2025 年 5 月 21 日,SEC 再次将加密监管推向聚光灯下。Unicoin公司被控通过虚假陈述筹集超过 1 亿美元,宣称其代币由数十亿美元资产支持,实际价值却远低于预期。

过去十年,SEC 对加密行业的监管从打击欺诈性 ICO 到针对大型交易所的全面执法,经历了大风大浪。亲加密的新主席上台后监管明显缓和,撤销了多起旧案,而如今诉讼再起,强监管又要卷土重来了吗?

SEC 的「监管风暴」

自 2013 年 SEC 首次针对加密货币采取执法行动以来,加密行业一直是监管的「灰色地带」。SEC 的核心监管工具是 1946 年的 Howey 测试,用于判断某一资产是否为证券,即是否涉及「金钱投资、共同事业、期待他人努力获利」。这一标准在传统金融中清晰明了,但在 DeFi 和代币经济的复杂环境中却引发了诸多争议。SEC 长期以来依靠零散的执法行动而非明确规则来规范数字资产行业,导致市场缺乏可预测性,投资者和企业面临合规困境。

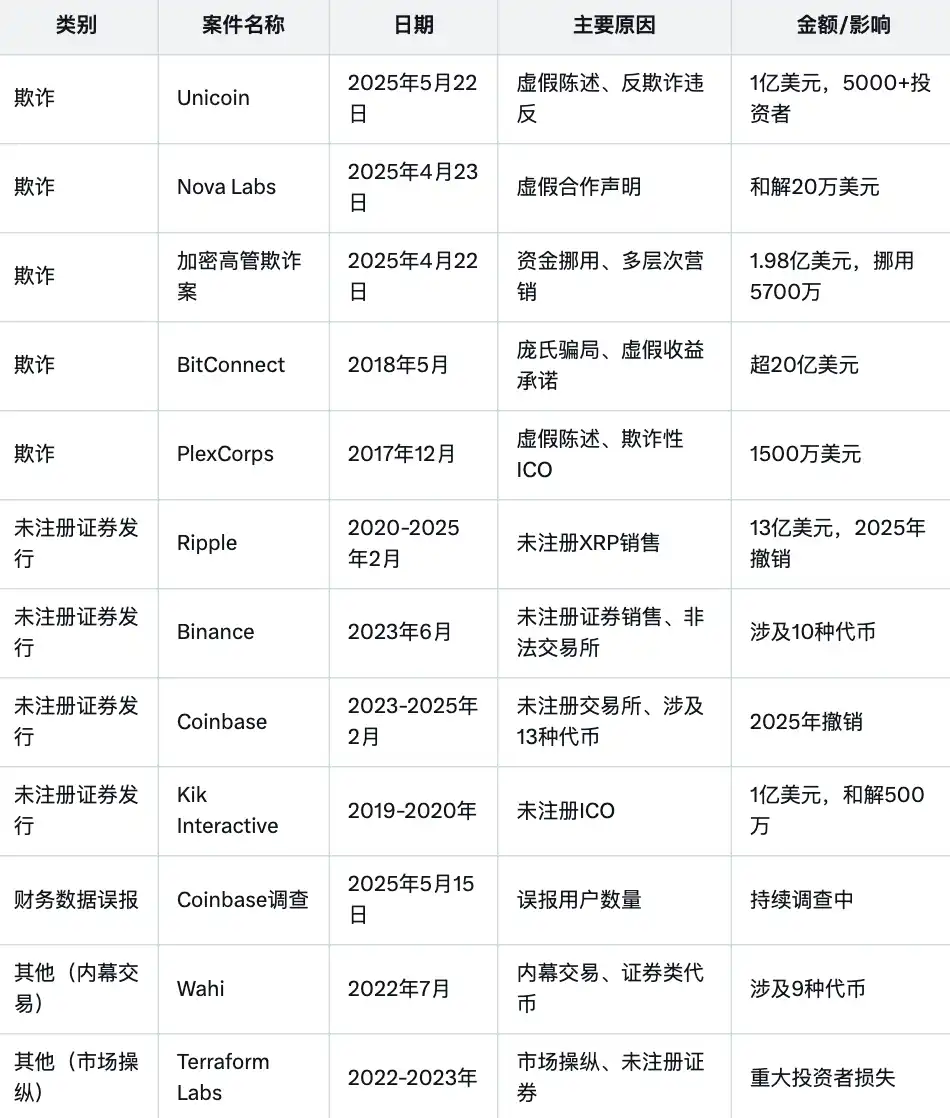

在加密货币的早期,初始代币发行如雨后春笋般涌现,但许多项目涉嫌欺诈。2017 年,SEC 发布《DAO 报告》,明确指出代币可能被视为证券,标志着监管的正式介入。同年 12 月,SEC 对 PlexCorps 发起诉讼,指控其通过虚假宣传筹集 1500 万美元,开启了对欺诈性 ICO 的强硬打击。2018 年,BitConnect 案成为焦点,这家平台通过庞氏骗局式投资计划筹集超过 20 亿美元,虚假承诺高回报,最终在 2021 年被判支付巨额罚款。这些早期案件的共同特点是项目方通过虚假陈述或资金挪用欺骗投资者,SEC 的执法目标明确,就是要保护投资者免受「野蛮生长」的加密市场侵害。

2021 年,Gary Gensler 担任 SEC 主席后,加密行业迎来了「监管风暴」。Gensler 主张「执法即监管」,认为绝大多数加密资产是证券,必须遵守联邦证券法。2023 年 6 月,SEC 对 Binance 和 Coinbase 发起重磅诉讼,指控两者作为未注册证券交易所运营,涉及 BNB、SOL、ADA 等数十种代币。

Binance 被指非法销售证券并操控市场,Coinbase 则被控提供未注册的经纪和清算服务。这些诉讼不仅震慑市场,还导致相关代币价格下跌 5.2% 至 17.2%。同期,始于 2020 年的 Ripple 案成为行业标杆,SEC 指控 Ripple 通过未注册销售 XRP 筹集 13 亿美元。2023 年,法院裁定 XRP 在二级市场交易不一定为证券,但程序化销售仍属违规,这一分裂裁定凸显了监管定义的复杂性。2022 年的 Terraform Labs 案进一步暴露了市场风险,SEC 指控其创始人 Do Kwon 通过 TerraUSD 和 LUNA 操纵市场,导致投资者损失数十亿美元。

这些案件反映了 Gensler 时期的强硬立场,通过高调诉讼划定监管红线,试图将加密行业纳入传统金融框架。然而,Gensler 时期的执法基于 1933 年的证券法,试图将全新的数字资产强行套入传统框架,缺乏适应性和清晰性。

《Binance 会和 SEC 和解吗?看看历史上被 SEC 罚过的知名项目们》

加密友好的监管转向

自从特朗普重回白宫以来,就一直高调地将「加密友好」作为自己的重要政治宣言之一。2025 年 4 月 10 日,特朗普治下的 SEC 迎来了新任主席 Paul Atkins,他带来了监管风向的显著变化。以亲市场立场著称的 Atkins 强调通过制定清晰规则而非单纯执法来规范加密行业。2025 年 2 月,SEC 撤销了对 Ripple、Coinbase 和 Kraken 的民事诉讼,结束了 Gensler 时期的标志性案件。

此外,SEC 废除了员工会计公告 121(SAB 121),将加密资产托管恢复为表外项目,并明确自挖矿和矿池活动通常不构成证券。这些举措被视为对加密行业的「解绑」,旨在减轻企业的合规负担,激发创新活力。SEC 此前的「拼凑式执法」缺乏用户友好性,未能提供可预测的合规路径,而 Atkins 的举措正试图改变这一现状。

更重要的是,Atkins 推动成立了加密任务小组,由 SEC 专员 Hester Peirce 领导,旨在与行业合作制定涵盖稳定币、迷因币和 DeFi 的明确规则。Peirce 于 2 月 21 日发布公告,邀请公众就加密资产和区块链技术提供意见,提出了涵盖四大类别的 100 多个问题,包括证券类加密资产、投资合同中的代币、代币化证券以及非证券类加密资产。

这一任务小组的努力不仅限于 SEC 内部,还与特朗普于 1 月 23 日签署的数字资产行政命令相呼应,该命令成立了一个跨机构的数字资产工作小组,涉及 SEC、商品期货交易委员会(CFTC)等机构。这种跨机构合作旨在解决长期以来困扰行业的监管重叠问题,例如 SEC 认为代币是证券,CFTC 认为其是商品,消费者金融保护局(CFPB)则将其视为电子资金转移法案下的「资金」。Atkins 的亲市场立场和任务小组的设立被视为行业的新曙光,预示着从「以罚代管」向「以导代管」的转变的转型。

相关阅读:《新主席上任 48 小时,SEC 变成了「加密奶爸」》

为何又有新诉讼?

尽管 Atkins 上台后撤销了多起诉讼,但今年以来的多起案件也引发了一些关于监管是否收紧的猜测。这些案件包括 Unicoin 案、Nova Labs 案、加密高管欺诈案和 Coinbase 用户数据调查。为何在政策宽松的背景下,SEC 仍频频发起诉讼?答案在于监管的底线、行业的复杂性以及规则制定的过渡期。

这次的 Unicoin 案可能是 2025 年的重要的标志性案件。SEC 指控 Unicoin 及其高管通过虚假陈述筹集超过 1 亿美元,宣称其代币由数十亿美元资产支持,实际价值却远低于预期,误导了超过 5000 名投资者。此外,公司还被控未经注册销售 3790 万份权利证书。欺诈仍是 SEC 的监管底线,与其保护投资者的核心使命高度一致。即使执法力度减弱,SEC 仍将聚焦于欺诈和庞氏骗局,尤其是针对零售投资者的保护。

未注册证券发行的争议也还没有得到明确定论。Unicoin 案的指控不仅限于欺诈,还涉及未经注册的证券销售。尽管 Atkins 推动规则制定,Howey 测试的适用性尚未完全清晰化。Gensler 时期试图将所有代币一概视为证券,而新任务小组则尝试区分不同类型的加密资产,例如证券类代币和非证券类代币。这种精准化监管使得 2025 年的案件更聚焦于具体违规,而非全面挑战交易所或代币的合法性。

此外,SEC 对数据透明度的要求正在升级。5 月 15 日,SEC 启动对 Coinbase 的调查,质疑其在 IPO 文件中夸大「验证用户」数量,可能误导投资者。Coinbase 案曾分为两条轨道:SEC 指控其交易平台非法运营未注册证券交易所,同时 Coinbase 主动提起诉讼,要求 SEC 制定明确规则。2025 年初,第三巡回法院裁定 SEC 对 Coinbase 规则制定请求的拒绝理由不足,责令其进一步解释。随后,SEC 撤销了在第二巡回法院的诉讼,显示出监管重心的转变。这一案件标志着 SEC 从单纯关注证券定义转向更广泛的合规性审查,特别是在财务披露方面。

加密行业的复杂性与监管滞后是新诉讼的深层原因。从 DeFi 到 NFT 再到资产支持代币,市场快速发展让监管框架难以跟上。Unicoin 案涉及的资产支持代币等新兴模式让 SEC 不得不通过执法测试监管边界。SEC、CFTC 和 CFPB 之间的「地盘争夺战」加剧了监管的不确定性,而 Atkins 的任务小组和跨机构工作小组正试图解决这一问题。尽管如此,规则制定的过程需要时间,短期内诉讼仍是填补监管空白的主要工具。

加密监管又要「反转」了吗?

2025 年的新诉讼与过去十年相比,在目标、范围和影响上呈现出显著差异,反映了 SEC 监管策略的演变。首先,执法目标更加聚焦。Gensler 时期,SEC 试图通过针对 Binance、Coinbase 等龙头企业的诉讼,将大部分加密资产纳入证券框架,认定 68 种代币为证券,引发市场广泛震动。而 2025 年的新诉讼更关注具体违规行为,如 Unicoin 的欺诈和未注册销售,避免了对整个生态系统的攻击,显示出 SEC 更倾向于打击「害群之马」。Gensler 时期的执法基于过时的 1933 年证券法,缺乏适应性,而新任务小组旨在制定适合数字资产的「公平规则」。

其次,诉讼范围更加精准。历史案件如 Ripple 和 Binance 案涉及数十亿美元的交易和多种代币,影响波及整个市场。而 Unicoin 案涉及 1 亿美元,Nova Labs 案和解金额仅 20 万美元,Coinbase 调查也仅限于数据披露问题,未触及其核心业务。新案件的规模和影响更为局限,避免了市场剧烈波动。

此外,监管语气更加温和。Gensler 时期的诉讼常伴随强硬声明,如「加密资产几乎都是证券」,引发行业强烈反弹。而 Atkins 领导下的 SEC 更注重与行业合作,撤销 SAB 121 和成立加密任务小组显示出对创新的支持。新诉讼的措辞聚焦具体违规,而非否定整个行业,展现了更温和的监管姿态。Hester Peirce 的公开征求意见行动「相当不寻常」,反映了 SEC 对行业合作的重视。

最后,法律争议有所减少。Ripple 案中,法院对 XRP 的证券属性作出分裂裁定,凸显了 Howey 测试的局限性。而 Unicoin 案等新诉讼主要基于欺诈和未注册销售,法律争议较少,避免了定义代币属性的复杂性。这种精准执法有助于减少行业的不确定性。随着明确规则的出台,未来可能出现更多私人证券诉讼和集体诉讼,而 SEC 的执法资源将更聚焦于传统欺诈和庞氏骗局。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。