If you are wealthy, use Bitcoin to protect your wealth and maintain it.

Author: Duo Nine⚡YCC

Translation: Deep Tide TechFlow

This guide is designed for three types of cryptocurrency investors. Here are their investment amounts:

- $1,000 - Beginners

- $10,000 - Intermediate

- $100,000 - Experts

I assume that all of you are here to get rich, and cryptocurrency is your best opportunity. Let's get started, and there is a brief summary at the end.

If you have $10k or $100k in hand, or are ready to invest, most people will ask themselves:

- Should I start a business or buy Bitcoin?

Unless your future business can outperform Bitcoin, it's not worth doing. This leads to an important point applicable to all investment portfolios, regardless of their size.

- If your returns do not exceed Bitcoin's, you are wasting time!

Now take some time to measure the returns of Bitcoin since you started investing in cryptocurrencies and compare it with the returns of your investment portfolio. If you haven't exceeded Bitcoin, it's time to reassess your investment strategy and assumptions.

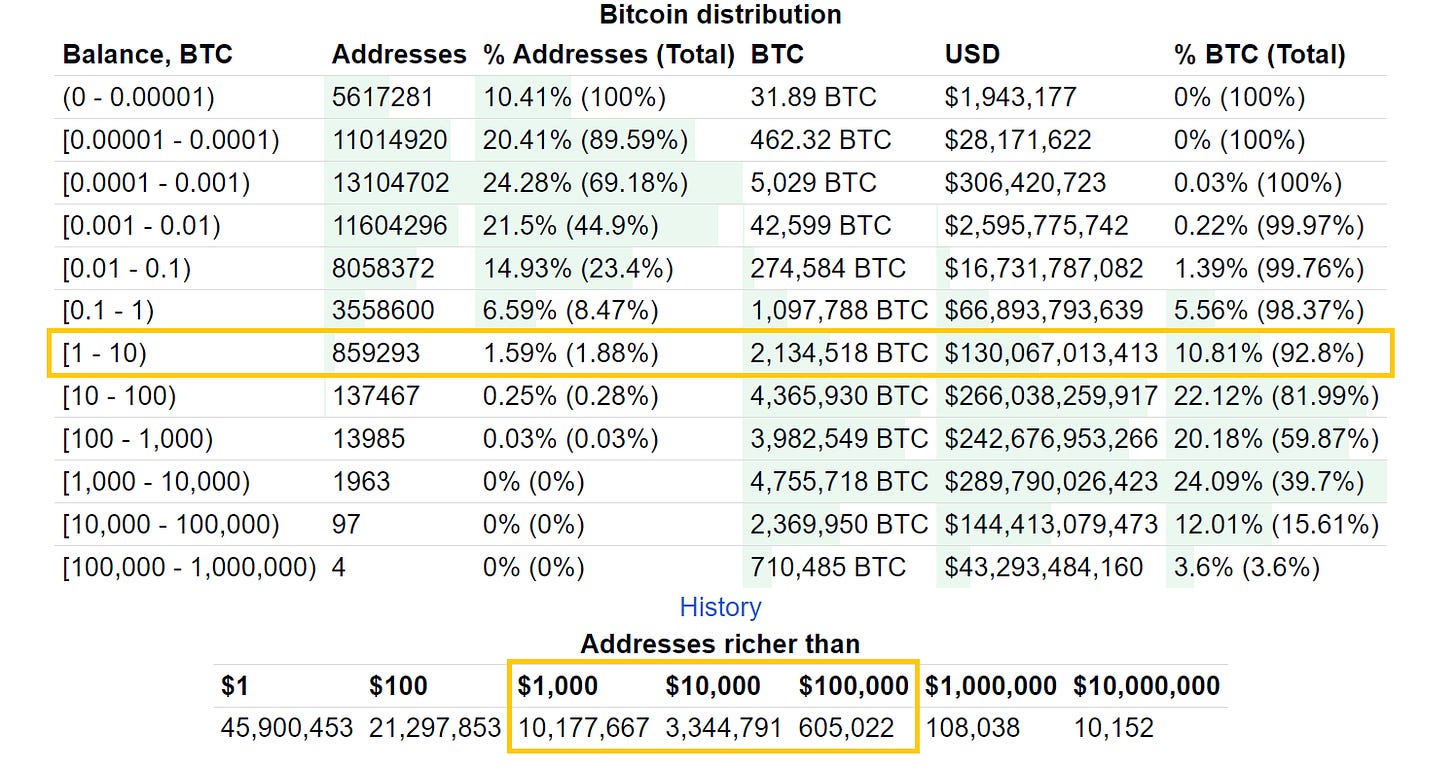

With that said, let's start from the basics. We have three categories of investment portfolios: 1k, 10k, 100k. Interestingly, they reflect the distribution of Bitcoin. Let's discuss them one by one.

Beginners - $1,000

You are currently at the starting point of cryptocurrency investment, but this is your opportunity to make big money. Your advantage is that you can afford high-risk investments because even if you lose this money, it won't have a big impact on your life.

With a small investment portfolio, it's not possible to get rich overnight with Bitcoin. Before reaching the next investment level, there's no need to focus too much on the top 100 ranked coins. Your sole purpose here is:

No matter what you buy, it needs to have at least 2 to 10 times the potential return. This usually means investing in smaller market cap but potential coins, including some speculative coins like meme coins.

Your strategy is not to hold long-term, but to profit from selling when the price rises. Your main goal is to find high returns and sell in a timely manner when the market is up. Get in and out quickly, don't get attached to any altcoins. Their sole purpose is to bring you profit and increase your investment amount.

Due to limited time, don't hold for a long time and hope for a rise in a certain coin. Chase market trends, hotspots, and speculation. Abandon old investment logic in a timely manner and quickly switch to new market hotspots, even if it means selling at a loss. Don't hold losing coins for a long time, stop loss in time and move on.

If you are new to cryptocurrency, the altcoin market may be the most difficult to navigate. Most altcoins are scams, and many people will promote these coins, using you as their liquidity to exit. Don't be fooled by these games, exit decisively when profitable, and never look back.

You need to spend time understanding Tokenomics, market dynamics, and pump cycles. If you are lucky enough to get a return of 10 times or more, it is recommended to transfer the returns to Bitcoin. Ideally, do not put all your funds into one altcoin, but spread the risk across 3-4 different investments. If one fails, you can still continue to invest.

You are highly likely to lose this $1,000.

If you cannot afford this loss, or cannot invest another $1,000 in a short time, then you need to seriously consider whether this is the investment path you want to take. If investing $1,000 in yourself or your family can have a significant positive impact, think twice before proceeding.

Intermediate Level - $10,000

You are still focused on investment growth, but high-risk investments are no longer the core of your investment portfolio. Now, you need to start thinking about how to protect your profits. As your investment portfolio grows, this becomes increasingly important.

If you started from $1,000 and reached this level, well done! But now it's time to adjust your mindset. Before this, your focus was on finding high returns and potentially rising coins. Now, you also need to protect the newly acquired wealth.

You can achieve this by investing a portion of your funds in Bitcoin. Review your investment portfolio, decide the proportion you plan to continue to risk, and the proportion you need to protect. Use Bitcoin to protect your wealth and use altcoins for risk-taking.

If your investment portfolio exceeds $10,000 but does not include Bitcoin, it means you are too greedy. Don't fall into this trap. The right approach is:

- Decide how much of your assets you want to protect. Invest this portion in Bitcoin and never sell. Never. Even in the face of promising altcoins, do not waver. You will hold this portion long-term and add the future returns of altcoins to it.

Congratulations on taking an important step towards financial independence. Few people can reach the stage where Bitcoin is the primary investment goal. Unfortunately, many people always stay in the mindset of altcoins, which often leads to disastrous consequences.

The Bitcoin reserve will gradually become your sanctuary, providing balance and relaxation, countering the pressure brought by investing in altcoins. No matter how turbulent the altcoin market is, you can be sure that your Bitcoin is safe. This prudent investment will make you a better investor over time.

As your investment portfolio expands, having at least one Bitcoin and never selling it should be your goal. This is the cornerstone of your financial independence and retirement security. If you are young and reading this article, time is on your side. Let time work for you, you don't need to do anything else in this regard.

Expert Level - $100,000

You have entered a whole new level. A six-figure asset has exceeded the value of one Bitcoin at the time of this article's publication. Congratulations, you are now part of the global top 1%! Be sure to maintain and increase this wealth, while managing risks.

You now belong to a very rare group. Few people reach this level, and most can only dream of it.

- You are in the top 1% in the global cryptocurrency field!

Even more surprisingly, among the 8.2 billion people in the world, you are one of the 605,022 people who own more than $100,000 worth of Bitcoin. This is actually 0.007% of the global population. It sounds crazy, but these data are accurate.

Therefore, at this stage, instead of thinking about getting rich through risk-taking, it's important to realize that you are already wealthy. Not because you have $100,000, but because you have 1 or more Bitcoins. This is true wealth. The $100,000 in your bank account does not represent wealth.

Being in the top 0.007% globally means that out of 100,000 people, only 7 people are like you. This is a very unique group. So, you have only one task now:

- Protect your wealth!

Not doing so would be irresponsible.

Achieve this by continuously increasing the amount of Bitcoin you hold. Ideally, you should never sell these Bitcoins, especially if you only have one. Therefore, altcoins should not be your main focus.

Ideally, altcoins should only make up 1% to 10% of your investment portfolio. They are asymmetric investments with the potential to achieve 10 times returns, which you can then convert into more Bitcoin. It's that simple.

If you hold Ethereum, its allocation ratio should always be much smaller than Bitcoin. In the long run, you should consider selling all Ethereum because the macroeconomic environment is not favorable to it, and since 2022, its performance has been inferior to Bitcoin. Remember, do not hold assets that perform worse than Bitcoin.

In long-term investments, you should always be cautious about altcoins. That's why you shouldn't hold them for the long term. This short video will help explain some of the points I mentioned. Please pay attention to his views on Ethereum, Solana, and other altcoins.

Over time, altcoins are becoming increasingly difficult to find a competitive advantage, as they gradually erode market confidence. This only further proves that Bitcoin is the better investment choice. If you are already wealthy, investing in Bitcoin is the way to maintain your wealth.

Finally, if you have $100,000 and are just entering the cryptocurrency market, just buy one Bitcoin. Don't make things complicated. This is a low-cost way to permanently enter the top 1%.

Summary and Memory Tips

- If your investment returns are not as good as Bitcoin, you should adjust your investment strategy.

- Beginners need to make high-risk investments in asymmetric opportunities.

- Once you reach a certain level of wealth, you need to learn to protect your investment portfolio, not just expand it.

- When your wealth reaches six figures, you should focus on Bitcoin, ignoring this is irresponsible.

- In the long run, you should be cautious about altcoins.

- Apart from gold, Bitcoin is currently the only sound currency globally.

- If you are wealthy, use Bitcoin to protect your wealth and maintain it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。