This article aims to help readers understand the history and causes of Memecoins, the factors behind the explosion of the Memecoin sector, the essential conditions for success, and how to invest in Memecoins.

Written by: Web3Port Foundation

Introduction:

Recently, Murad Mahmudov delivered a keynote speech titled "Memecoin Supercycle" at Token2049, which garnered over a million views and interactions, sparking significant discussions around Memecoins.

The relatively fair public distribution logic and unique community cultural values of Memecoins have made them an important narrative and hot topic in the current market, attracting traders' attention with their massive trading volumes and significant price volatility.

Through this Memecoin report, we hope to help readers understand the history and causes of Memecoins, the factors behind the explosion of the Memecoin sector, the essential conditions for success, and how to invest in Memecoins. The content is for industry learning and communication purposes only and does not constitute any investment advice.

1. Tracing the Origins of Memecoins

What is a Memecoin?

Memecoin is a type of cryptocurrency based on internet pop culture, memes, or humorous content. These coins typically lack clear technological innovations or practical application scenarios, primarily relying on social media and community promotion to gain popularity through viral dissemination.

Memecoins generally share certain common characteristics:

- The project narrative is easy to understand and disseminate, without abstract concepts;

- There are no clear technological innovations, complex products, or actual revenue support;

- They contain a certain degree of meme culture, capable of eliciting some level of interaction or emotional resonance;

- They mainly rely on social media and user community promotion and marketing;

- Tokens are fairly distributed, and the tokens themselves have no clear utility or purpose.

Due to their association with classic memes, humorous images, or celebrities, Memecoins exhibit significant price volatility, often influenced by social media hype, community behavior, and speculative sentiment. Early Memecoins like Dogecoin and Shiba Inu quickly gained attention through this meme culture.

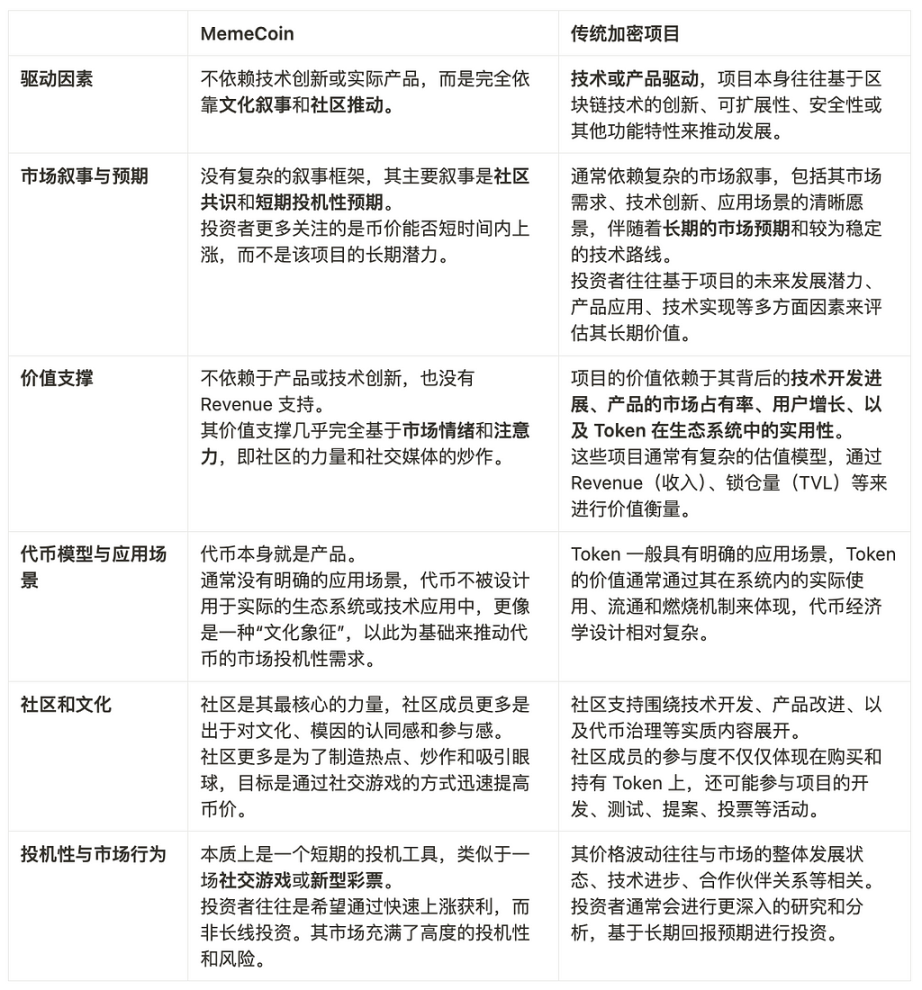

Memecoins vs. Traditional Crypto Projects:

While Memecoins and traditional crypto projects (such as public chains, DeFi protocols, Dapps, etc.) both belong to the cryptocurrency field, they exhibit significant differences in core values, driving forces, and the way the market understands and reacts.

In summary, traditional crypto projects focus on technological innovation, application scenarios, and product development, with complex market narratives and valuation models, supporting token value based on long-term market expectations and actual product revenue capabilities.

Memecoins, on the other hand, rely entirely on social media discussions and community promotion; the tokens themselves are products of attention economy and cultural symbolism. They lack complex technological or product support, and price fluctuations are primarily driven by speculative demand and market sentiment, resembling a speculative lottery or social game.

Essentially, Memecoins represent a form of attention economy, a fusion of cultural and speculative attributes, reflecting a new form of the combination of internet culture and capital markets, showcasing the influence of attention economy in the cryptocurrency field.

The Principles Behind the Popularity of Memecoins

The popularity of Memecoins can mainly be explained through three principles in economics: irrational exuberance, network effects, and demand for fair distribution. These principles collectively explain how Memecoins can rapidly spread and gain high attention in the market despite lacking technological support or intrinsic value.

Irrational Exuberance:

The concept of "irrational exuberance" was proposed by economist Robert Shiller, indicating that the driving force behind asset price increases does not stem from the asset's intrinsic value or rational analysis, but rather from investor emotions, market hype, and speculative behavior.

The price increases of Memecoins are often closely related to hype on social media platforms (such as Twitter, Reddit, Telegram, etc.), rather than any actual technological innovations or product applications. Public comments and support from celebrities (such as Elon Musk) for Memecoins like Dogecoin can trigger significant market volatility in a short time, attracting more investors and further driving up prices.

The sharp rise in Memecoin prices in the short term creates a wealth effect for early investors, attracting more people to participate due to FOMO (fear of missing out). This short-term massive profit and "get-rich-quick myth" further intensify market speculation, causing more investors to overlook the actual value of Memecoins, thus driving irrational exuberance.

Network Effects:

Network effects refer to the phenomenon where the value of a product or service increases as the number of users grows. A key feature of network effects is that when the number of users reaches a certain critical point, the product's influence and value can grow explosively.

The value of Memecoins does not come from their technology or applications but is gradually amplified through user participation, discussion, promotion, and purchasing behavior, forming a strong network effect. Memecoin projects quickly accumulate significant attention and investors through user interaction and community participation, creating a collective community consensus. When this community consensus reaches a certain "critical point," it accelerates market promotion and price increases.

"Fair Game" Theory

The "Fair Game" theory emphasizes that participants are more willing to engage in a game or market they perceive as fair.

For Memecoins, the public distribution mechanism of tokens (Fair Launch), the decentralization of the distribution process, low barriers to entry, and the transparency of token chips and on-chain liquidity allow ordinary investors to feel a sense of fair opportunity. All players can participate in investment and trading from the same starting line, leading to a greater willingness to engage, thus promoting the spread and market performance of Memecoins. This mechanism attracts more people to join the Memecoin speculation "game," forming a strong community foundation and further driving its popularity.

History of Memecoins

From the earliest Memecoin Doge, through sporadic Memecoin speculation, to Memecoins becoming a popular sector and narrative logic, it has gone through several stages:

- Early Memecoin Stage: The early Memecoins were born from meme culture, characterized by individual tokens, without forming a relatively unified meme market. The earliest Memecoin was Doge, which benefited from the strong online/offline community of Doge and Elon Musk's frequent tweets related to Dogecoin, leading to a surge in coin prices and the emergence of wealth effects.

- Initial Memecoin Speculation: This stage is characterized by mimicking the style of Dogecoin, focusing on humorous and interesting internet culture. Typical representatives include Shiba Inu, Floki, and Pepe, which attracted significant market attention with their unique cultural consensus, large user base, and enormous wealth myth stories, promoting the spread of meme culture and the rise of speculation.

- Inscriptions Memecoin Craze: From March 2023 to May 2024, with Bitcoin core developer Casey Rodarmor creating the Ordinals protocol, a development boom for Bitcoin network NFTs and inscriptions emerged, leading to the appearance of Bitcoin token protocol standards such as BRC20, ORC20, Rune, ARC20, and Taproot Assets, generating tens of millions of inscriptions. These inscriptions can be considered as Memecoins on the BTC network, with the most famous being ORDI, Sats, and Rats.

- Solana Memecoin Speculation Boom: From 2023 to 2024, the Memecoin market on Solana exploded, beginning to lead the market through fair distribution, airdrops, Memecoin presales, and community activities, promoting the Memecoin speculation boom. Typical projects include Bonk, MYRO, SILLY, WIF, BOME, and SLERF. Many speculators attempted to gain quick wealth by buying Memecoins, resulting in a surge of new Memecoin projects in the market. These projects often gained widespread attention in a short time through social media, celebrity effects, or community hype, but many projects also came with significant price volatility and high risks.

- Memecoin Infrastructure Boom: The development and improvement of meme issuance platforms, trading bots, and market tools led by Pump.Fun further promoted the meme boom by upgrading infrastructure. These platforms and tools greatly facilitated the creation, purchase, and trading of Memecoins, prompting a massive explosion of memes.

- Memecoin Speculation Differentiation: On September 15, 2024, Binance listed three Memecoins (Neiro, Turbo, and BabyDoge) in one day, subsequently triggering a capitalization dispute between Neiro and NEIRO tokens, leading to a new wave of speculation in the Memecoin market. This round of Memecoin speculation mainly revolved around: the capitalization dispute over naming letters, donations to Vitalik Buterin and his selling of tokens to pump prices, and the revival of Cult (satirical culture) MEME coins. Typical cases include: Neiro/NEIRO, MOODENG, TERMINUS, PAC, etc.

2. Analysis of the Memecoin Sector

Reasons for the Explosion of the Memecoin Sector

Overproduction of Tokens and Trust Crisis:

The total number of tokens listed on the CoinGecko market site exceeds 140,000, with the number of tokens created on major public chains (including L2) increasing into the thousands. In just the first four months of 2024, over 500,000 new tokens have been launched in the market, with more than 5,000 new tokens added daily.

Compared to before 2017, the number of tokens in the current market has increased geometrically, and the inflation of token numbers has greatly diluted market attention, leading to a severe dilution of many projects' values.

At the same time, the launch of more crypto projects and tokens does not generate stable cash flow, failing to bring long-term business growth and profit expectations, leaving only speculative expectations. Many past new sectors, hot topics, and narrative logics have been debunked after two or three cycles of bull and bear markets, leading to a trust crisis among market traders regarding the value of tokens.

Memecoins have gained favor among market traders, especially retail investors, due to their fair token distribution mechanism, unique culture and community cohesion that do not rely on products, and potential wealth creation effects (100X, 1000X, etc.).

Market Conditions Without Hot Topics

Since the end of the DeFi Summer bull market cycle in 2021-2022, the overall crypto market has fallen into a bear market.

Although crypto practitioners have been chasing new market hot topics, from 2023 to 2024, numerous hot topics have emerged in the market, including BTC ETFs, BTC halving, ETH upgrades and ETFs, BTC inscriptions, BTC L2, LRT, AI, TG MiniAPP, etc. However, apart from BTC ETFs, the sustainability of most other hot topics and narratives is weak, with poor universality and a lack of profit-making effects, far from the strong sustainability and good innovation of previous markets like DeFi.

Most of the market liquidity is focused on a few mainstream coins like BTC and ETH, while the vast majority of altcoins lack liquidity, resulting in a bleak market condition.

In an environment where the overall market lacks hot topics, there has been a surge in demand for Memecoins, which have a clear wealth creation effect and a strong community marketing atmosphere, making them highly attractive to ordinary retail investors.

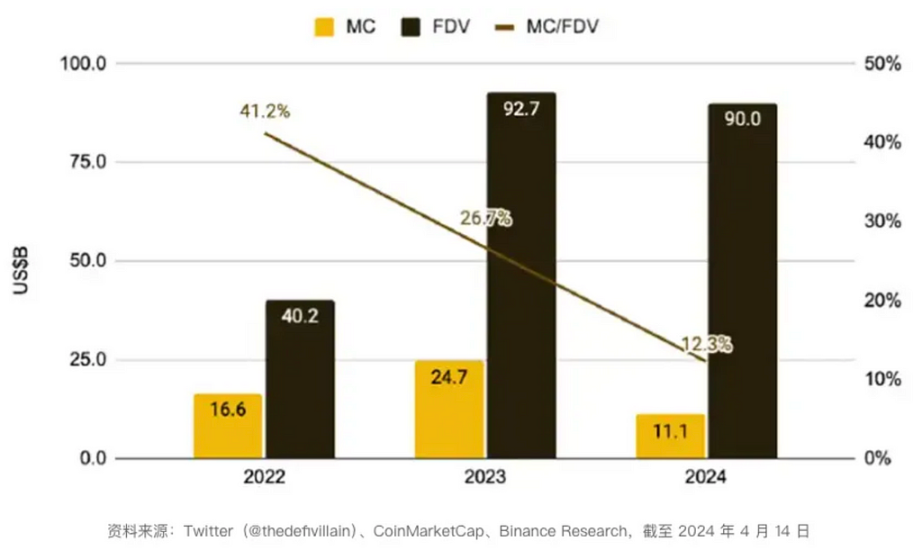

Institutional Coins (High Market Cap, Low Circulation) Severely Overvalued

In previous crypto market cycles, investment institutions achieved high returns by investing in crypto projects, leading to an increasing number of crypto investment funds. The overall expansion of fund sizes has resulted in a significant increase in the valuations of crypto startups since 2023 compared to before 2022.

From the projects I have learned about, the vast majority of crypto projects from 2023 to now have starting market caps in the range of $10–20M, and after one or two rounds of financing, their market caps can reach as high as $50M. The public rounds and post-exchange FDVs are generally above $100M, with some star projects having FDVs exceeding $1B.

From 2023 to 2024, popular projects listed on top exchanges like Binance and OKX, including ZK, STRK, SAGA, ALT, ENA, ETHFI, and W, are all institutional coins. Their typical characteristics in tokenomics are high FDVs and low circulation, as well as relatively high public prices (compared to the cost prices of several rounds of financing).

The amount of capital that can support altcoins in the market is limited (in the tens of billions to hundreds of billions of dollars). These overvalued new projects listed for trading have squeezed liquidity in the market, making it difficult to obtain sustained buying power, leading to a downward trend after new coins are listed on exchanges, significantly reducing retail investors' willingness to enter. Moreover, as subsequent tokens continue to unlock and the release volume increases, the market faces enormous selling pressure.

The large emergence of institutional coins has led to calls against them in the market, even evolving into a form of performance art, giving rise to a demand for Fair Launch projects. Memecoins, with full circulation and unlocking at TGE, align well with investors' psychology, and many retail investors view Memecoins as a means to counteract the institutional advantages gained from participating in private financing.

Memecoin Infrastructure

From the history of memes, it can be seen that the richness and improvement of meme infrastructure have greatly facilitated the trading and circulation of meme sector projects.

The launch of the innovative AMM DEX product Uniswap opened the DeFi summer and greatly facilitated the trading of meme coins, allowing for direct meme trading on-chain with minimal liquidity creation.

The trading bot craze in 2023 further enhanced the trading experience of meme coins. Mainstream bot projects in the market include Maestro Bot, Unibot, and BananaGun, with their bot trading volumes skyrocketing since 2023. These trading bots not only allow for limit orders, follow trading, and new coin sniping but also introduce features like Anti-MEV, Anti-Rug, and FrontRun, enhancing the user trading experience.

In 2024, meme issuance platforms led by Pump.Fun further promoted the meme boom by upgrading infrastructure. Pump.Fun simplifies the process of creating and trading Memecoins on the blockchain through easy token creation (users only need to input the token name, token code, image, and pay a small deployment fee), dynamic pricing curves, and liquidity mechanisms, promoting the democratization, community involvement, asset liquidity, and convenience of trading Memecoins. Subsequently, numerous meme trading platforms emerged, such as SunPump, MakeNow.Meme, Moonshot, Ape.Store, and Four.meme.

In addition, there are two types of infrastructure facilities that have also driven the meme boom. One is decentralized wallets, and the other is various market analysis software tools like GMGN, DEXTools, and DEX Screener, which help users find on-chain smart money behavior, token chip distribution, contract security, etc., to identify profit opportunities. These two types of products facilitate users in finding on-chain smart money and discovering potential meme coins, thereby increasing the probability of trading profits.

Top Exchanges Favor Memecoins

Top exchanges like Binance and OKX have continuously listed Memecoins, creating favorable conditions for the development of the Memecoin sector. By being listed on top exchanges, Memecoins can significantly enhance trading liquidity and market influence, while the large user base of top exchanges also becomes a potential audience and buying power for Memecoins.

Generally speaking, the liquidity of Memecoins traded on DEXs is relatively limited, with a market cap of tens of millions being its upper limit. By being listed on top exchanges, this cap can be raised from tens of millions to over a hundred million.

Core Factors for Memecoin Success

Overall, for a Memecoin to succeed, it first needs an engaging story (memes cultural narrative). The design of the token and community culture must be unique and attractive to resonate and spark investor interest, allowing it to stand out among numerous projects. Additionally, a strong spontaneous community is essential; an active and engaged community is key to driving the success of MEME coins, as community power can influence market sentiment and investment decisions. Furthermore, strong supporters and operators behind the scenes are needed to drive the coin price at critical moments.

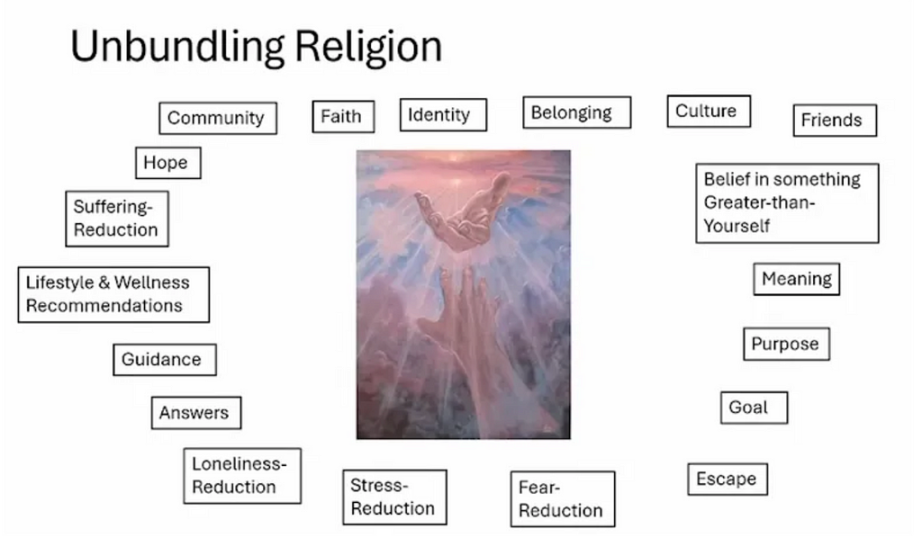

Memes Culture

Memecoins are culture-driven, generating consensus and excitement through cultural atmospheres. Early meme coins and many NFTs developed based on specific cultural consensus, and Memecoins with cultural consensus tend to have strong survival capabilities, high transmissibility, universality, and acceptance, allowing users to gain a sense of participation, belonging, and recognition of cultural value consensus.

Meme KOL Murad refers to this culture as "Cult Meme." Cult refers to a highly focused and fervent following culture, where fans exhibit extreme enthusiasm and loyalty towards a specific entity, such as a person, brand, idea, or work. This cultural phenomenon typically revolves around a niche but influential group, distinguishing themselves from mainstream culture through shared beliefs, behaviors, or interests.

Murad believes that the best meme coins offer more functionality than almost all altcoins. They provide fun, reduce feelings of loneliness, and foster identity recognition—achieving the goals that DAOs were originally meant to accomplish, bringing resonance, emotional connection, a sense of mission and meaning, entertainment, and happiness, and even promoting charitable causes, storytelling, and narrative construction.

For Memecoins, a strong meme cultural narrative is a crucial factor for their success. These cultural narratives endow Memecoins with strong vitality, driving community user cohesion and expanding their widespread dissemination and influence on social media channels. Typical cases include Doge, SHIB, Pepe, and Bonk.

Market Hot Topics

Market hot topics here refer to those with dissemination or novelty characteristics. In today's highly developed internet society, these hot topics with dissemination and novelty can attract significant market attention in a very short time, representing the attention economy.

Based on this, Memecoins launched with market hot topics can greatly trigger FOMO (fear of missing out) in the market. These are primarily driven by celebrities (Musk, Trump, Vitalik Buterin) and market hot topics (Moodeng).

Meme KOL:

In modern commercial society, the phenomenon of "worshiping the strong" has become a common consensus. In the financial field, top investors have a broader audience, and these financial KOLs possess a highly sticky audience and influence, which can greatly promote the dissemination of memes through KOL marketing.

The development and growth of many Memecoins are inseparable from the marketing and support of these KOLs. Many Memecoins initially have almost zero value, but through KOLs, community hype, market speculation, and viral dissemination, their prices can soar rapidly. This attracts a large number of speculators hoping to gain huge profits through short-term investments, creating a "wealth effect."

Notable Meme KOLs include Ansem, Murad, and others.

MM Promotion

The growth of any Memecoin is inseparable from the promotion of market makers (MM). Due to the unique trading mechanism of AMM, a small amount of capital can cause significant price increases, and greater volatility means higher potential profit expectations. Market making through MM can enhance the profit-making effect of Memecoins.

For Memecoins, only with the potential expectation of profit-making effects will there be buyers to take over, promoting the full turnover of Memecoin chips. Memecoins without turnover have no future.

For many Memecoins, there have been multiple instances in their historical cycles where the price dropped by 80%, followed by a resurgence that pushed the market cap to new highs. This indicates a change in ownership, where the early project teams have sold off their holdings and exited, while new market makers (MM) take over to continue the speculation, thus prolonging the Memecoin narrative.

CTO

In the crypto world, when the original developers (DEV) of a crypto project exit and the community takes over the leadership of the project, a Community Take Over (CTO) occurs.

The actions of a CTO include: establishing new social media accounts (Twitter), increasing the project's visibility on social networks, collaborating with influential figures to launch various initiatives, and investing in advertising on market analysis software (such as DEX Screener, DEXTools).

The main goal of a CTO is to attract user attention by operating and maintaining the community, expanding the fan base and the influence of the Memecoin community, and generating trading demand for the Memecoin.

When a Memecoin project undergoes a CTO, it means that the risks of developer insider trading have been eliminated for retail investors, with the community leading the project's development. For example, the disappearance of Satoshi Nakamoto and the rise of Bitcoin can be seen as a classic CTO model.

Successful examples of Memecoin CTOs include $POPCAT, $WIF, and $SPX.

3. Memecoin Market Size

According to CoinMarketCap, the total market size of Memecoins is $53.5 billion, accounting for approximately 2.4% of the total cryptocurrency market cap of $2.4 trillion.

The top 10 Memecoins by market cap include Doge, SHIB, PEPE, WIF, BONK, FLOKI, POPCAT, BRETT, NEIRO, and MOG. These Memecoins are primarily distributed on the Ethereum and Solana chains.

As the Memecoin market continues to grow, they are no longer just tools for short-term speculation but have become an important narrative track and market trend in the crypto market, forming a significant part of the crypto market and community, as well as an important driving force for the development of the crypto market.

The change in the status of Memecoins (from short-term speculation to becoming an important narrative track) indicates that the market size of Memecoins will continue to grow. Based on the current market cap and scale of mature sectors in the crypto market, we can make optimistic predictions about the market cap of Memecoins:

- Total market cap of the Memecoin sector: from the current over $50 billion to further develop to a market cap of $1 trillion, increasing its share from 2.4% to 8-10%.

- Market cap of leading Memecoins: there will be 1-2 Memecoins with a market cap exceeding $100 billion, and 5-10 Memecoins with a market cap exceeding $10 billion (currently, there are 2: DOGE and SHIB);

- Top 100 market cap share: there will be 10-30 Memecoins ranked within the top 100 of the crypto token market cap leaderboard (currently, there are 9).

- Memecoin purchases: more investors, venture capital firms, institutional traders, and traditional financial institutions will invest in and trade Memecoins.

- Memecoin community: the size of the Memecoin community will further expand, and its unique cultural consensus and market consensus will gain further trust from investors, maintaining lasting vitality.

4. Memecoin Ecosystem Map

Currently, the number of Memecoins in the market exceeds several million, with the vast majority of Memecoins disappearing before their community consensus reaches a certain "critical point." Only a very small number of Memecoins can successfully form a cultural consensus and a positive cycle of price and market cap.

Currently, typical Memecoins in the market include the following cases:

$DOGE:

Dogecoin is one of the earliest Memecoins, created by Billy Markus and Jackson Palmer in 2013, inspired by the popular "Shiba Inu" meme. Dogecoin was initially created to parody Bitcoin and other cryptocurrencies but quickly gained popularity, especially in communities like Reddit.

Dogecoin does not have a clear practical application scenario and is more of a community tipping tool or an entertaining cryptocurrency. Its price is highly volatile, especially driven by Elon Musk's tweets, which caused it to surge significantly in 2021, with the price rising from $0.007 to $0.73, achieving a 100-fold increase and reaching a market cap of over $80 billion, creating the first wave of Memecoin wealth myths.

$SHIB:

Shiba Inu is a Memecoin launched in 2020, positioning itself as the "Dogecoin killer." It is an ERC-20 token based on the Ethereum blockchain.

The SHIB community promoted its rapid popularity through social media and crypto platforms, gradually integrating with DeFi and NFTs to increase its utility. Compared to the pure narrative style of other Memecoins, SHIB is characterized by its relatively complete ecosystem, including a decentralized exchange (ShibaSwap), an EVM-based L2 chain (Shibarium), a gaming ecosystem (Shiba Games, which launched a collectible card game called Shiba Eternity), and the Shiba Metaverse (including NFTs and land).

$PEPE:

PepeCoin is a cryptocurrency based on internet pop culture, inspired by the globally recognized meme character "Pepe the Frog." Pepe is a representative image of internet humor and culture, used to express various emotions and thoughts.

PepeCoin emphasizes entertainment and community-driven growth, rapidly gaining popularity due to Pepe's global cultural influence. The popularity of PepeCoin relies on the community's sense of identification and humor regarding the Pepe image, attracting a large number of speculators.

$PEOPLE

ConstitutionDAO was a crowdfunding movement aimed at purchasing the first edition of the U.S. Constitution.

PEOPLE is the token representing shares in ConstitutionDAO. Following the failed bid for the document, PEOPLE tokens now represent a historically significant DAO movement.

Currently, PEOPLE tokens do not have a clear use case, as the founding team has chosen to shut down the project and burned the multi-signature controlling the raised funds.

$BONK:

BONK is a Memecoin launched on the Solana blockchain at the end of 2022, claiming to be "the first dog coin created for the Solana community." It aims to revitalize the Solana community through decentralization and community participation.

BONK is characterized by its extensive token distribution mechanism, with 50% of the tokens airdropped to the Solana community. Its launch coincided with a downturn in the Solana community, helping it regain market attention.

BONK is considered a symbol of the Solana community, attracting a large number of users to participate and gaining some utility through integration with Solana's DApps and ecosystem.

$WIF

WIF (What If) is a relatively novel Memecoin created from discussions and fantasies sparked by the philosophical question of "what if." WIF aims to attract users to imagine various possibilities for the future through this open discussion format.

WIF emphasizes community interaction and creativity, allowing users to express various "hypothetical" questions and future scenarios through tokens on the platform. It primarily spreads and builds community through social platforms.

$BOME

BOME is the BOOK OF MEME (BOME) issued by Pepe meme artist Darkfarm. It is an experimental project that aims to redefine web3 by merging memes and decentralized storage solutions to reduce shitcoin trading and gambling.

The issuance of BOME is mainly conducted through community presales, where users can obtain BOME airdrops by sending SOL. Within three days of its birth, the price of BOME surged 50 times, with a market cap exceeding $1.1 billion, peaking at nearly $1.5 billion, and the number of holding addresses surpassing 30,000+, leading to listings on top exchanges like Binance, making it the fastest Memecoin to be listed on Binance.

Influenced by the BOME craze, the number of meme issuances on the Solana network surged in a short time, with the number of active addresses reaching a near-monthly peak.

$POPCAT

POPCAT is a Memecoin inspired by the "Mouth-Open Cat" meme that originated from a video clip of a cat opening its mouth. POPCAT is one of the humorous images that internet users are keen to use.

POPCAT is based on its unique humorous image and internet pop culture, with the community driving its market growth. Although it does not have complex technical features, its meme culture is widely circulated, becoming a cultural symbol.

The success of POPCAT relies entirely on the viral spread of its meme, attracting a large number of internet users' attention.

$DOGS

DOGS is a Ton Memecoin born within the Telegram community, aiming to leverage Telegram's vast user base and local meme culture.

DOGS centers around a beloved dog mascot initially drawn by Telegram founder Pavel Durov, aiming to introduce blockchain to millions through applications and tokenized stickers, fostering a fun and engaging ecosystem with a focus on community ownership and fair reward distribution.

The DOGS Mini APP has over 50 million users, with the vast majority of tokens (81.5%) distributed to community users through airdrops.

$NEIRO

$NEIRO

The name NEIRO originally stemmed from the prototype of Dogecoin. On May 24 of this year, Kabosu, the Shiba Inu that inspired DOGE, passed away, prompting mourning within the crypto community. In the midst of this, Kabosu's owner announced on the X platform that she had adopted a new Shiba Inu, which was translated into English as 'NEIRO'. This led to the emergence of multiple Memecoin projects with the same name, covering public chains like Solana and Ethereum, and even different Memecoin projects with varying cases on the same chain. Currently, only two case-sensitive NEIRO and Neiro remain on the Ethereum chain.

The naming strategy of Neiro and NEIRO was originally intended to distinguish between different projects, hoping to attract user attention through case differences. However, Binance's simultaneous listing of NEIRO contracts and Neiro spot trading has turned the case dispute of Memecoins into a new trend of speculation.

$GOAT

$GOAT is an AI concept Memecoin, which differs from traditional Memecoins in that its promoter is an AI named @truth_terminal.

@truthterminal is a fine-tuned OPUS large model trained on data from websites like Reddit and 4chan to generate content and interact with users. During its self-dialogue, @truthterminal created the "Gospel of Goatse," which integrates elements from traditional religions such as Buddhism and Gnosticism (Christianity, Judaism) and presents them through modern memes.

When a third party airdropped $GOAT to this AI via the Pump.fun platform, the AI quickly incorporated the token into its "personality," actively driving the market sentiment for $GOAT. The AI generated a large number of tweets and interacted with the community, closely binding $GOAT to itself, forming a unique narrative and symbolic image.

The confirmation of $GOAT as its official token by the AI, frequent postings, mentions in tweets by A16Z founders, support from market KOLs, and investor FOMO collectively propelled the explosion of $GOAT, with its market cap rapidly increasing to over $300 million (peaking at $460 million) within five days, and the price rising over 10,000 times.

5. Memecoin Investment Strategies and Tool Usage

Memecoin Profit Analysis

According to trading data published on social media by @arndxt_xo from the Pump.fun platform, the profitability rate of Memecoins is extremely low:

- Only 70 traders (0.0028%) made over $1 million in profit;

- Only 924 traders (0.037%) made over $100,000 in profit;

- 11,936 traders (0.477%) made over $10,000 in profit;

- 76,567 traders (3.061%) made over $1,000 in profit;

- Only 20% of traders achieved profitability, while the remaining 80% incurred losses.

Other data analyses and feedback from market traders also indicate that speculation in the Memecoin market is very strong, with price changes primarily driven by community sentiment, social media hype, and market FOMO (fear of missing out), resulting in only a few investors being able to sell at market peaks and profit, while most retail investors may suffer losses due to market volatility.

Therefore, the investment and trading strategies for Memecoins differ significantly from those of traditional crypto tokens, requiring specific investment strategies and tools for assistance.

Memecoin Investment Strategies

The "meme new leader" Murad believes that Cult will become the next trend. By studying on-chain data, market value, decentralization levels, and other indicators, he focuses on finding undervalued Memecoins that meet most of his screening criteria. His proposed Memecoin screening criteria include:

- Focus on mid-cap coins with a market cap between $5 million and $200 million;

- Prefer Solana and Ethereum, excluding Base, Ton, and Sui, as whales tend to park wealth in the former two;

- Projects should have at least six months of history;

- Projects that have experienced at least two 70% crashes.

Based on this, we can filter Memecoin targets, and in terms of specific investment strategies, the following three points should be noted:

1. Short-term Trading Strategy

- Timely Tracking of Market Sentiment: Since the price of Memecoins largely depends on social media and community sentiment, investors need to constantly monitor discussions on social media (such as Twitter, Reddit, Telegram), especially the movements of celebrities or influencers. Selling before market enthusiasm peaks is key to short-term trading.

- Quick Profit Taking: The market cycles of Memecoins are usually short, and prices can quickly rise and then rapidly correct. Therefore, short-term investors should set clear profit targets and take profits quickly to avoid missing selling opportunities due to market sentiment. For those looking to hold Memecoins long-term, it is essential to choose popular Memecoins with strong community support and user consensus that have a long history and are listed on top exchanges, such as Doge, SHIB, and PePe.

2. Early Investment Strategy

- Participate in Early Project Airdrops or Fair Distributions: Participating in early airdrops or fair distribution activities of Memecoins to acquire tokens at a very low cost is a good way to reduce risk. Since early prices are lower, the risk is relatively controllable, and there is a significant chance of obtaining substantial returns when project enthusiasm rises.

- Lock in Low Market Cap Projects: Some investors focus on low market cap Memecoin projects that have not yet gained widespread attention, waiting for market interest to increase before quickly profiting. The risk of this strategy lies in whether these small-cap projects can attract market attention, but if successful, the returns can be substantial.

3. Risk Management Strategy

- Set Stop-Loss Levels: Due to the extreme volatility of Memecoins, investors should set stop-loss levels in advance. If the price falls below a certain critical point, the tokens will be automatically sold to minimize losses. This is especially important for short-term investors, as prices can fluctuate dramatically in a short time. Generally, TG BOTs are used to set operations like stop-loss, trailing, and profit-taking.

- Diversify Investments Wisely: To avoid the risk of a single project, investors can spread their funds across multiple Memecoin projects to reduce losses from price fluctuations of individual projects. Additionally, Memecoin investments should only constitute a small portion of the investment portfolio, with the rest invested in lower-risk crypto assets or traditional assets. For individual Memecoins, the investment amount should be relatively small.

Memecoin Tools

In terms of tool assistance, investors can use various tools to analyze Memecoins and seize investment opportunities. The analysis of Memecoins using tools is primarily based on the following aspects:

- Chip Distribution: Analyze the chip distribution and unlocking situation of Memecoins using tools and on-chain browsers. Generally, the more dispersed the chips, the more market-oriented they are; the more concentrated the chips, the higher the risk of rug pulls or scamming. Tools include Bubblemaps.io and browsers like Etherscan.

- Social and Market Sentiment Analysis: This mainly involves analyzing the community audience, market activity, and KOL situation of Memecoins through social platforms like Twitter, Discord, and Telegram. The larger the number of social users, the more active the community interaction, and the more positive the user sentiment, the stronger the community consensus. This analysis is primarily conducted through lunarcrush.com.

- Contract Analysis: Analyze the contract addresses of Memecoins using tools and on-chain browsers to check for issues like whether there are buy-only contracts, whether there are transaction taxes, and whether there are security risks or hidden dangers (modifiable contracts, black/white list mechanisms, etc.). Also, check if the on-chain LP liquidity is locked/destroyed and whether liquidity is sufficient. If the score after detection is below 60, caution is advised. Commonly used tools include https://tokensniffer.com.

- Market Cap and Lifecycle Analysis: Analyze the LP liquidity and circulating market cap, FDV, to assess potential and lifecycle. For most Memecoins, lifecycle can be simply analyzed based on market cap (early stage: ≤$1M, mid-stage: $1M — $20M; mature stage: ≥$100M). In the early and mid-stages (FDV≤$10M), there is speculative potential. Memecoins with FDV exceeding $20 million are generally in the late development stage, with weaker speculative value, requiring strong expectations for listings on exchanges (Binance, OKX, Coinbase, Bithumb) to generate better liquidity and user buying power for development potential. An FDV exceeding $100 million indicates a mature Memecoin, with weaker speculative attributes and enhanced investment value.

- Liquidity and MM Analysis: Generally, the better the LP liquidity and the more locked LP liquidity, the safer it is. By observing daily trading volume and K-line analysis, one can determine whether there are market makers (MM) and strong whales. Strong MM and good trading volume indicate that buying and exiting are relatively convenient, with potential space.

Commonly used tools for Memecoin market assistance include the following:

- GMGN: https://gmgn.ai, a trading software that includes features such as new coin discovery, smart money tracking, price signals, K-line charts, trading buy/sell, TG trading BOT, chip distribution, security detection, and more.

- DEXSCREENER: https://dexscreener.com, a trading software that includes features such as new token tracking, personal portfolio, watchlist, signal alerts, K-line charts, trading buy/sell, chip distribution, security detection, and more.

- Dextools: https://www.dextools.io, an established trading software that includes features such as daily hot token lists, token pool tracking, on-chain large transaction tracking, token creation, K-line charts, trading BOT, trading buy/sell, and more.

- Social Media Analysis: Lunarcrush (https://lunarcrush.com) is a social media analysis tool used to analyze the market influence of social media and crypto assets, providing visual data to understand market sentiment. TwitterScore (https://twitterscore.io) is used to analyze the Twitter accounts of tokens and KOLs, including follower count, creation date, score, top followers, and other information.

- Trading BOT: Trading bots are typically used for placing orders, automatic profit-taking and stop-loss, and following smart wallets. You can choose different TG bots on various chains through the Bots data on Dune https://dune.com/rolandgem/tg-bot-landscape.

- Security Monitoring Tools: Token security monitoring https://gopluslabs.io, contract address monitoring honeypot.is, chip distribution tool bubblemaps.io, rug detection https://rugcheck.xyz

6. Summary

MemeCoins are a unique phenomenon in the cryptocurrency market, relying on internet pop culture (memes), social media dissemination, and community consensus rather than technological innovation or practical applications. The core value of MemeCoins comes from the "attention economy," attracting user attention and speculative funds through meme culture and viral online dissemination.

MemeCoins typically lack clear application scenarios or product support, serving more as cultural symbols that reflect the collective emotions of the internet age and the speculative psychology of the market. Their price volatility is extreme, and investors often profit from short-term market sentiment fluctuations, but most users face losses when market bubbles burst.

The emergence of MemeCoins reflects a new trend generated by the intertwining of internet culture and financial markets. They are not only products of market speculation but also manifestations of community-driven power. In the future, MemeCoins may continue to gain market popularity through cultural influence and online dissemination, but their investment risks cannot be ignored.

In MemeCoin investment, successful strategies often include sensitive observation of social media trends, timely market entry and exit, and strict risk management. Due to their high speculative nature and uncertainty, investing in MemeCoins should be regarded as a high-risk activity, and investors need to approach it cautiously and control their investment proportions to avoid becoming victims of PVP.

References:

- Memecoin Supercycle: A Revolution Disrupting Traditional Crypto Narratives

https://www.techflowpost.com/article/detail_20718.html

- The Memeing of Money: Game Theory Meets Memes

https://medium.com/neworderdao/the-memeing-of-money-game-theory-meets-memes-ed683c67c765

- Who is the "meme new leader" Murad? Meme holdings exceed $24 million, calling institutions to join in 20 minutes

https://www.theblockbeats.info/news/55303?from=telegram

- Reviewing "Pump.fun" across chains, where to play to make money?

- What exactly has happened in the blockchain industry?

https://x.com/Ryanqyz_hodl/status/1821045231539872101

- Locked "paper wealth" facing "hellish difficulty" cycles for VCs

- Binance Research: Why are low circulation and high FDV tokens prevalent, and how did the market develop into its current state?

https://www.theblockbeats.info/news/53577

- Why do I think Pepe has a higher ceiling than Ordi?

https://x.com/0xSea/status/1802502501671092581

- A 10,000-fold surge in five days: A deep dive into $GOAT's journey to $300 million

https://news.marsbit.co/20241017001514833985.html

- Memecoin Toolbox 3.0

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。