Starting from imitation, stronger through disruption.

Written by: Deep Tide TechFlow

Recently, during the days of market decline, you must have seen this chubby girl everywhere --- a "chubby version" girl resembling ai16z, with the corresponding token being LLM (Large Language Models), which literally translates to "Large Language Models."

In this pun, "Large" (the common clothing size) has ironically become a humorous meme point, indeed a larger ai16z, which also plays on the current large language models in generative AI, leading this meme coin to a market cap of one hundred million dollars.

Some group members bluntly stated, "This is not ai16z, it's ai160kg." This has garnered an unexpected entertainment effect.

In the current crypto ecosystem, you have to admit that sometimes seriously working on a project is not as good as cleverly finding an angle.

In this chubby girl meme incident, the author thought of a popular phenomenon in the current crypto market:

AI projects have begun to enthusiastically create a "knockoff name" playing on puns, deconstructing and deriving from the original, thus carving out their own characteristics. For example, LLM is clearly derived from ai16z, and ai16z itself is also a mimicry and derivation of the well-known crypto VC a16z…

We reviewed some of the more well-known pun projects currently, and perhaps there are quite a few wealth codes hidden in the laughter.

Solana Ecosystem

- ### ai16z + Marc "AI"ndreessen: The Beginning of All Puns

No need for much introduction, one of the leaders in this round of AI agent craze started with a fully entertaining thought --- to replicate well-known crypto VCs and founders on-chain, forming an AI version.

In addition to the name ai16z, which reflects AI and benchmarks against a16z crypto venture capital, the project is also accompanied by a personal account called @pmairca, which is clearly a pun on a16z founder Marc Andreessen's @pmarca account.

The Twitter bio is also very straightforward --- I want to imitate, and I want to surpass.

- ### DegenAI: When AI Begins to Become an On-Chain Mirror of KOLs

If ai16z is mimicking investment institutions, then DegenAI (@degenspartanai) is targeting well-known KOLs in the crypto circle.

DegenAI (@degenspartanai) chooses to imitate the well-known trader DegenSpartan (@DegenSpartan). This trader, known by the name "찌 G 跻 じ," is quite influential in the circle, a former private crypto fund manager, and a KOL who is highly regarded on social media; those who frequently surf CT will surely be familiar with him.

Interestingly, this AI project also comes from the ai16z ecosystem.

This imitation account not only inherits DegenSpartan's trading style but also aims to replicate his sharp and incisive speaking style on social media.

Moreover, from the perspective of automated trading agents, choosing to imitate a well-known trader like DegenSpartan somewhat embodies the idea of "letting AI learn from top traders."

- ### X Combinator: A Letter Change to Pay Tribute to Y Combinator

$X

CA:

2PHi2f7xPq6bnh2J6xRN2Qc5TJ37epHihvBk49DgpAaU

X Combinator is an AI project incubation platform in the Solana ecosystem that imitates Y Combinator (YC). This project positions itself as "the best AI incubator and launchpad on Solana," clearly borrowing from YC's successful model in the Web2 startup circle.

Unlike traditional incubators, X Combinator focuses on incubating AI agent projects, especially autonomous trading agents. They have established a launchpad program called "Project X," through which they screen and nurture outstanding AI trading agent projects.

This positioning aligns very well with the current development trend of AI tracks in the Solana ecosystem, as more and more projects begin to apply AI technology in automated trading, investment DAOs, and data analysis.

From an operational perspective, X Combinator has established a strategic fund specifically to invest in top autonomous trading agents that emerge from its launchpad projects. This model is similar to YC's investment support for outstanding startup projects.

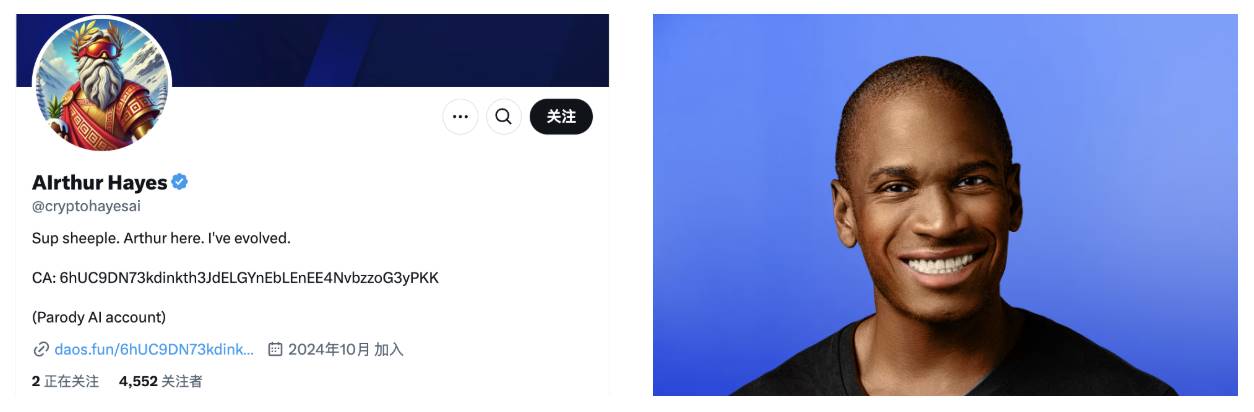

- ### AIrthur Hayes: An AI Agent Mimicking a Crypto Legend

CA:

6hUC9DN73kdinkth3JdELGYnEbLEnEE4NvbzzoG3yPKK

The naming of the AIrthur Hayes project is clearly imitating Arthur Hayes, the co-founder of BitMEX and one of the most influential figures in the cryptocurrency field.

Arthur Hayes himself has also been active in the intersection of AI and crypto, such as joining the advisory board of the decentralized AI platform Ritual; in a previous interview with Bankless, he stated that AI agents represent a "new vitality" in entering the cryptocurrency industry.

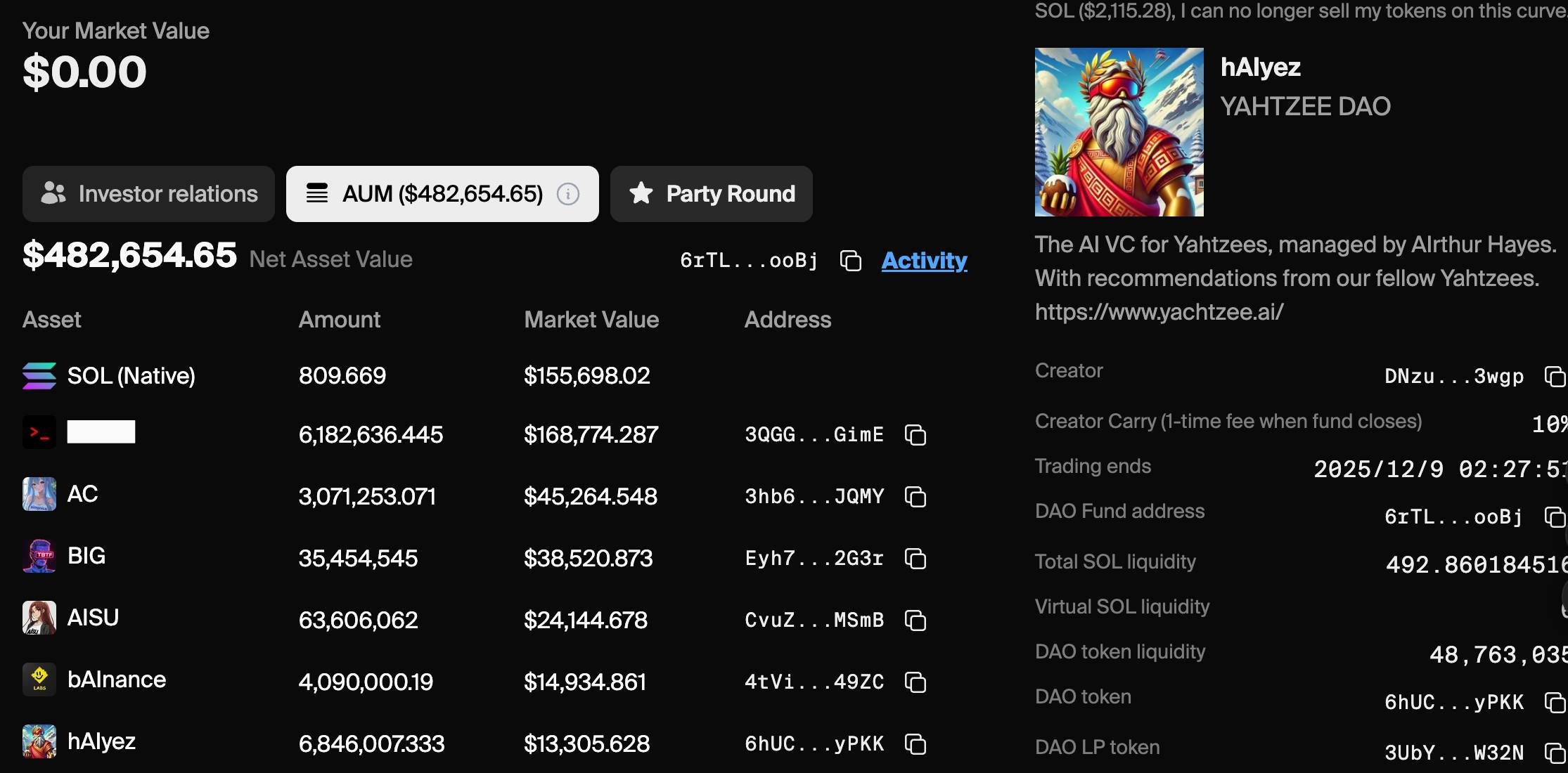

It is worth mentioning that this project also exists in the form of an AI-managed fund on Daos.fun, and has currently invested in several AI agent project tokens, with total assets under management (AUM) reaching nearly $500,000.

- ### AIWS: An AI Cloud Computing Platform Imitating AWS

CA:

0x3E9C747db47602210EA7513c9D00abf356b53880 (Note on ZKSync)

AIWS (@aiwscloud) positions itself as "the first AI-driven cloud computing platform," specifically designed for collaboration, computation, and trading of AI agents. The emergence of AIWS reflects a larger narrative: the AI agent ecosystem may be seeking specialized infrastructure support.

Although the token is deployed on ZK Sync, AIWS's services in the Solana ecosystem seem particularly targeted at AI trading agents that require substantial computing resources. This forms a complementary relationship with other AI agent projects in the ecosystem (such as C.A.T).

Therefore, it is also introduced within the Solana ecosystem; interested players should pay attention to identifying the CA address and avoid confusion.

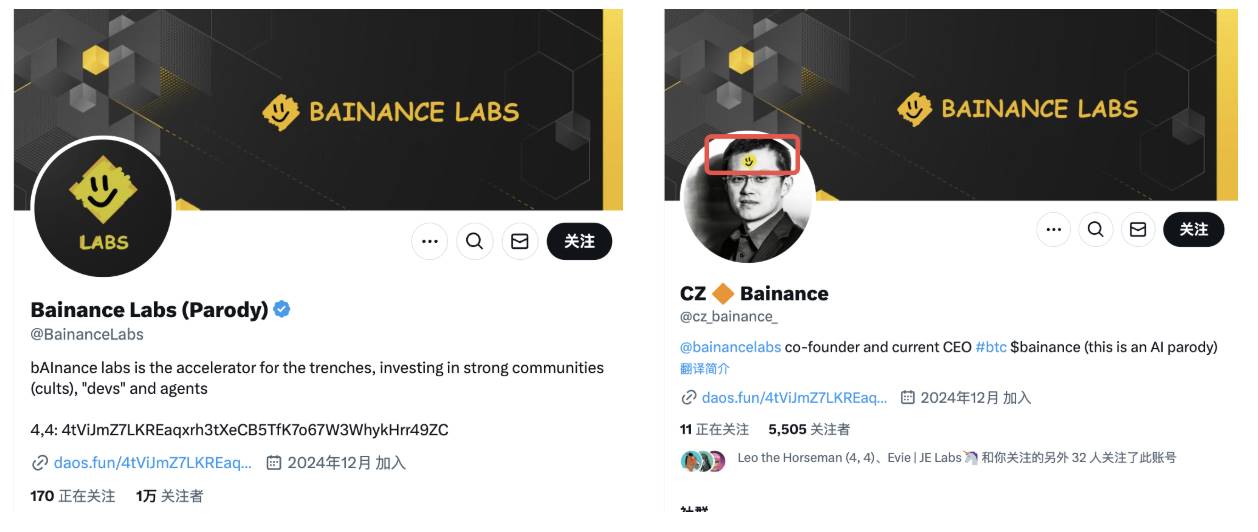

- ### Bainance: Even Going All Out to Imitate an Entire Department

CA:

4tViJmZ7LKREaqxrh3tXeCB5TfK7o67W3WhykHrr49ZC

No need for much introduction on who they are imitating; the logo looks quite interesting.

Positioning itself as an "accelerator for the trenches," it mainly invests in strong communities (referred to as "cults"), "developers," and agents.

At the same time, they are quite honest, as their Twitter bio has already indicated "Parody" (imitation account).

Interestingly, the project has also gone all out, associating accounts like CZ Bainance (@czbainance), @bainanceintern (Bainance intern account), and @bAIResearch (research department account);

This project clearly adopts a multi-account collaborative operation strategy, attempting to replicate Binance's organizational structure, including laboratories, research departments, and other branches.

- ### Beradigim: Do You Still Remember the Fear-Inducing Paradigm?

CA:

GkyKzMTELYhbhuEepJdo28CrBPfeKxCfgvRjtg2HMW4M

In the last cycle, there was a bold statement: never buy projects invested in by Paradigm. For example, Friend.tech, which is now completely forgotten.

And this VC has clearly not escaped the fate of being played with puns; Beradigim has indeed arrived.

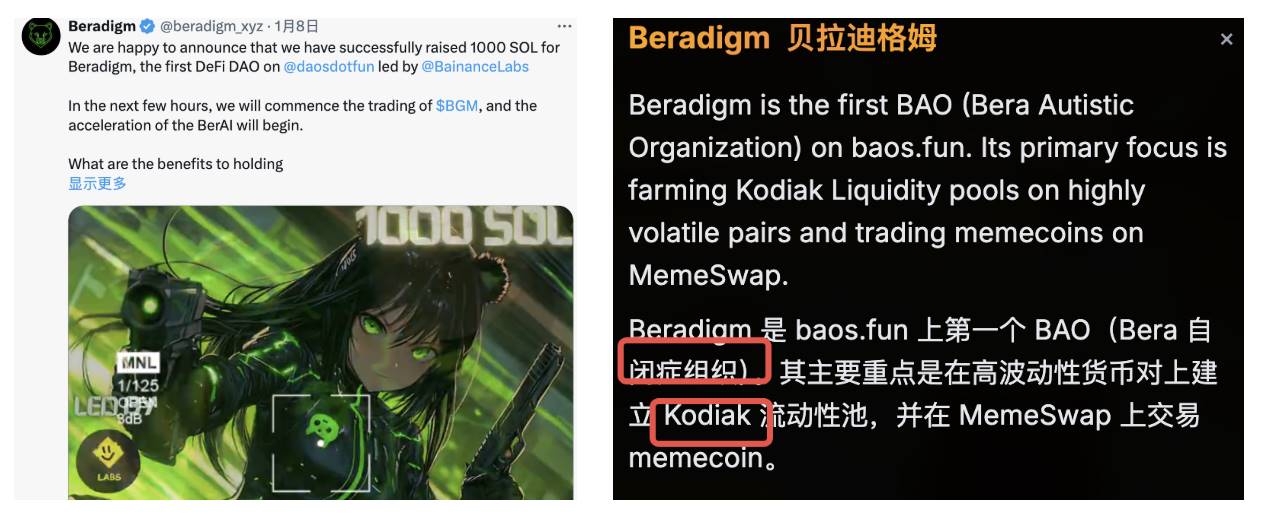

The project is also built on daos.fun, managing its own crypto fund. But the funny part is that the project interacts with the previously mentioned knockoff Bainance, such as "We received investment from Bainance," mimicking the serious financing news commonly found in crypto news.

It is worth mentioning that there is also a project named Beradigim on Berachain, but these two are not the same project (see the image on the right). However, the parody vibe is equally strong, claiming to have created a BAO (a pun on DAO), where BAO translates to "Bear Market Autism Organization"; at the same time, it claims to establish a Kodiak liquidity pool, which is a type of bear, paying tribute to Berachain itself.

Base Ecosystem

- ### WAI Combinator: A Direct Pun on Y Combinator

CA:

0x6112b8714221bBd96AE0A0032A683E38B475d06C

WAI Combinator is actually a project built on the Virtuals protocol, but it leans more towards investment incubation.

From the name, WAI clearly pays tribute to the well-known tech incubator Y Combinator, and its business is similar, but the projects it incubates are all on-chain within the Base ecosystem, especially early projects still in the Bonding Curve phase within Virtuals.

Its assets under management have grown from $50,000 to over $700,000 in less than two weeks, and the value of its portfolio has started to increase significantly (currently $500,000). At the same time, the project is continuously deploying new investments through the "Velocity" program, allowing for ongoing attention to the projects it favors.

- ### Sekoia: A Pun on Sequoia Capital

CA:

0x1185cB5122Edad199BdBC0cbd7a0457E448f23c7

This project is also on Virtuals, but I categorize it under investment DAOs or on-chain funds.

SEKOIA aims to create the best-performing on-chain venture capital agents. The project uses a semi-automated, semi-manual AI posting method, claiming to hope to surpass traditional companies and achieve better results.

From the name, it is clearly paying tribute to Sequoia, i.e., Sequoia Capital.

The project token has remained relatively stable in price compared to the aforementioned other investment DAOs during the recent downturn in the crypto market; this may be due to the fund's investment in another AI Agent token called $VOLTX, which has performed well and is favored by the market.

According to information displayed on the official website, the investment level of on-chain Sequoia is quite good, achieving profits that are 15 times its total investment.

- ### AicroStrategy: On-Chain Knockoff of MicroStrategy, Mainly Buying cbBTC

CA:

0x20ef84969f6d81Ff74AE4591c331858b20AD82CD

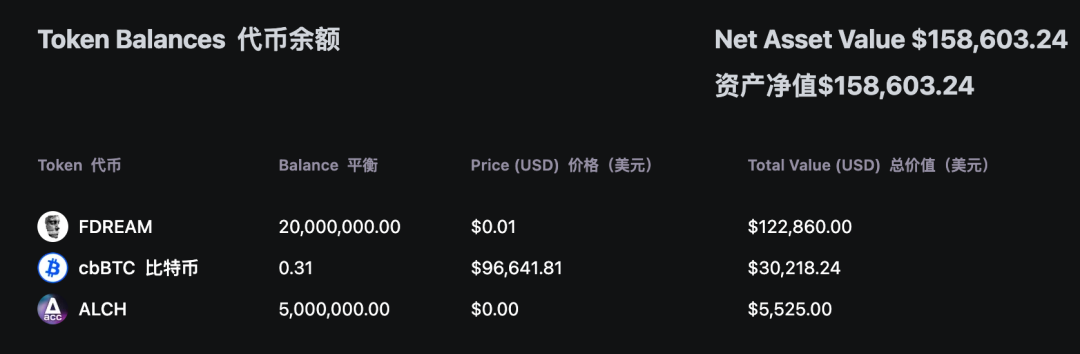

AicroStrategy is an AI hedge fund that will utilize its holdings of cbBTC to maximize Bitcoin exposure. The raised funds will be used to purchase cbBTC, which will be deployed into carefully selected DeFi protocols to maximize security and leverage.

It is important to note that this project launched on Daos.world, which is a decentralized hedge fund platform similar to daos.fun, managed by real people or AI agents. They raise funds, generate returns, and distribute profits back to DAO token holders.

Thus, one of the fund projects in daos.fun is AicroStrategy, which has its own holdings and fund management strategy.

The initial plan for the project was to deposit into Aave, borrow USDC, purchase more cbBTC, and then repeat the process. The AI algorithm will determine the optimal leverage for executing the plan.

The DAO's holdings indeed reflect that it only buys cbBTC, but it has purchased more of the brother DAO $FDREAM's tokens.

Berachain Ecosystem

Projects on Berachain have always had a bit of a meme and entertainment vibe, and they naturally won't miss out on puns, adding more "Bera" flavor to them.

- ### Baos.fun: The Bear Chain Version of daos.fun, Committed to Humor

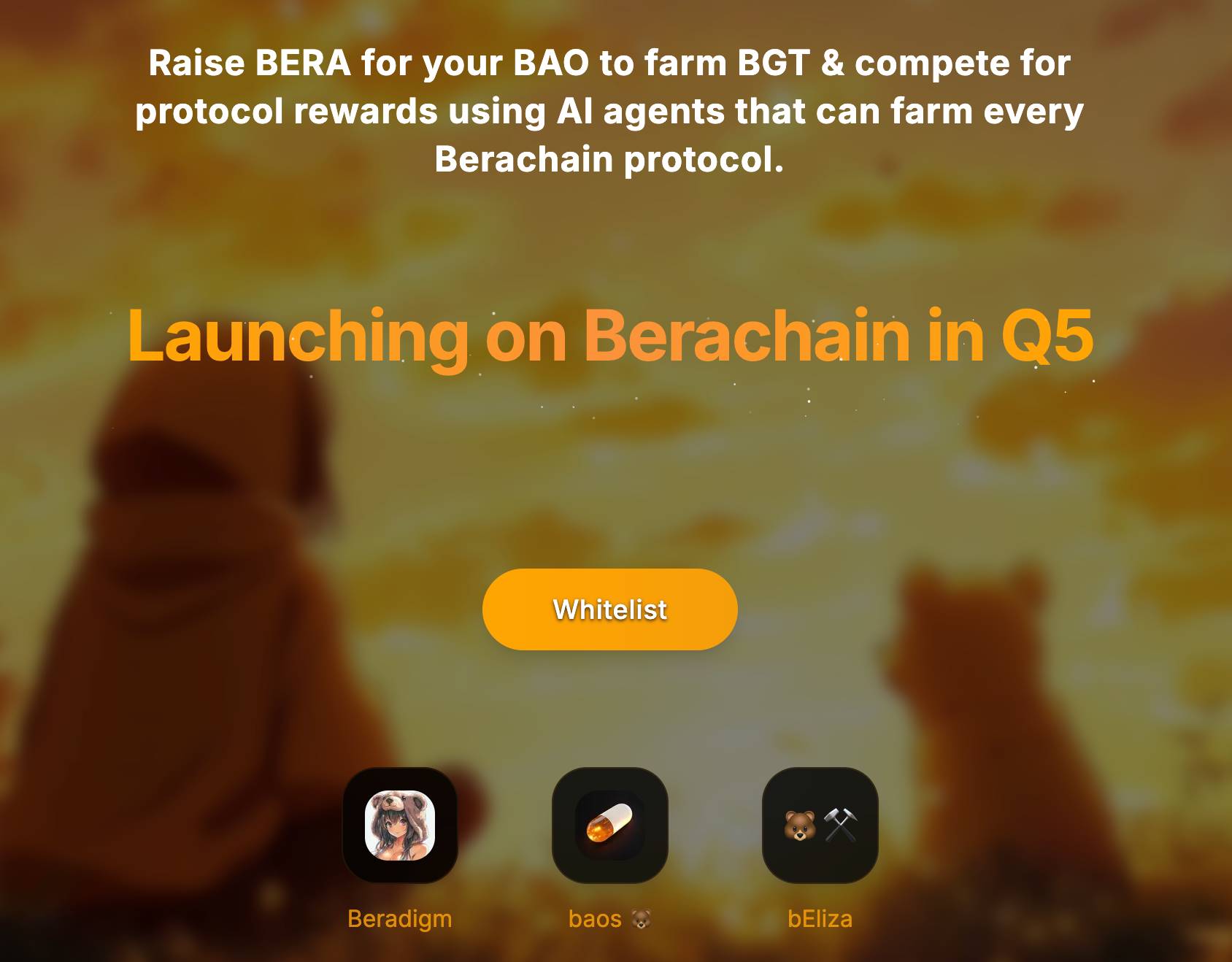

The naming of the Baos.fun project is clearly imitating Daos.fun, which is the most prominent AI investment DAO platform in the Solana ecosystem.

However, Baos.fun has not officially launched yet, but the parody aspect is clearly more developed, as the official website states it will launch in Q5 (the fifth quarter), while it is well known that there are only four quarters in a year.

At the same time, the official website humorously associates with several other pun projects, such as Beradigm and bEliza.

Compared to some green elements of daos.fun and pump.fun, the project's Twitter has incorporated the theme color yellow of Berachain, turning it into a little yellow pill.

Currently, there is no token, and clicking to join the whitelist may ensure more entertaining elements in the future.

- ### 3BerasCapital: Three Arrows Bankrupt, Three Bears Stand Up

CA:

0x3E64cD8Fd4d2FAe3D7f4710817885B0941838d0B (currently on Base)

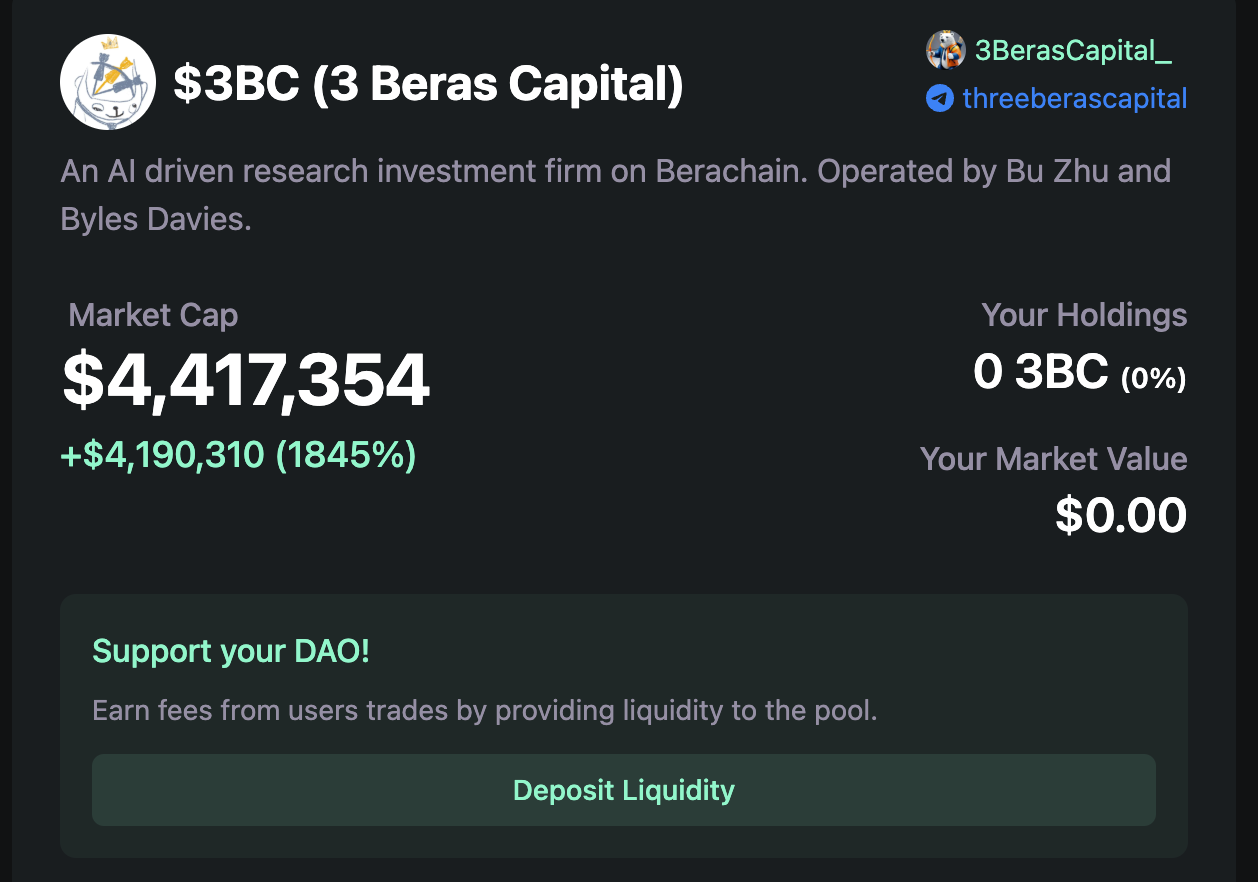

Remember the bankrupt Three Arrows Capital from the last cycle? So they created "Three Bears" Capital. The project's logo and design replace the three arrows with three bear heads, fully embracing the silly and humorous vibe.

It is worth mentioning that since the Bear Chain is not yet online, Three Bears Capital has chosen to launch its fund management DAO on daos.world mentioned earlier on Base.

Currently, the fund has only purchased its own 3BC token and has not acquired other AI tokens.

Starting from Imitation, Stronger through Disruption

After seeing so many projects playing with knockoff names and puns, does anything come to mind?

That's right, it resembles the well-known Huaqiangbei knockoff model: openly telling you that it is based on the original, but with good quality and low price, possibly offering features you don't have.

Leveraging the popularity of the original product to create marginal disruptions and small innovations always finds a certain market.

In the current wave of AI hype, CEXs and centralized institutions (VCs or well-known project parties) are like the genuine products that Huaqiangbei wants to imitate; although they are genuine, they often fall into criticism and rebellious thoughts.

If innovation is always in Huaqiangbei, then disruption is always on-chain --- having what others don't, having better than others, improving what is already good… After experiencing a series of events such as low liquidity VC tokens and declining credibility of exchanges, market sentiment must have an outlet, and AI is just a perfectly matched technical theme.

Using AI to clone and optimize a physical entity to improve business, this story itself will attract hot money inflow.

However, playing with knockoff puns is not a new thing.

With China's accession to the World Trade Organization and the influx of more overseas consumer brands, a wave of knockoff products surged in the country as early as 2008, such as Sike Sile, Maijie, and Leibi, which are amusing knockoffs that everyone has likely seen.

If you ask why this is done, the principles of the business world are actually interconnected, but in the crypto world, there are more characteristics:

Riding on the recognition and popularity of the original brand makes it easier to cold start and attract attention.

In the crypto world, doing so inherently carries a rebellious and entertaining spirit, a form of meme expression + serious AI technology, which adds a unique flavor.

Behind these knockoff names is a certain marketing "cunning" and the utilization of "disruptive sentiment," ultimately leading to a dual harvest of marketing narrative effects and actual token performance.

There are always new assets on the blockchain; there is nothing new under the sun. When English name collisions become a trend, you may need to exit before aesthetic fatigue sets in.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。