Author: @Arthur_0x

Compiled by: Wang Eryu, PANews

On-chain lending is one of the most important markets in the cryptocurrency industry, and as the undisputed leader in this market, Aave has strong competitive barriers and user stickiness. We believe that the value of Aave is severely underestimated, as it has enormous growth potential that the market has yet to recognize.

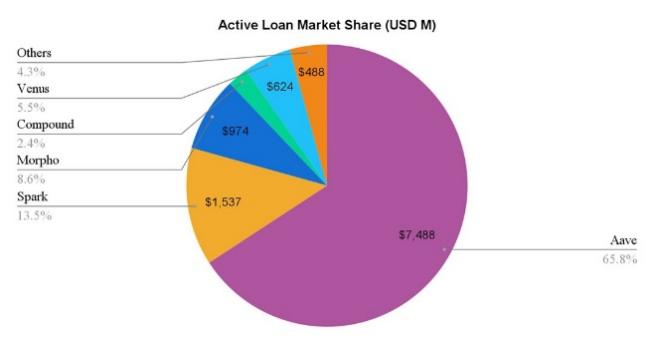

In January 2020, Aave launched on the Ethereum mainnet, and this year marks its 5th year online. Today, Aave is the largest lending protocol, with an active loan amount of $7.5 billion, which is five times more than the second-ranked Spark.

(Data as of August 5, 2024)

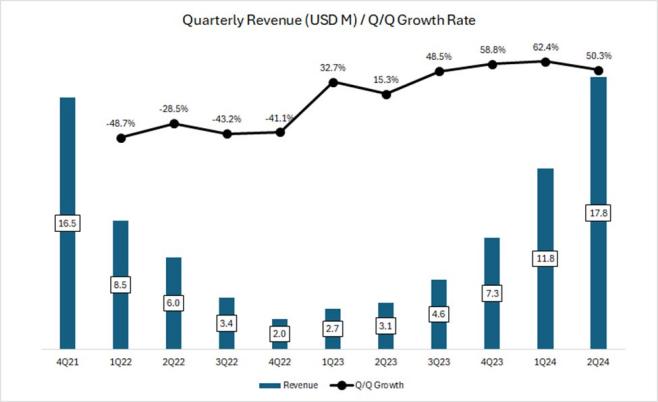

Protocol metrics continue to grow, surpassing the previous cycle's peak

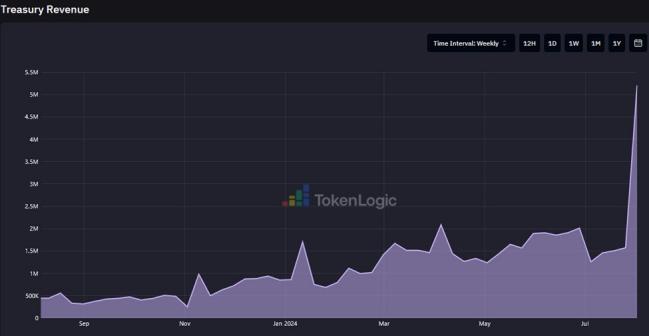

Aave is also one of the few DeFi protocols whose metrics have surpassed the levels of the 2021 bull market. For example, its quarterly revenue has exceeded the peak of the bull market in the fourth quarter of 2021. Particularly noteworthy is that even during the market consolidation period from November 2022 to October 2023, Aave's revenue continued to accelerate. As the market warmed up in the first and second quarters of 2024, Aave's momentum did not diminish, with a quarter-on-quarter growth rate of 50-60%.

(Source: Token Terminal)

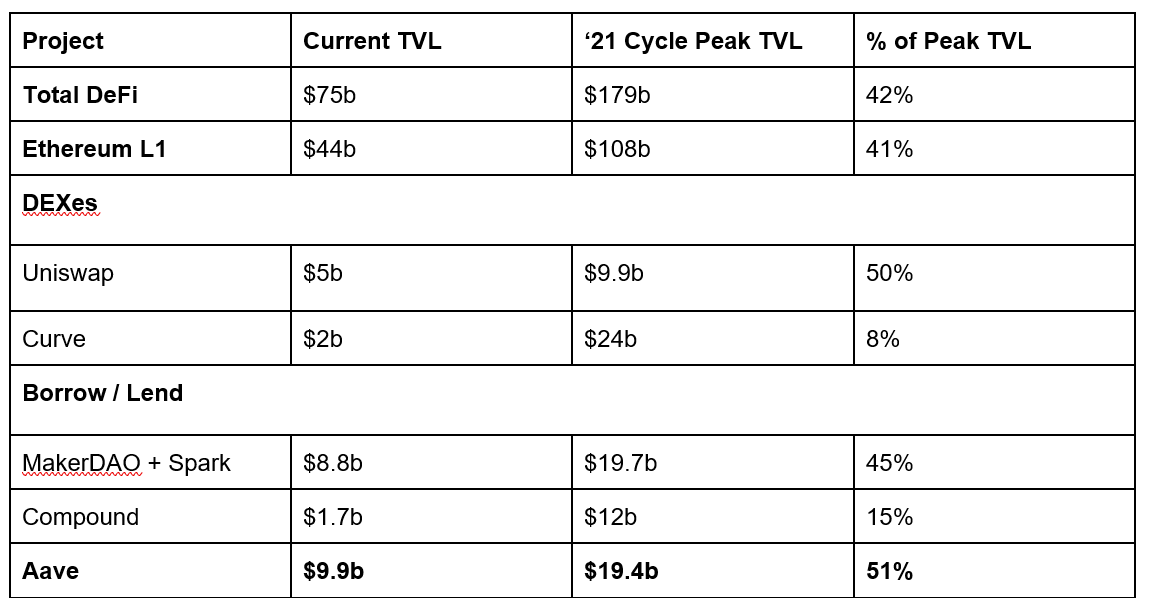

Since the beginning of the year, thanks to the increase in deposits and the rise in prices of underlying assets such as WBTC and ETH, Aave's Total Value Locked (TVL) has nearly doubled, recovering to 51% of the peak value in the 2021 cycle. This indicates that Aave is more resilient compared to other leading DeFi protocols.

(Data as of August 5, 2024)

Strong profit performance reflects a high degree of product-market fit

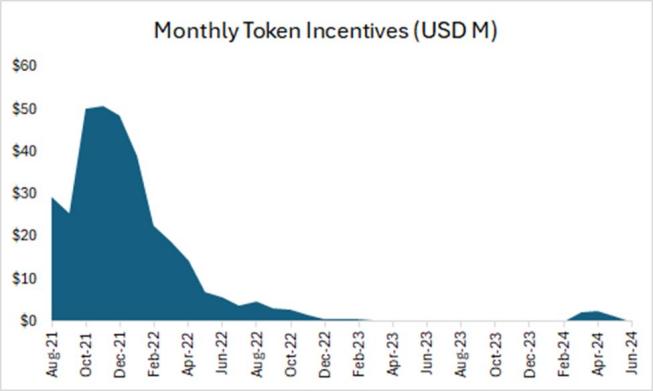

Aave's revenue peaked in the previous cycle, coinciding with the issuance of a large number of tokens as incentives on multiple smart contract platforms such as Polygon, Avalanche, and Fantom to attract users and liquidity. This brought unsustainable speculative capital and leverage levels, amplifying the revenue figures of most protocols.

Today, the token incentives on the main chain have dried up, and Aave's own token incentives have also decreased to negligible levels.

(Source: Token Terminal)

This indicates that the growth in metrics over the past few months has been organic and sustainable, driven by the resurgence of market speculation, which has pushed up active loans and borrowing rates.

Furthermore, even during periods of reduced speculative activity, Aave has demonstrated the ability to drive fundamental growth. In early August, amid a major global sell-off in risk assets, Aave's revenue remained strong, benefiting from successful collection of liquidation fees during the loan repayment process. This demonstrates Aave's ability to withstand market fluctuations in different collateral and multi-chain environments.

(Data as of August 5, source: TokenLogic)

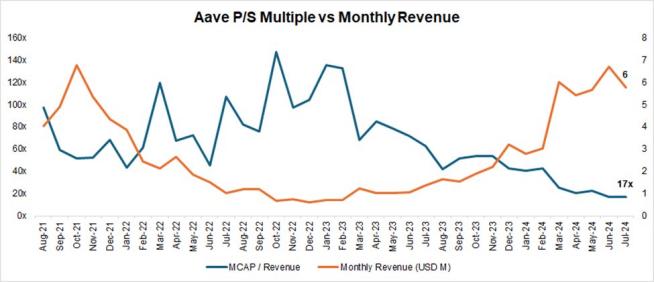

Despite strong fundamental recovery, Aave's market-to-sales ratio remains at its lowest level in three years

Despite the strong recovery in metrics over the past few months, Aave's market-to-sales ratio is only 17 times, the lowest level in three years, far below the median level of 62 times during the same period.

(Source: Coingecko, Token Terminal)

Aave is expected to strengthen its dominant position in the decentralized lending field

Aave's competitive advantages are mainly reflected in four points:

- Good record of protocol security management: Most new lending protocols encounter security issues in the early stages of operation. To date, Aave has not experienced any major smart contract-level security incidents. The strong risk management capabilities and good security record are often the primary considerations for DeFi users when choosing lending platforms, especially for large fund holders.

- Bilateral network effects: DeFi lending is a typical bilateral market. Depositors and borrowers constitute the supply and demand sides. Growth on one side will drive growth on the other side, and latecomers will find it increasingly difficult to catch up. In addition, the more abundant the overall liquidity on the platform, the smoother the inflow and outflow of deposits and borrowings, the more attractive the platform is to large fund users, and the further it can stimulate the platform's business growth.

- Well-managed DAO governance: The Aave protocol has fully implemented a DAO-based governance model. Compared to centralized team management models, DAO involves more comprehensive information disclosure and more thorough community discussions. In addition, Aave's DAO community has brought together a group of professional institutions with high governance levels, such as top risk management service providers, market makers, third-party development teams, and financial advisory teams. This diversified participant structure has brought active governance participation to the platform.

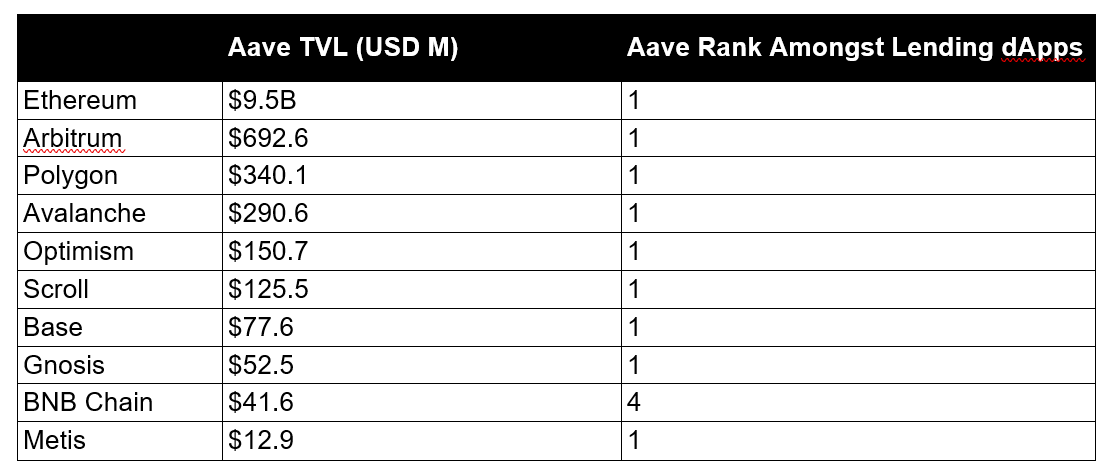

- Multi-chain ecosystem positioning: Aave has been deployed on almost all mainstream EVM L1/L2, and on all deployment chains except BNB Chain, the TVL remains leading. The upcoming Aave V4 version will bridge cross-chain liquidity, further demonstrating its cross-chain liquidity advantage. See the following figure for details:

(Data as of August 5, source: DeFiLlama)

Reforming Token Economics, Promoting Value Accumulation, and Mitigating Slashing Risks

The Aave Chain Initiative (ACI) has just launched a proposal aimed at reforming the AAVE token economics, hoping to introduce a revenue-sharing mechanism to enhance the token's utility.

The first major change is the mitigation of the slashing risk for AAVE stakers in the Safety Module.

Currently, stakers of AAVE tokens in the Safety Module (stkAAVE - $228 million TVL) and AAVE/ETH Balancer LP tokens (stkABPT - $99 million TVL) face the risk of token slashing to cover shortfall events.

However, since stkAAVE and stkABPT lack correlation with the accumulated collateral assets, they are not ideal coverage assets. In such events, selling pressure on AAVE would also reduce the coverage level.

With the introduction of the new Umbrella Safety Module, stkAAVE and stkABPT will be replaced by stk aTokens, initially aUSDC and awETH. Providers of aUSDC and awETH can choose to stake their assets to earn additional fees beyond the interest paid by borrowers (including AAVE, GHO, and protocol revenue). These collateral assets face the risk of slashing and destruction in shortfall events.

This arrangement will benefit both platform users and AAVE holders.

Additionally, the revenue-sharing mechanism will further increase the demand for AAVE.

Introduction of Anti-GHO

Currently, stkAAVE users enjoy a 3% discount when minting and borrowing GHO.

This will be replaced by the new "anti-GHO" token, generated by stkAAVE holders minting GHO. Its generation is linear and proportional to the interest accumulated by all GHO borrowers.

Users can claim anti-GHO and use it in two ways:

Burn anti-GHO to mint GHO, which can be used to repay debts for free.

Deposit into the GHO Safety Module to receive stkGHO.

This enhances the alignment of interests between AAVE stakers and GHO borrowers and will be the first step in a broad revenue-sharing strategy.

Burn and Distribution Plan

Aave will allow the redistribution of net excess protocol revenue to token stakers, subject to the following conditions:

Aave Collector's net holdings equal the recurring costs of two annual service providers in the past 30 days.

Aave protocol's 90-day annualized revenue reaches 150% of all protocol expenses (including AAVE acquisition budget and aWETH & aUSDC Umbrella budget) from the beginning of the year to date.

As a result, the Aave protocol will initiate a continuous eight-digit buyback program, which will increase in scale as the protocol continues to grow.

Furthermore, the circulation of AAVE tokens has almost reached complete dilution, and there will be no large-scale supply unlocking in the future. In contrast, some recent token issuances have suffered severe value loss during the Token Generation Event (TGE) due to low circulation and high fully diluted valuation (FDV).

Aave is Poised for Significant Growth

Aave has several growth drivers in the pipeline and is expected to benefit from the long-term growth trend of cryptocurrencies as an asset class. From a fundamental perspective, Aave has multiple avenues for revenue growth:

Aave v4

Aave V4 will further enhance its competitiveness and help it attract the next wave of billions of users to DeFi. Firstly, Aave will focus on revolutionizing the interaction experience in DeFi by building a unified liquidity layer. By enabling seamless liquidity access across multiple networks (including EVM, and eventually non-EVM), Aave will simplify cross-chain lending processes. The unified liquidity layer will also deeply integrate Account Abstraction and Smart Accounts, allowing users to manage positions of multiple isolated assets.

Secondly, Aave will improve platform accessibility by expanding to more chains and introducing more asset categories. In June of this year, the Aave community voted to support the protocol's deployment on zkSync. This is the 13th blockchain network Aave has entered. Subsequently, in July, the Aptos Foundation proposed the deployment of Aave on Aptos. If approved, this will be Aave's first entry into a non-EVM network, further solidifying its position as a true multi-chain DeFi giant. Additionally, Aave plans to explore the integration of Real World Asset (RWA)-based products, which will be built around GHO and are expected to bridge traditional finance with DeFi, attracting institutional investors and injecting a large amount of new capital into the Aave ecosystem.

These developments will ultimately give rise to the Aave Network, which will serve as the central hub for stakeholders to interact with the Aave protocol. GHO will be used to pay fees, and AAVE will serve as the primary staking asset for decentralized validators. As the Aave Network is developed for L1 or L2 networks, we expect the market to reevaluate its token to reflect the value of this new infrastructure layer.

Growth Correlated with BTC and ETH as Asset Classes

This year, the introduction of Bitcoin and Ethereum ETFs marks a significant milestone in the mainstreaming of cryptocurrencies. Investors now have a traditional and regulated tool to easily gain exposure to digital assets and avoid the complexities of directly holding these assets. By lowering the barriers to entry, these ETFs are expected to attract a large amount of capital from both institutions and retail investors, further integrating digital assets into mainstream portfolios.

For Aave, the overall growth of the crypto market is a positive factor, as over 75% of its asset composition belongs to non-stable assets (primarily Bitcoin and Ethereum derivatives). Therefore, Aave's TVL and revenue growth are directly correlated with the growth of these assets.

Growth Tied to Stablecoin Supply

In the future, Aave is also expected to benefit from the growth of the stablecoin market. As signals of central banks entering a period of interest rate cuts become clearer, the opportunity cost for investors seeking sources of income will decrease. This may incentivize capital to flow out of traditional financial yield instruments and into stablecoin farming in the DeFi space to earn higher returns. Additionally, during bull markets, investor risk appetite increases, leading to more risk-taking behavior, further stimulating stablecoin lending activities on platforms like Aave.

Conclusion

To reiterate, we are optimistic about the prospects of Aave, the leader in the growing decentralized lending space. We have further elaborated on the core elements driving its future growth and analyzed how each element will be further expanded.

We also believe that with strong network effects and excellent token liquidity and composability, Aave will continue to consolidate and expand its market leadership. The upcoming token economics upgrade will further enhance the protocol's security and value-capturing capabilities.

In recent years, the market has generalized all DeFi protocols and priced them as asset categories with limited growth potential. This phenomenon is evident from the steady increase in Aave's TVL and revenue while its valuation multiples have declined. We believe that this misalignment of valuation with fundamentals will not last long. AAVE currently offers an excellent risk-adjusted investment opportunity in the cryptocurrency industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。