Tether has minted USDT worth $35 billion in the past year.

Source: beincrypto

Translation: Blockchain Knight

Tether's largest stablecoin USDT is continuing to grow, further consolidating its dominant position in the market.

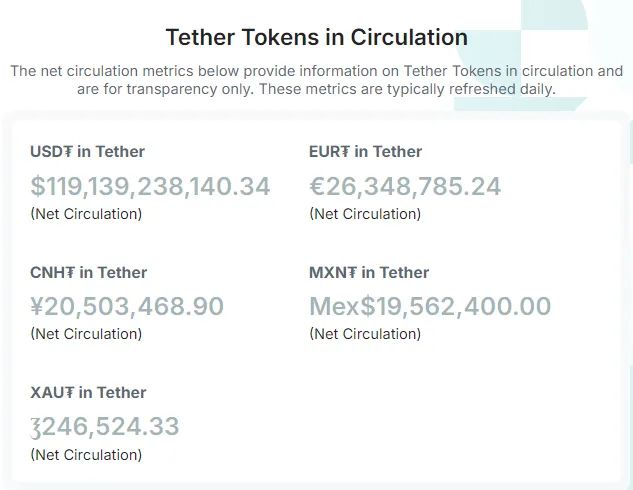

According to Bein Crypto's data, the market value of USDT has approached $120 billion for the first time.

Last week, Tether minted USDT worth $1 billion on the Ethereum blockchain, bringing its market value to $119 billion.

Blockchain platform SpotOnChain revealed that Tether has minted USDT worth $35 billion in the past year.

This growth solidifies USDT's position as the largest stablecoin.

It is worth noting that USDT's closest competitor, Circle's USDC, still has a small scale, with a market share of less than one-third of Tether's.

As of the second quarter of 2024, Tether holds over $97 billion in U.S. Treasury bonds and repurchase agreements. This makes the company the 18th largest holder of U.S. Treasury bonds globally, surpassing countries such as Germany, the United Arab Emirates, and Australia.

Stablecoins are one of the most practical applications of crypto assets in the real world, providing a stable alternative for volatile digital assets.

These assets have gained significant adoption in emerging markets such as Nigeria, where they are increasingly relied upon for savings, payments, and cross-border transactions.

It is worth noting that this has significantly increased Tether's adoption, with USDT stablecoin having over 350 million users globally.

According to Token Terminal's data, the company's net profit has exceeded $400 million in the past 30 days.

Meanwhile, Tether is also expanding into sectors such as agriculture and restructuring its business into four departments, including finance, data, education, and power.

This diversification supports the company's efforts to promote USDT issuance and invest in enterprises such as artificial intelligence and BTC mining.

Despite its growth, Tether also faces criticism.

Consumer research organizations have expressed concerns about the risks posed by Tether's business model, suggesting that it may face significant user risks. Additionally, some market observers have also issued warnings about the company's reserves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。