If you can only do one thing to combat the devaluation of fiat currency, it is Bitcoin.

Original Title: 《Black or White?》

Author: Arthur Hayes, Founder of BitMEX

Translation: 0xjs@Golden Finance

When asked about his pragmatic approach to the economic system in China, former Chinese leader Deng Xiaoping famously said, "It doesn't matter whether a cat is black or white, as long as it catches mice."

If you've ever heard Kamala Harris speak without a teleprompter, you know what I'm talking about. In the land of "freedom," pickup trucks, and Doritos, there is similar sophistry. I want to express my views on a malleable economic "ism" within the peaceful economic system under American governance. I will refer to the current policies implemented by Trump fans and the newly elected Trump president as American capitalism with Chinese characteristics.

The elites ruling the peaceful United States do not care whether the economic system is capitalism, socialism, or fascism; they care whether the implemented policies help them retain power. The United States has not been a purely capitalist country since the early 19th century. Capitalism means that the rich lose money if they make wrong decisions. This was abolished as early as 1913 when the Federal Reserve was established. With the privatization of profits and the socialization of losses affecting the nation, and creating extreme class division between the many miserable or vile people living inland and the upright, respectable, and sophisticated coastal elites, President Franklin Roosevelt had to correct the course by distributing some crumbs to the poor through his New Deal policies. At that time, just like now, expanding government relief for the underprivileged was not a policy welcomed by the so-called wealthy capitalists.

The pendulum swung from extreme socialism (in 1944, the highest marginal tax rate for those earning over $200,000 was raised to 94%) back to the unrestrained corporate socialism that began in the Reagan era of the 1980s. Since then, the neoliberal economic policy of printing money by central banks has funneled cash to the financial services industry, hoping that wealth would trickle down from the top. This was the status quo before the outbreak of COVID-19 in 2020. President Trump responded to the crisis by channeling his inner Roosevelt's New Deal; he distributed the most money since the New Deal directly to everyone. From 2020 to 2021, the U.S. printed 40% of the total existing dollars. Trump kicked off the stimulus check party, and President Biden continued the popular handouts during his term. When assessing the impact on the government's balance sheet, something strange happened between 2008 to 2020 and 2020 to 2022.

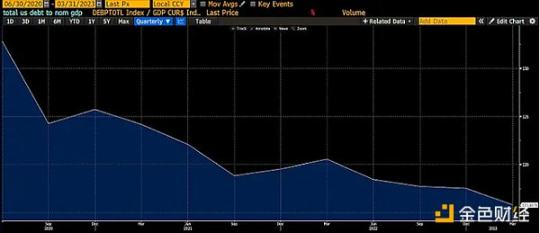

From 2009 to Q2 2020 was the peak of trickle-down economics, funded by central bank money printing and euphemistically called quantitative easing (QE). As you can see, the growth rate of the economy (nominal GDP) was lower than the accumulation of national debt. In other words, the rich spent the government's windfall on assets. These types of transactions did not generate any real economic activity. Therefore, distributing trillions of dollars in debt funding to wealthy financial asset holders increased the debt-to-nominal GDP ratio.

From Q2 2020 to Q1 2023, Presidents Trump and Biden went against the trend. Their Treasury issued bonds, which the Federal Reserve purchased with printed dollars (QE), but the Treasury did not send the bonds to the wealthy; instead, they mailed checks to everyone. The poor had real cash in their bank accounts. Clearly, Jamie Dimon, CEO of JPMorgan Chase, profited from the transaction fees of government transfer payments… he is the Li Ka-shing of America; you can't escape paying this old guy. The poor are poor because they spend all their money on goods and services, which is exactly what they did during this period. With the velocity of money circulation far exceeding 1, economic growth thrived. That is to say, $1 of debt created more than $1 of economic activity. Thus, miraculously, the U.S. debt-to-nominal GDP ratio decreased.

Inflation ran rampant because the supply of goods and services could not keep up with the increase in purchasing power financed by government debt. The wealthy who held government bonds were not satisfied with these populist policies. These bondholders suffered the worst total return since 1812. The rich sent out their white knight, Federal Reserve Chairman Jay Powell, to fight back. He began raising interest rates in early 2022 to control inflation, although the public had hoped for another round of stimulus, such policies were prohibited. U.S. Treasury Secretary Janet Yellen intervened to mitigate the effects of the Fed's attempts to tighten monetary conditions. She drained the Fed's reverse repo tool (RRP) by shifting debt issuance from the long end (coupons) to the short end (notes). This provided nearly $2.5 trillion in fiscal stimulus, primarily benefiting the wealthy who have held financial assets since September 2002; the asset markets thrived as a result. Just like after 2008, this generous government assistance did not generate any real economic activity, and the U.S. debt-to-nominal GDP ratio began to rise again.

Did Trump's new cabinet learn the right lessons from the recent economic history of governance in the United States? I believe so.

Most people think Scott Bassett will be chosen by Trump to replace Yellen as U.S. Treasury Secretary; he has given numerous speeches on how to "fix" America. His speeches and columns detail how to implement Trump's "America First" plan, which is quite similar to China's development plan (starting from Deng Xiaoping in the 1980s and continuing to this day). The plan aims to boost nominal GDP by bringing back key industries (shipbuilding, semiconductor plants, automotive manufacturing, etc.) through government tax credits and subsidies. Eligible companies will receive cheap bank financing. Banks will once again rush to lend to real companies, as their profitability is guaranteed by the U.S. government. As companies expand within the U.S., they must hire American workers. Higher-paying jobs for ordinary Americans mean more consumer spending. If Trump limits the number of immigrants crossing from "shithole countries" wearing Mexican sombreros, eating cats and dogs, with dark skin, and being dirty, the impact will be further amplified. These measures stimulate economic activity, and the government funds itself through corporate profits and income taxes. The government deficit must remain large to fund these projects, and the Treasury provides funding for the government by selling bonds to banks. Banks can now readjust their balance sheets because the Fed or lawmakers have suspended the supplementary leverage ratio. The winners are ordinary workers, companies producing "approved" products and services, and the U.S. government, whose debt-to-nominal GDP ratio decreases. This is a reinforced version of quantitative easing targeting the poor.

Wow, sounds great. Who would oppose such a magical era of prosperity in America?

The losers are those holding long-term bonds or savings deposits. This is because the yields on these instruments will be intentionally kept below the nominal growth rate of the U.S. economy. If wages do not keep up with higher inflation levels, people will also suffer losses. If you haven't noticed, joining a union has become cool again. "4 and 40" is the new slogan. That is, paying workers more than 40% in wages over the next four years, or a 10% raise each year, to keep them working.

For those readers who consider themselves wealthy, don't worry. Here’s a memo on what to buy. This is not financial advice; I’m just sharing my management of the portfolio. Every time a bill passes and funds are allocated to approved industries, read it and buy stocks in those vertical industries. Do not save with fiat bonds or bank deposits; instead, buy gold (a hedge against financial repression for the baby boomer generation) or Bitcoin (a hedge against financial repression for the millennial generation).

Clearly, the hierarchy of my portfolio starts with Bitcoin, followed by other cryptocurrencies and equities related to cryptocurrencies, then gold stored in a vault, and finally stonks. I will keep a small amount of dirty fiat currency in a money market fund to pay my American Express bill.

I will use the remainder of this article to explain how quantitative easing targeting the rich and the poor affects economic growth and the money supply. Then, I will predict how exempting banks from the supplementary leverage ratio (SLR) will again create the ability for unlimited quantitative easing for the poor. In the final section, I will introduce a new index to track the supply of bank credit in the U.S. and show how Bitcoin outperforms all other assets when the supply of bank credit shrinks.

Money Supply

I must express extreme admiration for the quality of Zoltan Pozar's paper "Ex Uno Plures." During a long weekend spent in the Maldives, I read his entire article in between surfing, Iyengar yoga, and myofascial massages. His work will play a significant role in the remainder of this article.

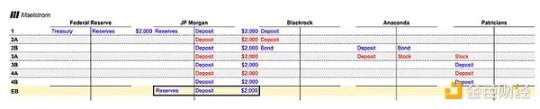

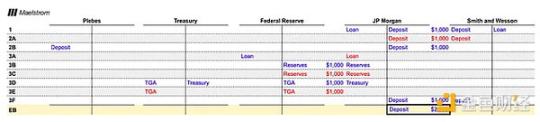

I will present a series of hypothetical accounting ledgers. The left side of T represents assets. The right side of T represents liabilities. Blue entries indicate value increases, while red entries indicate value decreases.

The first example focuses on how the Federal Reserve's purchase of bonds through quantitative easing affects the money supply and economic growth. Of course, this example and the remaining ones will be a bit silly to make them interesting and engaging.

Imagine you are Powell during the U.S. regional banking crisis in March 2023. To vent, Powell heads to the tennis club at 370 Park Avenue in New York City to play squash with another millionaire financial partner. Powell's friend is furious.

This friend, whom we will call Kevin, is a hot-tempered financier who says, "Jay, I have to sell my house in the Hamptons. I put all my money in Signature Bank, and obviously, I don't qualify for federal deposit insurance because my balance exceeds the limit. You have to do something. You know what Bonnie is like when she has to stay in town for a day in the summer. She's unbearable."

Jay responds, "Don't worry, I get your point. I will implement $2 trillion in quantitative easing. It will be announced on Sunday night. You know the Fed always has your back. Without your contributions, who knows what America would become? Just imagine if Donald Trump regained power because Biden had to deal with a financial crisis during his term. I still remember Trump stealing my girl at Dorsia in the early '80s; fuck that guy."

The Federal Reserve has established a bank term funding program, which, unlike direct quantitative easing, aims to address the banking crisis. But allow me some artistic freedom here. Now, let’s examine what $2 trillion in quantitative easing would do to the money supply. All figures will be in billions of dollars.

The Federal Reserve purchases $2,000 in U.S. Treasury bonds from BlackRock and pays with reserves. JPMorgan Chase fulfills its banking duties by facilitating this swap. JPMorgan receives $2,000 in reserves and deposits $2,000 with BlackRock. The Fed's quantitative easing leads to banks creating deposits, which ultimately turn into money.

BlackRock now loses the U.S. Treasury bonds and must lend that money to someone else, i.e., acquire another income-generating asset. BlackRock CEO Larry Fink does not associate with the poor. He only collaborates with industry leaders. But now, he is immersed in the tech sector. There is a new social networking loot app building a community for users to share voluptuous photos. It’s called Anaconda. Their slogan is, "My anaconda don’t want none unless you got buns, hun." Anaconda is in its growth phase, and BlackRock is pleased to purchase $2,000 in bonds.

Anaconda is a pillar of American capitalism. They have conquered the market by getting the male population aged 18-45 addicted to their app. As they stop reading and start browsing, the productivity of this group has declined. Anaconda funds stock buybacks through debt issuance for tax optimization, so they don’t have to repatriate retained earnings abroad. Reducing the number of shares not only boosts the stock price but also increases their earnings, as even if their earnings do not grow per share, their earnings will increase due to a lower denominator. Thus, passive index investors like BlackRock are more likely to buy their stock. The result is that after the nobles sell their stocks, there is $2,000 in bank deposits.

The wealthy shareholders of Anaconda do not immediately spend the money they received. Larry Gagosian (note: founder of a famous gallery) throws a grand party at the Miami Basel Art Fair. Despite various things going wrong, the financial elite decide to purchase the latest canvas graffiti to enhance their credentials as serious art collectors and impress the bad guys at the booth. The sellers of the artwork belong to the same economic class as them. The net effect of sponsoring "art" is that the seller's bank account is debited, and the buyer's account is credited.

After all these transactions, no real economic activity has occurred. The Federal Reserve injected $2 trillion of printed money into the economy, and all it did was increase the bank deposits of the wealthy. Even financing for an American company did not lead to any growth, as these funds were used to inflate stock prices, creating zero job opportunities. $1 of quantitative easing resulted in a $1 increase in the money supply, leading to $0 in economic activity. This is not a good use of debt. Therefore, from 2008 to 2020, the debt-to-nominal GDP ratio of the wealthy rose during the period of quantitative easing.

Now, let’s look at President Trump’s decision-making process during the COVID-19 pandemic. Recall March 2020: the pandemic had just begun, and Trump’s advisors instructed him to "flatten the curve" (remember that nonsense?). He was advised to shut down the economy, allowing only "essential workers" (remember them, the poor souls delivering to you for less than minimum wage?) to continue working.

Trump: "Fuck, do I need to shut down the economy just because some quacks think the flu is real?"

Advisor: "Yes, Mr. President. I should remind you that the majority of deaths from complications caused by COVID-19 infections are among obese baby boomers like you. I should also add that if people over 65 get sick and need hospitalization, treating all those over 65 will be costly. You need to lock down all non-essential workers."

Trump: "This will lead to an economic collapse; let’s just send checks to everyone so they won’t complain. The Fed can buy the debt issued by the Treasury to fund these distributions."

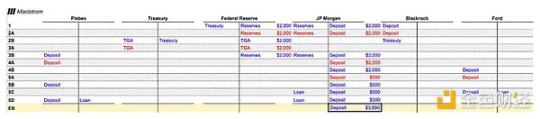

Using the same accounting framework, let’s step through how quantitative easing helps the poor.

Just like in the first example, the Federal Reserve conducts quantitative easing by purchasing $2,000 in Treasury bonds using reserves.

Unlike the first example, the Treasury is involved in the flow of funds. To pay for Trump’s stimulus checks, the government must borrow money by issuing Treasury bonds. BlackRock is buying Treasury bonds instead of corporate bonds. JPMorgan helps BlackRock convert its bank deposits into reserves held by the Fed, which can be used to purchase Treasury bonds. The Treasury receives deposits from the Fed in its Treasury General Account (TGA), similar to a checking account.

The Treasury sends out stimulus checks to everyone, primarily to the vast civilian population. This leads to a depletion of the TGA balance, while the reserves held by the Fed increase correspondingly, becoming deposits for civilians at JPMorgan.

Civilians are civilians; they spend all the stimulus on new Ford F-150 trucks. Fuck electric vehicles; this is America, so they are all splurging on that black gold. The civilians’ bank accounts are debited, while Ford’s bank account is credited.

When Ford sells these trucks, they do two things. First, they pay workers' wages, transferring bank deposits from Ford’s account to the accounts of ordinary workers. Then, Ford goes to the bank to take out loans to increase production; as you can see, the issuance of loans creates its own deposits from the recipient, Ford, and increases the money supply. Finally, ordinary workers want to go on vacation and obtain personal loans from the bank, which is happy to provide the loan given the strong economy and high-paying jobs. Ordinary bank loans create additional deposits, just like Ford borrowing money.

The ending balance of deposits or funds is $3,000. This is $1,000 higher than the $2,000 initially injected by the Fed through quantitative easing.

From this example, it is clear that quantitative easing targeting the poor stimulates economic growth. The Treasury’s distribution of stimulus encourages civilians to purchase trucks. Due to demand for goods, Ford is able to pay employee wages and apply for loans to increase production. High-paying employees qualify for bank credit, enabling them to consume more. $1 of debt generates more than $1 of economic activity. This is a good outcome for the government.

I want to further discuss how banks provide unlimited financing to the Treasury.

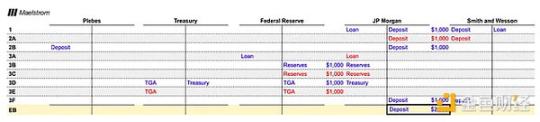

We will start from step 3 above.

The Treasury is issuing a new round of stimulus plans. To raise funds, the Treasury auctions bonds, with JPMorgan acting as a primary dealer, using reserves held by the Fed to purchase these bonds. Selling bonds increases the Treasury’s TGA balance at the Fed.

As in the previous example, the checks sent out by the Treasury appear as deposits for civilians at JPMorgan.

When the Treasury issues bonds purchased by the banking system, it converts reserves held by the Fed, which have no productive effect on the economy, into deposits held by civilians, which can be used to purchase goods and generate economic activity.

Let’s look at another T-chart. What happens when the government implements industrial policy by promising tax breaks and subsidies to companies producing necessary goods and services?

In this example, peace under American governance is exhausting the bullets needed for gunfights inspired by Clint Eastwood westerns in the Persian Gulf. The government passed a bill promising subsidies for bullet production. Smith & Wesson applies for and receives a contract to supply ammunition to the military. Smith & Wesson cannot produce enough bullets to fulfill the contract, so they apply for a loan from JPMorgan to build a new factory.

JPMorgan’s credit officer, upon receiving the government contract, confidently loans $1,000 to Smith & Wesson. The loan creates $1,000 out of thin air.

Smith & Wesson builds the factory, creating wages for civilians, which ultimately turn into deposits at JPMorgan. The money created by JPMorgan becomes deposits for those most likely to consume, namely civilians. I have already discussed how the consumption habits of civilians create economic activity. Let’s slightly alter this example.

The Treasury needs to provide a subsidy to Smith & Wesson by issuing $1,000 in new bonds at the auction. JPMorgan attends the auction to purchase the bonds but has no reserves to buy them. Since using the Fed’s discount window is no longer stigmatized, JPMorgan uses its Smith & Wesson bond assets as collateral for a reserve loan from the Fed. These reserves are used to purchase the newly issued Treasury bonds. The Treasury then pays the subsidy to Smith & Wesson, which becomes a deposit for JPMorgan.

This example illustrates how the U.S. government uses industrial policy to induce JPMorgan to issue loans and uses the assets created by those loans as collateral to purchase additional U.S. Treasury bonds from the Fed.

Constraints

It seems that the Treasury, the Federal Reserve, and banks operate a magical money-making machine that can accomplish one or more of the following tasks:

They can inject financial assets into the wealthy without triggering any real economic activity.

They can fill the bank accounts of the poor, who often use relief funds to purchase goods and services, thereby generating real economic activity.

They can ensure the profitability of specific participants in certain industries. This allows businesses to utilize bank credit for expansion, resulting in actual economic activity.

Are there any constraints?

Yes, banks cannot create unlimited amounts of money because they must allocate expensive equity for every debt asset they hold. In technical terms, different types of assets have risk-weighted asset costs. Even so-called "risk-free" government bonds and central bank reserves incur equity capital costs. This is why, at some point, banks cannot meaningfully participate in bidding for U.S. Treasury bonds or issuing corporate loans.

There is a reason why equity capital must be used for mortgages and other types of debt securities. If a borrower defaults, whether a government or a corporation, someone has to bear the loss. Given that banks decide to create money to lend or purchase government bonds for profit, it is fair to let their shareholders bear the losses. When losses exceed a bank's equity capital, the bank will fail. When a bank fails, depositors lose their funds, which is bad. However, from a systemic perspective, it is worse that banks cannot continue to increase the amount of credit in the economy. Given that part of the statutory financial system requires stable credit issuance to survive, bank failures could bring down the entire house of cards. Remember—one player’s asset is another player’s liability.

When bank equity credit is exhausted, the only way to save the system is for the central bank to create new fiat currency and exchange it for the bank's negative assets. Imagine Signature Bank only lending to Su Zhu and Kyle Davies of the now-defunct Three Arrows Capital (3AC). Su and Kyle provided the bank with a false balance sheet, distorting the health of the company. They then withdrew cash from the fund and handed it to their wives, hoping it would be shielded from bankruptcy, and when the fund went bankrupt, the bank had nothing to seize, rendering the loan worthless. This is fictional; Su and Kyle are good people. They would never do what I described ;) Signature made substantial campaign contributions to U.S. Senate Banking Committee member Elizabeth Warren. Using their political influence, Signature convinced Senator Warren that they deserved to be saved. Senator Warren called Powell, telling him the Fed must exchange dollars for 3AC debt at face value through the discount window. The Fed complied, allowing Signature to exchange 3AC bonds for new dollar bills, enabling the bank to absorb any deposit outflows. Again, this did not actually happen; it is just a "stupid" example. But the moral of the story is that if banks do not put up enough equity themselves, the entire population will ultimately pay for it due to currency devaluation.

Perhaps my hypothetical example has some merit; here is a recent report from The Straits Times:

The wife of Zhu Su, co-founder of the bankrupt cryptocurrency hedge fund Three Arrows Capital (3AC), successfully sold a mansion she owned in Singapore for $51 million, despite some of the couple's other assets being frozen by the court.

Back to reality.

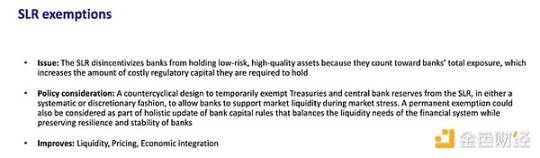

Assuming the government wants to create unlimited bank credit. In this case, they must change the rules to exempt Treasury bonds and certain types of "approved" corporate debt (which can be categorized by type, such as investment-grade bonds, or by industry, such as debt issued by semiconductor companies) from the so-called Supplementary Leverage Ratio (SLR).

If U.S. Treasury bonds, central bank reserves, and/or approved corporate debt securities are not subject to SLR constraints, banks can purchase unlimited amounts of debt without incurring any expensive equity burdens. The Fed has the authority to grant exemptions. They did this from April 2020 to March 2021. If you recall, the U.S. credit markets were frozen at that time. The Fed needed to get banks to lend to the U.S. government again by participating in Treasury auctions, as the government was about to roll out a multi-trillion-dollar stimulus plan without the tax revenue to pay for it. The exemption was very effective. This led to banks purchasing large amounts of U.S. Treasury bonds. The downside is that after Powell raised interest rates from 0% to 5%, the prices of the same U.S. Treasury bonds plummeted, triggering the regional banking crisis in March 2023. There is no such thing as a free lunch.

The level of bank reserves also limits the willingness of the banking sector to purchase U.S. Treasury bonds at auctions. When banks feel that their reserves at the Fed have reached the Minimum Comfortable Reserve Level (LCLoR), they will stop participating in auctions. You only know what the LCLoR is in hindsight.

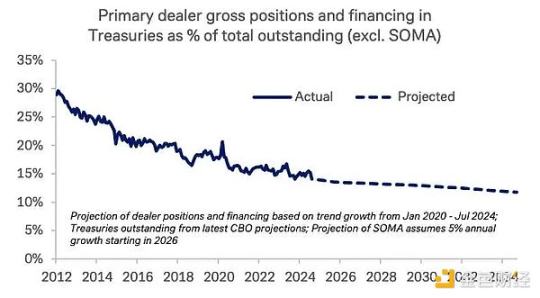

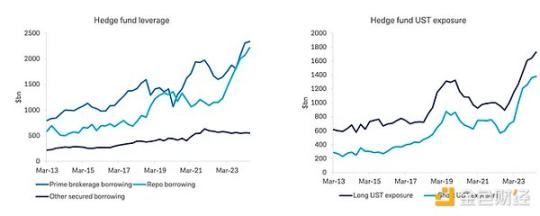

This is a chart from the U.S. Treasury Borrowing Advisory Committee (TBAC) presentation titled "Financial Resilience in the Treasury Market," released on October 29, 2024. The chart shows that the proportion of Treasury bonds held by the banking system is decreasing relative to the total outstanding Treasury debt, thus approaching the LCLoR. This is a problem because as the Fed engages in quantitative tightening (QT) and surplus national central banks sell off (or stop reinvesting) their net export earnings (de-dollarization), the marginal buyers in the Treasury market become erratic bond trading hedge funds.

This is another chart from the same presentation. As you can see, hedge funds are filling the gap. But hedge funds are not true monetary buyers. They are engaging in arbitrage, buying cheap spot Treasury bonds and shorting Treasury futures contracts. The cash portion of the trade is financed by the repo market. A repo refers to exchanging an asset (Treasury bills) for cash at a certain interest rate over a specified period. The pricing of overnight financing using Treasury bonds as collateral in the repo market is based on the amount of available commercial bank balance sheet capacity. As balance sheet capacity decreases, repo rates rise. If the cost of financing Treasury bonds rises, hedge funds can only buy more Treasury bonds when prices fall relative to futures prices. This ultimately means that the auction prices of Treasury bonds must decrease, and yields must rise. This is not what the Treasury wants to happen, as it needs to issue more debt at increasingly cheaper prices.

Due to regulatory constraints, banks cannot purchase enough U.S. Treasury bonds, nor can they provide hedge funds with financing to buy U.S. Treasury bonds at affordable prices. This is why the Fed must again exempt banks from the SLR. It increases liquidity in the Treasury market and allows for unlimited quantitative easing, which can target the productive part of the U.S. economy.

If you are unsure whether the Treasury and the Fed have recognized the necessity of relaxing bank regulations, TBAC explicitly states what needs to be done on slide 29 of the same presentation:

Tracking Numbers

If Trumponomics works as I just described, then we must focus on the amount of bank credit growth we expect to see. From the examples above, we know that quantitative easing targeting the wealthy is achieved by increasing bank reserves, while quantitative easing targeting the poor is achieved by increasing bank deposits. Fortunately, the Fed provides two data points for the entire banking system every week.

I created a custom Bloomie index, which is a combination of reserves and other deposits and liabilities, the BANKUS U index.

This is my custom index for tracking the amount of bank credit in the U.S. In my view, this is the most important indicator of the money supply. As you can see, sometimes it leads Bitcoin, such as in 2020, and sometimes it lags behind Bitcoin, such as in 2024.

However, more importantly, how an asset performs when the supply of bank credit shrinks. Bitcoin (white), the S&P 500 index (gold), and gold (green) have all been divided by my bank credit index. The index values are set to 100, and as you can see, Bitcoin has performed outstandingly, rising over 400% since 2020. If you can only do one thing to combat fiat currency devaluation, it is Bitcoin. You cannot argue with math.

The Road Ahead

Trump and his monetary aides have made it very clear that they will pursue policies that weaken the dollar and provide the necessary funding for the repatriation of American industry. Given that the Republican Party will control all three branches of government for the next two years, they can pass Trump's entire economic plan without any effective opposition from the Democrats. Note that I believe Democrats will join the money printing party, as which politician can refuse to give free stuff to voters?

The Republicans will first pass legislation encouraging key commodity and material manufacturers to expand domestic production. These bills will be similar to the CHIPS Act, the Infrastructure Act, and the Green New Deal passed by the Biden administration. As businesses accept these government subsidies and obtain loans, bank credit growth will surge. For those who pride themselves on being stock-picking experts, buy shares of publicly traded companies that produce what the government wants to manufacture.

At some point, the Fed will concede and at least exempt U.S. Treasury bonds and central bank reserves from the SLR burden. By then, the path for unlimited quantitative easing will be clear.

The combination of legislative industrial policy and SLR exemptions will lead to a massive influx of bank credit. I have shown that the velocity of money under such policies is far higher than the traditional quantitative easing policies targeting the wealthy under Fed supervision. Therefore, we can expect the performance of Bitcoin and cryptocurrencies to be as good, if not better, than during the period from March 2020 to November 2021. The real question is, how much credit will be created?

The COVID stimulus plan injected about $4 trillion in credit. This event will be even more severe. The growth rate of defense and healthcare spending alone will exceed nominal GDP. As the U.S. increases defense spending to respond to the shift toward a multipolar geopolitical environment, it will continue to grow rapidly. The proportion of people over 65 in the U.S. population will peak in 2030, meaning that healthcare spending growth will accelerate from now until then. No politician can cut defense spending and healthcare, as they will quickly be voted out of office if they do. All of this means that the Treasury will be busy injecting large amounts of debt into the market quarter after quarter to keep things running. I have previously shown how combining quantitative easing with Treasury borrowing can result in a velocity of money greater than 1. This deficit spending will enhance the nominal growth potential of the U.S.

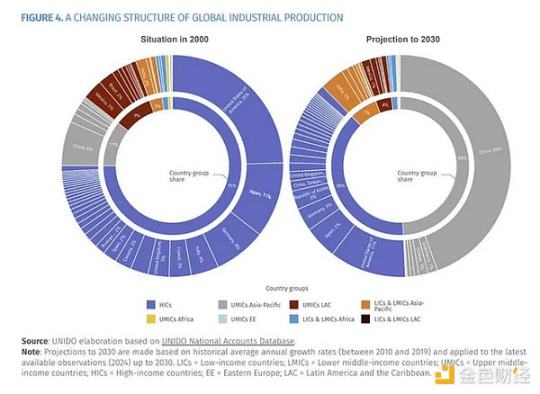

Speaking of repatriating American businesses, the cost of achieving this will also reach trillions of dollars. Since China was allowed to join the World Trade Organization in 2001, the U.S. has voluntarily handed over its manufacturing base to China. In less than thirty years, China has become the world's factory, producing the highest quality products at the lowest prices. Even companies that want to shift their supply chains from China to so-called cheaper countries realize that the integration of so many suppliers in China's eastern coastal regions is so deep and effective that even with much lower hourly wages in Vietnam, these companies still need to import intermediate parts from China to produce finished products. In summary, readjusting the supply chain to the U.S. will be a daunting task, and if it must be done for political expediency, the costs will be very high. I am talking about the need for cheap bank financing in the high single-digit to low double-digit trillions (i.e., about $6-14 trillion) to shift production capacity from China to the U.S.

It took $4 trillion to reduce the debt-to-nominal GDP ratio from 132% to 115%. Assuming the U.S. further reduces it to 70%, the level seen in September 2008. Just using linear extrapolation, this equates to needing to create $10.5 trillion in credit to achieve this deleveraging.

This is why Bitcoin is headed to $1 million, as prices are set at the margin. As the free trading supply of Bitcoin decreases, the most fiat currency in history will chase safe havens not only from Americans but also from Chinese, Japanese, and Western Europeans. Invest more, hold more.

If you doubt my analysis of the impact of quantitative easing on the poor, just read the economic history of China over the past thirty years, and you will understand why I refer to the new economic system under American governance as "Chinese-style American capitalism."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。