Author: Deep Tide TechFlow

In recent days, you must have seen the figure of this young man in the picture above—long hair, big beard, and glasses, exuding a full rock vibe.

His name is Murad Mahmudov. Previously, he wasn't considered a prominent figure in the crypto space, but in the past few days, he has rapidly become the king of meme calls due to intense analysis and commentary from the external internet.

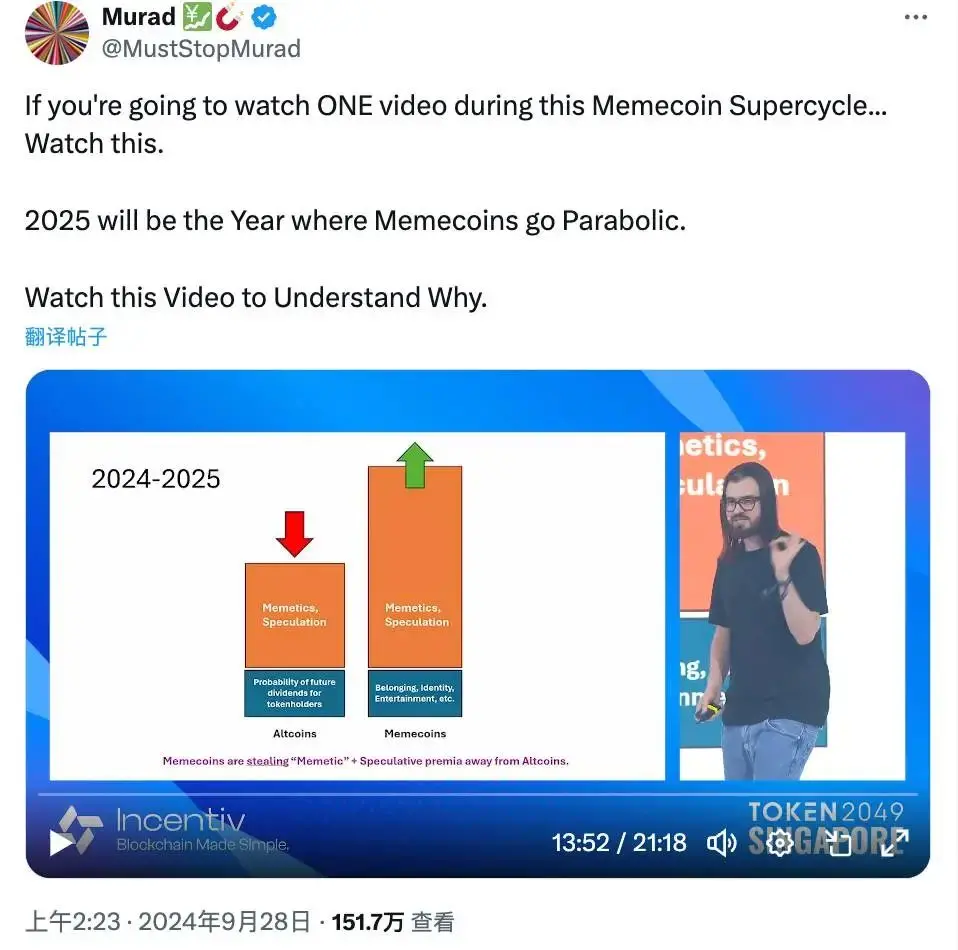

What made him famous was his speech titled "Meme Coin Supercycle" at the 2049 conference in Singapore this year, which has already garnered 1.76 million views as of the time of writing.

If you haven't heard of this young man yet, you might want to watch this video, where you'll find him using extremely formal theories, detailed data, and unwavering confidence to market meme coins to you. His insightful remarks are filled with emotional value, reminiscent of the saying "speak boldly or die trying":

For example, the total market cap of meme coins is expected to exceed one trillion dollars, and Bitcoin will reach 200 trillion dollars in 20 years. You need to overturn your investment logic to embrace this new cycle of meme…

The speech itself has already attracted a large audience, but very few people mention Murad's past:

From learning Chinese to entering the crypto world, from founding a hedge fund that went bankrupt to becoming a master of meme marketing, and then having his wallet address exposed, which raised suspicions of "butt deciding brain" when calling people to invest…

We have gathered more information to help you quickly understand the past and present of the new king of calls.

Learning Chinese, Originating from OKcoin

Initially, Murad was not part of the crypto circle.

He grew up in Azerbaijan, moved to the United States at the age of 16 to study, and later attended Princeton University; the beginning of his story is similar to that of many young people who come to study with the American dream.

Interestingly, according to an interview with Blockworks, Murad revealed that during this period, he began learning Chinese and French.

It was also because of learning Chinese that he had the opportunity to stay in China for a year.

That year, Murad was 17, and in 2013, Bitcoin experienced its largest annual increase to date, nearly 6000%.

At the same time, seasoned investors surely know that year China was undoubtedly the center of the crypto world, with growing awareness of mining and Bitcoin. In such an environment, Murad, in his own words during the interview, said:

"I was in the right place at the right time."

In the foreigner community in Beijing, Murad met the fifth employee of OKcoin, an American, and began to learn about cryptocurrencies from him.

And OKcoin is the predecessor of what is now OKX.

Clearly, Murad was exposed to the crypto world relatively early; the "right time" he mentioned carries another layer of meaning—before the historic crash of 2017 known as "94," he learned about crypto in China before the bubble burst, which influenced his later life, views, and work.

Afterward, Murad joined Goldman Sachs and became an advisor, but his early experiences deepened his understanding of BTC as a store of value.

Let’s not forget, at that time, memes were not yet rampant, and the old consensus of "Bitcoin is gold, Litecoin is silver" was unbreakable.

Thus, Murad initially belonged to the Bitcoin cult rather than the meme cult.

Running a Fund, Exposed During the Pandemic

The turning point in his fate came in 2017.

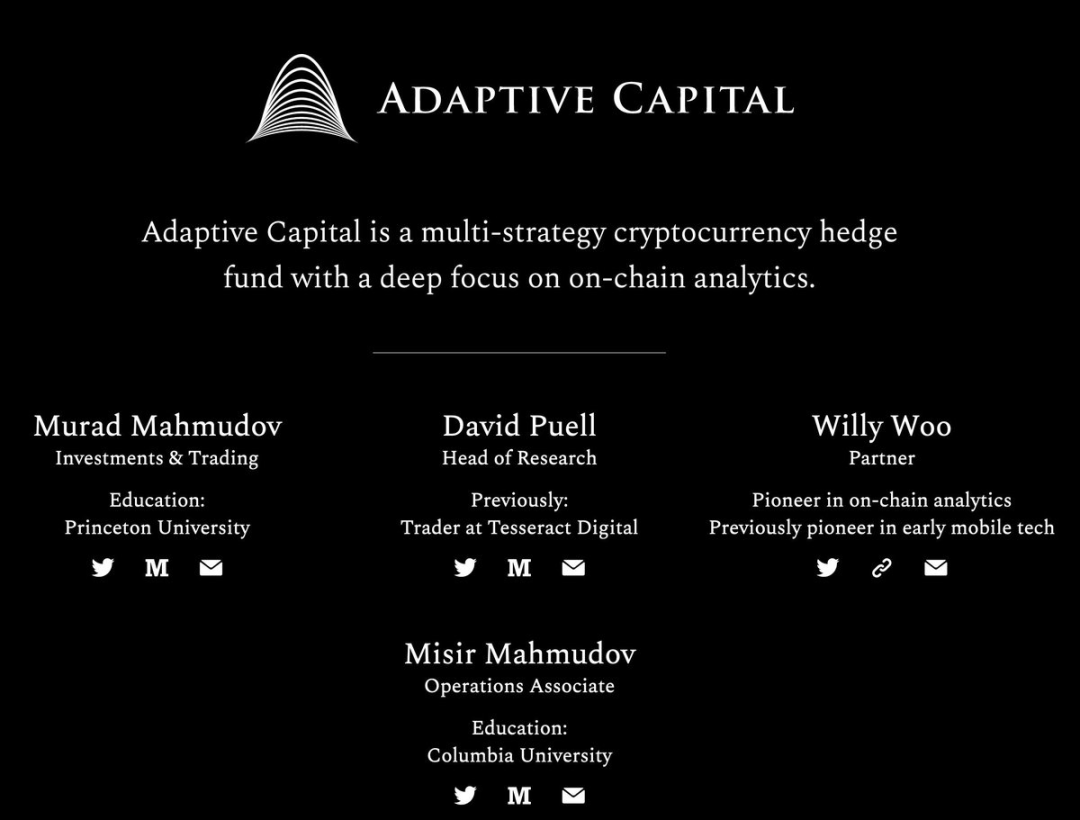

Although that year the entire crypto world was in turmoil due to the "94 incident," Murad founded Adaptive Capital, a smaller crypto hedge fund company.

If you do some image archaeology on search engines, you can still find promotional pages for the company; Murad was responsible for investment and trading-related positions there, which, if not taken too seriously, looks like the so-called "trader."

Being on the front lines, Murad undoubtedly accumulated a lot of trading and market observation experience.

But those who walk by the river often get their shoes wet. Moreover, in the perilous waters of crypto, where emotions are intangible and market shifts happen faster than changes in the weather.

In 2020, the COVID-19 pandemic swept the globe, and the international situation changed dramatically.

At the same time, the crypto market also experienced wild fluctuations. On March 13 of that year, after Bitcoin's price dropped by over $1,000, Murad's Adaptive Capital suffered a huge blow. The company sent a public letter to all investors, informing them that the fund would close and that it planned to return the remaining capital to its limited partners.

Adaptive Capital attributed this to CEX halting services during the price crash, which prevented timely position management, leading to liquidation:

"We used some reputable exchanges every day, but these platforms and tools stopped operating during the sell-off, severely hindering our ability to take appropriate action."

In the words of retail investors, this is a classic case of exchanges "pulling the plug."

The truth of the matter is hard to ascertain, but as the trading and investment head of this fund, Murad was clearly impacted by the "pulling the plug" incident, which perhaps laid the groundwork for his later search for opportunities in on-chain memes.

Supercycle, Gaining Fame from a Speech

In 2022, Murad became more active on social media and posted, "I’m back."

He firmly believed that this industry would attract more capital and considered the bear market the best time to plan for the next bull market.

It was also around this time that different memes began to emerge, and Murad took notice of them.

The subsequent story is well-known; the long-haired young man stood on the stage of 2049 and delivered a passionate speech titled "Memecoin Supercycle," igniting widespread viewing and discussion in the crypto community.

Before this, Murad's story was not widely known. But as the saying goes, "Those who provide emotional value will surely attract attention." Murad's remarks during the speech earned him extraordinary popularity, such as the claim that MEME would reach a market cap of one trillion dollars and that Bitcoin's price would soar to 200 trillion dollars in 20 years.

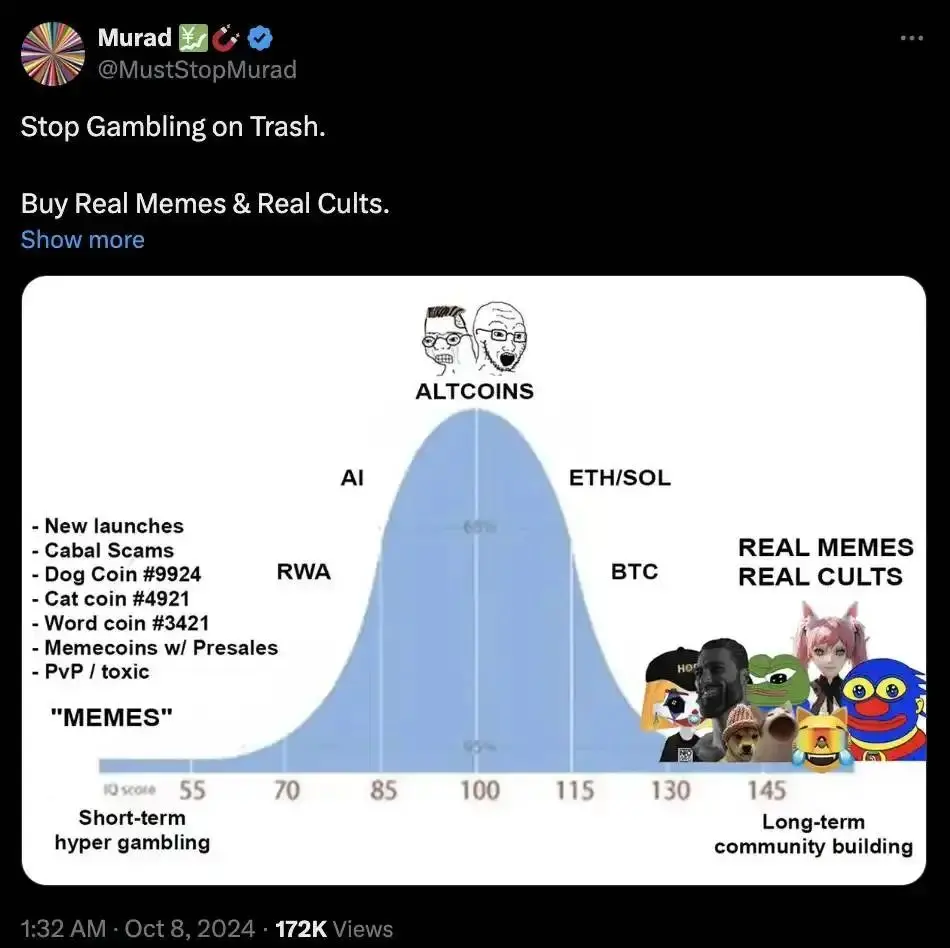

In this cycle where memes were rampant, with numerous memes entering the top 50 by market cap, Murad's supercycle speech provided every meme player with a rationale and legitimacy for holding their positions, and he was not merely calling for investments.

For instance, he characterized most crypto tokens in a slightly academic yet easily understandable manner—if a token is neither a store of value nor distributes income, then it is a memecoin.

To borrow the words of Twitter user @0xWendy99:

"What sets this Princeton guy apart is that his 'orthodoxy' is much stronger than Ansem's; he speaks with the flavor of a regular army, 'tokenized community,' 'token is the product,' memes are no longer subordinate or out of touch, using theory to guide memes and using systems to drive speculation, making retail investors feel sophisticated and institutions feel justified."

With early trading experience and strong marketing skills, Murad became famous in the supercycle with just one speech.

High Places Are Cold, Butt Decides Brain?

With fame comes controversy, and Murad is no exception.

After his rapid rise to fame, Murad often called for investments and analyzed the quality and worthiness of various memes.

This has led to ongoing suspicions that Murad's steadfastness as a meme bull may be driven by profit motives and a desire to offload his holdings.

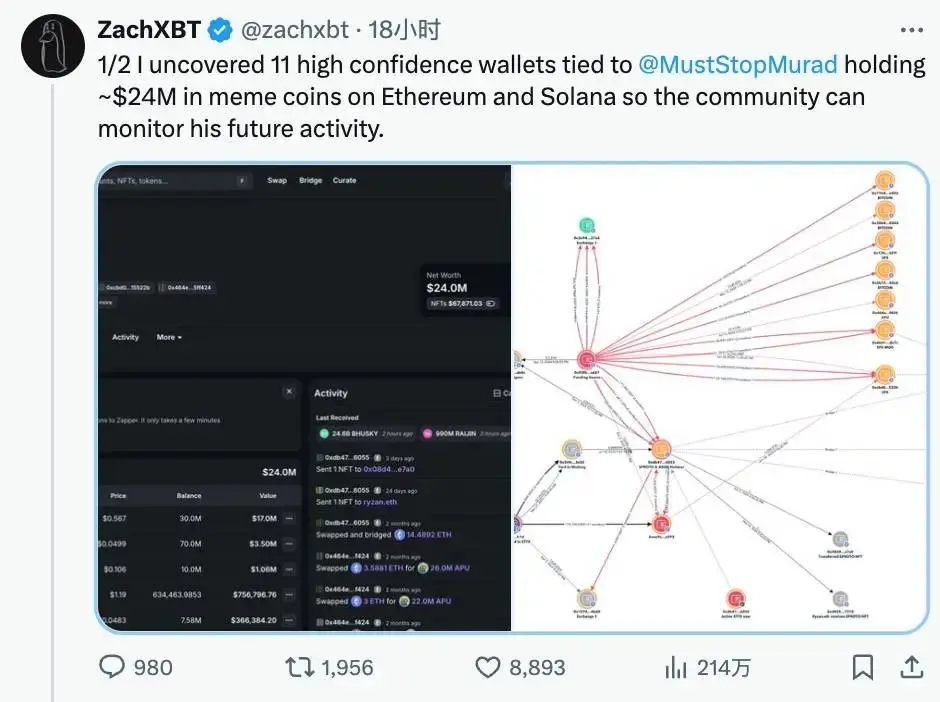

Notable on-chain detective ZachXBT certainly did not miss this and recently uncovered 11 wallet addresses suspected to be highly associated with Murad, which hold a total value of approximately $24 million in memes on Ethereum and Solana.

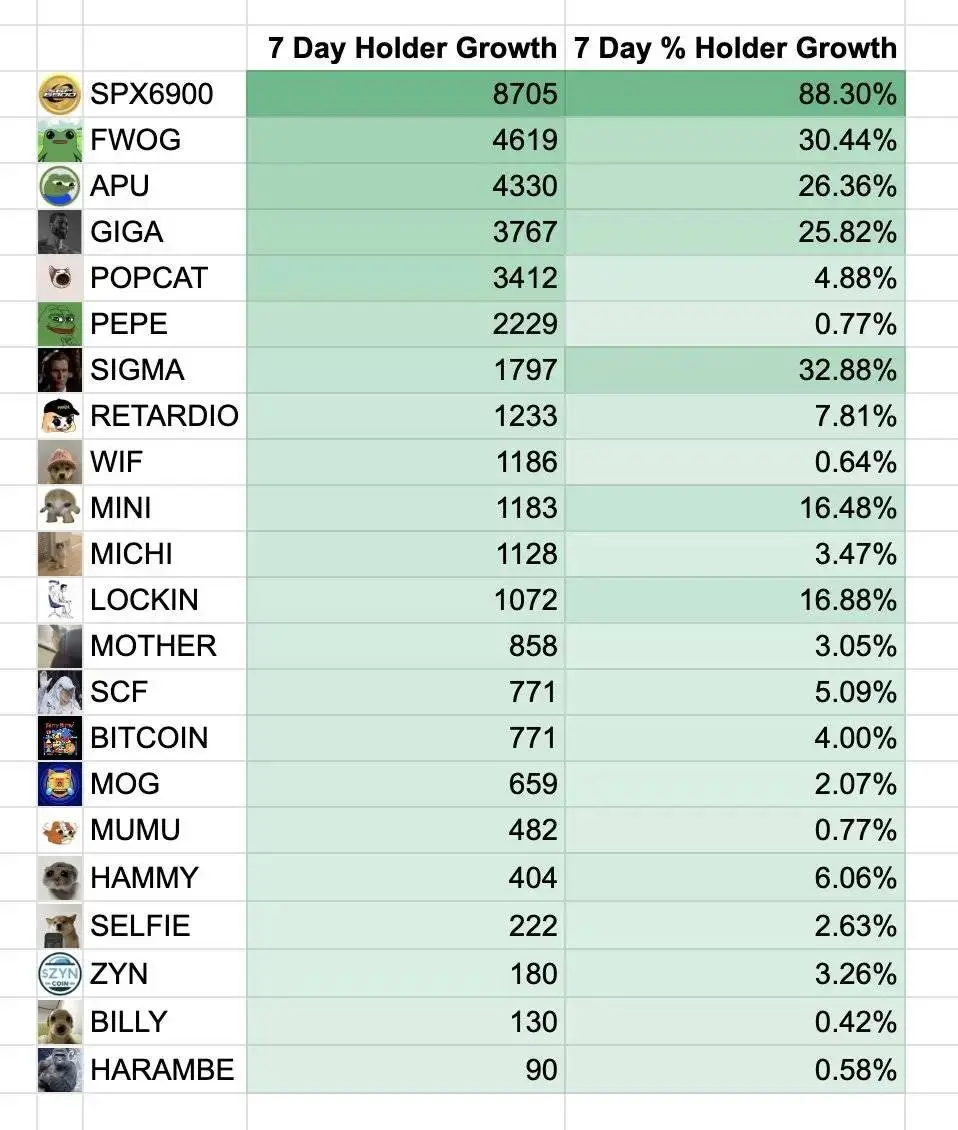

Data shows that some of these addresses purchased large amounts of the meme coin SPX between June and August and achieved over 60 times returns within four months; this aligns with the meme coins Murad publicly recommended:

However, a classic saying in the crypto world goes:

Buying a coin without engaging in marketing is a foolish act.

Murad bought and marketed, which in some ways can be seen as aligning knowledge with action; whether he first bought and then called retail investors to jump on board or purely believed in the meme cult and wanted everyone to believe in him is a matter of perspective.

Currently, the community is engaged in heated debates regarding the detective's exposure of Murad's holding addresses.

Some Twitter users believe that ZachXBT's actions can prevent followers from being dumped on, while Slorg, the project leader of the Solana tool Sol Incinerator, questioned, "Do you really think these things are hidden?" implying that this information was public to begin with, and exposing it is not unreasonable.

On the other hand, there are also many voices opposing the exposure:

Udi Wertheimer, co-founder of Taproots Wizards, stated that publicly seizing someone's wallet to prevent potential illegal activities is madness; some users also disapprove of targeting Murad in advance, especially when he hasn't done anything wrong.

Buying and selling tokens and engaging in trading is not inherently lawless;

But high places are cold. When a meme bull suddenly gains a large following and potential influence, people will inevitably target him, placing him under a microscope to uncover more information.

Whether for personal fame or to uphold justice against insider trading, being famous inevitably brings controversy, and high places are naturally cold.

We cannot conclude whether Murad is merely a die-hard bull or a master of manipulating retail investors, but he himself mentioned in an interview: "For certain tokens, I will definitely sell some by the end of 2025 or early 2026… but for other coins, I plan to hold them long-term to ride out the cycles."

But as the saying goes, peaks generate false support, while dusk witnesses devoted followers.

After a supercycle, whether the newly crowned king of calls, Murad, holds memes or BTC, time will surely provide the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。