Technical Analysis of Hyperliquid's Hot Events from a Blockchain Security Perspective

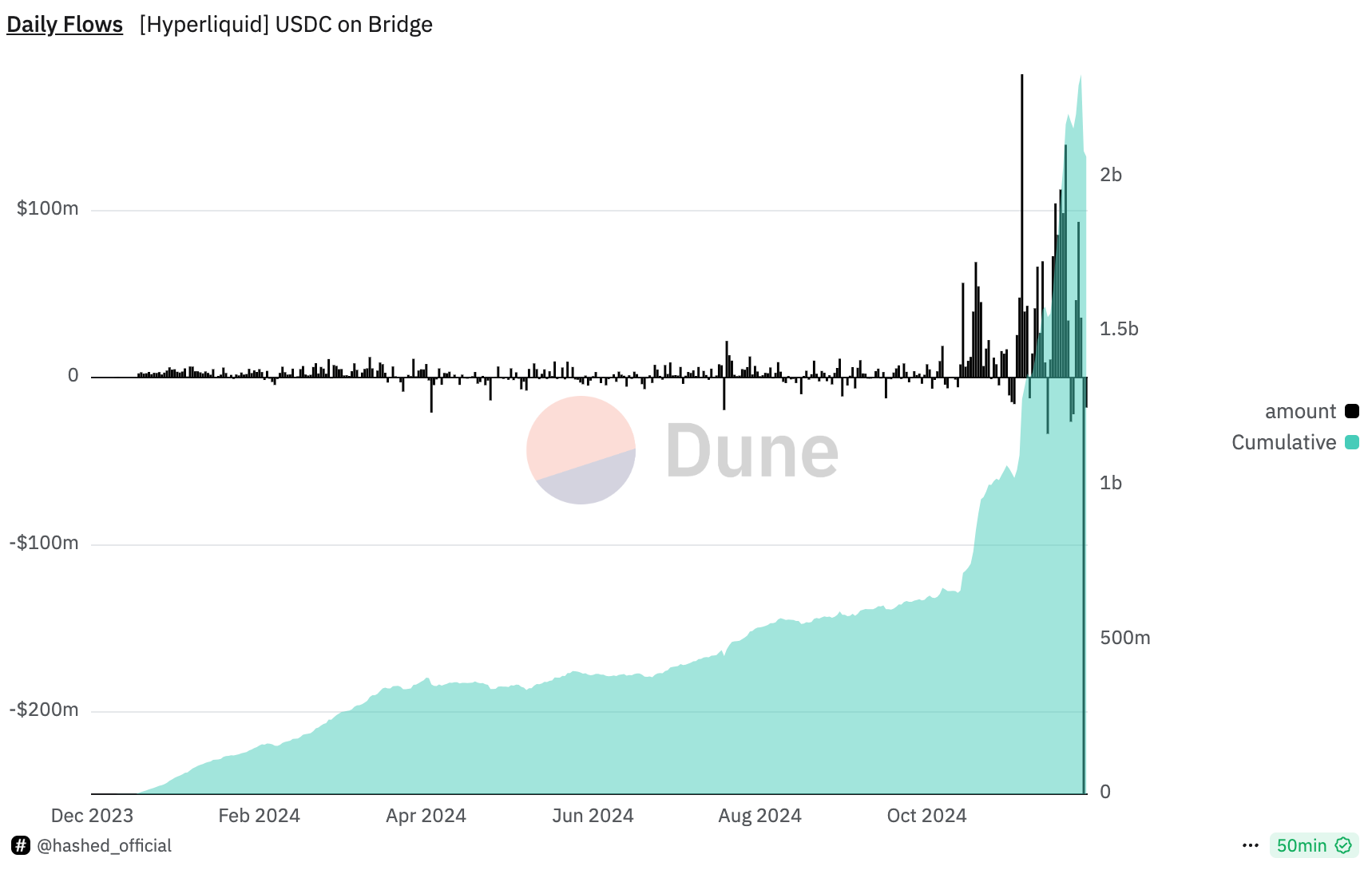

The main reason for the widespread discussion in the community about Hyperliquid today is the potential security risks in its bridging contract—$2.3 billion in USDC assets relies on a 3/4 multi-signature mechanism among 4 validators for protection, while multiple known North Korean hacker addresses have recently been active in trading on its platform. This has led to some panic selling in the community, with hype experiencing a maximum drop of over 25% on the day, a market cap evaporation of over $7 billion, and over $150 million in on-chain ecosystem funds fleeing.

This conflict at the technical and ecological level is very representative of current DeFi security issues.

The following will provide an in-depth analysis from three aspects: risks of the validator mechanism, behavior patterns of North Korean hackers, and potential mitigation measures:

I. Core Issues of the Validator Mechanism: Over-Centralized Design and Potential Attack Scenarios

Currently, Hyperliquid's bridging contract has only 4 validators, which is an extreme multi-signature architecture in DeFi projects. The $2.3 billion in USDC assets relies on the rule of 3/4 validator agreement, exposing two obvious risks:

(1) Validator Compromise

Attack Outcome: If hackers control 3 validators, they can sign malicious transactions to transfer $2.3 billion USDC to the attacker's address. This risk is extremely severe and almost impossible to intercept through conventional firewalls. Unless the assets transferred from Arbitrum are rolled back, this would lose all meaning of decentralization.

Technical Infiltration Paths: North Korean hacker teams possess top-tier attack capabilities in the crypto industry, with classic infiltration paths including:

Social Engineering Attacks: Sending phishing emails disguised as partners or trusted entities with malicious links, implanting RAT (Remote Access Trojan).

Supply Chain Attacks: If the validator's devices rely on unsigned binaries or third-party components, hackers can gain control by implanting malicious update packages.

Zero-Day Vulnerability Attacks: Exploiting zero-day vulnerabilities in Chrome or other commonly used software to execute malicious code directly on the validator's device.

(2) Trustworthiness and Distribution Issues of Validators

Currently, Hyperliquid's validator architecture seems to have the following weaknesses:

Is the code run by validators completely consistent? Is there a decentralized construction and operating environment?

Is there a physical concentration of validators? If validators in the same region are physically attacked or lose network connectivity, attackers may find it easier to target the remaining nodes.

Is the security of validators' personal devices managed uniformly by the enterprise? If validators use personal devices to access critical systems without deploying security monitoring measures like EDR (Endpoint Detection and Response), it will further enlarge the attack surface.

II. North Korean Hacker Attack Techniques: From Traces to Potential Threats

The hacker behavior patterns disclosed by overseas blogger Tay are highly alarming, as the underlying logic suggests a systematic attack strategy:

(1) Why Do Hackers Choose Hyperliquid?

High-Value Target: $2.3 billion in USDC is enough to attract any top hacker team, and this scale of assets provides sufficient motivation for an attack.

Weak Validator Mechanism: Only needing to compromise 3 validators to control all assets makes this low-threshold attack path very attractive.

Trading Activity as a Testing Method: Hackers may execute trades to test system stability, possibly to collect behavioral patterns of the Hyperliquid system, such as transaction processing delays and anomaly detection mechanisms, providing data support for the next attack.

(2) Expected Attack Pathways

Hackers are likely to take the following steps:

Collect identity information and social activities of validators, sending targeted phishing emails or messages.

Implant RAT on the validator's device to gain remote access and control.

Analyze Hyperliquid's trading logic and submit fund withdrawal requests with forged transaction signatures.

Ultimately execute fund transfers, sending USDC to multiple chain-based mixing services for laundering.

(3) Expansion of Attack Targets

Although Hyperliquid's assets have not yet been stolen, the active trading traces of hackers indicate they are conducting "lurking" or "probe attacks." The community should not ignore these warnings, as they often represent an important preparatory phase for hacker teams before executing an attack.

III. Currently Feasible Mitigation Measures: How to Prevent Attacks from Materializing?

To address these risks, Hyperliquid needs to implement the following improvements as soon as possible:

(1) Decentralization of the Validator Architecture

Increase the Number of Validators: Increase from the current 4 validators to 15-20, significantly raising the difficulty for hackers to simultaneously compromise the majority of validators.

Adopt a Distributed Operating Environment: Ensure that validator nodes are distributed across multiple regions globally, with physical and network environments isolated from each other.

Introduce Different Code Implementations: To avoid single points of failure, the running code of validators can adopt different implementations (e.g., dual versions of Rust and Go).

(2) Enhance the Security of Validators' Devices

Dedicated Device Management: All critical operations of validators must be conducted on dedicated devices managed by Hyperliquid, with a complete EDR system deployed for monitoring.

Disable Unsigned Binaries: All files running on validator devices must undergo unified signature verification by Hyperliquid to prevent supply chain attacks.

Regular Security Training: Educate and train validators on social engineering attacks to enhance their ability to recognize phishing emails and malicious links.

(3) Protective Mechanisms at the Bridging Contract Level

Delayed Transaction Mechanism: Set a delay execution mechanism for large fund withdrawals (e.g., over $10 million) to provide the community and team with response time.

Dynamic Verification Thresholds: Adjust the number of required validators based on the withdrawal amount, for example, requiring 90% of validators' signatures for amounts exceeding a certain threshold.

(4) Improve Attack Detection and Response Capabilities

Blacklist Mechanism: Collaborate with Circle to directly reject transaction requests marked as malicious addresses.

On-Chain Activity Monitoring: Real-time monitoring of all abnormal activities on Hyperliquid, such as sudden increases in large transaction frequencies and abnormal validator signing behaviors.

Conclusion

The issues exposed by Hyperliquid today are not isolated incidents but represent a systemic risk prevalent in the current DeFi ecosystem: the level of attention to the validator mechanism and off-chain security is far lower than that at the contract level.

While no actual attacks have occurred yet, this incident serves as a strong warning. Hyperliquid needs to rapidly enhance the decentralization and security of its validators at the technical level and promote comprehensive discussions and improvements regarding the risks of bridging contracts within the community. Otherwise, these potential hazards may be exploited in the future, leading to irreversible losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。