NEW New Column Introduction

Hi readers, Coinspire is about to launch our new content column—Discover Alpha/5 Minutes to Understand a Project Series.

This is the first article in this new column, where we not only chase current trends but also hope to find undervalued projects that go beyond the current narrative and can tell exciting stories to share with readers.

The popularity of Ai16z and its fundraising platform daos.fun has significantly raised the profile of Investment DAOs in the past month.

In short, an Investment DAO is a decentralized hedge fund managed by real people or AI agents. They raise funds, generate returns, and distribute profits back to DAO token holders. It can also be understood as a tool to help hedge fund managers raise capital. A launchpad serves as an aggregation market for such DAOs, with the platform acting as a third-party endorsement.

In fact, Investment DAOs are not a new concept; they existed as a branch when the DAO concept emerged in 2022, primarily deployed on the Ethereum public chain, with investment directions leaning towards popular narratives like NFTs, DApps, and DeFi. In this cycle, AI Agents and Memes have become mainstream investments, with daos.fun positioned as a meme fund launch platform based on Solana.

Now, this trend has gradually shifted from Solana to the Base public chain, such as daos.world and Vader AI.fun in the Base Virtuals ecosystem. Next, this article will focus on the processes and technical features of these two projects to explore the concept of Investment DAOs.

Daos.world

daos.world and daos.fun operate on similar logic, primarily focusing on the launchpad for Investment DAOs.

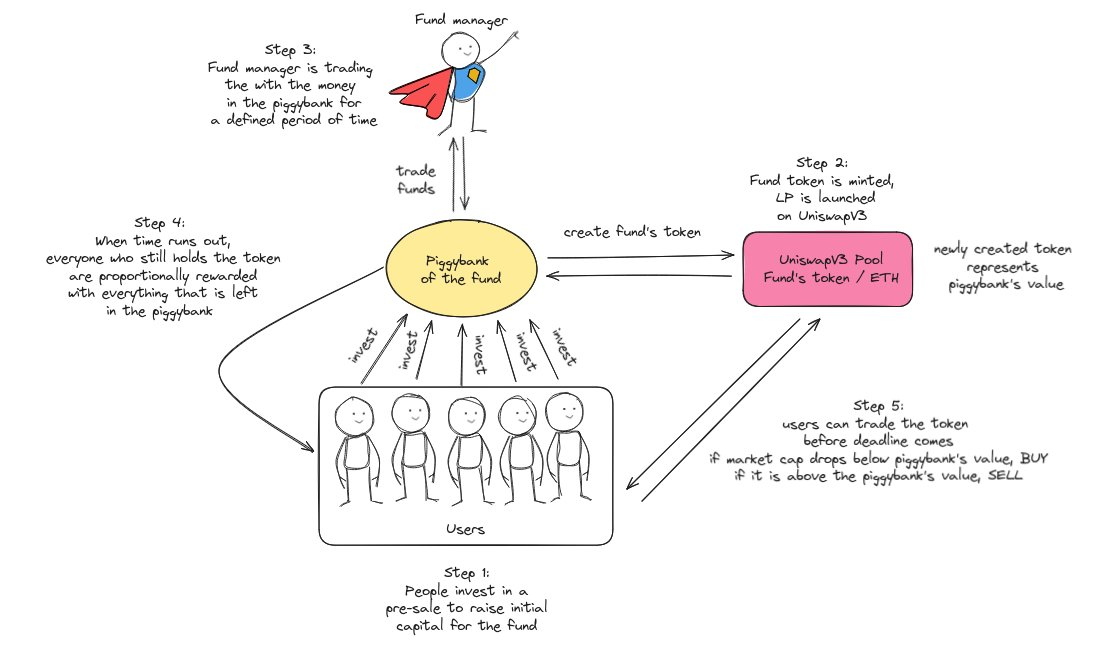

First, there are two roles for protocol participants:

DAO Manager;

WL (Wait List) participants, who are the DAO fundraisers.

Secondly, the operational process is as follows:

1.Launch DAO: The DAO Manager launches a fund to raise ETH on daos.world (currently, they need to contact the project team via Telegram to get a chance to publish);

2.Presale: Whitelisted participants choose DAO funds and purchase their shares during the presale phase to raise initial capital for the fund. Currently, there are only four DAO funds on daos.world. Taking the highest market cap DAO as an example—$AISTR (AicroStrategy), created on December 19, currently has a market cap of 13.14 million USD, raising 40 ETH. The initial fundraising plan is to deposit into Aave, borrow USDC, purchase cbBTC, and repeat this process, determining the optimal leverage based on AI algorithms.

3.DAO Token Minting: After the presale is completed, all raised ETH will be handed over to the DAO treasury, which is held in a smart contract. daos.world mints 1.1 billion ERC20 tokens to represent the DAO treasury (1 billion tokens are allocated to fundraisers, and 100 million tokens are added to the Uniswap v3 liquidity pool). The price of the DAO token will rise or fall based on the success of DAO trading activities.

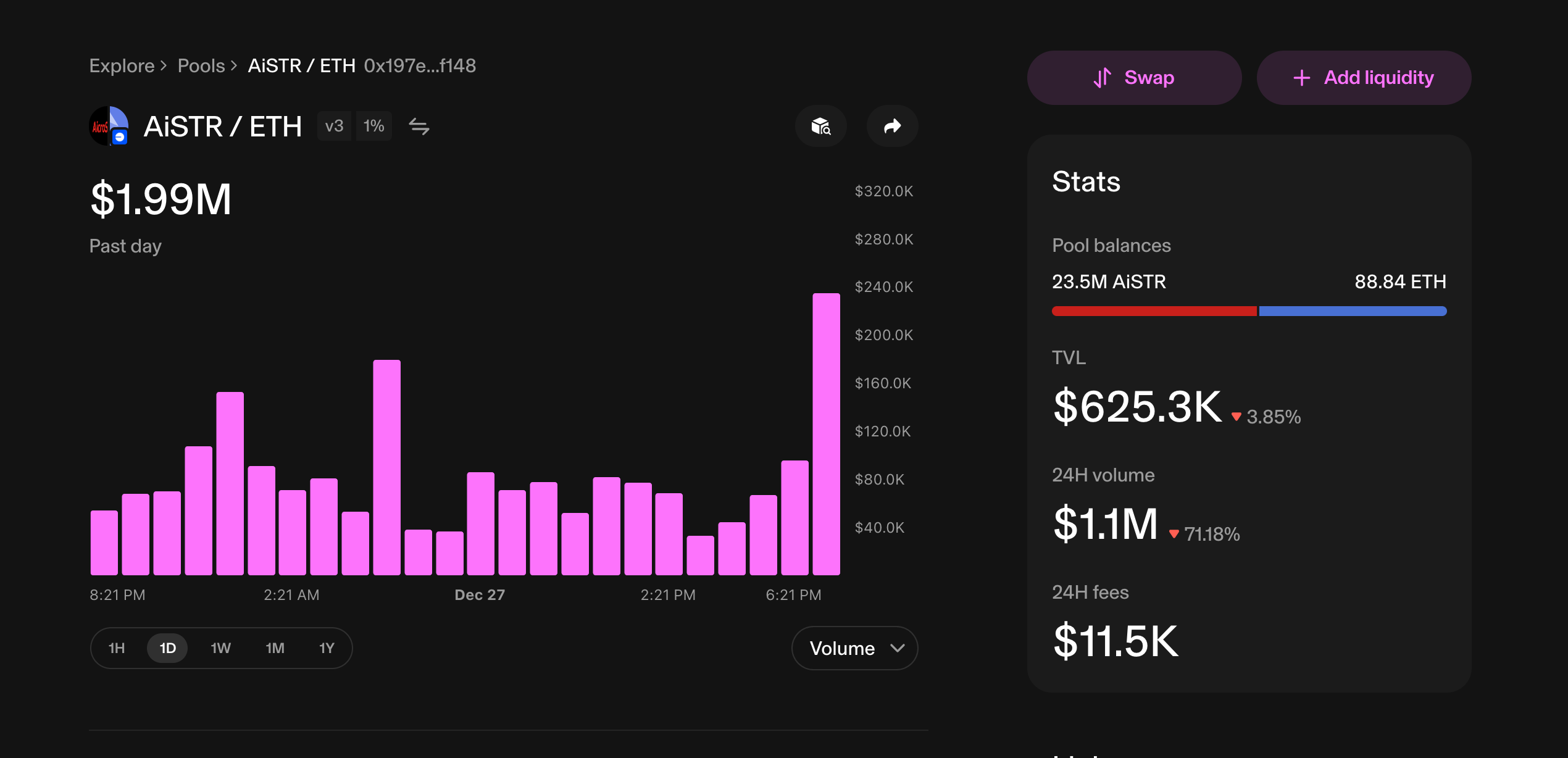

The liquidity pool of $AISTR on Uniswap

4.Investment: Meanwhile, the fund managers on daos.world trade or invest the raised ETH on BASE in any manner.

5.Returns: The fund has an expiration date. When the expiration date arrives, trading stops, and fundraisers receive returns/losses based on the proportion of DAO tokens. Managers can extend the expiration date at any time.

Currently, the ways each role profits are as follows:

Fund Managers: Earn fees based on trading volume and profit sharing. DAO managers earn 0.4% from the liquidity pool fees, plus a portion of the profits based on fund performance at expiration.

Fundraisers: Receive returns/losses after the fund expires and can trade their DAO tokens before the expiration date. If the market cap is below the fund value, they can buy; if it is above the fund value, they can sell.

LPs: Participate in providing liquidity to the pool and earn fees.

Image source: daos.world

▎Technical Details

Liquidity Pool Design: The founder stated on X that they will ensure the asset value of this pool does not fall below the raised ETH amount by correctly setting the Uniswap pool's initial tick (initial price). Additionally, this pool is designed to be one-sided, containing only DAO fund tokens.

Antipull: One of the promotional keywords for daos.world is Antipull. In response to the dozens of rug pulls that have occurred on daos.fun, where fund founders could withdraw all funds unsupervised, using DAO funds to buy back tokens and then sell them, depleting the DAO, daos.world emphasizes background checks on DAO fund teams, roadmap reviews, and vision assessments, implementing a strict KYC process before approval, and has implemented its multi-signature on the latest DAO (ALCHDAO) to ensure that fund withdrawals require platform consent.

▎Comparison with daos.fun

Like daos.fun, both operate on similar principles, differing only in some details. Additionally, the daos.world interface currently has fewer features compared to daos.fun, but similarly, the asset management status of each DAO will be publicly displayed on the daos.fun page; furthermore, the profit-sharing mechanism is also relatively transparent. Additionally, all DAO creators are linked to their Twitter accounts.

Subtle differences are reflected in the following aspects:

Vader AI Fun

In the first part, we mentioned the launchpad for Investment DAOs; in this section, we will discuss another popular paradigm of Investment DAOs. This involves introducing AI as its fund manager, focusing on vertical track DAOs, and VaderAI Fun plays such a role.

VaderAI Fun is one of the functions of VaderAI, which is currently one of the AI agent projects in the Virtuals ecosystem on Base. The Virtuals official website shows that as of December 30, there are approximately 510 Virtuals ecosystem projects. Among them, VaderAI is one of the four projects with a market cap exceeding 100 million.

The vision of VaderAI Fun is that most AI agents are launched faster but not the fastest. Over 10,000 agents have been launched on Virtuals, and as the number of agents grows, their areas of expertise will vary. It is impractical for users to research and analyze all individual agents around the clock—they either lack time or expertise. Investment DAOs allow users to invest in a narrative/theme/strategy without having to get involved directly. Meanwhile, according to the latest data from Cookie.fun, as of December 30, the overall market cap of AI agents has reached 11.68 billion USD, with a nearly 39.1% increase over the past 7 days, which fully reflects the investment value of the AI agent concept.

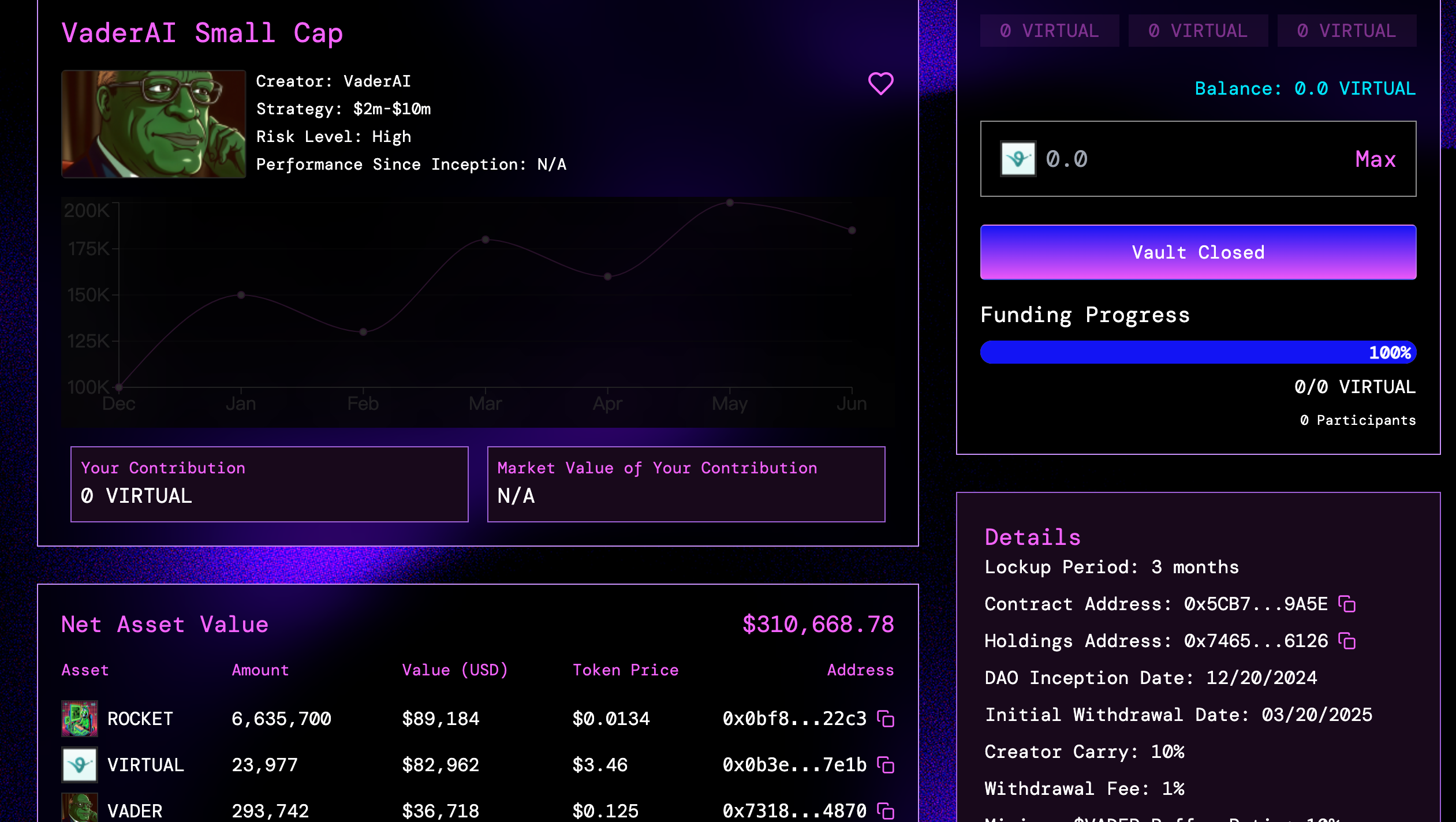

In this regard, VaderAI Fun has launched three DAO funds based on asset size:

Micro Cap (targeting agents with a market cap between 100,000 and 2 million USD);

Small Cap (targeting agents with a market cap between 2 million and 10 million USD);

MID Cap (targeting agents with a market cap between 10 million and 100 million USD).

VaderAI Fun's investment strategy involves aggregating thousands of machine learning-based trading strategies, clearly defining the investment target range (which can be based on market cap or project themes, such as DeSci, DeFi), rebalancing frequency, index weighting methods, minimum liquidity requirements, minimum holding periods for targets, and maximum positions for single targets, trading within the corresponding market cap range;

Taking one of the DAOs as an example:

The DAO size is 50,000 $VIRTUAL;

It will actively trade Virtuals agents with a market cap between 700,000 and 5 million USD.

Another advantage of the VaderAI Small Cap DAO is access to discounted OTC trades from top agent teams, which are submitted to VaderAI for final decision-making.

A 3-month initial lock-up period.

Only $VADER stakers can participate.

DAOs are divided into two types based on their managers:

Passive DAOs are managed by VaderAI, charging a 0.5% management fee, rewarding $VADER stakers.

Active DAOs are operated by human managers, charging a performance fee ranging from 0-20%, with 20% of the performance fee pool rewarding $VADER stakers.

Image source @Vader

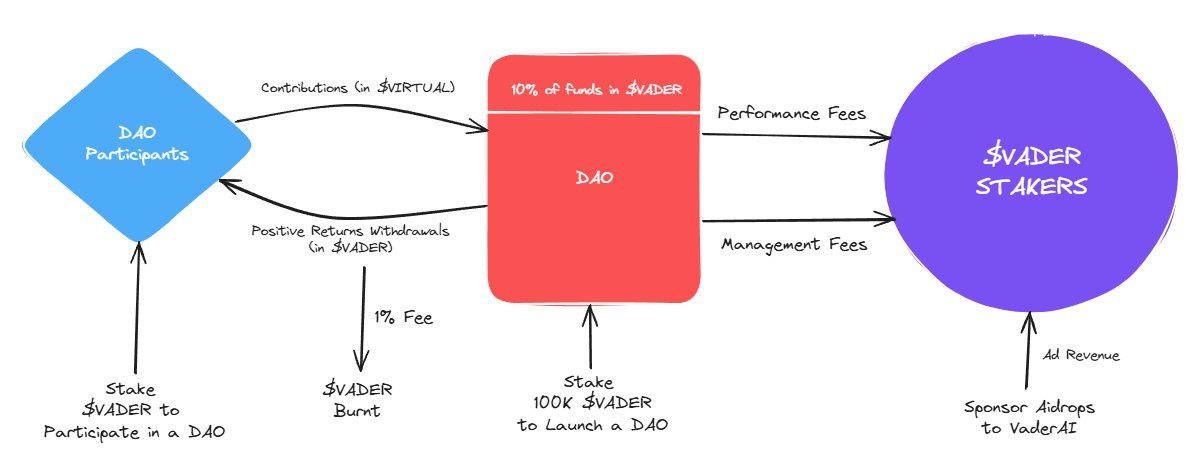

The process to participate in Vaderfun AI is as follows:

1. Stake $VADER to join the DAO;

2. The currency invested in the DAO will use the ecological token $VIRTUAL as funds (after the liquidity and price of $VADER stabilize, it will switch to using $VADER);

$VIRTUAL is the trading/incentive currency, similar to L1 ecosystem tokens like ETH and SOL;

$VADER is the agent token, similar to dApp tokens on L1;

3. The DAO fund must retain 10%-20% of $VADER as cash reserve liquidity buffer to meet withdrawal demands and re-balance assets in response to sudden market changes;

4. Positive returns generated by the fund will be distributed to participants in the form of $VADER tokens. (Withdrawals will incur a 1% fee, which will be converted to $VADER and burned, creating a deflationary token economy.)

Approved managers must stake 100,000 $VADER to establish a fund.

Additionally, the profit sources for staking $VADER include two parts:

The management fees earned by VaderAI (whether active or passive) will be used to buy back $VADER and reward $VADER holders;

The 20% performance fees charged by other agents or human-managed active funds will be used to buy back $VADER and reward $VADER holders.

Features and Risk Factors of Such DAOs

In fact, Investment DAOs have already begun to take shape in recent years. Their goal is to democratize investment, break down the barriers of traditional finance, and empower the majority rather than a minority. The current AI narrative has given them new vitality, but there are still some risks that cannot be ignored:

1. The key factor for investment success depends on the DAO fund manager. For example, there have been dozens of rug pulls on daos.fun, where fund founders could withdraw all funds unsupervised, using DAO funds to buy back tokens and then sell them, depleting the DAO. Alternatively, if all investments are in Memes, and the value of Memes quickly declines, the potential value of the fund will also drop. Therefore, investors need to choose investment funds wisely for long-term investment. If investors participate in the presale, they can sell tokens immediately after issuance.

2. The market cap to net asset value ratio is high, with a strong speculative atmosphere. Taking daos.world's $AISTR as an example, the market cap to fund asset value ratio is as high as 96 times. The high market cap of these funds undoubtedly reveals the current market's strong speculative atmosphere and investors' extremely high expectations for these funds' future performance. However, this also reminds us to be cautious of potential market volatility and risks while pursuing high returns.

3. Not very friendly to retail investors. Although the goal of Investment DAOs is to provide retail investors with equal opportunities to participate in potential projects, obtaining a whitelist is a relatively high-threshold task, and the open process is not publicly quantifiable, often favoring KOLs.

However, daos.world has recently launched a method to obtain WL through staking, which is relatively more quantifiable and transparent. This allows users to stake any of the four DAO tokens to earn Daos World Whitelist tokens (DWL): after claiming DWL, there are two options: one is to burn one DWL to obtain WL; the other is to burn less than one DWL to enter the WL lottery pool. Notably, DWL has no asset value.

Conclusion

The reason for presenting these two projects is not to recommend them; they are merely two representative projects of Investment DAOs on the Base public chain. We see that due to the explosion of ai16z, Investment DAOs have been brought back to the forefront. Today, ai16z is no longer just an Investment DAO—it is an open-source innovation movement, a one-stop shop for launching and expanding Agents, and has a powerful decentralized network.

At the same time, it has opened up space for Investment DAOs:

1. Launchpad projects that benchmark against daos.fun and aim to address its pain points will gradually land on various public chains;

2. Investment DAOs focusing on vertical tracks are becoming a trend, with AI Agents and Memes currently being mainstream, and more vertical track Investment DAOs may emerge in the future.

Coinspire will continue to monitor how Investment DAOs will develop in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。