The full text of Powell's speech is here, concerning the interest rate cut!

On Friday local time, Federal Reserve Chairman Powell delivered a speech at the annual Jackson Hole Symposium. As a highly anticipated moment for the global market, the Fed Chairman publicly announced that the Fed is about to officially enter a rate-cutting cycle.

The full text of the speech is as follows:

Today, four and a half years after the outbreak of the COVID-19 pandemic, the economic distortions related to the pandemic are gradually receding from their most severe state. The inflation rate has dropped significantly, the labor market is no longer overheated, and the current market conditions are looser than before the pandemic. Supply constraints have returned to normal, and the risk balance facing our dual mandate has also changed. Our goal is to restore price stability while maintaining a strong labor market, avoiding a situation where unemployment rates rise sharply as inflation expectations become unstable, as in the past. We have made considerable progress in achieving this goal. Although the task is not yet complete, we have indeed made significant progress.

Today, I will first discuss the current economic situation and the path forward for monetary policy. Then, I will discuss the economic events since the pandemic began, exploring why inflation has risen to levels not seen in generations and why inflation has decreased significantly while the unemployment rate remains low.

Short-term Outlook for Policy

Let's start with the current situation and the short-term outlook for policy.

For most of the past three years, the inflation rate has been well above our 2% target, and labor market conditions have been extremely tight. The Federal Open Market Committee's (FOMC) primary focus has been on reducing inflation, which is entirely correct. Before this event, most living Americans had never experienced the pain of sustained high inflation. Inflation has brought great difficulties, especially for those who are most vulnerable to rising costs of essential goods such as food, housing, and transportation. High inflation has created pressure and a sense of unfairness that has persisted to this day.

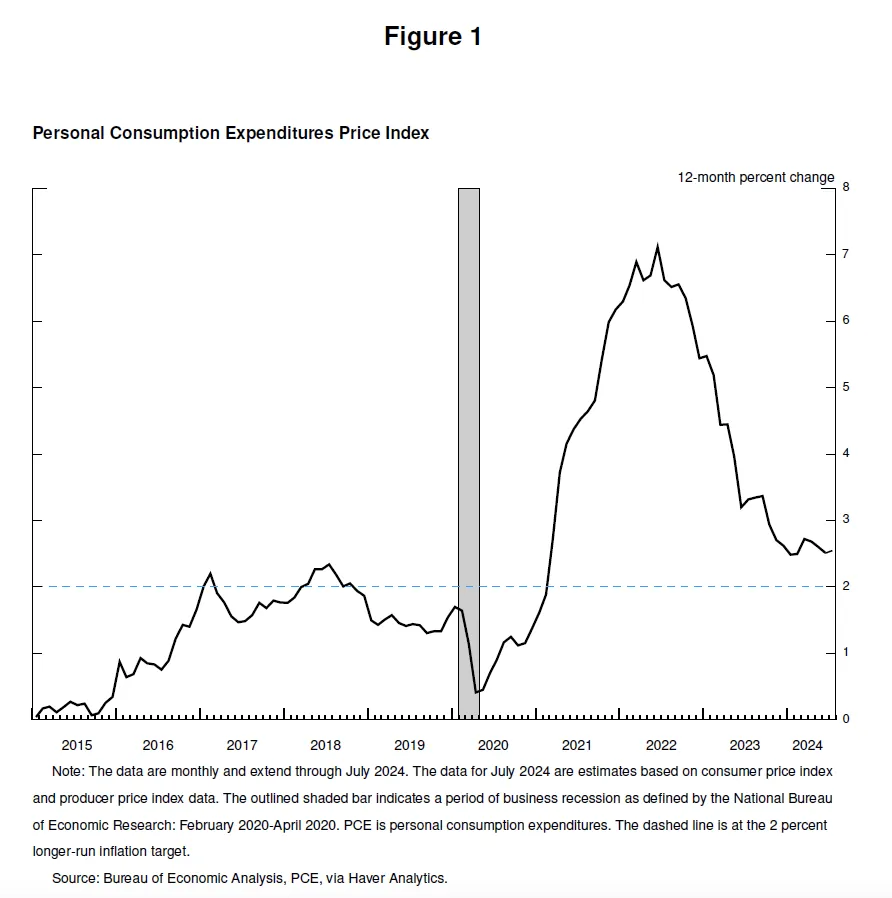

Our tight monetary policy has helped restore the balance between total supply and demand, easing inflationary pressures and ensuring stable inflation expectations. Now, inflation is closer to our policy target, with prices rising 2.5% over the past 12 months. Progress toward our 2% target has resumed after a temporary slowdown earlier this year. I am increasingly confident that inflation is sustainably returning to the path toward 2%.

Regarding employment, in the years before the pandemic, we saw significant benefits to society from a strong labor market: low unemployment rates, high labor force participation rates, historically low racial employment gaps, and healthy real wage growth in a low and stable inflation environment, with these gains increasingly concentrated among low-income groups.

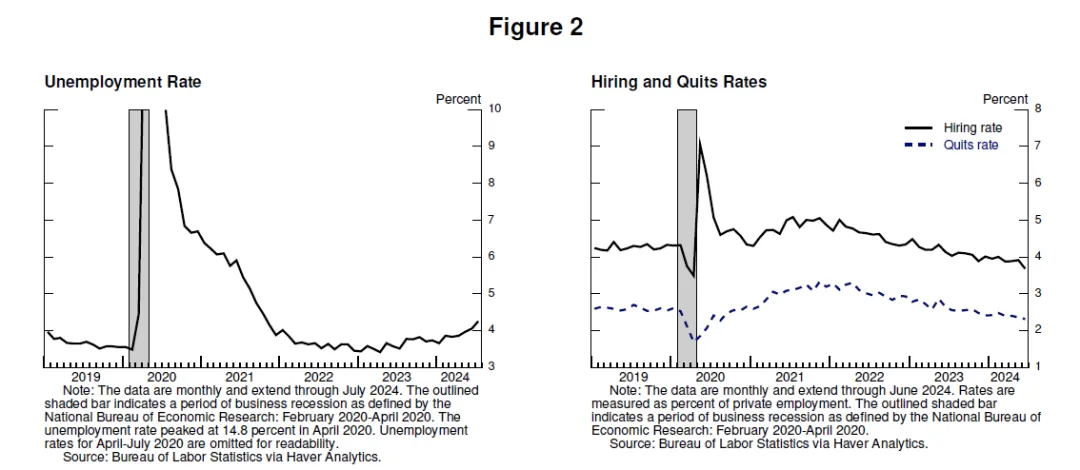

Today, the labor market has clearly cooled down and is no longer as overheated as before. The unemployment rate began to rise over a year ago and is now at 4.3%, still historically low but nearly a percentage point higher than in early 2023. Most of the increase occurred in the past six months.

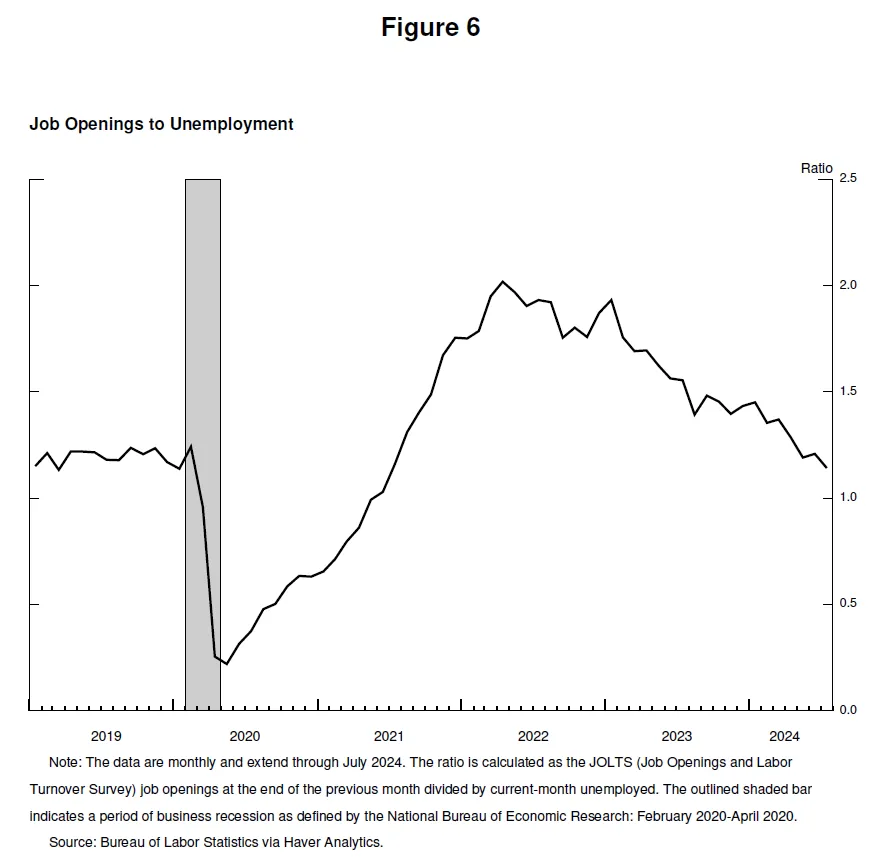

So far, the rise in the unemployment rate has not been due to large-scale layoffs typically seen during an economic downturn, but mainly reflects a significant increase in labor supply and a slowdown in hiring. Nevertheless, the labor market cooling is evident. Employment growth remains robust but has slowed this year. Job vacancies have decreased, and the ratio of job vacancies to unemployment has returned to pre-pandemic levels. Hiring and quit rates are now lower than in 2018 and 2019. Nominal wage growth has slowed. Overall, the labor market is much looser now than in 2019 (before the pandemic), a year when the inflation rate was below 2%. The labor market seems unlikely to be a source of inflationary pressure in the short term. We are not seeking or welcoming further cooling of labor market conditions.

Overall, the economy is still growing at a steady pace. However, the data on inflation and the labor market indicate that the situation is evolving. The upward risks to inflation have diminished, while the downward risks to employment have increased. As we emphasized in the previous FOMC statement, we are focused on the risks to both aspects of our dual mandate.

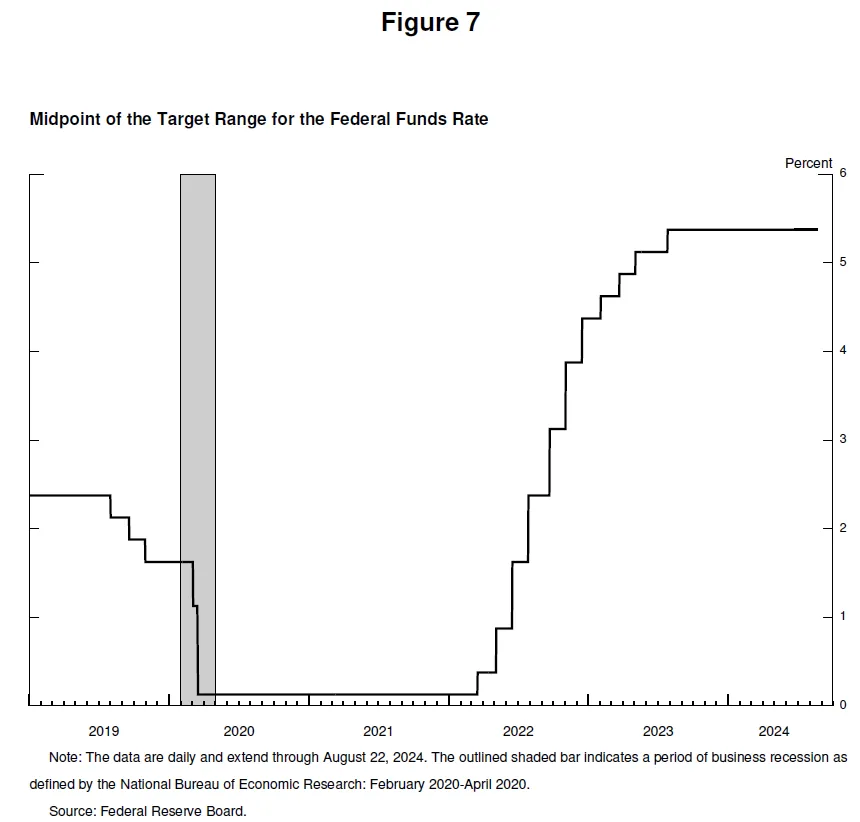

Now is the time to adjust the policy. The direction forward is clear, and the timing and pace of rate cuts will depend on future data, evolving outlook, and the balance of risks.

We will make every effort to support a strong labor market while continuing to progress toward the goal of price stability. With the appropriate reduction in policy constraints, there is ample reason to believe that the economy will return to a 2% inflation rate while maintaining a strong labor market. Our current policy interest rate level provides sufficient room to address any risks, including further deterioration in labor market conditions.

Fluctuations in Inflation

Now let's turn to why inflation has risen and why inflation has significantly decreased while the unemployment rate remains low. Research on these issues is constantly increasing, and now is a good time to discuss these issues. Of course, it is still too early to make a definitive assessment. This period will be analyzed and discussed for many years to come.

The arrival of the COVID-19 pandemic quickly led to an economic shutdown on a global scale. This was a period of great uncertainty and severe downside risks. During the crisis, Americans adapted and innovated as they always have. The government responded with unprecedented strength, especially in the United States, where Congress unanimously passed the CARES Act. At the Federal Reserve, we used our powers with unprecedented force to stabilize the financial system and help prevent an economic depression.

After experiencing a historically deep but short-lived recession, the economy began to recover in mid-2020. As the risks of a severe, prolonged recession receded, the economy reopened, and we faced the risk of a slow recovery similar to that after the global financial crisis.

Congress provided significant additional fiscal support at the end of 2020 and the beginning of 2021. Consumer spending surged in the first half of 2021. The ongoing pandemic shaped the pattern of the recovery in consumer markets. Continued concerns about the pandemic affected in-person service consumption. However, pent-up demand, stimulus policies, changes in work and leisure patterns due to the pandemic, and additional savings from restricted service consumption collectively drove historic increases in consumer goods spending.

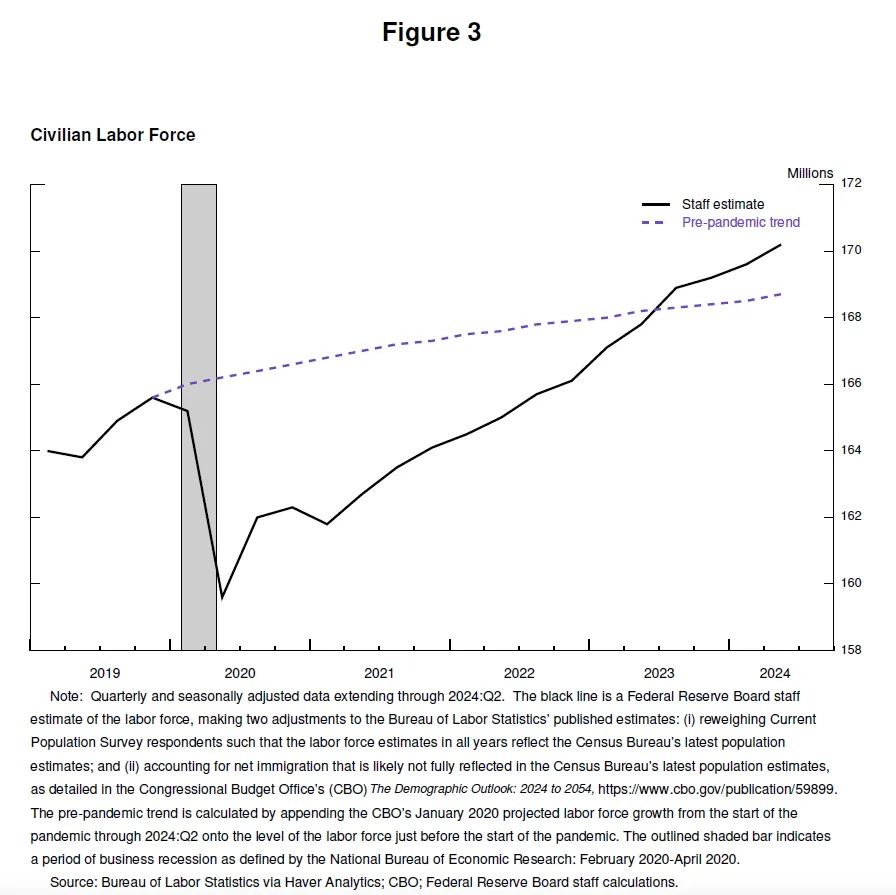

The pandemic also caused severe disruptions to the supply situation. At the outset of the pandemic, 8 million people left the labor force, and by early 2021, the labor force was still 4 million smaller than before the pandemic. The labor force did not recover to pre-pandemic trends until mid-2023.

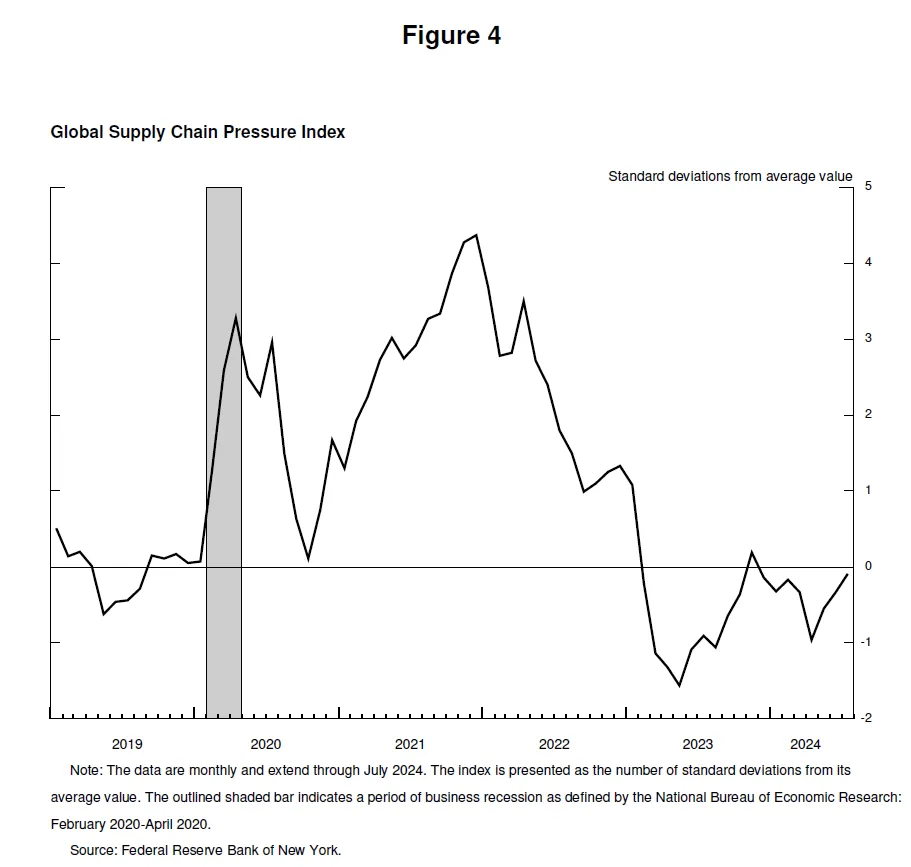

Supply chains were thrown into chaos due to worker attrition, interruptions in international trade links, and dramatic changes in the structure and level of demand. Clearly, this is entirely different from the slow recovery after the global financial crisis.

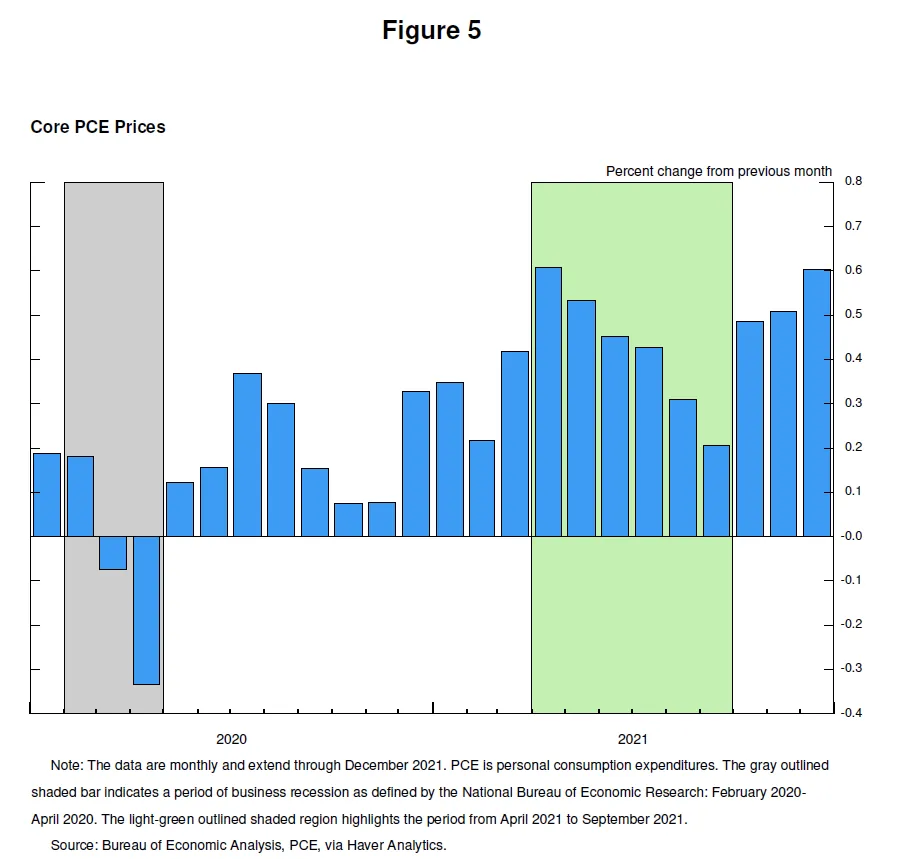

Inflation followed. After inflation was below target in 2020, inflation surged significantly in March and April 2021. The initial surge in inflation was concentrated in goods with supply shortages, such as motor vehicles, with prices rising sharply. Initially, my colleagues and I judged that these pandemic-related factors would not persist, so we believed that the sudden rise in inflation might quickly pass without the need for monetary policy intervention—in short, inflation was temporary. The long-standing conventional view is that as long as inflation expectations remain stable, central banks can ignore temporary increases in inflation.

The view of "transitory inflation" was widely accepted at the time, held by most mainstream analysts and central bank governors in advanced economies. The general expectation was that supply conditions would improve relatively quickly, the rapid recovery in demand would come to an end, demand would shift from goods to services, thereby reducing inflation.

For a period, the data were consistent with the assumption of transitory inflation. From April to September 2021, the monthly readings for core inflation declined each month, although progress was slower than expected.

By mid-year, the support for this assumption began to weaken, and our communications reflected that. Starting in October, the data no longer supported the assumption of transitory inflation. The rise in inflation began to expand from goods to services. It became clear that high inflation was not temporary, and strong policy responses were needed to maintain stable inflation expectations. We recognized this and began adjusting our policies from November. Financial conditions began to tighten. After gradually ending asset purchases, we initiated rate hikes in March 2022.

By early 2022, overall inflation had exceeded 6%, and core inflation had surpassed 5%. New supply shocks emerged. The outbreak of the Russia-Ukraine war led to a sharp increase in energy and commodity prices. The improvement in supply conditions, as well as the longer-than-expected shift in demand from goods to services, partly due to the further development of the pandemic in the United States, contributed to this. The pandemic also continued to disrupt the production of major economies globally.

High inflation is a global phenomenon, reflecting a common experience: rapid increases in demand for goods, supply chain constraints, tight labor markets, and sharp increases in commodity prices. Global inflation is unlike any period since the 1970s. At that time, high inflation was entrenched—we are firmly committed to avoiding this situation.

By mid-2022, the labor market was extremely tight, with over 6.5 million additional labor demand since mid-2021. Some of this increase in labor demand could be met by workers returning to the workforce after the pandemic receded. However, labor supply remained constrained, and by the summer of 2022, the labor force participation rate was still far below pre-pandemic levels. From March 2022 to the end of the year, job vacancies were almost twice the number of unemployed, indicating a severe labor shortage. In June 2022, inflation peaked at 7.1%.

Two years ago, on this platform, I discussed some of the pain that controlling inflation might bring, such as rising unemployment and slowing economic growth. Some believed that controlling inflation would require a recession and long-term high unemployment rates. I expressed our unwavering commitment to fully restoring price stability and sticking with it until the job is done.

The FOMC did not flinch and steadfastly fulfilled our responsibilities, and our actions strongly demonstrated our commitment to restoring price stability. In 2022, we raised the policy rate by 425 basis points, and by 2023, we raised it by another 100 basis points. Since July 2023, we have maintained the policy rate at the current tight level.

The summer of 2022 became the peak of inflation. In the span of two years, inflation has decreased by 4.5 percentage points from its peak, while the unemployment rate remained low, a popular and historically uncommon outcome.

Why did inflation decrease while the unemployment rate did not significantly rise?

The pandemic-related supply and demand distortions, as well as severe shocks in the energy and commodity markets, were important drivers of high inflation, and their reversal was also a key part of the decrease in inflation. The fading of these factors took longer than expected, but ultimately played an important role in the subsequent decrease in inflation. Our tight monetary policy prompted a moderate decrease in total demand, combined with the improvement in total supply, reducing inflationary pressures while allowing the economy to continue to grow at a healthy pace. With the slowdown in labor demand, the normalization of job vacancies relative to the historically high level of unemployment, and the absence of large-scale and disruptive layoffs, the labor market is no longer a source of inflationary pressure.

Here, the critical importance of inflation expectations must also be mentioned. The long-standing view of the standard economic model has been that as long as the product and labor markets are balanced, inflation will return to the target level—without the need for an economic slowdown—as long as inflation expectations are stable at our target level. This is what the model says, but since the 2000s, the stability of long-term inflation expectations has never been tested by sustained high inflation. The stability of the inflation anchor is far from certain. Concerns about the decoupling of inflation expectations have intensified a view that inflation decrease requires an economic slowdown, especially in the labor market. The important lesson from recent experience is that stable inflation expectations, combined with strong central bank action, can achieve inflation decrease without the need for an economic slowdown.

The narrative attributes the rise in inflation mainly to the exceptional collision between overheated and temporarily distorted demand and constrained supply. Although researchers differ in their methods and conclusions, there seems to be a consensus forming that attributes the main cause of the rise in inflation to this collision. Overall, as the markets recover from the distortions caused by the pandemic, we are working to moderately suppress total demand and anchor expectations, and these combined efforts are increasingly putting inflation on a sustainable path toward reaching our 2% target.

Achieving a decrease in inflation while maintaining a strong labor market is only possible with anchored inflation expectations, reflecting the public's confidence in the central bank's ability to achieve 2% inflation over time. This confidence has been built over decades and has been strengthened by our actions.

This is my assessment of the events. You may have a different view.

Conclusion

Finally, I want to emphasize that the pandemic economy has proven to be unlike any period before, and there is much to learn from this extraordinary time. The Federal Reserve has committed in the "Statement on Longer-Run Goals and Monetary Policy Strategy" to review our principles comprehensively every five years and make appropriate adjustments. As we begin this process later this year, we will remain open to criticism and new ideas while maintaining the strength of our framework. The limitations of our knowledge—evident during the pandemic—require us to remain humble and inquisitive, focusing on drawing lessons from past experiences and flexibly applying them to current challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。