Consumer-grade encryption is the last blue ocean in this industry.

Author: Luca Netz

Translation: DeepTechFlow

In this article, I would like to explore my understanding of consumer-grade encryption, why we have not yet achieved its widespread adoption, and why I believe consumer-grade encryption is the last blue ocean in this industry.

What is consumer-grade encryption?

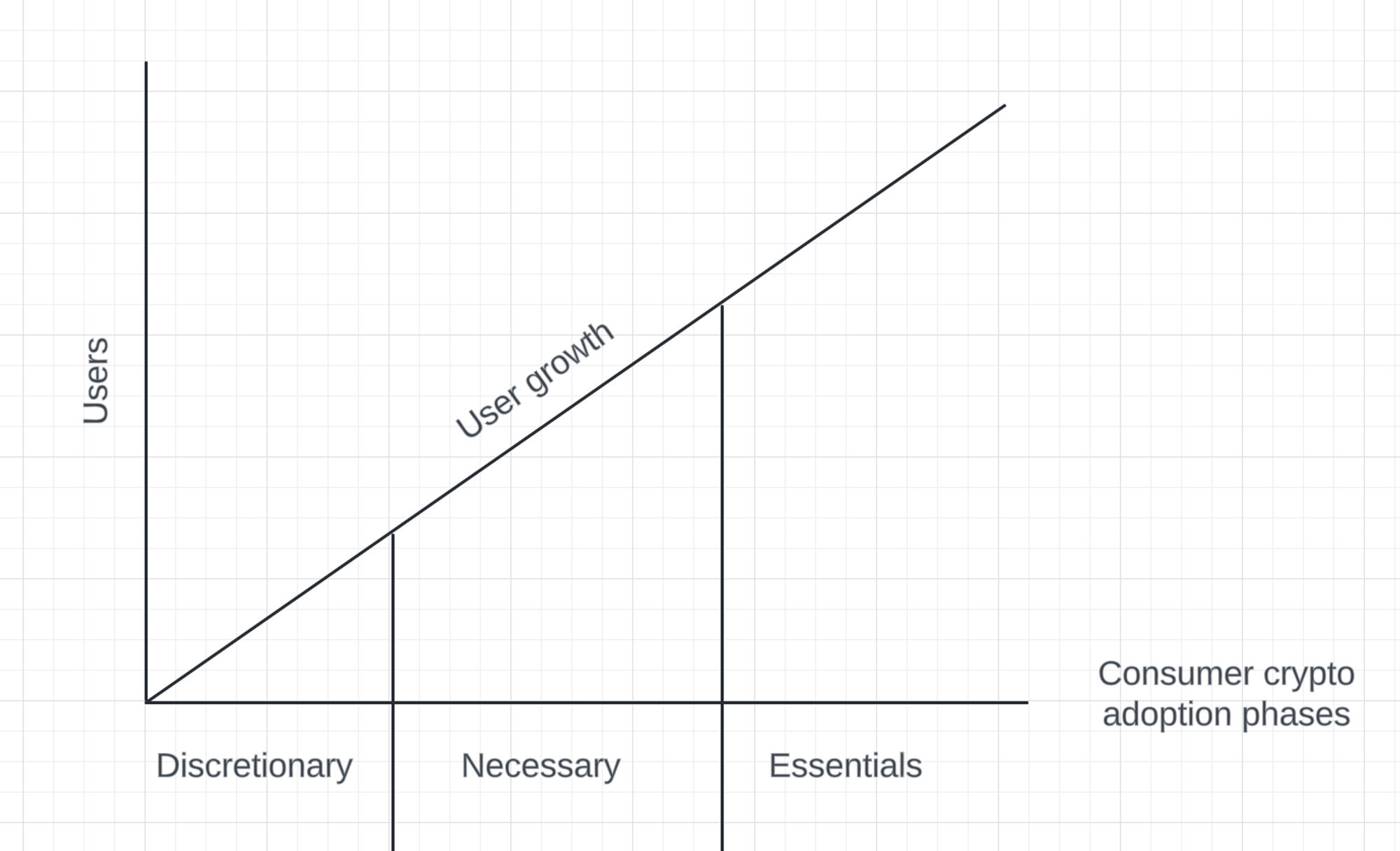

I define consumer-grade encryption as blockchain-driven applications used by billions of individuals in their daily lives. However, this definition is broad. To be more specific, I believe the adoption of consumer-grade encryption will go through three stages. I categorize each stage based on consumer habits:

Stage 1: Discretionary spending

Stage 2: Essential spending

Stage 3: Basic spending

The following diagram shows the relationship between each stage and user growth:

Discretionary Spending - First 50 Million Users

The initial stage of the consumer-grade encryption revolution will focus on discretionary spending—consumer-oriented businesses built around non-essential or leisure spending, in other words, applications that occupy people's leisure time. These types of applications will be the first to break through because they are more likely to go viral, easier to market to consumers, and can address issues that Web2 applications cannot on the blockchain.

Businesses focusing on discretionary spending typically revolve around "fun." However, in the consumer market, "fun" often faces significant entry barriers, such as payment processing issues, geographical restrictions, and regulations that hinder the expansion and development of internet businesses. To illustrate this point, we can look at some of the challenges faced by consumer-oriented Web2 businesses:

Fees: Conventional payment processors charge high fees and exert too much control over merchants. Typically, merchants need to pay transaction fees ranging from 2.9% to 10%. The higher the risk (common in entertainment applications), the higher the fees.

Geographical Restrictions: Conducting business in one's own country is relatively straightforward, but global expansion poses significant challenges, especially when complying with different regional regulatory requirements. Most applications cannot expand beyond their current jurisdiction. While "fun" is universal, unfortunately, Web2 infrastructure is not.

Refund Risk: Current Web2 applications are limited in consumer scale. Processor-imposed restrictions prevent businesses from fully tapping into the potential of their core users, as these limitations prevent users from spending as they wish.

Censorship Risk: Businesses may face censorship from service providers, hindering their active expansion or realization of their full potential.

Building consumer applications around discretionary spending is the most accessible opportunity in the consumer encryption ecosystem and will be the first stage to achieve mass adoption, as entrepreneurs find it easier to develop interesting products on the blockchain. To clarify, I believe the following consumer categories in discretionary spending are best suited for disruption:

Gaming

Social (creator platforms)

Trading

Casinos

Betting

Digital collectibles

Tokenized culture: transforming intangible assets into tangible, tradable, exchangeable, and permanent assets.

I believe these categories have the potential to drive the widespread adoption of consumer encryption applications, reaching the first 50 million active users. To support this point, here are some of the most important consumer encryption applications we currently see. It is worth noting that they all belong to business types aimed at gaining market share in discretionary spending:

OpenSea - Digital collectibles

Topshot - Digital collectibles

Polymarket - Betting

pump.fun - Social and tokenized culture

Uniswap - Trading

Rollbit - Casinos

Pudgy Penguins - Digital collectibles

Friendtech - Social

StepN - Social

Axie - Gaming

Essential Spending - Path to 250 Million Users

Once the first 50 million users are reached, the focus will shift to gaining market share in essential spending, integrating cryptocurrencies into more aspects of life beyond leisure time. Applications in this stage include the following categories:

DeFi

DePin

SaaS

Digital media

E-commerce

Payments

Basic Spending - On-chain World

After breaking through the barriers of essential spending, we will witness the widespread adoption of basic spending. This means consumer applications will be built around basic needs, allowing users to do everything on-chain that they can do off-chain. Examples include:

Online banking

Credit

Tokenization (RWAs)

Insurance

Data

Internet of Things

Identity

Voting

Since the path to success is clear, why have we not achieved mass adoption? How can we achieve this goal?

Issue: Why have we not achieved breakthrough mass adoption?

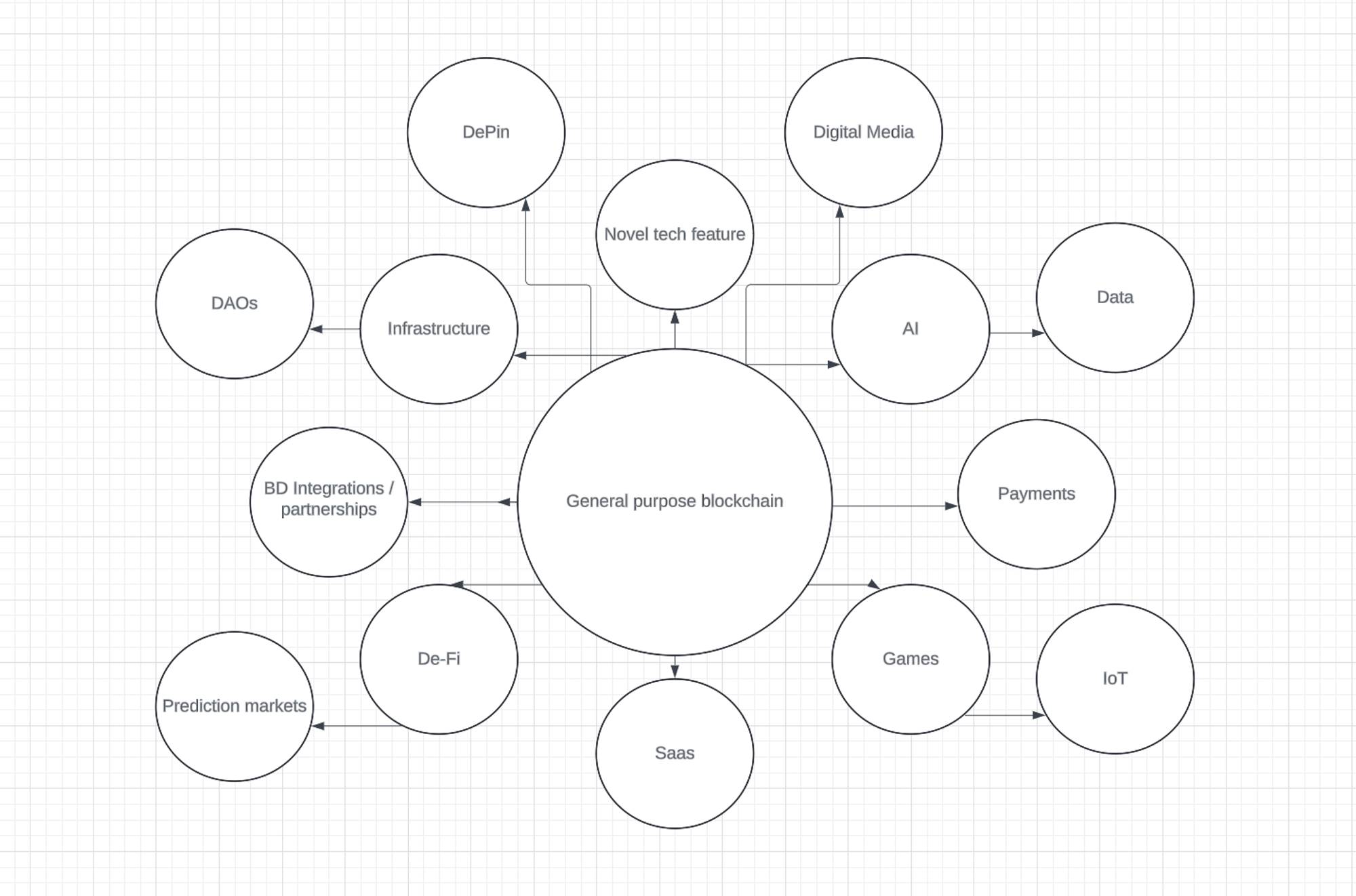

Over the past decade, the responsibility for driving consumer adoption has been shouldered by blockchain projects that have raised hundreds of billions of dollars. Unfortunately, only a few projects have succeeded in this process. I believe the reason lies in the concepts they have built. Many blockchain companies have adopted a "universal" strategy from zero to one hundred, ambitiously aiming to become the infrastructure for the next generation of the internet economy. The following is an illustration of how a universal blockchain grows and prioritizes.

Universal blockchain:

The universal model shows a classic case of fragmentation. Unfortunately, mass market penetration and fragmentation do not go hand in hand. While the universal approach is ambitious, the effort required to achieve it is enormous. Therefore, teams lacking the necessary talent or resources pursuing this approach are likely to face bankruptcy earlier, ultimately wasting time, energy, and resources that could have been used to achieve mass adoption.

Solution: Focus is the key to achieving mass adoption

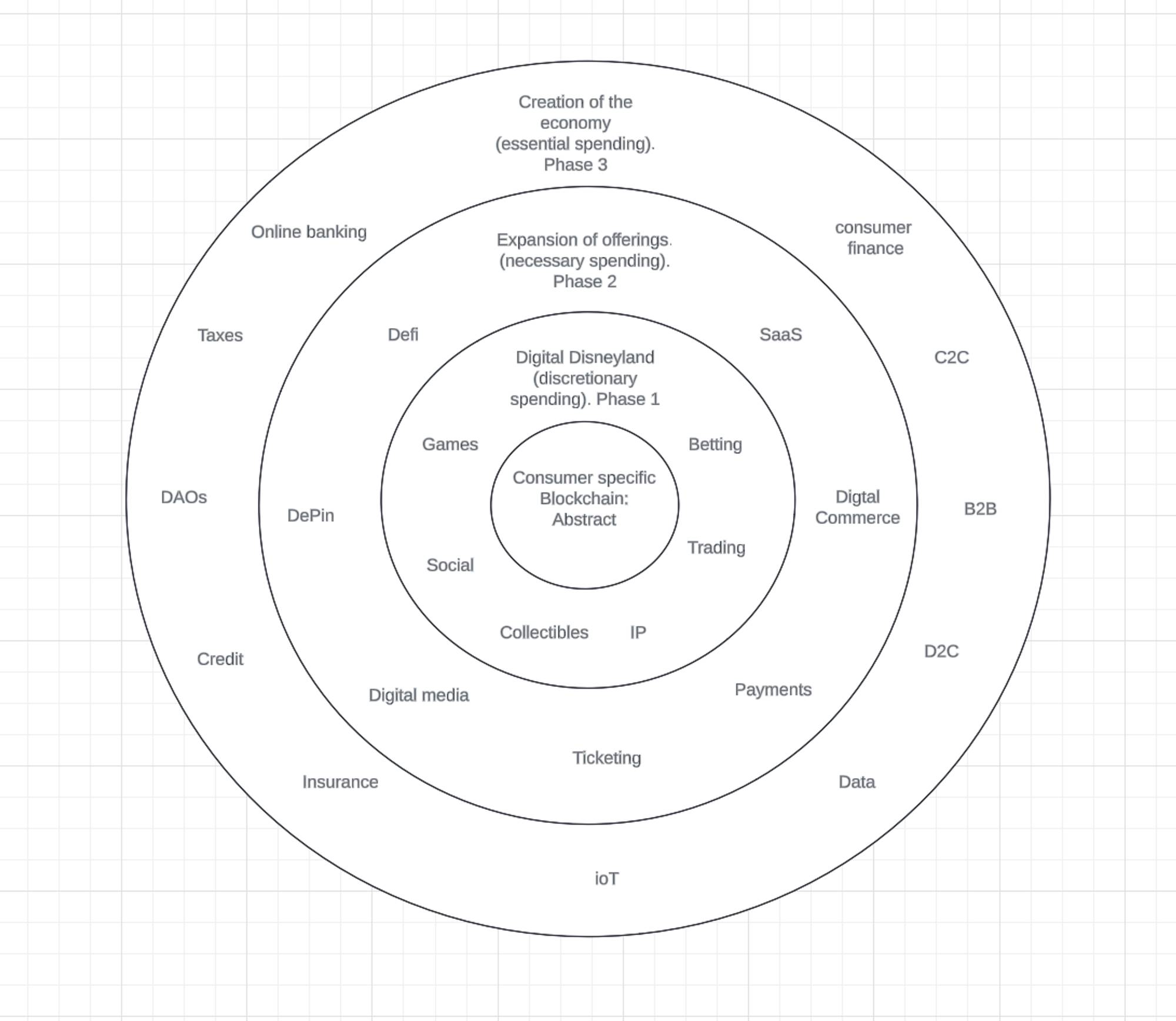

I believe blockchain is like a city, and like all cities, its needs are driven by the attractiveness and activities it offers. Therefore, I believe the breakthrough in consumer adoption will come from teams focusing on creating top attractions within their "city." Once you have an attraction that can draw people into your ecosystem, you can build an entire city around it.

Consumer-specific blockchain:

Based on the background above, my assessment is that we have not achieved mass adoption not due to lack of capability, but because we have not focused on the right approach. Universal blockchains and consumer-centric blockchains are not interchangeable. Building a "consumer chain" is not just an attractive slogan, but a fundamental goal and concept that has not been fully embraced. Recognizing this gap, we found a unique opportunity in the blockchain space, leading Igloo to acquire the Frame team to help build Abstract.

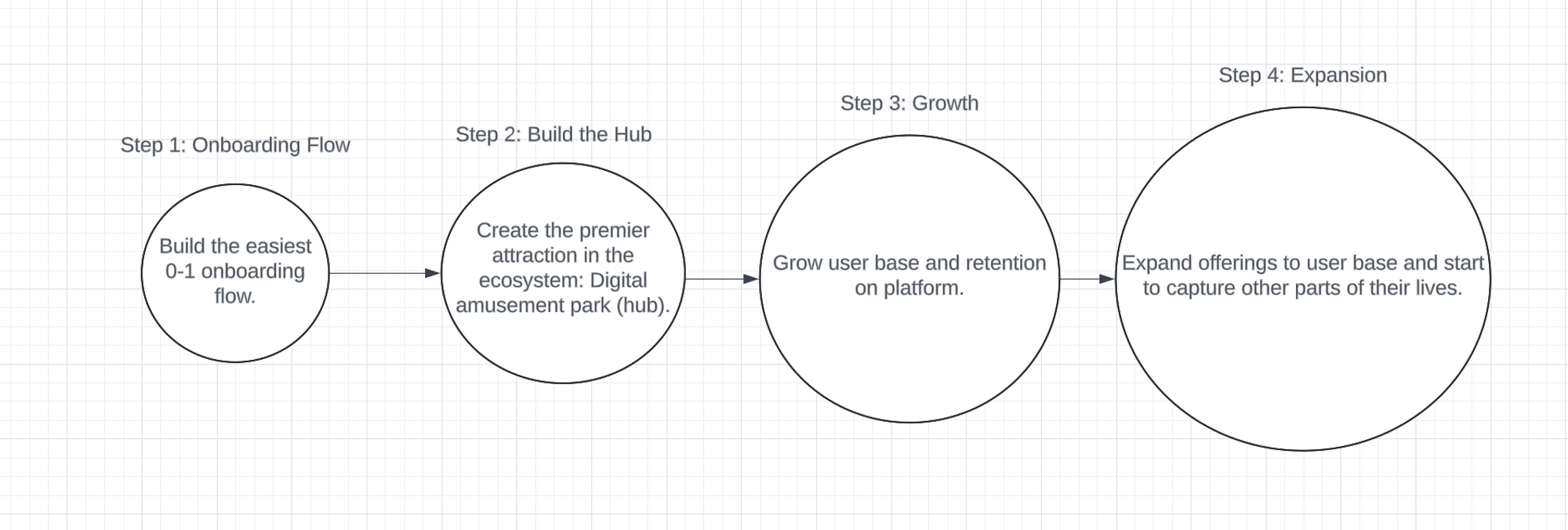

Our team is dedicated to creating a top destination on-chain, designed to be the most interesting place on the internet—I call it the "encrypted digital playground" or the "Disneyland of the internet." The diagram below highlights our firm commitment to providing an excellent 0-1 consumer experience, undisturbed by other factors. Over time, as we build a loyal user base by introducing new products covering various aspects of people's lives, we can gradually develop into a universal chain. For us, this is a highly concentrated strategy, achieving specific success first and then expanding, which is more advantageous compared to the fragmented approach of a universal chain.

The road to success for Abstract:

Consumer-grade encryption is the last crucial frontier of cryptocurrency

Today's cryptocurrency market is similar to the early 2000s internet boom. In the first decade of that era, innovative infrastructure companies emerged, but only a few were widely accepted. Over time, only those that achieved breakthrough mass adoption survived and thrived. Today, cryptocurrency is at a similar critical juncture. After 10 years of infrastructure development, the industry needs to move towards the mainstream.

However, the discourse surrounding cryptocurrency is very fragile. Currently, the field is at risk of being seen as a refuge for gambling and high-risk financial activities. As more people suffer losses, the impression of cryptocurrency as a scam targeting degenerate gamblers is gradually taking shape in the public consciousness. While this may be a joke for seasoned cryptocurrency users, it is a very real concern for the general public, and unfortunately, this is the current mainstream view of cryptocurrency. I am concerned that if we cannot achieve meaningful mass adoption in the near future, the potential of the entire industry may be limited. Therefore, I believe consumer-grade encryption is the most crucial and final frontier in the lifecycle of cryptocurrency.

Community Questions

To conclude this article, I asked my X community if they had any questions about consumer-grade encryption. Here are some questions they raised and my responses.

Question 1

Nejmo @ExpensiveJPEG: What niche markets in the cryptocurrency consumer market are worth exploring?

Answer: Tangibility.

One breakthrough of tokenization is the ability to make intangible things tangible. A huge potential innovation in cryptocurrency may be to affect and extract value from culture through tokenization. Let me explain: historically, investors have always tied their investment proportions to actual value, P/E ratios, or future predictions. It wasn't until cryptocurrency emerged that symbolic value became a new concept, but until now, I haven't heard anyone describe it that way. To me, a new asset class has been unlocked, marking a paradigm shift where the intangible parts of culture can now become tangible. I believe the biggest opportunity in tokenization is to tokenize influence and ultimately make influence tangible. We have seen some products in the past, such as bitclout, friendtech, etc., attempting to crack this puzzle. However, I don't think they have truly succeeded. In my view, a combination of pump.fun with Bitclout, Polymarket, and Instagram-like products could potentially become one of the most valuable companies in the cryptocurrency space.

Question 2:

Fifi @fifilechien: Is creating entirely new products really more efficient than improving existing products?

Answer: Don't reinvent the wheel for now.

Developers in the cryptocurrency industry often work too hard to reinvent foundational technology. Today, there are some groundbreaking consumer products that, if leveraged with the infrastructure and incentive mechanisms of cryptocurrency, could scale tenfold. Instead of trying to create an entirely new model, it's more efficient to tokenize existing models. I believe there are still many consumer-grade encryption applications waiting to be developed, and their Web2 versions are waiting to unleash tremendous growth potential through encryption technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。