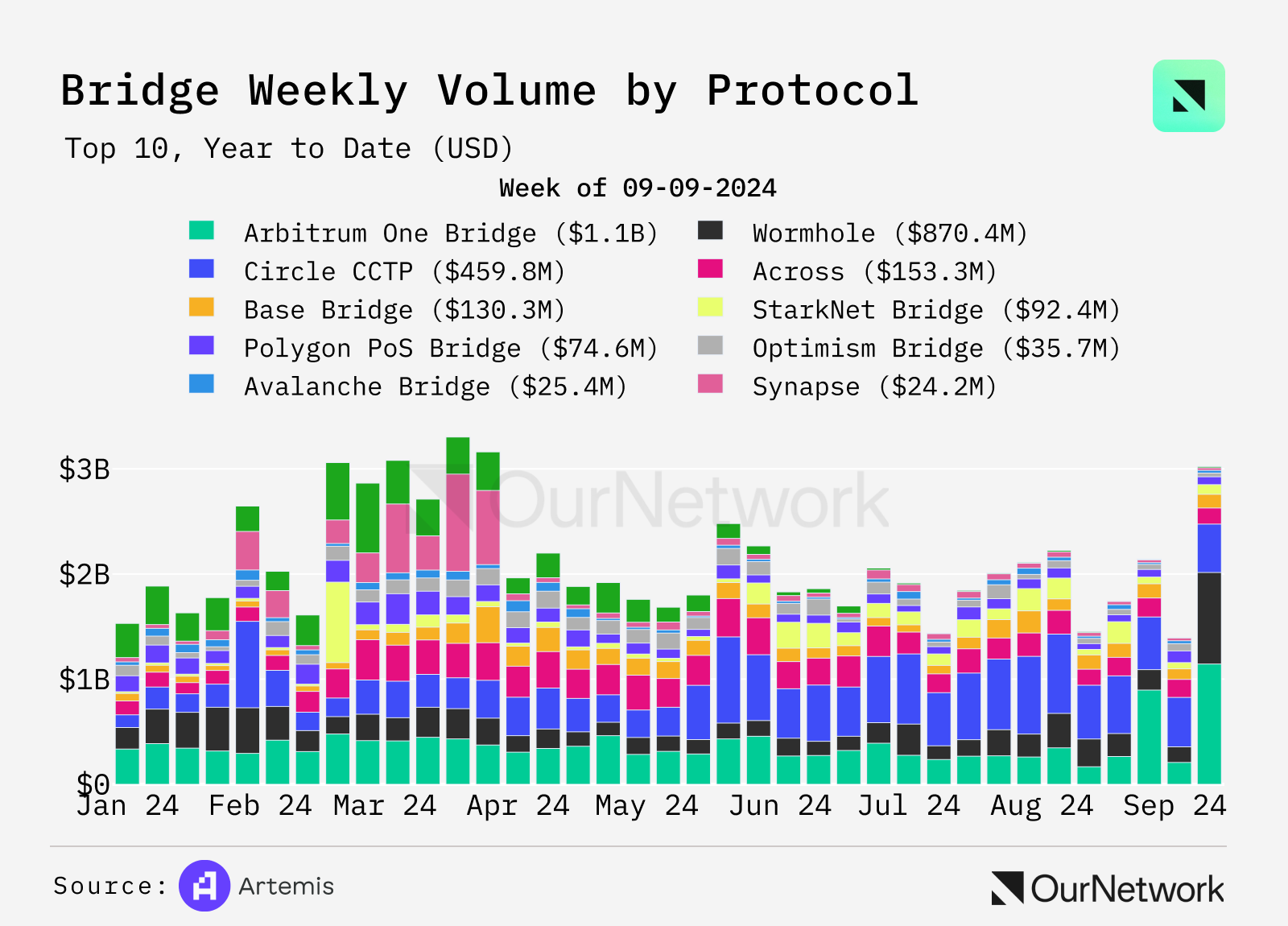

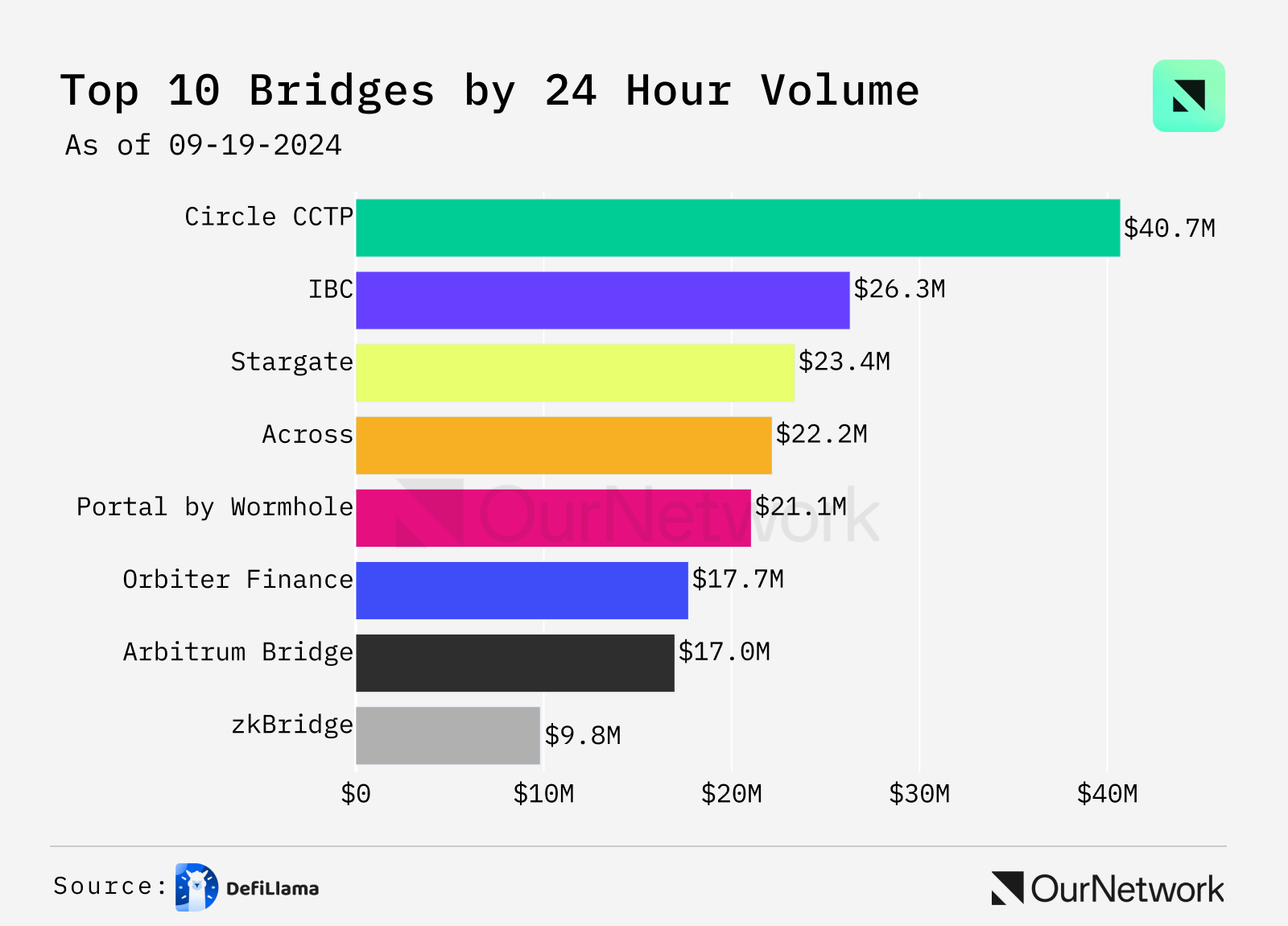

Except for Circle's CCTP dedicated to USDC transfers, no single bridge occupies more than 20% of the total traffic, with the majority of bridges' traffic share ranging between 10% and 20%.

Author: OurNetwork

Translator: DeepTechFlow

Bridges

Synapse | deBridge | Across | zkBridge

Weekly bridge traffic reaches about $2 billion, a year-on-year increase of over 60%

- According to Artemis data, the weekly bridge activity traffic has exceeded $2 billion. The traffic distribution among various bridges is relatively balanced—most of the time, except for Circle's CCTP dedicated to USDC transfers, no single bridge occupies more than 20% of the total traffic, with the majority of bridges' traffic share ranging between 10% and 20%.

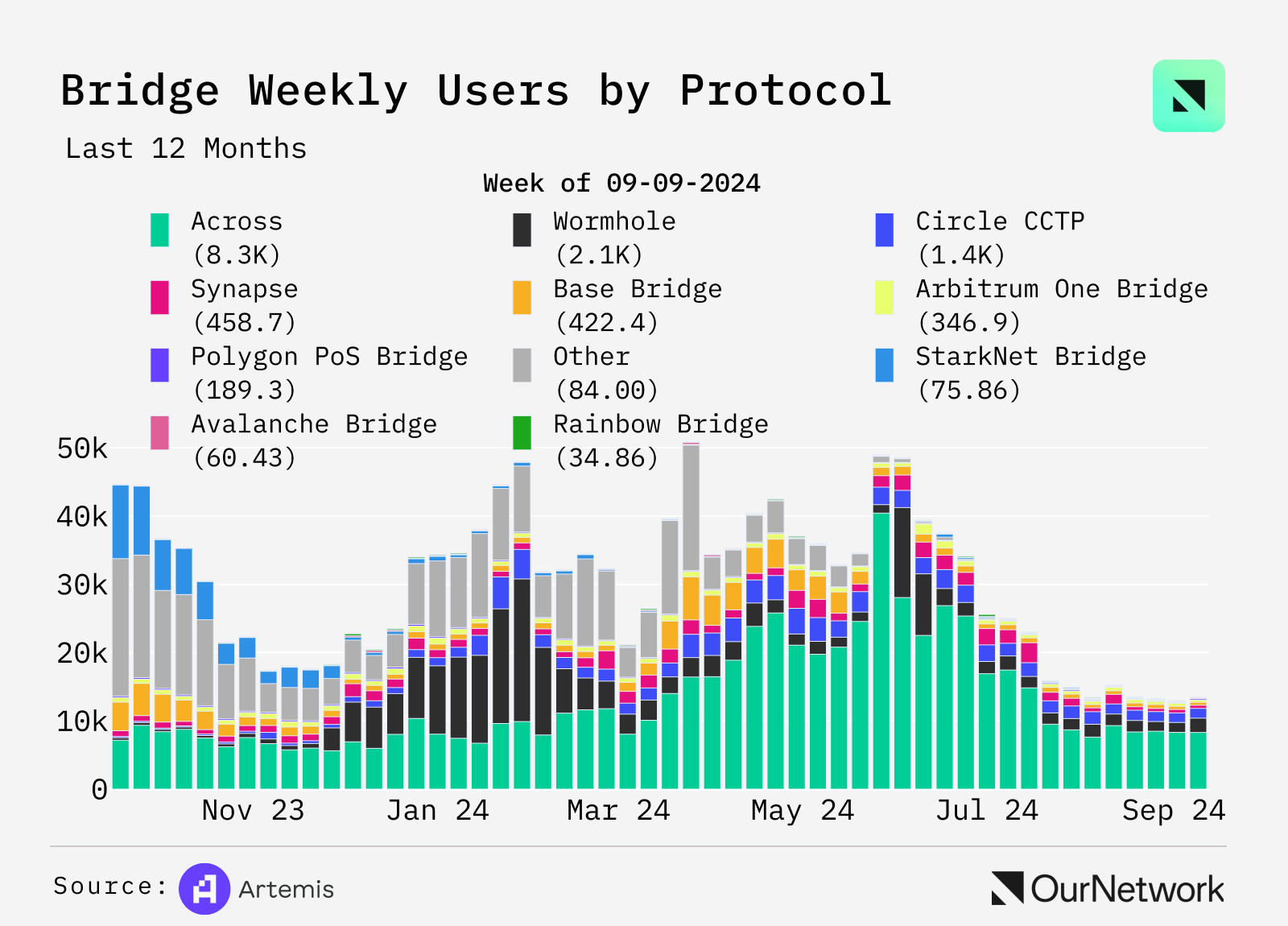

- The number of daily active addresses for bridges has decreased by over 70% as users who were previously active to receive ZK-rollups, StarkNet, and zkSync airdrop rewards have ceased activity after the tokens went live. Across Network remains the leading unofficial bridge, with approximately 7,000 addresses participating in bridge activities daily.

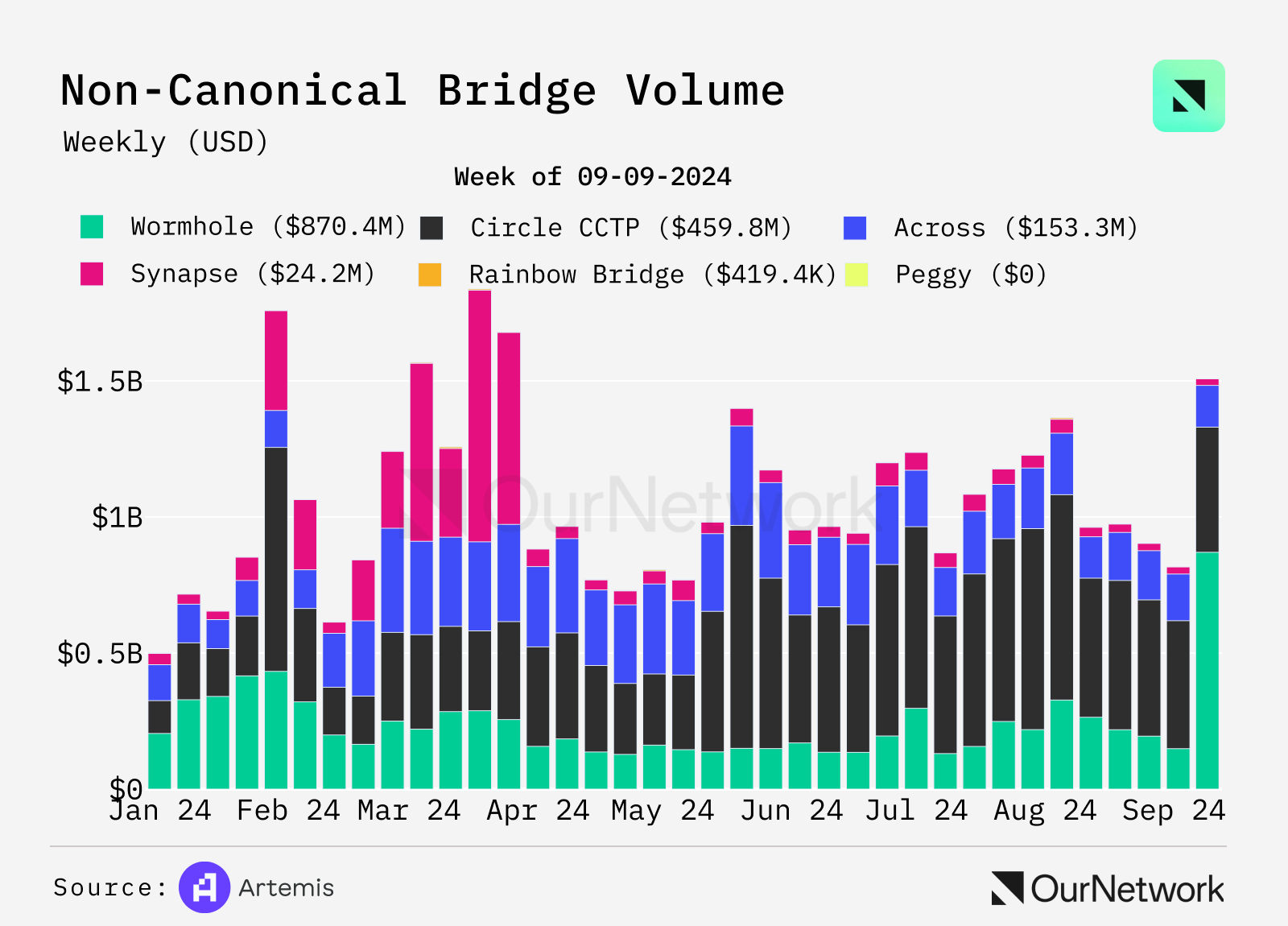

- Unofficial bridges—those used for general cross-chain transactions rather than internally designed solutions to connect two blockchains—have seen explosive growth this year. Circle's CCTP has a weekly transaction volume of about $400 million, nearly 10 times the growth compared to last year.

Synapse

Synapse's total trading volume approaches $55 billion, with 2.5 million users

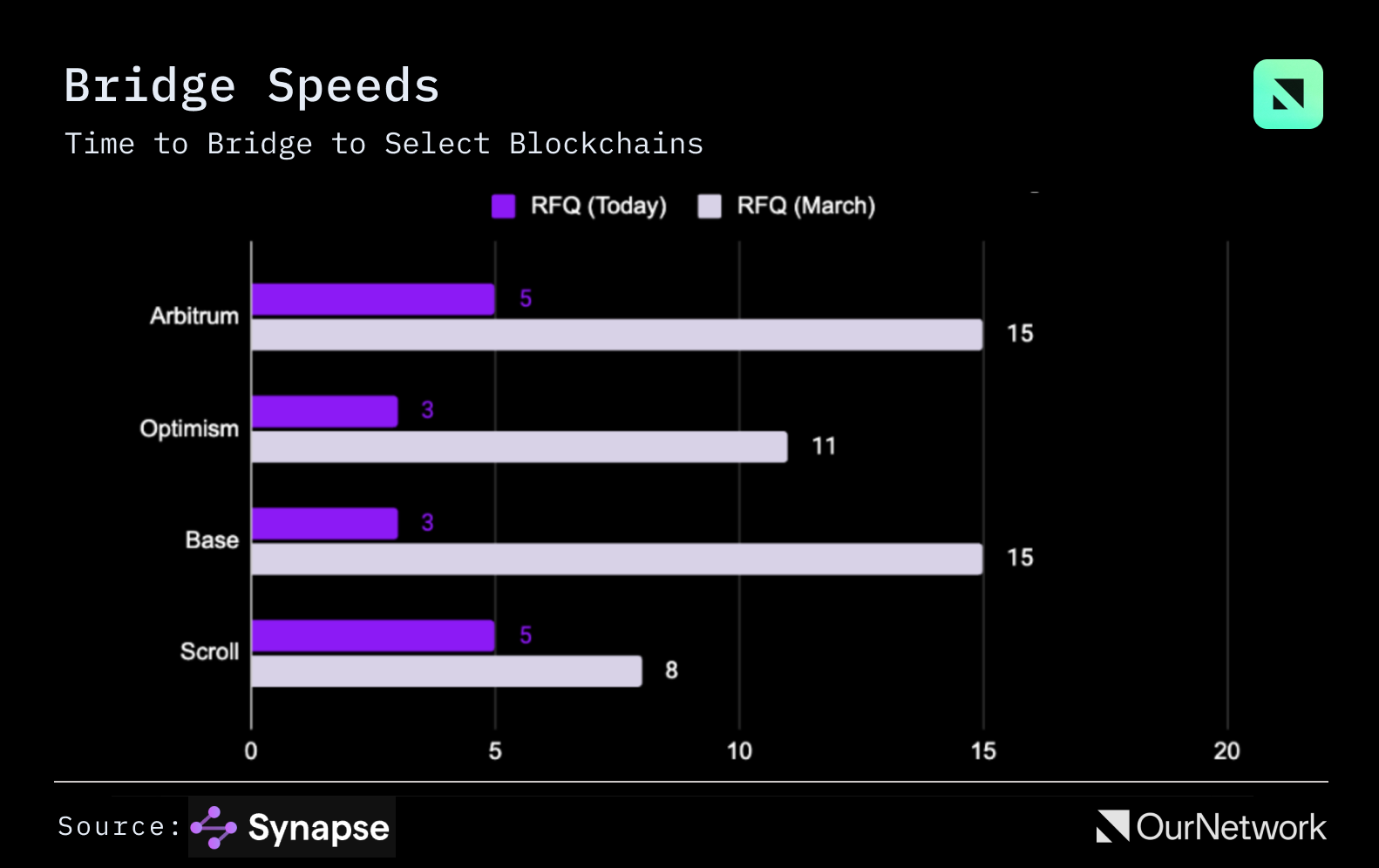

- Synapse Protocol is a decentralized cross-chain network that allows developers and users to read and write data across different blockchains. To date, over 2 million users have completed $500 billion in transactions through the bridge, generating over $30 million in fees. In the past 6 months, Synapse has launched SynapseRFQ, an intent-based bridge that offers zero slippage and fast confirmations. Since its launch, bridge time has been reduced by 60-80%, and in some routes, confirmation times can even be completed in milliseconds, making it one of the fastest bridges.

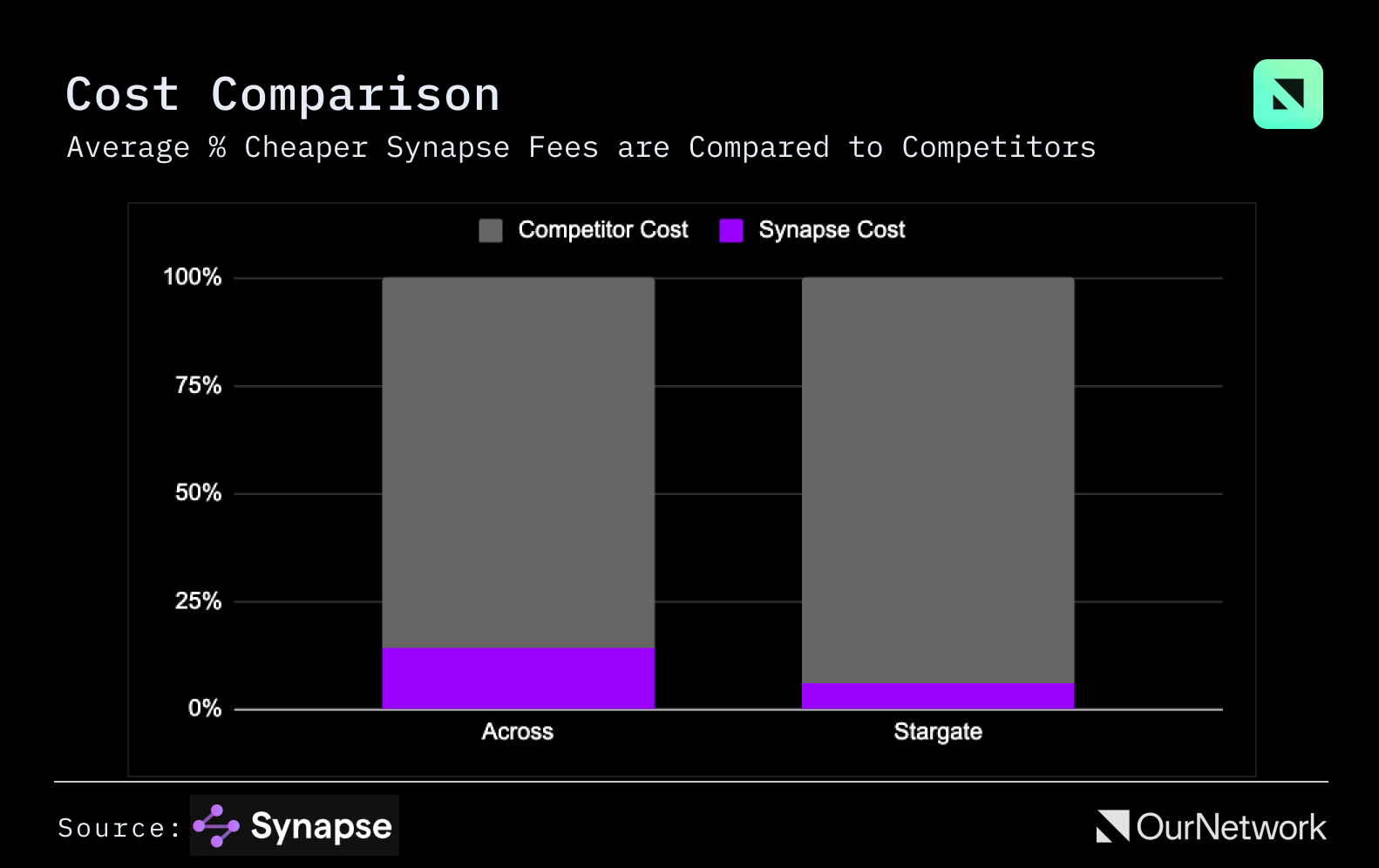

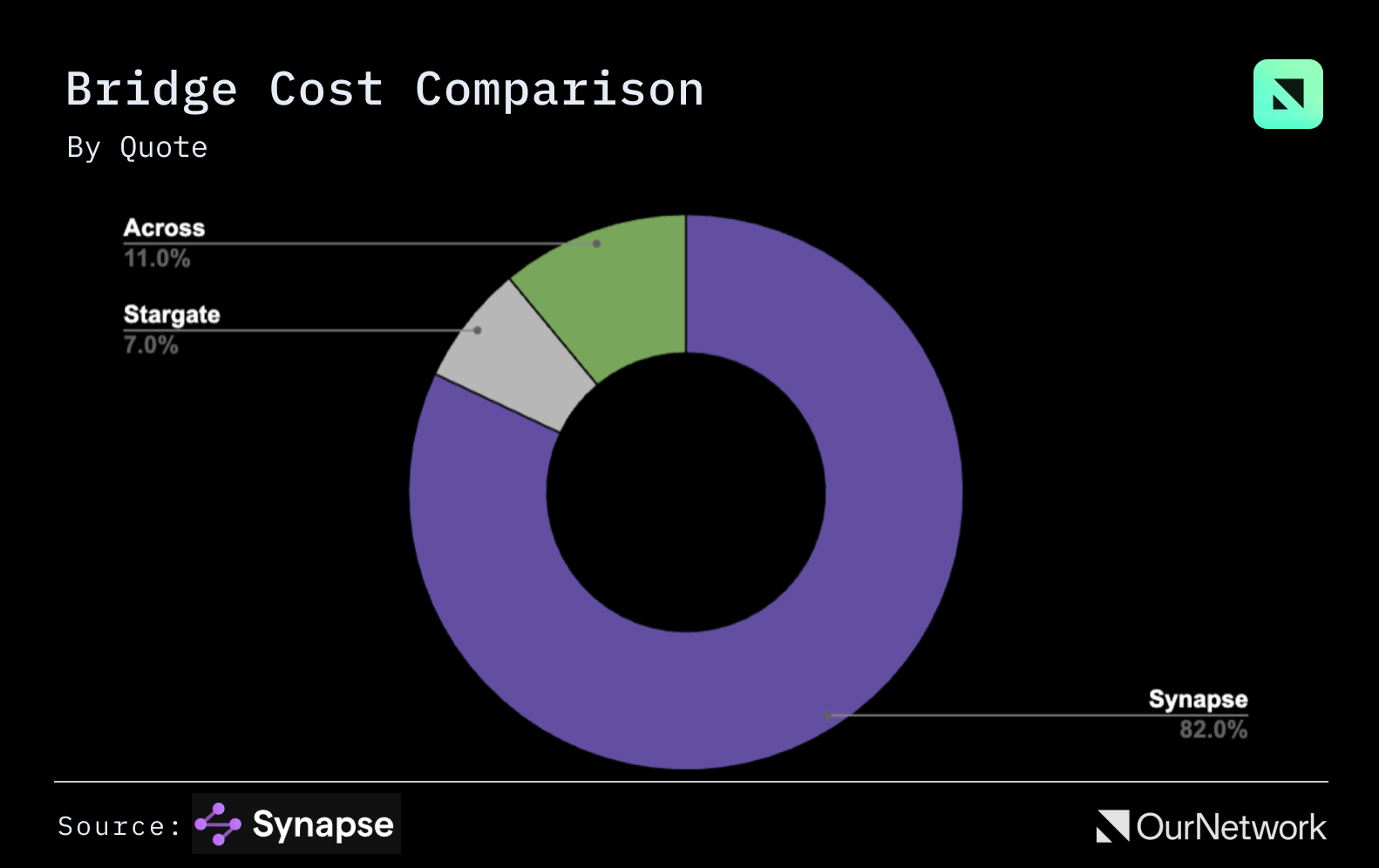

- In an analysis of Synapse, Across, and Stargate, covering various route combinations between Ethereum and major L2s, the Synapse team found that Synapse provides the best quote in 82% of routes. Additionally, when Synapse provides the best quote, transaction costs can be reduced by 85-95%, meaning users save 85-90% on fees.

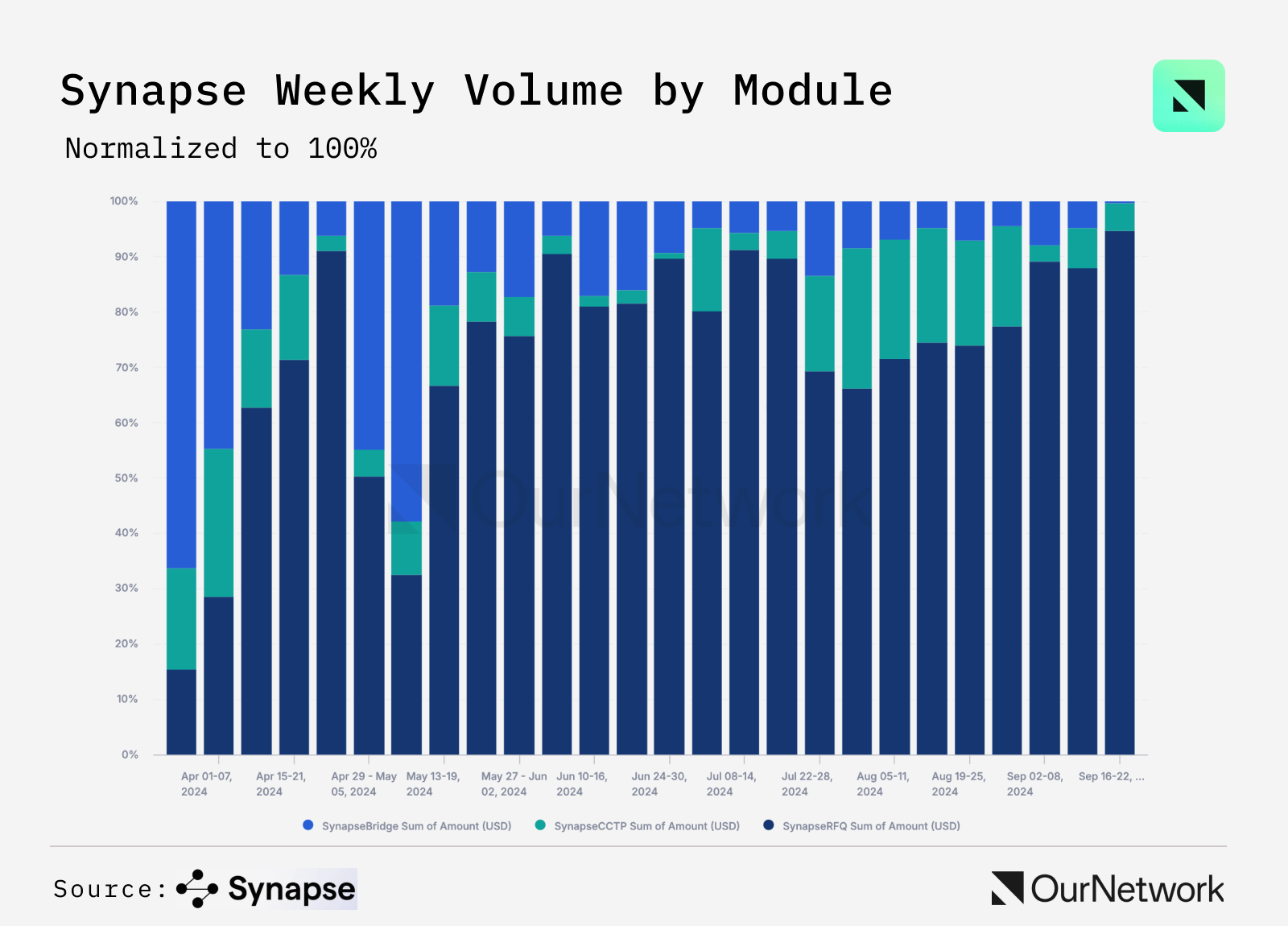

- Since its launch at the end of March 2024, SynapseRFQ has quickly become the preferred method for users to route orders through the Synapse protocol. With increased liquidity, more relayers joining, and improved price competitiveness, almost 95% of Synapse order traffic is routed through SynapseRFQ.

- Transaction Highlight: This $700,000 transaction was completed in less than two seconds. Such fast bridging, combined with instant and reliable settlement, allows applications to build functionality that hides the complexity of blockchain from users. Sufficient liquidity and fast confirmation speeds are the final pieces of the puzzle for achieving true cross-chain applications.

deBridge

Jonnie Emsley | Website | Dashboard

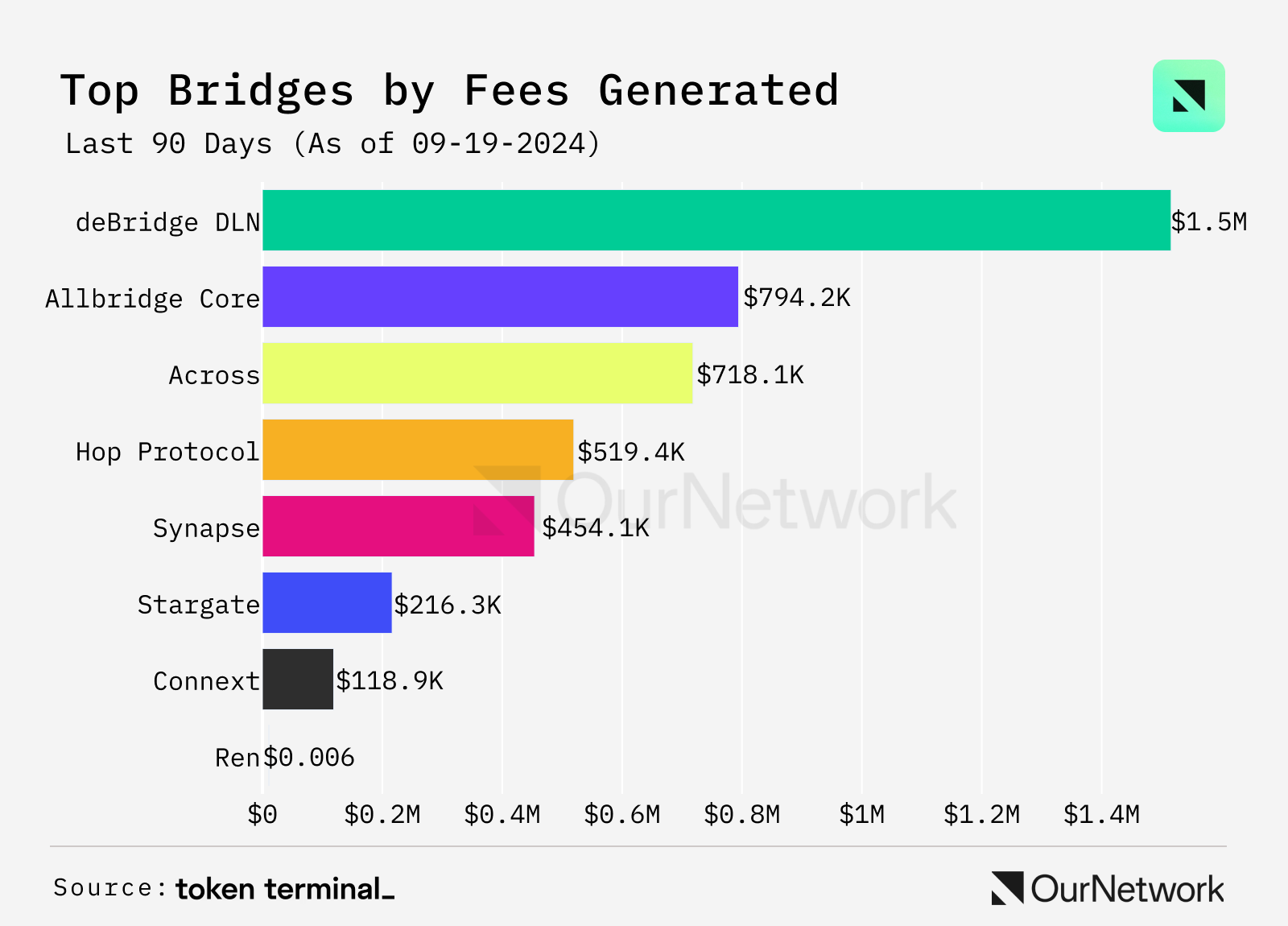

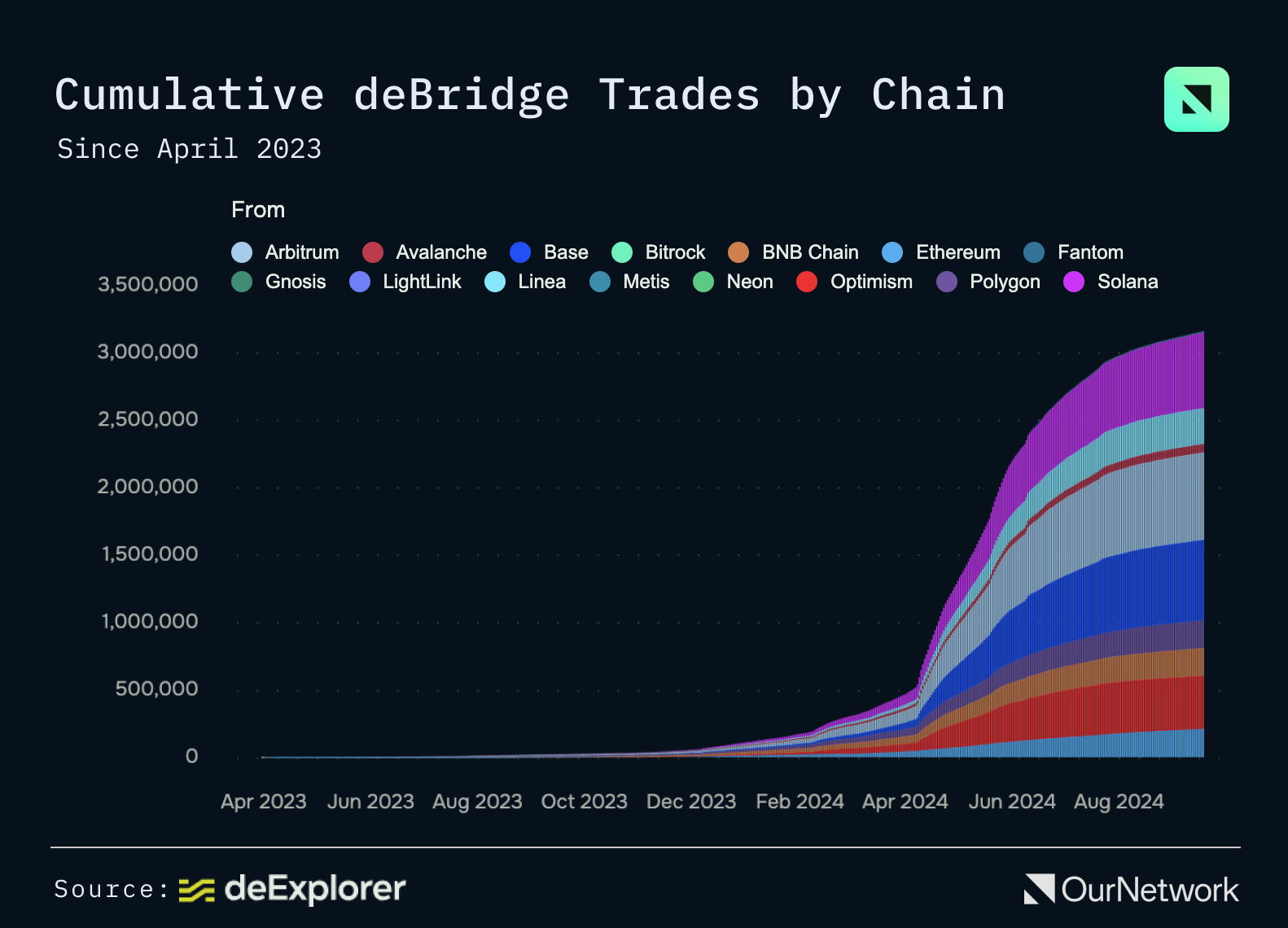

deBridge becomes the largest bridging economy, having collected $12.5 million in fees with no TVL

- Historically, bridges have typically incentivized the establishment of economies through TVL, but these incentives often exceeded the fees collected, leading to long-term sustainability issues. However, since the introduction of the 0-TVL design in early 2023, deBridge has become the largest bridging economy. It generates fees of $100,000 to $180,000 per day, with the total fees collected surpassing the sum of Stargate, Hop, Connext, Synapse, and other providers.

- deBridge has become the preferred bridging platform for Solana, with over 117,000 active users bridging over $20 billion on Solana through the platform. Over 30,000 users come from Jupiter, a trading aggregator built on Solana, which has integrated with deBridge.

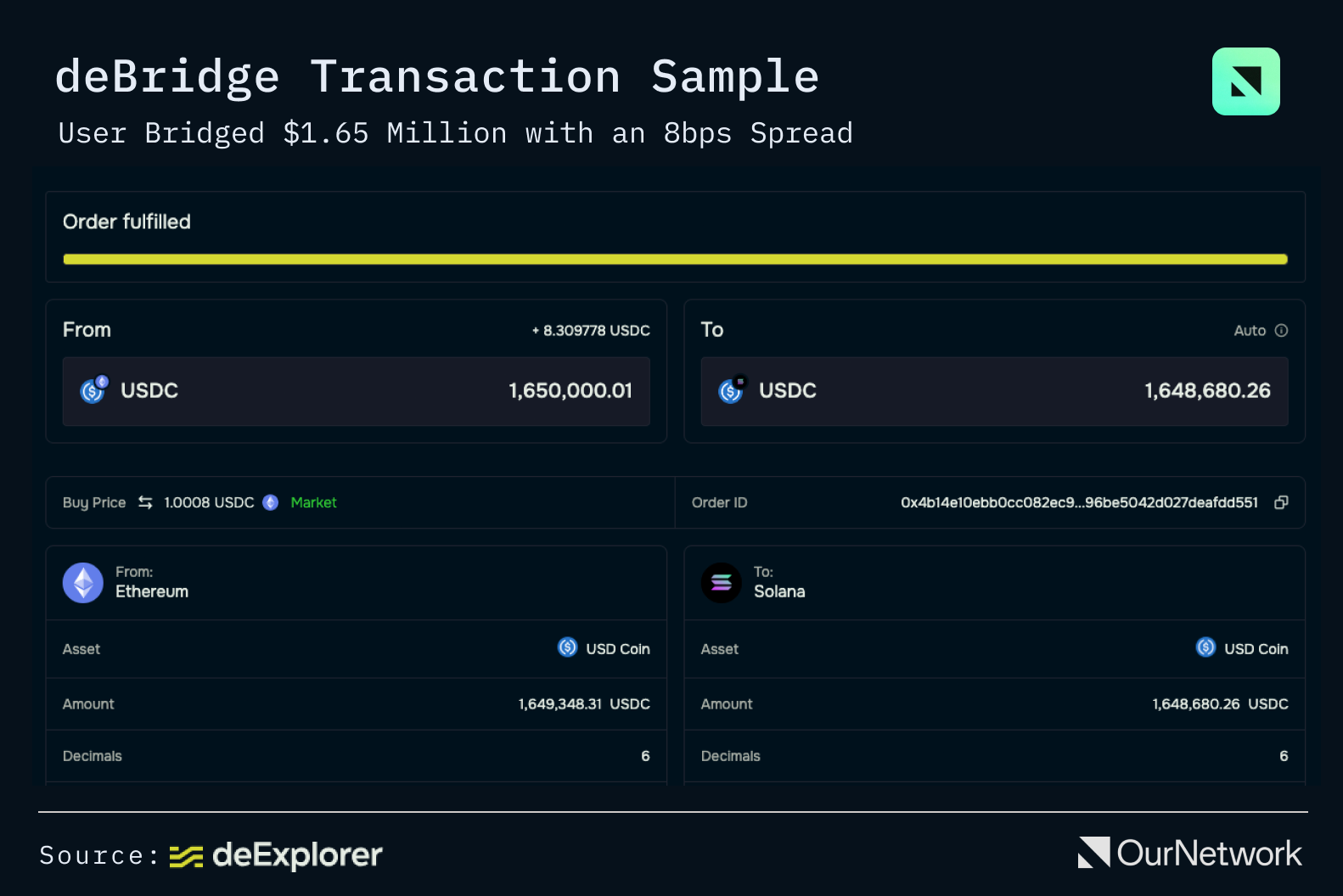

- Through deBridge's peer-to-peer bridging engine, users can transfer over $1 million between blockchains and enjoy guaranteed exchange rates and minimal spreads. For example, a user successfully bridged $1.65 million with an 8 basis point spread.

- Transaction Highlight: In this transaction, a user utilized deBridge's peer-to-peer functionality, the world's first cross-chain OTC platform, to successfully complete a $920,000 bsdETH to WBTC cross-chain OTC trade from Base to Ethereum. This is the first known large-scale OTC trade conducted at a cross-chain scale.

Across

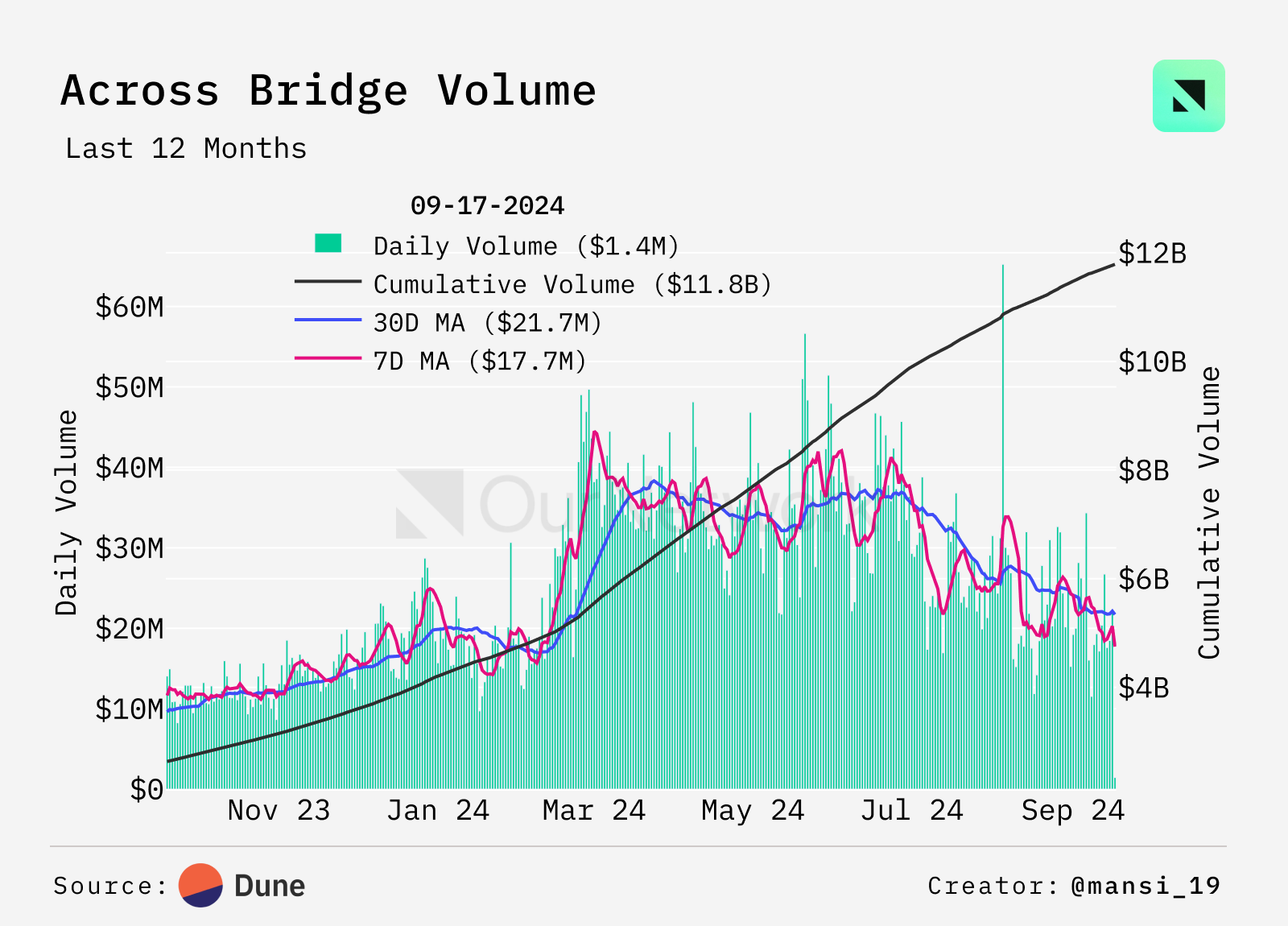

Across Protocol's daily trading volume reached a peak of $65 million in August 2024, with a cumulative trading volume approaching $12 billion!

- As one of the leading intent-based cross-chain bridges, Across has seen significant growth in 2024, nearly tripling since December 2023. The period from March to June was crucial for Across, with bridge volumes exceeding $1 billion each month, especially reaching a peak in May 2024. However, after the second quarter, activity volumes have continued to decline. While Across was leading the bridging industry until mid-year, it is now ranked 4th on DefiLlama. This may be due to the increasing popularity of Stargate V2, which significantly reduces costs by introducing transaction batching through "Stargate Buses."

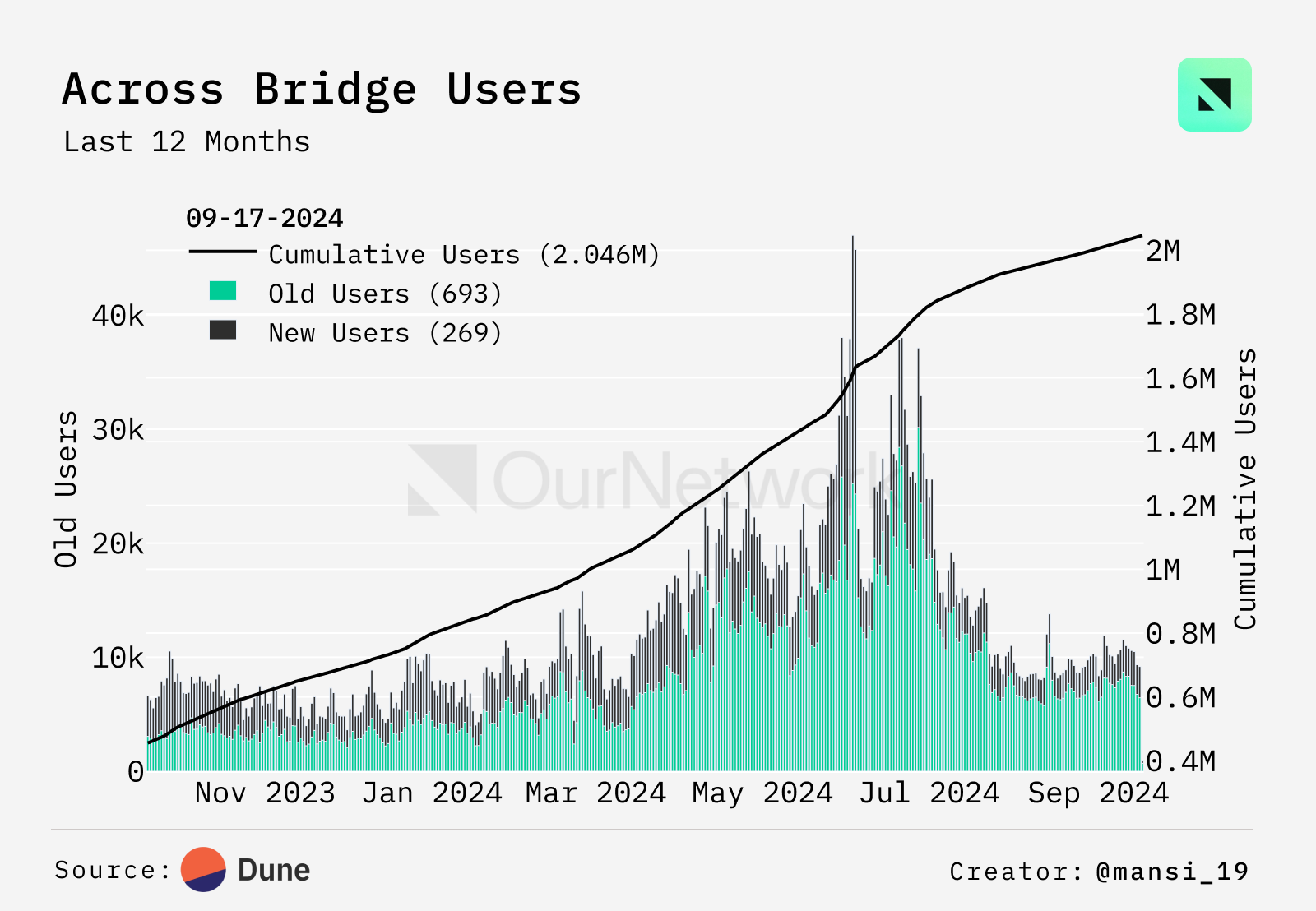

- Over 2 million users have completed 8.1 million transfers through Across, with an average of 4 transactions per wallet. Until the second quarter of 2024, the number of new users and returning users was almost equal. Since then, "old" users have gradually outnumbered new users, with the daily average ratio of old users to new users now at approximately 2.5 to 1.

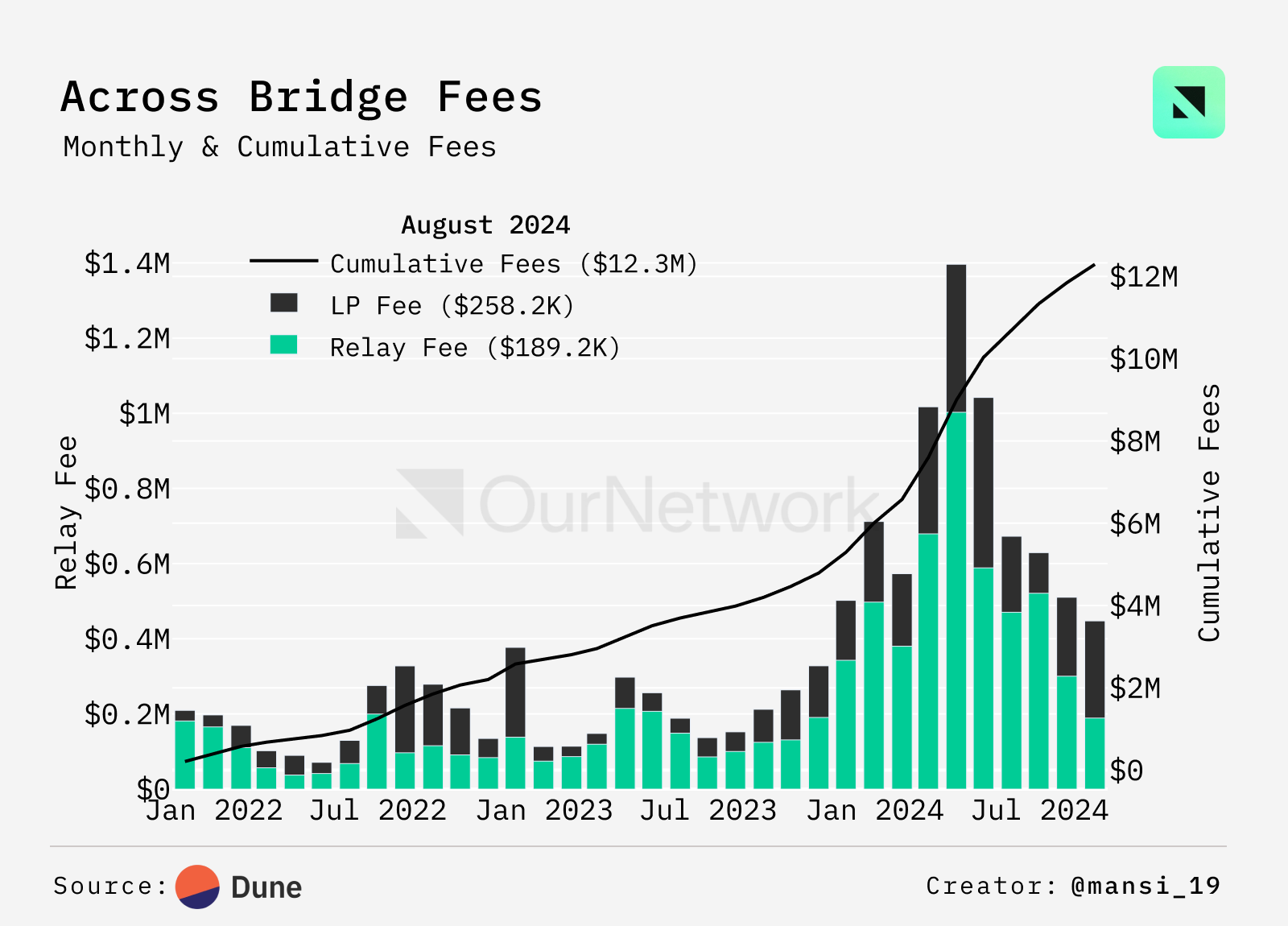

- Across charges two main fees: "Liquidity Provider Fees" and "Relayer Fees." Relayer fees are used to incentivize relayers to process user transactions, similar to gas fees in the Ethereum ecosystem. Liquidity provider fees are allocated to users providing liquidity. The protocol has generated over $11.5 million in revenue for its liquidity providers and relayers during this period.

zkBridge by Polyhedra

Eric Vreeland | Website | Dashboard

zkBridge's monthly trading volume has exceeded $320 million

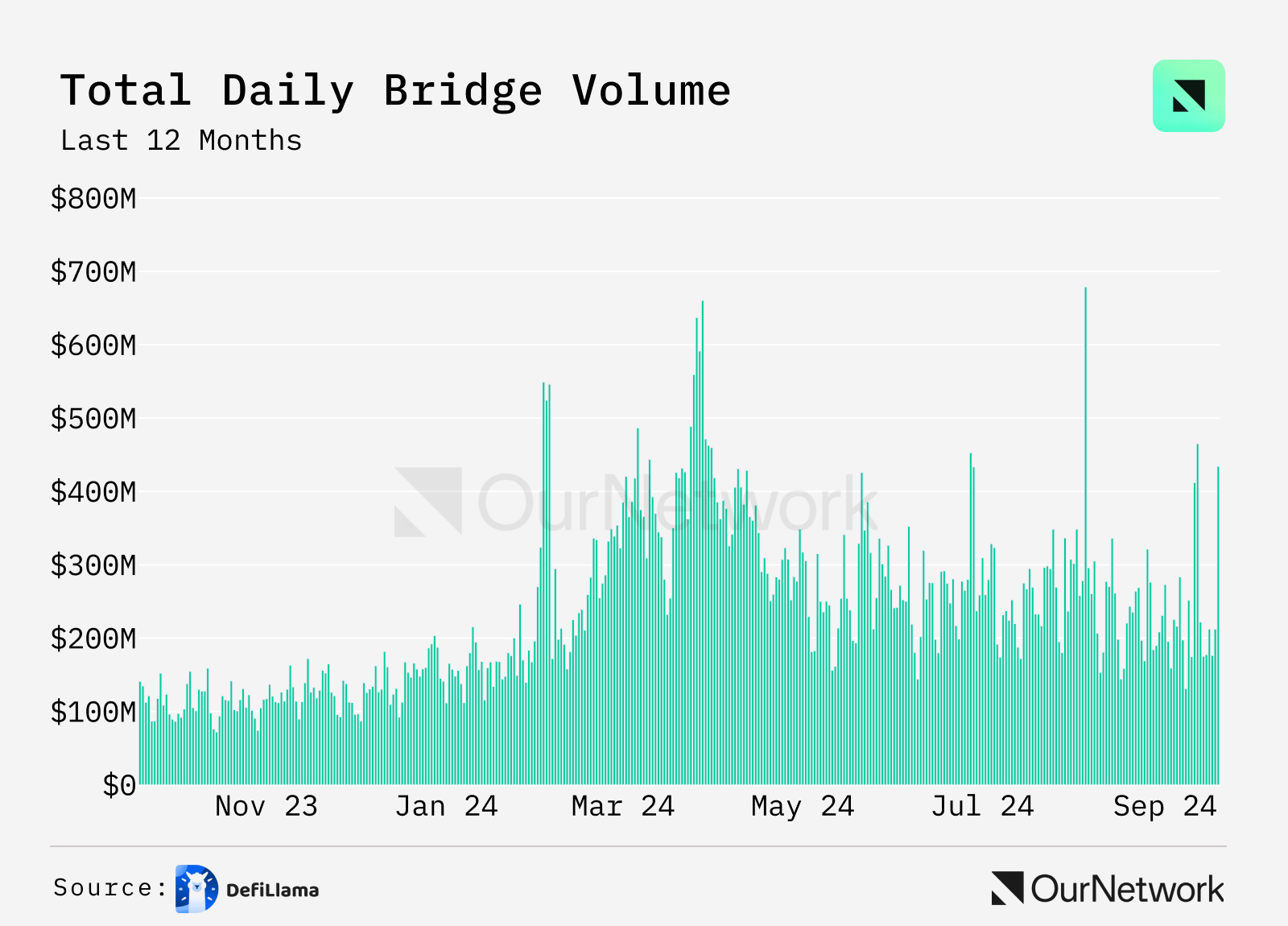

- With the continuous onboarding of new blockchains and the attraction of liquidity through incentives, bridging transaction volume has seen a significant year-on-year increase. The 24-hour bridging transaction volume on September 19, 2024, reached $434 million, a significant increase from $142 million during the same period last year. The two days with the highest bridging transaction volume were March 11, 2023, when Bitcoin hit a historical high of $71,000, and August 5, 2024, when Bitcoin began a 30% sell-off—during these extreme fluctuations, savvy Web3 users quickly utilized bridging to seek investment opportunities.

- zkBridge has consistently been among the top ten bridges in terms of trading volume, despite having fewer transactions than other bridges. In the past 24 hours, the average transfer amount on IBC was $722, while zkBridge's average transfer amount was $1,591. Due to its stronger security and fewer trust assumptions, zkBridge is often the preferred choice for high-value transfers.

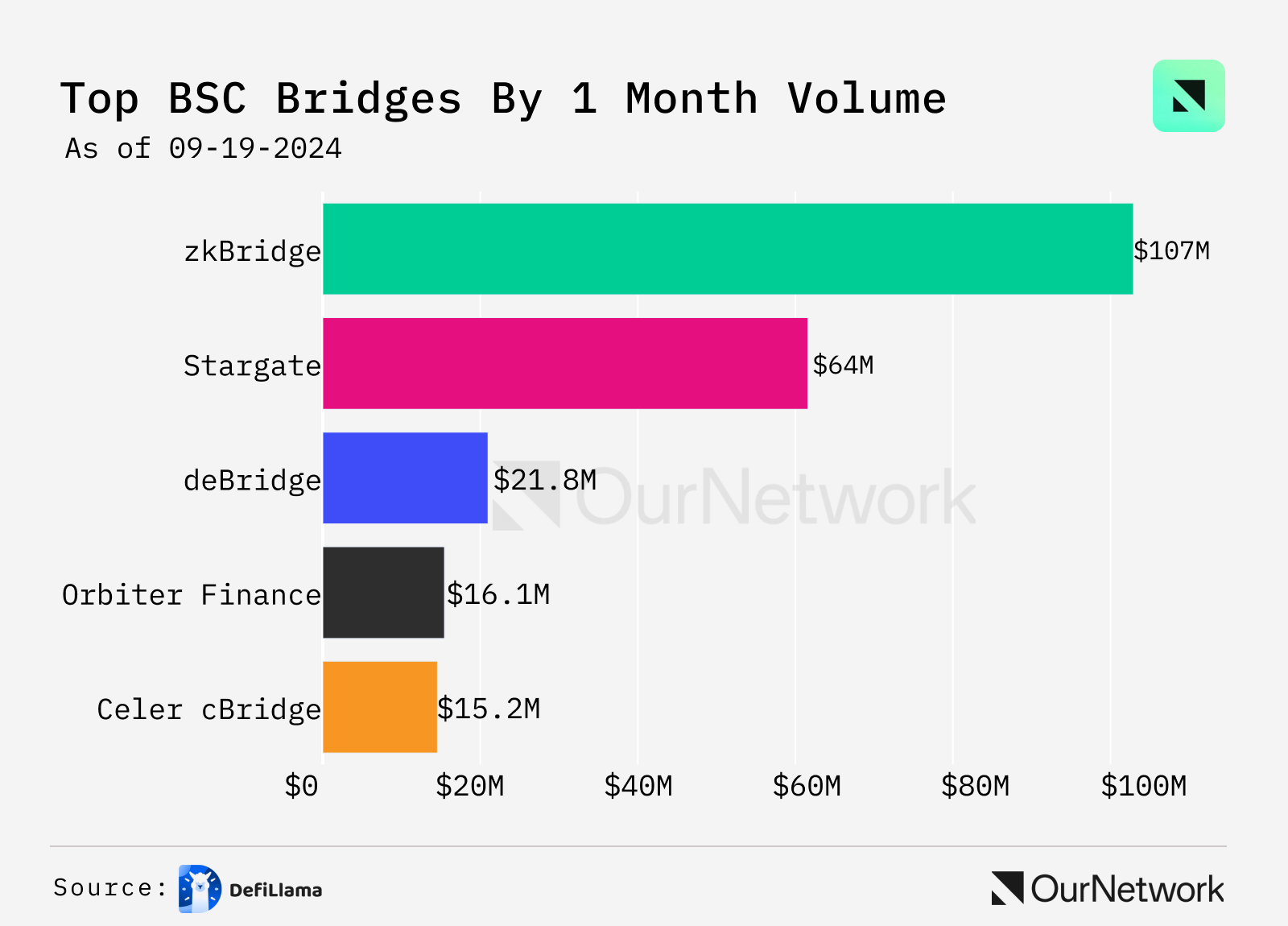

- Due to frequent collaborations with Binance and a high degree of community overlap with the BNB ecosystem, zkBridge is the largest bridge in terms of trading volume on the BNB Chain, with a monthly trading volume exceeding $100 million. zkBridge is also the official bridge for Binance's opBNB (the exchange's Layer 2 solution).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。