The reasons for the poor performance of Ethereum ETFs include low investor activity during the summer, a sideways market, and traditional investors' unresolved need to understand Bitcoin. Nevertheless, the related ETFs are still growing rapidly, and their future remains full of potential.

Written by: @HHorsley

Translation: Plain Blockchain

Why hasn't the performance of Ethereum ETFs been better?

This was a question I received at an event last week. Here are a few points I would like to share.

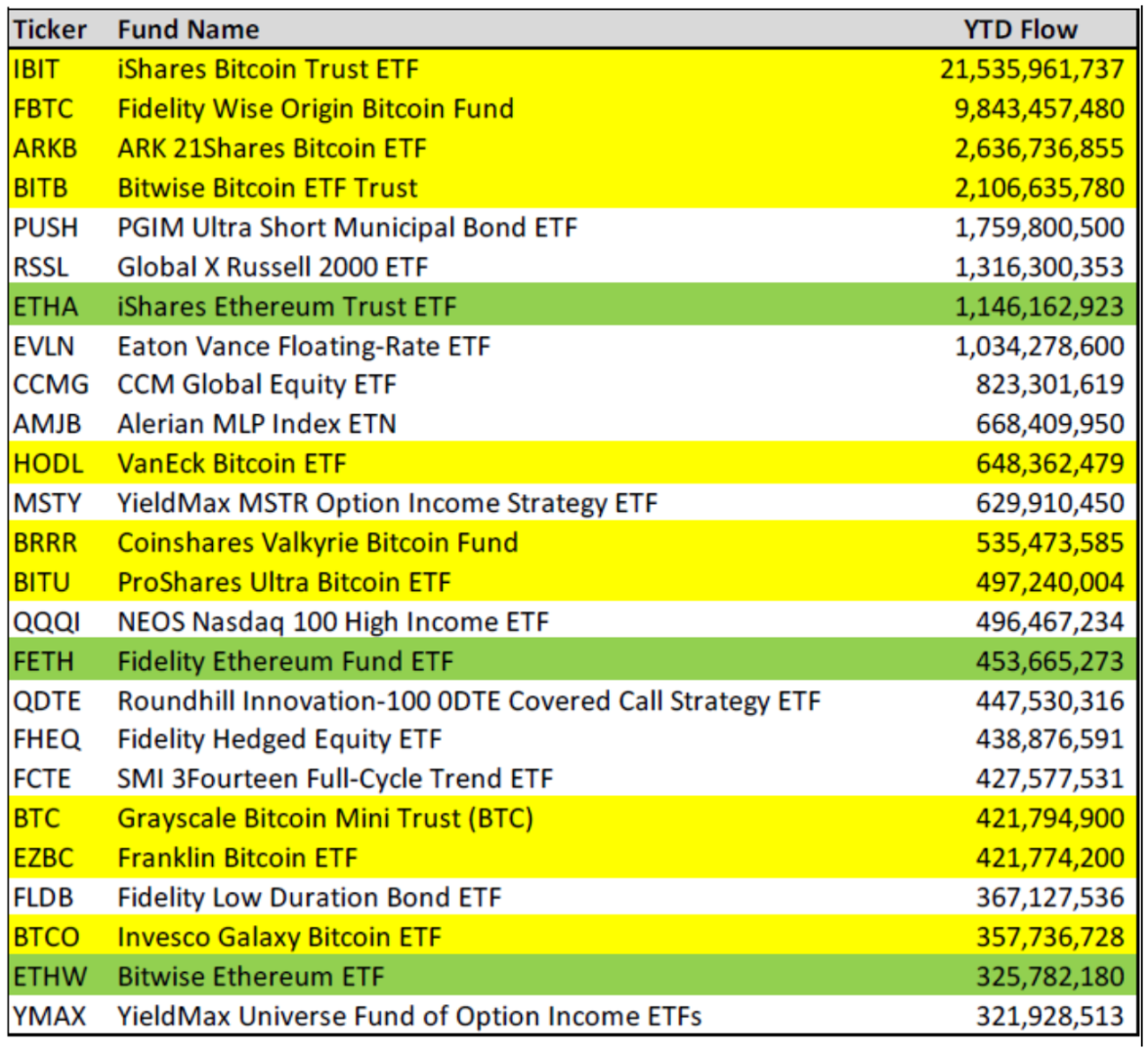

Among the 525 ETFs launched in 2024, 13 belong to the top 25 and are related to Bitcoin or Ethereum. If we include the MSTR options strategy ETF, there are a total of 14. The top four ETFs are all spot Bitcoin. Of the seven crypto-related ETFs, five are. I call this masterpiece "no (market) demand."

First, how do we judge success? The ETFs from iShares, Fidelity, and Bitwise are among the top 25 fastest-growing new ETFs this year.

I believe there are three factors that influenced their launch:

(1) Summer: For many investors, summer is a slow period. People stay informed but do not invest heavily in new projects.

(2) Market: Bull markets always attract more attention. Bitcoin ETFs were launched during a Bitcoin price increase, while Ethereum ETFs were launched in a sideways market.

(3) Following Bitcoin ETFs: For many traditional investors, after the launch of Bitcoin ETFs, they need some time to understand how to incorporate Bitcoin into their portfolios. Ethereum was launched while this issue was still unresolved, making it difficult for attention to shift.

Nevertheless, the three ETFs mentioned earlier are still the fastest-growing this year.

The story of Ethereum ETFs is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。