Introduction

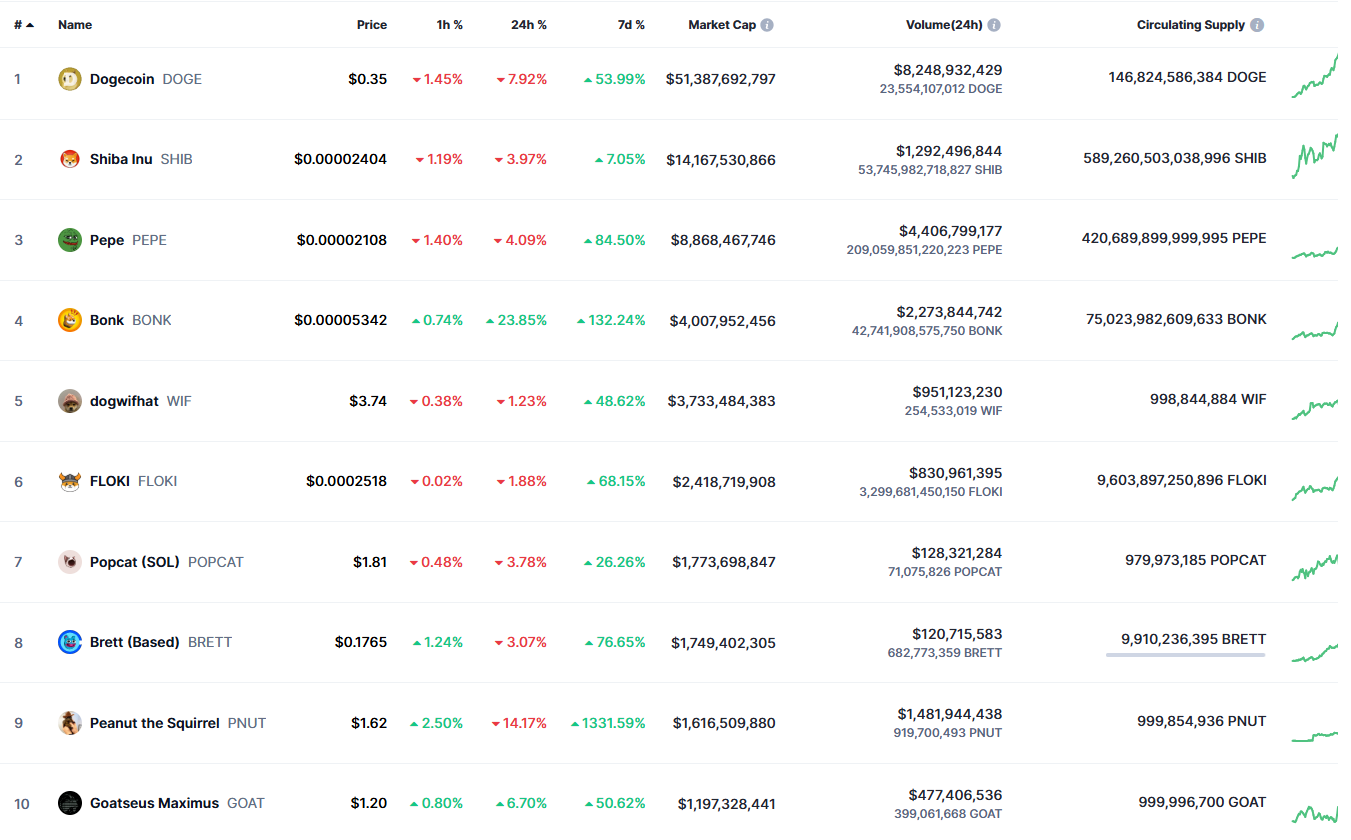

In the current bull market atmosphere, the sentiment in the crypto market is high, with various mainstream coins and altcoins experiencing explosive growth. Bitcoin ($BTC) continues to set new historical highs, Solana ($SOL) has surpassed a market cap of $100 billion, and even Ethereum ($ETH), which was once heavily questioned, is seeing a strong upward trend. Amid this frenzy, Memecoins have become the focus of investors, with Dogecoin ($DOGE), as a representative of Meme coins, doubling in value, and various long-dormant Meme coins also experiencing a resurgence.

The rise of Memecoins is not just a natural extension of market demand but also a significant strategic shift for exchanges moving from high-valuation, low-circulation traditional VC tokens to fully circulating, narrative-driven tokens. As more and more Memecoins are listed on centralized exchanges, retail investors' enthusiasm for participation continues to grow, leading exchanges to reap substantial traffic and fee income. However, alongside this prosperity comes the inherent high risk of Memecoins. From low survival rates to market manipulation and a lack of technological innovation, the future of Memecoins is fraught with uncertainty.

This article will analyze the causes, processes, and risks of the Memecoin craze, exploring the background, logic, and future potential of this phenomenon, and discussing how to find truly valuable investment projects amid this frenzy.

1. Causes

1.1 The High Valuation Trap of VC Tokens

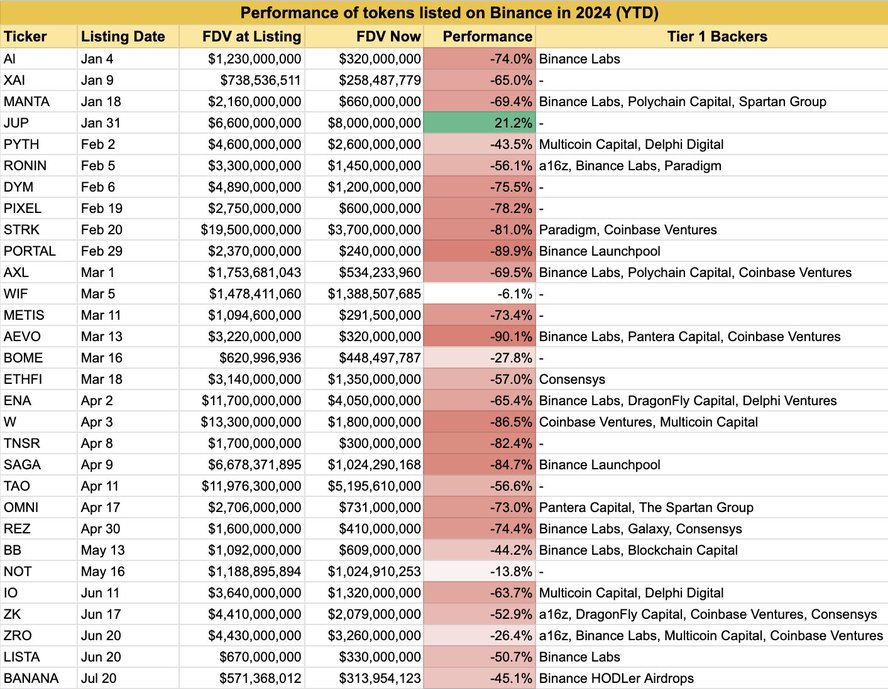

The continuous launch of new Memecoins by exchanges can be traced back to a report released by Binance Research in May this year titled "High Valuation, Low Initial Liquidity Tokens." The report pointed out that VC tokens launched in 2024 generally exhibit characteristics of "overvaluation but low initial circulation," while also emphasizing the selling pressure risk posed by token unlocks. The report specifically mentioned the unique advantages of Memecoins: most Memecoins achieve a fully circulating state, and the ratio of MC (market cap) to FDV (fully diluted valuation) is 1. This means that holders of Memecoins do not face value dilution issues due to token issuance. Although Memecoins lack practicality, these characteristics have attracted considerable attention and interest from retail investors.

(Related Reading: "In-Depth Analysis: Binance's Announcement on Recruiting Small and Medium Market Cap Projects for Listing")

Source: Twitter (@Coin98Analytics) Figure 1.1

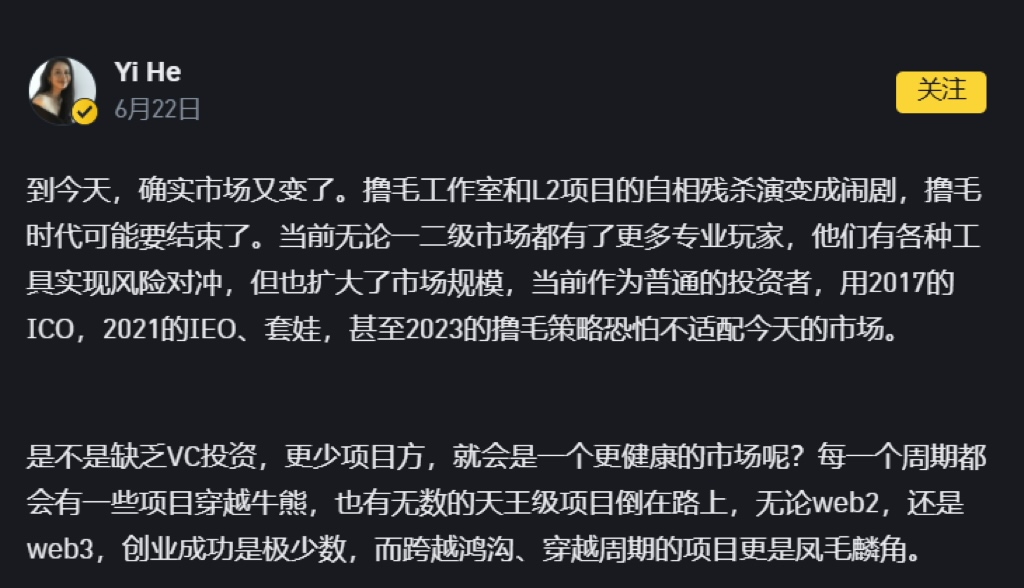

The release of this report sparked widespread market reactions, indicating that Binance had long recognized the potential of Memecoins and acknowledged their appeal to users. Subsequently, Binance co-founder He Yi published an article on Binance Square in June, clarifying community concerns and explicitly stating that Binance does not control pricing. At the same time, she reflected on the industry's development history and pointed out that the ICOs of 2017, IEOs of 2021, and the "haircut" strategies of 2023 may no longer be applicable to the current market environment. More importantly, she subtly raised a thought-provoking question: Would the market be healthier without VC investments or project party interventions?

Figure 1.2 Source: Binance Square

These signals not only reveal the unique appeal of Memecoins in the current market but also reflect the exchanges' profound insights into the market environment and investor behavior.

1.2 User Conversion Advantages of Memecoins

For leading exchanges like Binance, there may be deeper reasons behind the launch of Memecoins. Binance Research's report "Understanding the Rise of Memecoins," published on November 4, pointed out that compared to most altcoins currently supported by VCs, Memecoins are widely regarded as not only fairer but also providing ordinary investors with narratives that are easier to understand and more appealing. For ordinary retail investors who are not familiar with technology, they can often grasp the logic behind Memecoins driven by cute images or engaging stories more quickly, whereas the technically complex Layer 2 solutions or DeFi primitives seem to have a higher barrier to entry and are harder to digest quickly. In other words, the user conversion time for Memecoins is significantly faster than that for technology-driven altcoins.

More importantly, this rapid conversion characteristic allows the narratives of Memecoins to spread to potential buyer groups at an extremely fast pace, quickly forming communities and stimulating speculative enthusiasm. Compared to traditional altcoins, Memecoins can more easily leverage their high transmissibility to drive market sentiment, which directly leads to extremely rapid market dynamics and high user adoption rates.

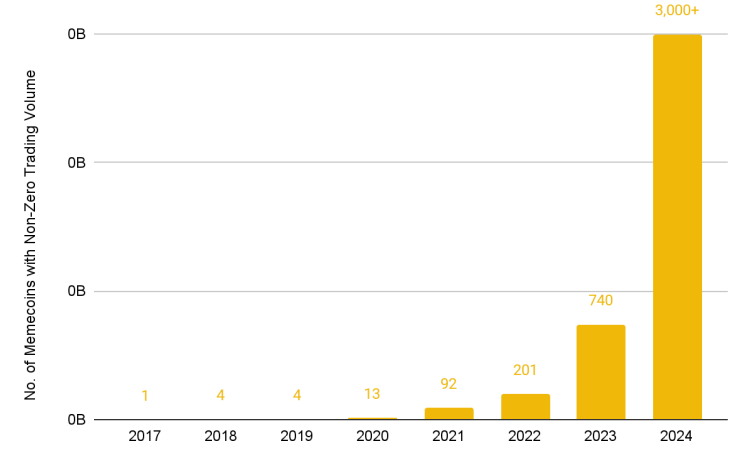

This phenomenon is also evidenced by the speed of capital flowing into emerging Memecoins. For example, $WIF grew from a market cap of zero to $1 billion in just 104 days, while $SHIB achieved the same goal in 279 days. Even the earliest $DOGE took 8 years to reach this milestone. Today, the speed of creating new Memecoins and the influx of capital far exceed previous levels, thanks to their simple and understandable attributes. The generation and diffusion speed of Memecoins is faster than any previous type of token. As shown in Figure 1.3, over 75% of Memecoins were created in the past year.

Source: Binance Research Figure 1.3

This trend not only indicates that Memecoins are reshaping market rules but also showcases their unique growth dynamics and appeal in the current crypto ecosystem.

1.3 The Breakout Effect of Memecoins

Additionally, the potential of Memecoins to "break out" is quite significant. Compared to traditional altcoins, Memecoins are more adept at building communities and attracting users' speculative interest, quickly converting potential users into actual investors. For those looking to enter the market, the purchasing experience on exchanges is more convenient and direct compared to on-chain operations, making this advantage a crucial lever for exchanges to attract new users and capital during a bull market.

2. Process

In September of this year, Binance officially kicked off its entry into the Memecoin space by simultaneously launching the uppercase and lowercase Memecoin Neiro, marking Binance's recognition of Memecoins and opening a new strategic direction in the market.

Source: Binance Announcement Figure 2.1

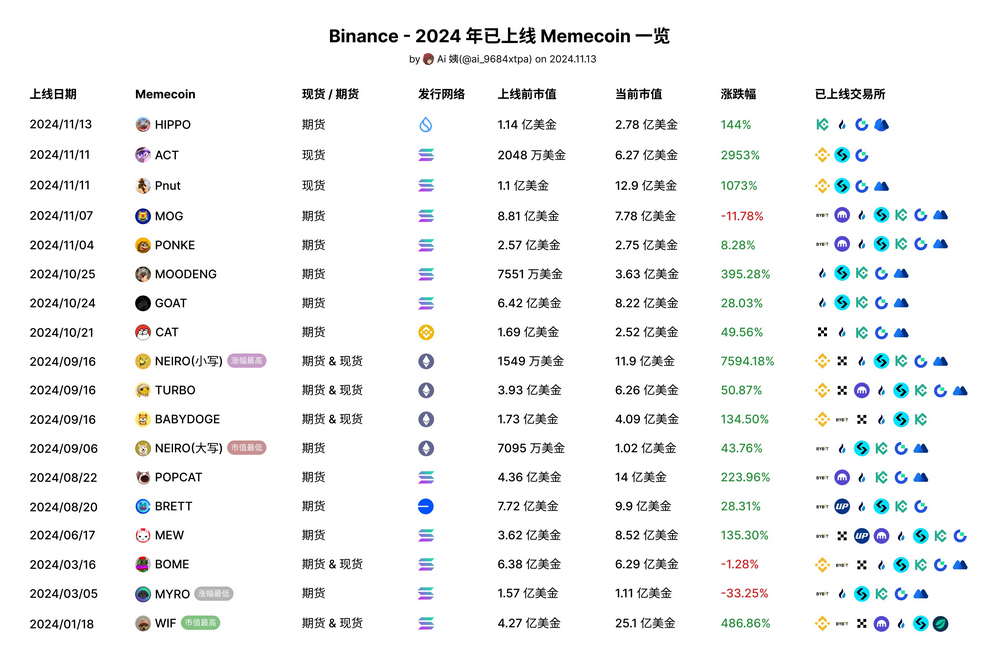

Although the launch of Neiro and several subsequent Memecoins by Binance sparked some controversy, compared to the widespread criticism faced when launching VC-supported altcoins, the introduction of Memecoins has clearly garnered more understanding and support from users. According to statistics from on-chain analyst @ai_9684xtpa, Binance has launched 18 Memecoins in 2024, covering both spot and futures markets. Each Memecoin has varied market performance, with some doubling or even increasing several times in value, such as the Memecoins $PNUT and $ACT. Among them, $PNUT gained popularity due to the concept of "animal protection + election politics + Musk," surpassing a market cap of $400 million shortly after its launch; while $ACT saw an increase of over 2500% within less than half a day after the announcement. This frequent launch of Memecoins indicates that Binance is actively responding to the heightened market sentiment, attracting more user attention, and enhancing platform trading activity through a diverse selection of Memecoins. This strategy not only meets the market's demand for emerging coins but also demonstrates the exchange's adaptability in the current competitive environment.

Source: Twitter (@ai_9684xtpa) Figure 2.2

It is worth noting that Binance co-founder He Yi stated on social media that the listing fees for ACT and PNUT were zero, further reinforcing the centralized exchanges' supportive stance towards Memecoins. This approach indicates that centralized exchanges like Binance aim to attract more popular Memecoins by reducing listing costs, thereby maintaining platform activity and user stickiness, while also encouraging more project parties and investors to participate in the Memecoin market.

Source: Twitter (@heyibinance) Figure 2.3

From the launch of Neiro to the surge of ACT, Binance's strategic deployment of Memecoins has not only attracted a large number of users but also seized the development opportunities brought by the bull market. This process not only showcases the exchange's flexibility in responding to market changes but also provides valuable experience for future market positioning.

3. Risks

Despite the significant attraction of Memecoins due to their simple narratives and ease of dissemination, the risks behind them cannot be ignored. The following explores the potential issues of Memecoins from three aspects: low survival rates, malicious manipulation under PVP attributes, and a lack of technological innovation and progress.

3.1 Low Survival Rates

Most Memecoins born in 2023 and 2024 are "flash in the pan." 97% of Memecoins have already "died," meaning their trading volume is close to $0. While representative Memecoins like $DOGE and $SHIB have survived for 10 years and 4 years respectively and have successfully established themselves in the market, the overall survival rate of Memecoins remains extremely low. Rapid growth and speculation make Memecoins a high-risk, high-reward asset class, but they are heavily reliant on market sentiment, with almost no fundamental valuation support. This means that investors face a very high risk of capital loss when participating in the Memecoin market.

Source: CoinMarketCap Figure 3.1

3.2 "Conspiracy Groups" in the PVP Market

The high speculative nature of the Memecoin market attracts some groups attempting to manipulate the market. Some so-called "conspiracy groups" profit from retail investors' exit liquidity through carefully designed pump-and-dump schemes. These groups often mislead the market in the following ways:

Creating multiple new addresses to concentrate token holdings, disguising the illusion of widespread token distribution.

Using the transparency of blockchain to attract investors, while making it difficult to identify the actual controllers behind token holders.

Compensating key opinion leaders (KOLs) to create false hype on social media, prompting retail investors to chase after the tokens.

These manipulative behaviors make retail investors victims in a high-risk speculative market. Although blockchain technology brings transparency, information asymmetry remains prevalent in the Memecoin market. Investors should remain highly vigilant against such market behaviors.

3.3 Lack of Technological Innovation and Progress

The core appeal of Memecoins lies in their narratives rather than technological value. Unlike technology-driven projects such as DeFi or Layer 2, Memecoins rely more on sentiment and hype. Many Memecoins lack practical application scenarios and contribute almost nothing to the technological advancement of the crypto industry. This phenomenon not only leads to market saturation but also diminishes the industry's ability to attract talented developers and innovative projects.

3.4 Future Concerns

In addition to the potential exploitation of retail traders, the popularity of Memecoins may lead to inefficiencies in the allocation of resources within the crypto industry. If the industry's time, capital, and human resources are overly concentrated on Memecoins lacking innovation, technological development may stagnate. A significant flow of funds into such tokens will also weaken support for projects that truly possess technological breakthroughs and practical application scenarios.

4. Conclusion

As a narrative-driven asset class, Memecoins have sparked widespread discussion and participation in the crypto market. With their simple logic, rapid dissemination capabilities, and low barriers to entry, they have successfully attracted a large number of retail investors and have become an important tool for exchanges to expand their user base. However, Memecoins also exhibit high risks, including low survival rates, market manipulation, and a lack of technological innovation.

Nevertheless, the potential of Memecoins remains worthy of attention. In a reasonable market environment, they can not only bring short-term wealth effects to investors but may also provide new community participation models for the crypto industry. However, investors and industry participants need to remain cautious, avoiding blind chases after trends and concentrating resources on projects that truly possess innovation and long-term value. Only through rational investment and effective resource allocation can the entire industry achieve sustainable and healthy development.

Disclaimer: Readers are advised to strictly comply with the laws and regulations of their location; this article does not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。