Unlike utility tokens with low circulation and high fully diluted valuation (FDV), Usual's token economics places greater emphasis on community distribution.

Author: Ignas | DeFi

Translated by: Deep Tide TechFlow

The stablecoin market has surpassed $100 billion, but most of that value is controlled by centralized giants like Tether and Circle, leaving ordinary users unable to benefit.

In this market cycle, we have seen the rise of Ethena, and now Usual has joined the competition.

Usual is a decentralized, transparent, and community-driven stablecoin protocol.

Usual has launched USD0, a stablecoin backed by fiat currency and collateralized by ultra-short-term U.S. Treasury bonds.

Recently, they partnered with Ethena, allowing users to use USDtb as collateral for USD0.

Additionally, the protocol offers a 1:1 exchange mechanism between USDtb, USD0, and sUSDe.

Usual also launched USD0++, a liquid staking token that allows users to earn rewards by staking USD0.

Users can earn daily rewards through USD0++, which can be in the form of $USUAL tokens or risk-free USD0.

The current annualized yield is as high as 80%.

$USUAL brings new innovations in token economics:

It represents 100% ownership of the protocol's revenue.

Holders enjoy governance rights over the treasury and protocol decisions.

Holders can also share in the future growth dividends of the protocol.

Unlike utility tokens with low circulation and high fully diluted valuation (FDV), Usual's token economics focuses more on community distribution:

90% of $USUAL will be allocated to the community, including users, liquidity providers, and contributors.

Only 10% is allocated to insiders (team and investors).

$USUAL holders will control significant decisions regarding the treasury and the protocol.

The issuance mechanism of $USUAL is dynamic and directly linked to the protocol's actual revenue.

New $USUAL is minted and distributed daily based on the protocol's revenue.

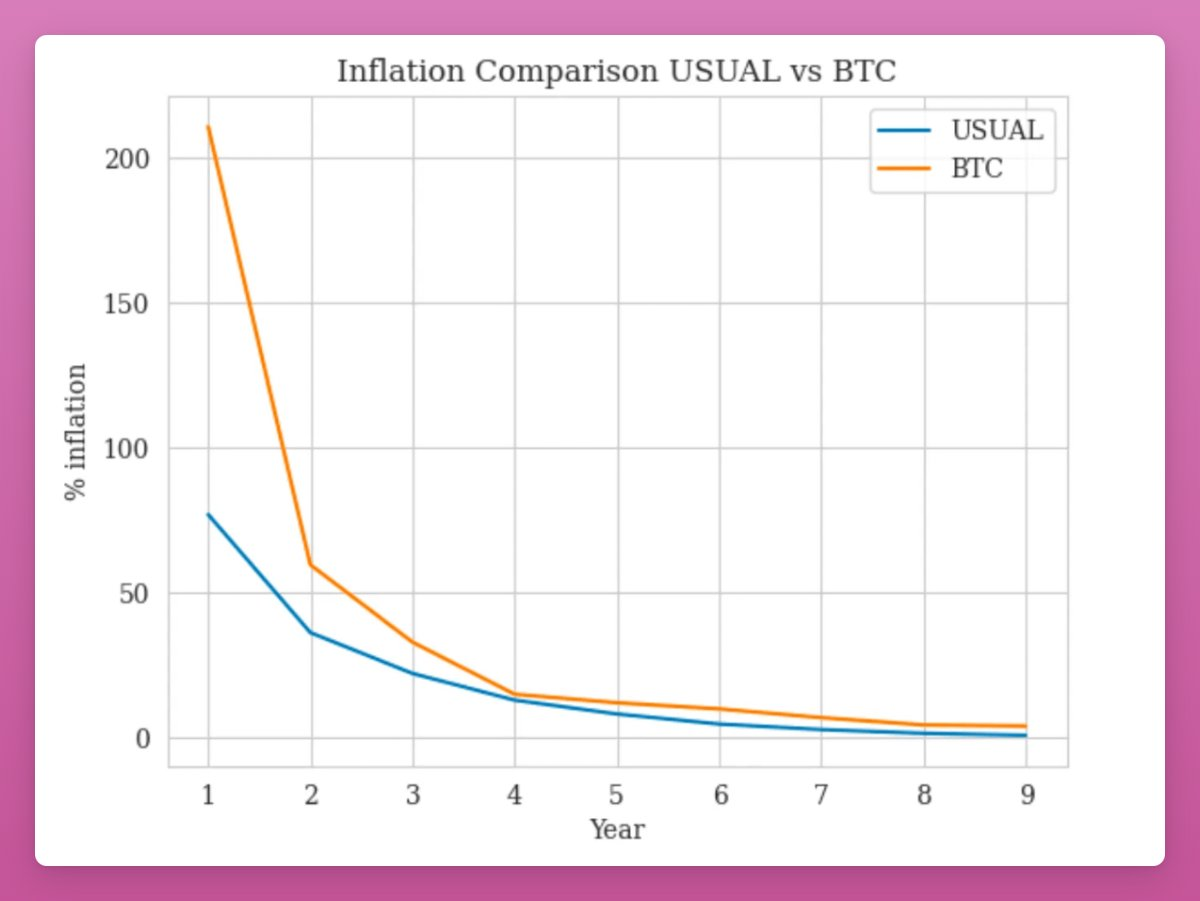

As the total value locked (TVL) of USD0++ increases, the issuance rate of $USUAL will gradually slow down.

Although the official documentation claims that the token is not inflationary, in reality, $USUAL is inflationary.

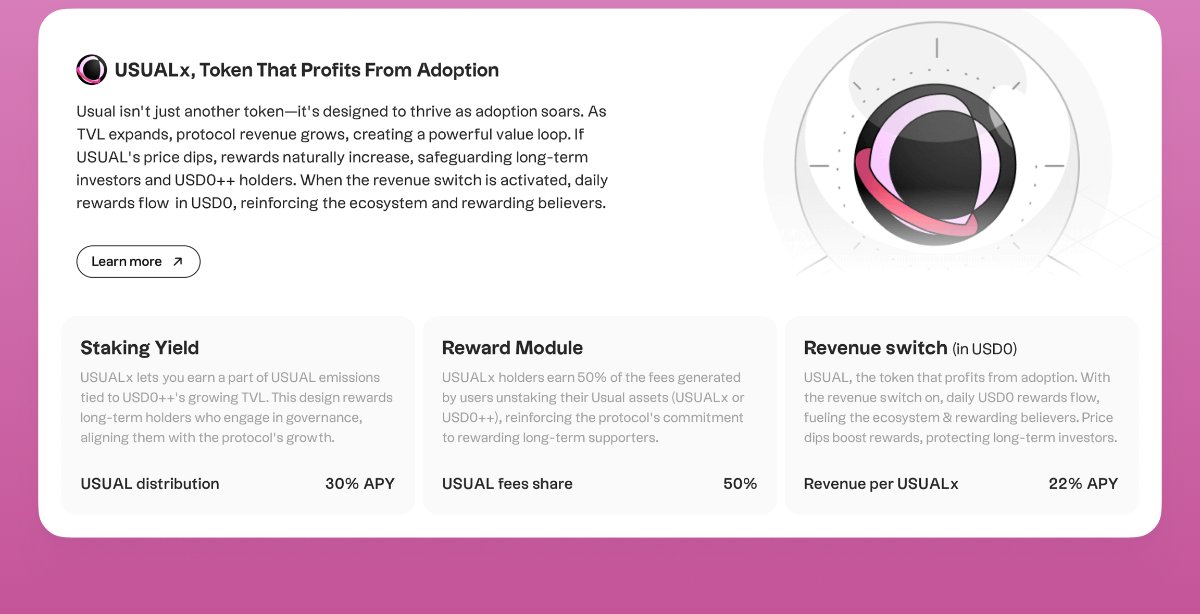

The solution is to stake $USUAL as USUALx, which can earn 10% of the total daily minting of the protocol.

If unstaked, a 10% penalty will be charged, half of which will be rewarded to other USUALx stakers.

The current annualized yield is as high as 1737%.

The maximum distribution of $USUAL occurs during the initial airdrop phase (which I completely missed).

Over time, the token issuance rate will gradually slow down, giving early participants an advantage; the key is to enter early and anticipate the growth of TVL.

The longer the time, the more pronounced the dilution effect of the tokens.

The good news is that the partnership with Ethena will help drive rapid growth in TVL.

Disclaimer: I have not received any compensation for this article!

However, it is indeed exciting to see innovative projects like Ethena and Usual challenge USDT and USDC. These traditional stablecoin giants have not shared profits with users, while new projects are changing that status quo.

Now, we have two alternative options worth watching, betting on further growth in the stablecoin market.

If I have any information wrong, please feel free to point it out!

I am still researching this protocol and, as always, learning while documenting my understanding!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。