As the November U.S. elections approach, the trading theme will gradually shift towards the elections.

Author: Chen Min

Market changes are always unexpected and perplexing.

Just like the cautious you, the questioning you, the confused you, who just believed the Federal Reserve's explanation of "why to cut 50bps," only to turn around and try to understand "why it can't cut 50bps."

The Federal Reserve's words are truly "deceptive."

It seems that overnight, the tone of the Federal Reserve's statements has completely shifted to "cautious," "balanced," and "data-dependent."

New York Fed President Williams: It is a very good baseline scenario to have two more 25 basis point rate cuts this year.

Atlanta Fed President Bostic: The Fed must balance various competing risks when considering the pace of future rate cuts in the coming months.

Boston Fed President Collins: Policymakers should adopt a cautious, data-dependent approach when lowering interest rates to help maintain the strong momentum of the U.S. economy.

Fed Vice Chair Jefferson: The risks to the Fed's employment and inflation targets are currently roughly equal.

Fed Governor Cook: The Fed should continue to commit to bringing inflation down to the 2% target, but take a "balanced approach" to avoid an "undesirable slowdown" in job growth and economic expansion.

The emergence of such changes can be attributed to the following reasons:

First, the recent non-farm payroll data significantly exceeded market expectations. In September, the number of new non-farm jobs increased by 254,000, the largest monthly increase in six months, surpassing the expected increase of 150,000 by 69.3%.

Second, as the election approaches and becomes increasingly heated, the polling between the two candidates is extremely close. Any action by the Fed could be interpreted as "election assistance," leading the Fed to prefer to maintain "steadiness" and "caution" before the election.

Third, the recent escalation of the Israel-Palestine conflict could lead to a worsening situation, with the potential for a chain reaction of rising oil prices, price rebounds, and upward inflation, forcing the Fed to consider this variable.

Fourth, after the initial rate cut, the attractiveness of emerging market assets, represented by A-shares and Hong Kong stocks, has surged, increasing the pressure of capital outflow from the dollar and motivating the Fed to choose to slow down its actions before the election.

Market pricing for the Fed's rate cut expectations this year has now returned to the scope of one cut each in November and December.

Figure 1 Fed Rate Cut Expectations

With the adjustment of dollar rate cut expectations, the dollar index formed a "V" shape in early October. This is influenced not only by factors related to the dollar itself but also significantly by the weakness of major currencies like the euro and yen.

Figure 2 Dollar Index V-Shaped Reversal

- Regarding the euro, the European Central Bank's stance remains dovish.

After the German central bank president acknowledged a rate cut in October, French central bank president Villeroy stated that the ECB is likely to cut rates next week and will further ease monetary policy in future meetings. The euro's movement is largely synchronized with the interest rate differentials between Europe and the U.S., reflecting the direct impact of interest rate pricing on exchange rates.

- Regarding the yen, the risk of a "hawkish" new prime minister is gradually being alleviated.

New Japanese Prime Minister Kishida Shigeru has already conveyed a dovish signal regarding the continuation of monetary policy in his first press conference, becoming an important factor for the yen's recent weakness. Former Bank of Japan board member Maeda predicts that the next rate hike by the BOJ is most likely to occur in January next year, significantly delayed from previous expectations of the end of this year.

- Benefiting from the attractiveness of renminbi assets, the renminbi, despite some weakening, remains relatively strong among many currencies.

Figure 3 CFETS Renminbi Index

Regarding the future market, I believe that as the November U.S. elections approach, the trading theme will gradually shift towards the elections.

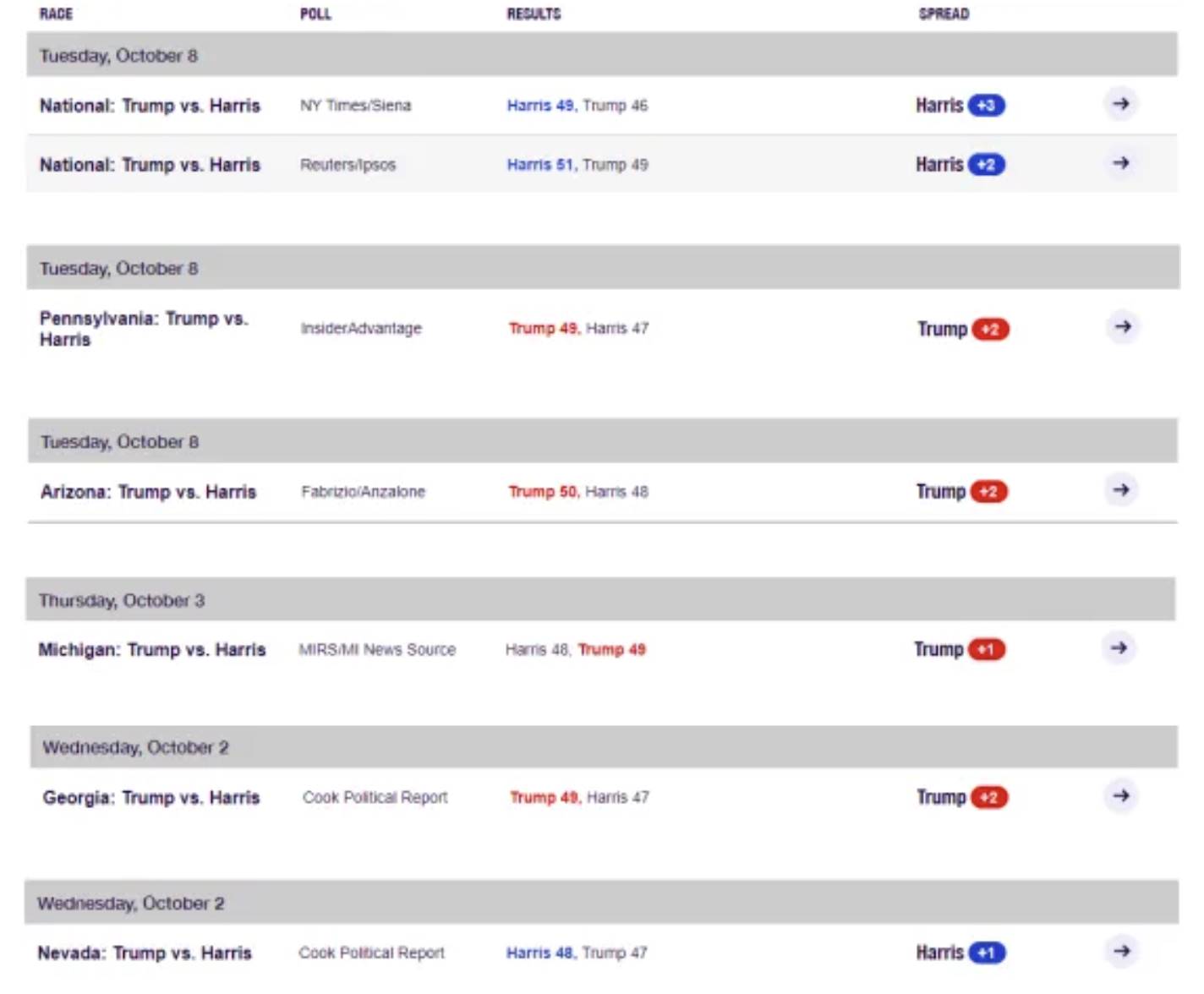

According to the latest polls, Trump's national support has once again approached Harris, maintaining a lead in several swing states.

If the "Trump trade" dominates, the dollar may exhibit a stronger performance.

Figure 4 Trump and Harris Polling Situation Nationwide and in Swing States

However, from a medium to long-term perspective, I remain optimistic about non-U.S. currencies.

First, recent renminbi assets have maintained a high level of attractiveness. Although there has been some pullback, the market still holds expectations for policy.

Market trading may gradually advance along the lines of policy sentiment, policy implementation, and policy effects.

Second, my judgment is that the pace of dollar rate cuts will slow down but not pause. As the dollar's interest rate advantage narrows, the outflow of funds to emerging markets will only accelerate.

In the future, I still have a positive outlook on China.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。