In this cycle, with the gradual entry of external institutions and the continuous improvement of infrastructure, we will witness the arrival of the next DeFi wave driven by BTCFi.

Rapid Development of Bitcoin

As the world's first cryptocurrency, Bitcoin has the highest social consensus and security, and has become the digital gold. In this cycle, Bitcoin has achieved rapid development in infrastructure, applications, and consensus.

Improvement of Infrastructure

The OP_CAT opcode and BitVM computing paradigm for expanding the mainnet programmability are gradually improving, and numerous BTC Layer2 and interoperability protocols have been launched.

Innovation in Applications

The Ordinals and Runes protocols introduce native assets to the Bitcoin ecosystem, the Babylon native habitat scheme injects vitality into the Bitcoin ecosystem, and the BTCFi ecosystem has achieved a breakthrough from scratch.

Strengthening of Consensus

The Bitcoin mainnet has experienced its fourth block reward halving, with mining rewards halved and mining costs continuing to rise.

Breakthrough in Traditional Markets

BTC ETFs have been approved by regulatory authorities in the United States and Hong Kong, allowing retail and institutional investors to include Bitcoin in their portfolios.

Looking ahead, with the continuous improvement of Bitcoin network programmability and the strengthening of token consensus, the total market value of Bitcoin and the DeFi ecosystem market value will be far more than this. The rapid development of Bitcoin in the BTCFi field will bring revolutionary changes to the crypto world and even the global financial system.

Broad Prospects of BTCFi

The market prospects of Bitcoin are immeasurable, and its influence in the global financial market is continuously expanding.

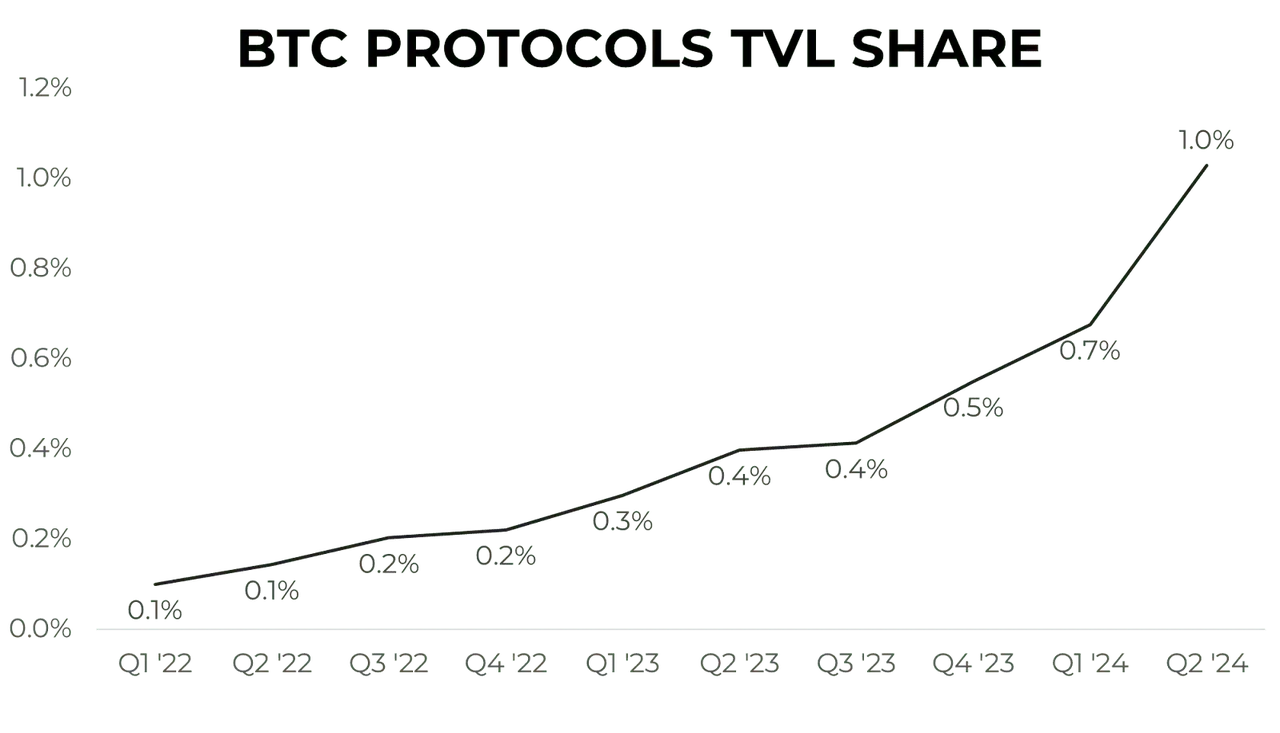

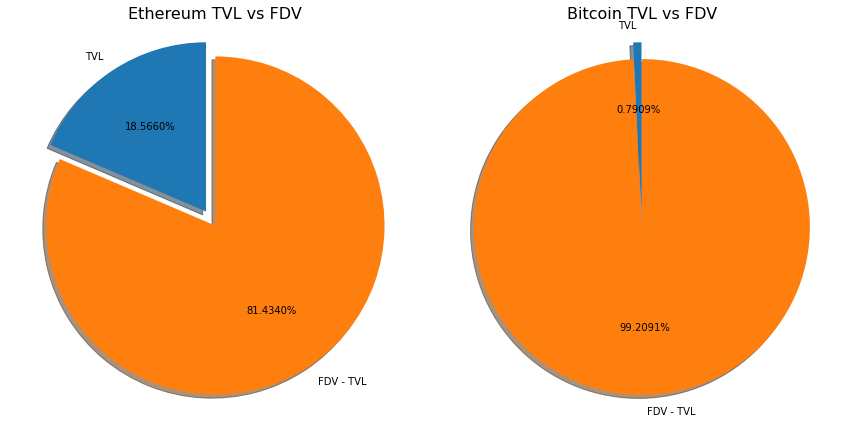

Although the Total Value Locked (TVL) of the Bitcoin protocol is increasing year by year, as of the second quarter of 2024, the total TVL of BTCFi (Bitcoin Decentralized Finance) accounts for only 1% of the total market value of Bitcoin. In comparison, the total TVL of the Ethereum mainnet protocol and Layer2 accounts for 18.6% of the Fully Diluted Valuation (FDV) of ETH. Conservatively, if BTCFi can reach a corresponding scale to the Ethereum DeFi ecosystem, there is at least 20 times the growth potential, creating a blue ocean market worth billions of dollars.

The BTCFi ecosystem needs to meet the following three key requirements to fully unleash the potential of this blue ocean market:

Solid Role in the Base Layer

The BTCFi ecosystem needs to fully unleash the potential of the Bitcoin mainnet and sidechains as the foundational issuance layer for tokenized assets, by providing the most secure and stable technical support to establish a solid foundation for DeFi applications.

Increased Productivity of Bitcoin

The BTCFi ecosystem needs to meet the growing market demand for increasing the productivity of Bitcoin assets. Users expect Bitcoin to not only serve as a store of value but also actively participate in various financial activities, utilizing their BTC for asset appreciation through collateralized borrowing, liquidity staking, and re-staking.

Truly Decentralized Financial System

The BTCFi ecosystem needs to build a truly decentralized financial system that reflects the principles of Bitcoin decentralization, reducing reliance on centralized institutions and providing more fair and transparent financial services to global users.

With the continuous development of technologies such as mainnet programming, expansion schemes, zero-knowledge proofs, and AVS cross-chain communication, these needs will gradually be met, and the potential of Bitcoin DeFi will continue to be unleashed.

Potential Beyond Ethereum DeFi

In the field of decentralized finance (DeFi), Ethereum has long been in a leading position, mainly due to its powerful smart contract functionality and rich application ecosystem.

However, in the current market cycle, with the decentralization of the Ethereum consensus mechanism and the emergence of institutionalization, BTCFi is expected to surpass Ethereum DeFi and lead the future institutionalized DeFi market.

ETH/BTC Ratio Continues to Decline

The current market cycle places unprecedented emphasis on compliance, user growth, and stable profit models. Binance has invested as much as $213 million in compliance within a year; at the same time, Binance has continued to list TON ecosystem tokens such as $NOT and $CATI. Delta-neutral on-chain financial products such as Ethena also receive widespread support. DeFi is gradually transitioning from a speculative tool to the next generation of financial means for promoting inclusive finance.

Compared to Ethereum's DeFi, BTCFi is better suited to future market demands and is expected to fill market gaps and drive the continuous development of the industry through long-term strategies and solutions.

Development Trends of the Bitcoin Ecosystem

Growth in the Number of Developers

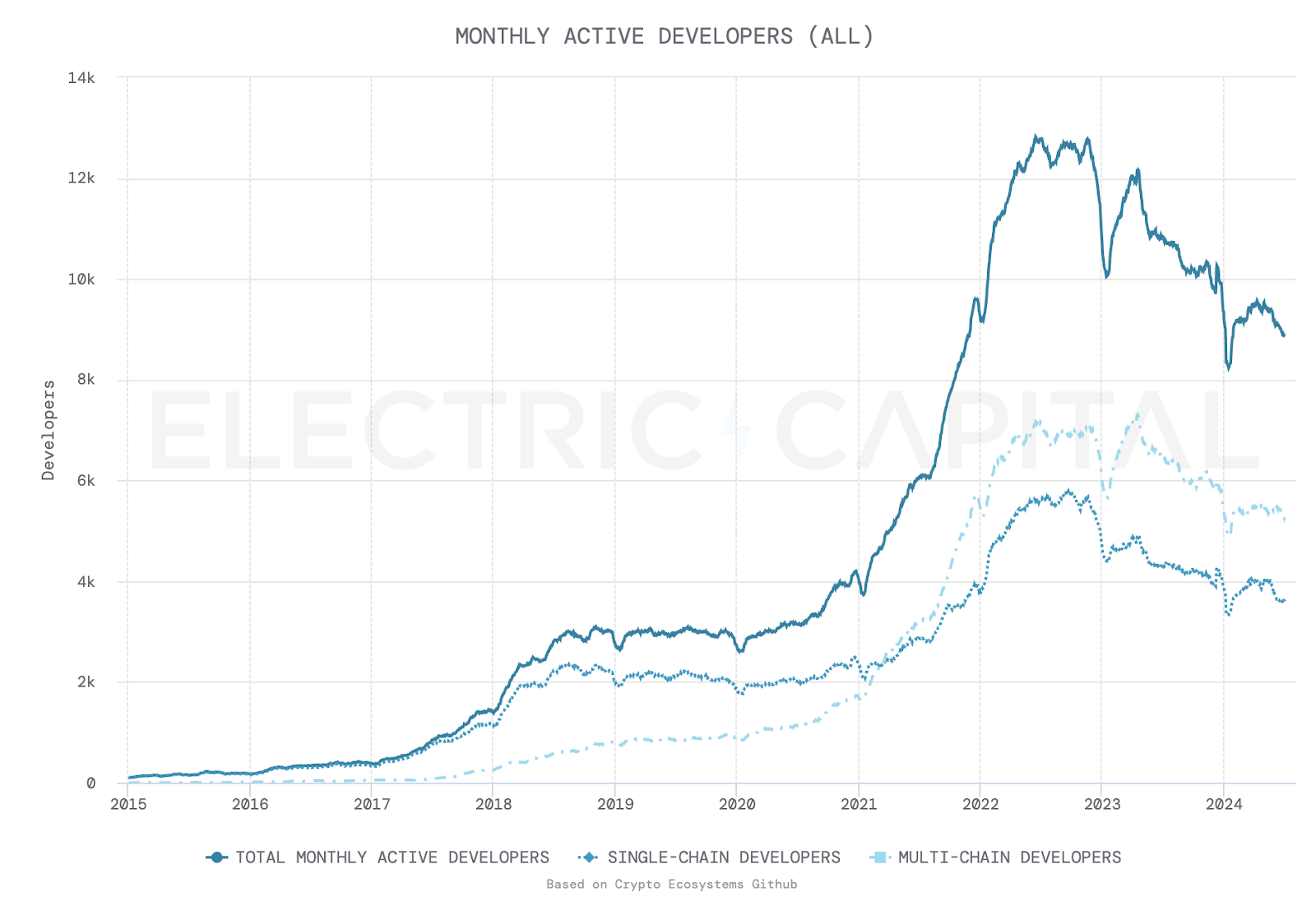

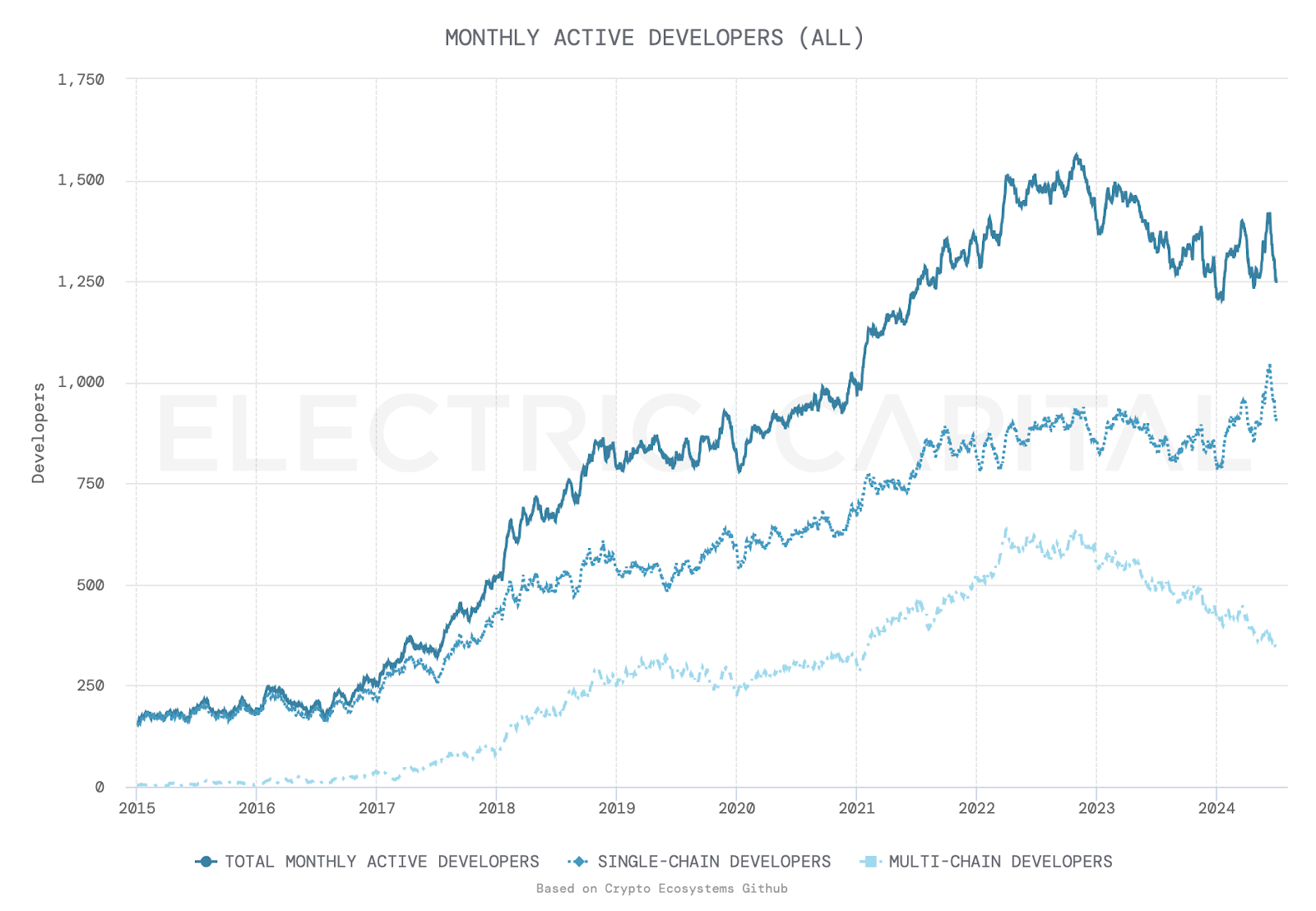

As of January 2024, Ethereum's monthly active developer count was 7,864, a 25% decrease from the previous year. In comparison, the number of Bitcoin developers is still steadily increasing, gradually surpassing 1,000. This trend indicates that the attractiveness of the Bitcoin ecosystem in the developer community is increasing, heralding the emergence of more innovative applications.

Left: The number of Ethereum developers has shown a significant downward trend since the end of 2022; Right: The number of Bitcoin developers is steadily increasing

Increase in Institutional Holdings

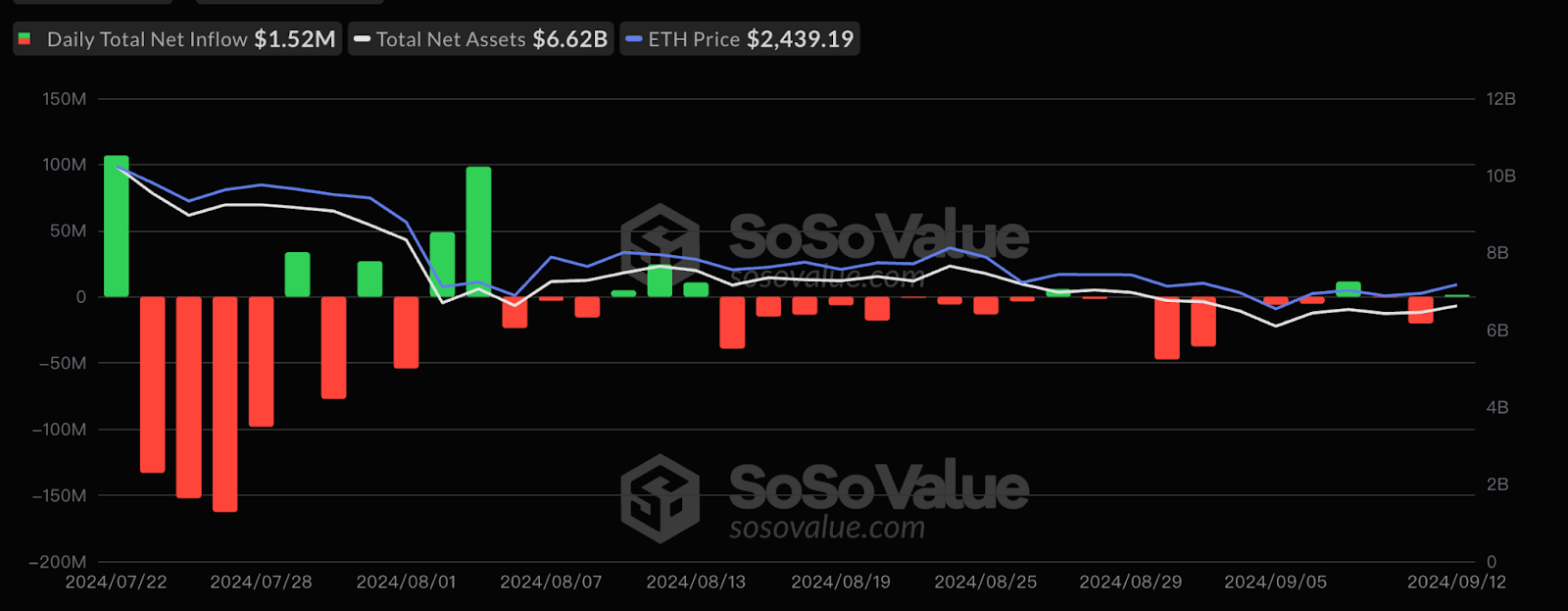

As Bitcoin is gradually seen as the preferred digital gold and alternative asset, more and more institutional investors are beginning to allocate Bitcoin assets. These institutional investors typically have longer holding periods and a strong demand for risk-free appreciation of BTC. Since the approval of BTC and ETH ETFs, institutional net inflows into Bitcoin have continued to increase, while net inflows into Ethereum have relatively decreased.

Left: Net inflows into ETH have continued to decline after the approval of ETH ETFs; Right: Net inflows into BTC have steadily increased after the approval of BTC ETFs

Unparalleled Network Security and Token Deflation Mechanism

The Bitcoin network is renowned for its high security, having stood the test of time. Its massive hash power and decentralized nature ensure the robustness and resistance to attacks of the network. This makes Bitcoin an ideal choice for high-security financial scenarios. Bitcoin's preset deflation and halving mechanism effectively ensure the stable growth of token market value.

Innovative Technological Extensions

Through technologies such as the Lightning Network, RGB, and sidechain technology, Bitcoin is breaking through its limitations in smart contract functionality. These technological innovations enable Bitcoin to support more complex DeFi applications while maintaining the security and stability of the main chain.

Conclusion

Since the DeFi Summer of 2020, DeFi has gone through a full cycle of 4 years, and the existing DeFi services and product quality are significantly different from those of the past. In this cycle, with the gradual entry of external institutions and the continuous improvement of infrastructure, we will witness the arrival of the next DeFi wave driven by BTCFi, expanding the global consensus on BTC to the DeFi scene, bringing greater adoption to Web3.

About Uniquid Layer

Uniquid Layer is a liquidity platform designed for a wider community, dedicated to being the gateway for newcomers in the Bitcoin space, maximizing Bitcoin earnings with the highest security.

Website: https://uniquid.io

Telegram: https://t.me/uniquid_layer

Puni Telegram Mini App: https://t.me/uniquidpunibot/uniquid

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。