Against the backdrop of a return in risk appetite, the Bitcoin bulls successfully broke through $65,000.

By BitpushNews

On Thursday, the financial markets continued to rise.

Data released by the US Department of Labor showed that the number of initial jobless claims in the week ending September 21 was 218,000, the lowest since May, and lower than expected, indicating the resilience of the labor market. At the same time, durable goods orders in August remained flat, breaking the expected decline, and the GDP in the second quarter remained stable at 3%, enhancing investors' confidence in the fundamental strength of the US economy.

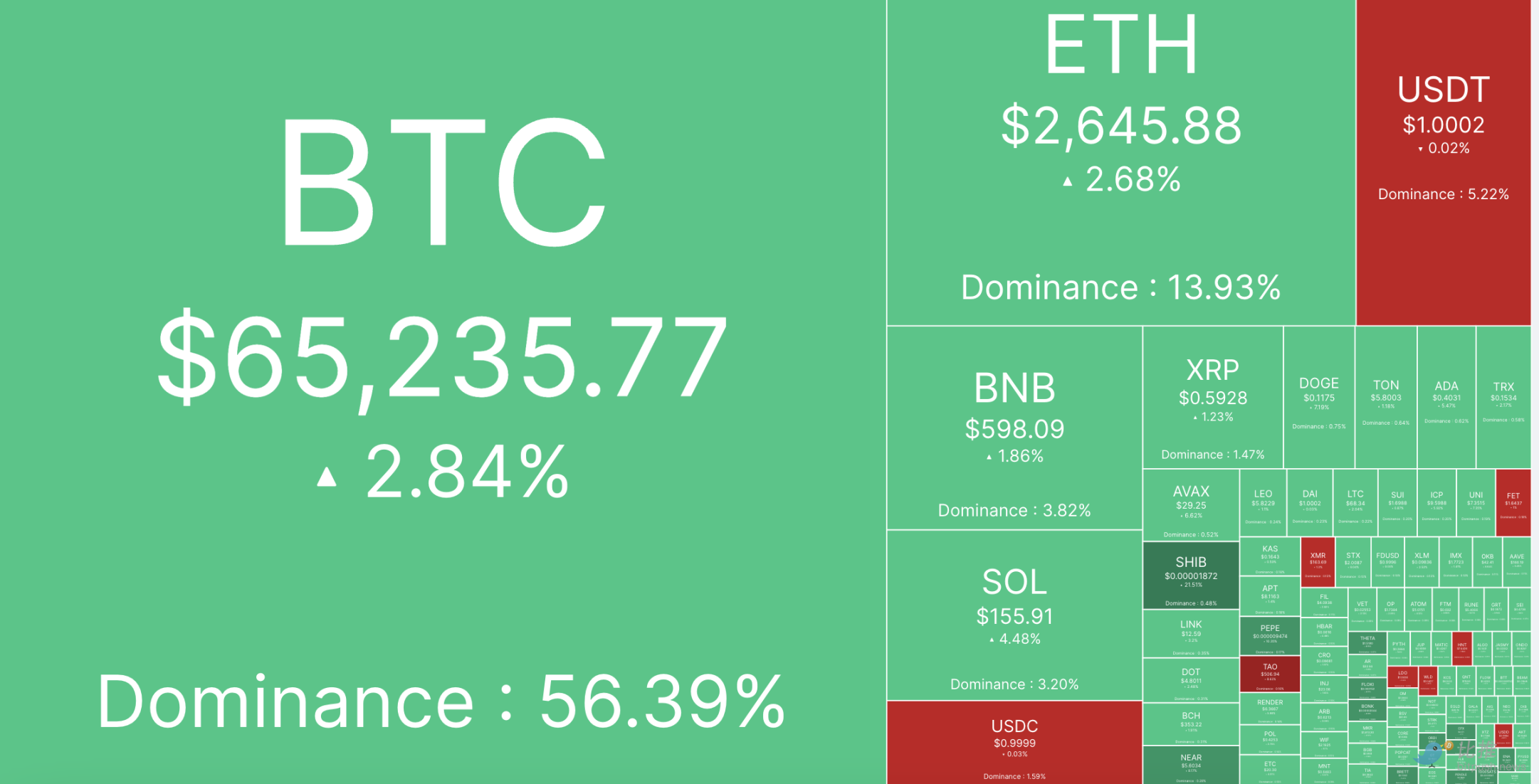

Data from Bitpush shows that against the backdrop of a return in risk appetite, the Bitcoin bulls successfully broke through $65,000, reaching a high of $65,887 in the afternoon before a slight pullback. At the time of writing, the trading price of Bitcoin was $65,235, with a 24-hour increase of 2.84%.

Among the top 200 tokens by market capitalization, most of the altcoin markets continued to rise.

The largest gainers were Shiba Inu (SHIB), up 21%, followed by Ethena (ENA) with a 17.5% increase, and Wormhole (W) with a 16.6% increase. Hamster Combat (HMSTR) led the decline with a 31.3% decrease, followed by Bittensor (TAO) with a 6.1% decrease, and Baby Doge Coin (BabyDoge) with a 5.1% decrease.

The total market capitalization of cryptocurrencies is currently $2.29 trillion, with Bitcoin's market share at 56.3%.

At the close of the day, the S&P 500 index, the Dow Jones index, and the Nasdaq index all rose by 0.40%, 0.62%, and 0.60% respectively.

Bitcoin and PCE Report

TradingView analyst Arman Shaban pointed out: "Given that Bitcoin has recently risen on the weekly chart and reached the expected $65,000, with strong support at $52,750 and the price not falling below $49,000, in this scenario, the short-term targets for Bitcoin are $67,700 and $71,800. In addition, based on previous analysis, the mid-term target for Bitcoin is $80,000."

The core PCE price index (personal consumption expenditures) report is set to be released tomorrow, which directly affects the monetary policy decisions of the Federal Reserve.

Shaban stated, "If the core personal consumption expenditures data meets expectations (0.2%) or even lower, the market may feel less pressure for interest rate hikes, which would benefit higher-risk assets such as Bitcoin, as investors facing controlled inflation and more accommodative monetary policy would turn to digital and high-risk assets."

Shaban added, "If the core PCE is in line with expectations, Bitcoin may continue its upward trend and reach the short-term targets of $67,700 and $71,800. Looking at the mid-term, with easing inflation concerns and stable interest rates, Bitcoin may further strengthen, possibly reaching the level of $80,000."

However, if the core PCE data exceeds expectations, indicating higher-than-expected inflation, the Federal Reserve may decide to implement more aggressive tightening measures. Shaban warned, "This could push up the US dollar and create short-term pressure on risk assets such as Bitcoin. In this scenario, Bitcoin may experience some downward fluctuations, with potential support at $62,000 and $60,000. Considering Bitcoin's strong fundamental demand and technical factors, these fluctuations may be temporary, and Bitcoin is expected to ultimately resume its upward trajectory."

Based on some of the currently released economic data, the most likely scenario is that core personal consumption expenditures will remain flat or below expectations, providing further upward momentum for the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。