Various signs indicate that World Liberty Financial appears to be a DeFi product under the Trump family's OEM.

Written by: 0xjs, Golden Finance

Since former U.S. President Trump fully embraced cryptocurrency, his supportive remarks about crypto have become increasingly common in the industry.

However, since September 2024, Trump's personal endorsement of the DeFi project World Liberty Financial, even occasionally promoting it on his official account with nearly 100 million followers, has left industry insiders astonished.

Moreover, well-known institutions and projects in the crypto industry have also been continuously involved, such as Luke Pearson from Polychain Capital, Sandy Peng from Scroll, Ryan Fang from Tomo Wallet, and Rich Teo from Paxos, all becoming advisors or team members of World Liberty Financial.

On the evening of October 15, 2024, World Liberty Financial officially began its public sale, and the veil over World Liberty Financial finally lifted.

Golden Finance reporters delved into World Liberty Financial and summarized everything you need to know about it.

What is World Liberty Financial?

According to official information from World Liberty Financial, it describes itself as inspired by Trump, promoting the widespread adoption of stablecoins and DeFi, particularly USD stablecoins, to ensure the dominance of the U.S. dollar. A key part of World Liberty Financial is leveraging the global influence and recognition of the Trump brand to bring as many Web2 users into the Web3 world as possible.

Thus, World Liberty Financial will be a DeFi platform where users can borrow and lend cryptocurrencies, create liquidity pools, and trade using stablecoins.

According to a proposal by World Liberty Financial on the Aave governance forum, it requests a temperature check on a motion to deploy an Aave V3 instance, which would allow USDC, USDT, ETH, and WBTC as collateral assets for lending. World Liberty Financial will allocate 7% of its token supply to the Aave DAO (valued at $105 million) for governance and liquidity provision, while also providing 20% of the fees generated by its platform.

Public information indicates that the first phase of World Liberty Financial is launching a version of Aave on the Ethereum Layer 2 network Scroll, allowing users to lend and borrow tokens.

World Liberty Financial's Deep Ties to the Trump Family

When discussing World Liberty Financial, it is often prefixed with "Trump family-supported" World Liberty Financial.

The reason for this is that World Liberty Financial has deep ties to the Trump family.

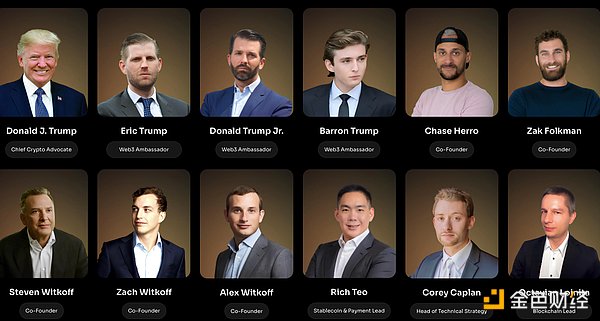

Trump has repeatedly promoted World Liberty Financial on social media, calling himself the "Chief Crypto Advocate" of the World Liberty Financial project.

Trump's two eldest sons, Donald Jr. and Eric, serve as "Web 3 Ambassadors" for World Liberty Financial, while his 18-year-old son Barron Trump is the "DeFi Visionary" for World Liberty Financial.

Despite the deep ties between World Liberty Financial and the Trump family, various signs suggest that World Liberty Financial resembles an OEM product of the Trump family. The Trump family brands and profits, while an unknown operator leverages the Trump family's reputation to launch the product.

This seems to be a common business practice for the Trump family. For instance, many Trump-branded hotels or towers around the world are collaborations with Trump under licensing and OEM agreements. Beyond real estate, Trump has continuously licensed his name to other sectors such as perfumes, steaks, and bottled water. Trump's daughter Ivanka is also a frequent participant in OEM deals.

Suspected OEM of World Liberty Financial

According to the World Liberty Financial white paper, DT Marks DEFI LLC agrees to make reasonable efforts to have the owners and principals of DT Marks DEFI LLC, including Donald Trump, occasionally promote WLF and the World Liberty Financial protocol, while granting World Liberty Financial and its related entities the right and license to use the name, image, and likeness of the owners and principals of DT Marks DEFI LLC for promotional purposes.

And indeed, Trump's photo appears on 11 out of 13 pages of the World Liberty Financial white paper, and World Liberty Financial has received endorsement from the Trump family.

Cover of the World Liberty Financial White Paper

In return, World Liberty Financial agrees that DT Marks DEFI LLC will receive 22.5 billion WLFI tokens and is entitled to receive 75% of the net income from the protocol, which is determined after deducting agreed operational expenses and initial treasury reserves. The service agreement can be terminated by DT Marks DEFI LLC under certain conditions for "good reason" or due to non-renewal after the initial 5-year term.

DT Marks DEFI LLC is a limited liability company based in Delaware (with Trump as one of the owners), and its affiliated entities have received or may receive compensation for services provided to World Liberty Financial and its affiliates. These services are provided under a service agreement with Axiom Management Group, LLC ("AMG"), a Puerto Rico limited liability company wholly owned by Chase Herro and Zachary Folkman, under whose guidance World Liberty Financial was established. AMG is entitled to receive 7.5 billion WLFI tokens and 25% of the net income from the protocol but agrees to allocate 50% of that to WC Digital Fi LLC, which is an affiliate of Steve Witkoff and some of his family members.

Now, let's take a look at the members of the World Liberty Financial team.

World Liberty Financial co-founders Chase Herro and Zak Folkman own AMG, which can receive half of the 7.5 billion WLFI tokens and 25% of the net income from the World Liberty Financial protocol, while the other half of the tokens and protocol income belong to another co-founder, Steven Witkoff's family (co-founders Steven Witkoff, Zach Witkoff, Alex Witkoff).

The Behind-the-Scenes Operators of World Liberty Financial

Although World Liberty Financial co-founders Chase Herro and Zak Folkman have worked in the crypto industry, they are not well-known in the crypto world.

According to CoinDesk, Chase Herro and Zak Folkman previously developed the DeFi product Dough Finance but failed to gain attention and were hacked in the summer of 2024, losing $2 million. Chase Herro and Zak Folkman also co-founded the creator platform Subify, which claims to be an uncensored competitor to well-known creator platforms Patreon and OnlyFans. Folkman had previously registered a company called Date Hotter Girls LLC and posted content on YouTube about how to flirt with women.

The blockchain head of World Liberty Financial is Octavian Lojnita. According to Octavian Lojnita's online resume, he is from Romania and is a full-stack developer. Octavian Lojnita previously worked at Dough Finance. The anonymous front-end developer of World Liberty Financial, Boga, is listed as an author in the source code of Dough Finance (under 0xboga).

Coindesk also reported that World Liberty Financial had previously published a code repository on GitHub, which was later deleted. A review of its code repository indicated that World Liberty Financial (at least in its early stages) seemed to have directly copied code from Dough Finance.

However, on September 4, 2024, World Liberty Financial posted on X stating that it did not want to take any risks, and its code "has been thoroughly reviewed by auditing firms such as BlockSec, Fuzzland, PeckShield, and Zokyo."

Although World Liberty Financial has begun a public sale of its governance token WLFI on its official website, the World Liberty Financial protocol and application have not yet been launched. It is currently unconfirmed whether future versions of World Liberty Financial will include early code or vulnerabilities from Dough Finance.

The other three co-founders of World Liberty Financial are from the Steven Witkoff family. According to public information, Steven Witkoff is a well-known real estate developer and a longtime friend of Trump.

WLFI Token Information

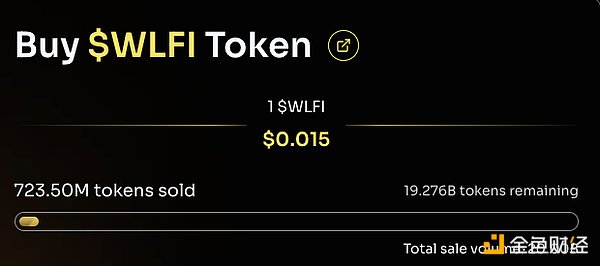

WLFI Token Price: $0.015

Total Public Sale Amount: 20 billion (equivalent to $300 million)

Sold: As of the time of writing, only 723 million have been sold (approximately $10 million), with 19.2 billion remaining for sale.

Total Token Supply: 100 billion

FDV: $1.5 billion

Contract Address: 0xda5e1988097297dcdc1f90d4dfe7909e847cbef6

WLFI Token Distribution:

- 35% Token Sale: A significant proportion of WLFI tokens will be allocated to eligible participants through token sales, encouraging their broad participation in WLF protocol decision-making and growth.

- 32.5% Community Growth and Incentives: This portion will be reserved for expanding governance participation in the WLF community and supporting the construction of the WLF protocol.

- 30% Initial Supporter Allocation: This portion of tokens is allocated to initial supporters (22.5 billion + 7.5 billion, which has already been allocated to Trump and the World Liberty Financial operating team).

- 2.5% Team and Advisors: This portion of tokens will be used to reward the core team, advisors, service providers, and those who contribute to the development of the WLF protocol.

The WLFI token has a special feature: the token status is non-transferable and is indefinitely locked in wallets or smart contracts. Users should consider purchasing WLFI tokens as a purchase of other non-refundable goods and services.

World Liberty Financial claims that if there is a future desire to unlock the transferability of WLFI through the protocol governance process, such unlocking will only be allowed if it is determined not to violate applicable laws, and it must be more than 12 months after the completion of the token sale. WLFI holders should assume that the tokens are indefinitely non-transferable. World Liberty Financial also does not plan to create a secondary market for WLFI tokens.

The reason for the non-transferability of WLFI tokens may be to circumvent regulation. This move aims to make WLFI appear less like a security in the eyes of regulators, as it makes the asset difficult to buy and sell like other cryptocurrencies.

In addition to the non-transferable tokens, the operators of World Liberty Financial have skillfully taken several actions in advance to avoid regulatory scrutiny from U.S. law enforcement.

How WLFI Tokens Avoid U.S. Regulation

First is the requirement for investors. Given Trump's significant influence in the U.S., World Liberty Financial primarily targets Americans. World Liberty Financial requires American participants in the investment to be "accredited investors" as defined by Regulation D and to undergo KYC procedures. Overseas investors are also required to undergo KYC and provide and sell tokens in a manner that complies with the safe harbor conditions of Section 506(c) of the Securities Act.

Secondly, regarding the utility of the tokens. According to the World Liberty Financial official website, World Liberty Financial has made special provisions for the utility of its WLFI tokens, requiring WLFI tokens to be:

- Used solely for governance. The only purpose of holding WLFI is for governance, not for any investment. As a token holder, one will only have the right to propose and vote on proposals that help shape the future of the World Liberty Financial protocol, including decisions regarding marketing plans, future features, etc.

- No economic rights. The tokens do not grant any express or implied rights, except for the right to use the tokens as a means of participating in the governance of the WLF protocol through the WLF governance platform. WLF tokens do not represent or grant any ownership or equity, shares, or guarantees or equivalent rights, or any rights to receive any distributions, revenue sharing, additional tokens, intellectual property, or any other form of participation or rights related to the WLF protocol and/or the company and its affiliates.

- Non-transferable. All WLFI tokens are non-transferable and are indefinitely locked in wallets or smart contracts. Users should consider purchasing WLFI tokens as a purchase of other non-refundable goods and services and accept the risks. If there is a future desire to unlock the transferability of WLFI through the protocol governance process, such unlocking will only be allowed if it is determined not to violate applicable laws, and it must be more than 12 months after the completion of the token sale. WLFI holders should assume that the tokens are indefinitely non-transferable. Due to the non-transferability of the tokens, the World Liberty Financial protocol has not taken any action and does not plan to create a secondary market for the tokens.

World Liberty Financial has also made a strict distinction between WLFI tokens, the WLF governance platform, and the WLF protocol. WLFI tokens do not provide any economic or other rights related to the WLF protocol or other aspects. Therefore, there is no right to receive any fees generated by the WLF protocol or earned by the company.

World Liberty Financial explicitly states that WLFI tokens are not intended to be digital currencies, securities, derivatives, transferable crypto assets, or any other type of financial instrument. Tokens cannot be transferred or sold in exchange for money or other assets (including crypto assets), nor can they be used to purchase goods or services from any party.

Conclusion

Various signs indicate that World Liberty Financial resembles a DeFi product under the Trump family's OEM.

The real operating team behind World Liberty Financial has a "black" history, and the WLFI token is in a completely locked state, with no secondary market and no liquidity, which has resulted in the slow progress of the WLFI token's public sale, with only $10 million sold. This is far from matching Trump's momentum.

However, this does not negate the possibility of World Liberty Financial's future success. After all, the U.S. is set to hold elections in three weeks, and Trump has a strong chance of returning to the White House.

Given Trump's attitude towards crypto, his interests in WLF, and his appeal to Americans and people around the world, the global crypto population may very well rise to a billion level in the next four years.

With this massive traffic and Trump's endorsement, OEM could also lead to success, just like other products where Trump has sold naming rights through OEM.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。