Author: Frank, PANews

The first major project launched in the Year of the Snake, Berachain, officially began its airdrop distribution on February 6. From the market trend, its token BERA showed a low opening and high rise after launch, with the price soaring from $7.5 to a peak of $15.5, and the initial circulating market value reaching a maximum of $1.58 billion.

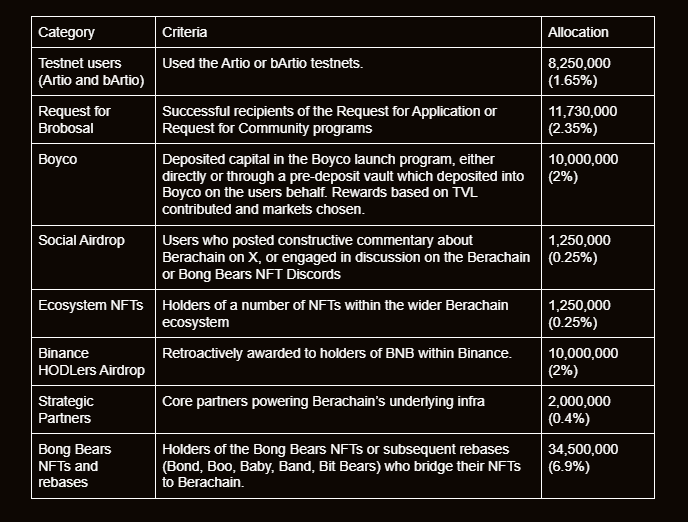

However, the airdrop distribution of Berachain has sparked considerable controversy on social media, with many testnet users expressing dissatisfaction that the allocation for testnet users was only 1.65%, while the allocation for Binance users and NFT holders was 2% and 6.9%, respectively, leading to community discontent.

Since Berachain did not launch a data dashboard for this airdrop, the official browser does not support viewing specific airdrop smart contract statistics. Therefore, based on some known data, PANews calculated and speculated on the airdrop situation of Berachain.

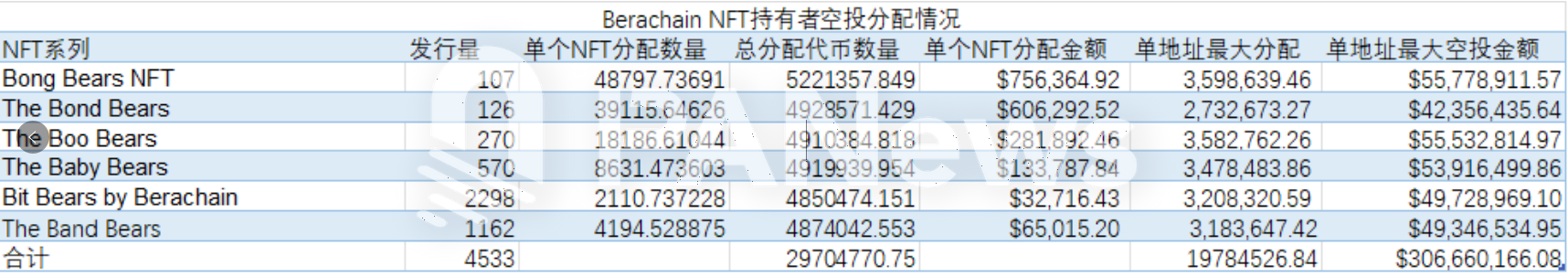

6 NFT Whales Received $306 Million, Highest Single Address Received $55.77 Million

According to the official airdrop announcement, holders of Bong Bears NFT or subsequent derivatives (Bond, Boo, Baby, Band, Bit Bears) can collectively receive 34.5 million tokens in the airdrop.

To review how many NFTs are involved, according to the official statement, there are 6 series of NFTs involved in this airdrop: 107 Bong Bears NFTs, 126 The Bond Bears, 270 The Boo Bears, 570 The Baby Bears, 2298 Bit Bears by Berachain, and 1162 The Band Bears.

The total number of NFTs is approximately 4533, with an average of 6553 tokens per NFT. Based on the peak price of $15.5, these NFT holders could receive up to $101,000. Of course, this distribution is not an average allocation but is based on the scarcity of each type of NFT.

According to PANews' investigation, the NFT series with the highest individual allocation is Bong Bears NFT, with each NFT receiving 48,797 tokens, valued at approximately $756,000. The Bond Bears follows, with each receiving 39,115 tokens, amounting to about $606,000.

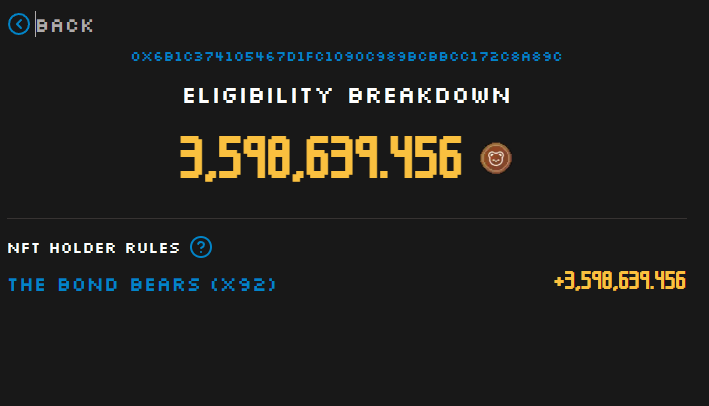

Since NFT holdings are often concentrated among a few large holders, for example, the address 0x6b1C…A89c holds 89 The Bond Bears, accounting for 70% of the issuance. Upon inquiry, this address received 3.598 million tokens, valued at approximately $55.77 million. The highest trading price for this series of NFTs reached 140 ETH (valued at $378,000) on the evening of February 6, calculating the total value of 92 NFTs at about $34.77 million, still below the airdrop earnings. Currently, the price of this series of NFTs has dropped to around 10 ETH.

According to PANews' inquiry, it was found that the allocations for these NFT holders are largely concentrated among a few large holders. The six largest holders can collectively receive 19.78 million tokens, valued at approximately $306 million. On average, each of these six addresses receives 3.29 million tokens. Just these six large holders received more tokens than the total airdrop allocation of 8.25 million tokens for millions of testnet addresses.

Testnet Users' Minimum Allocation May Be $60

In stark contrast to the wealth of NFT holders, the total allocation for testnet users is 8.25 million tokens. According to previous media reports, as of January 2, the cumulative number of wallets participating in Berachain's PoL mechanism exceeded 2.38 million, with an average of about 3.46 tokens per wallet, valued at approximately $53.7.

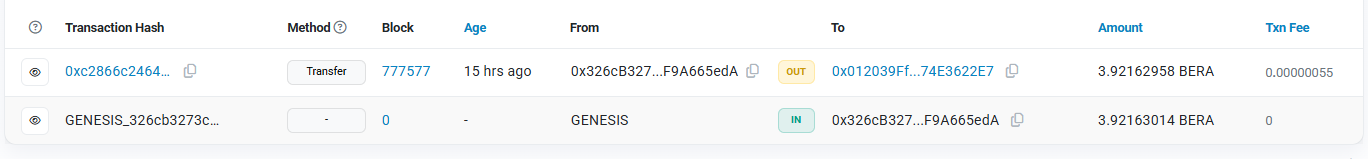

Looking at the overall picture, the total number of tokens for this airdrop is approximately 79 million. As of February 7, the number of holding addresses on the official website is about 730,000, with an average airdrop quantity of about 108 tokens per address (actual data may be lower, as some users have not claimed and there are token unlocking delays). On-chain data shows that the minimum airdrop quantity should be 3.92 tokens, with a maximum value of about $60.

However, compared to recent airdrops, the total scale of Berachain's airdrop is approximately $592 million (calculated at the opening price of $7.5), which is similar to HYPE. In terms of the highest single address allocation, Berachain's maximum single address received an airdrop amount of $55.77 million, the highest among recent projects. However, the minimum allocation of 3.92 tokens appears to be the lowest among recent large airdrop projects. From this perspective, the wealth disparity in Berachain's airdrop seems quite significant.

Significant Wealth Disparity, VC May Unlock Indirectly?

The airdrop allocation has also caused dissatisfaction among many early users who made significant contributions on the Berachain testnet. Especially since the total airdrop for testnet users is only 1.65%, while the total for Binance users is as high as 2%, and NFT holders reached 6.9%.

In response, the official explanation states, "Without Bong Bears and its subsequent derivatives, Berachain would never have existed. NFT holders have always been one of the oldest and most supportive members of the Berachain community, with countless holders developing their own dApps or community plans within the ecosystem."

The explanation for the allocation to Binance users is that Berachain has great respect for the BSC chain.

The explanation for the allocation to Binance users is that Berachain has great respect for the BSC chain.

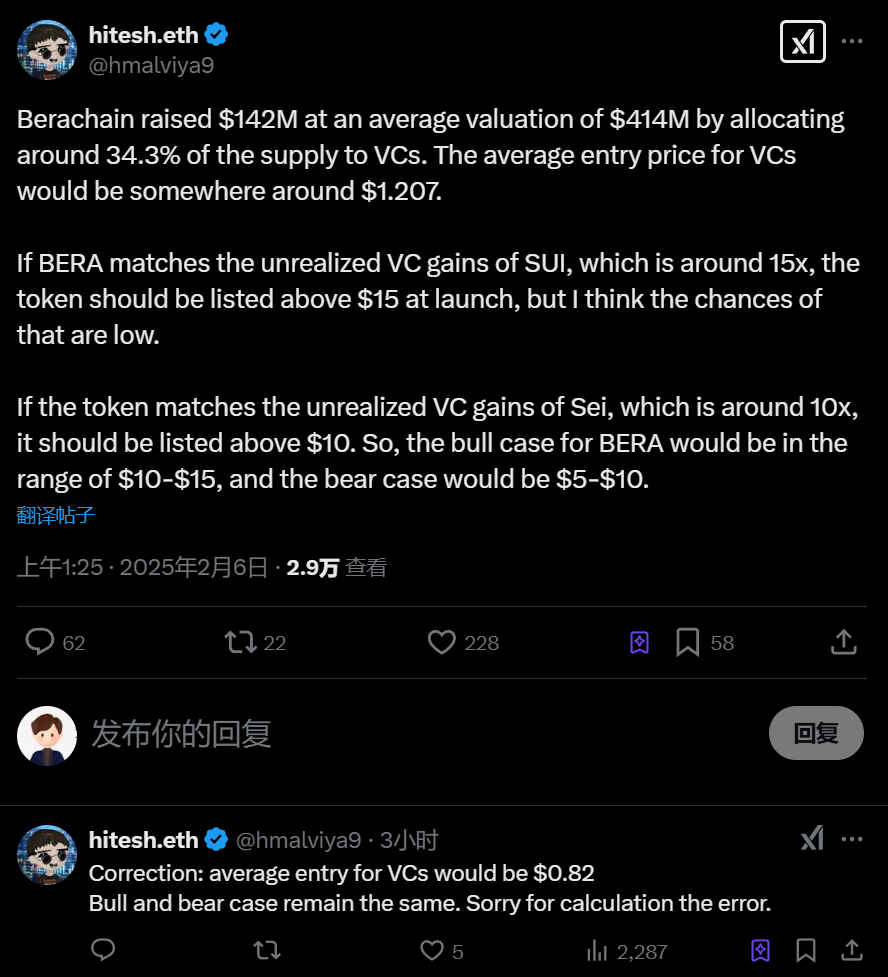

Additionally, the VC earnings from this airdrop have also been a focal point of market attention. hitesh.eth, founder of DYθR, posted on X stating that Berachain allocated about 34.3% of the supply to VCs, with an average entry price of about $0.82. If BERA matches the unrealized VC earnings of SUI (approximately 15 times), the token's price at launch should be above $15, but hitesh-eth believes this possibility is low. If the token matches the unrealized VC earnings of Sei (approximately 10 times), its listing price should be above $10. Therefore, the bull market price for BERA will be between $10 and $15, while the bear market price will be between $5 and $10.

In terms of subsequent price trends, BERA did briefly exceed $15. However, the unlocking time for VCs is still a year away, making it difficult to predict the price at that time. However, some KOLs on social media have stated that the unlocked tokens of Berachain can be staked for rewards, which undoubtedly represents another form of monetization unlocking. This behavior has also raised questions within the community.

After briefly surpassing $15.5, BERA began to rapidly decline, dropping to a low of $6.7, with a correction of over half. In this regard, Rui from HashKey Capital believes the reason for this phenomenon is: "On one hand, the overall market liquidity is very poor, and on the other hand, the volume of short-selling sentiment has peaked this time."

From on-chain data, the number of transactions on the first day of Berachain's mainnet launch exceeded 1.14 million, with the number of unique addresses exceeding 140,000. With the ongoing claims of the airdrop, these numbers are expected to continue to rise in the short term. However, in the face of the current widespread controversy over airdrop distribution within the community and the intense short-selling sentiment in the market, whether Berachain's on-chain activity can maintain a high level after the airdrop ends remains an unknown. Whether the price trend can continue the script of Hyperliquid is also uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。