Funding

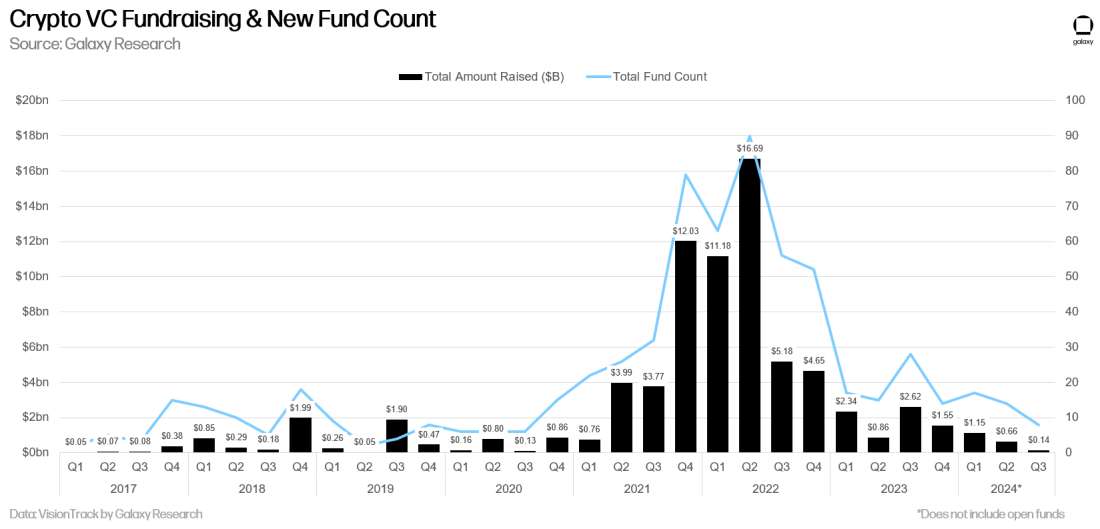

Investor interest remains low, with only 8 new funds raising $140 million in the third quarter of 2024.

Authors: Alex Thorn & Gabe Parker

Translation: Deep Tide TechFlow

Introduction

Since March, Bitcoin's price has fluctuated within a fixed range, while other major cryptocurrencies have failed to return to previous historical highs, resulting in a continued low level of venture capital activity in 2024. The "dumbbell market" refers to a situation where Bitcoin is leading on one side, while meme coins are highly active on the other, coupled with a lack of interest from large investors and traditional venture capital funds, making the overall crypto venture capital market in 2024 relatively flat. However, opportunities still exist, especially as experienced managers in the crypto space dominate trading activities. With declining interest rates and a potentially relaxed regulatory environment, venture capital activity may accelerate in the fourth quarter and the first quarter of 2025. Our quarterly report analyzes two aspects of venture capital—investments by venture funds in crypto startups and the allocation of funds by institutional investors to venture funds—based on research from public documents, data providers like Pitchbook, and Galaxy Research's proprietary VisionTrack fund performance database.

Key Points

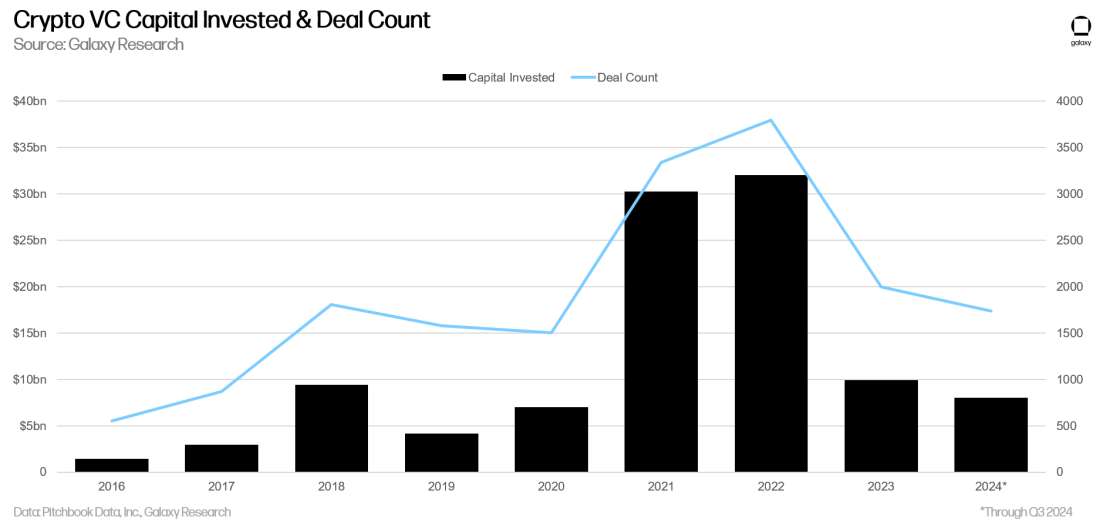

In the third quarter of 2024, venture capital investment in crypto startups totaled $2.4 billion, a 20% decrease quarter-over-quarter, with 478 deals completed, a 17% decrease quarter-over-quarter.

In the first three quarters, venture capitalists have invested $8 billion in crypto startups, with total investment in 2024 expected to be flat or slightly higher than in 2023.

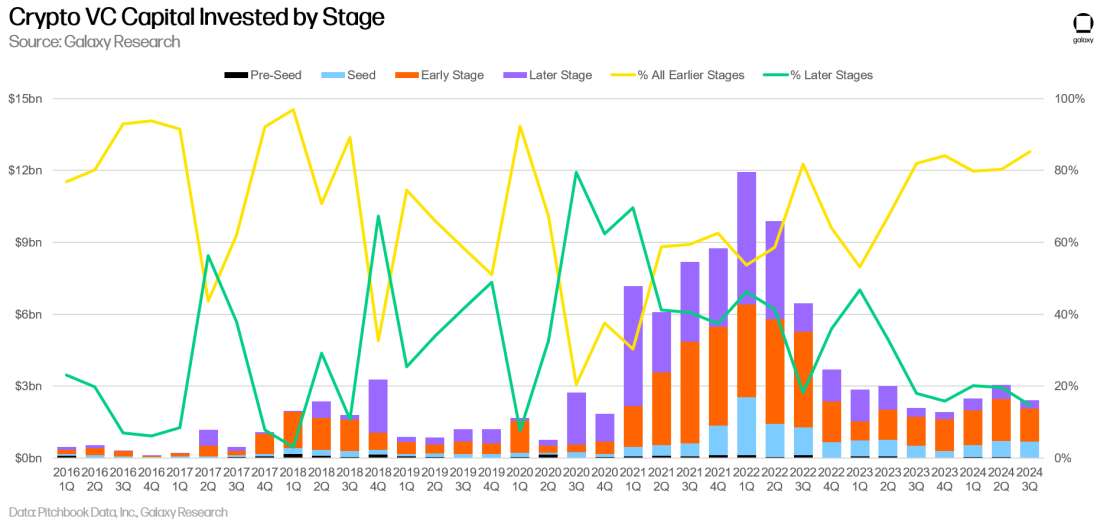

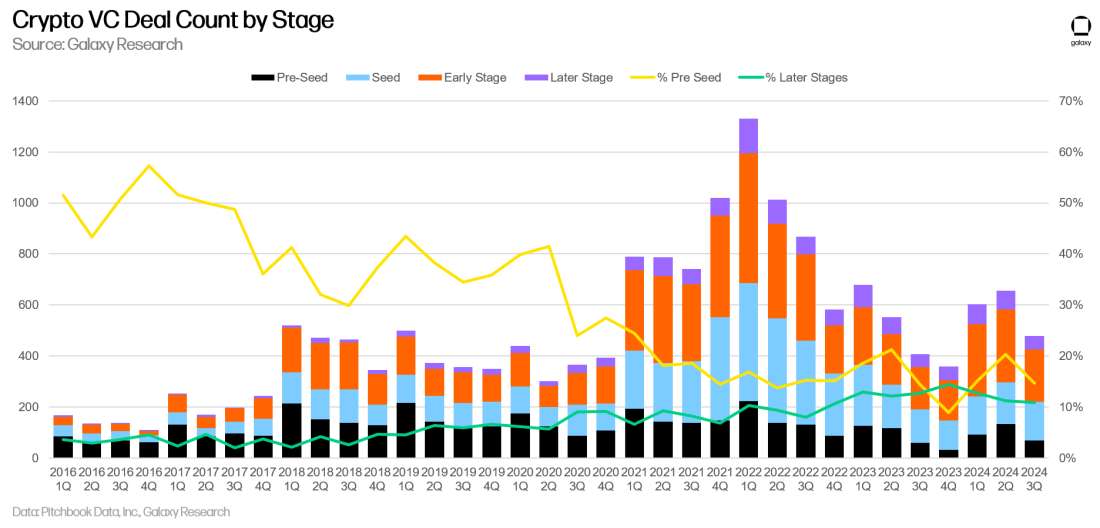

Early-stage deals attracted the most funding (85%), while late-stage deals accounted for only 15%, the lowest level since the first quarter of 2020.

The median valuation of venture capital increased in the second and third quarters, with valuations in the crypto space growing faster than the overall venture capital industry. The median valuation for deals in the third quarter of 2024 was $23.8 million, slightly below the $25 million in the second quarter.

Layer 1 projects and companies raised the most funds, followed by cryptocurrency exchanges and infrastructure companies, with most deals involving infrastructure, gaming, and DeFi projects and companies.

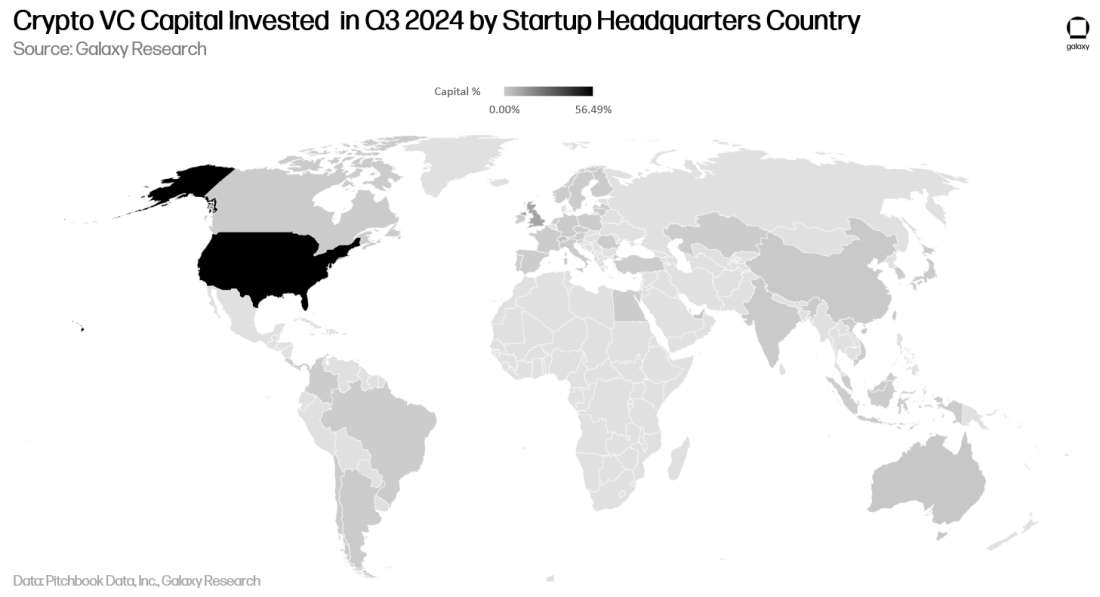

The U.S. continues to dominate the crypto venture capital space, with 56% of capital investment and 44% of deals involving companies headquartered in the U.S.

In terms of fundraising, investor interest remains low, with only 8 new funds raising $140 million in the third quarter of 2024.

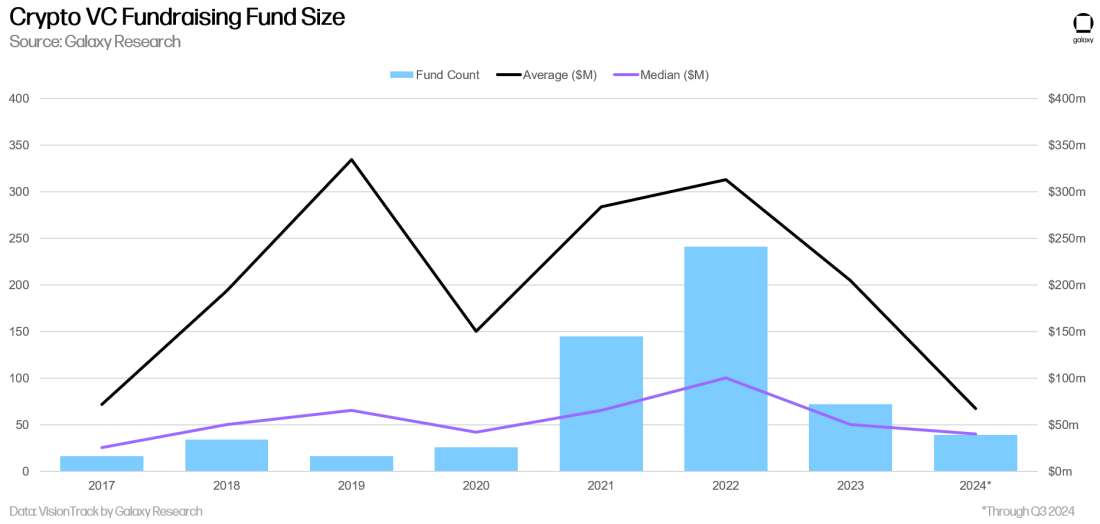

The median size of crypto venture capital funds continues to decline, with the median ($40 million) and average ($67 million) for new funds in 2024 being the lowest levels since we began tracking in 2017.

Venture Capital

Number of Deals and Investment Capital

In the third quarter of 2024, venture capitalists invested $2.4 billion in startups focused on crypto and blockchain, a 20% decrease quarter-over-quarter, completing 478 deals, a 17% decrease quarter-over-quarter.

2024 is expected to reach or slightly exceed the levels of 2023.

Investment Capital and Bitcoin Price

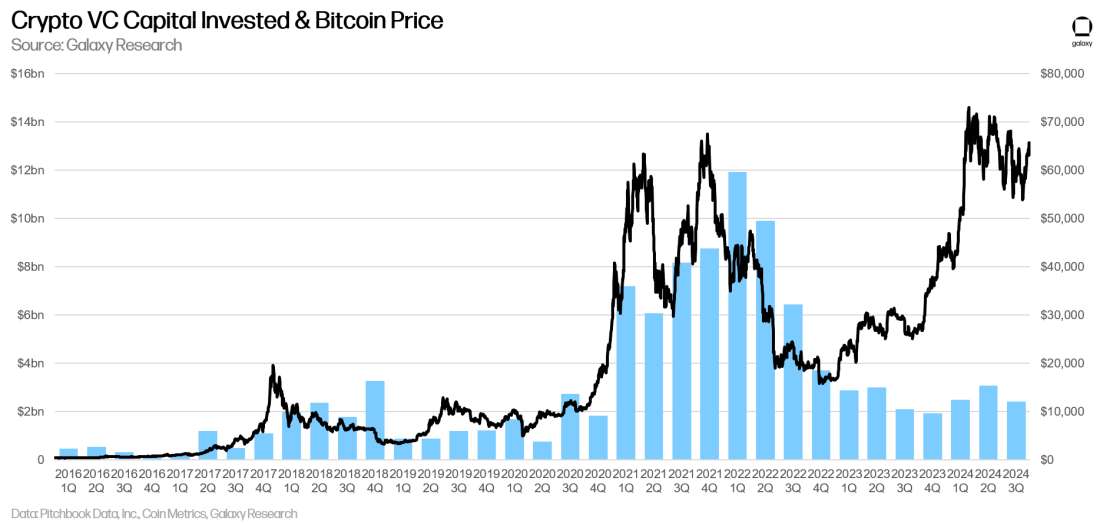

The long-term correlation between Bitcoin prices and investment capital in crypto startups has been broken, with Bitcoin significantly rising since January 2023, while venture capital activity has struggled to keep pace. The weak interest from fund allocators in the crypto space and overall venture capital, combined with market preferences for Bitcoin and neglect of many hot topics from 2021, partially explains this discrepancy.

Investment by Stage

In the third quarter of 2024, 85% of venture capital went to early-stage companies, while late-stage companies received only 15% of the investment. Funds focused on crypto may still be able to tap into leftover capital from large-scale financing a few years ago, and due to their close ties with entrepreneurs, they can uncover new deal opportunities from the renewed enthusiasm in the crypto market.

In terms of deals, the share of Pre-seed stage deals has slightly decreased but remains at a healthy level compared to previous cycles.

Valuation and Deal Size

In 2023, valuations of crypto companies backed by venture capital saw a significant decline, reaching the lowest point since the fourth quarter of 2020 in the fourth quarter. However, with Bitcoin hitting historical highs, valuations and deal sizes began to recover in the second quarter of 2024. In the second and third quarters of 2024, valuations reached their highest levels since 2022. The increase in crypto deal sizes and valuations in the second and third quarters aligns with trends in the overall venture capital space, but the rebound in the crypto sector is more pronounced. The median pre-deal valuation in the third quarter was $23 million, with an average deal size of $3.5 million.

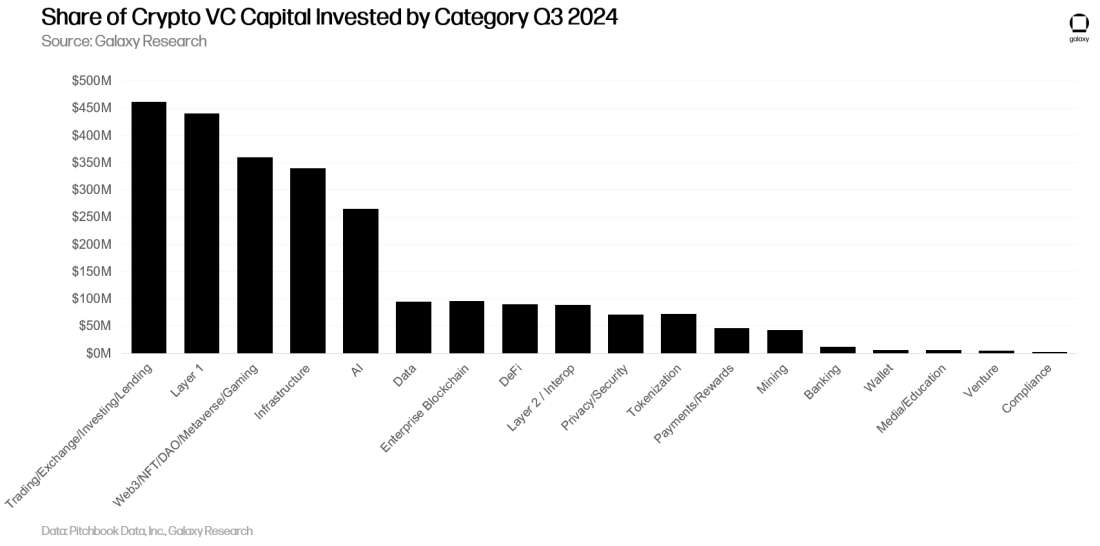

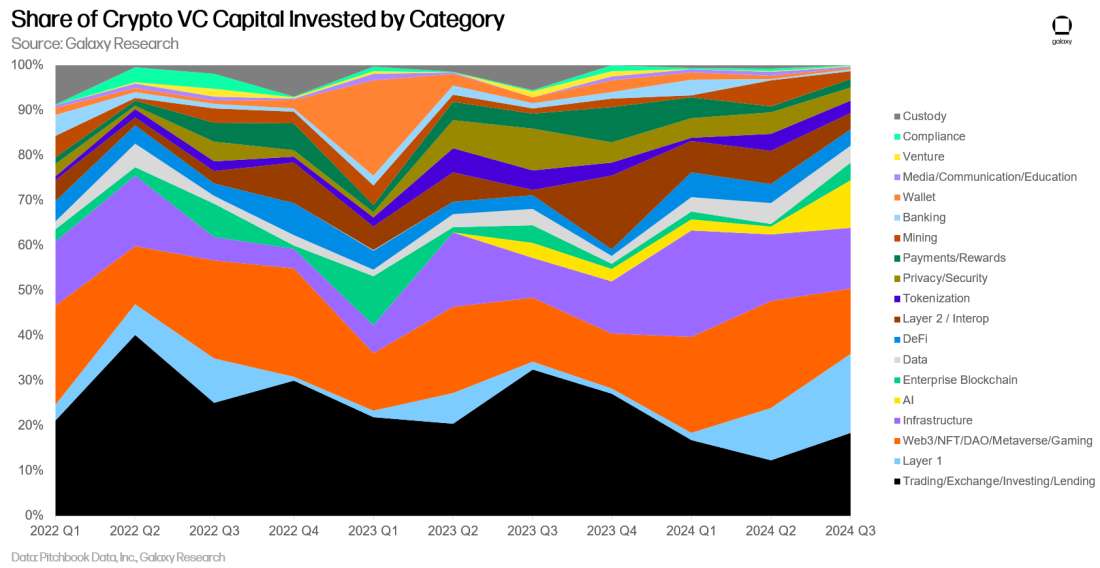

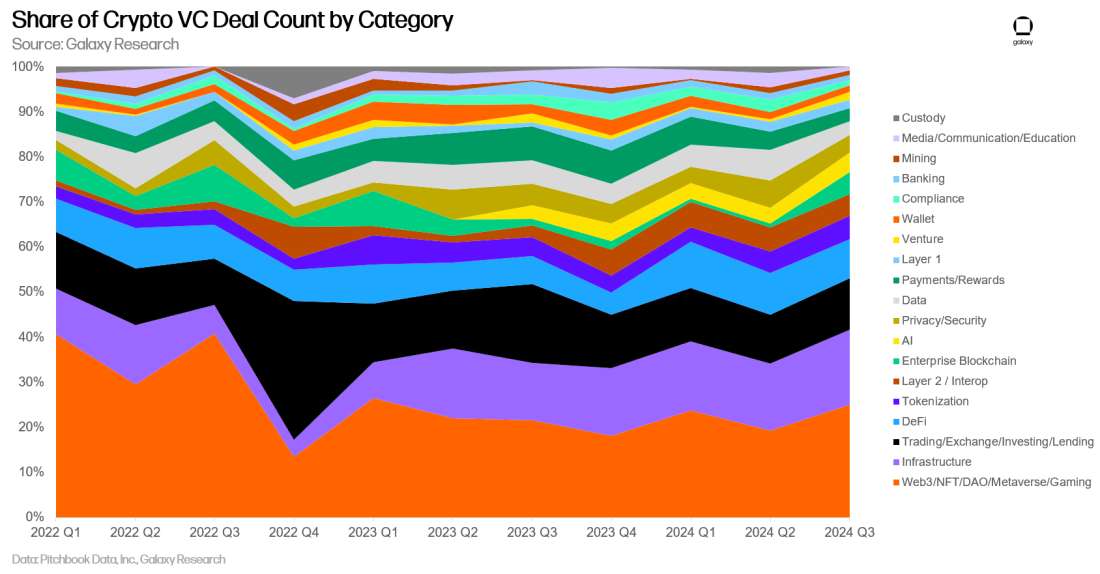

Investment by Category

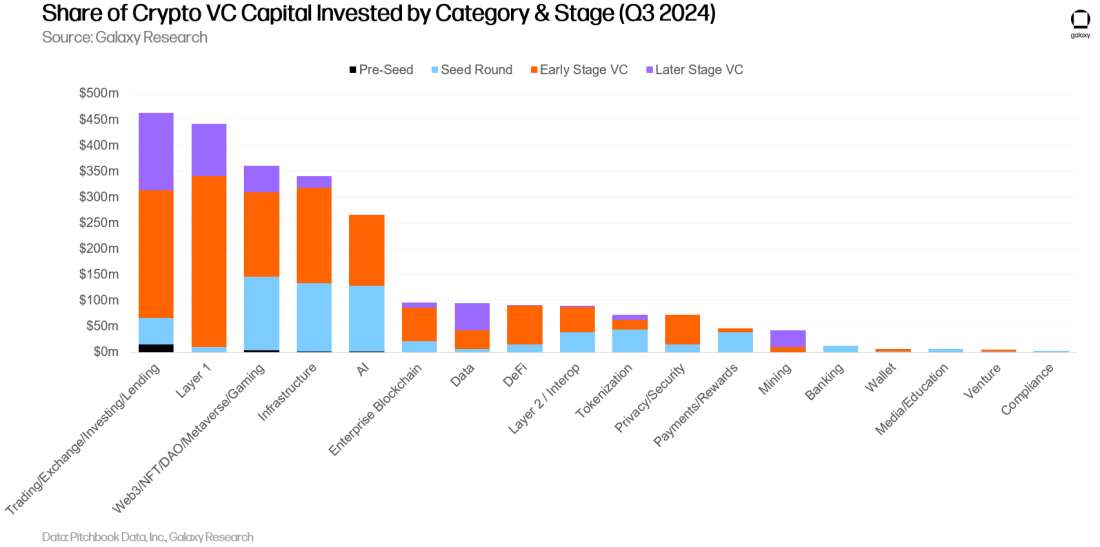

In the third quarter of 2024, companies and projects in the "Trading/Exchange/Investment/Lending" category received the most crypto venture capital, accounting for 18.43% of the total, raising $462.3 million. Among them, Cryptospherex and Figure Markets were the two largest deals in this category, raising $200 million and $73.3 million, respectively.

In the third quarter of 2024, crypto startups focused on building AI services achieved a 5-fold increase in crypto venture capital funding quarter-over-quarter. Sentient, CeTi, and Sahara AI made significant contributions to venture capital for AI crypto projects, raising $85 million, $60 million, and $43 million, respectively. Venture capital funding for Trading/Exchange/Investment/Lending and Layer 1 crypto projects also saw a significant increase of 50%. In contrast, venture capital funding for Web3/NFT/DAO/Metaverse/Gaming projects decreased by 39%, the largest decline among all categories.

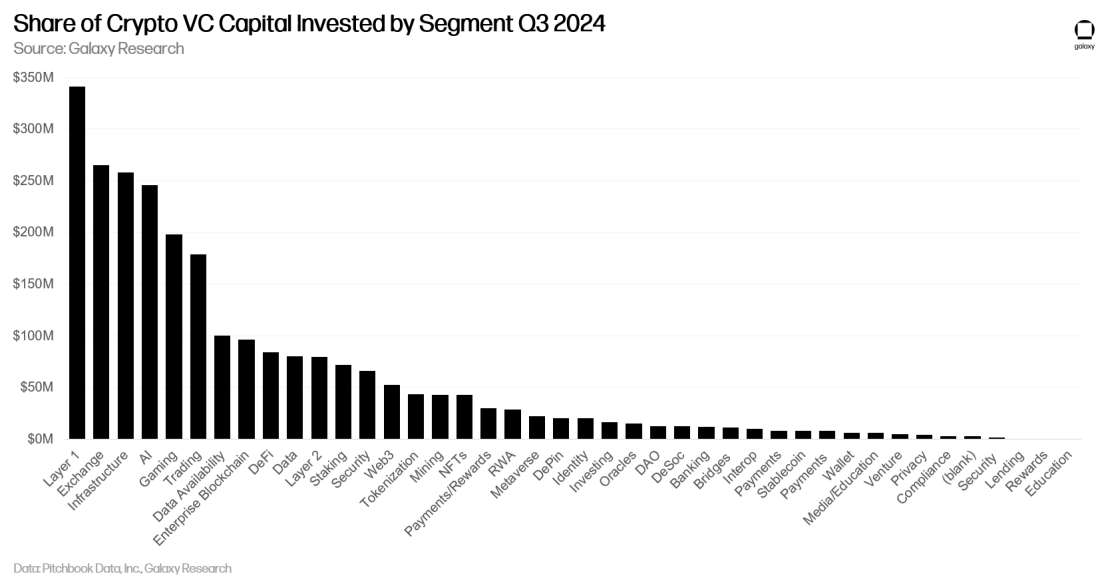

When further breaking down larger categories, crypto projects building Layer 1 blockchains accounted for the most crypto venture capital, reaching 13.6%, totaling $341 million. In the Layer 1 category, Exochain and Story Protocol were the top two deals, raising $183 million, accounting for 54% of the total Layer 1 venture capital for the quarter. Following them were cryptocurrency exchanges and infrastructure companies, raising $265.4 million and $258 million, respectively.

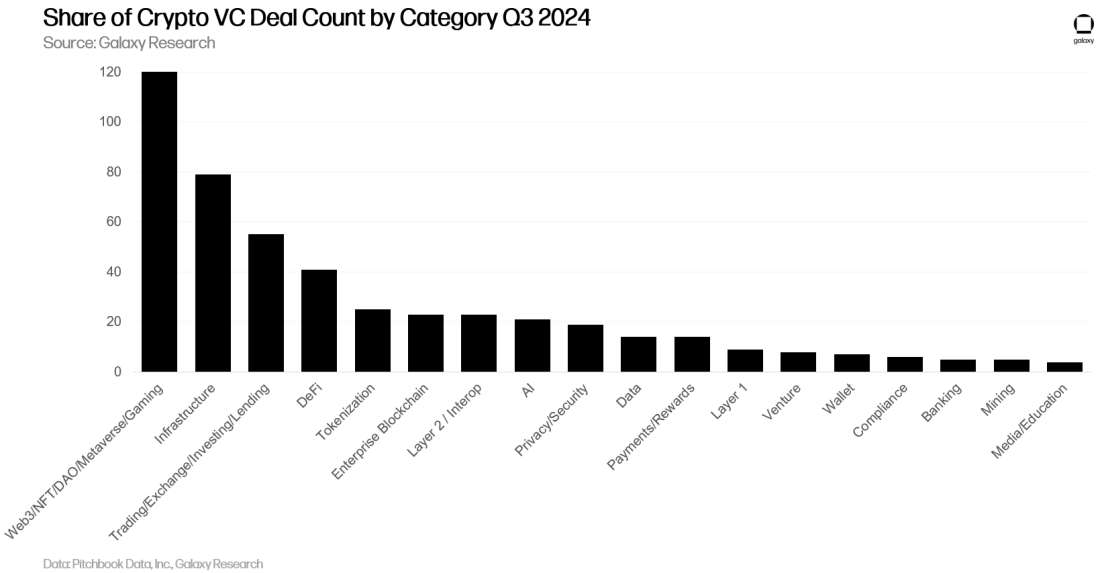

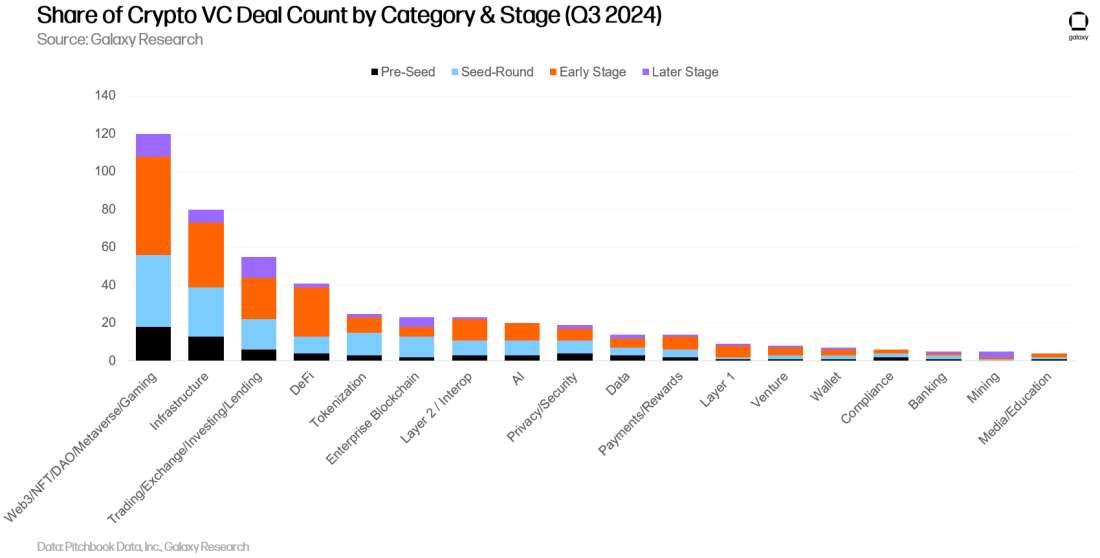

In terms of deal volume, the Web3/NFT/DAO/Metaverse/Gaming sector led with 25% of the total deals (120 deals), a 30% increase quarter-over-quarter, with 48 of those being gaming deals. The largest gaming deal in the third quarter of 2024 was Firefly Blockchain raising $50 million in its Series B funding.

Crypto infrastructure projects and companies ranked second in deal volume, accounting for 16.5% of total deals (79 deals), a 12% increase quarter-over-quarter. Following them were projects and companies in the Trading/Exchange/Investment/Lending category, ranking third with 11.5% of deal volume (55 deals). Notably, crypto companies focused on media/education and data businesses saw the largest quarter-over-quarter declines in deal volume, decreasing by 73% and 57%, respectively.

When further breaking down larger categories, projects and companies building crypto infrastructure had the highest number of deals across all sectors (64 deals). Gaming and DeFi-related crypto companies followed, completing 48 and 38 deals, respectively, in the third quarter of 2024.

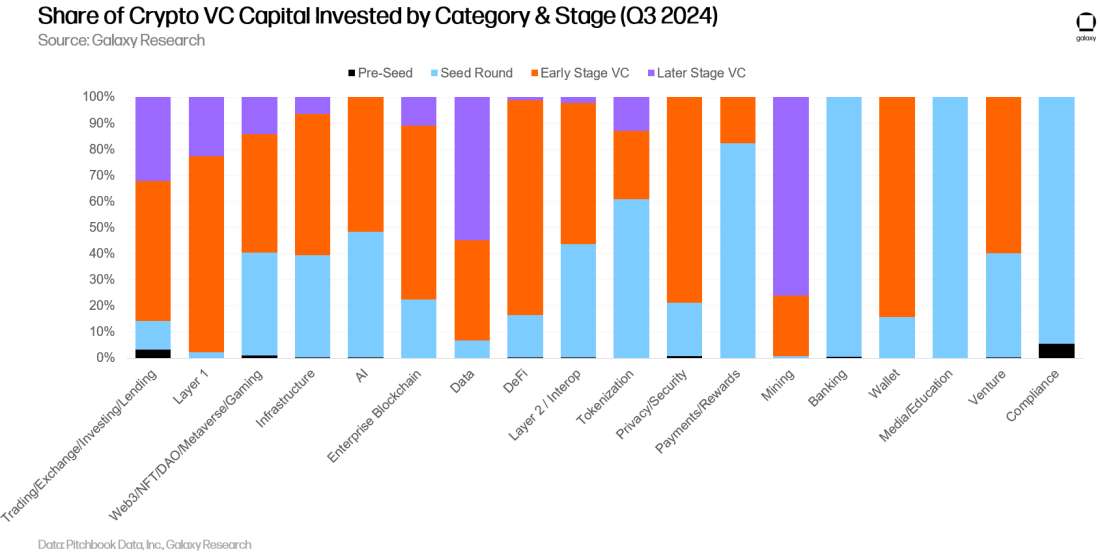

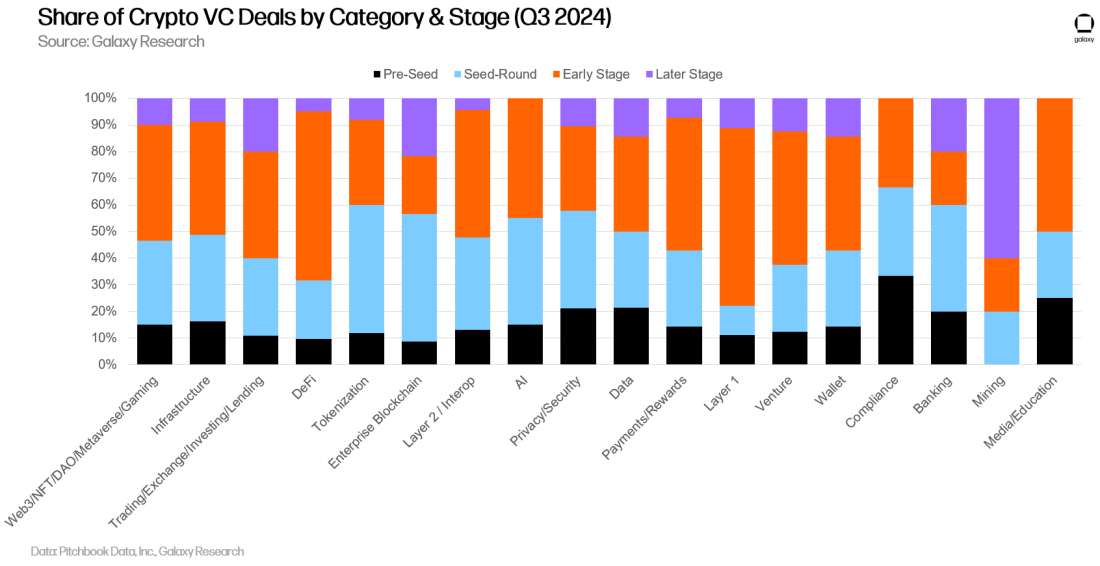

Investment by Stage and Category

By breaking down investment capital and deal volume by category and stage, we can gain clearer insights into which types of companies are raising funds within each category. In the third quarter of 2024, most of the investment in Layer 1, enterprise blockchain, and DeFi flowed to early-stage companies and projects. In contrast, a larger proportion of crypto venture capital funding in the mining sector went to late-stage companies.

Analyzing the distribution of investment capital across different stages in each category can reveal the relative maturity of various investment opportunities.

Similar to the second quarter of 2024, a significant portion of the deals completed in the third quarter of 2024 involved early-stage companies. The total amount of late-stage crypto venture capital deals across all categories remained unchanged from the second quarter of 2024.

Studying the proportion of deals completed by stage within each category can provide insights into the different development stages of each investable category.

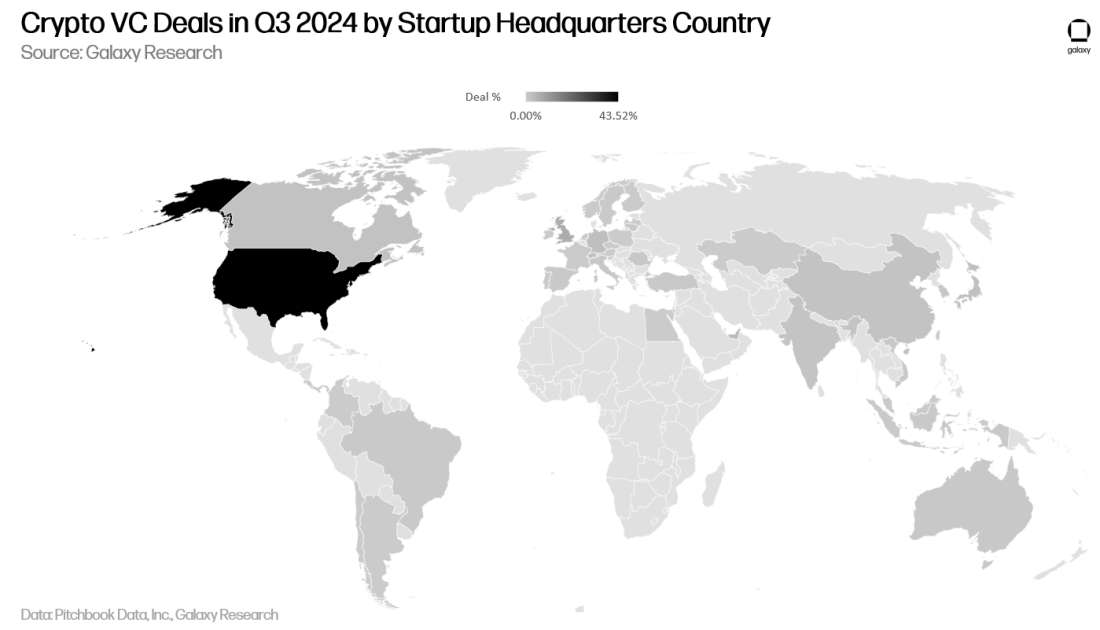

Investment by Geography

In the third quarter of 2024, 43.5% of the deals involved companies headquartered in the United States. Singapore ranked second with 8.7%, followed by the United Kingdom at 6.8%, the UAE at 3.8%, and Switzerland at 3%.

Venture capital from U.S. companies accounted for 56% of total investment, an increase of 5% from the previous quarter. The UK accounted for 11%, Singapore for 7%, and Hong Kong for 4%.

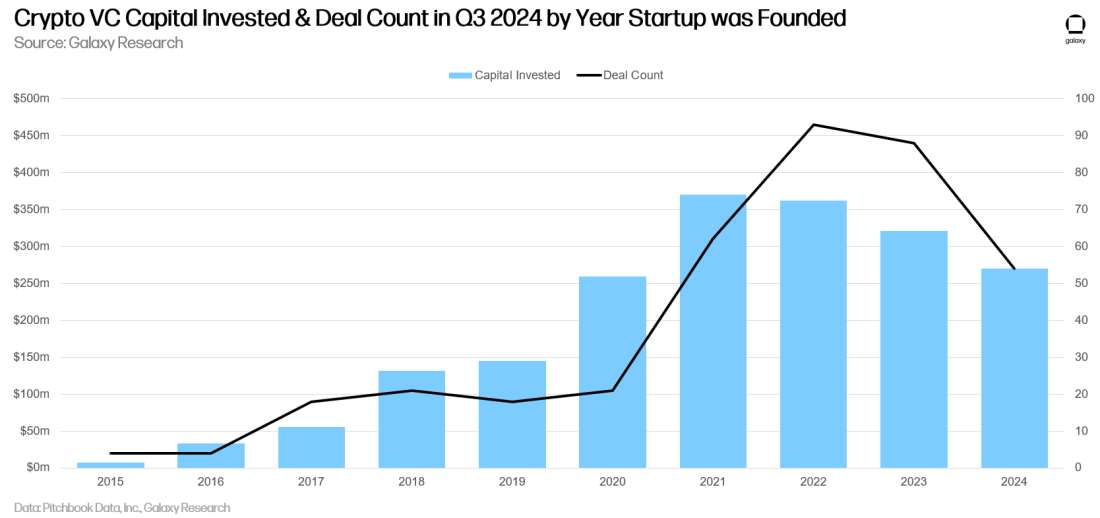

Investment by Year Established

Companies and projects established in 2021 received the most investment capital, while those established in 2022 completed the most deals.

Venture Capital Fundraising

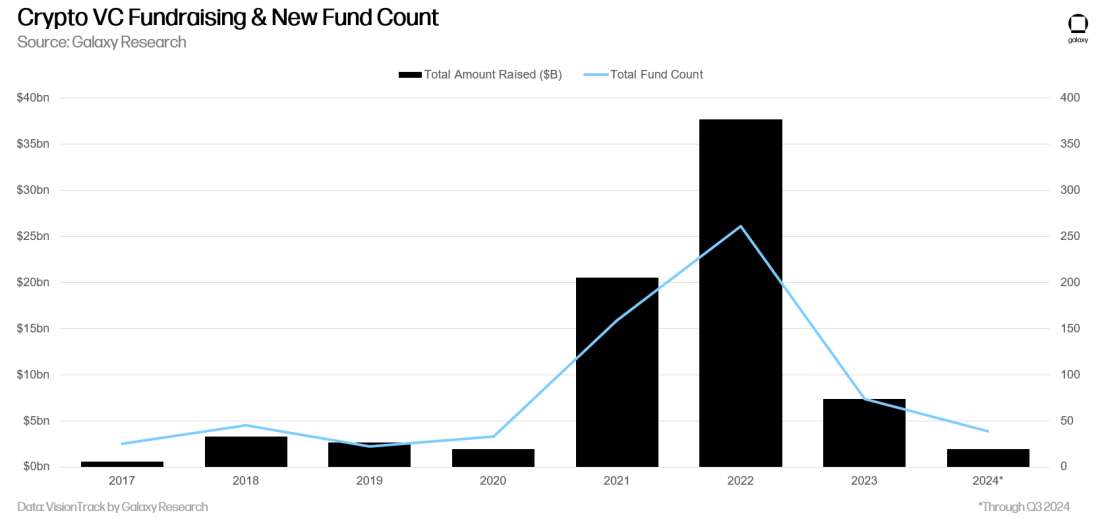

Fundraising for crypto venture funds continues to face challenges. The macro environment in 2022 and 2023, along with the volatility in the crypto market, has led some investors to be less aggressive in committing to crypto venture capital compared to early 2021 and 2022. At the beginning of 2024, investors generally expected interest rates to decline significantly within the year, but rate cuts only began to materialize gradually in the second half. Since the third quarter of 2023, the total capital allocated to venture funds has continued to decline, with the number of new funds raised in the third quarter of 2024 being the lowest since the third quarter of 2020.

On an annualized basis, 2024 may become the weakest year for crypto venture capital fundraising since 2020, with only 39 new funds raising $1.95 billion, far below the peaks of 2021-2022.

The decline in allocator interest has led to a reduction in the number of new crypto venture funds raising smaller amounts of capital, with the median and average fund sizes in 2024 (as of the third quarter) reaching their lowest levels since 2017.

Summary

Market sentiment and activity remain well below bull market levels. Although the liquidity crypto asset market has significantly rebounded since late 2022 and early 2023, venture capital activity is still below previous bull market levels. During the bull markets of 2017 and 2021, venture capital activity was highly correlated with liquidity crypto asset prices, but in the past two years, even as the cryptocurrency market has rebounded, venture capital activity has remained sluggish. There are many reasons for this stagnation, including a "dumbbell market" where Bitcoin (and its new ETFs) occupies a central position, while new activities on the periphery mainly come from meme coins that are difficult to fund and whose longevity is questionable.

Early-stage deals continue to lead the trend. Despite the challenges facing venture capital, interest in early-stage deals remains strong, which is a good sign for the long-term health of the cryptocurrency ecosystem. While late-stage companies face difficulties in raising funds, entrepreneurs are still able to find willing supporters for new innovative ideas. Projects and companies focused on building Layer 1, scaling solutions, gaming, and infrastructure are performing well in this challenging fundraising environment.

Bitcoin ETFs may pressure funds and startups. Some U.S. investors (such as pension funds, endowments, hedge funds, etc.) have shown a preference for entering the space through high-profile investments in spot Bitcoin ETFs, rather than opting for early-stage venture capital. Although there is little interest in the newly launched spot Ethereum ETF, if demand for other crypto sectors like DeFi and Web3 increases, the Ethereum ETF may also attract some funds that would have otherwise flowed into venture capital.

Fund managers still face a tough environment, although some newly established small funds are beginning to achieve some success in fundraising. The number of new funds and the capital allocated to these funds in the third quarter reached the lowest levels in four years (since the third quarter of 2020). With fewer and smaller new funds being launched, combined with the continued inactivity of traditional venture capitalists and fund allocators in the market, late-stage companies may continue to face challenges. If the U.S. significantly relaxes its regulatory policies on digital assets after the presidential election on November 5, late-stage companies may consider the public markets as an alternative option.

The U.S. continues to dominate the crypto startup ecosystem. Despite facing a complex and often unfriendly regulatory environment, companies and projects headquartered in the U.S. still account for the majority of deals and investments. If the U.S. wishes to maintain its long-term position as a center of technological innovation, policymakers should be aware of the potential impacts of their actions or inactions on the cryptocurrency and blockchain ecosystem. There may be good news ahead, as former President Donald Trump and current Vice President Kamala Harris have both expressed attitudes toward the industry ranging from extremely supportive to moderately supportive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。