Several Pathways for Projection.

Author: Jinze, Pretending to be in Flower Street

Although Trump did not sign any cryptocurrency-related executive orders after his official "ascension" today, the market is still eagerly anticipating the establishment of a BTC strategic reserve in the U.S., and individuals hold an optimistic view on this (though the pathways may not align with everyone's expectations).

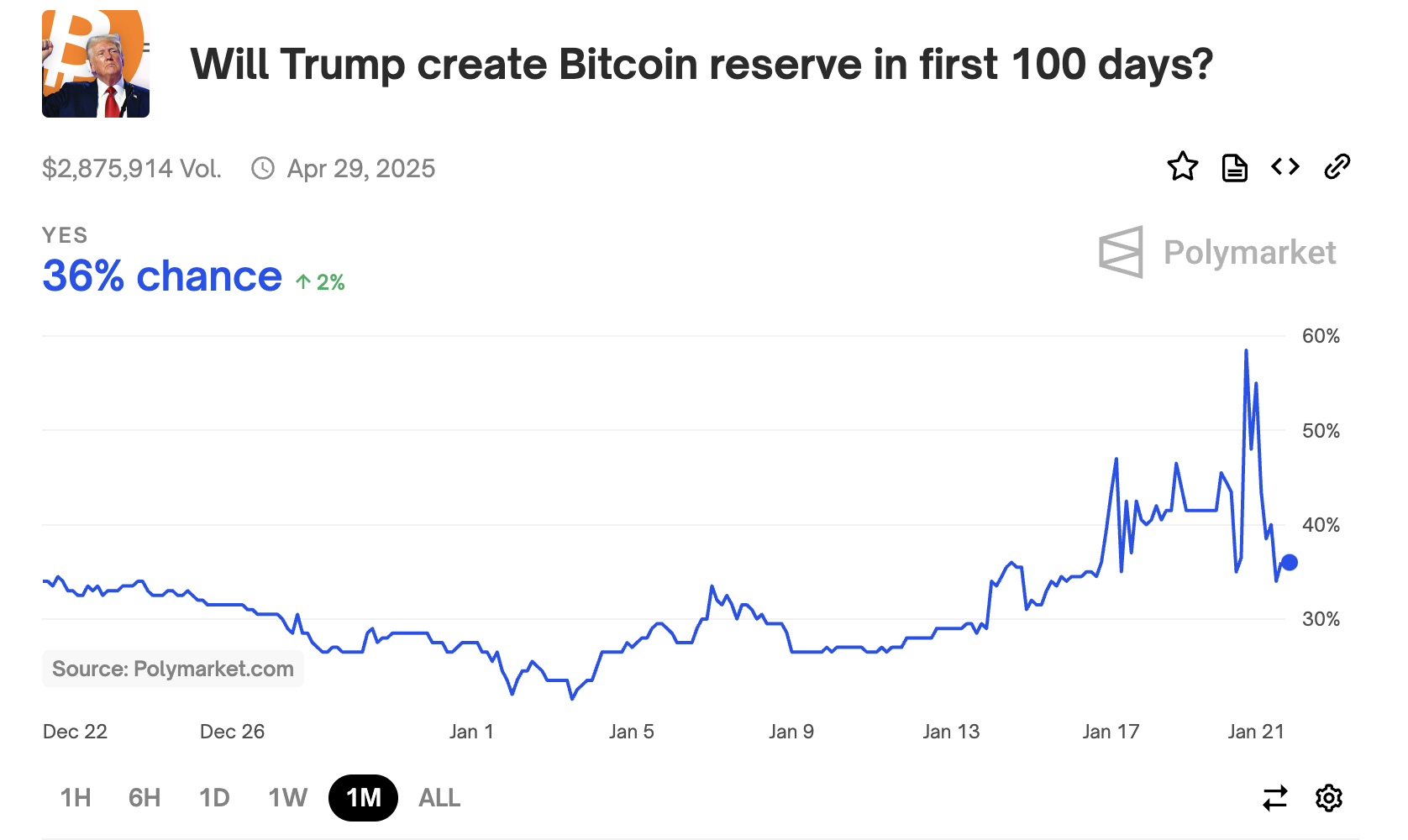

This possibility was proposed by Trump last summer, sparking endless imagination in the cryptocurrency market, especially within the first 100 days after Trump's official "ascension," where the market once predicted the likelihood of this happening to be over 50% (Polymarket betting data, which has since dropped to 36% at the time of writing).

Many skeptics have raised questions about the stability and security of BTC, but supporters believe that BTC reserves can strengthen the dollar and combat inflation. Currently, there is a divergence of opinions on whether Trump can use executive power to create a reserve fund, directly instruct the Treasury to spend money, or if a Congressional bill is necessary.

Next, I will guide readers to explore the potential pathways for the establishment of this reserve.

1. What is a strategic reserve?

A strategic reserve is a stockpile of critical resources that a country can quickly mobilize and utilize in response to emergencies, crises, or wartime situations. The most famous example is the U.S. Strategic Petroleum Reserve, which is the largest national oil reserve system in the world (700 million barrels), created by a Congressional act in 1975 to address the impact of the 1973-1974 Arab oil embargo on the U.S. economy. The U.S. has utilized this reserve during wartime or when oil infrastructure along the Gulf Coast was hit by hurricanes, as well as during the Ukraine war. The U.S. also has strategic reserves of gold, minerals, food, military supplies, and more.

2. How will the U.S. BTC strategic reserve operate?

The primary question is whether Trump can create a BTC strategic reserve through executive power.

——Initial Source

The initial source of the reserve is likely to be BTC confiscated by the U.S. government from criminals, currently estimated at around 200,000 BTC, valued at approximately $21 billion at current prices. Trump mentioned in a speech in July that these BTC could serve as the starting point for the reserve, but it remains unclear how they can be transferred from the Department of Justice.

Trump has not explicitly stated whether the government will increase the reserve by purchasing more BTC on the open market.

——Funding Source 1: ESF

Some believe that Trump could create the reserve using the U.S. Treasury's Exchange Stabilization Fund (ESF) through an executive order. This fund can be used to buy or sell foreign currencies and may also be used to hold BTC. This option is more realistic and can be executed quickly, as the ESF can be used within certain limits without needing individual Congressional approval, providing significant flexibility. The fund currently has over $200 billion, primarily used to stabilize the dollar's exchange rate and support international currency flow.

——Funding Source 2: Issuing New Debt

Additionally, there is a viewpoint that the government might issue new debt to purchase BTC, which I personally find unlikely. This is because U.S. government debt issuance requires Congressional approval, and the U.S. faces debt ceiling issues several times a year. It is unlikely that both parties would agree to increase debt for BTC purchases, as there are many higher-priority spending tasks, such as pensions, healthcare, and wars… However, historically, the U.S. has financed gold purchases through government bonds to increase reserves, leaving a glimmer of hope.

——Funding Source 3: Selling Gold

Finally, some supporters of BTC reserves imagine that the U.S. could sell part of its gold reserves and use the proceeds to buy BTC. The biggest issue here is that selling gold could lead to severe fluctuations in the global gold market, affecting the reserve security of all countries and potentially causing instability in international financial markets, as gold is collateral for many financial institutions. Moreover, gold prices are relatively stable and recognized as a scarce international asset with good liquidity, making the possibility of selling gold for BTC unlikely. It would be better for both assets to increase as reserves rather than a one-for-one exchange.

——Funding Source 4: Issuing Currency for Financing

In an era where the U.S. government struggles with debt, the president leading the family to issue currency opens up more possibilities. It is conceivable that a federal government agency could issue a new digital currency. This is because if the U.S. government were to purchase Bitcoin on a large scale, it could interfere with the Bitcoin market, driving up prices and creating a bubble. If the market bubble bursts, it could lead to a sharp decline in Bitcoin prices, resulting in significant losses for the government and many investors who entered the market late.

Thus, the government could initiate a project allowing people to deposit Bitcoin or WBTC into a smart contract address, corresponding to the issuance of a governance token without redemption rights, similar to Trump's $WLFI. This approach would likely attract many participants, allowing the U.S. government to acquire Bitcoin without affecting market prices or incurring additional debt, making it the best solution.

——Funding Source 5: Establishing a Company Similar to MSTR for Financing

The U.S. government could establish a government-controlled company that would finance the purchase of Bitcoin through debt financing or other capital market tools, thereby diversifying the assets for the U.S. strategic reserve. Similar to $MSTR, it could issue bonds, increase equity, or issue convertible bonds to raise funds, employing a three-pronged approach.

There are several cases where the U.S. government has held stakes in companies through the Treasury or the Federal Reserve, with the most typical examples being Fannie Mae and Freddie Mac. These two institutions were effectively turned into "government-controlled companies" after being bailed out by the government in 2008, with the government providing explicit guarantees for their debts. As a corporate entity, the company issues bonds or other securities in the capital market to finance the purchase and guarantee of residential mortgages, with the actual goal being macroeconomic regulation—improving liquidity in the U.S. housing market and lowering loan interest rates.

During the 2008 financial crisis, the U.S. government provided substantial loans to these two companies (from the Treasury and the Federal Reserve) and became their major shareholders through stock acquisitions after the crisis.

So, is it possible for the government to hold a stake in $MSTR or establish a similar enterprise? It is not entirely impossible, especially if one day Bitcoin becomes deeply integrated into the traditional financial system and is deemed as important as residential mortgage assets that need to be stabilized.

——Potential Purchase Scale of 1 Million

Currently, the most specific BTC reserve proposal circulating in Washington comes from pro-cryptocurrency Republican Senator Cynthia Lummis. She personally holds 5 BTC and proposed a bill in July that has yet to gain attention, which would create a reserve operated by the Treasury.

The bill envisions the Treasury creating a program to purchase 200,000 BTC annually over five years until the reserve reaches 1 million BTC. This would account for about 5% of the total global BTC supply (approximately 21 million BTC). The Treasury would fund these purchases using profits from deposits at the Federal Reserve Bank and gold holdings. The BTC reserve would be maintained for at least 20 years.

Lummis's proposal has not yet garnered attention from Congress, and its feasibility remains uncertain.

——Perhaps Starting at the State Level

Another possibility is that the establishment of the reserve will occur in phases, potentially starting with a state (possibly Pennsylvania or Texas, as six states in the U.S. have already proposed plans to establish BTC strategic reserves). State governments can act more flexibly and independently, viewing BTC as a tool to hedge against fiscal uncertainty or to attract crypto investment and innovation, before gradually escalating to the federal level.

For example, last November, Pennsylvania introduced the "Pennsylvania BTC Strategic Reserve Act," which would authorize the state Treasury to invest 10% of its $7 billion reserve in BTC.

A month later, Texas introduced a similar bill, the "Texas Strategic BTC Reserve Act," proposing to establish a special fund within the state treasury to hold BTC as a financial asset for at least five years.

——What is WLFI Plotting?

Finally, the WLFI (WORLD LIBERTY FINANCIAL) project controlled by the Trump family has recently used raised funds to purchase over $50 million in cryptocurrencies, including LINK, AAVE, BTC, ETH, ENA, and TRX, and may continue to purchase tens of millions of dollars more. The relationship of this project to a potential U.S. strategic reserve remains uncertain. I seriously suspect that $WLFI is testing the possibility of the government selling currency.

3. What are the benefits of BTC reserves?

Since this proposal is to be promoted, the Democrats must have a logically coherent explanation.

Trump's view is that BTC reserves will help the U.S. dominate the global BTC market in response to competition from China.

Other supporters believe that by holding BTC reserves (which they believe will continue to appreciate in the long term), the U.S. can reduce deficits without increasing taxes, thereby strengthening the dollar. Lummis's plan is projected to halve U.S. debt within 20 years. "This will help us resist inflation and protect the dollar on the global stage." Some supporters believe that a strong dollar will give the U.S. more leverage in its dealings with rivals like China and Russia.

4. What are the risks of BTC reserves?

Cryptocurrency skeptics argue that, unlike most other commodities, BTC has no practical use or intrinsic value and is not critical to the functioning of the U.S. economy. BTC is only 16 years old, still too young and unstable to assume its value will continue to rise in the long term. Additionally, cryptocurrency wallets are vulnerable to cyberattacks, and they point out that due to BTC's volatility, any government purchase or sale could have an outsized impact on BTC prices.

5. Conclusion: Want to do it, but no money

Since Trump's strategic reserve plan clearly faces numerous obstacles, the most important question is where to find additional funds to purchase new reserves? Until this question is resolved, it is unlikely that the U.S. federal government will purchase new BTC, but we can certainly expect to see state governments take the lead.

More importantly, with Trump's platform promotion and more policy relaxations (such as significant banking service deregulations, which are as beneficial as BTC reserves), the exposure of cryptocurrencies is gradually increasing, and the adoption rate is bound to rise. The U.S. will ultimately accept cryptocurrencies on a larger scale.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。