Author: A Ray's New World, BlockBeats

2024 has become a significant year for stablecoin projects, with an increasing number of innovative new stablecoin projects emerging in the market. In just the second half of last year, at least 23 stablecoin projects secured substantial funding ranging from 2 million to 45 million. Besides Ethena, which surpassed DAI's market share with USDe, Usual has emerged as another eye-catching stablecoin project. Not only does it have the backing of French Member of Parliament Pierre Person, but Usual also launched on Binance at the end of 2024, and its market performance has been noteworthy.

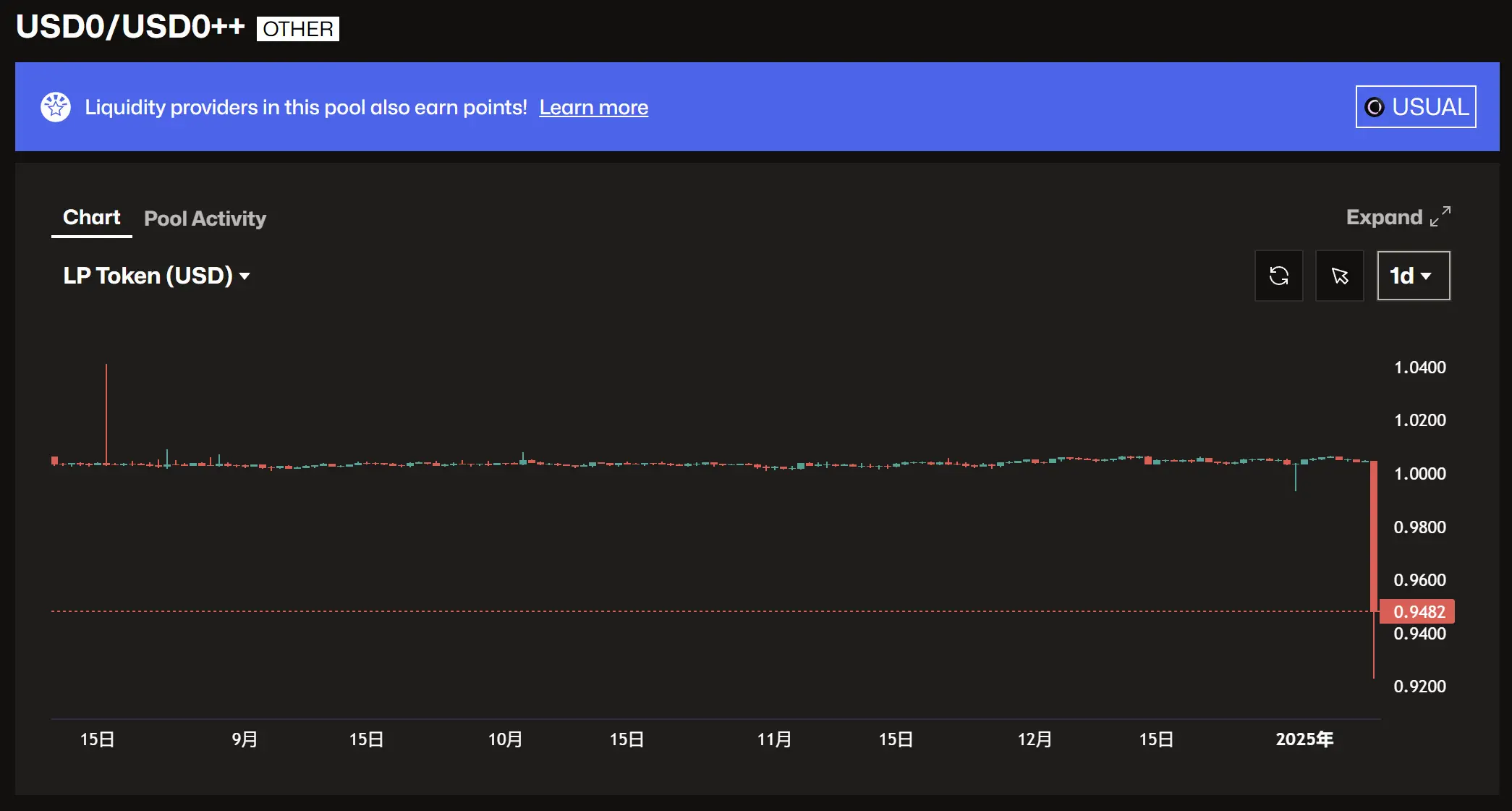

However, Usual, which was once a hot commodity in the market, has seen its token Usual drop over 30% within a week. This morning, its token USD0++ also suddenly de-pegged to around $0.946, with one USD0++ token only redeemable for about $0.94. Currently, the USD0++ proportion in the USD0/USD0++ pool on Curve has skewed to 90.75%.

USD0++ de-pegged, source: Curve

What exactly happened to Usual, and why did USD0++ suddenly experience a flash crash?

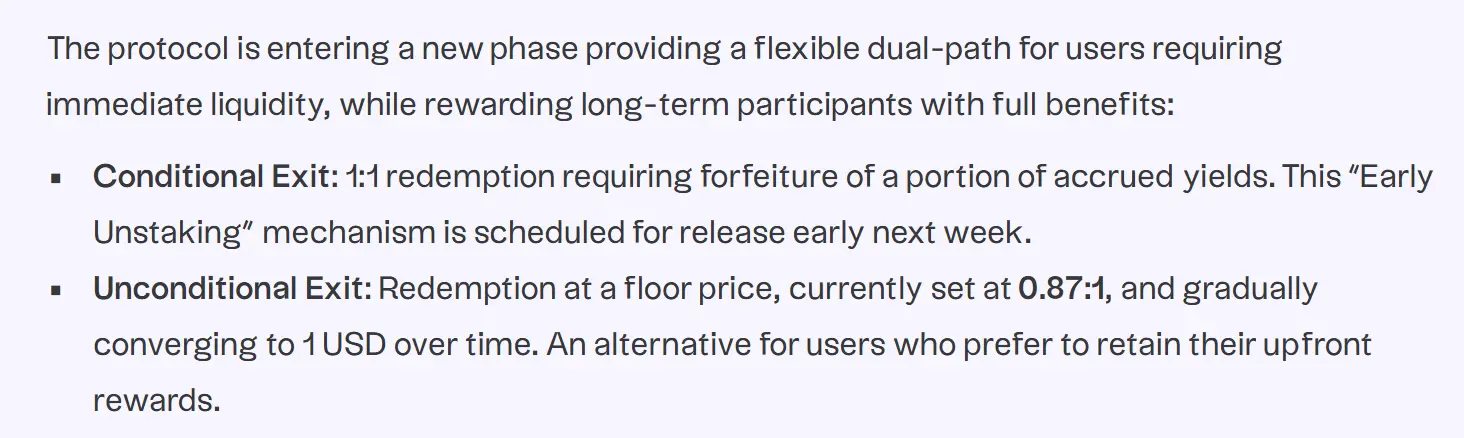

Panic Run Triggered by an Announcement

The de-pegging of USD0++ can be traced back to an announcement made by Usual's official team on the morning of January 10. In the announcement, Usual changed the redemption conditions for USD0++, shifting from the original 1:1 redemption to a new dual exit method. One method is a conditional exit, where users can still redeem USD0++ at a 1:1 ratio, but they must burn a portion of their earnings upon exit. The other method is an unconditional exit, but unlike the previous guaranteed 1:1, the official stipulated minimum exit ratio is 0.87:1, which will gradually re-peg to $1 over time.

Usual's announcement of two exit methods, source: Usual official website

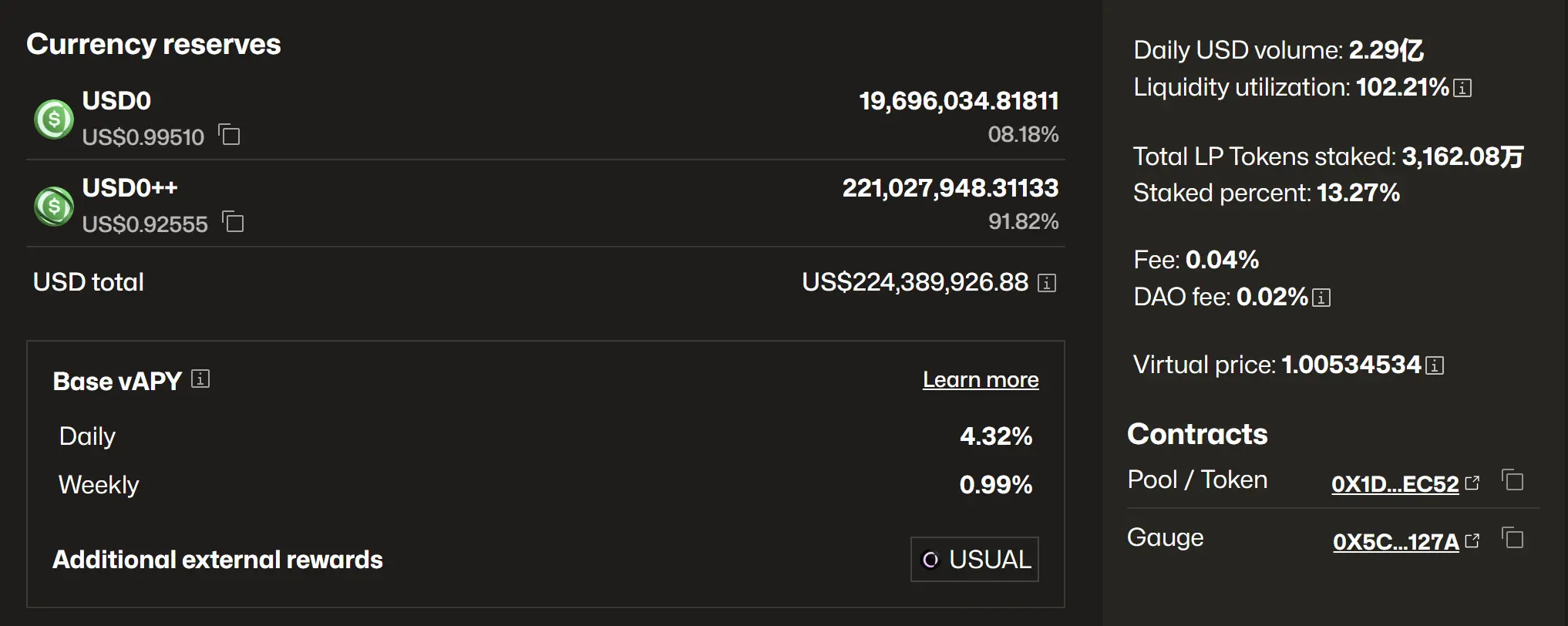

Usual's announcement quickly spread within the Usual community. As the new redemption rules for USD0++ took effect, panic began to spread from large holders to retail investors. In this "leopard chasing" game, users who ran first always suffered fewer losses than those who were slower. Following the announcement today, amidst the panic and the flight of large holders, retail investors also began to cut their losses and flee. The outflow of USD0 not only accelerated but the USD0/USD0++ pair on Curve was "smashed through." With a large number of USD0++ being redeemed, the proportion of USD0 also plummeted to an astonishing 8.18%.

Source: Curve

Let’s rewind to when Usual launched on Binance. Initially, the redemption mechanism set by Usual's official team last year allowed for 1:1 redemptions. Unlike Ethena, which is more oriented towards B2B, Usual's more consumer-oriented product attracted many large holders. Under the premise of a 1:1 full redemption guarantee from Usual's official team, many large holders not only took large positions but also continuously increased their leverage and capital efficiency through circular lending. This essentially provided all users with a form of risk-free yield from Usual. Such capital management was feasible as long as Usual's official team did not change the rules of the game, allowing large holders to gain the mining token USUAL without incurring additional opportunity costs.

At the same time, the price of USUAL continued to rise, leading to a surge in the apparent APY, which attracted more users to stake, thus creating a positive feedback loop under Usual's drive. Higher prices attracted excessive TVL, and more TVL further pushed up prices, creating a cycle. Usual's high control over the mining token and the apparent APY attracting TVL was almost an open strategy. Retail investors could also benefit from Usual's "left foot stepping on the right foot" model, following large holders to reap rewards. Therefore, Usual's positive feedback loop quickly began to spin.

Usual's extremely high APY, source: Usual official website

The most critical aspect of this mechanism is the exit issue. For long-term holders, USUAL's issuance is linked to the overall protocol's revenue; the higher the TVL, the less USUAL will be issued, creating a deflationary mechanism. By reducing the supply of USUAL on the supply side, a certain degree of scarcity is artificially created. The team also designed the mechanism for USUAL, where staking USUAL tokens would yield USUALx, allowing these holders to receive 10% of the newly minted USUAL daily, rewarding early participants in the ecosystem. Additionally, when USD0++ is redeemed early, 33% of the burned USUAL will be allocated to USUALx holders, creating an additional source of income. For short-term holders, the choices are to sell USUAL and flee or continue holding USUAL to earn more rewards. The question arises: should one choose "to pull out with minimal effort" or "to pull the plug and run"? Under the premise of continuously rising prices, pulling out would only yield current USUAL earnings, while choosing to stand on the side of time would yield "staking rewards + USUAL token appreciation + additional earnings." The prosperity of Usual is constantly being pulled between the economic games of short-term and long-term holders.

However, all gifts in fate come with a price tag. Usual's official team hinted long ago that USD0++ would require an exit fee. Almost all participants in Usual tacitly understood this, all playing a game of who would be the last to remain before the building collapses.

Why the "Mysterious" 0.87?

So, why did the official announcement today set the unconditional exit ratio at 0.87? How did the official team consider this precise ratio of 0.87?

Profit Burn Theory

The 0.87:1 ratio set in the official announcement triggered a reevaluation of interests among large holders. With the previous 1:1 guaranteed redemption strategy now ineffective and the loss of official backing, large holders now face the challenge of choosing the best option among the "short" ones. If they opt for conditional redemption, investors would need to return a portion of the profits obtained later to the project, but the details of this profit clawback have not been disclosed by the official team. Conversely, if they accept the unconditional redemption method, the worst-case scenario guarantees only 0.87, leaving the 0.13 portion as the core of the game. When either of the two exit methods offers higher returns, funds will naturally vote for the one with the highest yield, but a well-designed mechanism should allow users the freedom to choose rather than being "one-sided." Therefore, the existence of the 0.13 space likely indicates that the official team has yet to disclose the portion of profits that need to be burned, allowing users to make a choice between the two methods. From the user's perspective, if they have to pay a guaranteed cost of 0.13 later, it might be better to sell at the current de-pegged price (currently around 0.94). USD0++ would then shed its previous packaging and return to its economic essence as a bond. The 0.13 represents the discounted portion, while 0.87 reflects its intrinsic value.

Liquidation Bottom Line Theory

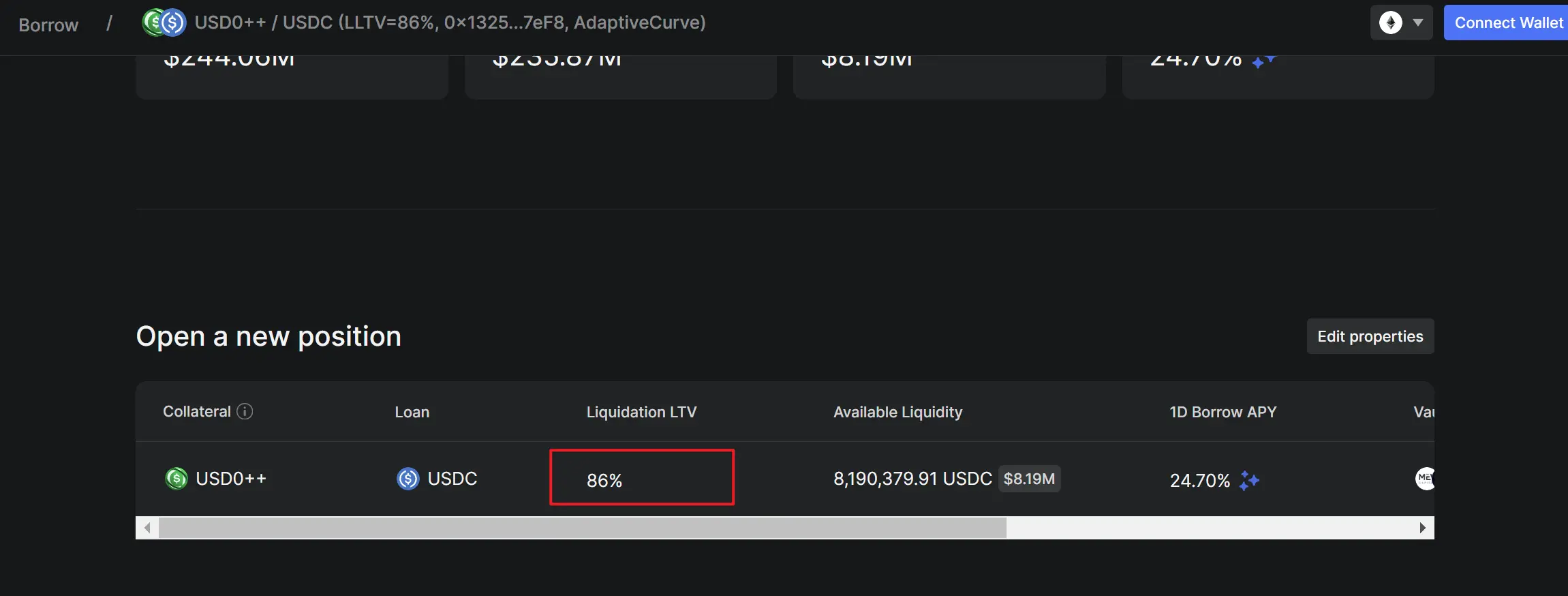

Previously, Usual's mechanism of providing a 1:1 peg for USD0++ allowed many large holders to safely take positions to obtain almost risk-free returns and further increase leverage through lending protocols like Morpho. Typically, these users engaging in circular lending would collateralize their USD0++, borrow a certain amount of USDC, then exchange this USDC for USD0++, and subsequently initiate a new round of circular lending. These users, keen on circular lending, provided Usual with considerable TVL, continuously elevating the situation, but behind the TVL "perpetual motion machine," there exists a liquidation line.

In the Morpho protocol, the liquidation line for USD0 is determined by the Loan-to-Value Ratio (LLTV). LLTV is a fixed ratio, and when a user's Loan-to-Value (LTV) exceeds LLTV, their position faces liquidation risk. Currently, Morpho's liquidation line is set at 86%, which is just a step away from the 0.87 bottom line in the official unconditional exit.

In Morpho, the liquidation line for USD0++ is 86%, source: Morpho

The 0.87 in Usual's official announcement is just above Morpho's 0.86 liquidation line. It can be seen as a final barrier set by the official team to prevent systemic liquidation risks. Although the 0.87 setting provides a final bottom line, it maintains a project's dignity towards its users.

However, this is also why many large holders are stepping back to observe. The 13-point space allows for free fluctuation, and many interpret it as meaning that as long as there is no final chain liquidation, it will ultimately be left to "free fall."

What Are the Short- and Long-Term Impacts After De-pegging?

So, how will the situation unfold after USD0++ de-pegs? Currently, the panic sentiment surrounding USD0++ in the market has not subsided; the vast majority of people are adopting a risk management approach, remaining still, and observing. The market's reasonable value for USD0++ stabilizes around 0.94, a consensus based on the temporary announcement. However, the official details on how the "unconditional exit" will burn and how much profit will be deducted have not been disclosed in detail, with further details expected to be announced next week. In an extreme scenario, if next week the official team does not burn the anticipated 13-point space but instead burns 0.5% of USUAL, then USD0++ could quickly re-peg to around 0.995. The re-pegging of USD0++ will depend on the burning details announced by Usual's official team next week.

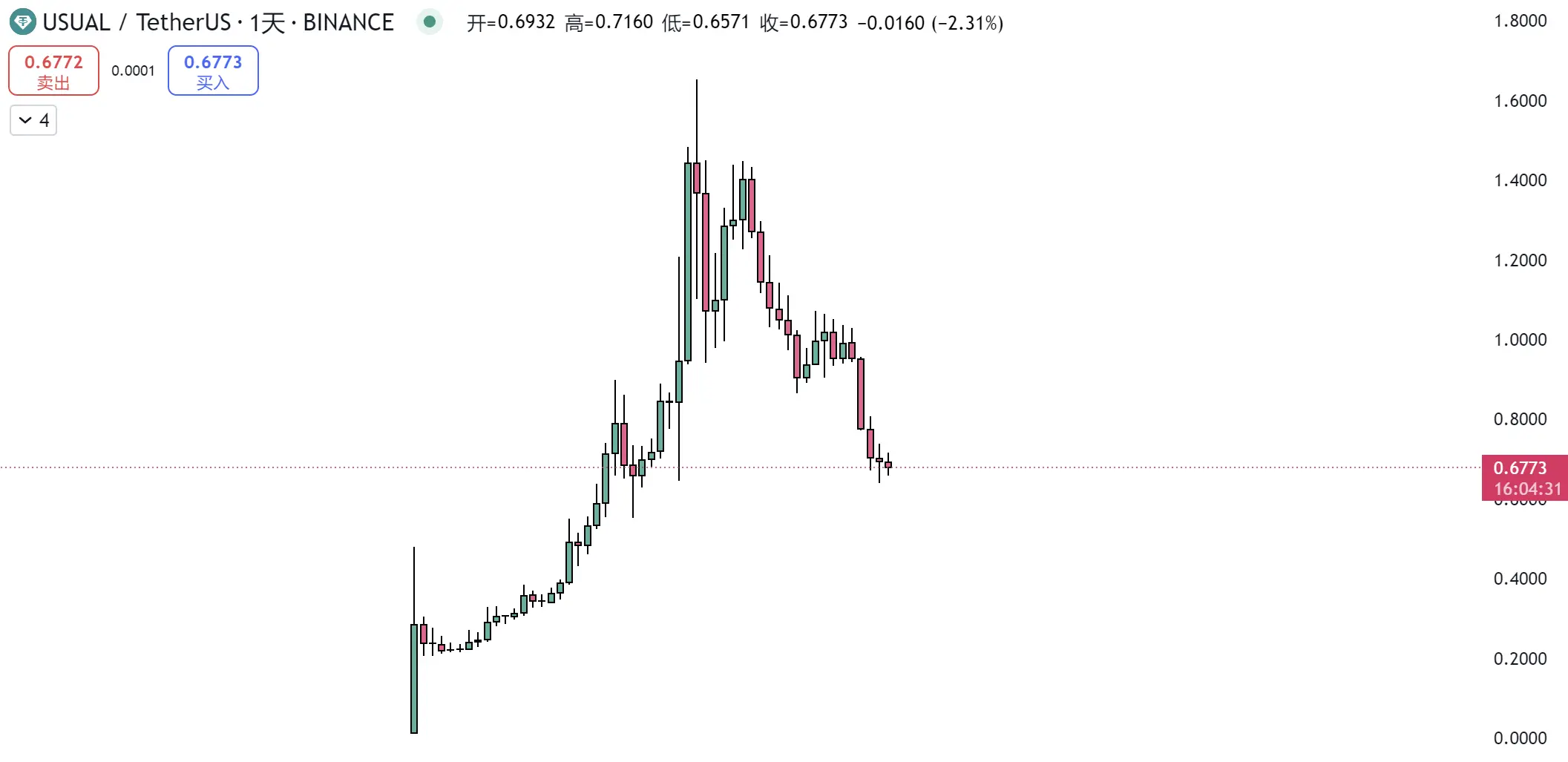

Regardless of how the final mechanism details are determined, it will benefit the holders of the tokens UsualX and USUAL. The Usual team has designed the new exit method to reduce the earnings of USD0++, and although the market's exit approach has been overly aggressive, it will lead to a decrease in the TVL of USUAL/USD0++, which will in turn drive up the price of the USUAL token. Once burning begins, USUAL will be consumed, leading to further token value capture, and the price will thus become more robust. From Usual's mechanism design, it is evident that USUAL is a key component in the design of the protocol's feedback loop. Since its peak of 1.6, USUAL has dropped about 58%, and a resurgence of USUAL is needed to get the feedback loop spinning again.

The price of the token USUAL has plummeted by 58%, source: tradingview

Ironically, while a large number of arbitrageurs have contributed significant TVL to Usual through Morpho's circular lending, the official announcement of the 0.87 bottom line seems more like a warning to those engaged in circular lending at the 0.86 liquidation line.

Now, the Usual team has removed the previous "privilege" of rigid 1:1 redemption, correcting a mechanism that "should not have existed." As for the re-pegging of USD0++, the entire market is waiting for the Usual team's announcement next week, and at that time, Rhythm Blockbeats will continue to follow up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。