Author: Zuo Ye

The Great Depression of 1929 led to the establishment of the Securities Exchange Act of 1934 and the SEC (U.S. Securities and Exchange Commission). However, whether this is a misfortune or a blessing depends on whether you view it from the perspective of e/acc accelerationism or regulated freedom. Since then, the SEC has never stopped financial innovation or crises.

In 1998, LTCM (Long-Term Capital Management) failed in Russian bonds through quantitative methods, nearly causing a repeat of the 1929 Great Crisis, but this did not prevent the ATS (Alternative Trading System) regulations from taking effect in 1999, as quantification, hedging, and arbitrage fully embraced information technology.

After the 2008 financial crisis, regulations were initiated against dark pool trading, but dark pools still exist. In 2025, after Gary Gensler's departure from the SEC, there was a determination to embrace new trends for the future—everything can be on-chain, and everything can be compliant.

- On-chain: RWA (Real World Assets) is just the starting point; future trading, asset allocation, and interest generation will revolve around on-chain activities, just like embracing blockchain as we use computers;

- Compliance: Airdrops, staking, IXO, and rewards will create a uniquely American super app (Reg Super-App), re-Americanizing all DeFi.

The Survival Crisis of the SEC

The Great Depression created the SEC, and cryptocurrency is ending the SEC.

Timeline of SEC regulatory shifts: Gary Gensler's resignation —> Crypto Task Force —> Project Crypto

There is a clear trajectory; the SEC's regulatory activities can be divided into the departure of Gary in January and the new crypto policies under the current chair, Atkins, who took office in April, marked by the establishment of the Crypto Task Force, culminating in Project Crypto by the end of July, which represents a comprehensive "surrender" to cryptocurrency.

To understand why Project Crypto emerged, one must look at the SEC's regulatory dynamics from April to July, during which there were frequent actions. On one hand, lawsuits against Ripple, Kraken, and others needed to conclude gracefully; on the other hand, companies like Coinbase and Grayscale were becoming increasingly powerful, actively requesting the SEC to ease regulations.

In particular, the Ripple case became a symbol of the SEC's shift from "enforcement-style regulation" to "regulatory-style service." The subsequent restart of Kraken's IPO process proved that the crypto concept was fully accepted by U.S. regulators, and Robinhood also began to promote tokenized stocks.

The approval of BTC/ETH ETF physical staking and redemption is the most significant progress, but more cryptocurrencies and forms remain in a case-by-case review status, such as the Trump Group's ETF, which is also in line.

To obstruct the journey of cryptocurrency in the U.S. is no longer a matter for an ordinary SEC; it must take strong action!

Image caption: SEC 2025 paradigm shift in crypto regulation, image source: @zuoyeweb3

Thus, Trump chose to play by unconventional rules, supporting the CFTC and initiating legislative actions like the Genius Act. The CFTC is already on the path to expanding its powers, and the White House's cryptocurrency report further announced substantial acceptance of existing DeFi.

The SEC had previously "transferred" stablecoin regulation to banking regulators, and more digital asset regulatory authority has shifted to the CFTC. The question of where the SEC goes next has become a pressing reality.

The more significant Clarity Act has yet to officially become law. If the SEC does not take proactive measures, it risks being completely overshadowed by the CFTC, especially as the issuance of stablecoins has essentially touched the core of securities law. The SEC must act from an administrative perspective to preemptively delineate regulatory boundaries before the Clarity Act becomes law, creating established facts.

However, within the current framework, there is little the SEC can do. Topics include approving more staking ETFs (like SOL), issuing arbitrary cryptocurrency ETFs, tokenized stocks, securities, and approvals for crypto companies and DATCO (Digital Asset Trust Company). The SEC's attitude is to wait for change, repeatedly delaying and pausing various topics.

On July 17, there were rumors of a plan for the SEC to merge with the CFTC. Just after the SEC's Project Crypto was announced, the CFTC's Crypto Sprint plan followed closely, with the details being less important.

The division of responsibilities between the SEC and CFTC will end in the era of cryptocurrency. The SEC's choice to maximize departmental interests can only be to embrace the new era and abandon all dogmas of the old world.

The "On-Chain" Reality

DeFi is fully compliant, and the era of offshore arbitrage is over.

Previously, I wrote that neither the Genius Act nor the Clarity Act specifically addressed DeFi regulation; the former only pertains to stablecoins, while the latter is too macro. Now, the SEC's Project Crypto details regulations from an administrative perspective, encompassing all aspects of DeFi in terms of people, finance, and rules.

There is no need to go overseas; people can return to the U.S.

In summary, what offshore exchanges and overseas foundations could do can now be done domestically in the U.S.

Whether it is stablecoins, IXO, or tokenization (stocks, bonds), although the regulatory jurisdiction may differ, the SEC will not casually prosecute for illegal securities issuance as long as communication is clear.

Furthermore, regarding the Tornado Cash founder's judgment, the SEC has no authority to interfere, but it can ensure the safety of developers, encouraging builders to choose the U.S. for development and fostering healthy and orderly competition.

DeFi has rules, and money comes back to the U.S.

In summary, there is no need for offshore shell games, nor is there a need to overly obsess over the degree of decentralization.

All token issuance, on-chain activities (staking, lending, trading, investing), and reward distribution related to DeFi are compliant, especially as self-custody trading has been elevated to the height of "American liberal values." Various crypto staking ETFs will be fully opened.

Finally, there should be no offshore regulatory arbitrage; everything can return to the U.S. for investment, development, and entrepreneurship, ensuring that crypto occurs in America.

RWA has regulations, and assets are on the U.S. chain.

In summary, on-chain has officially become the main theme.

Compared to DeFi, RWA has more specific regulations, distinguishing between stocks, bonds, equity, and physical assets. The window for tokenized stocks and tokenization in the private market (Pre-IPO) is now open.

This will be a more profound transformation than computerization, moving from paper-based certificates to electronic trading, and then to full on-chain integration. Any asset that can be financialized will be tokenized, and the information gap between a few and the many will be completely eliminated, though this may take many years.

Ultimately, DeFi will become a new form of finance, rather than a supplement to TradFi, and ETH will become the new vehicle for American financial hegemony.

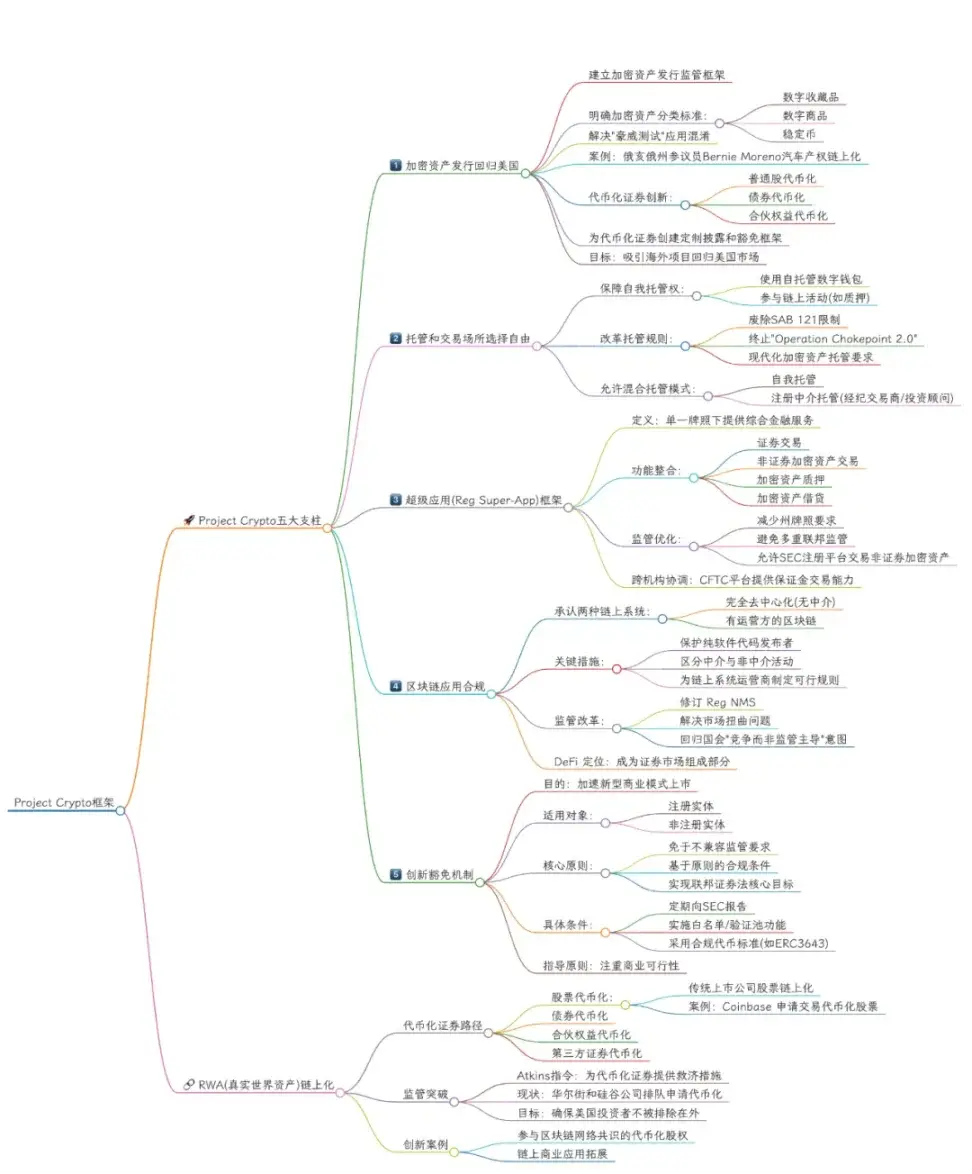

Image caption: SEC Project Crypto framework, image source: @zuoyeweb3

The title of this section borrows from the slogan of RWA L1 Rialo developed by Subzero Labs. This time, RWA will no longer be synthetic assets or virtualized custodial issuance but will directly enable the possibility of putting any asset on-chain, such as the recently listed Figma, which also retains the option to issue tokenized stocks.

Stocks are tokenized stocks, and assets are tokenized assets.

Conclusion

The booster of financial bubbles is also the necessary path for asset innovation.

From today onward, Project Crypto can be said to be the securities law moment for DeFi. However, how much of the departmental principles can be implemented and how much can be accepted by Trump and Capitol Hill remains to be seen.

Nevertheless, the CFTC and SEC will completely merge, as future digital commodities and digital securities will be difficult to distinguish from one another.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。