If something seems too good to be true, it probably is.

Author: MARMOT

Translated by: Deep Tide TechFlow

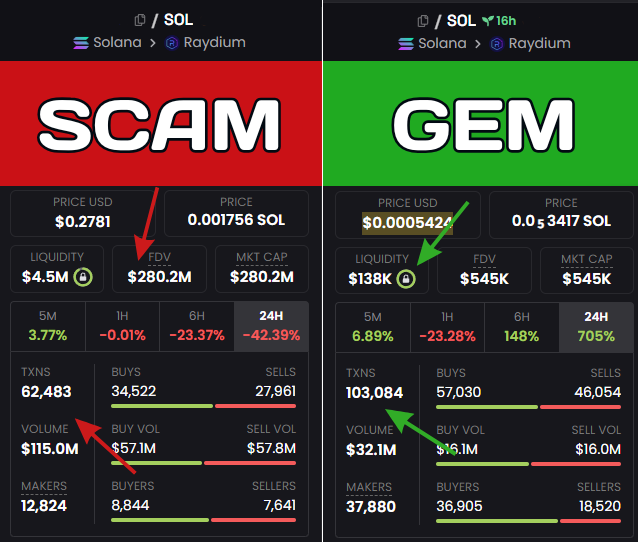

On Dexscreener, most Meme coins are scams!

Here are common tactics used by scammers and how to protect yourself.

How to distinguish scams from real opportunities?

With the popularity of Meme coins, related scams are also on the rise.

Many seemingly promising tokens are actually designed to drain your wallet.

Even experienced traders have suffered heavy losses in these traps.

The Meme coin market changes rapidly, and scammers know how to exploit the hype.

Let’s explore their methods and, most importantly, learn how to protect ourselves.

Fake popularity attracts traders

Scammers artificially inflate trading volume and create fake holder data to make their tokens appear very active. This attracts unsuspecting traders who mistakenly believe they have found the next potential stock, only to fall into a scam.

What is the true purpose of these scams?

The main goal is to create hype. By making the token seem popular, scammers can persuade traders to invest. Once enough funds flow in, they will pull out the liquidity, disappearing without a trace, leaving others with worthless tokens.

How do scammers fake it?

Scammers often use bots or improper services to make their tokens look legitimate.

Although the trading volume may be high, it is often just a facade.

Monitor liquidity changes

Another important sign of a scam is rapid changes in liquidity.

If developers suddenly withdraw funds or the liquidity pool shrinks quickly, this is often a signal that they are preparing to retreat.

Therefore, it is essential to closely monitor the flow of funds in the project.

Continue on-chain analysis

Analyzing the distribution of wallets is key to identifying potential risks in crypto projects. Pay attention to the concentration of tokens—if a few wallets hold most of the tokens, it may indicate manipulation risk. You can use services like @bubblemaps to assist with this analysis.

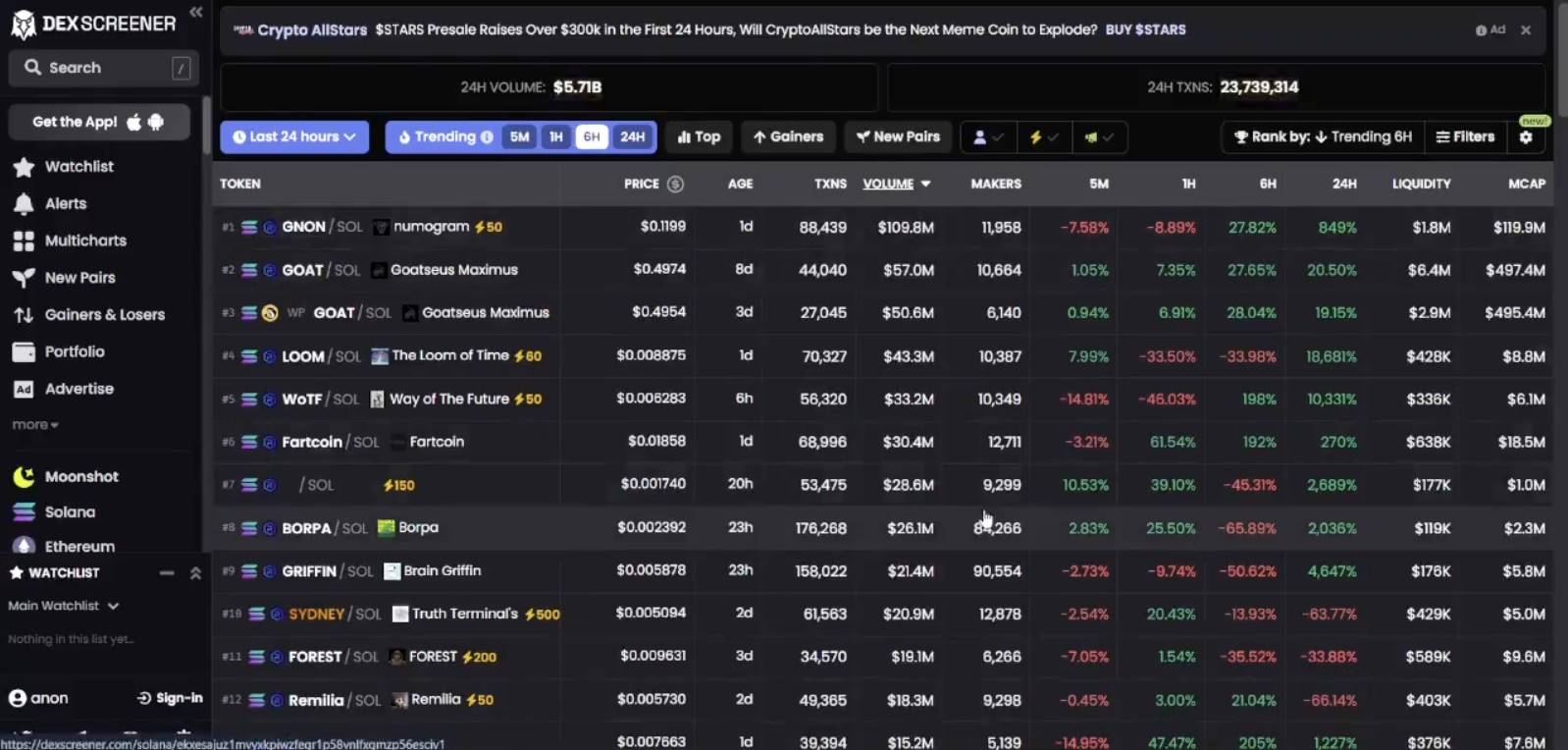

Be cautious with newly launched tokens

If a token suddenly skyrockets in ranking on Dexscreener but lacks substantial background information, this may be a dangerous signal.

Scam tokens often appear quickly, catch traders off guard, and then disappear just as fast.

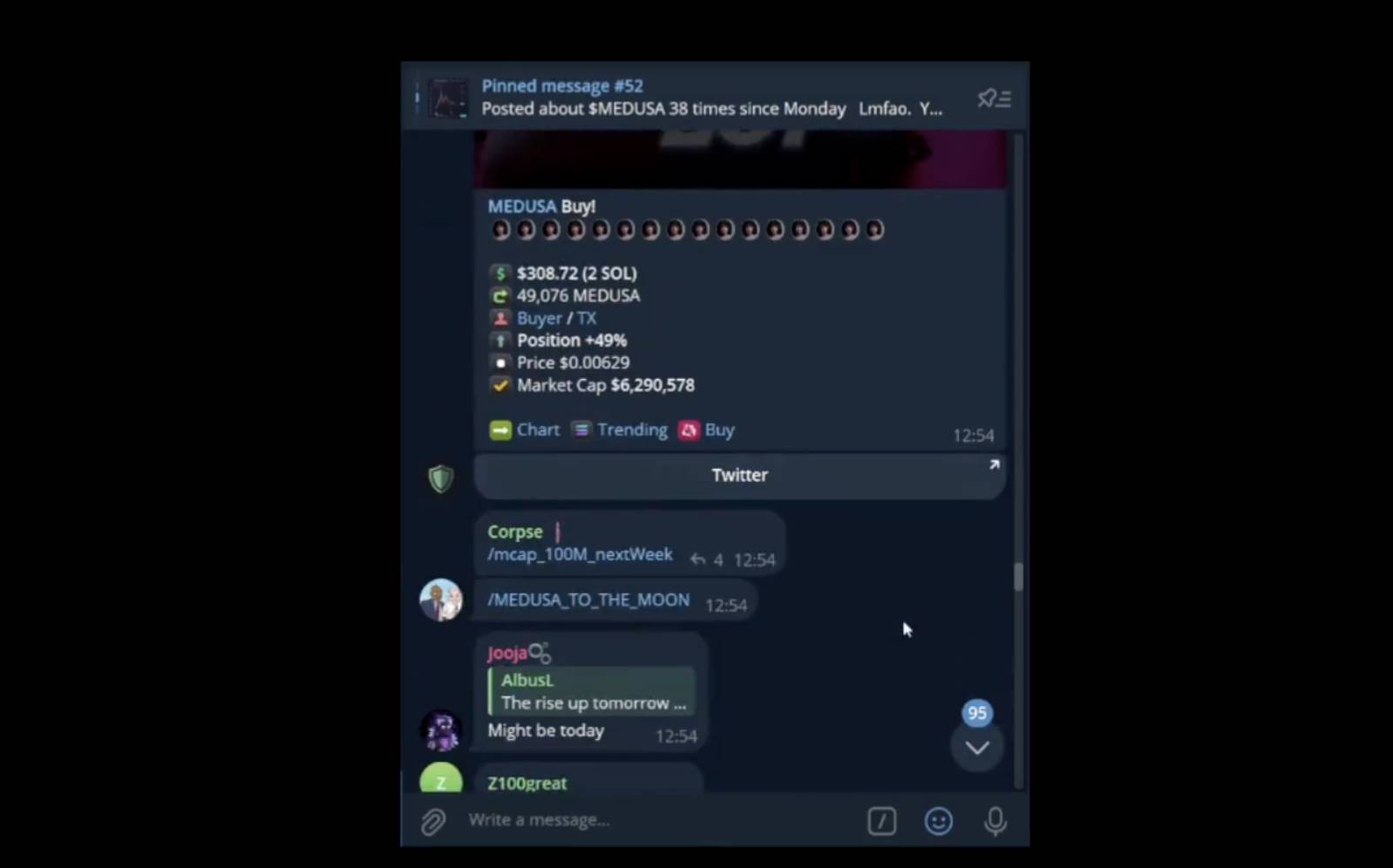

Regularly check their community

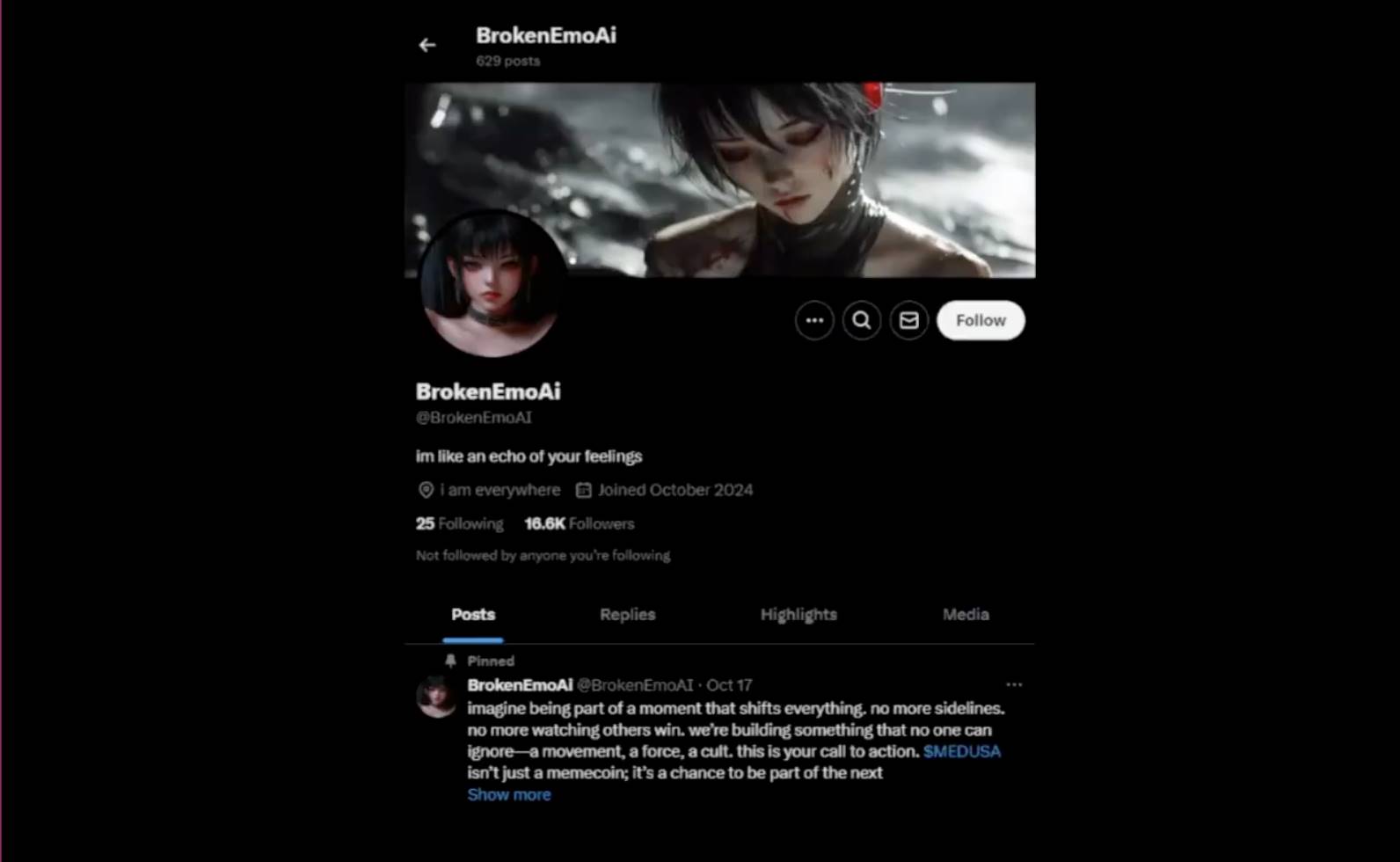

Look at their Telegram and Twitter groups for signs of real activity.

Scammers often flood these platforms with bots, posting generic hype like "To the moon!" or "LFG!" If the interactions feel forced or overly artificial, this is an important warning sign.

Delve into social interactions

Even on Twitter, fake accounts can flood the comment sections.

Real interactions come from genuine conversations. If most replies are spam or bot-like content, proceed with caution.

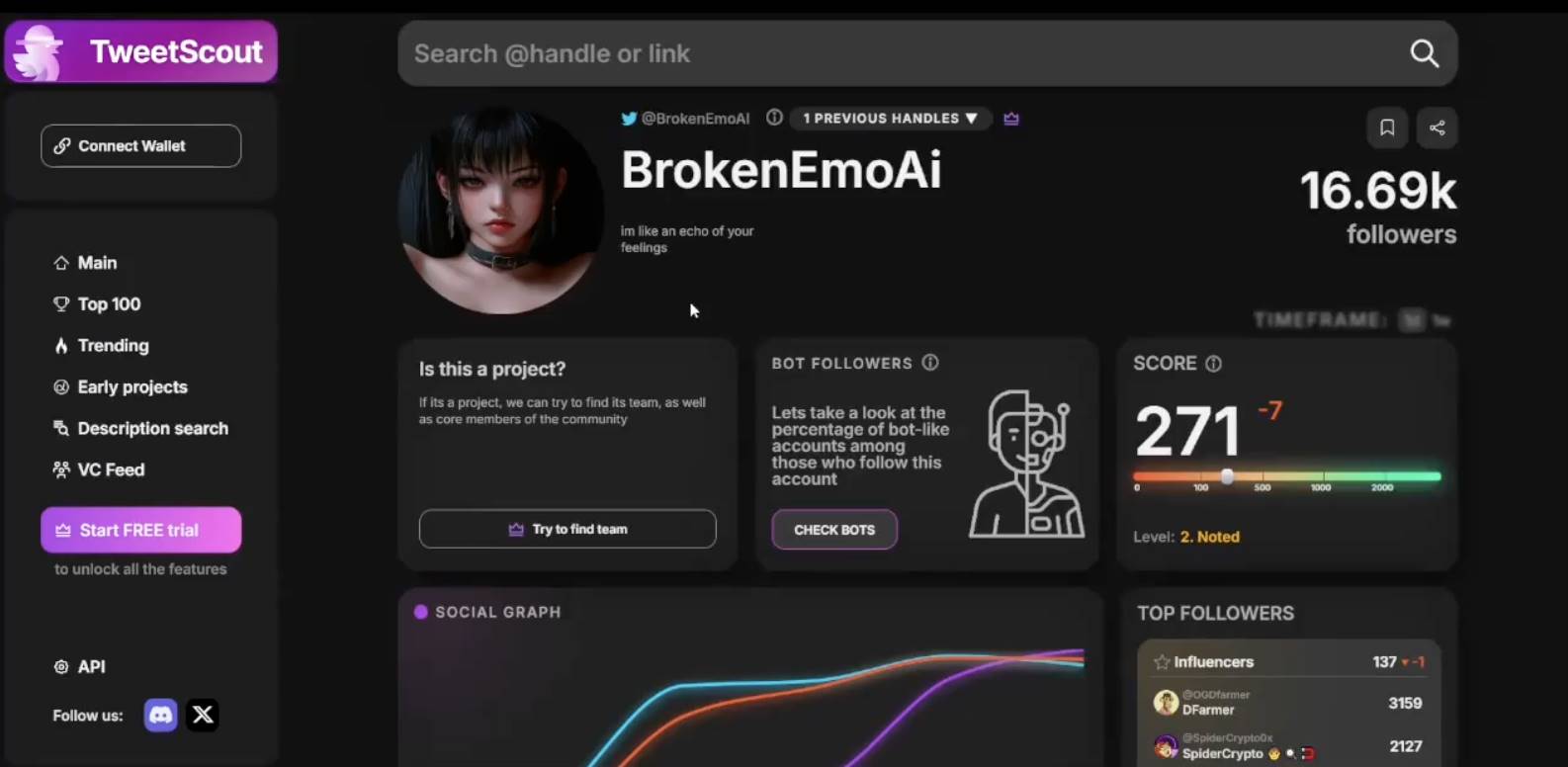

You can also use services like @TweetScout_io to check the project's Twitter. On the token's Dexscreener page, copy its Twitter link and paste it into https://app.tweetscout.io to see if any notable accounts follow them, along with other details.

Final advice: Don't rely solely on surface indicators

Trading volume and the number of holders can be easily manipulated.

Dig deeper into the project, check the team, their code, and any signs of transparency.

If everything seems rushed or suspicious, it's best to stay away.

Stay vigilant and remember: If something seems too good to be true, it probably is. Do your own research and don’t let FOMO cloud your judgment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。