Solv Protocol = HyperSolv

Author: Bitcoin Ecosystem

Compiled by: Deep Tide TechFlow

@SolvProtocol recently announced surprising news: “$SOLV is about to launch on Hyperliquid.”

What impact will it have when a leading BTCFi protocol with a reserve of 25,000 BTC collaborates with @HyperliquidX, known as the "on-chain Binance"? Let’s explore together.

Solv recently announced its highly anticipated TGE (Token Generation Event) and the launch of its native token $SOLV. For a high-profile project like Solv, it is common to prioritize top centralized exchanges (CEX) as the platform for token launches. However, this time Solv chose Hyperliquid as its primary platform for token release. What is special about this unconventional choice?

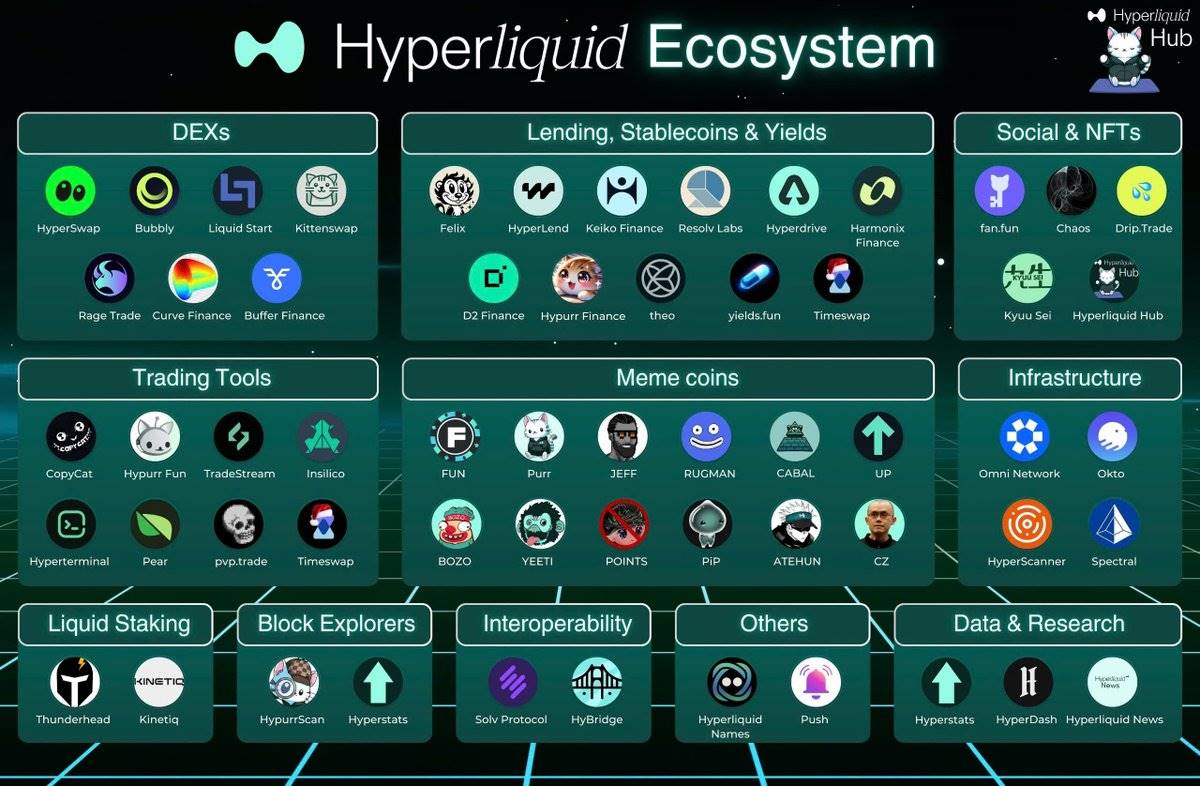

Hyperliquid is an on-chain exchange known for user experience, trading speed, and transparency, and has gained significant attention in the blockchain community. However, most of the tokens listed on its platform are memecoins (cryptocurrencies based on social trends).

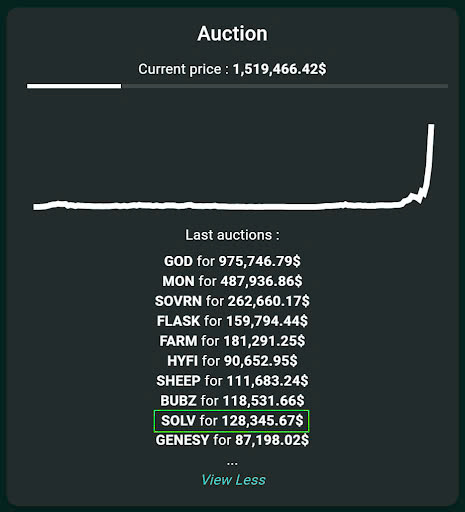

Solv is the first project to invest six figures on Hyperliquid, with an initial bid of $128,345.67. Now, this auction price has skyrocketed to $500,000, even reaching $1.5 million at its peak.

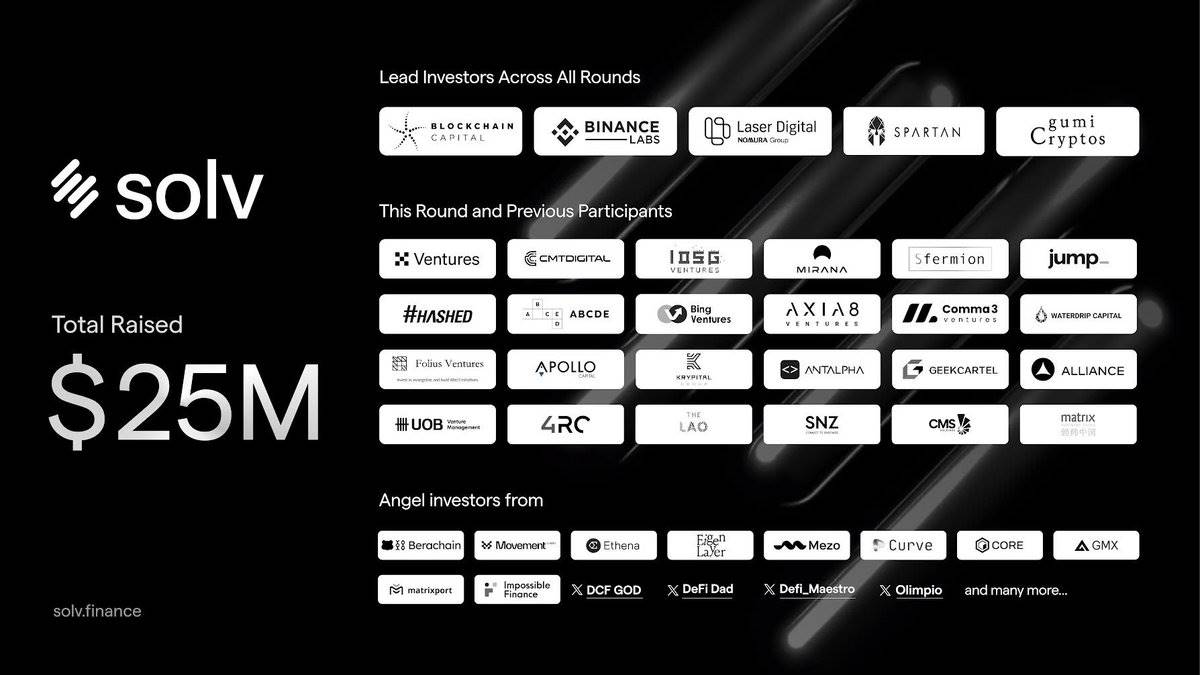

Solv raised $25 million from top investors and strategically chose Hyperliquid as the launch platform for $SOLV. As the first high-profile project on Hyperliquid, Solv not only gained a first-mover advantage but also successfully launched its flagship product SolvBTC on the upcoming Hyperliquid L1 network.

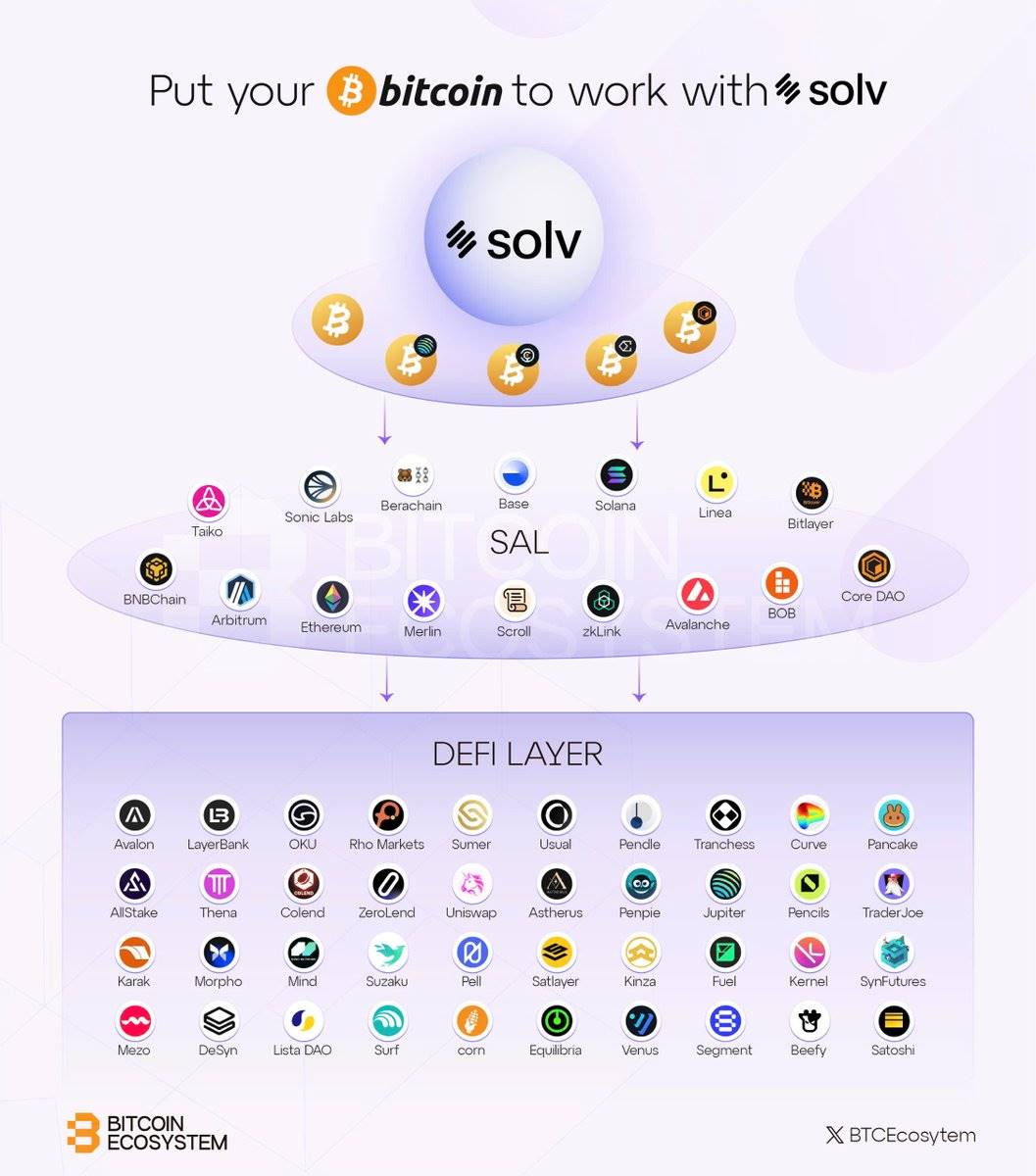

Currently, Solv holds over 25,000 BTC in reserves, making it the largest decentralized Bitcoin reserve in the world, supported by its innovative product SolvBTC.

Through its Staking Abstraction Layer, Solv provides a unified framework that supports seamless interoperability across more than 15 blockchains, laying the groundwork for future deep integration with the Hyperliquid ecosystem.

Hyperliquid is still in its early development stages. In the future, the platform may expand from existing dollar-based contracts to include the following features:

BTC-based contracts: Trading contracts priced in Bitcoin.

Joint margin model: Allowing users to use Bitcoin as margin for dollar contracts.

BTC spot trading pairs: Supporting direct trading of Bitcoin with other cryptocurrencies.

To achieve these expansions, Hyperliquid needs a significant inflow of Bitcoin into its ecosystem, which also requires a reliable Bitcoin cross-chain solution.

Additionally, the upcoming HyperEVM (Ethereum Virtual Machine compatible network) will make Hyperliquid a complete L1 blockchain. This transition, along with Hyperliquid's evolving DeFi ecosystem and its decentralized exchange (DEX) demand for Bitcoin derivatives, further solidifies SolvBTC's position as the preferred Bitcoin asset on the Hyperliquid network.

Through SolvBTC, Bitcoin holders can earn up to 20% annualized returns through innovative strategies.

The deep integration with the Hyperliquid ecosystem maximizes the potential of Bitcoin. Users can not only use it as collateral for trading contracts but also utilize it in DeFi protocols while continuously earning stable returns.

Unlike Bitcoin in traditional exchanges, SolvBTC on Hyperliquid is a secure and yield-generating asset, significantly enhancing the overall value of the Hyperliquid network.

As a pioneer of yield-bearing Bitcoin, Solv has introduced SolvBTC into emerging ecosystems such as Base, Sonic, and Berachain through its Staking Abstraction Layer. Hyperliquid will be Solv's next target, providing Bitcoin holders with a new platform to unlock the full potential of Bitcoin.

Summary:

@SolvProtocol = HyperSolv

Optimistic about the future of BTCFi? Choose Solv!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。