The recent influx of new funds into the US BTC and spot Ethereum ETFs indicates that there may have been some changes in market sentiment.

Source: bitcoinist

Translation: Blockchain Knight

The US BTC and spot Ethereum ETFs have recently seen new fund inflows, indicating that there may have been some changes in market sentiment.

The BTC ETF saw significant investment inflows on September 10, avoiding consecutive withdrawals. Although there are different issues with the Ethereum ETF, it also halted five consecutive days of fund outflows.

These fund inflows come at a time when institutions are taking a wait-and-see approach to crypto assets, with Ethereum seemingly losing its dominant position even as BTC attracts more funds.

In addition, global crypto asset ownership statistics paint a complex picture of future market trends.

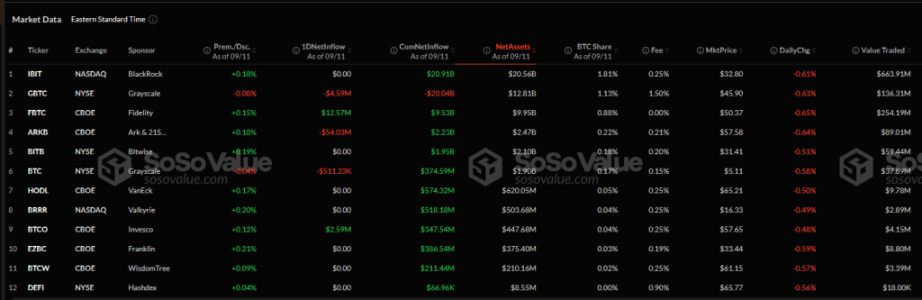

Data shows that the spot BTC ETF attracted nearly $117 million on September 10, a 400% increase from the previous day's $37.29 million.

This is another development following eight consecutive days of withdrawals, which reduced the total managed assets by over $1.18 billion.

Fidelity's FBTC led with a two-day inflow of $63 million, followed closely by Grayscale BTC Mini Trust and ARK 21Shares with inflows of $41 million and $12.7 million, respectively.

The total trading volume of the 12 BTC ETFs dropped from $1.61 billion to $712 million, a 55% decrease from the previous day.

While the fund inflows seem promising, the sharp decline in trading activity does warrant caution from investors.

Interestingly, these numbers align with the "2024 Global Crypto Asset Status Report" released by Gemini.

The survey shows that the ownership rate of crypto assets in France surged from 16% to 18%, while the ownership rates in the US and UK are 21% and 18%, respectively. In contrast, Singapore's ownership rate slightly decreased from 30% to 26%.

Although the situation with the Ethereum ETF is less clear, the BTC ETF shows strong liquidity.

On September 10, the spot Ethereum ETF saw a net inflow of $11.4 million, breaking the trend of significant fund outflows over five consecutive days.

Fidelity's FETH led with an inflow of $7 million, followed by BlackRock's ETHA with an inflow of $4.3 million.

However, the remaining seven Ethereum ETFs did not see any fund inflows.

Despite these positive fund inflows, Ethereum still faces more challenges. After VanEck announced the closure of its Ethereum strategy ETF, WisdomTree withdrew its application for a spot Ethereum ETF with the US Securities and Exchange Commission.

So far, the cumulative net outflow of the Ethereum ETF is $562 million, indicating a decline in institutional confidence in Ethereum-based products.

The development of crypto assets globally presents various patterns. While the ownership rate of crypto assets remains high in major markets such as the US and UK, there are signs of declining interest in some regions like Singapore.

The market's recovery depends on the resilience of long-term investors, so Gemini's research emphasizes that factors such as regulatory developments and spot ETFs may also drive future expansion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。