Overview of Derivatives Trading Platforms and Protocols.

Author: OurNetwork

Translation: ShenChao TechFlow

This report covers an overview of derivatives trading platforms and protocols

Jupiter | Drift | Synthetix | GMX | Vertex | Perennial

Jupiter Perps

Jupiter Perps has achieved a trading volume of $100 billion on Solana

- Launched in early October 2023, Jupiter Perps is the deepest liquidity source for perpetual contract trading on Solana. The Jupiter Liquidity Pool (JLP) serves as the counterparty for perpetual contract traders, with its total locked value (TVL) growing from $0 to over $700 million—enabling the protocol to support large-scale trading through a peer-to-pool model.

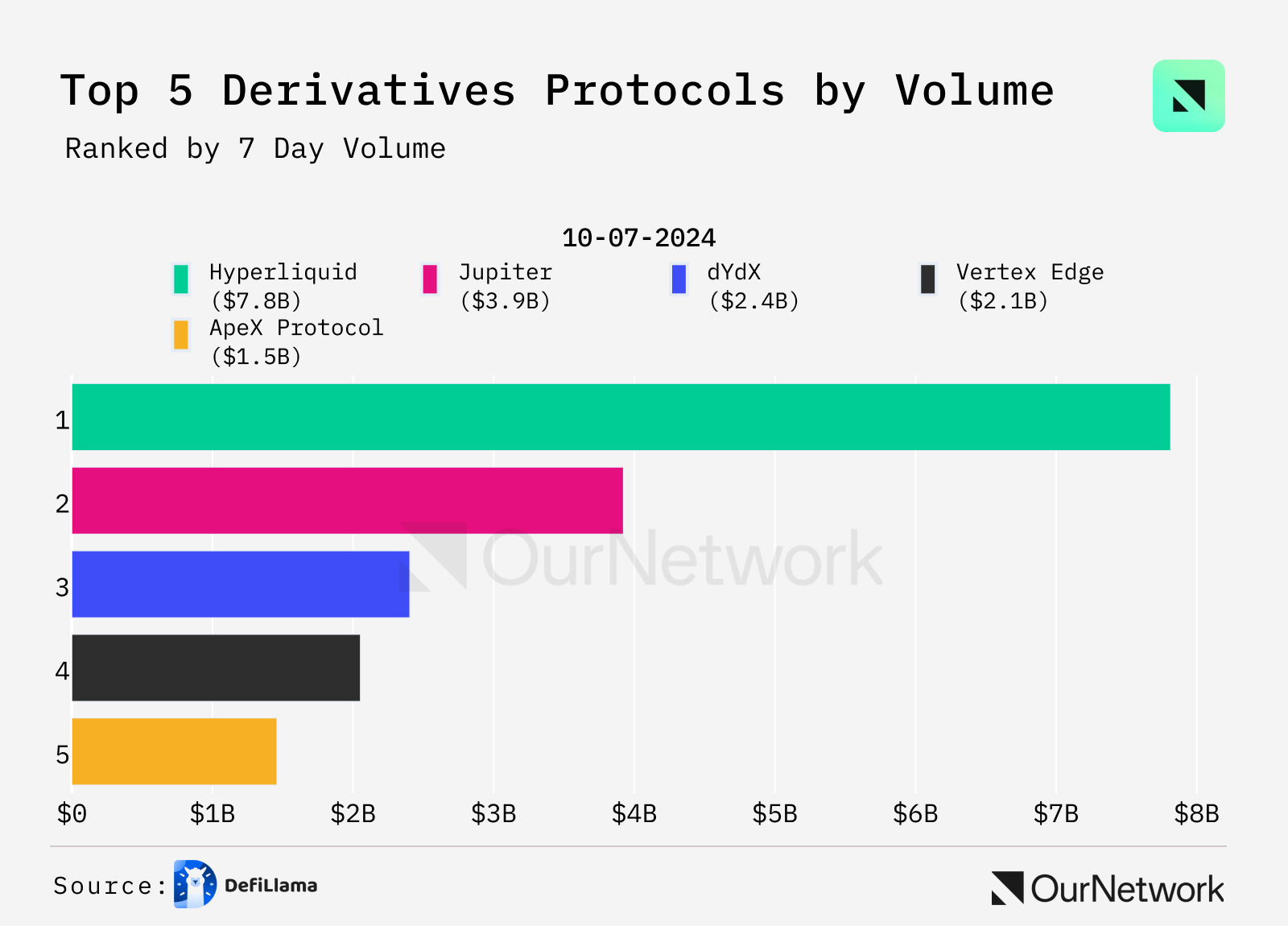

- Jupiter Perps ranks second in derivatives trading volume on DefiLlama, even surpassing order book-based competitors like Vertex and dYdX. The proportion of non-harmful traffic in the peer-to-pool model is higher, resulting in slightly lower trading volume compared to order books.

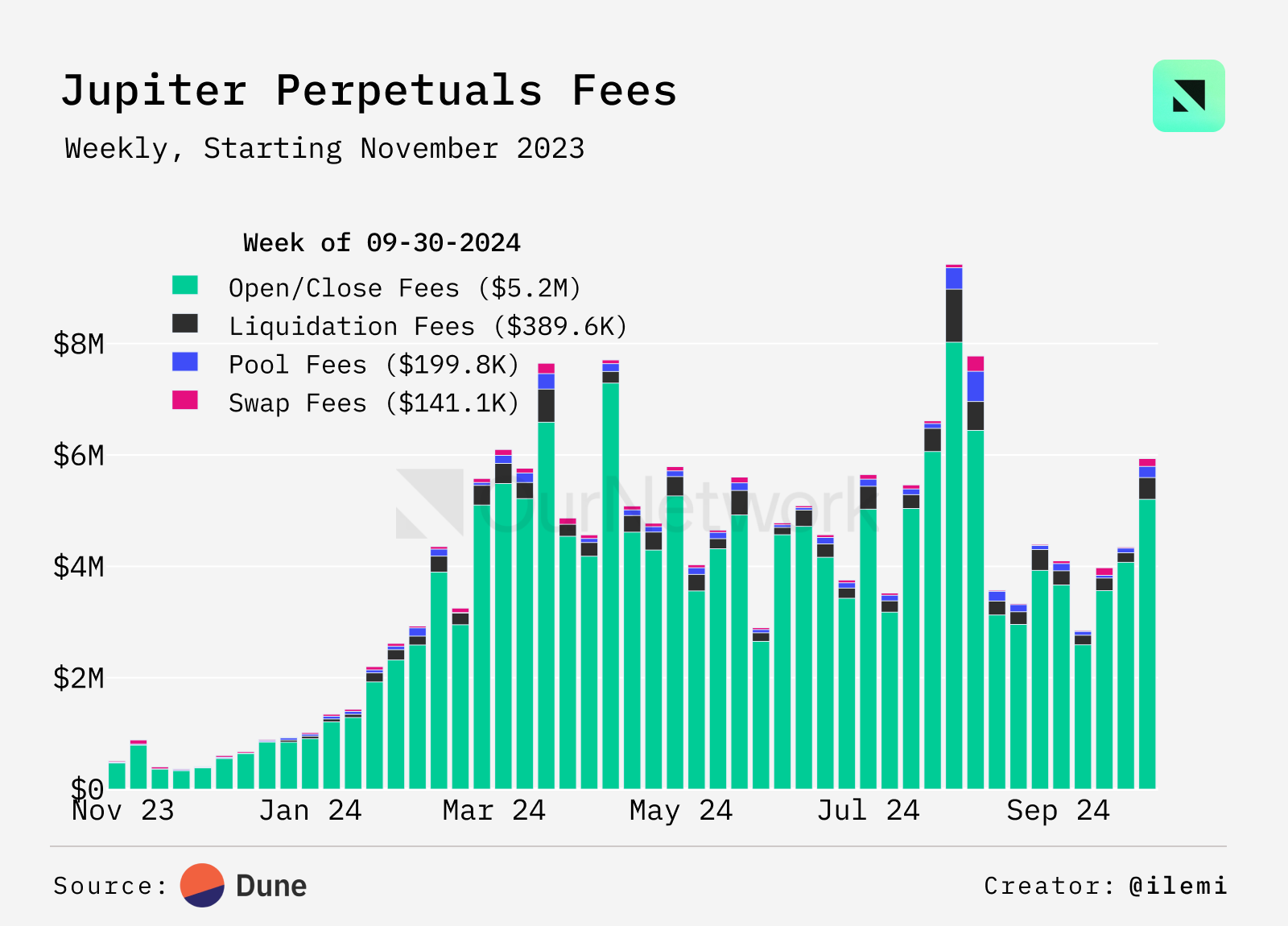

- With a large pool of ordinary traders, deep liquidity, and high trading volume, Jupiter Perps generates $2 million to $8 million in weekly earnings for JLP holders, further promoting the platform's growth.

Drift

BigZ Pubkey | Website | Dashboard

Drift has achieved over $900 million in trading volume in the past week

- Drift is the largest full-service decentralized exchange (DEX) on Solana, integrating perpetual contracts, spot trading, lending, staking, and prediction markets under a cross-margin engine to maximize capital efficiency. BET is the name of Drift's prediction market, allowing users to use various crypto assets as collateral without sacrificing yield, thus avoiding odds distortion due to opportunity costs. In this way, it has achieved the highest trading volume in prediction markets on Solana (nearly $30 million in 1.5 months).

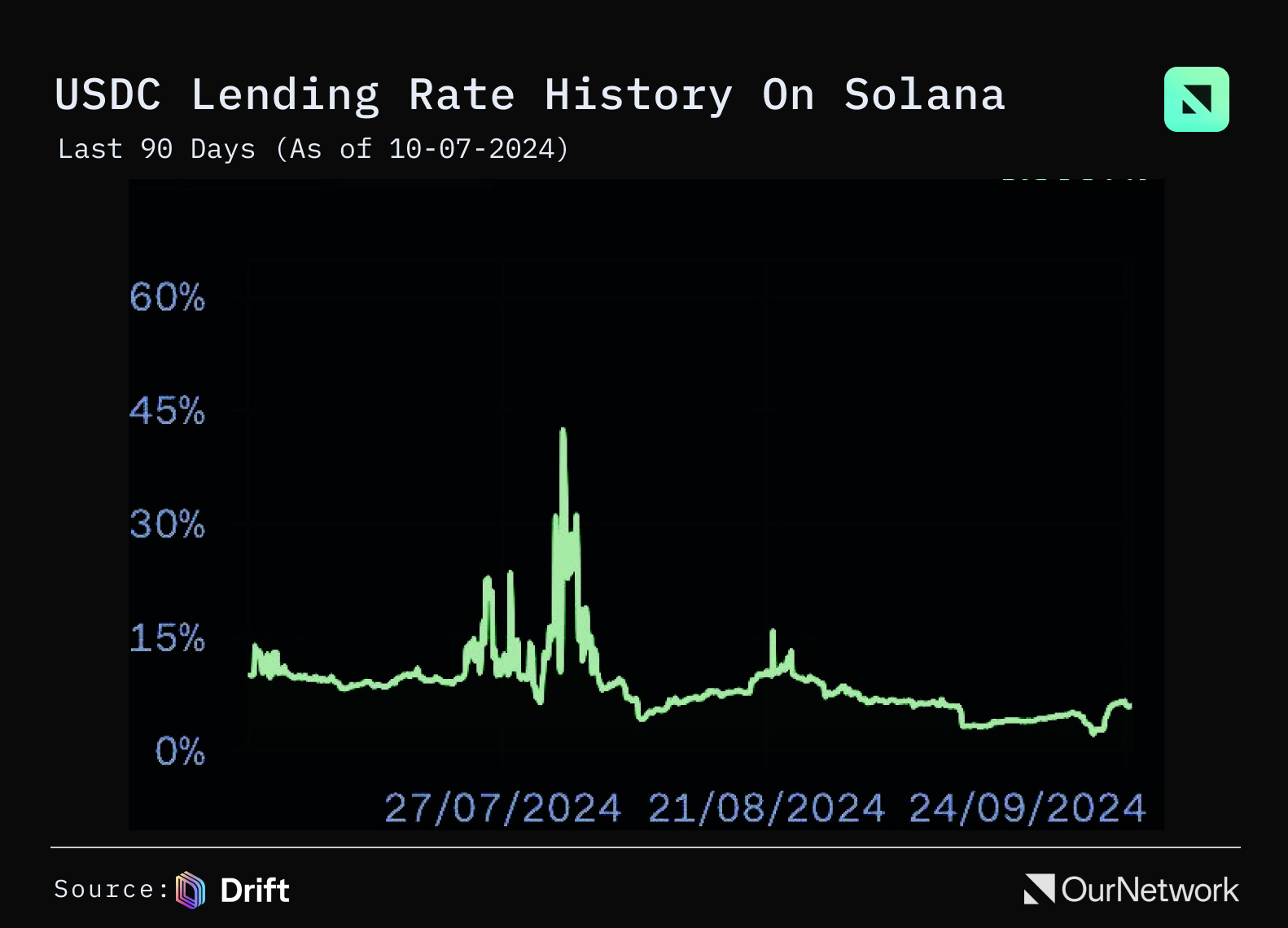

- Over the past 90 days, the average DeFi lending rate for USDC on Solana has been 8.5% APR. This is a significant return on investment that can drive other prediction markets. Interest is only forfeited when positions incur losses and are settled with counterparties through regular market settlements.

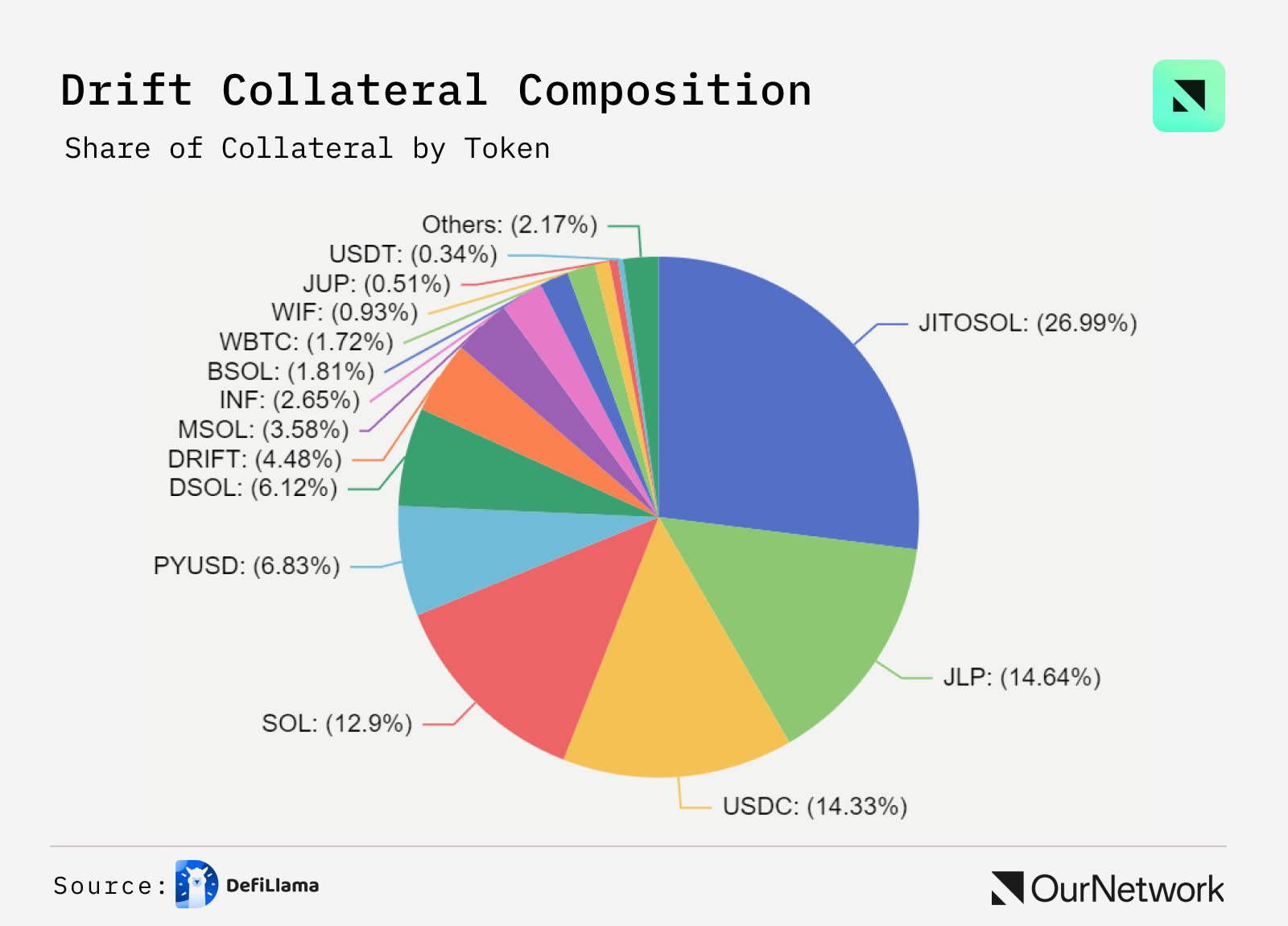

- The composition of collateral shows a high demand from users for non-stablecoin trading, even when bets are ultimately settled in stablecoins. As of October 1, only 22% of Drift's total locked value (TVL) was held in popular stablecoins like USDC, PYUSD, USDT, and others like USDe/sUSDe and USDY.

- Trading Highlights: Notably, one user used non-stablecoins (JitoSOL, SOL, wBTC) as collateral to bet on Trump's victory (with a nominal amount of about $50,000). Additionally, they regularly trade the volatility of BTC-PERP without affecting long-term prediction bets and crypto positions while engaging in short-term trading.

Synthetix

Synthetix lays the foundation for a significant reboot, with a substantial increase in open positions and annual percentage rate (APR)

- Synthetix is a DeFi pioneer in perpetual derivatives trading, offering a wide range of synthetic assets and derivatives, including perpetual futures, options, and spot trading. To date, Synthetix has surpassed $63 billion in derivatives trading volume on Optimism ($60.74 billion), Base ($3.6 billion), and Arbitrum ($1.2 million). Synthetix is undergoing a SR-2 reboot plan, a governance referendum aimed at helping Synthetix regain its position at the forefront of the DeFi ecosystem.

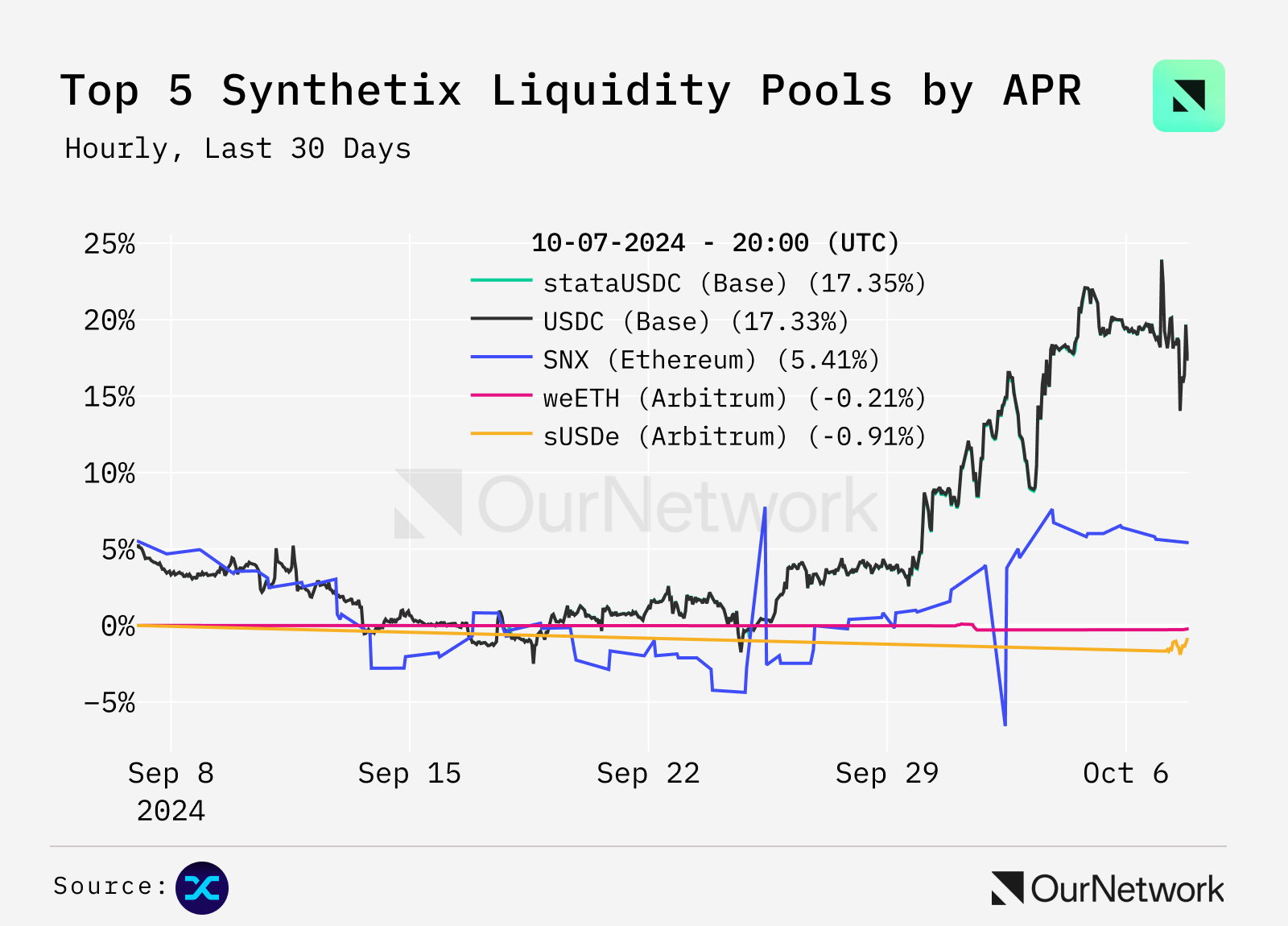

- In September of this year, the 7-day average annual percentage rate (APR) for USDC liquidity surged by 300%, skyrocketing from 5% to over 20% in just a few weeks. This growth highlights the rapid increase in demand for stable yields within the Synthetix ecosystem.

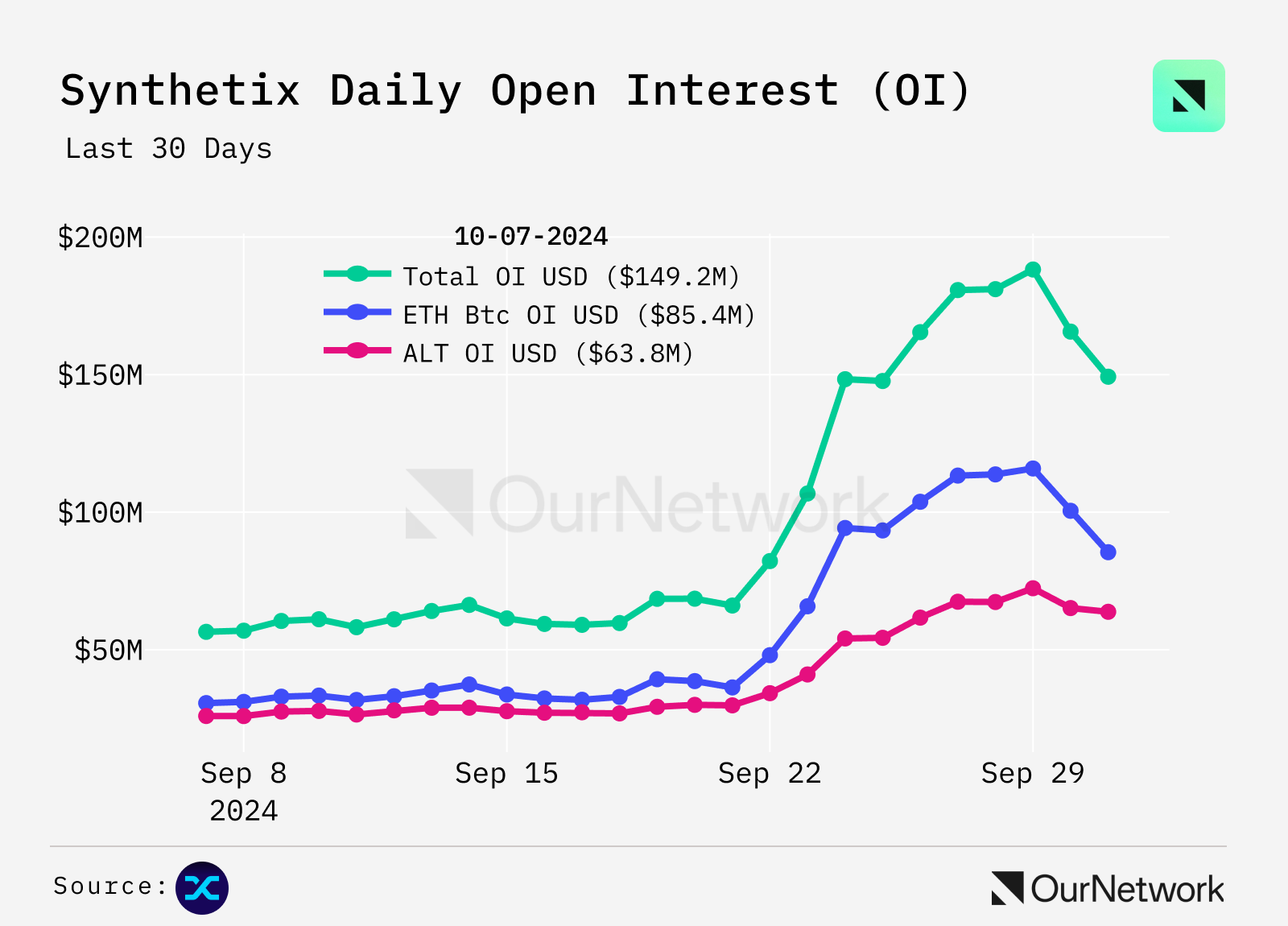

- The open positions for sBTC and sETH have expanded from $50 million to over $150 million, reflecting a 200% increase in leveraged positions. This growth aligns with the increased trading volume from SNX integrators and the anticipated product launches (such as multi-collateral perpetual contracts).

- Trading Highlights: Synthetix may have achieved the largest governance reform to date—SR-2 Synthetix reboot—approved with an astonishing 104 million SNX tokens (worth over $150 million) approved, reaching nearly 99.94% consensus. This reboot brings comprehensive governance reforms, a growth-focused roadmap for 2025, and new optimistic expectations for anticipated product launches (such as the launch of multi-collateral perpetual contracts on Synthetix V3).

GMX

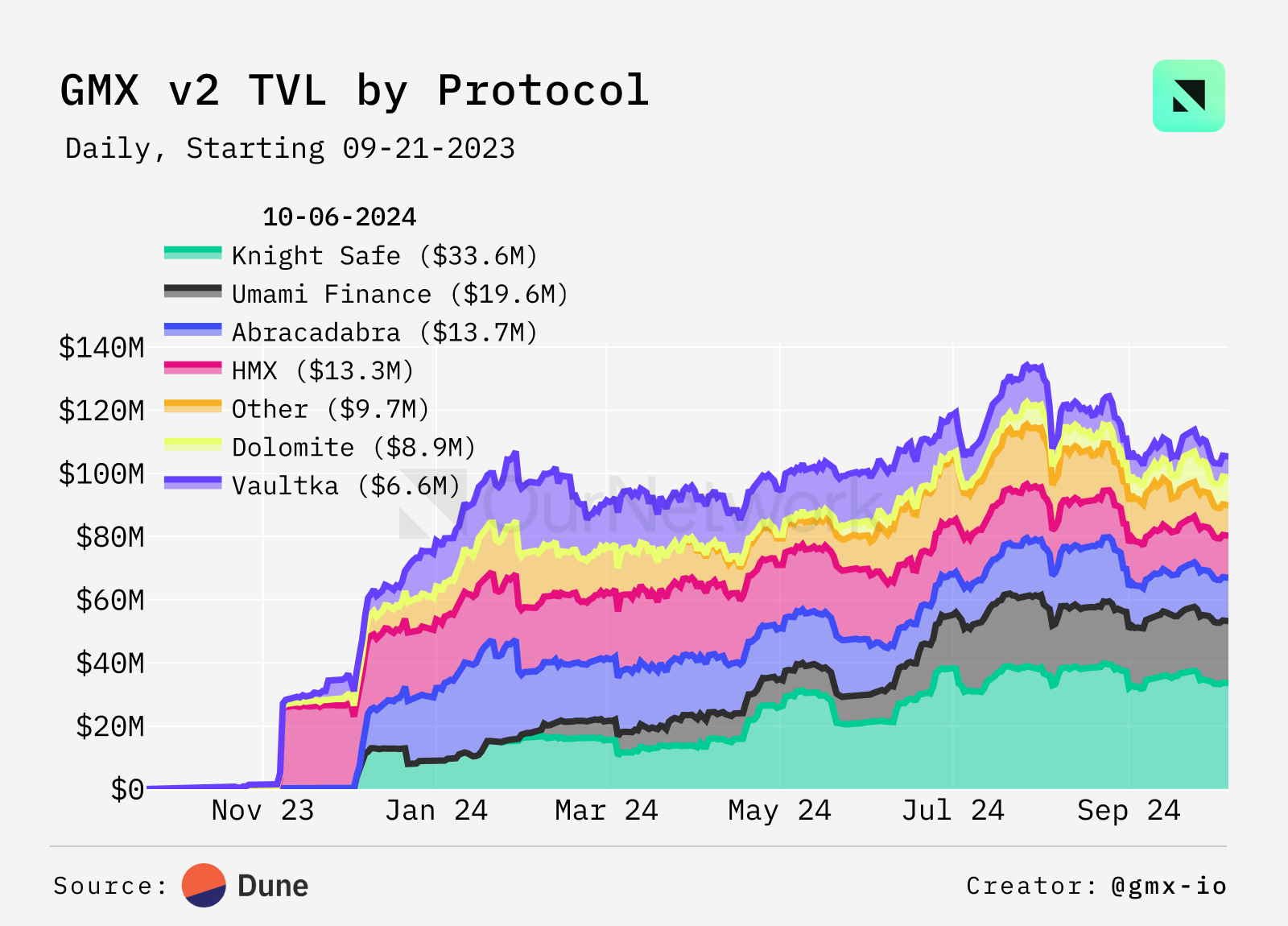

GMX cooperative protocol's TVL surges, accounting for 41% of GMX V2's total locked value

- GMX is a protocol primarily offering perpetual contract trading. Since the launch of GMX V2 in 2023, collaborations with other protocols have significantly boosted the TVL of perpetual contract trading. These protocols have developed innovative yield strategies to draw liquidity from GMX's pools to enhance their respective platforms. The $109 million TVL of GMX V2 demonstrates its success in providing good yields for blue-chip assets, long-tail assets, and more emerging assets in the future.

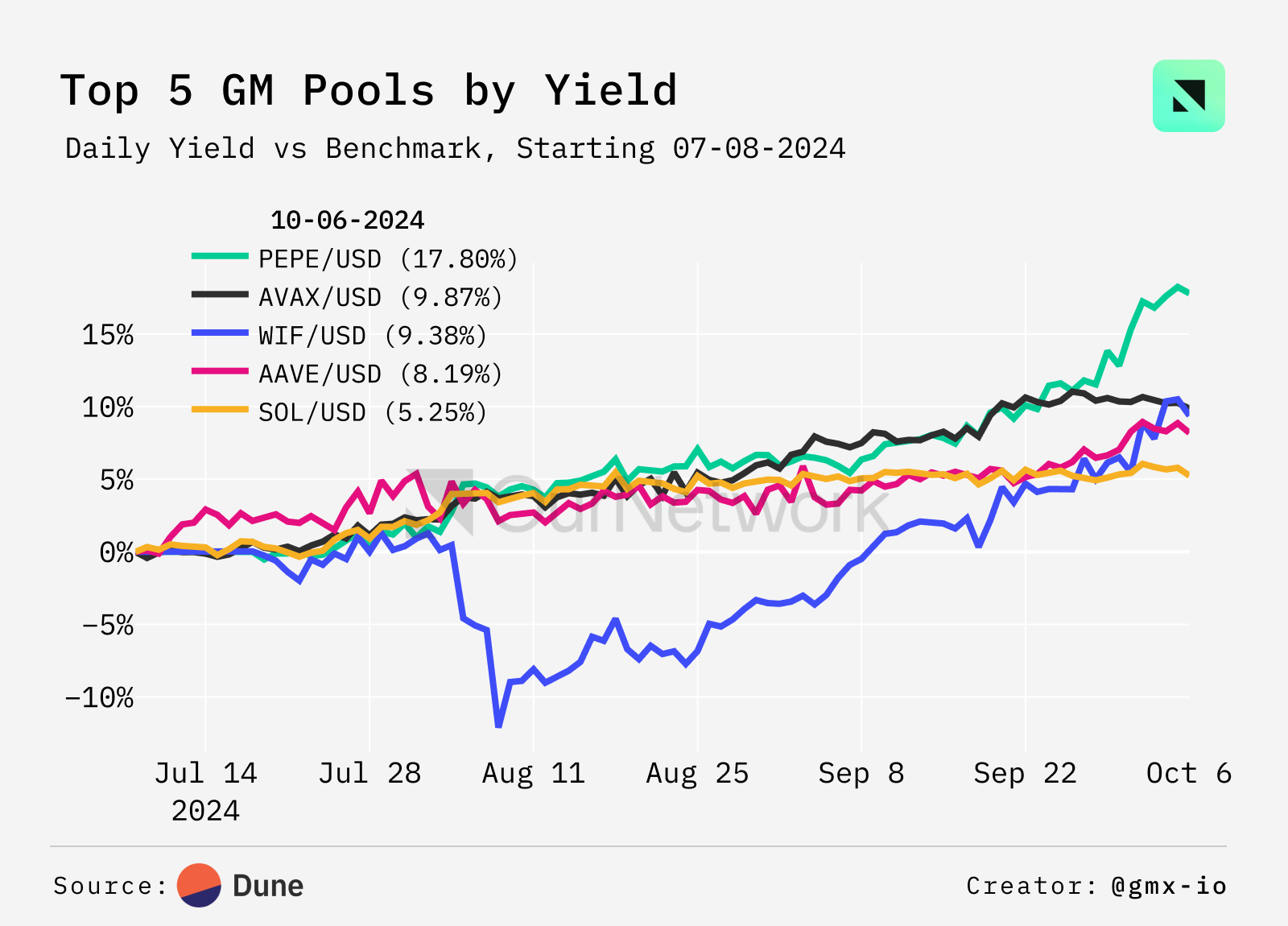

- With the launch of many GM pools, most liquidity providers have achieved positive yield growth. The best-performing GM pools over the past three months, compared to their benchmark—holding the underlying asset—include AVAX/USD, PEPE/USD, and WIF/USD, which have risen by 10%, 18%, and 11%, respectively.

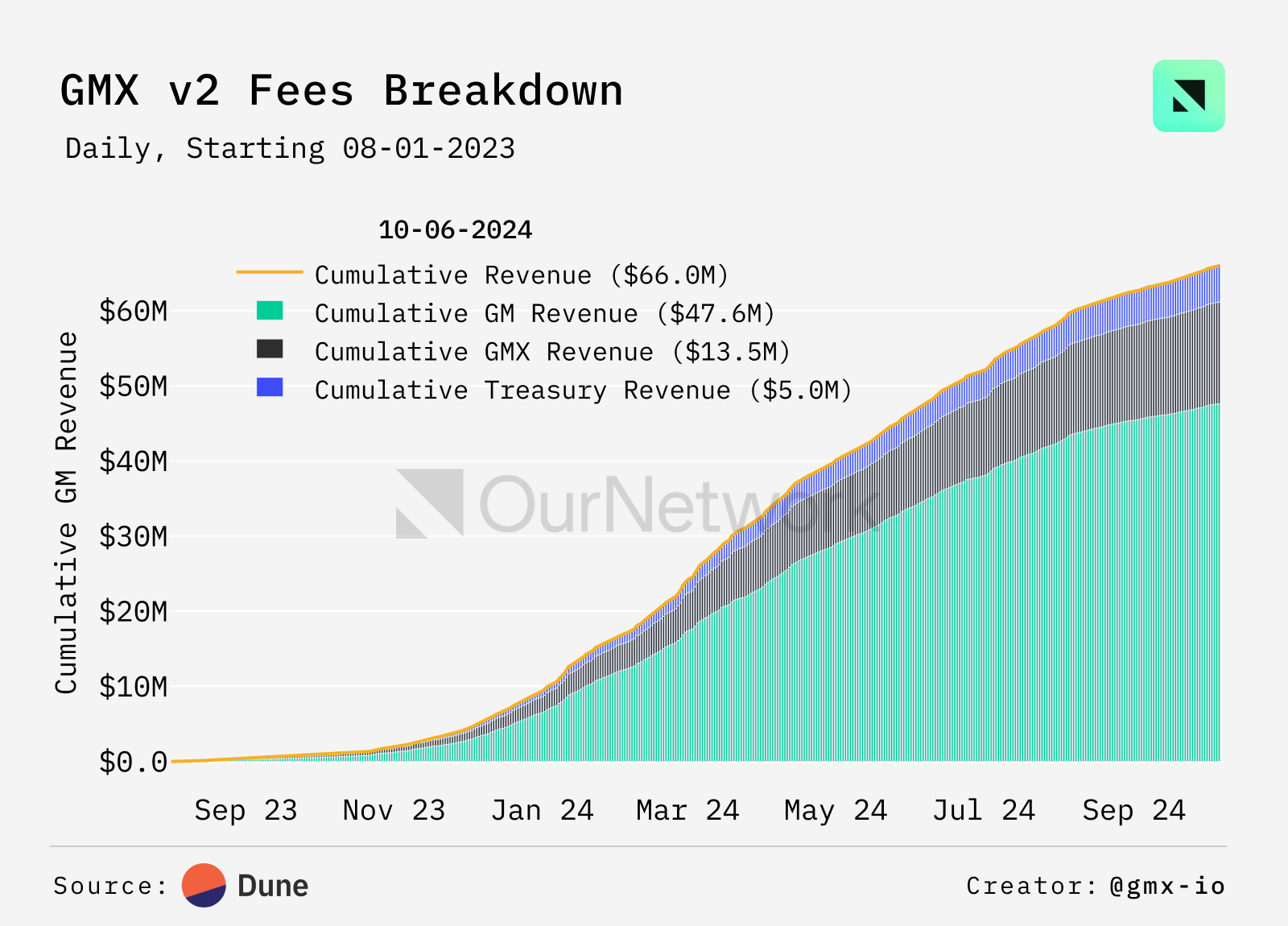

- During its operation, GMX V2 has generated nearly $66 million in revenue for the protocol, in the form of ETH or AVAX. In the future, this will change with GMX's buyback and distribution, as outlined in the snapshot vote from July, which proposed a new tokenomics aimed at benefiting token holders and stakers. Trading highlights:

- Trading Highlights: Recently, a large trader on GMX V2 locked in $100,865 in ETH long profits. They currently still hold $60,894.9 in BTC longs, with a profit and loss of $118,996. This trader typically has a high hit rate—achieving a historical net profit and loss of $790,000.

Vertex

Vertex reaches a historical total trading volume of $130 billion

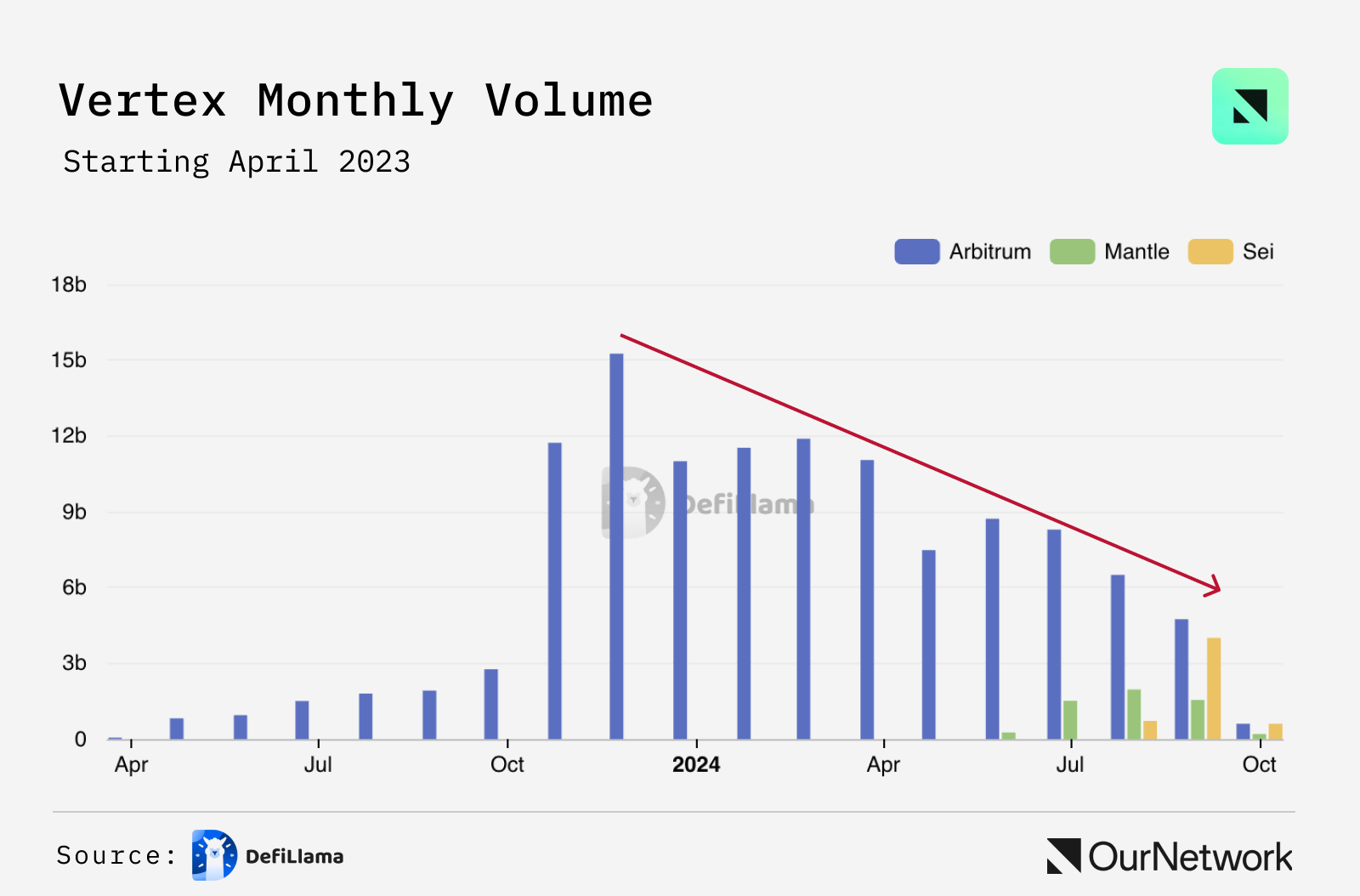

- Vertex is a platform offering perpetual contracts and spot trading. Although the platform's total trading volume has reached a new milestone of $130 billion, Vertex seems to be facing challenges in attracting more business. In fact, the monthly trading volume chart shows a decline starting in December 2023. This is particularly concerning as Vertex has recently expanded its business to other chains, such as Base, Mantle, and Sei, after initially focusing on Arbitrum.

- Dune charts show that Vertex has maintained a stable user base. After reaching a historical high in July 2024—thanks to the expansion to Layer 2 Mantle—the number of new users subsequently fell back to previous lows.

- While trading metrics are temporarily unfavorable for Vertex, token metrics seem more encouraging—42% of the platform's $VRTX tokens are staked, indicating strong user engagement with the platform.

Perennial

Perennial's daily trading volume exceeds $44 million

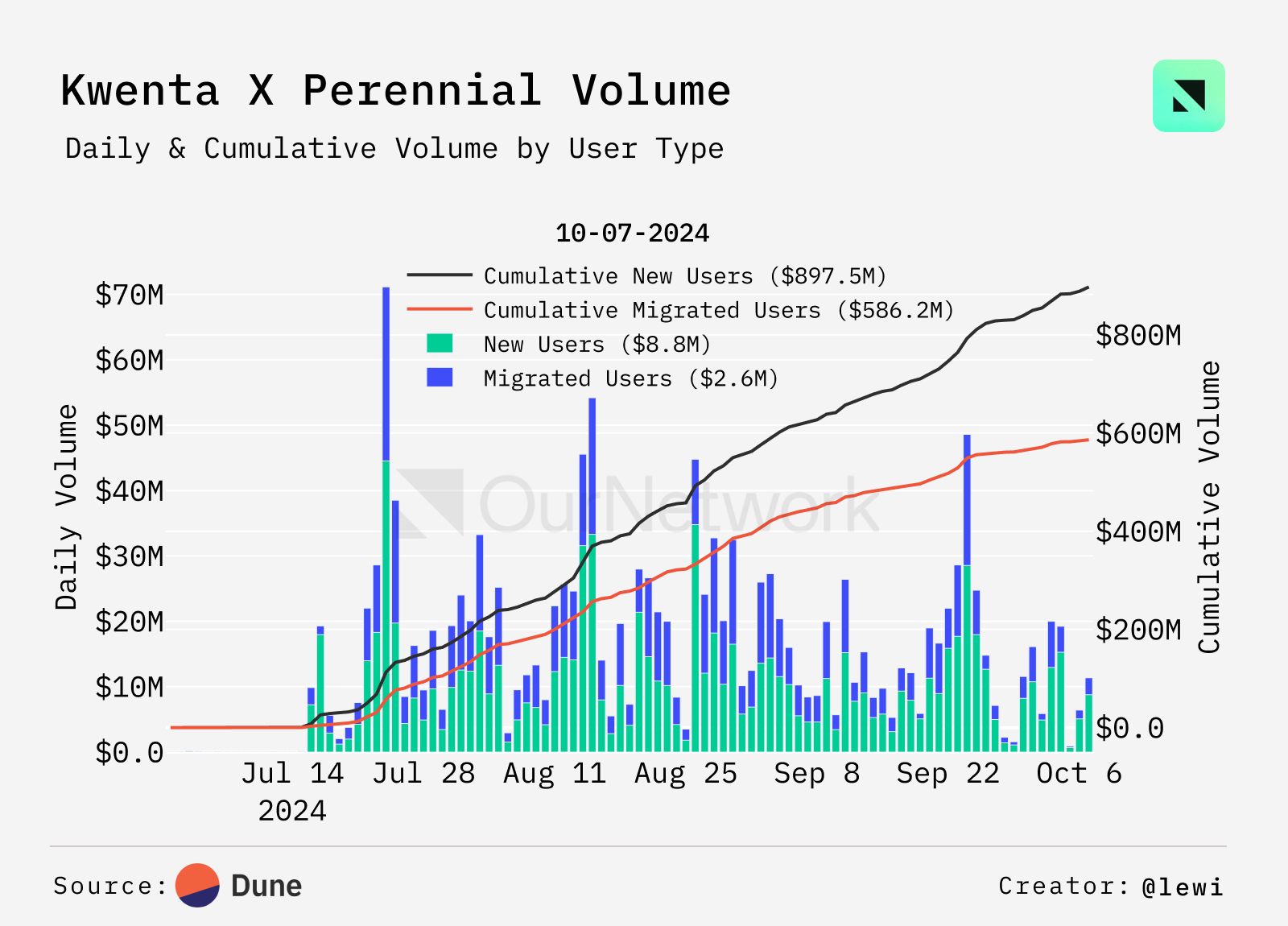

- Perennial provides the infrastructure for perpetual contract trading, allowing partnered front-ends to connect, share liquidity, and order flow. As Perennial integrates new applications, trading volume increases with the addition of new user groups to the trading network. Following a recent integration with Kwenta, a leading perpetual contract aggregator on Arbitrum, Perennial achieved its highest daily trading volume to date. During the ETH ETF news in mid-July, Perennial's daily trading volume surged to over $44 million as market makers delta-hedged their volatility bets.

- One of the most notable features of Perennial is its leveraged market making. Over the past few months, Perennial's average market-making leverage has increased by 229%, indicating users' confidence and understanding of the protocol and its capital efficiency.

- Perennial's funding rate mechanism balances demand between longs and shorts, helping to reduce the risk exposure for market makers. Over the past few months, due to the participation of arbitrageurs, the funding rate has decreased from as high as 5% to the current approximately 0.01%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。