The appeal of Memecoins partly lies in their presentation of wealth creation as an entertainment product, offering fair and convenient participation opportunities.

Author: Simon de la Rouviere

Translation: Deep Tide TechFlow

I consider myself a socialist in a sense because I wish for more people in society to have more wealth. This is not just about supporting public services through taxation in a welfare state, but is closer to the classical definition of socialism: allowing more people to directly own "means of production." When more people own capital, capitalism can operate at its best.

In the cryptocurrency space, since the emergence of Dogecoin in 2013, internet memes have gradually become an important part of the market. With improvements in blockchain scalability and user experience, issuing any token has become unprecedentedly simple, and this trend has resurged since 2021, with a market value exceeding $50 billion.

For some, cryptocurrency itself is difficult to understand, let alone Memecoins. From the outside, it seems like a zero-sum gambling game, filled with scams promising high returns, ultimately just draining investors' money. This situation does exist, but there are also people who enjoy participating in this financial contest. If you delve into the reasons behind it, you may find that the lessons contained within can provide insights for improving modern economic systems. Sometimes, solutions need to be sought from unique perspectives.

Community Atmosphere. Memecoins are not just investments; they are more like a form of entertainment, filled with fun and excitement. By purchasing Memecoins, people can easily integrate into a social community.

Increased Fairness. Over time, the opportunities for wealth creation have become more equitable. While this community atmosphere may not appeal to everyone (after all, trading animal derivatives or politically themed Memecoins similar to 4chan does not have widespread appeal), the aspect of fairness reveals some issues within our current wealth creation structure. Many successful Memecoins were considered "fair" at the time of issuance, meaning they avoided making a few individuals wealthy, often lacking centralized leadership, with rules enforced through transparent and verifiable smart contracts. Therefore, the risk of investors being "rug pulled" is relatively low.

Thus, the appeal of Memecoins partly lies in their presentation of wealth creation as an entertainment product, offering fair and convenient participation opportunities. If the issuance of Memecoins is fair (not dominated by a specific group), it is almost free from regulatory constraints. This means that regardless of where you are or who you are, you can participate. Once involved, whether you are a wealthy fashion designer in Manhattan or a self-sufficient farmer in the Philippines, the opportunities are equal.

However, the reality is that most forms of wealth creation today are only accessible to the wealthy, with increasing barriers to entry. For example, obtaining liquidity has become difficult, certain rules favor the rich, and public access to the market is decreasing.

The Issue of Liquidity

Not everyone can enjoy sufficient liquidity. For instance, starting a tech company in South Africa is much more challenging than in the United States, as there is more funding available in the U.S. willing to invest in new ideas. Entrepreneurship itself is not easy, and the increasing compliance requirements make it even more difficult.

The Issue of Access to Opportunities

Even in the U.S., you may be excluded from some investment opportunities due to a lack of funds. In some cases, companies only allow wealthy individuals to participate in investments when selling securities. For example, under Rule 506c of the Securities Act, if you want to publicly advertise a private investment, only accredited investors can participate. If you lack sufficient financial resources, that's unfortunate. Essentially, this regulation excludes some individuals, even though this practice is deemed necessary to maintain an "orderly market."

Investing in Public Markets

Assuming you cannot become an accredited investor, what avenues do you have to participate in wealth-creating investments? In the U.S., aside from a few private investment opportunities, the main options remain public markets, such as directly holding stocks, ETFs, and bonds. Although companies may achieve substantial returns after going public, most significant gains are actually realized before the IPO.

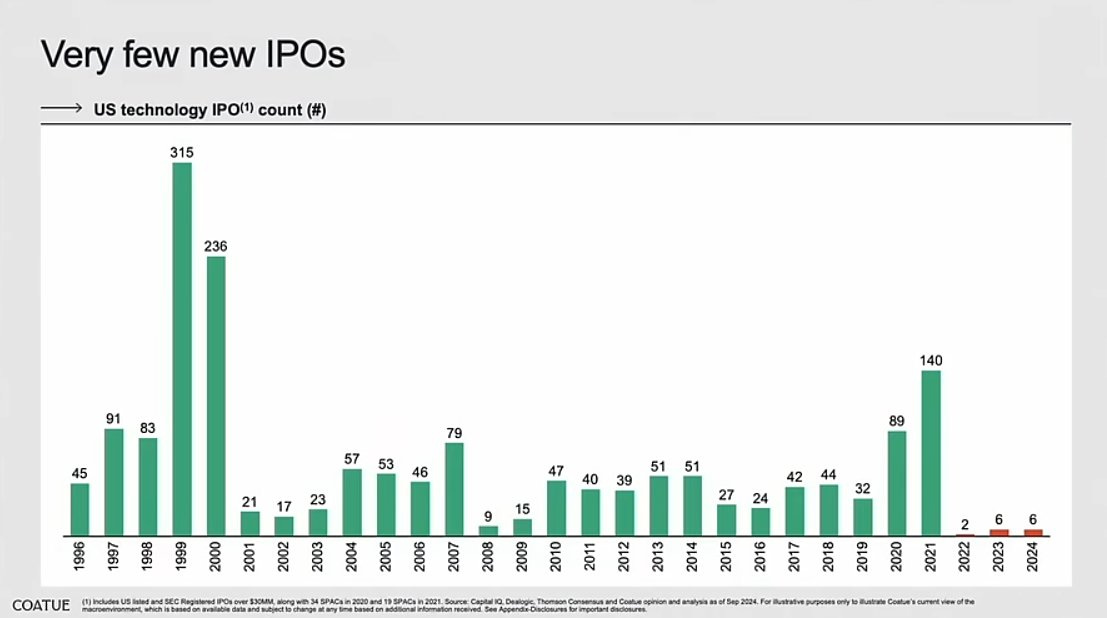

However, if you wish to invest in the public markets in the U.S., the costs of an IPO are quite high, and since 2022, the popularity of IPOs has waned. In 2019 alone, legal and accounting fees averaged over $2 million. The number of IPOs in the U.S. has been decreasing.

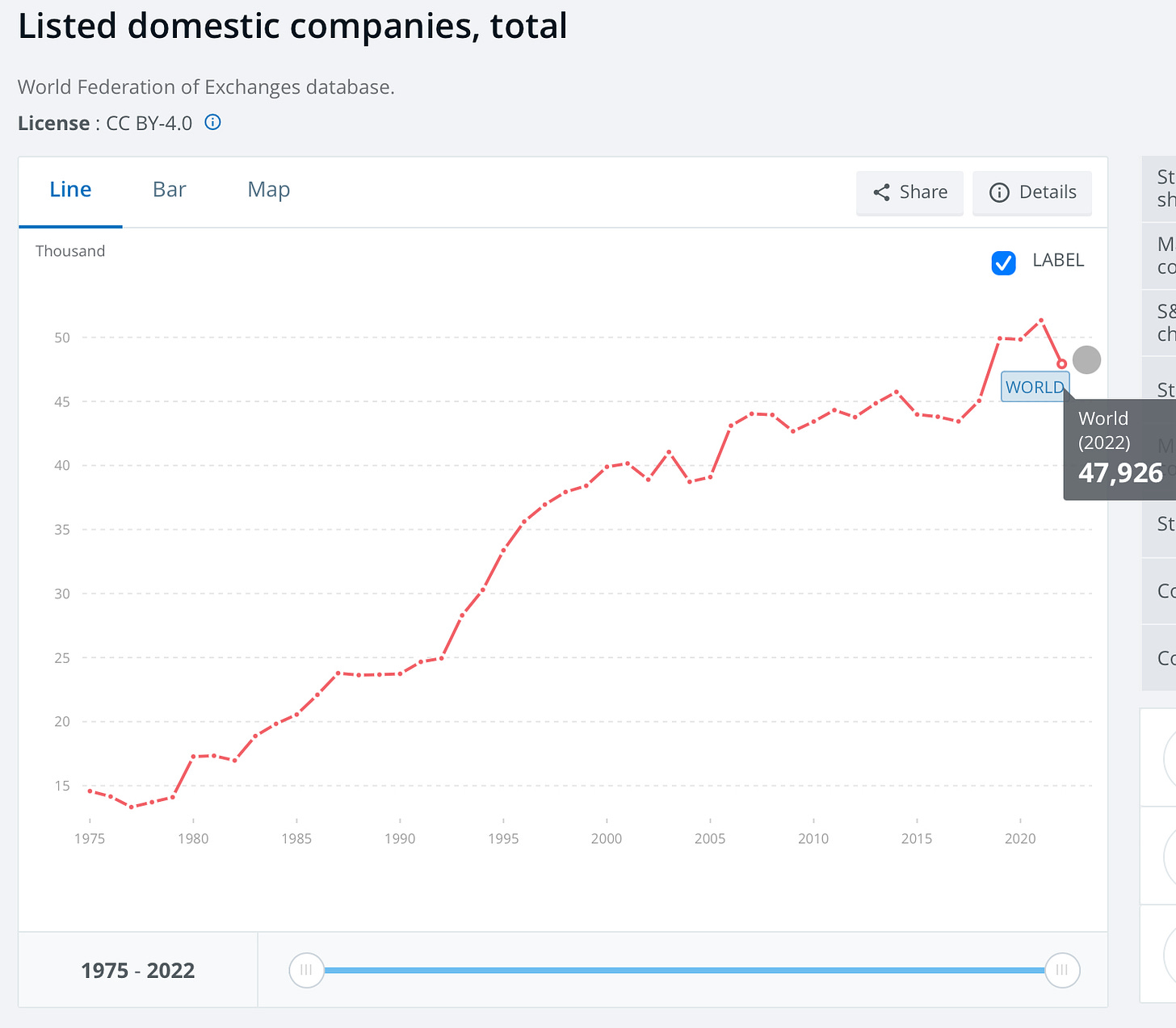

From the perspective of the total number of publicly listed companies globally, the situation does not seem very optimistic. I attempted to obtain global data, but there was an anomalous peak in the data from China in the World Bank's statistics, and I could not verify its source. Therefore, the unverified global data is roughly as follows:

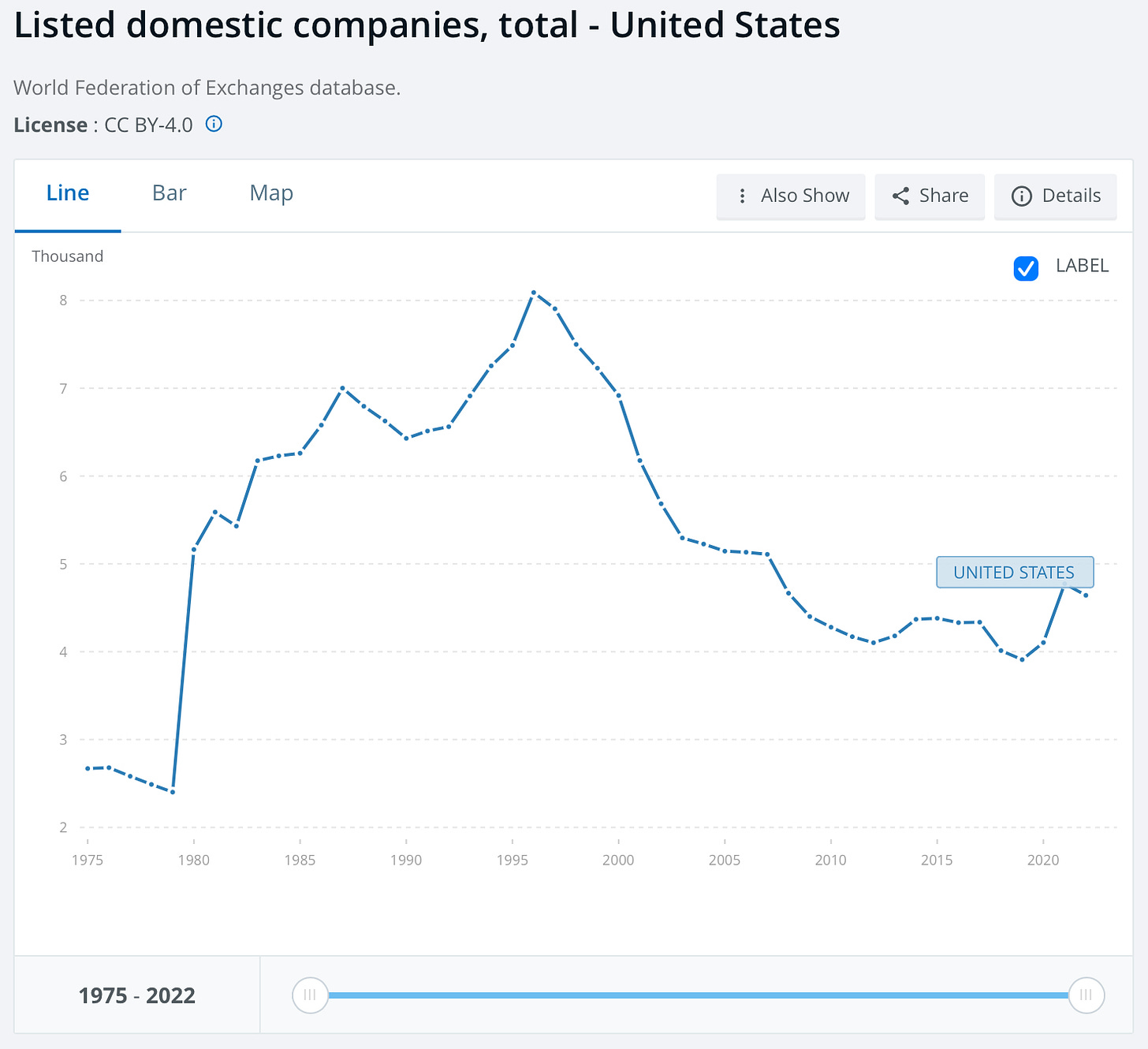

But more specifically, the situation in the U.S. looks like this.

Globally, as industrialization progresses in other regions, per capita investment opportunities have increased in some places, but in developed countries like the U.S., this growth has stagnated. As more countries catch up with industrialization, will this trend continue or become the norm?

So, how should we respond?

In the face of these dilemmas, many may lean towards relaxing regulations, but this requires weighing the pros and cons. The original intention of financial regulation is to ensure the orderly operation of markets, protect investors, and maintain a relatively healthy investment environment. While increasing compliance layers can indeed reduce risks, it also means that funds may flow to places where investors feel more secure, even if this excludes many from these investment opportunities.

A complete relaxation of regulations may help increase ownership in some respects, but it could also undermine many good attempts aimed at creating wealth.

Therefore, the solution is not necessarily to simply relax regulations, but to rethink how to effectively protect investors in modern society. Many existing protective measures were designed before the internet age, such as issues related to the fraud of bearer stock certificates. So, if we want to provide reasonable protection without adding too many barriers, how should modern society achieve this goal?

One area to focus on is Memecoins. In the financial games of Memecoins, standout projects indicate that we can reconsider how to access wealth creation opportunities earlier and ensure reasonable investor protection by setting protective measures at different stages. This means:

Protect investors not by exclusion, but by providing certainty through innovative means.

Ensure transparency not through expensive administrative compliance and documentation requirements, but through code that prevents misconduct.

Maintain market order from a systemic perspective, rather than merely focusing on individual impacts.

For example, many recently popular Memecoins have adopted a token bonding curve mechanism. This mechanism (which I have participated in promoting) initially establishes a reserve, transparently allowing participants to buy and sell along the price curve, thereby creating new supply. This means that funds do not flow to a specific entity but are used for a singular purpose: liquidity. When a certain threshold is reached, supply is limited, and reserve funds are transferred to an automated market maker, providing ample liquidity to the market.

This means:

Investors do not need to worry about their funds being siphoned off.

There are no internal privileges; everyone can participate equally (similar to the public market, only dependent on the timing of participation).

The guaranteed liquidity reduces the possibility of market manipulation.

All processes are transparent and public.

In many cases, this model allows for earlier and fairer participation while protecting small investors to some extent. While it cannot completely eliminate scams and fraudulent activities, it is an example of adjusting the position of protective measures.

Yes, this is great, but should everyone invest?

I believe that viewing the less wealthy as incapable of understanding risks is somewhat condescending. Nevertheless, in the effort to eliminate class disparities so that more people can create wealth, concerns about the over-financialization of the world are understandable.

This contradiction is difficult to resolve: In a capitalist society, how can we ensure that people can create their own wealth without allowing wealth to overshadow all relationships?

This may itself be a topic. For example, recent studies indicate that the legalization of sports betting increases debt burdens and subsequent bankruptcies. In legalized states, credit scores have dropped by 1%.

Here, one might ask the same question: should people be allowed to freely take on these gambling risks? Yes or no? In one study, despite gambling players spending more than usual, the average still showed a small percentage deviation.

In fact, most of the bets come from a small number of high-intensity gamblers. According to the ranking of total betting deposits, the top third of gamblers bet an average of $299 per quarter, accounting for 1.7% of their income, while the bottom third of gamblers bet an average of only $1.39 per quarter.

This is similar to the data from New Jersey:

In New Jersey, 5% of bettors accounted for nearly 50% of the bets and 70% of the funds. The profits of gambling websites come from extracting losses from those bettors—just like casinos.

This raises an age-old question: How do we balance individual freedom when a certain legal behavior has a significant impact on a minority?

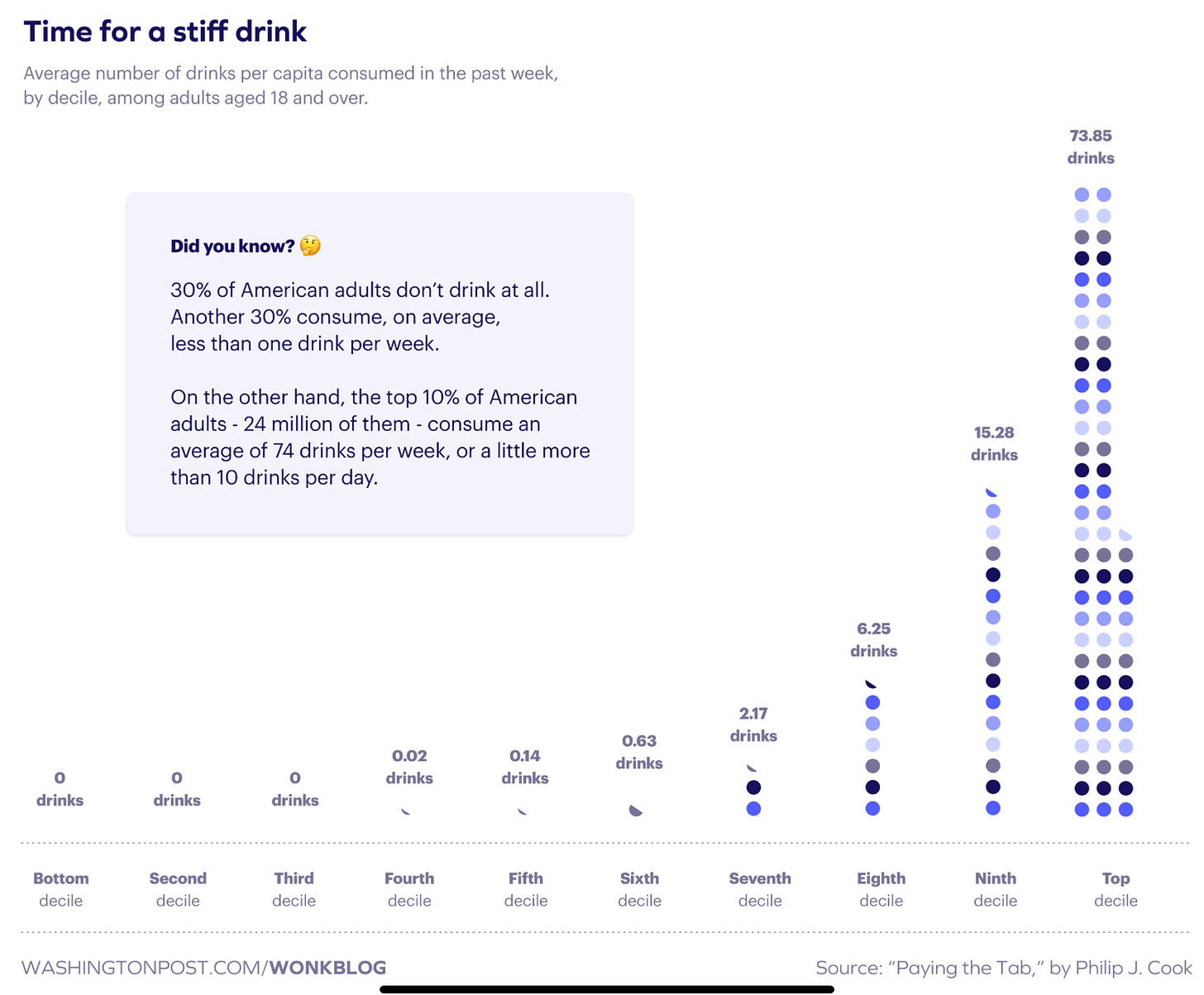

Take alcohol as an example, the situation in many countries is as follows:

If the personal freedoms of the top tenth lead to systemic negative impacts, society may view this differently. The issue of alcohol is a typical example; despite leading to drunk driving accidents, abuse, and intolerable public disorder, it is still tolerated by society. In contrast, regarding gun control, although most gun owners may be responsible, the tragedies of mass and indiscriminate gun violence are not met with the same tolerance.

Therefore, some freedoms that seem harmless on an individual level may evolve into complex social issues. From this perspective, financial regulation for certain individuals is not only to ensure market order but also to reduce excessive financial transaction activities in daily life. I understand this and see why some societies may lean towards such measures.

Thus, the question of whether we want to live in a more financialized world and how we ensure the accessibility of the current world are two different issues. If you agree that opportunities for wealth creation should be increased and accept the trade-offs that come with it, then we can draw lessons from Memecoins without needing to fully relax regulations.

The influx of funds and liquidity into Memecoins is partly due to the fact that the rules of the traditional financial system were established before the advent of the internet and cryptocurrencies. These rules were designed to provide orderly markets and investor protection for a bygone era, but in reality, they have exacerbated inequality. If we can update these rules to 21st-century standards, we hope to reduce this gap between classes. This way, more people can participate in the process of "producing Memes."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。