMEX联合创始人Arthur Hayes认为,美国关税账单临近第三季度到期,加上非农就业数据疲软,全球经济体信贷增长乏力,难以支撑经济扩张,比特币可能会跌至10万美元。交易员Cipher X警告称,若无法重新站上11.6万美元,价格可能跌至10.4万美元。分析师CrypNuevo则预计价格可能短暂回调至11万美元,并认为该位置能提供有效支撑。分析师BitBull也认为,比特币可能在11万至11.2万美元区间触底。分析师Man of Bitcoin的技术分析表明,守住11.2万美元是开启新一轮上涨的关键,而跌破则可能确认顶部形成。尽管Matrixport报告指出8月和9月通常是比特币的弱势月份,但BitBull根据技术形态预测,比特币的反转形态仍在延续,目标价或达14.8万美元,市场普遍预测认为BTC可能在2025年10月达到15万美元。

以太坊方面,Arthur Hayes同样预测其可能测试3000美元。交易员IncomeSharks认为当前价格表现疑似假突破,建议投资者谨慎操作。知名加密分析师0xENAS则关注其再次冲击3.8K-4K区间的短线机会,并认为作为类ETF工具的DAT(代币化资产信托)模式潜力被低估,可能成为吸引传统金融大规模资金流入的关键。Fundstrat Capital的Tomas Lee则给出了极为乐观的预测,他认为随着华尔街涌入,以太坊在未来12个月内的公允价格可能达到1万至2万美元。

周末链上因马斯克转发相关推文,与Grok概念相关的Meme币全线上涨,其中女性AI伴侣概念的Ani 24小时上涨45%,男性AI伴侣概念的Valentine更是上涨了103%。

2. 关键数据(截至8月4日12:00 HKT)

(数据来源:Coinglass、Upbit、Coingecko、SoSoValue、Tomars、GMGN)

比特币:114,556美元(年初至今+22.42%),日现货交易量234.95亿美元

以太坊:3,555.34美元(年初至今+6.4%),日现货交易量为188.79亿美元

恐贪指数:64(贪婪)

平均GAS:BTC:1 sat/vB、ETH:0.21 Gwei

市场占有率:BTC 61.2%,ETH 11.5%

Upbit 24 小时交易量排行:XRP、ETH、BTC、ENA、TOKAMAK

24小时BTC多空比:49.52%/50.48%

板块涨跌:PayFi上涨6.78%;RWA上涨5.46%

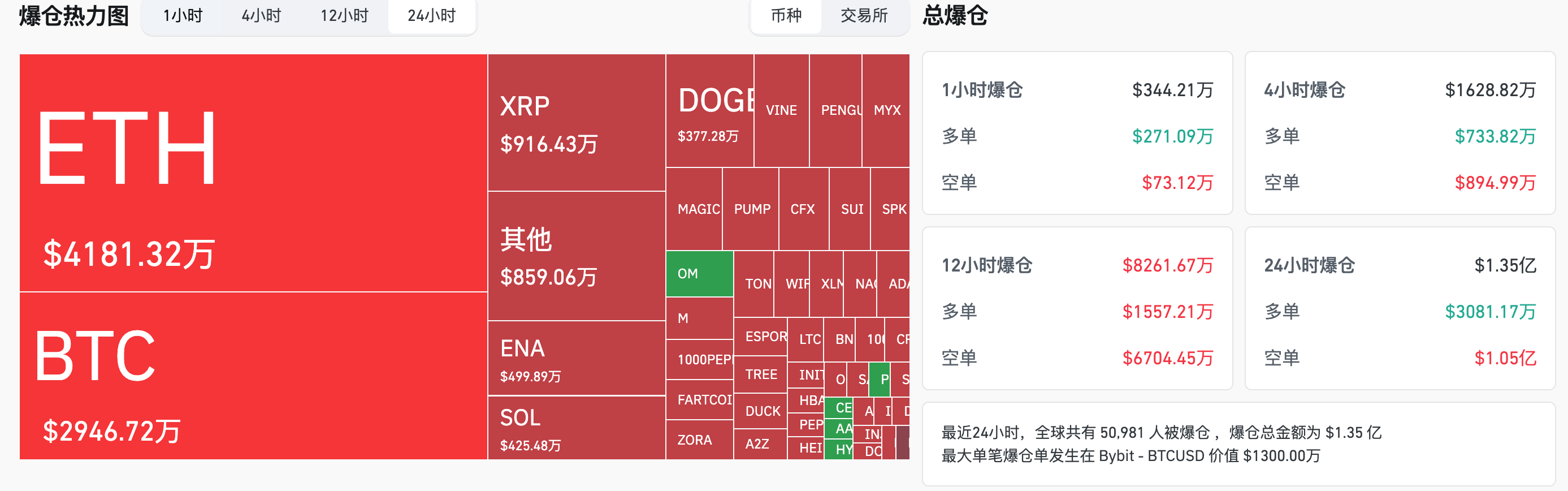

24小时爆仓数据:全球共50981人被爆仓 ,爆仓总金额为1.35亿美元,其BTC爆仓2946万美元、ETH爆仓4181万美元、XRP爆仓916万美元

BTC中长线趋势通道:通道上沿线(116909.47美元),下沿线(114594.43美元)

ETH中长线趋势通道:通道上沿线(3615.31美元),下沿线(3543.72美元)

*注:当价格高于上沿和下沿时则为中长期看多趋势,反之则为看空趋势,当价格在区间内或短期反复通过成本区间则为筑底或筑顶状态。

3.ETF流向(截至8月1日)

比特币ETF:-8.12亿美元,为历史第二高

以太坊ETF:-1.52亿美元,持续20日净流入遭终结

4. 今日前瞻

IOTA(IOTA)将于8月4日上午8点解锁约863万枚代币,与现流通量的比例为0.22%,价值约160万美元

GoGoPool(GGP)将于8月4日上午8点解锁约75万枚代币,与现流通量的比例为10.60%,价值约120万美元

Ethena(ENA)将于8月5日下午3点解锁约1.72亿枚代币,与现流通量的比例为2.70%,价值约9580万美元

Spectral(SPEC)将于8月5日上午8点解锁约362万枚代币,与现流通量的比例为17.57%,价值约180万美元

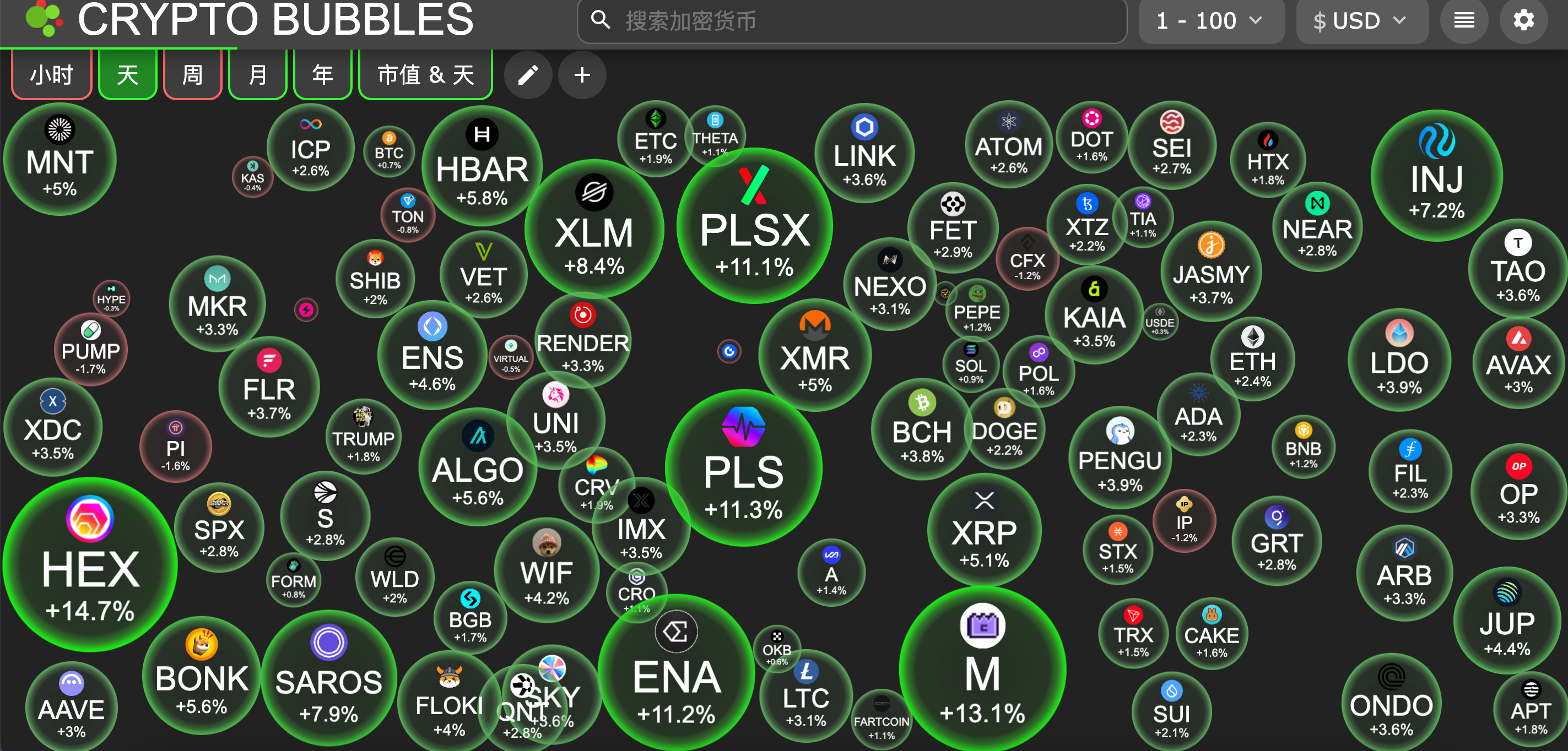

今日市值前100最大涨幅:HEX涨14.7%,MemeCore涨13.1%,Pulsechain涨11.3%,Ethena涨11.2%,PulseX涨11.1%。

5. 热点新闻

本文由HashKey提供支持,HashKey Exchange是香港最大持牌虚拟资产交易所,也是亚洲最值得信赖的加密资产法币门户。致力于在合规、资金安全和平台保障方面为虚拟资产交易所定义新标杆。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。