Pre-market trading allows you to exit before the airdrop token is listed.

Author: 𝕋𝕖𝕞𝕞𝕪

Translator: TechFlow

I have researched the pre-market of all cryptocurrencies and their operation mechanisms.

Here are some important matters and taboos about pre-market trading:

I really wish I knew these before my first order.

I sold 10,000 $dogs in the pre-market and found out that I owned 550,000.

The pre-market is often underestimated, but a small mistake can lead to heavy losses. I have made mistakes, so you don't have to make the same ones.

This is a guide on how to properly conduct pre-market trading.

The pre-market is a platform where you can trade tokens that have not yet been listed on the spot market.

It can be imagined that this brings us many opportunities, but only a few people can fully take advantage of these opportunities.

In fact, the reason why most people do not fully take advantage of the pre-market is that they are more complex and riskier than the spot market.

But I will guide you through everything about these markets.

According to the operation mode, the pre-market can usually be divided into two categories.

Futures pre-market, such as @aevoxyz and OKX, is similar to futures contracts, usually settled in stable coins such as USDT before listing on the spot market.

Based on the spot pre-market, such as @bitgetglobal and @WhalesMarket, is similar to a custody system, holding the buyer's funds and the seller's collateral.

The trade is settled when the seller provides the spot token they are selling. If the seller fails to provide the token, their collateral will be used to compensate the buyer.

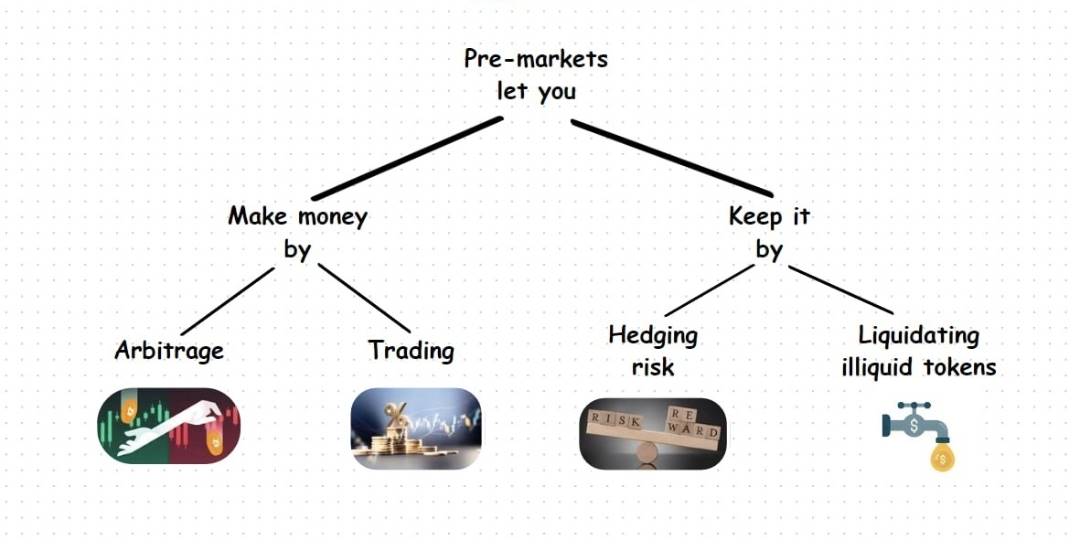

So what can you do in these markets?

Hedge against insufficient airdrop liquidity.

We have seen airdrop tokens like $Eigen drop from $12 to $4 on Aevo, and $Order drop from $2 to $0.3. But while most people are waiting for the spot market listing, some have already sold their quotas at a high price.

Selling in the pre-market allows you to exit before the airdrop token is listed.

The goal here is not to predict market downturns or speculate, but to exit your airdrop quota at a price you are satisfied with.

Arbitrage

Due to low liquidity, there may be significant price differences between different pre-market platforms.

Depending on the size of the price difference, risk-free arbitrage trades can actually be found, with the worst case being a break-even. But before you get too excited, there are several factors to consider when placing an order.

Making a mistake here can be costly, so be careful!

1. Clearly understand what you are trading!

On @WhalesMarket, points are traded separately from the actual pre-market, and there are differences between the two.

Although the pre-market is 1:1 corresponding to the spot token, the points are calculated based on the ratio provided by the project.

If you are not clear about this ratio, do not trade the points!

In addition, when trading tokens that have not announced the token economics, the pre-market usually assumes a random supply, and then adjusts the trading token quantity after the actual token economics is released (e.g. $Dogs). This is very dangerous, and I personally recommend avoiding trading before the token economics is announced!

2. TGE Date

Understand the exact listing time of the token to avoid funds being locked for too long.

If you are using a centralized exchange (CEX) pre-market, make sure they will list the token on the TGE date rather than later!

3. Settlement time and duration

The settlement time may vary on different platforms. For example, @bitgetglobal usually settles pre-market orders within 4 hours after listing.

While on @WhalesMarket, settlement starts from TGE but lasts for 24 hours.

4. Withdrawal time

This is particularly important when arbitraging with CEX pre-market. Sometimes, a CEX may list a token but not enable withdrawals on the same day, such as $Dogs. Ideally, the withdrawal time should be within the settlement period, but this is not mandatory.

Therefore, this is much more complex than the regular spot market and requires consideration of many factors.

But when all these factors happen to align - and it does occasionally happen - it can bring very substantial returns with almost no risk.

That's all about the pre-market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。