The centralized trading supply chain makes DeFi more vulnerable.

Author: Yellow Propeller

Translated by: Deep Tide TechFlow

Key Points Summary:

Economies of scale lead to the centralization of the trading supply chain: Due to the lack of standards and the resulting complexity, economies of scale are created for solvers, seekers, builders, liquidity providers (LPs), and decentralized exchanges (DEXs), driving their centralization.

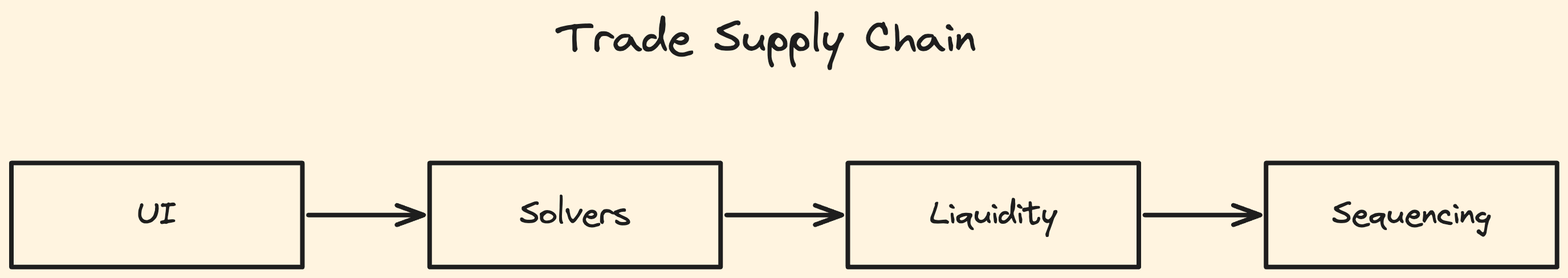

The centralized trading supply chain makes DeFi more vulnerable: The core of decentralized finance (DeFi) is the exchange operation. Even if the underlying protocols are decentralized, a centralized trading supply chain remains susceptible to censorship and exploitation.

Simplifying solutions, liquidity provision, and trading processes: To build robust and efficient financial infrastructure, we need to simplify the tasks within the trading supply chain, making it simple enough for small teams to compete and achieve decentralization.

Complexity of the Trading Supply Chain Centralization

If you pay attention to the trends in solutions, market making, and block building, you will find that the trading supply chain is trending towards centralization.

However, this is not inevitable. The reason for centralization lies in economies of scale, as the work of many participants in the trading supply chain is overly burdensome.

The solution is to simplify these roles, allowing independent operators to compete. This can maintain diversity, decentralization, and innovation in solutions, searching, block building, decentralized exchanges (DEXs), and decentralized applications (dapps) based on them.

In this article, we will explore the fundamental reasons and limiting assumptions that lead to the current market making, solving/searching, and on-chain trading complexities.

Complexity Leads to Centralization of Market Making

The original intention of automated market makers (AMMs) was to make market making so simple that anyone could become a market maker with just one "deposit" operation.

However, since the launch of Uniswap v2, the situation has become more complex: now, you either need to invest a lot of effort to manage liquidity positions or rely on additional automation tools.

Meanwhile, active market makers occupy a larger share of DeFi trading volume. Notably, the traffic is mostly controlled by a few teams rather than being shared by diverse participants.

Market making tends to centralize because it is very difficult to do well.

The reasons for the difficulty in market making are outlined as follows:

Trading across multiple markets: Liquidity is distributed across multiple markets, including on-chain and off-chain spot, futures, and perpetual contracts. You need to manage inventory and hedge across all these markets to provide the lowest spreads, thus winning the most trading volume. You also need to establish and maintain various integrated systems to effectively manage inventory and risk in competition.

Preventing harmful traffic: To avoid losses, you need to dynamically adjust the spreads for buyers, whitelisting, blacklisting, or graylisting them. This requires continuous monitoring and heuristic analysis.

Winning the latency race: Mastering the latest price information (from centralized exchanges and decentralized exchanges) and executing trades are both about a race against latency. The lower the latency, the smaller the spread you can offer, and the more traffic you can win. Latency optimization is an endless process, requiring continuous optimization of various aspects such as network, computing resources, and business development partnerships.

Increasing liquidity and reducing fees: Your trading capacity depends on the liquidity on a particular platform or chain. The less you pay in fees (for example, by increasing your level on centralized exchanges), the more competitive your quotes can be, thus winning more trading traffic.

These barriers create a positive feedback loop, making it easier for existing winners to maintain their lead, while new entrants (including automated market makers) find it harder to enter the market.

But it doesn't have to be this way.

Market Making Can Actually Be Simple

Typically, people believe that market making is both necessary (because it integrates market signals) and difficult (due to the need for liquidity, low-latency infrastructure, risk management, and system integration), so we cannot do without it. However, the complexity of market making is not due to the nature of the work—it's not as complex as predicting protein folding—but rather due to the existence of zero-sum competition driven by imperfect market design.

There are three main flaws in the market:

Time priority: The time priority (or ordering) mechanism leads to latency races, which are the main causes of complex market crossings and harmful traffic.

Lack of standards: The lack of uniformity in exchange interfaces (whether on-chain or off-chain) makes market crossings more complex than necessary.

Lack of coordination: The lack of effective coordination among small participants makes having a large amount of liquidity a competitive advantage.

The core of market making is actually simple: Provide liquidity at market prices and add a spread to cover capital costs. If the prices in two markets differ, buy in one market and sell in the other. The remaining part is competition and confrontation caused by market design flaws, which do not bring any substantial benefits to end users (such as better prices).

Complexity of On-Chain Routing and Searching

Since Flashboys, the roots of market making complexity have not been a big secret. However, what makes solving and searching difficult, and what distinguishes the excellent from the rest, is not well known.

Let’s analyze why solving these problems is so difficult:

Indexing liquidity: For solvers, the most labor-intensive task is integrating each decentralized exchange, lending, staking, stablecoin pools, and market makers. Integration means understanding the internal mechanisms of the protocols (including their mathematical principles) and how to map logs and storage slot updates to price and exchange functions.

Routing: Designing and scaling algorithms that can efficiently combine orders, route, and split in liquidity pools is a challenge. If you only have a few hundred milliseconds, it becomes even more challenging.

Relationships: Solving problems also involves a lot of business development work. You need to get auction platforms to whitelist you, have wallets and aggregators integrate your services, gain traders' trust in your API, and collaborate with developers. Obtaining audits, paying deposits, and building a brand are necessary to gain more opportunities.

Countless small issues: Each auction, chain, and execution environment has its uniqueness and design flaws. Many issues do not directly relate to providing better prices for users. This requires time to learn, adapt, and manage.

If the solutions are too complex—then the intent will tend to centralize

The intent will persist. Most new decentralized exchanges (DEXs), bridges, and cross-chain architectures are explicitly designed with solvers at their core.

However, solving problems has already become quite difficult. Adding tasks like inventory management, searching, or market making makes it unrealistic for a single solving team to handle for most teams.

Protocols that expect solvers to juggle all these roles will struggle to attract enough solvers to participate—and may have to accept a certain degree of centralization.

Small DEXs Struggle to Achieve Integration

Apart from the largest DEXs, any other platform is struggling to compete for traffic.

Many well-designed DEXs have failed to achieve the total value locked (TVL) and trading volume that their design deserves.

In addition to obvious reasons like branding, marketing, and resources, another reason is that even the largest DEXs struggle to integrate order flow sources.

Solvers and routers can barely keep up with the largest liquidity sources, but they do not have the time to integrate and learn the complexities of smaller DEXs.

Just a few hooks from Univ4, even if there are only 5-10, require months of integration work.

As a result, large DEXs gain integration and attract more traffic, while smaller DEXs do not. As traffic decreases, the returns for liquidity providers (LPs) also diminish, leading LPs to withdraw. The reduction of liquidity in DEXs leads to price deterioration, further decreasing traffic for smaller DEXs.

Thus, in an ecosystem where traffic can only be gained through integration—but integration can only be achieved if you already have traffic, liquidity, or branding—small or emerging DEXs have almost no chance of competing.

Complexity of Trading Drives Traders Away from On-Chain

The poor user experience of on-chain trading seems to be an old story. However, we are not discussing bridging or account management issues, but rather focusing on the erroneous assumptions behind trading.

Currently, the types of orders we offer are similar to those used by professional traders in traditional finance. However, our execution infrastructure is completely different from traditional finance, and its goals are different (no central dependency, open access, transparent execution).

As a result, our trading environment is neither suitable for ordinary investors nor for professional traders:

Numerous parameters: Traders need to set slippage, gas fees, limit prices, choose urgency, and monitor order execution.

Complex context: Traders also need to at least implicitly consider block time, market volatility, priority fees, and any potential MEV attack vectors, such as the cost of transaction transparency.

User interface is not friendly enough: For professionals, the mathematics of AMM curves, MEV bundling, priority fee predictions, and even running block builders—these all present extremely challenging learning curves that only the most curious and determined companies will attempt.

Compliance uncertainty: The lack of compliant exchanges, audit logs, and trading guarantees prevents large funds from participating in trading.

No wonder—so many trades are conducted through intermediaries, who are responsible for custodial assets and providing familiar and simple interfaces (such as centralized exchanges, over-the-counter trading platforms, and Telegram bots).

To achieve decentralization—we need to simplify

Unnecessary complexity not only wastes resources but also fosters economies of scale that favor centralization.

A centralized trading supply chain will become vulnerable, susceptible to censorship and exploitation.

Worse still, it stifles innovation, as high entry barriers make it difficult for new designs to launch.

Such decentralized finance bears no substantial difference from traditional finance.

A healthy decentralized finance ecosystem requires a decentralized trading supply chain.

The way to achieve decentralization is simplification.

What Should a Simple Trading Supply Chain Look Like

A healthy decentralized trading supply chain should have the following characteristics:

Passive Liquidity Providers: Those participants with the lowest capital costs (such as long-term holders) provide liquidity to the market. Liquidity provision is a "single operation," easy to understand and simple enough to be automated. Many people can participate in providing liquidity.

Open to Innovation: If designed well, new decentralized exchange (DEX) developers can gain equal order flow and initial user attraction. Any individual contributor in the trading supply chain can improve specialized components, thereby gaining traffic.

Simplified Trading: The market design is simple and easy to understand, aimed at optimizing user experience. The market effectively integrates signals at low cost (known signals like arbitrage can be resolved cheaply, while novel signals are rewarded) without leaking value. Therefore, most trades are driven by directional demand (such as buyers and holders), and trading fees can be almost negligible.

Thus, the trading supply chain will be both efficient (low cost and fast) and robust (decentralized, open, and trustless).

Building a Decentralized Trading Supply Chain

Complexity can lead to the permanent centralization of the trading supply chain, resulting in an exploitative, fragile, censored, and stagnant ecosystem. Our goal is to change this situation by simplifying the creation, resolution, and trading processes of the market, achieving decentralization of the trading supply chain. In the coming days, we will provide three key elements for this goal:

A standard to combat liquidity fragmentation.

A tool to simplify coordination between solvers and liquidity providers.

A new market without latency competition and trust assumptions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。